FALSE000133691700013369172024-02-082024-02-080001336917us-gaap:CommonClassAMember2024-02-082024-02-080001336917us-gaap:CommonClassCMember2024-02-082024-02-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________________________________________________________

FORM 8-K

______________________________________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 8, 2024

________________________________________________________________________________

UNDER ARMOUR, INC.

________________________________________________________________________________ | | | | | | | | | | | | | | |

Maryland | | 001-33202 | | 52-1990078 |

(State or other jurisdiction of incorporation or organization) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| |

1020 Hull Street, Baltimore, Maryland | | 21230 |

(Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (410) 468-2512

(Former name or former address, if changed since last report)

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Class A Common Stock | UAA | New York Stock Exchange |

| Class C Common Stock | UA | New York Stock Exchange |

| (Title of each class) | (Trading Symbols) | (Name of each exchange on which registered) |

________________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). | | | | | |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

Item 2.02. Results of Operations and Financial Condition.

On February 8, 2024, Under Armour, Inc. (“Under Armour”, or the “Company”) issued a press release announcing its financial results for the quarter ended December 31, 2023. A copy of Under Armour’s press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference. Under Armour has scheduled a conference call for 8:30 a.m. ET on February 8, 2024 to discuss its financial results.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits. | | | | | | | | | | | |

Exhibit No. | | Exhibit |

| | Under Armour, Inc. press release announcing financial results for the quarter ended December 31, 2023. |

| 101 | | XBRL Instance Document - The instance document does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | UNDER ARMOUR, INC. |

| | | |

| Date: February 8, 2024 | | By: | | /s/ David E. Bergman |

| | | | David E. Bergman |

| | | | Chief Financial Officer |

Exhibit 99.1

UNDER ARMOUR REPORTS THIRD QUARTER FISCAL 2024 RESULTS;

TIGHTENS FISCAL 2024 OUTLOOK

BALTIMORE, Feb. 8, 2024 – Under Armour, Inc. (NYSE: UA, UAA) announced unaudited financial results for its third quarter fiscal 2024, which ended December 31, 2023. The company reports its financial performance following accounting principles generally accepted in the United States of America ("GAAP"). This press release refers to "currency neutral" and "adjusted" amounts, which are non-GAAP financial measures described below under the "Non-GAAP Financial Information" paragraph.

“Despite a mixed retail environment during the holiday season, our third quarter revenue results were in line with our expectations; we were able to deliver better than anticipated profitability and remain on track to achieve our full-year outlook,” said Under Armour President and CEO Stephanie Linnartz. “As we close out fiscal 2024 and our strengthened leadership team begins to come up to speed in the quarters ahead - we are working to reset Under Armour toward a path of improved revenue growth and enhanced value creation in the future.”

Third Quarter Fiscal 2024 Review

•Revenue was down 6 percent to $1.5 billion (down 7 percent currency neutral).

–Wholesale revenue decreased 13 percent to $712 million, and direct-to-consumer revenue increased 4 percent to $741 million due to a 5 percent increase in owned and operated store revenue and a 2 percent increase in eCommerce revenue, which represented 45 percent of the total direct-to-consumer business in the quarter.

–North America revenue decreased 12 percent to $915 million, and international revenue increased 7 percent to $566 million (up 4 percent currency neutral). In the international business, revenue increased 7 percent in EMEA (up 2 percent currency neutral), 7 percent in Asia-Pacific (up 8 percent currency neutral), and 9 percent in Latin America (up 3 percent currency neutral).

–Apparel revenue decreased 6 percent to $1 billion. Footwear revenue was down 7 percent to $331 million. Accessories revenue was flat at $105 million.

•Gross margin increased 100 basis points to 45.2 percent, driven primarily by supply chain benefits related to lower freight expenses, partially offset by proactive inventory management actions, including a higher percentage of sales to the off-price channel and increased promotional activities in our direct-to-consumer business.

•Selling, general & administrative expenses were flat year over year at $602 million, including a $23 million litigation reserve expense. Adjusted selling, general & administrative expenses were down 4 percent to $579 million.

•Operating income was $70 million. Adjusted operating income was $92 million.

•Net Income was $114 million. Excluding a $50 million earn-out benefit in connection with the sale of the MyFitnessPal platform, the litigation reserve expense, and related tax impacts, the adjusted net income was $84 million.

•Diluted earnings per share was $0.26. Adjusted diluted earnings per share was $0.19.

•Inventory was down 9 percent to $1.1 billion.

•Cash and Cash Equivalents were $1 billion at the end of the quarter, and no borrowings were outstanding under the company's $1.1 billion revolving credit facility.

Share Buyback Update

Under Armour repurchased $25 million of its Class C common stock during the third quarter, reflecting 3.1

million shares retired. As of December 31, 2023, 45.6 million shares for $500 million had been repurchased, which concluded the company's two-year program, approved by the Board of Directors in February 2022.

Updated Fiscal 2024 Outlook

Key points related to Under Armour's fiscal year 2024 outlook include:

•Revenue is expected to be down 3 to 4 percent, tightening the previous expectation of a 2 to 4 percent decline.

•Gross margin is expected to be up 120 to 130 basis points, an increase from the prior expectation of a 100 to 125 basis point increase.

•Selling, general & administrative expenses are unchanged from the previous expectation of "flat to down slightly."

•Operating income is expected to reach $287 million to $297 million. Excluding the company's litigation reserve, adjusted operating income is expected to be $310 million to $320 million.

•Diluted earnings per share is expected to be $0.57 to $0.59, which includes $0.12 of after-tax benefit from the company's final earn-out in connection with the sale of the MyFitnessPal platform and $0.05 of negative impact from the company's litigation reserve. Excluding these net positive impacts of $0.07, the company expects its adjusted diluted earnings per share to be $0.50 to $0.52.

•Capital expenditures are now expected to reach between $210 million and $230 million versus the previous expectation of $230 million and $250 million.

Conference Call and Webcast

Under Armour will hold its third quarter fiscal 2024 conference call today at approximately 8:30 a.m. Eastern Time. The call will be webcast live at https://about.underarmour.com/investor-relations/financials and will be archived and available for replay about three hours after the live event.

Non-GAAP Financial Information

This press release refers to “currency-neutral” and "adjusted" results, as well as "adjusted" forward-looking estimates of the company's results for its 2024 fiscal year ending March 31, 2024. Management believes this information is helpful to investors to compare the company’s results of operations period-over-period because it enhances visibility into its actual underlying results, excluding these impacts. Currency-neutral financial information is calculated to exclude changes in foreign currency exchange rates. References to adjusted financial measures exclude the effect of the company's litigation reserve expense and any gain or loss from divestitures (including associated earn-outs and expenses) and related tax effects. Management believes these adjustments are not core to the company’s operations. The reconciliation of non-GAAP amounts to the most directly comparable financial measure calculated according to GAAP is presented in supplemental financial information furnished with this release. All per-share amounts are reported on a diluted basis.These supplemental non-GAAP financial measures should not be considered in isolation. They should be contemplated in addition to, and not as an alternative to, the company’s reported results prepared

per GAAP. Additionally, the company’s non-GAAP financial information may not be comparable to similarly titled measures reported by other companies.

About Under Armour, Inc.

Under Armour, Inc., headquartered in Baltimore, Maryland, is a leading inventor, marketer, and distributor of branded athletic performance apparel, footwear, and accessories. Designed to empower human performance, Under Armour’s innovative products and experiences are engineered to make athletes better. For further information, please visit http://about.underarmour.com.

Forward-Looking Statements

Some of the statements contained in this press release constitute forward-looking statements. Forward-looking statements relate to expectations, beliefs, projections, plans and strategies, anticipated events or trends, and similar expressions concerning matters that are not historical facts, such as statements regarding our future financial condition or results of operations, our prospects and strategies for future growth, expectations regarding promotional activities, freight, product cost pressures, and foreign currency impacts, the impact of global economic conditions and inflation on our results of operations, our liquidity and use of capital resources, the development and introduction of new products, the implementation of our marketing and branding strategies, the future benefits and opportunities from significant investments, and the impact of litigation or other proceedings. In many cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “could,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “outlook,” “potential” or the negative of these terms or other comparable terminology. The forward-looking statements in this press release reflect our current views about future events. They are subject to risks, uncertainties, assumptions, and circumstances that may cause events or our actual activities or results to differ significantly from those expressed in any forward-looking statement. Although we believe the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future events, results, actions, activity levels, performance, or achievements. Readers are cautioned not to place undue reliance on these forward-looking statements. A number of important factors could cause actual results to differ materially from those indicated by these forward-looking statements, including, but not limited to: changes in general economic or market conditions, including inflation, that could affect overall consumer spending in our industry; the impact of the COVID-19 pandemic on our industry and our business, financial condition and results of operations, including impacts on the global supply chain; failure of our suppliers, manufacturers or logistics providers to produce or deliver our products in a timely or cost-effective manner; labor or other disruptions at ports or our suppliers or manufacturers; increased competition causing us to lose market share or reduce the prices of our products or to increase our marketing efforts significantly; fluctuations in the costs of raw materials and commodities we use in our products and costs related to our supply chain (including labor); changes to the financial health of our customers; our ability to successfully execute our long-term strategies; our ability to effectively develop and launch new, innovative and updated products; our ability to accurately forecast consumer shopping and engagement preferences and consumer demand for our products and manage our inventory in response to changing demands; loss of key customers, suppliers or manufacturers; our ability to effectively market and maintain a positive brand image; our ability to further expand our business globally and to drive brand awareness and consumer acceptance of our products in other countries; our ability to manage the increasingly complex operations of our global business; the impact of global events beyond our control, including military conflicts; our ability to successfully manage or realize expected results from significant transactions and investments; our ability to effectively meet the expectations of our stakeholders with respect to environmental, social and governance practices; the availability, integration and effective operation of information systems and other technology, as well as any potential interruption of such systems or technology; any disruptions, delays or deficiencies in the design, implementation or application of our

global operating and financial reporting information technology system; our ability to attract key talent and retain the services of our senior management and other key employees; our ability to effectively drive operational efficiency in our business; our ability to access capital and financing required to manage our business on terms acceptable to us; our ability to accurately anticipate and respond to seasonal or quarterly fluctuations in our operating results; risks related to foreign currency exchange rate fluctuations; our ability to comply with existing trade and other regulations, and the potential impact of new trade, tariff and tax regulations on our profitability; risks related to data security or privacy breaches; and our potential exposure to and the financial impact of litigation and other proceedings. The forward-looking statements here reflect our views and assumptions only as of the date of this press release. We undertake no obligation to update any forward-looking statement to reflect events or circumstances after the statement’s date or to reflect unanticipated events.

# # #

| | |

Under Armour Contacts: |

| Lance Allega |

| SVP, Investor Relations & Corporate Development |

| (410) 246-6810 |

|

| Amanda Miller |

| SVP, Chief Communications Officer |

| (408) 219-0563 |

Under Armour, Inc.

For the Three and Nine Months Ended December 31, 2023, and 2022

(Unaudited; in thousands, except per share amounts)

CONDENSED CONSOLIDATED STATEMENTS OF OPERATION | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Nine Months Ended December 31, |

| in '000s | 2023 | | % of Net

Revenues | | 2022 | | % of Net

Revenues | | 2023 | | % of Net

Revenues | | 2022 | | % of Net

Revenues |

| Net revenues | $ | 1,486,095 | | | 100.0 | % | | $ | 1,581,781 | | | 100.0 | % | | $ | 4,369,817 | | | 100.0 | % | | $ | 4,504,723 | | | 100.0 | % |

| Cost of goods sold | 814,914 | | | 54.8 | % | | 883,376 | | | 55.8 | % | | 2,338,905 | | | 53.5 | % | | 2,462,287 | | | 54.7 | % |

| Gross profit | 671,181 | | | 45.2 | % | | 698,405 | | | 44.2 | % | | 2,030,912 | | | 46.5 | % | | 2,042,436 | | | 45.3 | % |

| Selling, general and administrative expenses | 601,661 | | | 40.5 | % | | 603,746 | | | 38.2 | % | | 1,794,703 | | | 41.1 | % | | 1,793,884 | | | 39.8 | % |

| Income (loss) from operations | 69,520 | | | 4.7 | % | | 94,659 | | | 6.0 | % | | 236,209 | | | 5.4 | % | | 248,552 | | | 5.5 | % |

| Interest income (expense), net | (211) | | | — | % | | (1,615) | | | (0.1) | % | | (2,210) | | | (0.1) | % | | (11,175) | | | (0.2) | % |

| Other income (expense), net | 49,636 | | | 3.3 | % | | 47,312 | | | 3.0 | % | | 36,822 | | | 0.8 | % | | 27,300 | | | 0.6 | % |

| Income (loss) before income taxes | 118,945 | | | 8.0 | % | | 140,356 | | | 8.9 | % | | 270,821 | | | 6.2 | % | | 264,677 | | | 5.9 | % |

| Income tax expense (benefit) | 4,999 | | | 0.3 | % | | 18,811 | | | 1.2 | % | | 38,464 | | | 0.9 | % | | 46,719 | | | 1.0 | % |

| Income (loss) from equity method investments | 197 | | | — | % | | 72 | | | — | % | | (51) | | | — | % | | (1,734) | | | — | % |

| Net income (loss) | $ | 114,143 | | | 7.7 | % | | $ | 121,617 | | | 7.7 | % | | $ | 232,306 | | | 5.3 | % | | $ | 216,224 | | | 4.8 | % |

| | | | | | | | | | | | | | | |

| Basic net income (loss) per share of Class A, B and C common stock | $ | 0.26 | | | | | $ | 0.27 | | | | | $ | 0.53 | | | | | $ | 0.48 | | | |

| Diluted net income (loss) per share of Class A, B and C common stock | $ | 0.26 | | | | | $ | 0.27 | | | | | $ | 0.52 | | | | | $ | 0.47 | | | |

| Weighted average common shares outstanding Class A, B and C common stock | | | | | | | | |

| Basic | 437,314 | | | | | 448,833 | | | | | 441,893 | | | | | 453,840 | | | |

| Diluted | 448,435 | | | | | 458,990 | | | | | 452,208 | | | | | 463,750 | | | |

Under Armour, Inc.

For the Three and Nine Months Ended December 31, 2023, and 2022

(Unaudited; in thousands)

NET REVENUES BY PRODUCT CATEGORY | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Nine Months Ended December 31, |

| in '000s | 2023 | | 2022 | | % Change | | 2023 | | 2022 | | % Change |

| Apparel | $ | 1,016,707 | | | $ | 1,075,714 | | | (5.5) | % | | $ | 2,911,804 | | | $ | 2,982,410 | | | (2.4) | % |

| Footwear | 331,000 | | | 354,389 | | | (6.6) | % | | 1,045,872 | | | 1,077,525 | | | (2.9) | % |

| Accessories | 104,510 | | | 104,875 | | | (0.3) | % | | 316,305 | | | 312,823 | | | 1.1 | % |

| Net Sales | 1,452,217 | | | 1,534,978 | | | (5.4) | % | | 4,273,981 | | | 4,372,758 | | | (2.3) | % |

| Licensing revenues | 29,069 | | | 29,734 | | | (2.2) | % | | 82,787 | | | 90,992 | | | (9.0) | % |

Corporate Other (1) | 4,809 | | | 17,069 | | | (71.8) | % | | 13,049 | | | 40,973 | | | (68.2) | % |

| Total net revenues | $ | 1,486,095 | | | $ | 1,581,781 | | | (6.0) | % | | $ | 4,369,817 | | | $ | 4,504,723 | | | (3.0) | % |

NET REVENUES BY DISTRIBUTION CHANNEL | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Nine Months Ended December 31, |

| in '000s | 2023 | | 2022 | | % Change | | 2023 | | 2022 | | % Change |

| Wholesale | $ | 711,699 | | | $ | 819,781 | | | (13.2) | % | | $ | 2,393,382 | | | $ | 2,559,621 | | | (6.5) | % |

| Direct-to-consumer | 740,518 | | | 715,197 | | | 3.5 | % | | 1,880,599 | | | 1,813,137 | | | 3.7 | % |

| Net Sales | 1,452,217 | | | 1,534,978 | | | (5.4) | % | | 4,273,981 | | | 4,372,758 | | | (2.3) | % |

| License revenues | 29,069 | | | 29,734 | | | (2.2) | % | | 82,787 | | | 90,992 | | | (9.0) | % |

| | | | | | | | | | | |

Corporate Other (1) | 4,809 | | | 17,069 | | | (71.8) | % | | 13,049 | | | 40,973 | | | (68.2) | % |

| Total net revenues | $ | 1,486,095 | | | $ | 1,581,781 | | | (6.0) | % | | $ | 4,369,817 | | | $ | 4,504,723 | | | (3.0) | % |

NET REVENUES BY SEGMENT

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Nine Months Ended December 31, |

| in '000s | 2023 | | 2022 | | % Change | | 2023 | | 2022 | | % Change |

| North America | $ | 915,387 | | | $ | 1,037,637 | | | (11.8) | % | | $ | 2,733,432 | | | $ | 2,958,816 | | | (7.6) | % |

| EMEA | 284,049 | | | 265,250 | | | 7.1 | % | | 797,781 | | | 733,110 | | | 8.8 | % |

| Asia-Pacific | 212,018 | | | 198,021 | | | 7.1 | % | | 646,315 | | | 600,415 | | | 7.6 | % |

| Latin America | 69,832 | | | 63,804 | | | 9.4 | % | | 179,240 | | | 171,409 | | | 4.6 | % |

Corporate Other (1) | 4,809 | | | 17,069 | | | (71.8) | % | | 13,049 | | | 40,973 | | | (68.2) | % |

| Total net revenues | $ | 1,486,095 | | | $ | 1,581,781 | | | (6.0) | % | | $ | 4,369,817 | | | $ | 4,504,723 | | | (3.0) | % |

(1) Corporate Other primarily includes net revenues from foreign currency hedge gains and losses generated by entities within the Company’s operating segments but managed through the Company’s central foreign exchange risk management program, as well as subscription revenues from the Company's MapMyRun and MapMyRide platforms (collectively "MMR") and revenue from other digital business opportunities.

Under Armour, Inc.

For the Three and Nine Months Ended December 31, 2023, and 2022

(Unaudited; in thousands)

INCOME (LOSS) FROM OPERATIONS BY SEGMENT | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Nine Months Ended December 31, |

| in '000s | 2023 | % of Net Revenues (2) | | 2022 | % of Net Revenues (2) | | 2023 | % of Net Revenues (2) | | 2022 | % of Net Revenues (2) |

| North America | $ | 161,663 | | 17.7 | % | | $ | 198,919 | | 19.2 | % | | $ | 535,171 | | 19.6 | % | | $ | 598,049 | | 20.2 | % |

| EMEA | 51,635 | | 18.2 | % | | 30,947 | | 11.7 | % | | 123,281 | | 15.5 | % | | 85,023 | | 11.6 | % |

| Asia-Pacific | 16,014 | | 7.6 | % | | 10,811 | | 5.5 | % | | 86,020 | | 13.3 | % | | 76,890 | | 12.8 | % |

| Latin America | 13,569 | | 19.4 | % | | 5,805 | | 9.1 | % | | 32,990 | | 18.4 | % | | 19,216 | | 11.2 | % |

Corporate Other (1) | (173,361) | | NM | | (151,823) | | NM | | (541,253) | | NM | | (530,626) | | NM |

| Income (loss) from operations | $ | 69,520 | | 4.7 | % | | $ | 94,659 | | 6.0 | % | | $ | 236,209 | | 5.4 | % | | $ | 248,552 | | 5.5 | % |

(1) Corporate Other primarily includes net revenues from foreign currency hedge gains and losses generated by entities within the Company’s operating segments but managed through the Company’s central foreign exchange risk management program, as well as subscription revenues from the Company's MapMyRun and MapMyRide platforms (collectively "MMR") and revenue from other digital business opportunities. Corporate Other also includes expenses related to the Company's central supporting functions.

(2) The percentage of operating income (loss) is calculated based on total segment net revenues. The operating income (loss) percentage for Corporate Other is not presented as a meaningful metric (NM).

Under Armour, Inc.

As of December 31, 2023, and March 31, 2023

(Unaudited; in thousands)

CONDENSED CONSOLIDATED BALANCE SHEETS | | | | | | | | | | | | | | |

| in '000s | | December 31, 2023 | | March 31, 2023 |

| Assets | | | | |

| Current assets | | | | |

| Cash and cash equivalents | | $ | 1,040,090 | | | $ | 711,910 | |

| Accounts receivable, net | | 691,546 | | | 759,860 | |

| Inventories | | 1,104,027 | | | 1,190,253 | |

| Prepaid expenses and other current assets, net | | 287,153 | | | 297,563 | |

| Total current assets | | 3,122,816 | | | 2,959,586 | |

| Property and equipment, net | | 714,183 | | | 672,736 | |

| Operating lease right-of-use assets | | 456,201 | | | 489,306 | |

| Goodwill | | 481,573 | | | 481,992 | |

| Intangible assets, net | | 8,002 | | | 8,940 | |

| Deferred income taxes | | 210,600 | | | 186,167 | |

| Other long-term assets | | 51,131 | | | 58,356 | |

| Total assets | | $ | 5,044,506 | | | $ | 4,857,083 | |

| Liabilities and Stockholders’ Equity | | | | |

| Current maturities of long-term debt | | $ | 80,919 | | | $ | — | |

| Accounts payable | | 699,431 | | | 649,116 | |

| Accrued expenses | | 322,780 | | | 354,643 | |

| Customer refund liabilities | | 160,786 | | | 160,533 | |

| Operating lease liabilities | | 143,425 | | | 140,990 | |

| Other current liabilities | | 58,841 | | | 51,609 | |

| Total current liabilities | | 1,466,182 | | | 1,356,891 | |

| Long-term debt, net of current maturities | | 595,124 | | | 674,478 | |

| Operating lease liabilities, non-current | | 654,216 | | | 705,713 | |

| Other long-term liabilities | | 155,964 | | | 121,598 | |

| Total liabilities | | 2,871,486 | | | 2,858,680 | |

| Total stockholders’ equity | | 2,173,020 | | | 1,998,403 | |

| Total liabilities and stockholders’ equity | | $ | 5,044,506 | | | $ | 4,857,083 | |

Under Armour, Inc.

For the Nine Months Ended December 31, 2023 and 2022

(Unaudited; in thousands)

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS | | | | | | | | | | | |

| | Nine Months Ended December 31, |

| in '000s | 2023 | | 2022 |

| Cash flows from operating activities | | | |

| Net income (loss) | $ | 232,306 | | | $ | 216,224 | |

| Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities | | | |

| Depreciation and amortization | 106,685 | | | 102,656 | |

| Unrealized foreign currency exchange rate (gain) loss | (904) | | | (19,424) | |

| Loss on disposal of property and equipment | 746 | | | 1,411 | |

| Amortization of bond premium and debt issuance costs | 1,565 | | | 1,644 | |

| Stock-based compensation | 33,163 | | | 29,362 | |

| Deferred income taxes | (24,430) | | | (132) | |

| Changes in reserves and allowances | 25,085 | | | 7,316 | |

| Changes in operating assets and liabilities: | | | |

| Accounts receivable | 55,912 | | | 1,026 | |

| Inventories | 71,400 | | | (401,551) | |

| Prepaid expenses and other assets | (45,363) | | | (68,931) | |

| Other non-current assets | 42,149 | | | (46,272) | |

| Accounts payable | 31,470 | | | 168,681 | |

| Accrued expenses and other liabilities | (42,630) | | | 50,892 | |

| Customer refund liabilities | 80 | | | 12,440 | |

| Income taxes payable and receivable | 5,884 | | | 19,057 | |

| Net cash provided by (used in) operating activities | 493,118 | | | 74,399 | |

| Cash flows from investing activities | | | |

| Purchases of property and equipment | (132,796) | | | (147,620) | |

| Earn-out from the sale of the MyFitnessPal platform | 45,000 | | | 35,000 | |

| Net cash provided by (used in) investing activities | (87,796) | | | (112,620) | |

| Cash flows from financing activities | | | |

| Common shares repurchased | (75,000) | | | (125,000) | |

| Employee taxes paid for shares withheld for income taxes | (2,428) | | | (868) | |

| Proceeds from exercise of stock options and other stock issuances | 2,443 | | | 2,809 | |

| Net cash provided by (used in) financing activities | (74,985) | | | (123,059) | |

| Effect of exchange rate changes on cash, cash equivalents and restricted cash | 136 | | | 3,205 | |

| Net increase in (decrease in) cash, cash equivalents and restricted cash | 330,473 | | | (158,075) | |

| Cash, cash equivalents and restricted cash | | | |

| Beginning of period | 727,726 | | | 1,022,126 | |

| End of period | $ | 1,058,199 | | | $ | 864,051 | |

Under Armour, Inc.

For the Three and Nine Months Ended December 31, 2023

(Unaudited)

The table below presents the reconciliation of net revenue growth (decline) calculated according to GAAP to currency-neutral net revenue, a non-GAAP measure. See "Non-GAAP Financial Information" above for further information regarding the Company's use of non-GAAP financial measures.

CURRENCY-NEUTRAL NET REVENUE GROWTH (DECLINE) RECONCILIATION | | | | | | | | | | | |

| Three Months Ended December 31, 2023 | | Nine Months Ended December 31, 2023 |

| Total Net Revenue | | | |

| Net revenue growth - GAAP | (6.0) | % | | (3.0) | % |

| Foreign exchange impact | (1.1) | % | | (0.2) | % |

| Currency neutral net revenue growth - Non-GAAP | (7.1) | % | | (3.2) | % |

| | | |

| North America | | | |

| Net revenue growth - GAAP | (11.8) | % | | (7.6) | % |

| Foreign exchange impact | — | % | | 0.3 | % |

| Currency neutral net revenue growth - Non-GAAP | (11.8) | % | | (7.3) | % |

| | | |

| EMEA | | | |

| Net revenue growth - GAAP | 7.1 | % | | 8.8 | % |

| Foreign exchange impact | (5.1) | % | | (3.5) | % |

| Currency neutral net revenue growth - Non-GAAP | 2.0 | % | | 5.3 | % |

| | | |

| Asia-Pacific | | | |

| Net revenue growth - GAAP | 7.1 | % | | 7.6 | % |

| Foreign exchange impact | 0.4 | % | | 3.5 | % |

| Currency neutral net revenue growth - Non-GAAP | 7.5 | % | | 11.1 | % |

| | | |

| Latin America | | | |

| Net revenue growth - GAAP | 9.4 | % | | 4.6 | % |

| Foreign exchange impact | (6.7) | % | | (8.7) | % |

| Currency neutral net revenue growth - Non-GAAP | 2.7 | % | | (4.1) | % |

| | | |

| Total International | | | |

| Net revenue growth - GAAP | 7.4 | % | | 7.9 | % |

| Foreign exchange impact | (3.3) | % | | (1.4) | % |

| Currency neutral net revenue growth - Non-GAAP | 4.1 | % | | 6.5 | % |

Under Armour, Inc.

For the Three and Nine Months Ended December 31, 2023

(Unaudited; in thousands, except per share amounts)

The tables below present the reconciliation of the Company's condensed consolidated statement of operations presented in accordance with GAAP to certain adjusted non-GAAP financial measures discussed in this press release. See "Non-GAAP Financial Information" above for further information regarding the Company's use of non-GAAP financial measures.

ADJUSTED SELLING GENERAL AND ADMINISTRATIVE EXPENSES

| | | | | | | | | | | |

| in '000s | Three months ended December 31, 2023 | | Nine months ended December 31, 2023 |

| GAAP selling, general and administrative expenses | $ | 601,661 | | | $ | 1,794,703 | |

| Add: Impact of litigation reserve | (22,500) | | | (22,500) | |

| Adjusted selling, general and administrative expenses | $ | 579,161 | | | $ | 1,772,203 | |

ADJUSTED OPERATING INCOME (LOSS) RECONCILIATION

| | | | | | | | | | | |

| in '000s | Three months ended December 31, 2023 | | Nine months ended December 31, 2023 |

| GAAP income from operations | $ | 69,520 | | | $ | 236,209 | |

| Add: Impact of litigation reserve | 22,500 | | | 22,500 | |

| Adjusted income from operations | $ | 92,020 | | | $ | 258,709 | |

ADJUSTED NET INCOME (LOSS) RECONCILIATION

| | | | | | | | | | | |

| in '000s | Three months ended December 31, 2023 | | Nine months ended December 31, 2023 |

| GAAP net income | $ | 114,143 | | | $ | 232,306 | |

| Add: Impact of litigation reserve | 22,500 | | | 22,500 | |

| Add: Impact of earn-out recorded in connection with the sale of the MyFitnessPal platform | (50,000) | | | (50,000) | |

| Add: Impact of commission expense in connection with the sale of the MyFitnessPal platform | 700 | | | 700 | |

| Add: Impact of provision for income taxes | (3,109) | | | (3,109) | |

| Adjusted net income | $ | 84,234 | | | $ | 202,397 | |

ADJUSTED DILUTED EARNINGS (LOSS) PER SHARE RECONCILIATION | | | | | | | | | | | |

| Three months ended December 31, 2023 | | Nine months ended December 31, 2023 |

| GAAP diluted net income per share | $ | 0.26 | | | $ | 0.52 | |

| Add: Impact of litigation reserve | 0.05 | | | 0.05 | |

| Add: Impact of earn-out recorded in connection with the sale of the MyFitnessPal platform | (0.11) | | | (0.11) | |

| Add: Impact of commission expense in connection with the sale of the MyFitnessPal platform | — | | | — | |

| Add: Impact of provision for income taxes | (0.01) | | | (0.01) | |

| Adjusted diluted net income per share | $ | 0.19 | | | $ | 0.45 | |

Under Armour, Inc.

Outlook for the Year Ended March 31, 2024

(Unaudited; in millions, except per share amounts)

The tables below present the reconciliation of the Company's fiscal 2024 outlook presented in accordance with GAAP to certain adjusted non-GAAP financial measures discussed in this press release. See "Non-GAAP Financial Information" above for further information regarding the Company's use of non-GAAP financial measures.

ADJUSTED OPERATING INCOME RECONCILIATION

| | | | | | | | | | | | | | | | | |

| (in millions) | | | | Year Ended March 31, 2024 |

| | | | | Low end of estimate | | High end of estimate |

| GAAP income from operations | | | | | $ | 287 | | | $ | 297 | |

| Add: Impact of litigation reserve | | | | | 23 | | | 23 | |

| Adjusted income from operations | | | | | $ | 310 | | | $ | 320 | |

ADJUSTED DILUTED (LOSS) EARNINGS PER SHARE RECONCILIATION

| | | | | | | | | | | | | | | | | |

| (in millions) | | | | Year Ended March 31, 2024 |

| | | | | Low end of estimate | | High end of estimate |

| GAAP diluted net income per share | | | | | $ | 0.57 | | | $ | 0.59 | |

| Add: Impact of litigation reserve, net of tax | | | | | 0.05 | | | 0.05 | |

| Add: Impact of earn-out recorded in connection with the sale of the MyFitnessPal platform, net of tax | | | | | (0.12) | | | (0.12) | |

| Adjusted diluted net income per share | | | | | $ | 0.50 | | | $ | 0.52 | |

Under Armour, Inc.

As of December 31, 2023, and 2022

COMPANY-OWNED & OPERATED DOOR COUNT | | | | | | | | | | | | | | |

| | December 31, |

| | 2023 | | 2022 |

| Factory House | | 183 | | 177 |

| Brand House | | 17 | | 18 |

| North America total doors | | 200 | | 195 |

| | | | |

| Factory House | | 173 | | 165 |

| Brand House | | 67 | | 78 |

| International total doors | | 240 | | 243 |

| | | | |

| Factory House | | 356 | | 342 |

| Brand House | | 84 | | 96 |

| Total doors | | 440 | | 438 |

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassCMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

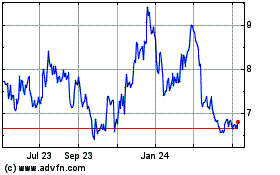

Under Armour (NYSE:UAA)

Historical Stock Chart

From Mar 2024 to Apr 2024

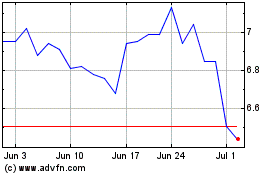

Under Armour (NYSE:UAA)

Historical Stock Chart

From Apr 2023 to Apr 2024