UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D/A

(Rule 13D-101)

Under the Securities Exchange Act of 1934

(Amendment No. 1)*

Body and Mind

Inc.

(Name of Issuer)

Common Stock,

par value $0.0001 per share

(Title of Class of Securities)

09689V100

(CUSIP Number)

Bengal Impact Partners,

LLC

c/o Joshua Rosen

6608 E. 2nd

St.

Scottsdale, AZ 85251

(312) 593-3311

Copies to:

Marc J. Adesso, Esq.

Akerman LLP

500 West 5th Street,

Suite 1210

Austin, TX 78701

(737) 999-7110

(Name, address and telephone

number of person authorized to receive notices and communications)

February 9,

2024

(Date of event which requires filing of this

statement)

If the filing person has previously filed a statement

on Schedule 13G to report the acquisition which is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e),

Rule 13d-1(f) or Rule 13d-1(g), check the following box ☐.

The information required on the remainder of this

cover page shall not be deemed to be “filed” for purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”)

or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see

the Notes).

CUSIP No. 09689V100

| 1 |

|

NAME OF REPORTING PERSONS

Bengal Impact Partners, LLC |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY |

| 4 |

|

SOURCE OF FUNDS

OO |

| 5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED

PURSUANT TO ITEM 2(d) or 2(e)

¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE VOTING POWER

56,864,678 Shares (1)(2)(3)(4) |

| 8 |

SHARED VOTING POWER

0 Shares |

| 9 |

SOLE DISPOSITIVE POWER

56,864,678 Shares (1)(2)(3)(4) |

| 10 |

SHARED DISPOSITIVE POWER

0 Shares |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING

PERSON

56,864,678 Shares (1)(2)(3)(4) |

| 12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES

CERTAIN SHARES (See Instructions)

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW

(11)

29.9% (5) |

| 14 |

|

TYPE OF REPORTING PERSON

OO |

(1) Unless otherwise specified, all Share

(as defined below) transaction prices referred to in this Schedule 13D are in Canadian dollars.

(2) On or around December 31, 2021, Bengal Catalyst

Fund, LP (the “Fund”) acquired 250,000 common shares, par value USD$0.0001 per share, (the “Shares”) of Body and

Mind Inc. (the “Company”) in a private placement transaction at a price of $0.30 per Share pursuant

to a Securities Purchase Agreement dated as of December 30, 2021 with the seller named therein. On February 3, 2022, the Fund acquired

3,400,000 Shares in a block trade with a broker at a price of $0.24 per Share. Between January 24, 2022 and April 14, 2022, the Fund acquired

3,509,310 Shares in a series of open market transactions, at prices between $0.22 and $0.34 per Share. On May 8, 2023, the Fund purchased

671,642 Shares in a private transaction. The Fund is managed by Bengal Impact Partners, LLC (the “Manager”). The Manager has

sole investment control and voting power over securities held by the Fund. On December 19, 2022, BAM I, a Series of Bengal Catalyst Fund

SPV, LP (the “Series”), purchased from the Company (i) 8% five year convertible debentures in the principal amount of USD$2,750,000,

the principal and accrued interest of which are convertible into Shares at a price of USD$0.10 per Share (“BAM Notes”), and

(ii) four year warrants exercisable for 13,750,000 Shares, at a price of USD$0.10 per Share (“BAM Warrants”). The Manager

acts as general partner of the Series, and has sole investment control and voting power over securities held by the Series. On December

23, 2022, the Company issued the Manager 1,333,333 Shares (the “CPNJ Shares”) in a transaction described further in Item 4

hereof. On February 9, 2024, the Company issued 2,700,393 Shares (the “SASA Shares”) to the Manager pursuant to that certain

Strategic Advisory Services Agreement, dated January 6, 2023, by and between the Company and the Manager (as described further in Item

3 and Item 6 hereof). Except for the CPNJ Shares and the SASA Shares, the Manager disclaims beneficial ownership of the securities reported

herein, except to the extent of its pecuniary interest therein.

(3) Pursuant to that certain Nominee Agreement

dated February 3, 2022, by and among Mindset Value Fund LP, a Delaware limited liability company, Mindset Value Wellness Fund LP, a Delaware

limited partnership, Mindset Capital LLC, a Delaware limited liability company (collectively, the “Mindset Entities”), and

the Manager, the Manager has sole voting and dispositive control over an aggregate of (i) 8% five year convertible debentures in the principal

amount of USD$250,000, the principal and accrued interest of which are convertible into Shares at a price of USD$0.10 per Share (“Mindset

Notes”), and (ii) four year warrants exercisable for 1,250,000 Shares, at a price of USD$0.10 per Share (“Mindset Warrants”)

owned by the Mindset Entities.

(4) Does not take into account any beneficial

ownership limitations set forth in the BAM Notes, Mindset Notes, BAM Warrants, and Mindset Warrants, which were waived in February 2022.

Also excludes Shares issuable at the election of the Series upon conversion of accrued interest (both past and future) into Shares.

(5) Based on 144,986,000

Shares issued and outstanding as of December 15, 2023, as reported in the Company’s

Quarterly Report on Form 10-Q, filed with the United States Securities and Exchange Commission on December

20, 2023.

CUSIP No. 09689V100

| 1 |

|

NAME OF REPORTING PERSONS

Bengal Catalyst Fund, LP |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY |

| 4 |

|

SOURCE OF FUNDS

WC |

| 5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED

PURSUANT TO ITEM 2(d) or 2(e)

¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE VOTING POWER

0 Shares |

| 8 |

SHARED VOTING POWER

7,830,952 Shares (1) |

| 9 |

SOLE DISPOSITIVE POWER

0 Shares |

| 10 |

SHARED DISPOSITIVE POWER

7,830,952 Shares (1) |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING

PERSON

7,830,952 Shares (1) |

| 12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES

CERTAIN SHARES (See Instructions)

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW

(11)

5.4% (2) |

| 14 |

|

TYPE OF REPORTING PERSON

PN |

(1) On or around December 31, 2021, Bengal

Catalyst Fund, LP (the “Fund”) acquired 250,000 common shares, par value USD$0.0001 per share, (the “Shares”)

of Body and Mind Inc. (the “Company”) in a private placement transaction at a price of $0.30 per Share pursuant to a Securities

Purchase Agreement dated as of December 30, 2021 with the seller named therein. On February 3, 2022, the Fund acquired 3,400,000 Shares

in a block trade with a broker at a price of $0.24 per Share. Between January 24, 2022 and April 14, 2022, the Fund acquired 3,509,310

Shares in a series of open market transactions, at prices between $0.22 and $0.34 per Share. On May 8, 2023, the Fund purchased 671,642

Shares in a private transaction. The Fund is managed by Bengal Impact Partners, LLC (the “Manager”). The Manager has sole

investment control and voting power over securities held by the Fund. The Manager disclaims beneficial ownership of the Shares held by

the Fund, except to the extent of its pecuniary interest therein.

(2) Based on 144,986,000

Shares issued and outstanding as of December 15, 2023, as reported in the Company’s

Quarterly Report on Form 10-Q, filed with the United States Securities and Exchange Commission on December

20, 2023.

CUSIP No. 09689V100

| 1 |

|

NAME OF REPORTING PERSONS

BAM I, a Series of Bengal Catalyst Fund SPV, LP |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY |

| 4 |

|

SOURCE OF FUNDS

WC |

| 5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED

PURSUANT TO ITEM 2(d) or 2(e)

¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE VOTING POWER

0 Shares |

| 8 |

SHARED VOTING POWER

41,250,000 Shares (1)(2) |

| 9 |

SOLE DISPOSITIVE POWER

0 Shares |

| 10 |

SHARED DISPOSITIVE POWER

41,250,000 Shares (1)(2) |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING

PERSON

41,250,000 Shares (1)(2) |

| 12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES

CERTAIN SHARES (See Instructions)

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW

(11)

22.1% (3) |

| 14 |

|

TYPE OF REPORTING PERSON

PN |

(1) On December 19, 2022, BAM I, a Series

of Bengal Catalyst Fund SPV, LP (the “Series”), purchased from the Company (i) BAM Notes in the principal amount of USD$2,750,000,

and (ii) BAM Warrants exercisable for 13,750,000 Shares. The Manager acts as general partner of the Series, and has sole investment control

and voting power over securities held by the Series. The Manager disclaims beneficial ownership of the Shares held by the Series, except

to the extent of its pecuniary interest therein.

(2) Does not take into account any beneficial

ownership limitations set forth in the BAM Notes and BAM Warrants, which were waived in February 2022. Also excludes Shares issuable at

the election of the Series upon conversion of accrued interest (both past and future) into Shares.

(3) Based on 144,986,000

Shares issued and outstanding as of December 15, 2023, as reported in the Company’s

Quarterly Report on Form 10-Q, filed with the United States Securities and Exchange Commission on December

20, 2023.

CUSIP No. 09689V100

| 1 |

|

NAME OF REPORTING PERSONS

Joshua Rosen |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY |

| 4 |

|

SOURCE OF FUNDS

OO |

| 5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED

PURSUANT TO ITEM 2(d) or 2(e)

¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Arizona |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE VOTING POWER

6,944,444 Shares (1) |

| 8 |

SHARED VOTING POWER

56,864,678 Shares (2)(3)(4) |

| 9 |

SOLE DISPOSITIVE POWER

6,944,444 Shares (1) |

| 10 |

SHARED DISPOSITIVE POWER

56,864,678 Shares (2)(3)(4) |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING

PERSON

63,809,122 Shares (1)(2)(3)(4) |

| 12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES

CERTAIN SHARES (See Instructions)

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW

(11)

33.6% (5) |

| 14 |

|

TYPE OF REPORTING PERSON

IN |

(1) On December 23, 2022, the Company issued

Mr. Rosen 6,944,444 Shares in a transaction described further in Item 4 hereof. Except for these Shares held in his name directly, Mr.

Rosen disclaims beneficial ownership of the securities reported herein, except to the extent of his pecuniary interest therein.

(2) On or around December 31, 2021, Bengal Catalyst

Fund, LP (the “Fund”) acquired 250,000 common shares, par value USD$0.0001 per share, (the “Shares”) of Body and

Mind Inc. (the “Company”) in a private placement transaction at a price of $0.30 per Share pursuant to a Securities Purchase

Agreement dated as of December 30, 2021 with the seller named therein. On February 3, 2022, the Fund acquired 3,400,000 Shares in a block

trade with a broker at a price of $0.24 per Share. Between January 24, 2022 and April 14, 2022, the Fund acquired 3,509,310 Shares in

a series of open market transactions, at prices between $0.22 and $0.34 per Share. On May 8, 2023, the Fund purchased 671,642 Shares in

a private transaction. The Fund is managed by Bengal Impact Partners, LLC (the “Manager”). The Manager has sole investment

control and voting power over securities held by the Fund. On December 19, 2022 the Series purchased from the Company (i) BAM Notes in

the principal amount of USD$2,750,000, and (ii) BAM Warrants exercisable for 13,750,000 Shares. The Manager acts as general partner of

the Series, and has sole investment control and voting power over securities held by the Series. On December 23, 2022, the Company issued

the Manager 1,333,333 CPNJ Shares and Mr. Rosen 6,944,444 Shares as part of the same transaction (as described further in Item 4 hereof).

On February 9, 2024, the Company issued 2,700,393 Shares to the Manager pursuant to that certain Strategic Advisory Services Agreement,

dated January 6, 2023, by and between the Company and the Manager (as described further in Item 3 and Item 6 hereof). Mr. Rosen shares

investment control and voting power over the Manager with Sanjay Tolia.

(3) Pursuant to that certain Nominee Agreement

dated February 3, 2022, by and among the Mindset Entities and the Manager, the Manager has sole voting and dispositive control over an

aggregate of (i) Mindset Notes in the principal amount of USD$250,000, and (ii) Mindset Warrants exercisable for 1,250,000 Shares owned

by the Mindset Entities. Mr. Rosen shares investment control and voting power over the Manager with Mr. Tolia.

(4) Does not take into account any beneficial

ownership limitations set forth in the BAM Notes, Mindset Notes, BAM Warrants, and Mindset Warrants, which were waived in February 2022.

Also excludes Shares issuable at the election of the Series upon conversion of accrued interest (both past and future) into Shares.

(5) Based on 144,986,000

Shares issued and outstanding as of December 15, 2023, as reported in the Company’s

Quarterly Report on Form 10-Q, filed with the United States Securities and Exchange Commission on December

20, 2023.

CUSIP No. 09689V100

| 1 |

|

NAME OF REPORTING PERSONS

Sanjay Tolia |

| 2 |

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

(a) ¨ (b) ¨ |

| 3 |

|

SEC USE ONLY |

| 4 |

|

SOURCE OF FUNDS

OO |

| 5 |

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED

PURSUANT TO ITEM 2(d) or 2(e)

¨ |

| 6 |

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Florida |

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH |

7 |

SOLE VOTING POWER

666,667 Shares (1) |

| 8 |

SHARED VOTING POWER

56,864,678 Shares (2)(3)(4) |

| 9 |

SOLE DISPOSITIVE POWER

666,667 Shares (1) |

| 10 |

SHARED DISPOSITIVE POWER

56,864,678 Shares (2)(3)(4) |

| 11 |

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING

PERSON

57,531,345 Shares (1)(2)(3)(4) |

| 12 |

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES

CERTAIN SHARES (See Instructions)

¨ |

| 13 |

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW

(11)

30.3% (5) |

| 14 |

|

TYPE OF REPORTING PERSON

IN |

(1) On December 23, 2022, the Company issued

Mr. Tolia 666,667 Shares in a transaction described further in Item 4 hereof. Except for these Shares held in his name directly, Mr. Tolia

disclaims beneficial ownership of the securities reported herein, except to the extent of his pecuniary interest therein.

(2) On or around December 31, 2021, Bengal Catalyst

Fund, LP (the “Fund”) acquired 250,000 common shares, par value USD$0.0001 per share, (the “Shares”) of Body and

Mind Inc. (the “Company”) in a private placement transaction at a price of $0.30 per Share pursuant to a Securities Purchase

Agreement dated as of December 30, 2021 with the seller named therein. On February 3, 2022, the Fund acquired 3,400,000 Shares in a block

trade with a broker at a price of $0.24 per Share. Between January 24, 2022 and April 14, 2022, the Fund acquired 3,509,310 Shares in

a series of open market transactions, at prices between $0.22 and $0.34 per Share. On May 8, 2023, the Fund purchased 671,642 Shares in

a private transaction. The Fund is managed by Bengal Impact Partners, LLC (the “Manager”). The Manager has sole investment

control and voting power over securities held by the Fund. On December 19, 2022 the Series purchased from the Company (i) BAM Notes in

the principal amount of USD$2,750,000, and (ii) BAM Warrants exercisable for 13,750,000 Shares, at a price of USD$0.10 per Share. The

Manager acts as general partner of the Series, and has sole investment control and voting power over securities held by the Series. On

December 23, 2022, the Company issued the Manager 1,333,333 CPNJ Shares and Mr. Tolia 666,667 Shares as part of the same transaction (as

described further in Item 4 hereof). On February 9, 2024, the Company issued 2,700,393 Shares to the Manager pursuant to that certain

Strategic Advisory Services Agreement, dated January 6, 2023, by and between the Company and the Manager (as described further in Item

3 and Item 6 hereof). Mr. Tolia shares investment control and voting power over the Manager with Mr. Rosen.

(3) Pursuant to that certain Nominee Agreement

dated February 3, 2022, by and among the Mindset Entities and the Manager, the Manager has sole voting and dispositive control over an

aggregate of (i) Mindset Notes in the principal amount of USD$250,000, and (ii) Mindset Warrants exercisable for 1,250,000 Shares owned

by the Mindset Entities. Mr. Tolia shares investment control and voting power over the Manager with Mr. Rosen.

(4) Does not take into account any beneficial

ownership limitations set forth in the BAM Notes, Mindset Notes, BAM Warrants, and Mindset Warrants, which were waived in February 2022.

Also excludes Shares issuable at the election of the Series upon conversion of accrued interest (both past and future) into Shares.

(5) Based on 144,986,000

Shares issued and outstanding as of December 15, 2023, as reported in the Company’s

Quarterly Report on Form 10-Q, filed with the United States Securities and Exchange Commission on December

20, 2023.

This Amendment No. 1 to Schedule 13D amends

and supplements the statement on Schedule 13D jointly filed by (i) Bengal Impact Partners, LLC, a Delaware limited liability company

(the “Manager”), (ii) Bengal Catalyst Fund, LP, a Delaware limited partnership (the “Fund”), (iii) BAM I, a

Series of Bengal Catalyst Fund SPV, LP, a Delaware series limited partnership, (iv) Joshua Rosen, an Arizona resident, and (v)

Sanjay Tolia, a California resident, with the United States Securities and Exchange Commission on April 3, 2023 (as may be amended

from time to time, this “Schedule 13D”), relating to the common shares, USD$0.0001 par value per share (the

“Shares”), of Body and Mind Inc. (the “Company”). Except to the extent supplemented or amended by the

information contained in this Amendment No. 1, the Schedule 13D remains in full force and effect. Capitalized terms used herein

without definition have the respective meanings ascribed to them in the Schedule 13D.

ITEM 3. Source and Amount of Funds or Other Consideration.

Item 3 is hereby amended to add the following:

On May 8, 2023, the Fund purchased 671,642 Shares

in a private transaction. The Fund’s source of funds for the transaction was working capital.

On January 6, 2023, the Company and its subsidiaries

entered into that certain Strategic Advisory Services Agreement (the “Strategic Advisory Services Agreement”) with the Manager,

pursuant to which the Manager will provide various strategic consulting services to the Company in exchange for consideration of USD$240,000

to be paid annually in the following manner: (i) USD$60,000 in cash; and (ii) USD$180,000 in cash, warrants, or Shares at the Company’s

discretion.

On February 9, 2024, the Company issued 2,700,393

Shares to the Manager based on a value of USD$180,000 pursuant to the Strategic Advisory Services Agreement.

ITEM 5. Interest in Securities of the Issuer.

Item 5 is hereby amended and restated in its entirety

as follows:

(a) and (b) The information contained on the cover

pages of this Schedule 13D is incorporated herein by reference.

ITEM 6. Contracts, Arrangements, Understandings

or Relationships with Respect to Securities of the Issuer.

Item 6 is hereby amended and restated in its entirety

as follows:

On January 6, 2023, the Company and its subsidiaries

entered into that certain Strategic Advisory Services Agreement (the “Strategic Advisory Services Agreement”) with the Manager,

pursuant to which the Manager will provide various strategic consulting services to the Company in exchange for consideration of USD$240,000

to be paid annually in the following manner: (i) USD$60,000 in cash; and (ii) USD$180,000 in cash, warrants, or Shares at the Company’s

discretion.

On February 9, 2024, the Company issued 2,700,393

Shares to the Manager based on a value of USD$180,000 pursuant to the Strategic Advisory Services Agreement.

Except as set forth in this

Statement, to the best knowledge of the Reporting Persons, there are no other contracts, arrangements, understandings or relationships

(legal or otherwise) among the persons named in Item 2 or listed on Schedule I hereto, and between such persons and any person, with

respect to any securities of the Company, including but not limited to, transfer or voting of any of the securities of the Company, joint

ventures, loan or option arrangements, puts or calls, guarantees or profits, division of profits or loss, or the giving or withholding

of proxies, or a pledge or contingency the occurrence of which would give another person voting power over the securities of the Company.

SIGNATURES

After reasonable inquiry and to the best of my knowledge

and belief, I certify that the information set forth in this statement is true, complete and correct.

| |

Bengal Impact Partners, LLC (1) |

| |

|

|

| Dated: February 13, 2024 |

By: |

/s/ Joshua Rosen |

| |

Name: |

Joshua Rosen |

| |

Title: |

Managing Partner

|

| |

Bengal Catalyst Fund, LP (1) |

| |

|

|

| Dated: February 13, 2024 |

By: |

/s/ Joshua Rosen |

| |

Name: |

Joshua Rosen |

| |

Title: |

Managing Partner of Bengal Impact Partners, LLC,

Bengal Catalyst Fund, LP’s Investment Manager

|

| |

BAM I, a Series of Bengal Catalyst Fund SPV, LP (1) |

| |

|

|

| Dated: February 13, 2024 |

By: |

/s/ Joshua Rosen |

| |

Name: |

Joshua Rosen |

| |

Title: |

Managing Partner of Bengal Impact Partners, LLC, BAM I, a Series of Bengal Catalyst Fund SPV, LP’s General Partner |

| |

|

|

| Dated: February 13, 2024 |

By: |

/s/ Joshua

Rosen(1) |

| |

Name: |

Joshua Rosen |

| |

Title: |

Joshua Rosen, Individually

|

| Dated: February 13, 2024 |

By: |

/s/ Sanjay

Tolia(1) |

| |

Name: |

Sanjay Tolia |

| |

Title: |

Sanjay Tolia, Individually |

|

|

|

|

| (1) | This Amendment is being filed

jointly by the Reporting Persons pursuant to the Joint Filing Agreement dated March 21, 2023, and included with the signature page to

the Reporting Persons’ Schedule 13D filed with respect to the Issuer on March 21, 2023, SEC File No. 005-90736, and incorporated

by reference herein. |

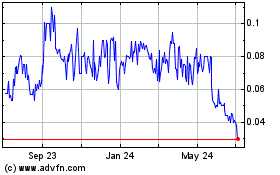

Body and Mind (QB) (USOTC:BMMJ)

Historical Stock Chart

From Mar 2024 to Apr 2024

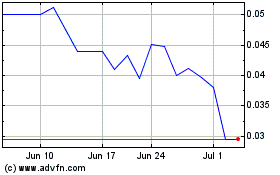

Body and Mind (QB) (USOTC:BMMJ)

Historical Stock Chart

From Apr 2023 to Apr 2024