8-K8-K0001500435FALSEDelaware001-3651477-062947400015004352024-02-072024-02-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 7, 2024

GOPRO, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-36514 | 77-0629474 |

(State or Other Jurisdiction of Incorporation) | (Commission File No.) | (I.R.S. Employer Identification No.) |

3025 Clearview Way, San Mateo, CA 94402

(Address of Principal Executive Offices) (Zip Code)

Registrant’s telephone number, including area code: (650) 332-7600

N/A

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A common stock, par value $0.0001 | GPRO | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On February 7, 2024, GoPro, Inc. (the “Company”) issued a press release to report its financial results for its fourth quarter and year ended December 31, 2023.

A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information in Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1, shall not be deemed “filed” for the purposes of Section 18 of the Exchange Act of 1934, as amended (“Exchange Act”), or otherwise subject to the liabilities of that section. The information in Item 2.02 of this Current Report on Form 8-K shall not be incorporated by reference into any filing or other document pursuant to the Securities Act of 1933, as amended (“Securities Act”), except as may be expressly set forth by specific reference in such filing or document.

Item 7.01. Regulation FD Disclosure.

On February 7, 2024, the Company held a live audio webcast to discuss its financial results for its fourth quarter and year ended December 31, 2023.

A copy of management commentary from Nicholas Woodman, the Company's Chief Executive Officer, and Brian McGee, the Company's Chief Financial Officer and Chief Operating Officer, is furnished as Exhibit 99.2 to this report, and is incorporated by reference into this Current Report on Form 8-K.

The information in Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.2, shall not be deemed “filed” for the purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section. The information in Item 7.01 of this Current Report on Form 8-K shall not be incorporated by reference into any filing or other document pursuant to the Securities Act, except as may be expressly set forth by specific reference in such filing or document.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

Exhibit Number | Description of Document |

| Press Release of GoPro, Inc. dated February 7, 2024 to report its financial results for its fourth quarter and year ended December 31, 2023. |

| Management commentary from Nicholas Woodman, Chief Executive Officer, and Brian McGee, Chief Financial Officer and Chief Operating Officer, dated February 7, 2024. |

| |

| Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | |

| | GoPro, Inc. |

| | (Registrant) |

| | |

| | |

| | |

| | |

| | |

| Dated: | February 7, 2024 | By: /s/ Brian McGee |

| | Brian McGee Chief Financial Officer and Chief Operating Officer (Principal Financial Officer) |

| | |

| | |

| | |

EXHIBIT 99.1

GoPro Announces Fourth Quarter and 2023 Results

2023 Revenue of $1.0 billion

3 million Camera Units Sold, up 6% Year-over-Year

GoPro Subscribers Grew 12% Year-over-Year to 2.5 million

Subscription and Service Revenue was $97 million, up 18% Year-over-Year

SAN MATEO, Calif., February 7, 2024 - GoPro, Inc. (NASDAQ: GPRO) today announced financial results for its fourth quarter and full year ended December 31, 2023 and posted management commentary, including forward-looking guidance, in the investor relations section of its website at https://investor.gopro.com.

“Our growth strategy led to significant retail channel sell-through increases in the fourth quarter and second half of 2023,” said Nicholas Woodman, GoPro’s founder and CEO. “We’re looking forward to launching several new products throughout the year, opening more retail doors at a steady rate and activating a larger number of marketing initiatives to drive awareness and demand.”

“During 2023, our capital allocation policy resulted in the repurchase of $50 million in aggregate principal amount of the 2025 Convertible Notes in exchange for $46 million, and we repurchased $40 million in stock, which resulted in a reduction of 15 million shares or 9% of fully diluted shares,” said Brian McGee, GoPro’s CFO and COO.

For details on GoPro’s Q4 and full year performance and outlook, please see the management commentary referenced above and posted in the investor relations section of our website at https://investor.gopro.com.

Q4 2023 Financial Results

•Revenue was $295 million, down 8% year-over-year.

•Subscription and service revenue increased 13% year-over-year to $25 million.

•GoPro subscriber count ended Q4 at 2.5 million, up 12% year-over-year.

•Revenue from the retail channel was $228 million, or 77% of total revenue and up 18% year-over-year. GoPro.com revenue, including subscription and service revenue, was $67 million, or 23% of total revenue and down 47% year-over-year.

•GAAP net loss was $2 million, or a $0.02 loss per share, down from net income of $3 million or $0.02 per share, in the prior year period. Non-GAAP net income was $2 million, or $0.02 per share, down from non-GAAP net income of $21 million, or $0.12 per share, in the prior year period.

•GAAP and non-GAAP gross margin was 34.2% and 34.4%, respectively. This compares to GAAP and non-GAAP gross margin of 32.5% and 35.1%, respectively, in the prior year period.

•Adjusted EBITDA was $3 million. This compares to $22 million in the prior year period.

•Cameras with Manufacturer’s Suggested Retail Prices (MSRP) at or above $400 represented 74% of Q4 2023 camera revenue. Entry level products accounted for 14% of camera revenue.

•Q4 2023 Street ASP was $330, a 13% decrease year-over-year.

•Cash and marketable securities were $247 million at the end of the fourth quarter.

2023 Financial Results

•Revenue was $1.0 billion, down 8% year-over-year.

•Subscription and service revenue increased 18% year-over-year to $97 million.

•GAAP net loss was $53 million, or a $0.35 loss per share, down from net income of $29 million or $0.18 per share, in the prior year period. Non-GAAP net loss was $31 million, or a $0.20 loss per share, down from non-GAAP net income of $81 million, or $0.47 per share, in the prior year period.

•GAAP and non-GAAP gross margin was 32.2% and 32.4%, respectively. This compares to GAAP and non-GAAP gross margin of 37.2% and 38.1%, respectively, in the prior year period.

•2023 Adjusted EBITDA was negative $27 million. This compares to $95 million in the prior year period.

Recent Business Highlights

•Capital allocations during the fourth quarter resulted in the repurchase of $50.0 million in aggregate principal amount of the 2025 Convertible Notes in exchange for $46.3 million and the repurchase of $10.0 million in stock in the fourth quarter, and $40.0 million total for 2023.

•In January 2024, GoPro announced its plan to acquire Australian maker of tech-enabled motorcycle helmets, Forcite Helmet Systems.

•In January 2024, GoPro returned to X Games sponsorship as the official action camera; GoPro also recently announced sponsorships as the official camera of the Freeride World Tour, the world’s biggest freeride ski and snowboard competition, and the official action camera of the Vans Pipe Masters surf contest.

•In November 2023, GoPro was recognized for the third consecutive year by Outside Magazine as one of the 50 Best Places to Work (No. 14) and the only company with more than 200 employees to make the list.

Results Summary:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended December 31, | | Year ended December 31, |

($ in thousands, except per share amounts) | | 2023 | | 2022 | | % Change | | 2023 | | 2022 | | % Change |

| Revenue | | $ | 295,420 | | | $ | 321,021 | | | (8.0) | % | | $ | 1,005,459 | | | $ | 1,093,541 | | | (8.1) | % |

| Gross margin | | | | | | | | | | | | |

| GAAP | | 34.2 | % | | 32.5 | % | | 170 bps | | 32.2 | % | | 37.2 | % | | (500) bps |

| Non-GAAP | | 34.4 | % | | 35.1 | % | | (70) bps | | 32.4 | % | | 38.1 | % | | (570) bps |

| Operating income (loss) | | | | | | | | | | | | |

| GAAP | | $ | (9,368) | | | $ | 1,707 | | | (648.8) | % | | $ | (75,463) | | | $ | 38,955 | | | (293.7) | % |

| Non-GAAP | | $ | 2,033 | | | $ | 19,077 | | | (89.3) | % | | $ | (34,075) | | | $ | 85,547 | | | (139.8) | % |

| Net income (loss) | | | | | | | | | | | | |

| GAAP | | $ | (2,418) | | | $ | 3,073 | | | (178.7) | % | | $ | (53,183) | | | $ | 28,847 | | | (284.4) | % |

| Non-GAAP | | $ | 2,424 | | | $ | 21,090 | | | (88.5) | % | | $ | (31,135) | | | $ | 80,923 | | | (138.5) | % |

| Diluted net income (loss) per share | | | | | | | | | | | | |

| GAAP | | $ | (0.02) | | | $ | 0.02 | | | (200.0) | % | | $ | (0.35) | | | $ | 0.18 | | | (294.4) | % |

| Non-GAAP | | $ | 0.02 | | | $ | 0.12 | | | (83.3) | % | | $ | (0.20) | | | $ | 0.47 | | | (142.6) | % |

| Adjusted EBITDA | | $ | 3,267 | | | $ | 22,014 | | | (85.2) | % | | $ | (27,317) | | | $ | 94,754 | | | (128.8) | % |

Conference Call

GoPro management will host a conference call and live webcast for analysts and investors today at 2 p.m. Pacific Time (5 p.m. Eastern Time) to discuss the Company’s financial results.

Prior to the start of the call, the Company will post Management Commentary on the “Events & Presentations” section of its investor relations website at https://investor.gopro.com. Management will make brief opening comments before taking questions.

To listen to the live conference call, please call +1 833-470-1428 (US) or +1 404-975-4839 (International) and enter access code 442389, approximately 15 minutes prior to the start of the call. A live webcast of the conference call will be accessible on the “Events & Presentations” section of the Company’s website at https://investor.gopro.com. A recording of the webcast will be available on GoPro’s website, https://investor.gopro.com, from approximately two hours after the call through May 1, 2024.

About GoPro, Inc. (NASDAQ: GPRO)

GoPro helps the world capture and share itself in immersive and exciting ways.

GoPro has been recognized as an employer of choice by both Outside Magazine and US News & World Report for being among the best places to work. Open roles can be found on our careers page. For more information, visit GoPro.com.

Connect with GoPro on Facebook, Instagram, LinkedIn, TikTok, X, YouTube, and GoPro's blog, The Current. GoPro customers can submit their photos and videos to GoPro Awards for an opportunity to be featured on GoPro's social channels and receive gear and cash awards. Members of the press can access official logos and imagery on our press portal.

GoPro, HERO and their respective logos are trademarks or registered trademarks of GoPro, Inc. in the United States and other countries.

GoPro’s Use of Social Media

GoPro announces material financial information using the Company’s investor relations website, SEC filings, press releases, public conference calls and webcasts. GoPro may also use social media channels to communicate about the Company, its brand and other matters; these communications could be deemed material information. Investors and others are encouraged to review posts on Facebook, Instagram, LinkedIn, TikTok, X, YouTube, and GoPro’s investor relations website and blog, The Current.

Note Regarding Use of Non-GAAP Financial Measures

GoPro reports gross profit, gross margin percentage, operating expenses, operating income (loss), other income (expense), tax expense, net income (loss) and diluted net income (loss) per share in accordance with U.S. generally accepted accounting principles (GAAP) and on a non-GAAP basis. Additionally, GoPro reports non-GAAP adjusted EBITDA. Non-GAAP items exclude, where applicable, the effects of stock-based compensation, acquisition-related costs, restructuring and other related costs, (gain) loss on extinguishment of debt, and the tax impact of these items. When planning, forecasting, and analyzing gross margin, operating expenses, operating income (loss), other income (expense), tax expense, net income (loss) and net income (loss) per share for future periods, GoPro does so primarily on a non-GAAP basis without preparing a GAAP analysis as that would require estimates for reconciling items which are inherently difficult to predict with reasonable accuracy. A reconciliation of preliminary GAAP to non-GAAP measures has been provided in this press release, and investors are encouraged to review the reconciliation.

Note on Forward-looking Statements

This press release may contain projections or other forward-looking statements within the meaning Section 27A of the Private Securities Litigation Reform Act. Words such as “anticipate,” “believe,” “estimate,” “expect,” “intend,” “should,” “will,” “plan” and variations of these terms or the negative of these terms and similar expressions are intended to identify these forward-looking statements. Forward-looking statements in this press release may include but are not limited to statements regarding our expectations for profitability, revenue growth and subscription growth; expanded product roadmap, product pricing strategy, expanded distribution and overall consumer demand for our products. These statements involve risks and uncertainties, and actual events or results may differ materially. Among the important factors that could cause actual results to differ materially from those in the forward-looking statements include the inability to achieve our revenue growth or profitability in the future, and if revenue growth or profitability is achieved, the inability to sustain it; the fact that an economic downturn or economic uncertainty in our key U.S. and international markets, inflation, and fluctuations in interest rates or currency exchange rates may adversely affect consumer discretionary spending and demand for our products; the fact that our goal to grow

revenue and be profitable relies upon our ability to grow sales from our direct-to-consumer business and our retail partners and distributors; our ability to acquire and retain subscribers; our reliance on third-party suppliers, some of which are sole-source suppliers, to provide services and components for our products which may be impacted due to supply shortages, long lead times or other service disruptions that may lead to increased costs due to the effects of global conflicts and geopolitical issues such as the ongoing conflicts in the Middle East, Ukraine or China-Taiwan relations; our ability to maintain the value and reputation of our brand and protect our intellectual property and proprietary rights; the risk that our sales fall below our forecasts, especially during the holiday season; the risk we fail to manage our operating expenses effectively, which may result in our financial performance suffering the fact that our continued profitability depends in part on further penetrating our total addressable market, and we may not be successful in doing so; the fact that we rely on sales of our cameras, mounts and accessories for substantially all of our revenue, and any decrease in the sales or change in sales mix of these products could harm our business; the risk that we may not successfully manage product introductions, product transitions, product pricing and marketing; the fact that a small number of retailers and distributors account for a substantial portion of our revenue and our level of business with them could be significantly reduced; our ability to attract, engage and retain qualified personnel; any changes to trade agreements, trade policies, tariffs, and import/export regulations; the impact of competition on our market share, revenue and profitability; the fact that we may experience fluctuating revenue, expenses and profitability in the future; risks related to inventory, purchase commitments and long-lived assets; the risk that we will encounter problems with our distribution system; the threat of a security breach or other disruption including cyberattacks; the concern that our intellectual property and proprietary rights may not adequately protect our products and services; the effects of global conflicts and geopolitical issues such as the conflicts in the Middle East, Ukraine or China-Taiwan relations and its effects on the United States and global economies and our business in particular; and other factors detailed in the Risk Factors section of our Annual Report on Form 10-K for the year ended December 31, 2022, which is on file with the Securities and Exchange Commission (SEC), and as updated in filings with the SEC. These forward-looking statements speak only as of the date hereof or as of the date otherwise stated herein. GoPro disclaims any obligation to update these forward-looking statements.

GoPro, Inc.

Preliminary Condensed Consolidated Statements of Operations

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended December 31, | | Year ended December 31, |

| (in thousands, except per share data) | 2023 | | 2022 | | 2023 | | 2022 |

| Revenue | $ | 295,420 | | | $ | 321,021 | | | $ | 1,005,459 | | | $ | 1,093,541 | |

| Cost of revenue | 194,325 | | | 216,718 | | | 681,886 | | | 686,713 | |

| Gross profit | 101,095 | | | 104,303 | | | 323,573 | | | 406,828 | |

| | | | | | | |

| Operating expenses: | | | | | | | |

Research and development | 43,892 | | | 36,026 | | | 165,688 | | | 139,885 | |

Sales and marketing | 50,363 | | | 51,079 | | | 169,578 | | | 166,967 | |

General and administrative | 16,208 | | | 15,491 | | | 63,770 | | | 61,021 | |

Total operating expenses | 110,463 | | | 102,596 | | | 399,036 | | | 367,873 | |

| Operating income (loss) | (9,368) | | | 1,707 | | | (75,463) | | | 38,955 | |

Other income (expense): | | | | | | | |

Interest expense | (1,236) | | | (1,310) | | | (4,699) | | | (6,242) | |

| Other income, net | 5,198 | | | 2,263 | | | 12,429 | | | 1,740 | |

| Total other income (expense), net | 3,962 | | | 953 | | | 7,730 | | | (4,502) | |

| Income (loss) before income taxes | (5,406) | | | 2,660 | | | (67,733) | | | 34,453 | |

| Income tax expense (benefit) | (2,988) | | | (413) | | | (14,550) | | | 5,606 | |

| Net income (loss) | $ | (2,418) | | | $ | 3,073 | | | $ | (53,183) | | | $ | 28,847 | |

| | | | | | | |

| Net income (loss) per share: | | | | | | | |

| Basic | $ | (0.02) | | | $ | 0.02 | | | $ | (0.35) | | | $ | 0.18 | |

| Diluted | $ | (0.02) | | | $ | 0.02 | | | $ | (0.35) | | | $ | 0.18 | |

| | | | | | | |

| Shares used to compute net income (loss) per share: | | | | | | | |

| Basic | 151,078 | | | 155,340 | | | 153,348 | | | 156,181 | |

| Diluted | 151,078 | | | 172,124 | | | 153,348 | | | 178,279 | |

GoPro, Inc.

Preliminary Condensed Consolidated Balance Sheets

(unaudited)

| | | | | | | | | | | |

| (in thousands) | December 31,

2023 | | December 31,

2022 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 222,708 | | | $ | 223,735 | |

| | | |

| Marketable securities | 23,867 | | | 143,602 | |

Accounts receivable, net | 91,452 | | | 77,008 | |

| Inventory | 106,266 | | | 127,131 | |

| Prepaid expenses and other current assets | 38,298 | | | 34,551 | |

| Total current assets | 482,591 | | | 606,027 | |

| Property and equipment, net | 8,686 | | | 13,327 | |

| Operating lease right-of-use assets | 18,729 | | | 21,819 | |

| Goodwill | 146,459 | | | 146,459 | |

| Other long-term assets | 311,486 | | | 289,293 | |

| Total assets | $ | 967,951 | | | $ | 1,076,925 | |

| | | |

| Liabilities and Stockholders’ Equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 102,612 | | | $ | 91,648 | |

| Accrued expenses and other current liabilities | 110,049 | | | 118,877 | |

| Short-term operating lease liabilities | 10,520 | | | 9,553 | |

| Deferred revenue | 55,913 | | | 55,850 | |

| | | |

| Total current liabilities | 279,094 | | | 275,928 | |

| Long-term taxes payable | 11,199 | | | 9,536 | |

| Long-term debt | 92,615 | | | 141,017 | |

| Long-term operating lease liabilities | 25,527 | | | 33,446 | |

| Other long-term liabilities | 3,670 | | | 5,439 | |

| Total liabilities | 412,105 | | | 465,366 | |

| | | |

| Stockholders’ equity: | | | |

| Common stock and additional paid-in capital | 998,373 | | | 960,903 | |

Treasury stock, at cost | (193,231) | | | (153,231) | |

Accumulated deficit | (249,296) | | | (196,113) | |

| Total stockholders’ equity | 555,846 | | | 611,559 | |

| Total liabilities and stockholders’ equity | $ | 967,951 | | | $ | 1,076,925 | |

GoPro, Inc.

Preliminary Condensed Consolidated Statements of Cash Flows

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended December 31, | | Year ended December 31, |

| (in thousands) | 2023 | | 2022 | | 2023 | | 2022 |

Operating activities: | | | | | | | |

| Net income (loss) | $ | (2,418) | | | $ | 3,073 | | | $ | (53,183) | | | $ | 28,847 | |

| Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: | | | | | | | |

Depreciation and amortization | 1,159 | | | 1,980 | | | 6,160 | | | 8,570 | |

| Non-cash operating lease cost | 957 | | | 1,335 | | | 3,090 | | | 5,501 | |

| Stock-based compensation | 10,031 | | | 9,565 | | | 41,479 | | | 38,991 | |

| Deferred income taxes | 73 | | | (3,437) | | | (17,891) | | | 2,710 | |

| Non-cash restructuring charges | — | | | 228 | | | — | | | 228 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Gain on extinguishment of debt | (3,092) | | | — | | | (3,092) | | | — | |

| Other | (632) | | | (1,361) | | | (2,600) | | | 1,022 | |

| Net changes in operating assets and liabilities | 37,651 | | | 14,179 | | | (6,826) | | | (80,122) | |

| Net cash provided by (used in) operating activities | 43,729 | | | 25,562 | | | (32,863) | | | 5,747 | |

| | | | | | | |

| Investing activities: | | | | | | | |

| Purchases of property and equipment, net | (535) | | | (242) | | | (1,520) | | | (3,447) | |

| Purchases of marketable securities | — | | | (61,857) | | | (25,782) | | | (165,590) | |

| Maturities of marketable securities | 15,000 | | | 51,000 | | | 149,204 | | | 160,649 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Net cash provided by (used in) investing activities | 14,465 | | | (11,099) | | | 121,902 | | | (8,388) | |

| | | | | | | |

| Financing activities: | | | | | | | |

| Proceeds from issuance of common stock | — | | | 74 | | | 3,876 | | | 4,760 | |

| Taxes paid related to net share settlement of equity awards | (862) | | | (1,083) | | | (8,008) | | | (13,410) | |

| | | | | | | |

| Repurchase of outstanding common stock | (10,000) | | | (8,001) | | | (40,000) | | | (39,619) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Payment to partially repurchase 2025 convertible senior notes | (46,250) | | | — | | | (46,250) | | | — | |

| | | | | | | |

| Repayment of debt | — | | | — | | | — | | | (125,000) | |

| Net cash used in financing activities | (57,112) | | | (9,010) | | | (90,382) | | | (173,269) | |

| Effect of exchange rate changes on cash and cash equivalents | 642 | | | 1,121 | | | 316 | | | (1,442) | |

| Net change in cash and cash equivalents | 1,724 | | | 6,574 | | | (1,027) | | | (177,352) | |

| Cash and cash equivalents at beginning of period | 220,984 | | | 217,161 | | | 223,735 | | | 401,087 | |

| Cash and cash equivalents at end of period | $ | 222,708 | | | $ | 223,735 | | | $ | 222,708 | | | $ | 223,735 | |

| | | | | | | |

GoPro, Inc.

Reconciliation of Preliminary GAAP to Non-GAAP Financial Measures

To supplement our unaudited selected financial data presented on a basis consistent with GAAP, we disclose certain non-GAAP financial measures, including non-GAAP gross profit, gross margin, operating expenses, operating income (loss), other income (expense), tax expense, net income (loss), diluted net income (loss) per share and adjusted EBITDA. We also provide forecasts of non-GAAP gross margin, non-GAAP operating expenses, non-GAAP other income (expense), non-GAAP tax expense, non-GAAP net income (loss) and non-GAAP diluted net income (loss) per share. We use these non-GAAP financial measures to help us understand and evaluate our core operating performance and trends, to prepare and approve our annual budget, and to develop short-term and long-term operational plans. Our management uses, and believes that investors benefit from referring to these non-GAAP financial measures in assessing our operating results. These non-GAAP financial measures should not be considered in isolation from, or as an alternative to, the measures prepared in accordance with GAAP, and are not based on any comprehensive set of accounting rules or principles. We believe that these non-GAAP measures, when read in conjunction with our GAAP financials, provide useful information to investors by facilitating:

•the comparability of our on-going operating results over the periods presented;

•the ability to identify trends in our underlying business; and

•the comparison of our operating results against analyst financial models and operating results of other public companies that supplement their GAAP results with non-GAAP financial measures.

These non-GAAP financial measures have limitations in that they do not reflect all of the amounts associated with our results of operations as determined in accordance with GAAP. Some of these limitations are:

•adjusted EBITDA does not reflect tax payments that reduce cash available to us;

•adjusted EBITDA excludes depreciation and amortization and, although these are non-cash charges, the property and equipment being depreciated and amortized often will have to be replaced in the future, and adjusted EBITDA does not reflect any cash capital expenditure requirements for such replacements;

•adjusted EBITDA excludes the amortization of point of purchase (POP) display assets because it is a non-cash charge, and is treated similarly to depreciation of property and equipment and amortization of acquired intangible assets;

•adjusted EBITDA and non-GAAP net income (loss) exclude restructuring and other related costs which primarily include severance-related costs, stock-based compensation expenses, manufacturing consolidation charges, facilities consolidation charges recorded in connection with restructuring actions, including right-of-use asset impairment charges (if applicable), and the related ongoing operating lease cost of those facilities recorded under ASC 842, Leases. These expenses do not reflect expected future operating expenses and do not contribute to a meaningful evaluation of current operating performance or comparisons to the operating performance in other periods;

•adjusted EBITDA and non-GAAP net income (loss) exclude stock-based compensation expense related to equity awards granted primarily to our workforce. We exclude stock-based compensation expense because we believe that the non-GAAP financial measures excluding this item provide meaningful supplemental information regarding operational performance. In particular, we note that companies calculate stock-based compensation expense for the variety of award types that they employ using different valuation methodologies and subjective assumptions. These non-cash charges are not factored into our internal evaluation of net income (loss) as we believe their inclusion would hinder our ability to assess core operational performance;

•adjusted EBITDA and non-GAAP net income (loss) excludes any gain or loss on the extinguishment of debt because it is not reflective of ongoing operating results in the period, and the frequency and amount of such gains and losses vary;

•non-GAAP net income (loss) excludes acquisition-related costs including the amortization of acquired intangible assets (primarily consisting of acquired technology), the impairment of acquired intangible assets (if applicable), as well as third-party transaction costs incurred for legal and other professional services. These costs are not factored into our evaluation of potential acquisitions, or of our performance after completion of the acquisitions, because these costs are not related to our core operating performance or reflective of ongoing operating results in the period, and the frequency and amount of such costs vary

significantly based on the timing and magnitude of our acquisition transactions and the maturities of the businesses being acquired. Although we exclude the amortization of acquired intangible assets from our non-GAAP net income (loss), management believes that it is important for investors to understand that such intangible assets were recorded as part of purchase accounting and contribute to revenue generation;

•non-GAAP net income (loss) includes income tax adjustments. We utilize a cash-based non-GAAP tax expense approach (based upon expected annual cash payments for income taxes) for evaluating operating performance as well as for planning and forecasting purposes. This non-GAAP tax approach eliminates the effects of period specific items, which can vary in size and frequency and does not necessarily reflect our long-term operations. Historically, we computed a non-GAAP tax rate based on non-GAAP pre-tax income on a quarterly basis, which considered the income tax effects of the adjustments above;

•GAAP and non-GAAP net income (loss) per share includes the dilutive, tax effected cash interest expense associated with our 2022 Notes and 2025 Notes in periods of net income, as if converted at the beginning of the period; and

•other companies may calculate these non-GAAP financial measures differently than we do, limiting their usefulness as comparative measures.

GoPro, Inc.

Reconciliation of Preliminary GAAP to Non-GAAP Financial Measures

(unaudited)

Reconciliations of non-GAAP financial measures are set forth below:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended December 31, | | Year ended December 31, |

| (in thousands, except per share data) | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | |

| GAAP net income (loss) | $ | (2,418) | | | $ | 3,073 | | | $ | (53,183) | | | $ | 28,847 | |

| Stock-based compensation: | | | | | | | |

| Cost of revenue | 459 | | | 434 | | | 1,955 | | | 1,805 | |

| Research and development | 4,681 | | | 4,263 | | | 19,062 | | | 17,221 | |

| Sales and marketing | 2,074 | | | 2,002 | | | 8,736 | | | 8,173 | |

| General and administrative | 2,817 | | | 2,866 | | | 11,726 | | | 11,792 | |

| Total stock-based compensation | 10,031 | | | 9,565 | | | 41,479 | | | 38,991 | |

| | | | | | | |

| Acquisition-related costs: | | | | | | | |

| Cost of revenue | — | | | — | | | — | | | 47 | |

| | | | | | | |

| | | | | | | |

| General and administrative | 822 | | | — | | | 822 | | | — | |

| Total acquisition-related costs | 822 | | | — | | | 822 | | | 47 | |

| | | | | | | |

| Restructuring and other costs: | | | | | | | |

| Cost of revenue | 75 | | | 8,047 | | | (173) | | | 8,035 | |

| Research and development | 488 | | | (132) | | | (189) | | | (266) | |

| Sales and marketing | 26 | | | (74) | | | (330) | | | (144) | |

| General and administrative | (41) | | | (36) | | | (221) | | | (71) | |

| Total restructuring and other costs | 548 | | | 7,805 | | | (913) | | | 7,554 | |

| | | | | | | |

| | | | | | | |

| Gain on extinguishment of debt | (3,092) | | | — | | | (3,092) | | | — | |

| Income tax adjustments | (3,467) | | | 647 | | | (16,248) | | | 5,484 | |

| Non-GAAP net income (loss) | $ | 2,424 | | | $ | 21,090 | | | $ | (31,135) | | | $ | 80,923 | |

| | | | | | | |

| GAAP net income (loss) - basic | $ | (2,418) | | | $ | 3,073 | | | $ | (53,183) | | | $ | 28,847 | |

Add: Interest on convertible notes, tax

effected | — | | | 334 | | | — | | | 3,055 | |

| GAAP net income (loss) - diluted | $ | (2,418) | | | $ | 3,407 | | | $ | (53,183) | | | $ | 31,902 | |

| | | | | | | |

| Non-GAAP net income (loss) - basic | $ | 2,424 | | | $ | 21,090 | | | $ | (31,135) | | | $ | 80,923 | |

Add: Interest on convertible notes, tax

effected | 499 | | | 334 | | | — | | | 3,055 | |

| Non-GAAP net income (loss) - diluted | $ | 2,923 | | | $ | 21,424 | | | $ | (31,135) | | | $ | 83,978 | |

| | | | | | | |

| GAAP shares for diluted net income (loss) per share | 151,078 | | | 172,124 | | | 153,348 | | | 178,279 | |

| | | | | | | |

| | | | | | | |

| Add: Non-GAAP only dilutive securities | 13,541 | | | — | | | — | | | — | |

| Non-GAAP shares for diluted net income (loss) per share | 164,619 | | | 172,124 | | | 153,348 | | | 178,279 | |

| | | | | | | |

| GAAP diluted net income (loss) per share | $ | (0.02) | | | $ | 0.02 | | | $ | (0.35) | | | $ | 0.18 | |

| Non-GAAP diluted net income (loss) per share | $ | 0.02 | | | $ | 0.12 | | | $ | (0.20) | | | $ | 0.47 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended December 31, | | Year ended December 31, |

| (dollars in thousands) | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| GAAP gross margin as a % of revenue | 34.2 | % | | 32.5 | % | | 32.2 | % | | 37.2 | % |

| Stock-based compensation | 0.2 | | | 0.1 | | | 0.2 | | | 0.2 | |

| | | | | | | |

| Restructuring and other costs | — | | | 2.5 | | | — | | | 0.7 | |

| Non-GAAP gross margin as a % of revenue | 34.4 | % | | 35.1 | % | | 32.4 | % | | 38.1 | % |

| | | | | | | |

| GAAP operating expenses | $ | 110,463 | | | $ | 102,596 | | | $ | 399,036 | | | $ | 367,873 | |

| Stock-based compensation | (9,572) | | | (9,131) | | | (39,524) | | | (37,186) | |

| Acquisition-related costs | (822) | | | — | | | (822) | | | — | |

| Restructuring and other costs | (473) | | | 242 | | | 740 | | | 481 | |

| Non-GAAP operating expenses | $ | 99,596 | | | $ | 93,707 | | | $ | 359,430 | | | $ | 331,168 | |

| | | | | | | |

| GAAP operating income (loss) | $ | (9,368) | | | $ | 1,707 | | | $ | (75,463) | | | $ | 38,955 | |

| Stock-based compensation | 10,031 | | | 9,565 | | | 41,479 | | | 38,991 | |

| Acquisition-related costs | 822 | | | — | | | 822 | | | 47 | |

| Restructuring and other costs | 548 | | | 7,805 | | | (913) | | | 7,554 | |

| Non-GAAP operating income (loss) | $ | 2,033 | | | $ | 19,077 | | | $ | (34,075) | | | $ | 85,547 | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended December 31, | | Year ended December 31, |

| (in thousands) | 2023 | | 2022 | | 2023 | | 2022 |

| GAAP net income (loss) | $ | (2,418) | | | $ | 3,073 | | | $ | (53,183) | | | $ | 28,847 | |

| Income tax expense (benefit) | (2,988) | | | (413) | | | (14,550) | | | 5,606 | |

| Interest (income) expense, net | (707) | | | (486) | | | (5,233) | | | 3,131 | |

| Depreciation and amortization | 1,159 | | | 1,980 | | | 6,160 | | | 8,570 | |

| POP display amortization | 734 | | | 490 | | | 2,015 | | | 2,055 | |

| Stock-based compensation | 10,031 | | | 9,565 | | | 41,479 | | | 38,991 | |

| Gain on extinguishment of debt | (3,092) | | | — | | | (3,092) | | | — | |

| Restructuring and other costs | 548 | | | 7,805 | | | (913) | | | 7,554 | |

| Adjusted EBITDA | $ | 3,267 | | | $ | 22,014 | | | $ | (27,317) | | | $ | 94,754 | |

# # # # #

Investor Contact

investor@gopro.com

Media Contact

pr@gopro.com

EXHIBIT 99.2

February 7th, 2024

GoPro, Inc. (NASDAQ: GPRO)

Management Commentary

Q4 & Full Year 2023 Earnings Call

Christopher Clark

Vice President, Corporate Communications, GoPro, Inc.

Enclosed is GoPro’s fourth quarter and full year 2023 earnings report. Following this brief introduction is management commentary from GoPro’s CEO, Nicholas Woodman, and CFO and COO, Brian McGee. This commentary may include forward-looking statements. Forward-looking statements and all other statements that are not historical facts are not guarantees of future performance and are subject to a number of risks and uncertainties which may cause actual results to differ materially. Additionally, any forward-looking statements made today are based on assumptions as of today. This means that results could change at any time and we do not undertake any obligation to update these statements as a result of new information or future events. To better understand the risks and uncertainties that could cause actual results to differ from our commentary, we refer you to our most recent annual report on Form 10-K for the year ended December 31, 2022, which is on file with the Securities and Exchange Commission (“SEC”) and other reports that we may file from time to time with the SEC.

In the management commentary, we may discuss gross margin, operating expense, net profit and loss, adjusted EBITDA as well as basic and diluted net profit and loss per share in accordance with GAAP, and on a non-GAAP basis. A reconciliation of GAAP to non-GAAP operating expenses can be found in the press release that was issued this afternoon, which is posted on the investor relations section of our website. Unless otherwise noted, all income statement-related numbers that are discussed in the management commentary, other than revenue, are non-GAAP.

Nicholas Woodman

Founder, Chief Executive Officer and Chairman, GoPro, Inc.

Thank you for reading GoPro’s Q4 and full year 2023 management commentary.

2023 marked the beginning of our multi-year TAM expanding strategy, targeting long-term revenue, subscriber and profit growth. Beginning in May 2023, we initiated the first stage of our growth initiatives, including:

a.A return to lower pre-pandemic pricing to drive unit sales

b.The re-introduction of entry-level priced GoPro cameras to drive volume and reach new customers

c.Increased marketing to drive awareness

d.Expanding GoPro’s retail channel presence globally

These actions contributed to year-over-year retail channel unit sell-through growth of 25% in the period from our shift in May to the end of the year. In that same period, EMEA retail channels saw growth of 41%, APAC grew 26% and LATAM grew 43%. North American unit sell-through saw smaller growth of 12% in part due to a general reduction in weeks of inventory across the retail landscape, ongoing challenges at certain big box stores due to merchandise shrink issues, and specifically in Q4, softness in the consumer electronics category in December in the US.

Across all channels (retail combined with direct-to-consumer through GoPro.com), 2023 unit sell-through growth since our strategy shift was 3% from the period May 9th through the end of 2023, measured against the prior year period.

Our retail channel’s growth was largely offset by our GoPro.com direct-to-consumer channel, where we underestimated the impact of our strategic shift. In Q4, GoPro.com revenue, excluding subscription and services, was 14% of revenue, down from 33% in the prior year period, due primarily to our strategic decision in May to eliminate subscription-related camera discounts at the time of purchase on GoPro.com.

According to our research, GoPro.com’s revenue mix, excluding subscription and service revenue, is at the high-end of the range for consumer brands of our size with similar distribution. While we will endeavor to increase GoPro.com sales as a percentage of revenue, we believe our current mix is directionally indicative of what we can expect going forward as we continue to scale our presence in retail.

Bottom line – we believe our sell-through growth in retail gives us, and importantly gives our retailers and distributors, confidence to lean in as we look to launch a number of new products, as I’ll touch on shortly. This, combined with our aggressive efforts to open more doors and expand our brand presence in all of our doors, is creating a groundswell of opportunity at retail for GoPro.

Fourth quarter entry-level camera sell-through, priced at $199 and $249, represented 28% of our product mix, up from zero in the prior year when we had no products offered in this price band. However, in analyzing our 2023 holiday season performance, we believe consumers were looking for discounts irrespective of already low price points – which was an outlier from the behavior we’ve seen in prior years. This resulted in lower than expected sell-through of our $249 HERO10 Black product, which we did not discount during Q4. On the positive side, this resulted in better than expected margin in the fourth quarter.

In 2023 we reinvigorated our marketing strategy to re-establish GoPro’s larger-than-life brand presence across all of the major verticals we serve. Since the May strategy shift, we’ve been active in putting new sponsorships in place and planning product and brand integrations at events. 2024 is when we’ll see GoPro’s brand more loud and proud than we’ve seen in years, beginning with events like January’s X Games which had solid viewership across ABC, ESPN and ESPN2, and generated more than 62 million video views across YouTube, Twitch, XGames.com and other social media platforms. Fans tuned in to watch the world’s best skiers and snowboarders pushing the limits of their sport, with many athletes wearing GoPro cameras in competition, capturing footage that was integrated into the broadcasts to share first-person perspectives.

Over the course of 2024, the GoPro brand will shine at more than 100 different sporting events, including premier two-wheel and four-wheel motorsports, snow sports, mountain biking and other action sports. Additionally, going back to our roots and to further drive brand equity, GoPro’s field marketing team will activate at dozens of in-person events around the world where consumers will have the opportunity to interact firsthand with brand representatives to demo products, ask questions and purchase through local participating specialty retailers.

To help translate our expanded awareness efforts into sales, we’ve been aggressively expanding the number of retail doors where we sell our products. Since May of 2023, we added more than 3,200 new retail doors, which was ahead of our target for the year. We intend to continue to drive door growth with a target of 7,000 additional new doors over the next two years, bolstered by new products. In addition to growing door count, we plan to refresh our point-of-purchase (POP) merchandisers, expand in-store brand presence, and enhance account management throughout the retail channel.

Our stage-one growth initiatives, outlined above, delivered a profitable fourth quarter and second half in 2023 on a non-GAAP basis. Fourth quarter revenue was $295 million, below our guidance of $325 million. As mentioned above, revenue was impacted by lower-than-expected demand trends in North America, particularly in December, driven in part by competition for share of wallet as well as lower-than-anticipated sales of HERO10 Black due to our decision to not discount this entry-level priced camera. The upside is that we retained margin on the HERO10 Black units we sold, and this combined with our high margin subscription and service revenue to yield gross margin that outperformed the mid-point of guidance by 140 basis points. The improvement in gross margin, plus savings in operating expenses during the quarter resulted in non-GAAP earnings per share of $0.02 for the fourth quarter.

As we begin 2024 and look to the greater long-term opportunity for GoPro, we believe it’s essential that we significantly scale the number of products we sell to serve more consumers in more categories and markets. Our research identifies several growth opportunities where GoPro can extend our market leadership.

As we enter stage-two of our TAM expanding strategy we plan to expand our product roadmap over the next two years and in 2024 we plan to launch four new camera SKUs, giving us a lineup of cutting edge, industry leading cameras ranging in price from a volume-driving $199 up to $599, with more planned for 2025.

In January, we announced plans to acquire Forcite Helmet Systems, an Australian maker of tech-enabled motorcycle helmets. We believe tech-enabling motorcycle helmets represents a meaningful opportunity for GoPro to extend its technical and marketing capabilities to create differentiated solutions within a $6 billion motorcycle helmet market, of which we believe we can potentially service approximately $3 billion, with an eye towards entering additional helmet markets over time. There are a number of technologies used today by motorcycle enthusiasts including communications, digital imaging, navigation, safety alerts and more that we believe can be integrated into helmets for enhanced performance, convenience, value and safety. We are on track to close this acquisition this quarter and will share specifics about our product vision as we get closer to the expected launch of our first helmet in 2025.

To add more color, motorsports has been core to GoPro’s business for the last 15 years. We’ve developed a strong brand across all disciplines of professional and enthusiast categories of motorsports, with a very strong following among motorcyclists. We are a major sponsor across a broad range of racing series, events and athletes, including the world’s premier motorcycle racing series, MotoGP.

In addition to leveraging our existing motorsports marketing and brand, we intend to leverage the motorsports retail channel we are currently building to support sales of our current camera line to also sell our helmets beginning in 2025.

We also intend to partner with leading helmet brands as an OEM supplier to help them tech-enable their own premium SKUs. We have enormous respect for leading brands and look forward to working with them to help drive innovation together. We are encouraged by early interest shown by some leading brands.

Furthermore, we expect that success in the motorcycle helmet market can contribute to subscriber growth as we intend to support GoPro tech-enabled helmet owners with meaningful subscriber benefits and features.

Looking at our current subscriber base, we closed 2023 with more than 2.5 million subscribers, representing 12% year-over-year growth. The GoPro subscription continues to be a driver of value for our customers and a high margin contributor to our business. In Q4 2023, a new cohort of subscribers emerged – those who’ve come upon third year renewal, and we’re very happy with the results. Consistent with previous quarters, retention for annual subscribers, who represent 90% of total subscribers, was between 60% and 65% for first year renewals and between 70% and 75% for second year renewals. Our new third-year cohort is renewing at greater than 80%. Importantly, we now have a larger pool of subscribers who are up for renewal in their second or third year than we do for the first year, which we believe will be a tailwind for subscriber retention going forward. We expect aggregate retention to improve in 2024.

Another positive for our subscription offerings is the initial release of our Quik desktop app for macOS and our new Premium+ subscription tier, both of which launched yesterday. The Quik desktop app, which is available at no additional charge to GoPro subscribers, brings the simplicity and convenience of automatic edits to desktop users, along with powerful yet convenient manual editing tools, sync’d editing between mobile and desktop apps, and the ability to import footage from any camera. We plan to launch a Windows version of the Quik desktop app later this year.

The new Premium+ $99.99 subscription tier includes an advanced, desktop-based HyperSmooth Pro video stabilization feature, plus increased cloud storage for footage captured with any camera. GoPro subscribers at both the original $49.99 Premium tier and new $99.99 Premium+ tier will continue to enjoy unlimited cloud storage of footage captured with their GoPro at original quality.

We’ve also upgraded the Quik mobile app with a new feature called Local Suggestions, which extends Quik’s “Auto Highlight” functionality to make auto edits from a user’s phone footage as well as from their GoPro footage. We believe this can help drive further engagement and enable users to get more out of their phone-captured content as well as their GoPro-captured content. We will continue to release features and functionality that help users get more value out of their personal content, regardless of the camera they used.

To summarize, the retail expansion strategy we kicked off in May of last year is successfully growing our business at retail. We’re excited about our expanding product line, the significant number of retail doors we’re adding at a steady rate, and the significantly larger number of marketing activations we have planned throughout the year to drive awareness and demand – all of which we believe will contribute to growth.

Our acquisition of Forcite reflects our belief that the GoPro brand can scale across multiple verticals globally. We have a number of exciting opportunities in front of us, and as we move through 2024, we are focused on execution and creating value for our shareholders.

It’s good to be on the build again.

Brian McGee

Executive Vice President, Chief Financial Officer and Chief Operating Officer, GoPro, Inc.

The fourth quarter of 2023 represents the second full quarter operating under the growth and TAM expansion strategy that we implemented in May 2023, which includes:

•Reducing camera pricing to pre-pandemic price points and discontinuing subscription-related camera discounts at the time of purchase on GoPro.com

•The re-introduction of entry-level price point cameras to expand our TAM

•Expanding GoPro’s global retail channel presence to better serve consumers’ post-pandemic shopping behavior

•Introducing more hardware and software products over time to solve for more use cases

Fourth quarter 2023 performance highlights:

•Subscription and service revenue grew 13% year-over-year to $25 million

•GoPro subscribers grew 12% year-over-year to 2.5 million

•Subscription attach rate was approximately 30%, in-line with expectations

•GAAP loss per share was $(0.02); non-GAAP income per share was $0.02, in-line with guidance

•Revenue from our retail channel grew 18% year-over-year to $228 million

•Estimated sell-through increased 3% year-over-year to slightly more than 900,000 units

•Channel inventory reduced slightly in the quarter

•Net working capital changes resulted in cash inflows of $38 million, sequentially

•Repurchased $10 million of GoPro stock, or 2.8 million shares

•Repurchased $50 million in aggregate principal amount of our convertible notes in exchange for $46.3 million, which reduced share count by 5.4 million

For the fourth quarter of 2023, revenue was $295 million, down 8% year-over-year. We continued to be profitable on a non-GAAP basis with income of $0.02 per share. Our subscriber base continued to grow, exceeding 2.5 million subscribers in the quarter, or 12% growth year-over-year and flat sequentially. Our subscriber base represents approximately $125 million in annual recurring revenue. Gross margin of 34.4% was 140 bps ahead of the mid-point of our guidance, which benefited from product mix, reduced operating costs and subscription and service revenue. Additionally, we opened more than 3,200 new retail doors since May 2023, or a 17% increase, ahead of our year-end target.

We believe our strategy shift will support growth over the next two years. Near-term, similar to some of our consumer electronic peers, we encountered inconsistent consumer shopping trends, particularly in December. Specifically, we anticipated stronger December trends in North America and better sell-

through on our entry-level HERO10 Black camera. In North America, we kicked off the holiday season with strong performance over the Thanksgiving weekend, but trends softened later in the season, impacting December sell-through.

We began offering HERO10 Black in September 2023 at an entry-level MSRP of $249. During Q4, we did not offer promotions on HERO10 Black, but it became clear that consumers expected to see some level of discounting during this holiday season, even at entry-level price points. As a result, sell-through actualized well below our unit volume projections by 25%, or more than 60,000 units, contributing to more than 70% of our sell-through miss for the quarter. The upside is that we retained margin on the HERO10 Black units we sold during this time, which contributed to our outperformance on gross margin and a positive non-GAAP EPS result despite lower-than-expected revenue.

Our entry-level price point cameras generated 21% of camera unit volume during the quarter. Historically, entry-level price point cameras have represented approximately 26% of our camera unit volume. As mentioned previously, in the second quarter of 2024, we expect to replace our current low margin entry-level camera with a new entry-level camera at an appropriate product cost point with improved margin.

Full year 2023 performance highlights:

•Subscription and service revenue grew 18% year-over-year to $97 million

•Retail revenue was $704 million or 70% of total revenue, up 3% year-over-year

•GoPro.com revenue was $301 million or 30% of total revenue

•Street ASP was $337

•GAAP loss per share was $(0.35) and non-GAAP loss per share was $(0.20)

•Repurchased approximately $40 million in shares of GoPro stock in 2023, which largely covered our stock-based compensation expense of $41 million

•Ended the year with cash of $247 million, down $121 million from 2022, primarily due to the repayment of our convertible debt of $46 million, stock repurchases of $40 million, and cash used by operating activities of $33 million

2023 revenue was $1.0 billion, down 8% year-over-year; GAAP loss per share was $(0.35), and non-GAAP loss per share was in-line with guidance at $(0.20).

Actual Q4’23 and full year 2023 results compared to guidance for the same period follows:

Fourth Quarter Results and Prior Guidance

| | | | | | | | | | | |

| Q4’23 Results | | Q4’23 Guidance |

| Revenue | $295 | M | | $325M +/- $5M |

| Unit sell-through | >900ku | | ~1,000ku |

| Street ASP | $330 | | ~$335 |

| Gross margin | 34.4 | % | | 33.0% +/- 50bps |

| Non-GAAP income per share | $0.02 | | $0.02 +/- $0.01 |

| | | |

Annual Results and Prior Guidance

| | | | | | | | | | | |

| 2023 Results | | 2023 Guidance |

| Revenue | $1.01 | B | | $1.04B +/- $5M |

| Unit sell-through | >2.9mu | | ~3.0mu |

| Street ASP | $337 | | ~$340 |

| Gross margin | 32.4 | % | | 32.0 | % |

| Non-GAAP loss per share | ($0.20) | | ($0.20) +/- $0.02 |

| | | |

Turning to more detail on our financial performance, fourth quarter revenue of $295 million was down 8% year-over-year. Fourth quarter revenue from our retail channel grew 18% year-over-year to $228 million, or 77% of total revenue. We continue to see our retail sales grow as a result of the price move earlier this year, improving door count, and retail efforts including merchandising during the fourth quarter. As Nick shared, we continued to experience a decline in product sales on GoPro.com due primarily to the strategic decision in May to eliminate subscription-related camera discounts at the time of purchase on GoPro.com. For the fourth quarter, product revenue from GoPro.com was $42 million, a year-over-year decline of 60%, representing 14% of total revenue. Subscription and service revenue grew 13% year-over-year to $25 million, or 8% of total revenue. Importantly, we continue to drive our subscriber base across all camera price points.

Looking at fourth quarter revenue by geography year-over-year, Europe increased by 15%, Asia-Pacific decreased 14%, and Americas decreased by 17%. On an annual basis, revenue from Americas decreased 10%, Asia Pacific decreased 10%, and Europe decreased 3%.

Fourth quarter Street ASP was $330 compared to $378 in Q4’22. In the quarter, 74% of our camera revenue mix was from suggested retail prices of $400 and above, down from 90% in the year-ago quarter. For full year 2023, Street ASP decreased 13% year-over-year to $337. The year-over-year decrease in the fourth quarter and full year 2023 ASP was primarily driven by our camera price reductions in May 2023. Street ASP is defined as total reported revenue divided by camera units shipped.

Fourth quarter demand as measured via sell-through was slightly more than 900,000 units, up approximately 3% year-over-year. Year-over-year, changes in fourth quarter unit sell-through by geography were: Europe increased 14%, Asia Pacific increased 4%, and Americas decreased 3%.

GoPro continued to grow its subscriber base reaching 2.5 million, or 12% growth year-over-year. Our overall fourth quarter subscription attach rate from cameras sold across all channels was approximately 30%, as expected. Additionally, the subscription attach rate for our entry-level cameras was nearly 25% for the quarter. Our overall subscription attach rate is calculated from cameras purchased through both GoPro.com and at retail and represents the number of new GoPro subscribers in the period over the corresponding number of estimated camera units sold through both GoPro.com and retail channels. Our entry-level camera subscriber attach rate is calculated from entry-level price point cameras purchased on GoPro.com and represents the number of new GoPro subscribers in the period over the corresponding number of estimated entry-level price point camera units sold on GoPro.com.

As a reminder, we focus on driving annual subscriptions rather than monthly, and are pleased that our annual subscribers continue to account for 90% of our total, up from 87% in the prior year fourth quarter. Our annual subscriber retention rate for the first and second-year renewal remains consistent at 60% to 65% and 70% to 75%, respectively. And we are pleased to report that our third-year retention rate is exceeding 80%. Our annual GoPro subscriber retention rate represents the number of annual subscribers that renewed their subscription in the period.

Turning to expenses, fourth quarter operating expenses increased 6% year-over-year to $100 million. For the full year 2023, operating expenses increased 9% to $359 million. These increases were largely due to our continued investment in research and development to support our product and subscription roadmap.

Turning to the balance sheet, we ended the quarter with $247 million in cash, cash equivalents and marketable securities. Cash decreased $13 million sequentially, primarily from $46 million in cash used to repurchase $50 million in aggregate principal amount of convertible debt and $10 million in share repurchases, partially offset by net working capital changes resulting in cash inflows of $38 million, and by net income of $2 million. Fourth quarter cash net of debt was $153 million. For the full year 2023, cash decreased $121 million primarily from $46 million in cash used to repurchase $50 million in aggregate principal amount of convertible debt, $40 million in share repurchases, and a net loss of $31 million.

We ended the fourth quarter with inventory of $106 million, down 31% sequentially, and inventory days were 49, down from 55 days a year ago. Our days’ sales outstanding was 28 days, up from 22 days a year ago.

Outlook

First Quarter 2024 Guidance

| | | | | |

| Q1'24 Guidance |

| Revenue | $145M +/- $5M |

| Unit sell-through | >400ku |

| Street ASP | ~$375 |

| Gross margin | 32.5% +/- 50bps |

| Non-GAAP loss per share | ($0.25) +/- $0.02 |

For the first quarter of 2024, we expect to deliver revenue of approximately $145 million, down 17% year-over-year. We estimate Street ASP in the first quarter to be approximately $375, flat year-over-year, and up more than 10% sequentially. We expect unit sell-through to be flat to slightly down year-over-year to 550k +/-50k units.

Our guidance assumes channel inventory will reduce significantly during the first quarter by approximately 15% to roughly 700,000 units. This is due to the depletion of older products in the channel, including HERO9 Black, HERO10 Black and MAX cameras, ahead of new product launches in the second and third quarters, as well as the retail channel generally reducing weeks of inventory. We expect to rebuild the channel with new products and end the year with channel inventory of approximately 800,000 units, which is down slightly year-over-year. That said, there may still be macroeconomic pressures that impact consumer confidence, retailer behavior and spending in the first quarter and throughout 2024.

We expect gross margin in the first quarter to be 32.5% at the midpoint of guidance, up from 30% in the prior year quarter. The year-over-year improvement in gross margin percentage is primarily related to higher subscription and service revenue as a percentage of total revenue and improvements in operating costs.

We expect non-GAAP loss per share for the first quarter of $(0.25) at the midpoint of guidance. We expect shares outstanding to be approximately 150 million shares in the first quarter based on our current stock price and anticipated share repurchases in the quarter.

Looking ahead, we expect to improve gross margin of 32% we posted in 2023 to a range of 35% to 36% in 2024. In addition, we continue to expect gross margin to improve throughout the year to 35% in the

second and third quarters and to improve further in the fourth quarter to between 37% and 38%. We believe gross margin improvements will be driven by the following factors:

•the introduction of a lower product cost entry level product in Q2 2024

•reduced price protection incurred in 2023 for our strategic price move

•identified product cost and tariff savings

•subscription growth and other improvements

•partially offset by anticipated increases in memory pricing

We expect to grow subscribers in 2024 adding to the substantial ARR we are already generating. We expect to end the year with between 2.5 and 2.6 million subscribers, or 4% growth year-over-year at the high-end of the range. This assumes renewal rates consistent with what we’ve described earlier.

In 2023, we made solid progress on the first stage of our multi-year TAM expansion strategy. As Nick mentioned above, we understand what’s needed to drive growth in revenue and expand margins in 2024 and beyond. This includes introducing a number of new products to reach more consumers in more categories and markets. In this context, we view 2024 as a year of execution as we launch four new cameras, grow retail footprint and evaluate differentiated opportunities to leverage the GoPro brand as we are doing with tech-enabled motorcycle helmets, which will be one of several new product launches in 2025.

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

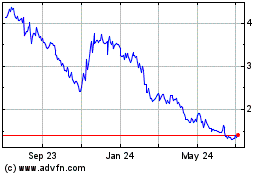

GoPro (NASDAQ:GPRO)

Historical Stock Chart

From Mar 2024 to Apr 2024

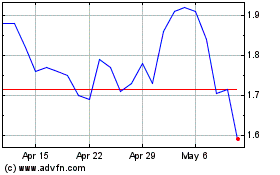

GoPro (NASDAQ:GPRO)

Historical Stock Chart

From Apr 2023 to Apr 2024