SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 1)*

QuantumScape Corporation

(Name of Issuer)

Class A common stock, par value $0.0001 per share

(Title of Class of Securities)

74767V 109

(CUSIP Number)

Fritz Prinz

1730 Technology Drive

San Jose, California 95110

(408) 452-2000

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

with a copy to:

|

|

Mark Baudler Wilson Sonsini Goodrich & Rosati, P.C. 650 Page Mill Road Palo Alto, California 94304 (650) 493-9300 |

April 26, 2021

(Date of Event Which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ☐

Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7 for other parties to whom copies are to be sent.

|

|

* |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page. |

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

|

|

1 |

|

NAMES OF REPORTING PERSON Fritz Prinz |

2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (a) ☐ (b) ☐ |

3 |

|

SEC USE ONLY |

4 |

|

SOURCE OF FUNDS (See Instructions) PF |

5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ☐ |

6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION Austria |

|

|

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH |

|

7 |

|

SOLE VOTING POWER 258,164(1) |

|

8 |

|

SHARED VOTING POWER 11,384,141(2)(3) |

|

9 |

|

SOLE DISPOSITIVE POWER 258,164(1) |

|

10 |

|

SHARED DISPOSITIVE POWER 11,384,141(2)(3) |

|

|

|

11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON 11,642,305(1)(2)(3) |

12 |

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (See Instructions) ☐ |

13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11) 2.6%(4)(5) |

14 |

|

TYPE OF REPORTING PERSON (See Instructions) IN |

|

|

(1) |

Consists of 258,614 shares of Class A common stock issued or issuable upon the vesting of restricted stock units (“RSUs”) directly held by Prof. Dr. Fritz Prinz. A portion of the RSUs vest each quarter and a portion of the RSUs vest upon achievement of certain performance milestones, subject to Fritz Prinz’s continued service as of each vesting date. |

|

|

(2) |

Consists of 777,906 shares of Class A common stock and 7,172,185 shares of Class B common stock directly owned by Friedrich Prinz and Gertrud Prinz, trustees of the Prinz Family Trust DTD 09/17/2018 (“Prinz Family Trust”), and 518,604 shares of Class A common stock and 2,915,446 shares of Class B common stock held in trusts in which Fritz Prinz’s family members are beneficiaries (collectively, the “Trusts”). Fritz Prinz shares voting and dispositive power over the Prinz Family Trust and the Trusts. |

|

|

(3) |

Each share of Class B common stock is convertible at any time into one share of Class A common stock. |

|

|

(4) |

Based on the quotient obtained by dividing (a) the aggregate number of shares of Class A common stock and Class B common stock beneficially owned by Fritz Prinz by (b) the sum of (i) 429,687,172 shares of Class A common stock outstanding as of October 20, 2023, as reported in the Issuer’s Quarterly Report on Form 10-Q filed with the Securities and Exchange Commission (the “SEC”) on October 27, 2023, (ii) 10,087,631 shares of Class B common stock and (iii) 233,858 shares of Class A common stock issuable upon the vesting of RSUs outstanding as of October 20, 2023. The aggregate number of shares of Class B common stock beneficially owned by Fritz Prinz as set forth in clauses “(a)” and “(b)” of this footnote are treated as converted into Class A common stock only for the purpose of computing the percentage ownership of Fritz Prinz. |

|

|

(5) |

Each share of Class A common stock is entitled to one vote and each share of Class B common stock is entitled to ten votes. There were 59,874,114 shares of Class B common stock outstanding as of October 20, 2023, as reported in the Issuer’s Quarterly Report on Form 10-Q filed with the SEC on October 27, 2023, including the 10,087,631 shares of Class B common stock beneficially owned by Fritz Prinz as set forth in footnote “(2)” above. The percentage reported does not reflect the ten for one voting power of the Class B common stock because these shares are treated as converted into Class A common stock for the purpose of this report. |

Explanatory Note

This Amendment No. 1 to Schedule 13D (“Amendment No. 1”) is being filed on behalf of the undersigned (the “Reporting Person”), to amend the Schedule 13D filed with the SEC on December 7, 2020 (the “Schedule 13D”). This Amendment No. 1 is being filed to disclose that the Reporting Person has ceased to be the beneficial owner of more than five percent of the outstanding shares of Class A common stock of the Issuer. This Amendment No. 1 is the final amendment to the Schedule 13D and constitutes an exit filing for the Reporting Person. Except as specifically amended and supplemented by this Amendment No. 1, the Schedule 13D remains in full force and effect. All capitalized terms contained herein but not otherwise defined shall have the meaning ascribed to such terms in the Schedule 13D. This Amendment No. 1 constitutes a late filing due to inadvertent administrative error.

Item 3. Source and Amount of Funds or Other Consideration.

Item 3 of the Schedule 13D is hereby amended and supplemented as follows:

As previously disclosed in Form 4s filed by the Reporting Person with the SEC on July 26, 2021, September 17, 2021, August 3, 2021, December 9, 2021, June 10, 2022, January 26, 2023, March 8, 2023 and April 7, 2023, (i) the Reporting Person and Trusts converted an aggregate of 3,396,910 shares of Class B common stock into 3,396,910 shares of Class A common stock, (ii) the Issuer granted the Reporting Person RSUs issuable for an aggregate of 258,164 shares of Class A common stock upon the vesting of such RSUs, and (iii) the Reporting Person transferred shares of common stock to and between trusts for estate planning purposes.

Item 4. Purpose of Transaction.

Item 4 of the Schedule 13D is hereby amended and supplemented as follows:

On March 14, 2023, the Reporting Person adopted a Rule 10b5-1 trading arrangement providing for the sale from time to time of an aggregate of up to 2,276,828 shares of our Class A common stock. The trading arrangement is intended to satisfy the affirmative defense in Rule 10b5-1(c) (the “Trading Plan”). The duration of the Trading Plan is until June 20, 2024, or earlier if all transactions under the Trading Plan are completed.

Item 5. Interest in Securities of the Issuer.

Item 5 of the Schedule 13D is hereby amended and supplemented as follows:

(a) As of the date hereof, the Reporting Person beneficially owns an aggregate of 11,642,305 shares of Class A common stock, on an as if converted and/or issued basis, or 2.6% of the Issuer’s outstanding shares of Class A common stock. The beneficial ownership percentages used in this Schedule are calculated based on a total of 429,687,172 shares of Class A common stock outstanding as of October 20, 2023 plus 10,321,489 shares from the as if converted and/or issued shares of Class B common stock and RSUs as of October 20, 2023. A portion of the RSUs vest each quarter and a portion of the RSUs vest upon achievement of certain performance milestones, subject to Fritz Prinz’s continued service as of each vesting date.

(b) Fritz Prinz has sole voting and dispositive power with respect to 258,164 shares of Class A common stock issued or issuable upon the vesting of RSUs. Fritz Prinz shares voting and dispositive power with respect to 777,906 shares of Class A common stock and 7,172,185 shares of Class B common stock beneficially owned by Prinz Family Trust, 518,604 shares of Class A common stock and 2,915,446 shares of Class B common stock beneficially owned by the Trusts.

(c) The Reporting Person has not effected any transactions in the Issuer’s common stock during the past 60 days.

(d) Except as disclosed in Item 2, no person is known to the Reporting Person to have the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, any securities covered by this Schedule.

(e) May 7, 2021.

Item 6. Contracts, Arrangements, Understandings or Relationships With Respect to Securities of the Issuer.

Item 6 of the Schedule 13D is hereby amended and supplemented as follows:

The information set forth in Item 4 regarding the Trading Plan is hereby incorporated by reference into this Item 6.

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Date: February 14, 2024

|

|

|

|

|

|

Fritz Prinz |

|

|

By: |

|

/s/ Fritz Prinz |

Name: |

|

Fritz Prinz |

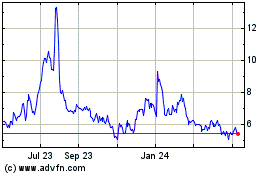

Quantumscape (NYSE:QS)

Historical Stock Chart

From Mar 2024 to Apr 2024

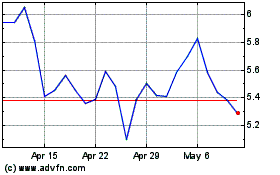

Quantumscape (NYSE:QS)

Historical Stock Chart

From Apr 2023 to Apr 2024