Futures Pointing To Roughly Flat Open On Wall Street

February 12 2024 - 9:08AM

IH Market News

The major U.S. index futures are currently pointing to a roughly

flat open on Monday, with stocks likely to show a lack of direction

after trending higher over the past several sessions.

Traders may take a breather following the recent strength on

Wall Street, which lifted the S&P 500 to a new record closing

high above 5,000.

The tech-heavy Nasdaq has also shown a significant advance in

recent sessions, closing in the on the record highs set in November

2021.

A lack of major U.S. economic data may also keep some traders on

the sidelines ahead of the release of several key reports in the

coming days.

On Tuesday, the Labor Department is due to release its report on

consumer price inflation in the month of January, which could have

a significant impact on the outlook for interest rates.

Reports on retail sales, industrial production, producer price

inflation and consumer sentiment are also likely to attract

attention later in the week.

With technology stocks leading the charge, stocks moved mostly

higher over the course of the trading session on Friday. The major

averages extended a recent upward trend, with the S&P 500

closing above 5,000 for the first time ever.

The tech-heavy Nasdaq posted a standout gain, surging 196.95

points or 1.3 percent to 15,990.66. The S&P 500 also climbed

28.70 points or 0.6 percent to 5,026.61, while the narrower Dow

bucked the uptrend amid a pullback by Disney (NYSE:DIS) and edged

down 54.64 points or 0.1 percent to 38,671.69.

For the week, the Nasdaq shot up by 2.3 percent and the S&P

500 jumped by 1.4 percent. The Dow inched slightly higher.

The strength on Wall Street partly reflected a positive reaction

to data from the Labor Department showing a modest downward

revision to consumer price growth in December.

The revised data showed the consumer price index rose by 0.2

percent in December compared to the previously reported 0.3 percent

increase.

Meanwhile, the increase by core consumer prices, which exclude

food and energy prices, was unrevised at 0.3 percent.

While the revised data is not likely to have a major impact on

the outlook for interest rates, the modest revision seemed to

provide a jolt to tech stocks.

Semiconductor stocks extended the rally seen over the two

previous sessions, driving the Philadelphia Semiconductor Index up

by 2.0 percent.

Computer hardware and software stocks also saw considerable

strength, with the NYSE Arca Computer Hardware Index and the Dow

Jones U.S. Software Index climbing by 1.8 percent and 1.4 percent,

respectively.

Outside of the tech sector, brokerage and retail stocks saw

notable strength, while energy stocks moved to the downside despite

a continued increase by the price of crude oil.

Among individual stocks, Bitcoin miner CleanSpark (NASDAQ:CLSK)

skyrocketed by 32.9 percent after reporting an unexpected fiscal

first quarter profit on better than expected revenues.

Shares of Cloudflare (NYSE:NET) also soared by 19.5 percent

after the cloud services provider reported fourth quarter results

that beat expectations and provided upbeat guidance.

Meanwhile, shares of Pinterest (NYSE:PINS) tumbled by 9.5

percent after the image-sharing company reported weaker than

expected fourth quarter revenues and provided disappointing

guidance.

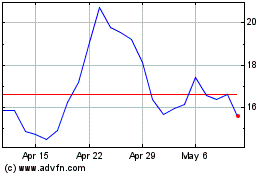

CleanSpark (NASDAQ:CLSK)

Historical Stock Chart

From Mar 2024 to Apr 2024

CleanSpark (NASDAQ:CLSK)

Historical Stock Chart

From Apr 2023 to Apr 2024