UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________

FORM 6-K

__________________________________

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 under

the Securities Exchange Act of 1934

For the quarterly period ended December 31, 2023

Commission File Number 001-38332

__________________________________

QIAGEN N.V.

(Translation of registrant’s name into English)

__________________________________

Hulsterweg 82

5912 PL Venlo

The Netherlands

__________________________________

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ý Form 40-F o

QIAGEN N.V.

Form 6-K

TABLE OF CONTENTS

| | | | | |

| |

| Item | Page |

| Other Information | |

| Signatures | |

| Exhibit Index | |

OTHER INFORMATION

On February 6, 2024, QIAGEN N.V. (NYSE: QGEN; Frankfurt, Prime Standard: QIA) issued a press release announcing its unaudited financial results for the fourth quarter and year ended December 31, 2023. The press release is furnished herewith as Exhibit 99.1 and is incorporated by reference herein.

QIAGEN has regularly reported adjusted results, which are considered non-GAAP financial measures, to give additional insight into our financial performance as a supplement to understand, manage, and evaluate our business results and make operating decisions. We also use the adjusted results when comparing to our historical operating results, which have consistently been presented on an adjusted basis.

Adjusted results should be considered in addition to the reported results prepared in accordance with U.S. generally accepted accounting principles, but should not be considered as a substitute. Reconciliations of reported results to adjusted results are included in the tables accompanying the press release. We believe certain items should be excluded from adjusted results when they are outside of our ongoing core operations, vary significantly from period to period, or affect the comparability of results with the Company’s competitors and our own prior periods.

The non-GAAP financial measures used in this press release are non-GAAP net sales, gross profit, operating income, pre-tax income, net income, tax rate and diluted earnings per share. These adjusted results exclude costs related to business integration, acquisition and restructuring related items, long-lived asset impairments, amortization of acquired intangible assets, non-cash interest expense charges as well as other special income and expense items. Management views these costs as not indicative of the profitability or cash flows of our ongoing or future operations and therefore considers the adjusted results as a supplement, and to be viewed in conjunction with, the reported GAAP results.

We use a measure of free cash flow to estimate the cash flow remaining after purchases of property, plant and equipment as required to maintain or expand our business. This measure provides us with supplemental information to assess our liquidity needs. We calculate free cash flow as net cash from operating activities less purchases of property, plant and equipment.

We also consider results on a constant currency basis. Our functional currency is the U.S. dollar and our subsidiaries’ functional currencies are the local currency of the respective countries in which they are headquartered. A significant portion of our revenues and expenses is denominated in euros and currencies other than the United States dollar. Management believes that analysis of constant currency period-over-period changes is useful because changes in exchange rates can affect the growth rate of net sales and expenses, potentially to a significant degree. Constant currency figures are calculated by translating the local currency actual results in the current period using the average exchange rates from the previous year’s respective period instead of the current period.

We use non-GAAP and constant currency financial measures internally in our planning, forecasting and reporting, as well as to measure and compensate our employees. We do not reconcile forward-looking non-GAAP financial measures to the corresponding GAAP measures due to the high variability and difficulty in making accurate forecasts and projections that are impacted by future decisions and actions. Accordingly, reconciliations of these forward-looking non-GAAP financial measures to the corresponding GAAP measures are not available without unreasonable effort. However, the actual amounts of these excluded items will have a significant impact on QIAGEN’s GAAP results.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | |

| | |

| QIAGEN N.V. | |

| |

| By: | /s/ Roland Sackers |

| | Roland Sackers |

| | Chief Financial Officer |

Date: February 8, 2024

EXHIBIT INDEX

| | | | | | | | |

| | |

Exhibit No. | | Exhibit |

| 99.1 | | Press Release dated February 6, 2024 |

QIAGEN exceeds outlook for Q4 2023, led by 8% CER sales growth in non-COVID products and improved operational profitability

•Q4 2023: Net sales of $509 million (+2% actual rates, +1% constant exchange rates, CER); diluted EPS of $0.42 and adjusted diluted EPS of $0.55 ($0.55 CER vs. $0.53 CER outlook)

•FY 2023: Achieved outlook for at least $1.97 billion CER sales and at least $2.07 CER adj. EPS, +8% CER sales growth in non-COVID portfolio and 27% adj. operating income margin

•2024 outlook for at least $2.0 billion CER net sales; adj. diluted EPS of at least $2.10 CER, reflects adj. operating income margin gains but significant non-operating income pressure

Venlo, the Netherlands, February 6, 2024 - QIAGEN N.V. (NYSE: QGEN; Frankfurt Prime Standard: QIA) announced results for the fourth quarter and full-year 2023.

Net sales results of $503 million at constant exchange rates (CER) for Q4 2023 achieved the outlook for at least $500 million CER, driven by 8% CER growth in the non-COVID-19 portfolio. Total sales for Q4 2023 rose 2% (+1% CER) to $509 million from Q4 2022, a period marked by significant COVID-19 sales. Adjusted diluted earnings per share (EPS) were $0.55 CER and above the outlook for at least $0.53 CER. Full-year 2023 sales declined 8% to $1.97 billion, achieving the outlook for $1.97 billion CER sales and were supported by 8% CER growth for non-COVID product groups. Adjusted diluted EPS were $2.09 CER and exceeded the outlook for at least $2.07 CER.

For 2024, QIAGEN has set an outlook for net sales of at least $2.0 billion CER. This reflects full-year total growth of at least 2% CER, with solid mid-single-digit CER sales growth in H2 2024 in the non-COVID portfolio over the year-ago period. This outlook also includes about one percentage point of COVID-19 sales headwinds from 2023. Consumables and related revenues are expected to drive growth, while larger-scale instrument sales remain challenging. QIAGEN also continues to closely monitor dynamic geopolitical and macro trends around the world. Adjusted diluted EPS are expected to be at least $2.10 CER. This reflects an at least one percentage point improvement in the adjusted operating income margin to above 28% for FY 2024 compared to 2023 while supporting investments in the portfolio, in particular to accelerate growth in the QIAGEN Digital Insights bioinformatics business. Significant pressure is expected on non-operating income for FY 2024 due to anticipated lower interest income and a higher tax rate compared to 2023, more than offsetting benefits from the recently completed $300 million synthetic share repurchase.

"We closed 2023 with strong results in the fourth quarter as we delivered sales growth in the top tier of our industry along with solid profitability. Amid a dynamic macro-environment, our teams executed well to advance our strategy of "Balance and Focus" on areas offering the highest growth potential. Driven by 8% CER growth in our non-COVID portfolio, we made solid progress in driving growth of our consumables business, which accounts for over 85% of sales, while also expanding our installed instrument base," said Thierry Bernard, Chief Executive Officer of QIAGEN. "These results demonstrate the power of our well-positioned portfolios to capture growth in dynamic applications across the Life Sciences and Molecular Diagnostics continuum. As we move into 2024, we are committed to delivering growth with sharpened focus and continued commitment to execution."

Roland Sackers, Chief Financial Officer of QIAGEN, said: "QIAGEN has consistently implemented a disciplined capital allocation policy over the last decade thanks to a solid balance sheet and healthy cash flows. We are investing to support internal growth with a high level of R&D investments, while also increasing returns through a $300 million synthetic share repurchase that underscores our commitment to value creation. We are confident in our outlook to deliver growth in 2024 in both sales as well as operational profitability as we overcome significant non-operating income headwinds."

Key figures

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

In $ millions

(Except EPS and diluted shares) | | Q4 | | FY |

| 2023 | | 2022 | | Change | | 2023 | | 2022 | | Change |

| | | | | | | | | | | | |

| Net sales | | 509 | | | 498 | | | 2 | % | | 1,965 | | | 2,142 | | | -8 | % |

| Net sales - CER | | 503 | | | | | 1 | % | | 1,972 | | | | | -8 | % |

Operating income | | 111 | | | 105 | | | 6 | % | | 410 | | | 531 | | | -23 | % |

Net income | | 98 | | | 89 | | | 10 | % | | 341 | | | 423 | | | -19 | % |

Diluted EPS | | $0.42 | | | $0.39 | | | 8 | % | | $1.48 | | | $1.84 | | | -20 | % |

| Diluted shares (in millions) | | 231 | | 230 | | | | 231 | | 230 | | |

| | | | | | | | | | | | |

| Adjusted operating income | | 142 | | | 135 | | | 6 | % | | 529 | | | 656 | | | -19 | % |

| Adjusted net income | | 127 | | | 122 | | | 4 | % | | 477 | | | 547 | | | -13 | % |

| Adjusted diluted EPS | | $0.55 | | | $0.53 | | | 4 | % | | $2.07 | | | $2.38 | | | -13 | % |

| Adjusted diluted EPS - CER | | $0.55 | | | | | 4 | % | | $2.09 | | | | | -12 | % |

Please refer to accompanying tables in this release for full income statement information and a reconciliation of reported to adjusted figures.

Tables may have rounding differences. Percentage changes are to prior-year periods.

Sales by product type, customer class and non-COVID / COVID-19 groups

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

In $ millions | | Q4 | | FY |

| 2023 sales | | 2022 sales | | Change | | CER change | | | 2023

sales | | 2022

sales | | Change | | CER change | |

| | | | | | | | | | | | | | | | | | |

| Consumables and related revenues | | 444 | | | 433 | | | +3 | % | | +1 | % | | | 1,726 | | | 1,889 | | | -9 | % | | -8 | % | |

| Instruments | | 65 | | | 65 | | | 0 | % | | -2 | % | | | 239 | | | 253 | | | -5 | % | | -5 | % | |

| | | | | | | | | | | | | | | | | | |

| Molecular Diagnostics | | 271 | | | 258 | | | +5 | % | | +4 | % | | | 1,035 | | | 1,126 | | | -8 | % | | -8 | % | |

| Life Sciences | | 238 | | | 240 | | | -1 | % | | -2 | % | | | 930 | | | 1,015 | | | -8 | % | | -8 | % | |

| | | | | | | | | | | | | | | | | | |

| Non-COVID product groups | | 472 | | | 432 | | | +9 | % | | +8 | % | | | 1,805 | | | 1,672 | | | +8 | % | | +8 | % | |

| COVID-19 product groups | | 38 | | | 66 | | | -43 | % | | -44 | % | | | 160 | | | 470 | | | -66 | % | | -66 | % | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

Tables may have rounding differences. Percentage changes are to prior-year periods.

•Sales: For Q4 and FY 2023, non-COVID product group sales rose 8% CER over the year-ago periods. The Molecular Diagnostics customer class grew 14% CER in Q4 2023 excluding COVID product groups over the 2022 quarter. This was due to solid growth of the QuantiFERON latent TB test and the Precision Medicine portfolio as well as growth in sales of the QIAstat-Dx syndromic testing system. Life Sciences sales were up 3% CER excluding COVID products while absorbing the significant decline in OEM products sold to other companies during 2023.

•Operating income: For Q4 2023, the adjusted operating income margin was 28.0% of sales compared with 27.1% in Q4 2022. In terms of components, the adjusted gross margin declined to 65.7% of sales in Q4 2023 from 67.0% in the year-ago period, affected in 2023 by lower capacity utilization and adverse product mix changes. R&D investments remained at a high level and steady at 9.0% of sales in Q4 2023 compared to the year-ago period. Sales and marketing expenses declined in Q4 2023 to 23.1% of sales from 24.5% in Q4 2022 amid efficiency gains through digital customer engagement. General and administrative expenses declined to 5.6% of sales from 6.4% in Q4 2022 despite absorbing IT investments. For FY 2023, the adjusted operating income margin was 26.9% of sales compared to 30.6% in 2022.

•EPS: For Q4 2023, adjusted diluted EPS of $0.55 ($0.55 CER) was above the outlook for at least $0.53 CER. For FY 2023, adjusted diluted EPS of $2.09 CER was above the outlook for at least $2.07 CER, while results at actual rates of $2.07 compared to $2.38 in 2022.

Sales by product groups

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

In $ millions | | Q4 | | FY |

| 2023 sales | | 2022 sales | | Change | | CER change | | | 2023 sales | | 2022 sales | | Change | | CER change | |

| | | | | | | | | | | | | | | | | | |

| Sample technologies | | 164 | | | 171 | | | -4 | % | | -5 | % | | | 663 | | | 797 | | | -17 | % | | -16 | % | |

| Diagnostic solutions | | 180 | | | 170 | | | +6 | % | | +4 | % | | | 698 | | | 661 | | | +6 | % | | +6 | % | |

| Of which QuantiFERON | | 102 | | | 82 | | | +25 | % | | +24 | % | | | 408 | | | 330 | | | +24 | % | | +24 | % | |

| Of which QIAstat-Dx | | 26 | | | 26 | | | 0 | % | | -2 | % | | | 88 | | | 88 | | | 0 | % | | 0 | % | |

| Of which NeuMoDx | | 11 | | | 20 | | | -47 | % | | -49 | % | | | 42 | | | 83 | | | -50 | % | | -50 | % | |

| Of which Other | | 41 | | | 43 | | | -4 | % | | -5 | % | | | 159 | | | 160 | | | 0 | % | | 0 | % | |

| PCR / Nucleic acid amplification | | 81 | | | 81 | | | 0 | % | | -1 | % | | | 300 | | | 391 | | | -23 | % | | -23 | % | |

| Genomics / NGS | | 65 | | | 59 | | | +10 | % | | +9 | % | | | 239 | | | 225 | | | +6 | % | | +7 | % | |

| Other | | 19 | | | 17 | | | +11 | % | | +10 | % | | | 66 | | | 68 | | | -4 | % | | -1 | % | |

Tables may have rounding differences. Percentage changes are to prior-year periods.

•Sample technologies: Q4 2023 and FY 2023 sales in the non-COVID product groups rose at a mid-single digit CER rate over the year ago periods, supported by higher sales of consumables that more than offset a modest decline in instruments. The overall sales decline of 5% CER from Q4 2022 was due to the significant drop-off in pandemic testing demand.

•Diagnostic solutions: Non-COVID product group sales grew at a mid-teens CER rate in Q4 2023, with overall sales up 4% CER over Q4 2022 and overcoming significant COVID-related sales headwinds. QuantiFERON-TB achieved its third consecutive quarter with sales above $100 million in Q4 2023, delivering 24% CER growth reflecting ongoing double-digit CER gains in all regions. QIAstat-Dx sales delivered single-digit CER growth in non-COVID sales in Q4 2023 and were supported by an ongoing high level of placements while sales grew nearly 20% CER outside the U.S. and represented the majority of product sales. At the end of 2023, more than 4,000 cumulative placements had been made. NeuMoDx results were down compared to the significant COVID-19 sales contributions in 2022, but above the FY 2023 target, with over 300 cumulative placements at the end of 2023. For FY 2023, Precision Medicine sales of consumables used to guide oncology treatments delivered single-digit CER growth, while revenues from companion diagnostic co-development partnerships exceeded $45 million on solid growth trends.

•PCR / Nucleic acid amplification: Overall product group sales in Q4 2023 fell due to the sharp decline in COVID product demand as well as the drop-off in sales of OEM products. However, underlying sales excluding COVID and OEM sales rose at a single-digit CER rate for both Q4 2023 and FY 2023 over the year-ago periods. QIAcuity digital PCR sales grew at a solid double-digit CER rate in 2023 and exceeded the full-year target for at least $70 million, with more than 2,000 cumulative instrument placements.

•Genomics / Next-generation sequencing (NGS): Sales growth of 9% CER in Q4 2023, as well as FY 2023 growth at 7% CER, came from business expansion in the QIAGEN Digital Insights (QDI) bioinformatics business and the portfolios of universal NGS (next-generation sequencing) solutions for use with various third-party NGS systems.

Sales by geographic regions

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

In $ millions | | Q4 | | FY |

| 2023 sales | | 2022 sales | | Change | | CER change | | | 2023 sales | | 2022 sales | | Change | | CER change | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| Americas | | 256 | | | 241 | | | +6 | % | | +6 | % | | | 1,020 | | | 998 | | | +2 | % | | +2 | % | |

| Europe / Middle East / Africa | | 173 | | | 169 | | | +3 | % | | -1 | % | | | 625 | | | 733 | | | -15 | % | | -16 | % | |

| Asia-Pacific / Japan | | 80 | | | 88 | | | -9 | % | | -8 | % | | | 320 | | | 410 | | | -22 | % | | -19 | % | |

Rest of world represented less than 1% of sales.

Tables may have rounding differences. Percentage changes are to prior-year periods.

•Americas: Q4 2023 sales grew 6% CER, as gains in the U.S. more than offset headwinds from COVID-19 sales in the year-ago period. For FY 2023, non-COVID sales in this region rose 10% CER, with overall results reflecting headwinds from COVID-19 product sales in 2022.

•Europe / Middle East / Africa: Sales for non-COVID product groups rose at a double-digit CER rate for both Q4 and FY 2023, while overall sales fell 16% CER in FY 2023 due to the COVID-19 sales contributions in 2022. Among the top-performing countries in terms of non-COVID sales results were France, Germany, Italy and the United Kingdom.

•Asia-Pacific / Japan: Sales for non-COVID product groups declined at a modest single-digit CER rate for Q4 and were largely unchanged for FY 2023 over the year-ago period, while the decline in overall sales over the same periods in 2022 reflected significant headwinds from COVID-19 sales. Non-COVID sales for the region excluding China rose at a single-digit CER rate in Q4 and FY 2023 over the 2022 periods. In China (about 6% of total QIAGEN sales in FY 2023), non-COVID sales declined at a low-single digit CER rate for the year over FY 2022, while Q4 2023 sales declined more than 10% CER over the year-ago period due to ongoing weaker macroeconomic trends.

Key cash flow data

| | | | | | | | | | | | | | | | | | | | |

| In $ millions | | FY |

| 2023 | | 2022 | | Change |

| | | | | | |

| Net cash provided by operating activities | | 459 | | | 715 | | | -36 | % |

| Purchases of property, plant and equipment | | (150) | | | (129) | | | 16 | % |

| Free cash flow | | 310 | | | 586 | | | -47 | % |

| | | | | | |

| Net cash used in investing activities | | (88) | | | (727) | | | NM |

| Net cash used in financing activities | | (434) | | | (126) | | | NM |

•Net cash from operating activities was $459 million in 2023 compared with $715 million in the year-ago period. Results for 2023 reflected the reduced net income compared with 2022 results, as well as higher working capital requirements during 2023, in particular due to an increase in operating assets driven by a decision to hold higher inventories to ensure adequate product availability in light of macroeconomic and geopolitical trends.

•As of December 31, 2023, cash, cash equivalents and short-term investments stood at $1.1 billion compared to $1.4 billion as of December 31, 2022. Including the recently completed $300 million synthetic share repurchase in January 2024, the leverage ratio was 1.1x (net debt to adjusted EBITDA) compared to 0.6x at December 31, 2023, and 0.5x at the end of 2022. In September 2023, QIAGEN repaid $400 million for convertible notes that reached maturity from existing cash reserves. In 2024, QIAGEN has approximately $500 million of convertible notes and $100 million of German private placements (Schuldschein) reaching maturity.

Portfolio update

Among recent developments in QIAGEN's Sample to Insight portfolio:

Sample technologies

•QIAGEN has expanded its portfolio of instruments and kits for use with challenging samples. The TissueLyser III was launched as a high-throughput instrument for enhanced disruption of biological samples such as bones, tissue and soil. Additionally, the RNeasy PowerMax Soil Pro Kit was launched for isolating RNA from challenging soil samples rich in PCR inhibitors.

Diagnostic solutions

•The LIAISON® LymeDetect® test was submitted by partner DiaSorin for U.S. regulatory approval to improve the early diagnosis of Lyme disease. The test leverages the QuantiFERON technology from QIAGEN with the LIAISON systems and other Lyme disease tests from DiaSorin. This expansion of the QuantiFERON test menu, which also includes the CE-IVD version of this test now available in Europe, builds on the successful partnership between QIAGEN and DiaSorin to offer an automated version of the QuantiFERON-TB Gold Plus TB test on LIAISON systems.

•QIAGEN and Myriad Genetics announced a master collaboration agreement to provide services and products to pharmaceutical companies. The initial project focus involves collaborating with partners to develop assays using NGS workflows or QIAGEN’s QIAcuity digital PCR platform.

PCR / Nucleic Acid Amplification

•QIAGEN introduced three new kits and a software update for its QIAcuity digital PCR systems, targeting customers in the pharma, biopharma research, and food and drug safety sectors. Customers now have access to around 30 dedicated kits for QIAcuity, along with access to QIAGEN's GeneGlobe website to create customized panels specific to their own needs.

Genomics / NGS

•QIAGEN and Element Biosciences recently announced a strategic partnership to offer NGS workflows for the AVITI System. The companies will provide customers with QIAGEN’s Sample to Insight NGS workflows, including validated QIAseq panels and integrated bioinformatic solutions. QIAGEN’s QIAseq panels have been validated on Element's AVITI sequencer, demonstrating robust performance, high specificity and consistent variant detection.

•QIAGEN announced plans to accelerate investments in its QIAGEN Digital Insights (QDI) bioinformatics business over the next five years. The goal is to expand QDI’s offerings in new geographic regions and market segments. The plan includes launching at least five new products and enhancing existing products, with additional omics knowledge bases. Furthermore, the investments will extend QDI’s augmented molecular intelligence approach with added Artificial Intelligence (AI) and Natural Language Processing (NLP) capabilities as well as a new regulatory-compliant secondary analysis solution for rapid NGS analysis within clinical labs.

Synthetic share repurchase completed in January 2024

QIAGEN completed the return of about $300 million to shareholders through a synthetic share repurchase in January 2024 that combined a direct capital repayment with a reverse stock split. This approach is designed to return cash to shareholders in a more efficient way than through a traditional open-market repurchase program. The repayment from existing cash reserves is expected to enhance earnings per share through a reduction in the number of shares outstanding.

Two new members to join the Supervisory Board

It is planned for Eva van Pelt and Bert van Meurs to join the Supervisory Board during early 2024 to further complement and enhance the Board’s already extensive experience in life sciences and diagnostics. They will stand for election to one-year terms at the next Annual General Meeting planned for June 2024.

Ms. van Pelt, who is expected to join the Board as of March 1, most recently served as Co-CEO and member of the management board of Eppendorf Group, a privately-held German Life Sciences company with more than EUR 1.2 billion of annual sales and over 5,000 employees worldwide. Prior to her time at Eppendorf, she held various international management positions of increasing responsibility with Siemens, Accenture, Hitachi Data Systems and Leica Microsystems. She also currently serves as a member of the Supervisory Board of Paul Hartmann AG, a publicly-listed German healthcare company and as President of the German-Dutch Chamber of Commerce. She earned a Diplom-Kauffrau degree from the Ludwig-Maximilians-Universität in Munich.

Mr. van Meurs, who is expected to join the Board as of April 1, is a member of the Executive Committee at Royal Philips N.V. of the Netherlands, where he serves as Executive Vice President and Chief Business Leader of Image Guided Therapy, and also as Chief Business Leader of Precision Diagnosis (ad interim) responsible for Diagnosis & Treatment. He has more than 30 years of experience since joining Philips in 1985 in various global business leadership positions in research and development, clinical science, and marketing and sales in Europe and Asia. He has a Master’s degree in Physics from the University of Utrecht and a degree in Business Marketing from the Technical University of Eindhoven, both in the Netherlands.

Outlook

For 2024, QIAGEN has set an outlook for net sales of at least $2.0 billion CER. This reflects full-year total growth of at least 2% CER, with solid mid-single-digit CER sales growth in H2 2024 in the non-COVID portfolio over the year-ago period. This outlook also includes about one percentage point of COVID-19 sales headwinds from 2023. Consumables and related revenues are expected to drive growth, while larger-scale instrument sales remain challenging. QIAGEN also continues to closely monitor dynamic geopolitical and macro trends around the world. Adjusted diluted EPS are expected to be at least $2.10 CER. This reflects an at least one percentage point improvement in the adjusted operating income margin to above 28% for FY 2024 compared to 2023 while supporting investments in the portfolio, in particular to accelerate growth in the QIAGEN Digital Insights bioinformatics business. Significant pressure is expected on non-operating income for FY 2024 due to anticipated lower interest income and a higher tax rate compared to 2023, more than offsetting benefits from the recently completed $300 million synthetic share repurchase. This outlook does not take into consideration any future acquisitions. Based on exchange rates as of January 31, 2024, currency movements against the U.S. dollar are expected to have a neutral impact on full-year net sales, but a negative impact of about $0.01 per share on adjusted EPS results.

For Q1 2024, net sales are expected to be at least $455 million CER, while adjusted diluted EPS are expected to be at least $0.44 CER per share. Based on exchange rates as of January 31, 2024, currency movements against the U.S. dollar are expected to have a neutral impact on Q1 2024 net sales, but a negative impact of about $0.01 per share on adjusted EPS results.

Investor presentation and conference call

A conference call is planned for Wednesday, February 7, 2024 at 15:00 Frankfurt Time / 14:00 London Time / 9:00 New York Time. A live audio webcast will be made available in the investor relations section of the QIAGEN website, and a recording will also be made available after the event. A presentation will be available before the conference call at https://corporate.qiagen.com/investor-relations/events-and-presentations/default.aspx.

Use of adjusted results

QIAGEN reports adjusted results, as well as results on a constant exchange rate (CER) basis, and other non-U.S. GAAP figures (generally accepted accounting principles), to provide additional insight into its performance. These results include adjusted net sales, adjusted gross income, adjusted gross profit, adjusted operating income, adjusted operating expenses, adjusted operating income margin, adjusted net income, adjusted net income before taxes, adjusted diluted EPS, adjusted EBITDA, adjusted EPS, adjusted income taxes, adjusted tax rate, and free cash flow. Free cash flow is calculated by deducting capital expenditures for Property, Plant & Equipment from cash flow from operating activities. Adjusted results are non-GAAP financial measures that QIAGEN believes should be considered in addition to reported results prepared in accordance with GAAP but should not be considered as a substitute. QIAGEN believes certain items should be excluded from adjusted results when they are outside of ongoing core operations, vary significantly from period to period, or affect the comparability of results with competitors and its own prior periods. Furthermore, QIAGEN uses non-GAAP and constant currency financial measures internally in planning, forecasting and reporting, as well as to measure and compensate employees. QIAGEN also uses adjusted results when comparing current performance to historical operating results, which have consistently been presented on an adjusted basis.

About QIAGEN

QIAGEN N.V., a Netherlands-based holding company, is the leading global provider of Sample to Insight solutions that enable customers to gain valuable molecular insights from samples containing the building blocks of life. Our sample technologies isolate and process DNA, RNA and proteins from blood, tissue and other materials. Assay technologies make these biomolecules visible and ready for analysis. Bioinformatics software and knowledge bases interpret data to report relevant, actionable insights. Automation solutions tie these together in seamless and cost-effective workflows. QIAGEN provides solutions to more than 500,000 customers around the world in Molecular Diagnostics (human healthcare) and Life Sciences (academia, pharma R&D and industrial applications, primarily forensics). As of December 31, 2023, QIAGEN employed approximately 6,000 people in over 35 locations worldwide. Further information can be found at https://www.qiagen.com.

Forward-Looking Statement

Certain statements contained in this press release may be considered forward-looking statements within the meaning of Section 27A of the U.S. Securities Act of 1933, as amended, and Section 21E of the U.S. Securities Exchange Act of 1934, as amended. To the extent that any of the statements contained herein relating to QIAGEN's products, timing for launch and development, marketing and/or regulatory approvals, financial and operational outlook, growth and expansion, collaborations, markets, strategy or operating results, including without limitation its expected adjusted net sales and adjusted diluted earnings results, are forward-looking, such statements are based on current expectations and assumptions that involve a number of uncertainties and risks. Such uncertainties and risks include, but are not limited to, risks associated with management of growth and international operations (including the effects of currency fluctuations, regulatory processes and dependence on logistics), variability of operating results and allocations between customer classes, the commercial development of markets for our products to customers in academia, pharma, applied testing and molecular diagnostics; changing relationships with customers, suppliers and strategic partners; competition; rapid or unexpected changes in technologies; fluctuations in demand for QIAGEN's products (including fluctuations due to general economic conditions, the level and timing of customers' funding, budgets and other factors); our ability to obtain regulatory approval of our products; difficulties in successfully adapting QIAGEN's products to integrated solutions and producing such products; the ability of QIAGEN to identify and develop new products and to differentiate and protect our products from competitors' products; market acceptance of QIAGEN's new products and the integration of acquired technologies and businesses; actions of governments, global or regional economic developments, weather or transportation delays, natural disasters, political or public health crises, and its impact on the demand for our products and other aspects of our business, or other force majeure events; as well as the possibility that expected benefits related to recent or pending acquisitions may not materialize as expected; and the other factors discussed under the heading “Risk Factors” contained in Item 3 of our most recent Annual Report on Form 20-F. For further information, please refer to the discussions in reports that QIAGEN has filed with, or furnished to, the U.S. Securities and Exchange Commission.

Contacts

John Gilardi

Vice President, Head of Corporate Communications and Investor Relations

+49 2103 29 11711 / john.gilardi@qiagen.com

Phoebe Loh

Senior Director, Global Investor Relations

+49 2103 29 11457 / phoebe.loh@qiagen.com

Dr. Thomas Theuringer

Senior Director, Head of External Communications

+49 2103 29 11826 / thomas.theuringer@qiagen.com

Daniela Berheide

Associate Director, External Communications

+49 2103 29 11676 / daniela.berheide@qiagen.com

QIAGEN N.V.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| (In $ thousands, except per share data) | | Three months | | Twelve months |

| ended December 31, | | ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | | |

| Net sales | | $509,162 | | | $497,984 | | | $1,965,311 | | | $2,141,518 | |

| Cost of sales: | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Cost of sales | | 177,018 | | | 165,462 | | | 667,425 | | | 696,472 | |

| Acquisition-related intangible amortization | | 16,044 | | | 14,998 | | | 64,198 | | | 60,483 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Total cost of sales | | 193,062 | | | 180,460 | | | 731,623 | | | 756,955 | |

| Gross profit | | 316,100 | | | 317,524 | | | 1,233,688 | | | 1,384,563 | |

| Operating expenses: | | | | | | | | |

| Sales and marketing | | 117,478 | | | 122,244 | | | 459,912 | | | 474,220 | |

| Research and development | | 45,966 | | | 44,719 | | | 198,511 | | | 189,859 | |

| | | | | | | | |

| General and administrative | | 28,474 | | | 31,967 | | | 119,254 | | | 129,725 | |

| Acquisition-related intangible amortization | | 2,692 | | | 5,969 | | | 10,764 | | | 14,531 | |

| | | | | | | | |

| | | | | | | | |

| Restructuring, acquisition, integration and other, net | | 10,875 | | | 8,052 | | | 35,309 | | | 44,768 | |

| Total operating expenses | | 205,485 | | | 212,951 | | | 823,750 | | | 853,103 | |

| Income from operations | | 110,615 | | | 104,573 | | | 409,938 | | | 531,460 | |

| Other income (expense): | | | | | | | | |

| Interest income | | 19,261 | | | 16,262 | | | 78,992 | | | 32,757 | |

| Interest expense | | (12,441) | | | (14,875) | | | (53,410) | | | (58,357) | |

| Other income (expense), net | | 1,441 | | | (123) | | | (5,711) | | | 6,741 | |

| Total other income (expense), net | | 8,261 | | | 1,264 | | | 19,871 | | | (18,859) | |

| Income before income tax expense | | 118,876 | | | 105,837 | | | 429,809 | | | 512,601 | |

| Income tax expense | | 21,212 | | | 16,993 | | | 88,506 | | | 89,390 | |

| | | | | | | | |

| | | | | | | | |

| Net income | | $97,664 | | | $88,844 | | | $341,303 | | | $423,211 | |

| | | | | | | | |

| Diluted earnings per common share | | $0.42 | | | $0.39 | | | $1.48 | | | $1.84 | |

| | | | | | | | |

| | | | | | | | |

| Diluted earnings per common share (adjusted) | | $0.55 | | | $0.53 | | | $2.07 | | | $2.38 | |

| Shares used in computing diluted earnings per common share | | 230,745 | | | 230,357 | | | 230,619 | | | 230,136 | |

QIAGEN N.V.

RECONCILIATION OF REPORTED TO ADJUSTED RESULTS

(In $ millions, except EPS data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Three months ended December 31, 2023 | | Net

Sales | | Gross

Profit | | Operating

Income | | Pre-tax

Income | | Income

Tax | | Tax

Rate | | Net

Income | | Diluted EPS* |

| | | | | | | | | | | | | | | | |

| Reported results | | 509.2 | | | 316.1 | | | 110.6 | | | 118.9 | | | (21.2) | | | 18 | % | | 97.7 | | | $0.42 | |

| Adjustments: | | | | | | | | | | | | | | | | |

| Business integration, acquisition and restructuring related items (a) | | — | | | 2.1 | | | 13.0 | | | 13.0 | | | (3.4) | | | | | 9.6 | | | 0.04 | |

| Purchased intangibles amortization (b) | | — | | | 16.1 | | | 18.7 | | | 18.7 | | | (4.6) | | | | | 14.1 | | | 0.06 | |

| | | | | | | | | | | | | | | | |

| Non-cash interest expense charges (c) | | — | | | — | | | — | | | 4.8 | | | — | | | | | 4.8 | | | 0.02 | |

| Non-cash other income, net (d) | | — | | | — | | | — | | | 0.5 | | | — | | | | | 0.5 | | | 0.00 | |

| Certain income tax items (e) | | — | | | — | | | — | | | — | | | 0.5 | | | | | 0.5 | | | 0.00 | |

| Total adjustments | | — | | | 18.2 | | | 31.8 | | | 36.9 | | | (7.5) | | | | | 29.5 | | | 0.13 | |

| Adjusted results | | 509.2 | | | 334.3 | | | 142.4 | | | 155.8 | | | (28.7) | | | 18 | % | | 127.2 | | | $0.55 | |

| | | | | | | | | | | | | | | | |

*Using 230.7 M diluted shares | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Three months ended December 31, 2022 | | Net

Sales | | Gross

Profit | | Operating

Income | | Pre-tax

Income | | Income

Tax | | Tax

Rate | | Net

Income | | Diluted EPS* |

| | | | | | | | | | | | | | | | |

| Reported results | | 498.0 | | | 317.5 | | | 104.6 | | | 105.8 | | | (17.0) | | | 16 | % | | 88.8 | | | $0.39 | |

| Adjustments: | | | | | | | | | | | | | | | | |

| Business integration, acquisition and restructuring related items (a) | | — | | | 1.3 | | | 9.4 | | | 9.5 | | | (2.8) | | | | | 6.8 | | | 0.02 | |

| Purchased intangibles amortization (b) | | — | | | 15.0 | | | 21.0 | | | 21.0 | | | (5.3) | | | | | 15.7 | | | 0.07 | |

| | | | | | | | | | | | | | | | |

| Non-cash interest expense charges (c) | | — | | | — | | | — | | | 8.2 | | | — | | | | | 8.2 | | | 0.04 | |

| Non-cash other income, net (d) | | — | | | — | | | — | | | (0.1) | | | — | | | | | (0.1) | | | 0.00 | |

| Certain income tax items (e) | | — | | | — | | | — | | | — | | | 2.8 | | | | | 2.8 | | | 0.01 | |

| Total adjustments | | — | | | 16.4 | | | 30.3 | | | 38.7 | | | (5.4) | | | | | 33.2 | | | 0.14 | |

| Adjusted results | | 498.0 | | | 333.9 | | | 134.9 | | | 144.5 | | | (22.4) | | | 16 | % | | 122.0 | | | $0.53 | |

| | | | | | | | | | | | | | | | |

*Using 230.4 M diluted shares | | | | | | | | | | | | | | | | |

Please see footnotes for these tables on the following page.

QIAGEN N.V.

RECONCILIATION OF REPORTED TO ADJUSTED RESULTS

(In $ millions, except EPS data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Twelve months ended December 31, 2023 | | Net

Sales | | Gross

Profit | | Operating

Income | | Pre-tax

Income | | Income

Tax | | Tax

Rate | | Net

Income | | Diluted EPS* |

| | | | | | | | | | | | | | | | |

| Reported results | | 1,965.3 | | | 1,233.7 | | | 409.9 | | | 429.8 | | | (88.5) | | | 21 | % | | 341.3 | | | $1.48 | |

| Adjustments: | | | | | | | | | | | | | | | | |

| Business integration, acquisition and restructuring related items (a) | | — | | | 8.4 | | | 43.7 | | | 43.7 | | | (10.9) | | | | | 32.8 | | | 0.14 | |

| Purchased intangibles amortization (b) | | — | | | 64.2 | | | 74.9 | | | 74.9 | | | (18.4) | | | | | 56.5 | | | 0.25 | |

| | | | | | | | | | | | | | | | |

| Non-cash interest expense charges (c) | | — | | | — | | | — | | | 29.1 | | | — | | | | | 29.1 | | | 0.13 | |

| Non-cash other income, net (d) | | — | | | — | | | — | | | 7.0 | | | — | | | | | 7.0 | | | 0.03 | |

| Certain income tax items (e) | | — | | | — | | | — | | | — | | | 10.3 | | | | | 10.3 | | | 0.04 | |

| Total adjustments | | — | | | 72.6 | | | 118.7 | | | 154.6 | | | (19.0) | | | | | 135.6 | | | 0.59 | |

| Adjusted results | | 1,965.3 | | | 1,306.3 | | | 528.6 | | | 584.4 | | | (107.5) | | | 18 | % | | 476.9 | | | $2.07 | |

| | | | | | | | | | | | | | | | |

*Using 230.6 M diluted shares | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Twelve months ended December 31, 2022 | | Net

Sales | | Gross

Profit | | Operating

Income | | Pre-tax

Income | | Income

Tax | | Tax

Rate | | Net

Income | | Diluted EPS* |

| | | | | | | | | | | | | | | | |

| Reported results | | 2,141.5 | | | 1,384.6 | | | 531.5 | | | 512.6 | | | (89.4) | | | 17 | % | | 423.2 | | | $1.84 | |

| Adjustments: | | | | | | | | | | | | | | | | |

| Business integration, acquisition and restructuring related items (a) | | — | | | 5.0 | | | 49.8 | | | 49.8 | | | (13.6) | | | | | 36.2 | | | 0.15 | |

| Purchased intangible amortization (b) | | — | | | 60.5 | | | 75.0 | | | 75.0 | | | (18.6) | | | | | 56.4 | | | 0.25 | |

| | | | | | | | | | | | | | | | |

| Non-cash interest expense charges (c) | | — | | | — | | | — | | | 32.2 | | | — | | | | | 32.2 | | | 0.14 | |

| Non-cash other income, net (d) | | — | | | — | | | — | | | (0.4) | | | — | | | | | (0.4) | | | 0.00 | |

| Certain income tax items (e) | | — | | | — | | | — | | | — | | | — | | | | | — | | | 0.00 | |

| Total adjustments | | — | | | 65.5 | | | 124.8 | | | 156.5 | | | (32.2) | | | | | 124.3 | | | 0.54 | |

| Adjusted results | | 2,141.5 | | | 1,450.1 | | | 656.3 | | | 669.1 | | | (121.6) | | | 18 | % | | 547.5 | | | $2.38 | |

| | | | | | | | | | | | | | | | |

*Using 230.1 M diluted shares | | | | | | | | | | | | | | | | |

(a) Results for 2023 include costs for acquisition projects, including the acquisition of Verogen Inc. completed on January 4, 2023. Results for 2022 include acquisition projects including continued integration activities at NeuMoDx and the Q2 2022 acquisition of BLIRT S.A.

(b) Results for 2023 include the amortization of Verogen intangible assets acquired in Q1 2023. Results for 2022 include the amortization of BLIRT S.A. intangible assets acquired in Q2 2022.

(c) Cash Convertible Notes were recorded at an original issue discount that is recognized as incremental non-cash interest expense over the expected life of the notes.

(d) Adjustment includes the net impact of changes in fair value of the Call Options and the Embedded Cash Conversion Options related to the Cash Convertible Notes and foreign currency impacts from highly inflationary accounting in Turkey in 2023.

(e) These items represent updates in QIAGEN's assessment of ongoing examinations or other tax items that are not indicative of the Company's normal future income tax expense.

Tables may contain rounding differences.

QIAGEN N.V.

CONDENSED CONSOLIDATED BALANCE SHEETS

| | | | | | | | | | | | | | |

| (In $ thousands, except par value) | | December 31, 2023 | | December 31, 2022 |

| | | | |

| Assets | | (unaudited) | | |

| Current assets: | | | | |

| Cash and cash equivalents | | $668,084 | | | $730,669 | |

| | | | |

| Short-term investments | | 389,698 | | | 687,597 | |

| Accounts receivable, net | | 381,877 | | | 323,750 | |

| Inventories, net | | 398,385 | | | 357,960 | |

| Prepaid expenses and other current assets | | 309,516 | | | 293,976 | |

| Total current assets | | 2,147,560 | | | 2,393,952 | |

| Long-term assets: | | | | |

| Property, plant and equipment, net | | 765,037 | | | 662,170 | |

| Goodwill | | 2,475,732 | | | 2,352,569 | |

| Intangible assets, net | | 526,821 | | | 544,796 | |

| Fair value of derivative instruments - long-term | | 3,083 | | | 131,354 | |

| | | | |

| | | | |

| Other long-term assets | | 196,957 | | | 202,894 | |

| Total long-term assets | | 3,967,630 | | | 3,893,783 | |

| Total assets | | $6,115,190 | | | $6,287,735 | |

Liabilities and equity | | | | |

| Current liabilities: | | | | |

| Current portion of long-term debt | | $587,970 | | | $389,552 | |

| | | | |

| Accrued and other current liabilities | | 407,168 | | | 486,237 | |

| Accounts payable | | 84,155 | | | 98,734 | |

| Total current liabilities | | 1,079,293 | | | 974,523 | |

| Long-term liabilities: | | | | |

| Long-term debt, net of current portion | | 921,824 | | | 1,471,898 | |

| Fair value of derivative instruments - long-term | | 98,908 | | | 156,718 | |

| | | | |

| | | | |

| Other long-term liabilities | | 207,401 | | | 217,985 | |

| Total long-term liabilities | | 1,228,133 | | | 1,846,601 | |

| Equity: | | | | |

Common shares, EUR 0.01 par value: authorized - 410,000,000 shares, issued - 230,829,265 shares | | 2,702 | | | 2,702 | |

| Additional paid-in capital | | 1,915,115 | | | 1,868,015 | |

| Retained earnings | | 2,456,800 | | | 2,160,173 | |

| Accumulated other comprehensive loss | | (433,830) | | | (404,091) | |

Less treasury stock, at cost — 2,626,510 and 3,112,832 shares, respectively | | (133,023) | | | (160,188) | |

| | | | |

| | | | |

| Total equity | | 3,807,764 | | | 3,466,611 | |

| Total liabilities and equity | | $6,115,190 | | | $6,287,735 | |

QIAGEN N.V.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

| | | | | | | | | | | | | | |

| (In $ thousands) | | Twelve Months Ended December 31, |

| 2023 | | 2022 |

| | | | |

| Cash flows from operating activities: | | (unaudited) | | |

| Net income | | $341,303 | | | $423,211 | |

| Adjustments to reconcile net income to net cash provided by operating activities, net of effects of businesses acquired: | | | | |

| Depreciation and amortization | | 205,336 | | | 208,397 | |

| Non-cash impairments | | 4,158 | | | 12,970 | |

| Amortization of debt discount and issuance costs | | 30,162 | | | 33,701 | |

| Share-based compensation expense | | 47,100 | | | 49,507 | |

| Deferred tax benefit | | 10,731 | | | (9,603) | |

| Other items, net including fair value changes in derivatives | | 7,623 | | | 28,962 | |

| Change in operating assets, net | | (94,825) | | | 10,475 | |

| Change in operating liabilities, net | | (92,133) | | | (42,356) | |

| Net cash provided by operating activities | | 459,455 | | | 715,264 | |

| Cash flows from investing activities: | | | | |

| Purchases of property, plant and equipment | | (149,710) | | | (129,224) | |

| Purchases of intangible assets | | (13,092) | | | (20,112) | |

| Purchases of short-term investments | | (976,448) | | | (1,385,929) | |

| Proceeds from redemptions of short-term investments | | 1,270,551 | | | 883,083 | |

| Cash paid for acquisitions, net of cash acquired | | (149,532) | | | (63,651) | |

| Cash paid for collateral asset | | (66,583) | | | (9,881) | |

| Purchases of investments, net | | (2,870) | | | (1,156) | |

| Other investing activities | | 29 | | | 107 | |

| Net cash used in investing activities | | (87,655) | | | (726,763) | |

| Cash flows from financing activities: | | | | |

| Proceeds from long-term debt, net of issuance costs | | — | | | 371,452 | |

| Repayment of long-term debt | | (400,000) | | | (480,003) | |

| | | | |

| Proceeds from exercise of call options related to cash convertible notes | | 36,762 | | | — | |

| Payment of intrinsic value of cash convertible notes | | (36,762) | | | — | |

| Tax withholding related to vesting of stock awards | | (17,675) | | | (25,357) | |

| Cash (paid) received for collateral liability | | (16,315) | | | 12,556 | |

| Proceeds from issuance of common shares | | 163 | | | 121 | |

| Cash paid for contingent consideration | | — | | | (4,572) | |

| | | | |

| | | | |

| Net cash used in financing activities | | (433,827) | | | (125,803) | |

| Effect of exchange rate changes on cash and cash equivalents | | (558) | | | (12,545) | |

| Net decrease in cash and cash equivalents | | (62,585) | | | (149,847) | |

| Cash and cash equivalents, beginning of period | | 730,669 | | | 880,516 | |

| Cash and cash equivalents, end of period | | $668,084 | | | $730,669 | |

| | | | |

Reconciliation of free cash flow(1) | | | | |

| Net cash provided by operating activities | | $459,455 | | | $715,264 | |

| Purchases of property, plant and equipment | | (149,710) | | | (129,224) | |

| Free cash flow | | $309,745 | | | $586,040 | |

(1) Free cash flow is a non-GAAP financial measure and is calculated from net cash provided by operating activities reduced by purchases of property, plant and equipment.

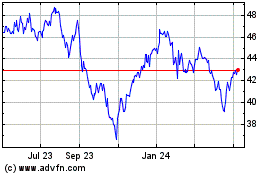

Qiagen NV (NYSE:QGEN)

Historical Stock Chart

From Mar 2024 to Apr 2024

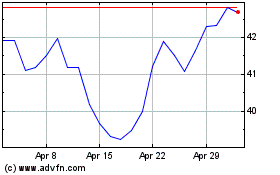

Qiagen NV (NYSE:QGEN)

Historical Stock Chart

From Apr 2023 to Apr 2024