ESCO Technologies Inc. (NYSE: ESE) (ESCO, or the Company) today

reported its operating results for the first quarter ended December

31, 2023 (Q1 2024).

Operating Highlights

- Q1 2024 Sales increased $12.8 million (6.2 percent) to $218.3

million compared to $205.5 million in Q1 2023.

- Q1 2024 Entered Orders increased $64.8 million (28 percent)

over the prior year period to $293.7 million (book-to-bill of

1.35x), resulting in record backlog of $848 million.

- Q1 2024 GAAP EPS increased 4 percent to $0.59 per share

compared to $0.57 per share in Q1 2023. Q1 2024 Adjusted EPS

increased 3 percent to $0.62 per share compared to $0.60 per share

in Q1 2023.

- Net cash provided by operating activities was $9 million in Q1

2024, an increase of $18 million compared to the prior year period,

as cash flow was positively impacted by lower working capital

requirements.

- Net debt (total borrowings less cash on hand) was $121 million,

resulting in a 0.82x leverage ratio and $572 million in liquidity

at December 31, 2023.

Bryan Sayler, Chief Executive Officer and President, commented,

“Our fiscal year got off to a great start in many ways, with orders

being particularly strong. This was evidenced by a $65 million

order for surface hull tiles for the Virginia Class Submarine

program. In addition, it was another solid quarter in aerospace

with strength in both commercial and defense OEM and aftermarket

orders. The book-to-bill for the quarter was 1.35x and resulted in

record backlog of almost $850 million.

“Revenue was up 6 percent over the prior year with double digit

growth in A&D and USG, driven by continuing strength across our

aerospace, Navy, utility, and renewables end-markets. Our teams

continue working hard to drive growth and deliver solid operating

results and their efforts enabled us to deliver solid Q1 EPS

results. Overall, it was good start to the year, giving us added

confidence in our ability to deliver our full year revenue and

earnings guidance.”

Segment PerformanceAerospace & Defense

(A&D)

- Sales increased $11.7 million (14 percent) to $94.7 million in

Q1 2024 from $83.0 million in Q1 2023. Q1 organic sales increased

$8.5 million (10 percent) in the quarter driven by strength across

commercial aerospace, defense aerospace, and Navy. In addition, the

CMT acquisition contributed $3.2 million (4 percent) of revenue

growth in the quarter.

- Q1 2024 EBIT increased $4.2 million to $16.7 million from $12.5

million in Q1 2023. Adjusted EBIT increased $4.0 million in Q1 2024

to $16.7 million (17.6 percent margin) from $12.7 million (15.3

percent margin) in Q1 2023. Margin improvement was driven by

leverage on revenue growth and price increases, partially offset by

inflationary pressures and mix.

- Entered Orders increased $74 million (76 percent) to $172

million in Q1 2024 compared to $97 million in Q1 2023.

The increase in orders was primarily driven by large Navy orders

for Virginia Class Block V surface hull tiles and Block VI long

lead material procurement for the Light Weight Wide Aperture Array

(LWWAA), along with a strong quarter for commercial and defense

aerospace. The orders strength in the quarter resulted in a segment

book-to-bill of 1.81x and record ending backlog of $561

million.

Utility Solutions Group (USG)

- Sales increased $12.0 million (17 percent) to $83.0 million in

Q1 2024 from $71.0 million in Q1 2023. Doble’s sales increased by

$7.6 million (13 percent) driven by a strong quarter for offline

products and services. NRG sales increased $4.4 million (30

percent) as they reduced backlog related to longer-term orders

placed during FY 2023.

- EBIT increased $1.5 million in Q1 2024 to $17.6 million from

$16.1 million in Q1 2023. Adjusted EBIT increased $1.6 million to

$17.7 million (21.4 percent margin) from $16.1 million (22.7

percent margin) in Q1 2023. In the quarter, margin was impacted

unfavorably by mix and inflationary pressures, which more than

offset leverage on higher revenue and price

increases.

- Entered Orders decreased $3 million (4 percent) to $77 million

in Q1 2024. Orders moderated in the quarter for Doble and NRG after

a record year in 2023. The segment book-to-bill was 0.93x in the

quarter and resulted in an ending backlog of $127 million.

RF Test & Measurement (Test)

- Sales decreased $10.9 million (21 percent) to $40.6 million in

Q1 2024 from $51.5 million in Q1 2023. Organic sales decreased

$12.0 million primarily related to lower T&M volume in the

U.S., Europe and China and lower OTC filter sales in the U.S.,

partially offset by $1.1 million of revenue growth related to the

MPE acquisition completed during the quarter.

- EBIT decreased $3.6 million in Q1 2024 to $1.8 million from

$5.4 million in Q1 2023. Adjusted EBIT decreased $3.3 million in Q1

2024 to $2.1 million (5.1 percent margin) from $5.4 million (10.5

percent margin) in Q1 2023. In the quarter, margin was impacted by

lower volume, partially offset by price increases and cost

reduction actions.

- Entered Orders decreased $6 million (12 percent) to $45 million

in Q1 2024. The decrease was primarily related to delays on a few

large projects in EMEA and China and was partially offset by the $5

million impact of MPE orders and backlog. Book-to-bill was 1.11x in

the quarter and resulted in ending backlog of $159 million.

Dividend PaymentThe next quarterly cash

dividend of $0.08 per share will be paid on April 16, 2024 to

stockholders of record on April 1, 2024.

Business Outlook – 2024 Management’s

expectation is for Q2 Adjusted EPS in the range of $0.85 to $0.90.

We are raising the lower end of our full year guidance which we now

expect to be in the range of $4.15 to $4.30 (12 to 16 percent

growth). This is based on sales in line with our initial guidance

range of $1.02 to $1.04 billion (7 to 9 percent annual growth).

Within our revenue guidance we are raising our expected A&D

growth to 11 to 13 percent (from 8 to 10 percent) and lowering our

expected Test growth to 1 to 3 percent (from 8 to 10 percent). We

do expect the Test business to improve sales and EBIT in the second

half of the year and we are currently implementing a plan to

streamline the cost structure of the business, which will further

enhance its margin profile going forward.

Conference CallThe Company will host a

conference call today, February 8, at 4:00 p.m. Central Time, to

discuss the Company’s Q1 2024 results. A live audio webcast and an

accompanying slide presentation will be available on ESCO’s

investor website. For those unable to participate, a webcast replay

will be available after the call on ESCO’s investor website.

Forward-Looking StatementsStatements in this

press release regarding Management’s expectations for fiscal 2024,

restructuring and cost reduction efforts, sales, inflationary

pressures, interest rates, supply chain performance and labor

shortages; our guidance for 2024 including revenues, earnings,

Adjusted EPS, Adjusted EBIT and Adjusted EBITDA margin; the effects

of acquisitions; and any other statements which are not strictly

historical, are “forward-looking statements within the meaning of

the safe harbor provisions of the U.S. securities laws.

Investors are cautioned that such statements are only

predictions and speak only as of the date of this release, and the

Company undertakes no duty to update them except as may be required

by applicable laws or regulations. The Company’s actual results in

the future may differ materially from those projected in the

forward-looking statements due to risks and uncertainties that

exist in the Company’s operations and business environment

including but not limited to those described in Item 1A, “Risk

Factors”, of the Company’s Annual Report on Form 10-K for the

fiscal year ended September 30, 2023 and the following: the impacts

of climate change and related regulation of greenhouse gases; the

impacts of labor disputes, civil disorder, wars, elections,

political changes, tariffs and trade disputes, terrorist

activities, cyberattacks or natural disasters on the Company’s

operations and those of the Company’s customers and suppliers;

disruptions in manufacturing or delivery arrangements due to

shortages or unavailability of materials or components, or supply

chain disruptions; inability to access work sites; the timing and

content of future contract awards or customer orders; the timely

appropriation, allocation and availability of Government funds; the

termination for convenience of Government and other customer

contracts or orders; weakening of economic conditions in served

markets; the success of the Company’s competitors; changes in

customer demands or customer insolvencies; competition;

intellectual property rights; technical difficulties or data

breaches; the availability of selected acquisitions; delivery

delays or defaults by customers; performance issues with key

customers, suppliers and subcontractors; material changes in the

costs and availability of certain raw materials; material changes

in the cost of credit; changes in laws and regulations including

but not limited to changes in accounting standards and taxation;

changes in interest rates; costs relating to environmental matters

arising from current or former facilities; uncertainty regarding

the ultimate resolution of current disputes, claims, litigation or

arbitration; and the integration and performance of recently

acquired businesses.

Non-GAAP Financial MeasuresThe financial

measures EBIT, Adjusted EBIT, EBITDA, Adjusted EBITDA, and Adjusted

EPS are presented in this press release. The Company defines “EBIT”

as earnings before interest and taxes, “EBITDA” as earnings before

interest, taxes, depreciation and amortization, “Adjusted EBIT” and

“Adjusted EBITDA” as excluding the net impact of the items

described in the attached Reconciliation of Non-GAAP Financial

Measures, and “Adjusted EPS” as GAAP earnings per share excluding

the net impact of the items described and reconciled in the

attached Reconciliation of Non-GAAP Financial Measures.

EBIT, Adjusted EBIT, EBITDA, Adjusted EBITDA, and Adjusted EPS

are not recognized in accordance with U.S. generally accepted

accounting principles (GAAP). However, Management believes EBIT,

Adjusted EBIT, EBITDA, and Adjusted EBITDA are useful in assessing

the operational profitability of the Company’s business segments

because they exclude interest, taxes, depreciation, and

amortization, which are generally accounted for across the entire

Company on a consolidated basis. EBIT is also one of the measures

used by Management in determining resource allocations within the

Company as well as incentive compensation. The presentation of

EBIT, Adjusted EBIT, EBITDA, Adjusted EBITDA, and Adjusted EPS

provides important supplemental information to investors by

facilitating comparisons with other companies, many of which use

similar non-GAAP financial measures to supplement their GAAP

results. The use of non-GAAP financial measures is not intended to

replace any measures of performance determined in accordance with

GAAP.

ESCO is a global provider of highly engineered products and

solutions serving diverse end-markets. It manufactures filtration

and fluid control products for the aviation, Navy, space, and

process markets worldwide and composite-based products and

solutions for Navy, defense, and industrial customers. ESCO is an

industry leader in designing and manufacturing RF test and

measurement products and systems; and provides diagnostic

instruments, software and services to industrial power users and

the electric utility and renewable energy industries. Headquartered

in St. Louis, Missouri, ESCO and its subsidiaries have offices and

manufacturing facilities worldwide. For more information on ESCO

and its subsidiaries, visit the Company’s website at

www.escotechnologies.com.

|

ESCO TECHNOLOGIES INC. AND SUBSIDIARIES |

|

|

Condensed Consolidated Statements of Operations (Unaudited) |

|

|

(Dollars in thousands, except per share amounts) |

|

|

|

|

| |

|

|

|

|

Three MonthsEndedDecember 31,2023 |

|

Three MonthsEndedDecember 31,2022 |

|

| |

|

|

|

|

|

|

|

|

| Net Sales |

|

$ |

218,314 |

|

205,501 |

|

| Cost and

Expenses: |

|

|

|

|

|

| |

Cost of sales |

|

134,151 |

|

126,383 |

|

| |

Selling, general

and administrative expenses |

|

53,968 |

|

51,302 |

|

| |

Amortization of

intangible assets |

|

7,868 |

|

6,861 |

|

| |

Interest

expense |

|

2,667 |

|

1,658 |

|

| |

Other expenses

(income), net |

|

206 |

|

398 |

|

| |

|

Total costs and

expenses |

|

198,860 |

|

186,602 |

|

| |

|

|

|

|

|

|

|

|

| Earnings before

income taxes |

|

19,454 |

|

18,899 |

|

| Income tax

expense |

|

4,285 |

|

4,172 |

|

| |

|

|

|

|

|

|

|

|

| |

|

Net earnings |

$ |

15,169 |

|

14,727 |

|

| |

|

|

|

|

|

|

|

|

| |

|

Earnings Per Share

(EPS) |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

| |

|

Diluted -

GAAP |

$ |

0.59 |

|

0.57 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

Diluted - As

Adjusted Basis |

$ |

0.62 |

(1 |

) |

0.60 |

(2 |

) |

|

|

|

|

|

|

|

|

|

|

| |

|

Diluted average

common shares O/S: |

|

25,846 |

|

25,943 |

|

| |

|

|

|

|

|

|

|

|

|

(1 |

) |

Q1 2024 Adjusted EPS

excludes $0.03 per share of after-tax charges consisting primarily

of MPE acquisition inventory step-up and backlog charges and

acquisition related costs. |

| |

|

|

|

|

|

|

|

|

|

(2 |

) |

Q1 2023 Adjusted EPS

excludes $0.03 per share of after-tax charges associated with

executive management transition costs at Corporate and

restructuring charges within the A&D segment. |

|

ESCO TECHNOLOGIES INC. AND SUBSIDIARIES |

|

Condensed Business Segment Information (Unaudited) |

|

(Dollars in thousands) |

|

|

|

|

|

|

|

GAAP |

|

As Adjusted |

|

| |

|

|

|

Q1 2024 |

|

Q1 2023 |

|

Q1 2024 |

|

Q1 2023 |

|

| Net Sales |

|

|

|

|

|

|

|

|

|

| |

Aerospace &

Defense |

$ |

94,733 |

|

|

82,983 |

|

|

94,733 |

|

|

82,983 |

|

|

| |

USG |

|

82,984 |

|

|

71,045 |

|

|

82,984 |

|

|

71,045 |

|

|

| |

Test |

|

40,597 |

|

|

51,473 |

|

|

40,597 |

|

|

51,473 |

|

|

| |

|

Totals |

$ |

218,314 |

|

|

205,501 |

|

|

218,314 |

|

|

205,501 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| EBIT |

|

|

|

|

|

|

|

|

|

|

| |

Aerospace &

Defense |

$ |

16,663 |

|

|

12,536 |

|

|

16,663 |

|

|

12,735 |

|

|

| |

USG |

|

17,625 |

|

|

16,131 |

|

|

17,745 |

|

|

16,131 |

|

|

| |

Test |

|

1,779 |

|

|

5,411 |

|

|

2,052 |

|

|

5,411 |

|

|

| |

Corporate |

|

(13,946 |

) |

|

(13,521 |

) |

|

(13,295 |

) |

|

(12,728 |

) |

|

| |

|

Consolidated EBIT |

|

22,121 |

|

|

20,557 |

|

|

23,165 |

|

|

21,549 |

|

|

| |

|

Less: Interest expense |

|

(2,667 |

) |

|

(1,658 |

) |

|

(2,667 |

) |

|

(1,658 |

) |

|

| |

|

Less: Income tax expense |

|

(4,285 |

) |

|

(4,172 |

) |

|

(4,525 |

) |

|

(4,400 |

) |

|

| |

|

Net earnings |

$ |

15,169 |

|

|

14,727 |

|

|

15,973 |

|

|

15,491 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Note 1: Adjusted

net earnings of $16.0 million in Q1 2024 exclude $0.8 million (or

$0.03 per share) of after-tax charges consisting primarily of MPE

acquisition inventory step-up and backlog charges and acquisition

related costs. |

| |

|

|

|

|

|

|

|

|

|

|

|

| Note 2: Adjusted net

earnings of $15.5 million in Q1 2023 exclude $0.8 million (or $0.03

per share) of after-tax charges associated with executive

management transition costs at Corporate and restructuring charges

within the A&D segment. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

EBITDA Reconciliation to Net earnings: |

|

|

|

|

|

Q1 2024 |

|

Q1 2023 |

|

|

|

|

|

|

Q1 2024 |

|

Q1 2023 |

|

As Adjusted |

|

As Adjusted |

|

|

Consolidated EBITDA |

$ |

35,573 |

|

|

32,924 |

|

|

36,408 |

|

|

33,916 |

|

|

| Less:

Depr & Amort |

|

(13,452 |

) |

|

(12,367 |

) |

|

(13,243 |

) |

|

(12,367 |

) |

|

|

Consolidated EBIT |

|

22,121 |

|

|

20,557 |

|

|

23,165 |

|

|

21,549 |

|

|

| Less:

Interest expense |

|

(2,667 |

) |

|

(1,658 |

) |

|

(2,667 |

) |

|

(1,658 |

) |

|

| Less:

Income tax expense |

|

(4,285 |

) |

|

(4,172 |

) |

|

(4,525 |

) |

|

(4,400 |

) |

|

| Net

earnings |

$ |

15,169 |

|

|

14,727 |

|

|

15,973 |

|

|

15,491 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ESCO TECHNOLOGIES INC. AND SUBSIDIARIES |

|

Condensed Consolidated Balance Sheets (Unaudited) |

|

(Dollars in thousands) |

|

|

|

|

|

|

|

December 31,2023 |

|

September 30,2023 |

|

|

|

|

|

|

|

|

| Assets |

|

|

|

|

|

| |

Cash and cash

equivalents |

$ |

51,396 |

|

41,866 |

|

|

Accounts

receivable, net |

|

194,395 |

|

198,557 |

|

|

Contract

assets |

|

138,393 |

|

138,633 |

|

|

Inventories |

|

202,577 |

|

184,067 |

|

|

Other current

assets |

|

16,441 |

|

17,972 |

|

|

|

Total current assets |

|

603,202 |

|

581,095 |

|

|

Property, plant

and equipment, net |

|

159,262 |

|

155,484 |

|

|

Intangible assets,

net |

|

422,053 |

|

392,124 |

|

|

Goodwill |

|

537,601 |

|

503,177 |

|

|

Operating lease

assets |

|

38,685 |

|

39,839 |

|

|

Other assets |

|

11,723 |

|

11,495 |

|

|

|

|

$ |

1,772,526 |

|

1,683,214 |

|

|

|

|

|

|

|

|

| Liabilities and

Shareholders' Equity |

|

|

|

|

| |

Current maturities

of long-term debt |

$ |

20,000 |

|

20,000 |

|

|

Accounts

payable |

|

77,960 |

|

86,973 |

|

|

Contract

liabilities |

|

121,149 |

|

112,277 |

|

|

Other current

liabilities |

|

85,584 |

|

95,401 |

|

|

|

Total current liabilities |

|

304,693 |

|

314,651 |

|

|

Deferred tax

liabilities |

|

83,802 |

|

75,531 |

|

|

Non-current

operating lease liabilities |

|

35,709 |

|

36,554 |

|

|

Other

liabilities |

|

42,228 |

|

43,336 |

|

|

Long-term

debt |

|

152,000 |

|

82,000 |

|

|

Shareholders'

equity |

|

1,154,094 |

|

1,131,142 |

|

|

|

|

$ |

1,772,526 |

|

1,683,214 |

|

ESCO TECHNOLOGIES INC. AND SUBSIDIARIES |

|

Consolidated Statements of Cash Flows |

|

(Dollars in thousands) |

|

|

|

|

| |

|

Three MonthsEndedDecember 31,2023 |

|

Three MonthsEndedDecember 31,2022 |

| Cash flows from operating

activities: |

|

|

|

|

| Net earnings |

$ |

15,169 |

|

|

14,727 |

|

| Adjustments to reconcile net

earnings to net cash |

|

|

|

|

| provided by operating

activities: |

|

|

|

|

| Depreciation and

amortization |

|

13,452 |

|

|

12,367 |

|

| Stock compensation expense |

|

2,180 |

|

|

1,860 |

|

| Changes in assets and

liabilities |

|

(22,539 |

) |

|

(36,920 |

) |

| Effect of deferred taxes |

|

484 |

|

|

(1,042 |

) |

| Net cash provided (used) by

operating activities |

|

8,746 |

|

|

(9,008 |

) |

|

|

|

|

|

|

| Cash flows from investing

activities: |

|

|

|

|

| Acquisition of business, net of

cash acquired |

|

(56,179 |

) |

|

- |

|

| Capital expenditures |

|

(7,848 |

) |

|

(4,791 |

) |

| Additions to capitalized

software |

|

(2,942 |

) |

|

(2,795 |

) |

| Net cash used by investing

activities |

|

(66,969 |

) |

|

(7,586 |

) |

|

|

|

|

|

|

| Cash flows from financing

activities: |

|

|

|

|

| Proceeds from long-term debt |

|

99,000 |

|

|

17,000 |

|

| Principal payments on long-term

debt and short-term borrowings |

|

(29,000 |

) |

|

(38,000 |

) |

| Dividends paid |

|

(2,064 |

) |

|

(2,067 |

) |

| Purchases of common stock into

treasury |

|

- |

|

|

(4,147 |

) |

| Other |

|

(1,432 |

) |

|

(2,412 |

) |

| Net cash provided (used) by

financing activities |

|

66,504 |

|

|

(29,626 |

) |

|

|

|

|

|

|

| Effect of exchange rate changes

on cash and cash equivalents |

|

1,249 |

|

|

418 |

|

|

|

|

|

|

|

| Net increase (decrease) in cash

and cash equivalents |

|

9,530 |

|

|

(45,802 |

) |

| Cash and cash equivalents,

beginning of period |

|

41,866 |

|

|

97,724 |

|

| Cash and cash equivalents, end of

period |

$ |

51,396 |

|

|

51,922 |

|

|

ESCO TECHNOLOGIES INC. AND SUBSIDIARIES |

|

Other Selected Financial Data (Unaudited) |

|

(Dollars in thousands) |

|

|

|

Backlog And Entered Orders - Q1 2024 |

|

Aerospace & Defense |

|

USG |

|

Test |

|

Total |

|

|

Beginning Backlog

- 10/1/23 |

$ |

484,069 |

|

|

133,459 |

|

|

154,834 |

|

|

772,362 |

|

|

|

Entered

Orders |

|

171,557 |

|

|

76,964 |

|

|

45,199 |

|

|

293,720 |

|

|

|

Sales |

|

|

(94,733 |

) |

|

(82,984 |

) |

|

(40,597 |

) |

|

(218,314 |

) |

|

|

Ending Backlog -

12/31/23 |

$ |

560,893 |

|

|

127,439 |

|

|

159,436 |

|

|

847,768 |

|

|

ESCO TECHNOLOGIES INC. AND SUBSIDIARIES |

|

Reconciliation of Non-GAAP Financial Measures (Unaudited) |

|

|

|

|

|

|

|

|

| EPS – Adjusted

Basis Reconciliation – Q1 2024 |

|

|

|

| |

EPS – GAAP Basis – Q1

2024 |

$ |

0.59 |

|

| |

Adjustments (defined

below) |

|

0.03 |

|

| |

EPS – As Adjusted Basis – Q1

2024 |

$ |

0.62 |

|

| |

|

|

|

|

| |

Adjustments exclude $0.03 per

share consisting primarily of MPE acquisition |

|

|

|

| |

inventory step-up and backlog

charges and acquisition related costs. |

|

|

|

| |

The $0.03 of EPS adjustments

per share consists of $1,044K of pre-tax charges |

|

|

|

| |

offset by $240K of tax benefit

for net impact of $804K. |

|

|

|

| |

|

|

|

|

| EPS – Adjusted

Basis Reconciliation – Q1 2023 |

|

|

|

| |

EPS – GAAP Basis – Q1

2023 |

$ |

0.57 |

|

| |

Adjustments (defined

below) |

|

0.03 |

|

| |

EPS – As Adjusted Basis – Q1

2023 |

$ |

0.60 |

|

| |

|

|

|

|

| |

Adjustments exclude $0.03 per

share consisting of executive management transition |

|

|

|

| |

costs at Corporate and

restructuring charges within the A&D segment. |

|

|

|

| |

The $0.03 of EPS adjustments

per share consists of $992K of pre-tax charges |

|

|

|

| |

offset by $228K of tax benefit

for net impact of $764K. |

|

|

|

SOURCE ESCO Technologies Inc.Kate Lowrey, Vice President of

Investor Relations, (314) 213-7277

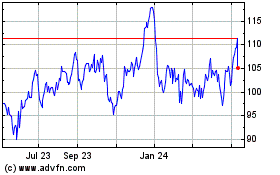

ESCO Technologies (NYSE:ESE)

Historical Stock Chart

From Mar 2024 to Apr 2024

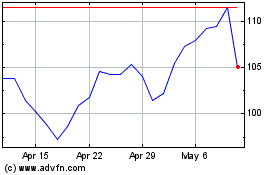

ESCO Technologies (NYSE:ESE)

Historical Stock Chart

From Apr 2023 to Apr 2024