Form SC 13G/A - Statement of acquisition of beneficial ownership by individuals: [Amend]

February 13 2024 - 4:30PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

SCHEDULE 13G

Under the Securities

Exchange Act of 1934

(Amendment No. 1)

VNET Group, Inc.

(Name of Issuer)

Class A Ordinary

Shares, par value US$0.00001 per share

(Title of Class of

Securities)

90138A103**

(CUSIP Number)

December 31, 2023

(Date of Event Which Requires

Filing of this Statement)

Check the appropriate box to designate the rule pursuant

to which this Schedule is filed:

| |

¨ | Rule |

13d-1(b) |

| |

| |

|

| |

x | Rule |

13d-1(c) |

| |

| |

|

| |

¨ | Rule |

13d-1(d) |

* The remainder of this cover page shall

be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any

subsequent amendment containing information which would alter the disclosures provided in a prior cover page. The information required

in the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities

Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all

other provisions of the Act (however, see the Notes).

**

There is no CUSIP number assigned to the Ordinary Shares. CUSIP number 90138A103 has been assigned to the American Depositary

Shares (“ADSs”) of the Issuer, each ADS representing six (6) Class A Ordinary Shares, which are quoted on the Nasdaq

Global Market under the symbol “VNET”.

| CUSIP No. 90138A103 | Schedule 13G | |

| 1 |

Names of Reporting Persons

Bold Ally (Cayman) Limited |

| 2 |

Check

the Appropriate Box if a Member of a Group |

| |

(a) |

¨ |

| |

(b) |

x |

| 3 |

SEC

Use Only |

| 4 |

Citizen or Place of Organization

Cayman Islands |

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

5 |

Sole Voting Power

0 |

| 6 |

Shared Voting Power

61,386,919 |

| 7 |

Sole Dispositive Power

0 |

| 8 |

Shared Dispositive Power

61,386,919 |

| 9 |

Aggregate Amount Beneficially Owned by Each Reporting Person

61,386,919 |

| 10 |

Check

if the Aggregate Amount in Row (9) Excludes Certain Shares ¨

Not Applicable |

| 11 |

Percent of Class Represented by Amount

in Row 9

6.9% |

| 12 |

Type of Reporting Person

FI |

| |

|

|

|

|

| CUSIP No. 90138A103 | Schedule 13G | |

| 1 |

Names of Reporting Persons

CP5 Hold Co 2 Limited |

| 2 |

Check

the Appropriate Box if a Member of a Group |

| |

(a) |

¨ |

| |

(b) |

x |

| 3 |

SEC

Use Only |

| 4 |

Citizen or Place of Organization

British Virgin Islands |

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

5 |

Sole Voting Power

0 |

| 6 |

Shared Voting Power

61,386,919 |

| 7 |

Sole Dispositive Power

0 |

| 8 |

Shared Dispositive Power

61,386,919 |

| 9 |

Aggregate Amount Beneficially Owned by Each Reporting Person

61,386,919 |

| 10 |

Check

if the Aggregate Amount in Row (9) Excludes Certain Shares ¨

Not Applicable |

| 11 |

Percent of Class Represented by Amount

in Row 9

6.9% |

| 12 |

Type of Reporting Person

FI |

| |

|

|

|

|

| CUSIP No. 90138A103 | Schedule 13G | |

| 1 |

Names of Reporting Persons

CP5 Hold Co 1 Limited |

| 2 |

Check

the Appropriate Box if a Member of a Group |

| |

(a) |

¨ |

| |

(b) |

x |

| 3 |

SEC

Use Only |

| 4 |

Citizen or Place of Organization

British Virgin Islands |

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

5 |

Sole Voting Power

0 |

| 6 |

Shared Voting Power

61,386,919 |

| 7 |

Sole Dispositive Power

0 |

| 8 |

Shared Dispositive Power

61,386,919 |

| 9 |

Aggregate Amount Beneficially Owned by Each Reporting Person

61,386,919 |

| 10 |

Check

if the Aggregate Amount in Row (9) Excludes Certain Shares ¨

Not Applicable |

| 11 |

Percent of Class Represented by Amount

in Row 9

6.9% |

| 12 |

Type of Reporting Person

FI |

| |

|

|

|

|

| CUSIP No. 90138A103 | Schedule 13G | |

| 1 |

Names of Reporting Persons

SSG Capital Partners V, L.P. |

| 2 |

Check

the Appropriate Box if a Member of a Group |

| |

(a) |

¨ |

| |

(b) |

x |

| 3 |

SEC

Use Only |

| 4 |

Citizen or Place of Organization

Cayman Islands |

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

5 |

Sole Voting Power

0 |

| 6 |

Shared Voting Power

61,386,919 |

| 7 |

Sole Dispositive Power

0 |

| 8 |

Shared Dispositive Power

61,386,919 |

| 9 |

Aggregate Amount Beneficially Owned by Each Reporting Person

61,386,919 |

| 10 |

Check

if the Aggregate Amount in Row (9) Excludes Certain Shares ¨

Not Applicable |

| 11 |

Percent of Class Represented by Amount

in Row 9

6.9% |

| 12 |

Type of Reporting Person

FI |

| |

|

|

|

|

| CUSIP No. 90138A103 | Schedule 13G | |

| 1 |

Names of Reporting Persons

Ares Management (Asia) Cayman Limited, f/k/a Ares SSG Capital

Management Limited |

| 2 |

Check

the Appropriate Box if a Member of a Group |

| |

(a) |

¨ |

| |

(b) |

x |

| 3 |

SEC

Use Only |

| 4 |

Citizen or Place of Organization

Cayman Islands |

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

5 |

Sole Voting Power

0 |

| 6 |

Shared Voting Power

61,386,919 |

| 7 |

Sole Dispositive Power

0 |

| 8 |

Shared Dispositive Power

61,386,919 |

| 9 |

Aggregate Amount Beneficially Owned by Each Reporting Person

61,386,919 |

| 10 |

Check

if the Aggregate Amount in Row (9) Excludes Certain Shares ¨

Not Applicable |

| 11 |

Percent of Class Represented by Amount

in Row 9

6.9% |

| 12 |

Type of Reporting Person

FI |

| |

|

|

|

|

| CUSIP No. 90138A103 | Schedule 13G | |

| 1 |

Names of Reporting Persons

Ares Management Asia (Holdings) Limited, f/k/a Ares SSG Capital

Holdings Limited |

| 2 |

Check

the Appropriate Box if a Member of a Group |

| |

(a) |

¨ |

| |

(b) |

x |

| 3 |

SEC

Use Only |

| 4 |

Citizen or Place of Organization

Cayman Islands |

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

5 |

Sole Voting Power

0 |

| 6 |

Shared Voting Power

61,386,919 |

| 7 |

Sole Dispositive Power

0 |

| 8 |

Shared Dispositive Power

61,386,919 |

| 9 |

Aggregate Amount Beneficially Owned by Each Reporting Person

61,386,919 |

| 10 |

Check

if the Aggregate Amount in Row (9) Excludes Certain Shares ¨

Not Applicable |

| 11 |

Percent of Class Represented by Amount

in Row 9

6.9% |

| 12 |

Type of Reporting Person

FI |

| |

|

|

|

|

| CUSIP No. 90138A103 | Schedule 13G | |

| 1 |

Names of Reporting Persons

Ares Management Asia Holdings, L.P., f/k/a Ares SSG Holdings,

L.P. |

| 2 |

Check

the Appropriate Box if a Member of a Group |

| |

(a) |

¨ |

| |

(b) |

x |

| 3 |

SEC

Use Only |

| 4 |

Citizen or Place of Organization

Delaware |

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

5 |

Sole Voting Power

0 |

| 6 |

Shared Voting Power

61,386,919 |

| 7 |

Sole Dispositive Power

0 |

| 8 |

Shared Dispositive Power

61,386,919 |

| 9 |

Aggregate Amount Beneficially Owned by Each Reporting Person

61,386,919 |

| 10 |

Check

if the Aggregate Amount in Row (9) Excludes Certain Shares ¨

Not Applicable |

| 11 |

Percent of Class Represented by Amount

in Row 9

6.9% |

| 12 |

Type of Reporting Person

PN |

| |

|

|

|

|

| CUSIP No. 90138A103 | Schedule 13G | |

| 1 |

Names of Reporting Persons

AS Holdings GP LLC |

| 2 |

Check

the Appropriate Box if a Member of a Group |

| |

(a) |

¨ |

| |

(b) |

x |

| 3 |

SEC

Use Only |

| 4 |

Citizen or Place of Organization

Delaware |

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

5 |

Sole Voting Power

0 |

| 6 |

Shared Voting Power

61,386,919 |

| 7 |

Sole Dispositive Power

0 |

| 8 |

Shared Dispositive Power

61,386,919 |

| 9 |

Aggregate Amount Beneficially Owned by Each Reporting Person

61,386,919 |

| 10 |

Check

if the Aggregate Amount in Row (9) Excludes Certain Shares ¨

Not Applicable |

| 11 |

Percent of Class Represented by Amount

in Row 9

6.9% |

| 12 |

Type of Reporting Person

OO |

| |

|

|

|

|

| CUSIP No. 90138A103 | Schedule 13G | |

| 1 |

Names of Reporting Persons

AS Holdings LP Ltd. |

| 2 |

Check

the Appropriate Box if a Member of a Group |

| |

(a) |

¨ |

| |

(b) |

x |

| 3 |

SEC

Use Only |

| 4 |

Citizen or Place of Organization

Cayman Islands |

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

5 |

Sole Voting Power

0 |

| 6 |

Shared Voting Power

61,386,919 |

| 7 |

Sole Dispositive Power

0 |

| 8 |

Shared Dispositive Power

61,386,919 |

| 9 |

Aggregate Amount Beneficially Owned by Each Reporting Person

61,386,919 |

| 10 |

Check

if the Aggregate Amount in Row (9) Excludes Certain Shares ¨

Not Applicable |

| 11 |

Percent of Class Represented by Amount

in Row 9

6.9% |

| 12 |

Type of Reporting Person

FI |

| |

|

|

|

|

| CUSIP No. 90138A103 | Schedule 13G | |

| 1 |

Names of Reporting Persons

Ares Holdings L.P. |

| 2 |

Check

the Appropriate Box if a Member of a Group |

| |

(a) |

¨ |

| |

(b) |

x |

| 3 |

SEC

Use Only |

| 4 |

Citizen or Place of Organization

Delaware |

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

5 |

Sole Voting Power

0 |

| 6 |

Shared Voting Power

61,386,919 |

| 7 |

Sole Dispositive Power

0 |

| 8 |

Shared Dispositive Power

61,386,919 |

| 9 |

Aggregate Amount Beneficially Owned by Each Reporting Person

61,386,919 |

| 10 |

Check

if the Aggregate Amount in Row (9) Excludes Certain Shares ¨

Not Applicable |

| 11 |

Percent of Class Represented by Amount

in Row 9

6.9% |

| 12 |

Type of Reporting Person

PN |

| |

|

|

|

|

| CUSIP No. 90138A103 | Schedule 13G | |

| 1 |

Names of Reporting Persons

Ares Holdco LLC |

| 2 |

Check

the Appropriate Box if a Member of a Group |

| |

(a) |

¨ |

| |

(b) |

x |

| 3 |

SEC

Use Only |

| 4 |

Citizen or Place of Organization

Delaware |

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

5 |

Sole Voting Power

0 |

| 6 |

Shared Voting Power

61,386,919 |

| 7 |

Sole Dispositive Power

0 |

| 8 |

Shared Dispositive Power

61,386,919 |

| 9 |

Aggregate Amount Beneficially Owned by Each Reporting Person

61,386,919 |

| 10 |

Check

if the Aggregate Amount in Row (9) Excludes Certain Shares ¨

Not Applicable |

| 11 |

Percent of Class Represented by Amount

in Row 9

6.9% |

| 12 |

Type of Reporting Person

OO |

| |

|

|

|

|

| CUSIP No. 90138A103 | Schedule 13G | |

| 1 |

Names of Reporting Persons

Ares Management Corporation |

| 2 |

Check

the Appropriate Box if a Member of a Group |

| |

(a) |

¨ |

| |

(b) |

x |

| 3 |

SEC

Use Only |

| 4 |

Citizen or Place of Organization

Delaware |

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

5 |

Sole Voting Power

0 |

| 6 |

Shared Voting Power

61,386,919 |

| 7 |

Sole Dispositive Power

0 |

| 8 |

Shared Dispositive Power

61,386,919 |

| 9 |

Aggregate Amount Beneficially Owned by Each Reporting Person

61,386,919 |

| 10 |

Check

if the Aggregate Amount in Row (9) Excludes Certain Shares ¨

Not Applicable |

| 11 |

Percent of Class Represented by Amount

in Row 9

6.9% |

| 12 |

Type of Reporting Person

CO |

| |

|

|

|

|

| CUSIP No. 90138A103 | Schedule 13G | |

| 1 |

Names of Reporting Persons

Ares Voting LLC |

| 2 |

Check

the Appropriate Box if a Member of a Group |

| |

(a) |

¨ |

| |

(b) |

x |

| 3 |

SEC

Use Only |

| 4 |

Citizen or Place of Organization

Delaware |

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

5 |

Sole Voting Power

0 |

| 6 |

Shared Voting Power

61,386,919 |

| 7 |

Sole Dispositive Power

0 |

| 8 |

Shared Dispositive Power

61,386,919 |

| 9 |

Aggregate Amount Beneficially Owned by Each Reporting Person

61,386,919 |

| 10 |

Check

if the Aggregate Amount in Row (9) Excludes Certain Shares ¨

Not Applicable |

| 11 |

Percent of Class Represented by Amount

in Row 9

6.9% |

| 12 |

Type of Reporting Person

OO |

| |

|

|

|

|

| CUSIP No. 90138A103 | Schedule 13G | |

| 1 |

Names of Reporting Persons

Ares Management GP LLC |

| 2 |

Check

the Appropriate Box if a Member of a Group |

| |

(a) |

¨ |

| |

(b) |

x |

| 3 |

SEC

Use Only |

| 4 |

Citizen or Place of Organization

Delaware |

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

5 |

Sole Voting Power

0 |

| 6 |

Shared Voting Power

61,386,919 |

| 7 |

Sole Dispositive Power

0 |

| 8 |

Shared Dispositive Power

61,386,919 |

| 9 |

Aggregate Amount Beneficially Owned by Each Reporting Person

61,386,919 |

| 10 |

Check

if the Aggregate Amount in Row (9) Excludes Certain Shares ¨

Not Applicable |

| 11 |

Percent of Class Represented by Amount

in Row 9

6.9% |

| 12 |

Type of Reporting Person

OO |

| |

|

|

|

|

| CUSIP No. 90138A103 | Schedule 13G | |

| 1 |

Names of Reporting Persons

Ares Partners Holdco LLC |

| 2 |

Check

the Appropriate Box if a Member of a Group |

| |

(a) |

¨ |

| |

(b) |

x |

| 3 |

SEC

Use Only |

| 4 |

Citizen or Place of Organization

Delaware |

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person With |

5 |

Sole Voting Power

0 |

| 6 |

Shared Voting Power

61,386,919 |

| 7 |

Sole Dispositive Power

0 |

| 8 |

Shared Dispositive Power

61,386,919 |

| 9 |

Aggregate Amount Beneficially Owned by Each Reporting Person

61,386,919 |

| 10 |

Check

if the Aggregate Amount in Row (9) Excludes Certain Shares ¨

Not Applicable |

| 11 |

Percent of Class Represented by Amount

in Row 9

6.9% |

| 12 |

Type of Reporting Person

OO |

| |

|

|

|

|

Item 1.

| |

(a) |

Name

of Issuer: |

| |

|

VNET

Group, Inc. |

| |

(b) |

Address

of Issuer’s Principal Executive Offices: |

| |

|

Guanjie

Building, Southeast 1st Floor 10# Jiuxianqiao East Road Chaoyang District Beijing 100016 The People’s Republic of China |

Item 2.

| |

(a) |

Name

of Person Filing: |

| |

|

Each of the following is hereinafter individually

referred to as a “Reporting Person” and collectively as the “Reporting Persons.” This

statement is filed on behalf of:

Bold Ally (Cayman) Limited (“Bold

Ally”)

CP5 Hold Co 2 Limited (“CP5 Hold

Co 2”)

CP5 Hold Co 1 Limited (“CP5 Hold

Co 1”)

SSG Capital Partners V, L.P. (“SSG

Capital Partners”)

Ares Management (Asia) Cayman Limited (“Ares

Management (Asia) Cayman”)

Ares Management Asia (Holdings) Limited (“Ares

Asia (Holdings) Limited”)

Ares Management Asia Holdings, L.P. (“Ares

Asia Holdings”)

AS Holdings GP LLC (“AS Holdings

GP”)

AS Holdings LP Ltd. (“AS Holdings

LP”)

Ares Holdings L.P. (“Ares Holdings”)

Ares Holdco LLC (“Ares Holdco”)

Ares Management Corporation (“Ares

Management”)

Ares Voting LLC (“Ares Voting”)

Ares Management GP LLC (“Ares Management

GP”)

Ares Partners Holdco LLC (“Ares

Partners”)

|

| |

(b) |

Address

or Principal Business Office: |

| |

|

The business address of Bold Ally, SSG Capital

Partners, Ares Management (Asia) Cayman, Ares Asia (Holdings) Limited and AS Holdings LP is Walkers Corporate Limited, 190 Elgin

Avenue, George Town, Grand Cayman KY1-9008, Cayman Islands.

The business address of CP5 Hold Co 2 and

CP5 Hold Co 1 is Vistra Corporate Services Centre, Wickhams Cay II, Road Town, Tortola, VG1110, British Virgin Islands.

The business address of each other Reporting

Person is c/o Ares Management LLC, 2000 Avenue of the Stars, 12th Floor, Los Angeles, California 90067.

|

| |

(c) |

Citizenship

of each Reporting Person is: |

| |

|

Bold Ally, SSG Capital Partners, Ares Management

(Asia) Cayman, Ares Asia (Holdings) Limited and AS Holdings LP are organized under the laws of the Cayman Islands.

CP5 Hold Co 2 and CP5 Hold Co 1 are organized

under the laws of the British Virgin Islands.

Each other Reporting Persons is organized

under the laws of the State of Delaware. |

| |

(d) |

Title

of Class of Securities: |

| |

|

Class A

ordinary shares, par value US$0.00001 per share (the “Class A Ordinary Shares”) |

| |

(e) |

CUSIP

Number: |

| |

|

There

is no CUSIP number assigned to the ordinary shares. CUSIP number 90138A103 has been assigned to the ADSs of the Issuer, each ADS

representing six (6) ordinary shares, which are quoted on the Nasdaq Global Market under the symbol “VNET”. |

Item 3.

Not applicable.

Ownership

(a-c)

The ownership

information presented below represents beneficial ownership of Class A Ordinary Shares as of December 31, 2023, based upon

(i) 859,932,323 Class A Ordinary Shares outstanding as of December 31, 2022, as disclosed by the Issuer in its Form 20-F

filed with the Securities and Exchange Commission on April 26, 2023, plus (ii) 27,757,992 Class A Ordinary Shares issuable

upon the exchange of 27,757,992 Class B Ordinary Shares, par value US$0.00001 per share (the “Class B Ordinary Shares”),

that may be deemed to be beneficially owned by the Reporting Persons.

| Reporting Person | |

Amount

beneficially

owned | | |

Percent

of class: | | |

Sole

power

to vote

or to

direct

the vote: | | |

Shared

power to

vote or to

direct the

vote: | | |

Sole

power to

dispose or

to direct

the

disposition

of: | | |

Shared

power to

dispose or

to direct

the

disposition

of: | |

| Bold Ally (Cayman) Limited | |

61,386,919 | | |

6.9 | % | |

0 | | |

61,386,919 | | |

0 | | |

61,386,919 | |

| CP5 Hold Co 2 Limited | |

61,386,919 | | |

6.9 | % | |

0 | | |

61,386,919 | | |

0 | | |

61,386,919 | |

| CP5 Hold Co 1 Limited | |

61,386,919 | | |

6.9 | % | |

0 | | |

61,386,919 | | |

0 | | |

61,386,919 | |

| SSG Capital Partners V, L.P. | |

61,386,919 | | |

6.9 | % | |

0 | | |

61,386,919 | | |

0 | | |

61,386,919 | |

| Ares Management (Asia) Cayman Limited | |

61,386,919 | | |

6.9 | % | |

0 | | |

61,386,919 | | |

0 | | |

61,386,919 | |

| Ares Management Asia (Holdings) Limited | |

61,386,919 | | |

6.9 | % | |

0 | | |

61,386,919 | | |

0 | | |

61,386,919 | |

| Ares Management Asia Holdings, L.P. | |

61,386,919 | | |

6.9 | % | |

0 | | |

61,386,919 | | |

0 | | |

61,386,919 | |

| AS Holdings GP LLC | |

61,386,919 | | |

6.9 | % | |

0 | | |

61,386,919 | | |

0 | | |

61,386,919 | |

| AS Holdings LP Ltd. | |

61,386,919 | | |

6.9 | % | |

0 | | |

61,386,919 | | |

0 | | |

61,386,919 | |

| Ares Holdings L.P. | |

61,386,919 | | |

6.9 | % | |

0 | | |

61,386,919 | | |

0 | | |

61,386,919 | |

| Ares Holdco LLC | |

61,386,919 | | |

6.9 | % | |

0 | | |

61,386,919 | | |

0 | | |

61,386,919 | |

| Ares Management Corporation | |

61,386,919 | | |

6.9 | % | |

0 | | |

61,386,919 | | |

0 | | |

61,386,919 | |

| Ares Voting LLC | |

61,386,919 | | |

6.9 | % | |

0 | | |

61,386,919 | | |

0 | | |

61,386,919 | |

| Ares Management GP LLC | |

61,386,919 | | |

6.9 | % | |

0 | | |

61,386,919 | | |

0 | | |

61,386,919 | |

| Ares Partners Holdco LLC | |

61,386,919 | | |

6.9 | % | |

0 | | |

61,386,919 | | |

0 | | |

61,386,919 | |

Bold Ally entered into a

term loan facility and, in connection with the facility agreement and related mortgage agreements, the borrower of that facility pledged

certain Class A Ordinary Shares and Class B Ordinary Shares to Bold Ally as security for the term loan facility (the “Pledged

Shares”). Pursuant to the terms of the mortgage agreements, Bold Ally may be deemed to beneficially own the Pledged Shares.

More specifically, as of

the date that this Schedule 13G is filed, Bold Ally may be deemed to beneficially own (i) 33,628,927 Class A Ordinary

Shares, based on 5,604,821 ADSs redeemable for 6 Class A Ordinary Shares each plus one Class A Ordinary Share and (ii) 27,757,992

Class B Ordinary Shares that are convertible into Class A Ordinary Shares on a one-for-one basis at any time. The Reporting

Persons, as a result of the relationships described below, may be deemed to directly or indirectly beneficially own the shares of Class A

Ordinary Shares that may be beneficially owned by Bold Ally.

Ares Partners is the sole member of each of Ares

Voting and Ares Management GP, which are respectively the holders of the Class B and Class C common stock of Ares Management,

which common stock allows them, collectively, to generally have the majority of the votes on any matter submitted to the stockholders

of Ares Management if certain conditions are met.

Ares Management is the sole member of Ares Holdco,

which is the general partner of Ares Holdings, which is the sole member of AS Holdings LP, which is the sole member of AS Holdings GP,

which is the general partner of Ares Asia Holdings, which is the sole shareholder of Ares Asia (Holdings) Limited, which is the sole shareholder

of Ares Management (Asia) Cayman, which is the Investment Advisor of SSG Capital Partners, which is the sole shareholder of CP5 Hold Co

1, which is the sole shareholder of CP5 Hold Co 2, which is the sole shareholder of Bold Ally.

Each of these entities may be deemed to share beneficial

ownership of the securities reported herein, but each disclaims any such beneficial ownership of securities not held of record by them.

Ares Partners is managed by a board of managers, which is composed of Michael J Arougheti, Ryan Berry, R. Kipp deVeer, David B. Kaplan,

Antony P. Ressler and Bennett Rosenthal (collectively, the “Board Members”). Mr. Ressler generally has veto authority

over Board Members’ decisions. Each of these individuals disclaims beneficial ownership of the securities that may be deemed to

be beneficially owned by Ares Partners.

| Item 5. | Ownership of Five Percent or Less

of a Class |

Not applicable.

| Item 6. | Ownership of More than Five Percent

on Behalf of Another Person |

Not applicable.

| Item 7. | Identification and Classification

of the Subsidiary Which Acquired the Security Being Reported on By the Parent Holding Company |

Not applicable.

| Item 8. | Identification and Classification

of Members of the Group |

Not applicable.

| Item 9. | Notice of Dissolution of Group |

Not applicable.

By signing below I certify that, to

the best of my knowledge and belief, the securities referred to above were not acquired and are not held for the purpose of or with the

effect of changing or influencing the control of the issuer of the securities and were not acquired and are not held in connection with

or as a participant in any transaction having that purpose or effect, other than activities solely in connection with a nomination under

§ 240.14a-11.

SIGNATURE

After reasonable inquiry and to the best of my

knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Date: February 13, 2024

| |

Bold

Ally (Cayman) Limited |

| |

|

| |

/s/

Isatou Smith |

| |

By:

Isatou Smith |

| |

Its:

Authorized Signatory |

| |

|

| |

CP5

Hold Co 2 Limited |

| |

|

| |

/s/

Smita Atchanah |

| |

By:

Smita Atchanah |

| |

Its:

Authorized Signatory |

| |

|

| |

/s/

Ranjan Lath |

| |

By:

Ranjan Lath |

| |

Its:

Authorized Signatory |

| |

|

| |

CP5

Hold Co 1 Limited |

| |

|

| |

/s/

Smita Atchanah |

| |

By:

Smita Atchanah |

| |

Its:

Authorized Signatory |

| |

|

| |

/s/

Ranjan Lath |

| |

By:

Ranjan Lath |

| |

Its:

Authorized Signatory |

| |

|

| |

SSG

Capital Partners V, L.P. |

| |

By:

SSG Capital Partners V GP, Ltd., its general partner |

| |

|

| |

/s/

Isatou Smith |

| |

By:

Isatou Smith |

| |

Its:

Authorized Signatory |

| |

|

| |

Ares

Management (Asia) Cayman Limited |

| |

|

| |

/s/

Isatou Smith |

| |

By:

Isatou Smith |

| |

Its:

Authorized Signatory |

| |

Ares

Management Asia (Holdings) Limited |

| |

|

| |

/s/

Eric Michel Joseph Vimont |

| |

By:

Eric Michel Joseph Vimont |

| |

Its:

Authorized Signatory |

| |

|

| |

Ares

Management Asia Holdings, L.P. |

| |

By:

AS Holdings GP LLC, its general partner |

| |

|

| |

/s/

Naseem Sagati Aghili |

| |

By:

Naseem Sagati Aghili |

| |

Its:

Authorized Signatory |

| |

|

| |

AS

Holdings GP LLC |

| |

|

| |

/s/

Naseem Sagati Aghili |

| |

By:

Naseem Sagati Aghili |

| |

Its:

Authorized Signatory |

| |

|

| |

AS

Holdings LP Ltd. |

| |

By:

Ares Holdings L.P., its sole member |

| |

By:

Ares Holdco LLC, its general partner |

| |

|

| |

/s/

Naseem Sagati Aghili |

| |

By:

Naseem Sagati Aghili |

| |

Its:

Authorized Signatory |

| |

|

| |

Ares

Holdings L.P. |

| |

By:

Ares Holdco LLC, its general partner |

| |

|

| |

/s/

Naseem Sagati Aghili |

| |

By:

Naseem Sagati Aghili |

| |

Its:

Authorized Signatory |

| |

|

| |

Ares

Holdco LLC |

| |

|

| |

/s/

Naseem Sagati Aghili |

| |

By:

Naseem Sagati Aghili |

| |

Its:

Authorized Signatory |

| |

|

| |

Ares

Management Corporation |

| |

|

| |

/s/

Naseem Sagati Aghili |

| |

By:

Naseem Sagati Aghili |

| |

Its:

Authorized Signatory |

| |

|

| |

Ares

Voting LLC |

| |

By:

Ares Partners Holdco LLC, its sole member |

| |

|

| |

/s/

Naseem Sagati Aghili |

| |

By:

Naseem Sagati Aghili |

| |

Its:

Authorized Signatory |

| |

|

| |

Ares

Management GP LLC |

| |

|

| |

/s/

Naseem Sagati Aghili |

| |

By:

Naseem Sagati Aghili |

| |

Its:

Authorized Signatory |

| |

|

| |

Ares

Partners Holdco LLC |

| |

|

| |

/s/

Naseem Sagati Aghili |

| |

By:

Naseem Sagati Aghili |

| |

Its:

Authorized Signatory |

LIST OF EXHIBITS

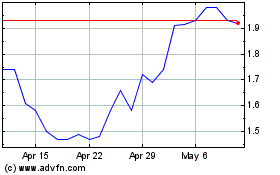

VNET (NASDAQ:VNET)

Historical Stock Chart

From Mar 2024 to Apr 2024

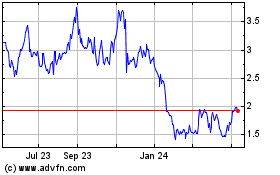

VNET (NASDAQ:VNET)

Historical Stock Chart

From Apr 2023 to Apr 2024