0001973239ARM HOLDINGS PLC /UK03-312024Q32/7/2024false00019732392024-02-072024-02-0700019732392023-04-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

| | |

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934 |

For the month of February, 2024

Commission file number 001-41800

Arm Holdings plc

| | |

|

110 Fulbourn Road Cambridge CB1 9NJ United Kingdom |

(Address of principal executive office) |

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

EXHIBIT INDEX

| | | | | |

| Exhibit Number | Description |

| 99.1 | |

| 99.2 | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | |

| ARM HOLDINGS PLC |

| | |

Date: February 7, 2024 | By: | /s/ Laura Bartels |

| Name: | Laura Bartels |

| Title: | Chief Accounting Officer (Principal Accounting Officer) |

Arm Holdings plc Reports Results for the Third Quarter of the Financial Year Ending 2024

Cambridge, England, February 7, 2024: Arm Holdings plc (NASDAQ: ARM), the company that is building the future of computing, has today published a letter to its shareholders containing the company’s results for its fiscal third quarter and three months ended December 31, 2023. The letter is available on its investor relations website (https://investors.arm.com/financials/quarterly-annual-results).

Arm will host an audio webcast to discuss its results with analysts at 14:00 PT / 17:00 ET / 22:00 GMT today, February 7. The live webcast will be available at https://edge.media-server.com/mmc/p/mdgzspqw/ and a replay will be available for four weeks at https://investors.arm.com.

About Arm:

Arm technology is building the future of computing. Our energy-efficient processor designs and software platforms have enabled advanced computing in more than 280 billion chips and our technologies securely power products from the sensor to the smartphone and the supercomputer. Together with 1,000+ technology partners, we are enabling artificial intelligence to work everywhere, and in cybersecurity, we are delivering the foundation for trust in the digital world – from chip to cloud. The future is being built on Arm.

All information is provided “as is” and without warranty or representation. This document may be shared freely, attributed and unmodified. Arm is a registered trademark of Arm Limited (or its subsidiaries). All brands or product names are the property of their respective holders. © 1995-2024 Arm Group.

Contacts:

Investors: Investor.Relations@arm.com

Media: Global-PRteam@arm.com

Exhibit 99.2

| | |

Arm will be hosting a conference call via an audio webcast to discuss earnings at 14:00 Pacific Time (17:00 Eastern Time, 22:00 GMT) on Wednesday, February 7, 2024. A replay of and a transcript of the call will be available the following day. |

| The webcast and replay can be accessed at: https://edge.media-server.com/mmc/p/mdgzspqw/ |

Dear Shareholder,

Arm’s second quarter as a public company has produced another strong set of results as we continue to build upon the most popular CPU platform in computing history. We had an outstanding Q3 delivering record revenues and exceeding the high-end of our guidance ranges for both revenue and non-GAAP EPS. Growth was driven by both royalty revenue and license revenue. Our highest-ever royalty revenue was driven by multiple factors. Firstly, we continue to benefit from higher royalty rates as the adoption of Armv9 technology increases. The royalty rates for Armv9 products are typically at least double the royalty rates for equivalent Armv8 products, and this will continue to generate royalty revenue growth as multiple end markets transition to Armv9. Secondly, Arm continues to gain market share in the growth markets of cloud servers and automotive which drive new streams of royalty growth. Lastly, the broader semiconductor market is showing signs of recovery, particularly in smartphones which returned to strong growth in Q3. Arm’s licensing revenue was supported by increasing demand for new technology driven by all things AI. From the most complex AI cloud applications to the smallest edge devices, AI on Arm is everywhere. Arm’s performant and power-efficient CPU platform is used by more and more software developers, making it easier for OEMs to adopt Arm technology, which generates further demand for Arm-based chips.

We believe these fundamental trends will continue going forward and as a result, we expect next quarter's revenue to be another record and exceed the previously communicated annual guidance.

Arm is the foundational compute platform for the world’s innovations. It is impossible to build an intelligent electronic device without a CPU, and more chips with Arm CPUs have been delivered in the last decade than any alternative. This virtuous cycle of more CPUs drives more software development on the Arm CPU platform which, in turn generates more demand for our technology. And with so many applications moving to AI, we expect this demand to accelerate.

We are only at the beginning. Arm’s strategy promotes multiple long-term growth drivers.

Growth will be driven by royalty revenue. We expect the demand for compute to continue to grow as the complexity and performance requirements of electronic devices increase. Additionally, we expect that Arm will continue to gain market share, especially in key end-applications such as automotive and cloud servers, where the virtuous cycle of more Arm-based chips going into more products drives more software development, which in turn generates more demand for Arm technology. This is compounded with increasing performance requirements that continue the trend of higher royalty rates as end products require more Arm CPU’s per chip and more advanced Arm technology, such as Armv9. Chips based on Armv9 technology now contribute around 15% of Arm’s royalty revenue, up from around 10% last quarter.

Growth will be driven by the need for more energy-efficient compute and AI capability. We are seeing the demand for Arm technology to enable AI everywhere, from the cloud to edge devices in your hand. Generative AI and Large Language Models (“LLM”) need very high-performance processors. These processors need to operate within constrained energy and thermal budgets making a power-efficient computing platform essential. The most demanding AI applications are already running on Arm today, for example, NVIDIA recently announced that dozens of new AI supercomputers are coming online incorporating their Arm-based GH200 Grace Hopper Superchip. Key players like Dell Technologies, Hewlett Packard Enterprise (HPE), Lenovo, Quanta and Supermicro are among those using the GH200 to tackle some of the world’s most challenging problems. At the edge, Google recently revealed their LLM, Gemini Nano, running on the latest Arm-based Pixel 8 smartphone, and Samsung, Vivo and Xiaomi all have announced new Arm-based smartphones that demonstrate generative AI and LLM capabilities. Some of the features include live call translation, intuitive search features such as circle to search, and advanced photo and video capabilities.

Growth will be driven by Compute Subsystems. The growth of AI is putting more demand on scarce design resources, creating the opportunity for Arm to do more. Complex chips are becoming more difficult and taking longer to design, compounded by chip manufacturing cycles taking longer as well. This means chip designers must do more in less time to hit their product launch window. Our solution to this is Arm Compute Subsystems ("CSS") which are integrated and verified configurations of Arm technology platforms targeting specific end markets and use cases. We are already seeing proof points of this strategy in the infrastructure market. One Arm Neoverse CSS customer successfully went from concept

to working silicon of an advanced server chip in just 13 months, reducing their development time by 50%, and another reported saving 80 years of engineering effort resulting in over $20 million savings in cost. During the quarter, Microsoft announced their first cloud server chip, the Microsoft Cobalt 100, which is based on Arm Neoverse CSS.

Growth will be driven by Arm’s unique ecosystem of software and design partners. Arm already has the world’s largest compute ecosystem with more than 15 million software developers. This unprecedented number of developers leads to seamless design choice by OEMs selecting Arm CPUs as the platform of choice. As more applications move to AI, we are investing in the software ecosystem needed to bring AI to the billions of Arm-based devices. One key solution is ArmNN, an optimized AI engine which seamlessly integrates with the most widely used AI frameworks and enables developers to create AI applications for mobile and consumer-electronic devices. Since its launch in 2018, ArmNN has been deployed on more than 700 million devices enabling a seamless way to port AI applications to existing products.

The CSS product offering is also benefiting from Arm’s broad ecosystem strength. During the quarter, we announced Arm Total Design which is a program to simplify delivery of custom chips based on Arm’s Neoverse CSS. Arm Total Design currently comprises 12 leading technology ecosystem partners who together combine all the ingredients required to build a complex server chip. This includes pre-integrated, validated IP and EDA tools, design services and expertise, foundry support for leading-edge process nodes and advanced packaging, and commercial software support all optimized for Arm Neoverse CSS. Arm Total Design broadens the number of potential customers for Arm and will fuel future growth.

These key growth drivers have Arm extremely well positioned for long term growth.

Quarterly Highlights

•Revenues of $824 million, up 14% year-over-year, with record royalty revenue and strong growth in licensing revenue.

•Royalty revenue of $470 million, up 11% year-over-year was driven by the semiconductor industry recovery and the rapidly increasing penetration of Armv9-based chips, which typically command a higher royalty rate.

•Better than expected license revenue of $354 million, up 18% year-over-year, and strong bookings were due to strong demand for more advanced Arm CPUs as companies increase investment in AI across all end markets.

•Non-GAAP operating profit increased 17% year-over-year to $338 million resulting in a 41.0% non-GAAP operating margin.

| | |

"Arm delivered another quarter of record revenues driven by continued adoption of the world’s most pervasive compute platform," said Rene Haas, CEO. “More customers moving to higher-value Armv9 technology combined with market share gains in cloud server and automotive resulted in strong royalty growth. The AI wave drove licensing growth as these new devices require Arm’s performant and power-efficient compute platform."

|

Guidance and Results

| | | | | | | | | | | |

| Quarterly Guidance & Results | Q3 FYE24 Prior Guidance(2) | Q3 FYE24 Results(2) | Q4 FYE24 Latest Guidance(3) |

| Revenue | $720m-$800m | $824m | $850m - $900m |

Non-GAAP operating expense (1)(2) | ~$460m | $459m | ~$490m |

Non-GAAP fully diluted earnings per share (1)(2) | $0.21 - $0.28 | $0.29 | $0.28 - $0.32 |

| Annual Guidance | FYE24 Prior Guidance(3) | | FYE24 Latest Guidance(3) |

| Revenue | $2,960m - $3,080m | | $3,155m - $3,205m |

Non-GAAP operating expense (1)(2) | ~$1,765m | | ~$1,700m |

Non-GAAP fully diluted earnings per share (1)(2) | $1.00 - $1.10 | | $1.20 - $1.24 |

(1) For more information and definitions of the non-GAAP measures see the “Key Financial and Operating Metrics” section below. A reconciliation of each of the projected non-GAAP operating expense and non-GAAP fully diluted earnings per share, which are forward-looking non-GAAP financial measures, to the most directly comparable GAAP financial measure, is not provided because Arm is unable to provide such reconciliation without unreasonable effort. The inability to provide each reconciliation is due to the unpredictability of the amounts and timing of events affecting the items we exclude from the non-GAAP measure.

(2) Q3 FYE24 results, unaudited, are presented consistent with non-GAAP presentation methodology used previously, and consistent with how guidance was set on November 8, 2023. Included within Q3 FYE24 non-GAAP operating expense results of $459m is $22m of employer taxes related to equity-classified awards vesting within the quarter, net of the research and development tax credit associated with these taxes. These amounts are dependent on our stock price at the time of vesting and as a result, these taxes may vary in any particular period independent of the financial and operating performance of our business. To improve comparability of our results, beginning with results to be reported next quarter for Q4 FYE24, this net expense will be excluded from our presentation of non-GAAP measures.

(3) Prior guidance, as of November 8, 2023, included the impact of employer taxes related to equity-classified awards vesting within the period, net of the research and development tax credit associated with these taxes. As of prior guidance, the estimated net impact of this expense totaled approximately $75m within the FYE24 non-GAAP operating expense guidance of ~$1,765m. Our latest FYE24 Non-GAAP operating expense guidance of ~$1,700m issued today, February 7, 2024, excludes the impact of employer taxes related to equity-classified awards vesting within the period, net of the research and development tax credit associated with these taxes, aligned to the presentation change taking effect with Q4 FYE24 results as noted in footnote (2) above.

Results for Q3 fiscal year ending 2024

Financial Metrics (1) (Unaudited)

| | | | | | | | | | | | | | | | | | | | |

| $million, unless stated | GAAP | Non-GAAP (1) |

Q3 FYE24 | Q3 FYE23 | Y/Y % | Q3 FYE24 | Q3 FYE23 | Y/Y % |

| Total revenue | 824 | 724 | 14% | 824 | 724 | 14% |

| License and other revenue | 354 | 299 | 18% | 354 | 299 | 18% |

| Royalty revenue | 470 | 425 | 11% | 470 | 425 | 11% |

| Cost of goods sold | (36) | (29) | 24% | (27) | (27) | —% |

| Gross profit | 788 | 695 | 13% | 797 | 697 | 14% |

| Gross margin (%) | 95.6% | 96.0% | | 96.7% | 96.3% | |

| Operating expenses | (654) | (451) | 45% | (459) | (408) | 13% |

| Operating profit | 134 | 244 | (45)% | 338 | 289 | 17% |

| Operating margin (%) | 16.3% | 33.7% | | 41.0% | 39.9% | |

| Net income | 87 | 182 | (52)% | 305 | 225 | 36% |

| Diluted earnings per share ($) | 0.08 | 0.18 | (55)% | 0.29 | 0.22 | 32% |

| Free cash flow | | | | 251 | 387 | (35)% |

Free cash flow trailing twelve months ("TTM") | | | | 724 | 445 | 63% |

(1) For more information, definitions, and reconciliations of Non-GAAP measures see the “Key Financial and Operating Metrics” section below.

Non-Financial Metrics (1) (Unaudited)

| | | | | | | | | | | |

| Q3 FYE24 | Q3 FYE23 | Y/Y % |

| Annualized contract value ("ACV") | $1,160 million | $1,009 million | 15% |

| Remaining performance obligations ("RPO") | $2,433 million | $1,758 million | 38% |

| Arm Total Access licenses | 27 | 15 | 80% |

| Arm Flexible Access licenses | 218 | 205 | 6% |

Chips reported as shipped (2) | 7.7 billion | 7.9 billion | (3)% |

| Total number of employees | 6,870 | 5,781 | 19% |

| Engineers as a percentage of total employees | 80% | 79% | |

(1) For more information and definitions of Non-Financial Metrics see the “Key Financial and Operating Metrics” section below.

(2) Chips reported as shipped reflect actual chip shipments from the prior quarter and are based off customers reports received in the quarter presented.

Financial Overview

(US GAAP unless otherwise stated)

Total revenue

Total revenue in Q3 FYE24 was $824 million, our highest ever, an increase of 14% from the same period in the prior year. This was driven by record royalty revenue and better than expected license and other revenue.

Royalty revenue

Royalty revenue was $470 million, up 11% year-over-year and 12% sequentially, reflecting the strong recovery in the smartphone market and increasing penetration of Armv9.

We continue to benefit from consistent robust growth in cloud servers driven by market share gains and higher royalty rates from the Armv9 transition. Royalty revenue from smartphones grew strongly year-over-year as smartphone sales started to recover, and we saw an increasing penetration of AI-enabled Armv9 based handsets which have a higher royalty rate. In the automotive market, Arm-based chips for ADAS continued to show strong growth, partially offset by the automotive microcontroller market that was impacted by an industry-wide slowdown. Royalty revenue from the IoT/embedded market was flat year on year, as the market works its way through last year's inventory correction.

Chips reported as shipped

We record and report actual chip shipments in the subsequent quarter. During the current quarter, Arm’s customers reported that they had shipped 7.7 billion Arm-based chips for the September quarter shipping period. This takes the cumulative number of Arm-based chips reported as shipped to 280.3 billion.

License and other revenue

License and other revenue for Q3 FYE24 was $354 million, up 18% year-over-year. This better-than-expected result was driven by multiple high-value, long-term license agreements signed with leading technology companies, and by more companies choosing Arm's most advanced CPUs to run AI , where more advanced CPUs command a higher license fee.

Annualized contract value

Annualized contract value ("ACV") at the end of Q3 FYE24 was $1,160 million, up 15% year-over-year and up 5% compared with Q2 FYE24. Sequential growth was primarily driven by the high-value license agreements, including Arm Total Access agreements.

Remaining performance obligations

As of the end of Q3 FYE24, remaining performance obligations (RPO) were $2,433 million, up 38% year-on-year and up slightly sequentially, driven by high-value license agreements and the renewal of a long-term customer agreement. We expect to recognize approximately 28% of RPO as revenue over the next 12 months, 26% over the subsequent 13-to-24-month period, and the remainder thereafter.

Licenses signed

During the quarter, Arm signed five additional Arm Total Access agreements, taking the total number of extant licenses to 27, which includes more than half of our top 20 customers. The new Arm Total Access agreements were signed with semiconductor companies developing chips for a wide range of end markets including embedded computing, wireless connectivity, AI enabled camera technology and smartphones. Three of the new Arm Total Access agreements were with companies that had previously been an Arm Flexible Access licensee and upgraded to Arm Total Access - the first time we have seen such an upgrade.

The Arm Flexible Access program enables early-stage companies to take advantage of the benefits of the broad Arm ecosystem as they enter into new markets. These agreements need to be renewed annually, and in Q3 FYE24 we had over 50 renewals and 14 new agreements signed, leading to six net additions, bringing the total number of extant licensees to 218. The companies that renewed existing agreements or signed new agreements during the quarter are developing products for a wide range of applications including multiple AI accelerators, edge servers, automotive applications, and sensors.

Gross profit and margin

Cost of sales in Q3 FYE24 was $36 million, resulting in a Gross Profit of $788 million and a 95.6% Gross Margin. Non-GAAP cost of sales was $27 million, resulting in a non-GAAP Gross Profit of $797 million and a 96.7% non-GAAP Gross Margin.

Operating expense and margin

Total operating expense in Q3 FYE24 was $654 million, including $188 million of share-based compensation cost (equity-settled) and $6 million for net disposal, restructuring, and other operating expenses. Total non-GAAP operating expense of $459 million was up 13% year-over-year, primarily due to a 19% increase in headcount, partly offset by the change in mix of share-based compensation cost from cash-settled to equity-settled. For more detail on share-based compensation cost see table in "GAAP to Non-GAAP Reconciliation" below.

Research and development (R&D) expense was $432 million, representing 52.4% of revenue. Non-GAAP R&D expense was $293 million, representing 35.6% of revenue, and up 9% year-over-year. Growth was driven by a 20% increase in engineering headcount, partially offset by the change in mix of share-based compensation cost.

Selling, general and administrative (SG&A) expense was $216 million, representing 26.2% of revenue. Non-GAAP SG&A expense was $166 million, representing 20.1% of revenue, up 20% year-over-year, primarily due to a 13% increase in non-engineering headcount and the prior year benefiting from a one-time bad debt reversal, partially offset by the change in mix of share-based compensation cost.

GAAP operating profit of $134 million was down 45% year-over-year, primarily due to the increase in revenue being more than offset by the investment in engineering. Non-GAAP operating profit of $338 million was up 17% year-over-year and represents a 41.0% non-GAAP operating margin, compared with 39.9% for the same period last year. The primary difference between GAAP and Non-GAAP operating profit was equity-settled share-based compensation cost.

Total share-based compensation cost (equity-settled) was $196 million with $8 million included in cost of sales, $139 million included in R&D and $49 million included in SG&A.

Income before income taxes, effective tax rate, net income, earnings per share, and share count

Income before income tax in Q3 FYE24 was $146 million down 36% year-over-year. Non-GAAP Income before income taxes was $351 million, up 26% year-over-year. Our effective tax rate for the quarter was 40.4% (non-GAAP 13.1%). We expect the non-GAAP effective tax rate to remain in the mid-teens on a go-forward basis. Net income in Q3 FYE24 was $87 million, down 52% year-over-year. Non-GAAP net income was $305 million, up 36% year-over-year.

Q3 FYE24 fully diluted earnings per share were $0.08 per share (non-GAAP: $0.29 per share) compared with Q3 FYE23 fully diluted earnings per share of $0.18 (non-GAAP: $0.22 per share).

On a GAAP and a non-GAAP basis, our basic share count was 1,026,894,266 and our fully diluted share count was 1,048,888,489.

Free cash flow

Non-GAAP free cash flow was $251 million for the quarter, with non-GAAP free cash flow for the trailing twelve months totaling $724 million, up 63% year-over-year. At the end of Q3 FYE24, Arm’s cash and cash equivalents, and short-term investments, totaled $2,401 million, up 9% from $2,206 million in the prior quarter and 35% year-over-year.

In closing

We are excited to report another quarter of record revenues. We expect next quarter to be even better and yet another record. We have delivered these results through the combination of our focus on growing royalty revenue, the need for more compute and AI across all markets, demand from customers for our platforms, as well as our unrivaled developer ecosystem. However, we believe this is only the start and that our strategy will drive significant revenue growth for years and decades to come.

Sincerely,

| | | | | |

Rene Haas, Chief Executive Officer | Jason Child, Chief Financial Officer |

| | | | | |

Investor Contact Ian Thornton Investor.Relations@arm.com | Media Contact Phil Hughes Global-PRteam@arm.com |

Arm Holdings plc

Condensed Consolidated Income Statements

(in millions, except share and per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Nine Months Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Revenue: | | | | | | | |

| Revenue from external customers | $ | 576 | | | $ | 533 | | | $ | 1,755 | | | $ | 1,526 | |

| Revenue from related parties | 248 | | | 191 | | | 550 | | | 520 | |

| Total revenue | 824 | | | 724 | | | 2,305 | | | 2,046 | |

| Cost of sales | (36) | | | (29) | | | (113) | | | (79) | |

| Gross profit | 788 | | | 695 | | | 2,192 | | | 1,967 | |

| Operating expenses: | | | | | | | |

| Research and development | (432) | | | (286) | | | (1,395) | | | (752) | |

| Selling, general and administrative | (216) | | | (163) | | | (702) | | | (488) | |

| | | | | | | |

| Disposal, restructuring and other operating expenses, net | (6) | | | (2) | | | (6) | | | (6) | |

| Total operating expense | (654) | | | (451) | | | (2,103) | | | (1,246) | |

| Operating income (loss) | 134 | | | 244 | | | 89 | | | 721 | |

| Income (loss) from equity investments, net | (1) | | | (6) | | | (13) | | | (80) | |

| Interest income, net | 28 | | | 13 | | | 80 | | | 21 | |

| Other non-operating income (loss), net | (15) | | | (23) | | | (2) | | | 4 | |

| Income (loss) before income taxes | 146 | | | 228 | | | 154 | | | 666 | |

| Income tax benefit (expense) | (59) | | | (46) | | | (72) | | | (145) | |

| Net income (loss) | 87 | | | 182 | | | 82 | | | 521 | |

| | | | | | | |

| Net income (loss) per share attributable to ordinary shareholders | | | | | | | |

| Basic | $ | 0.08 | | | $ | 0.18 | | | $ | 0.08 | | | $ | 0.51 | |

| Diluted | $ | 0.08 | | | $ | 0.18 | | | $ | 0.08 | | | $ | 0.51 | |

| | | | | | | |

| Weighted average ordinary shares outstanding | | | | | | | |

| Basic | 1,026,894,266 | | 1,025,234,000 | | 1,025,815,812 | | 1,025,234,000 |

| Diluted | 1,048,888,489 | | 1,027,918,937 | | 1,040,163,454 | | 1,026,956,431 |

Arm Holdings plc

Condensed Consolidated Balance Sheets

(in millions, except par value and share amounts)

(Unaudited)

| | | | | | | | | | | |

| As of |

| December 31,

2023 | | March 31,

2023 |

| Assets: | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 1,551 | | | $ | 1,554 | |

| Short-term investments | 850 | | | 661 | |

Accounts receivable, net (including receivables from related parties of $217 and $402 as of December 31, 2023 and March 31, 2023, respectively) | 799 | | | 999 | |

| Contract assets (including contract assets from related parties of $16 and $9 as of December 31, 2023 and March 31, 2023, respectively) | 280 | | | 154 | |

| Prepaid expenses and other current assets | 148 | | | 169 | |

| | | |

| Total current assets | 3,628 | | | 3,537 | |

| Non-current assets: | | | |

| Property and equipment, net | 221 | | | 185 | |

| Operating lease right of use assets | 204 | | | 206 | |

Equity investments (including investments held at fair value of $576 and $592 as of December 31, 2023 and March 31, 2023, respectively) | 748 | | | 723 | |

| Goodwill | 1,628 | | | 1,620 | |

| Intangible assets, net | 163 | | | 138 | |

| Deferred tax assets | 140 | | | 139 | |

| Non-current portion of contract assets | 143 | | | 116 | |

| Other non-current assets | 240 | | | 202 | |

| | | |

| Total non-current assets | 3,487 | | | 3,329 | |

| Total assets | $ | 7,115 | | | $ | 6,866 | |

| Liabilities: | | | |

| Current liabilities: | | | |

| Accrued compensation and benefits and share-based compensation | $ | 211 | | | $ | 589 | |

| Tax liabilities | 127 | | | 162 | |

Contract liabilities (including contract liabilities from related parties of $100 and $135 as of December 31, 2023 and March 31, 2023, respectively) | 223 | | | 293 | |

| Operating lease liabilities | 26 | | | 26 | |

Other current liabilities (including payables to related parties of $25 and $17 as of December 31, 2023 and March 31, 2023, respectively) | 279 | | | 293 | |

| | | |

| Total current liabilities | 866 | | | 1,363 | |

| Non-current liabilities: | | | |

| Non-current portion of accrued compensation and share-based compensation | 18 | | | 152 | |

| Deferred tax liabilities | 237 | | | 262 | |

| Non-current portion of contract liabilities | 734 | | | 807 | |

| Non-current portion of operating lease liabilities | 195 | | | 193 | |

| Other non-current liabilities | 61 | | | 38 | |

| | | |

| Total non-current liabilities | 1,245 | | | 1,452 | |

| Total liabilities | 2,111 | | | 2,815 | |

Arm Holdings plc

Condensed Consolidated Balance Sheets

(in millions, except par value and share amounts)

(Unaudited)

| | | | | | | | | | | |

| As of |

| December 31, 2023 | | March 31, 2023 |

| Shareholders’ equity: | | | |

Ordinary shares, $0.001 par value; 1,088,334,144 shares authorized and 1,028,075,347 shares issued and outstanding as of December 31, 2023; and 1,025,234,000 shares authorized, issued and outstanding as of March 31, 2023 | 2 | | | 2 | |

| Additional paid-in capital | 2,087 | | | 1,216 | |

| Accumulated other comprehensive income | 388 | | | 376 | |

| Retained earnings | 2,527 | | | 2,457 | |

| Total shareholders’ equity | 5,004 | | | 4,051 | |

| Total liabilities and shareholders’ equity | $ | 7,115 | | | $ | 6,866 | |

Arm Holdings plc

Condensed Consolidated Statements of Cash Flows

(in millions)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Nine Months Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Cash flows provided by (used for) operating activities: | | | | | | | |

| Net income (loss) | $ | 87 | | | $ | 182 | | | $ | 82 | | | $ | 521 | |

| Adjustments to reconcile net income (loss) to net cash provided by (used for) operating activities: | | | | | | | |

| Depreciation and amortization | 42 | | | 43 | | | 124 | | | 130 | |

| Deferred income taxes | (9) | | | (17) | | | (26) | | | (26) | |

| Income (loss) from equity investments, net | 1 | | | 6 | | | 13 | | | 80 | |

| | | | | | | |

| Share-based compensation cost | 199 | | | 38 | | | 852 | | | 85 | |

| Operating lease expense | 9 | | | 9 | | | 26 | | | 26 | |

| Other non-cash operating activities, net | 1 | | | (4) | | | (2) | | | (6) | |

| Changes in assets and liabilities: | | | | | | | |

| Accounts receivable, net (including receivables from related parties) | 65 | | | 57 | | | 200 | | | (152) | |

| Contract assets, net (including contract assets from related parties) | (67) | | | (32) | | | (154) | | | 7 | |

| Prepaid expenses and other assets | (32) | | | 16 | | | (19) | | | 29 | |

| Accrued compensation and benefits and share-based compensation | 59 | | | 111 | | | (383) | | | (398) | |

| Contract liabilities (including contract liabilities from related parties) | (76) | | | (22) | | | (148) | | | (10) | |

| Tax liabilities | 18 | | | 48 | | | (46) | | | 87 | |

| Operating lease liabilities | (1) | | | 6 | | | (18) | | | (53) | |

| Other liabilities (including payables to related parties) | 14 | | | (30) | | | (78) | | | (64) | |

| Net cash provided by (used for) operating activities | $ | 310 | | | $ | 411 | | | $ | 423 | | | $ | 256 | |

| | | | | | | |

| Cash flows provided by (used for) investing activities | | | | | | | |

| Purchase of short-term investments | (155) | | | (320) | | | (540) | | | (985) | |

| Proceeds from maturity of short-term investments | 105 | | | 335 | | | 351 | | | 945 | |

| Purchases of equity investments | (21) | | | (1) | | | (32) | | | (4) | |

| Purchases of intangible assets | (30) | | | (3) | | | (43) | | | (25) | |

| Purchases of property and equipment | (21) | | | (10) | | | (81) | | | (48) | |

| Other investing activities, net, including investments in convertible loans | (1) | | | — | | | (1) | | | — | |

| Net cash provided by (used for) investing activities | $ | (123) | | | $ | 1 | | | $ | (346) | | | $ | (117) | |

| | | | | | | |

| Cash flows provided by (used for) financing activities | | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Payment of intangible asset obligations | (8) | | | (11) | | | (29) | | | (31) | |

| Other financing activities, net | (4) | | | (1) | | | (10) | | | (1) | |

| Payment of withholding tax on vested shares | (36) | | | — | | | (48) | | | — | |

| Net cash provided by (used for) financing activities | $ | (48) | | | $ | (12) | | | $ | (87) | | | $ | (32) | |

| | | | | | | |

| Effect of foreign exchange rate changes on cash and cash equivalents | 6 | | | 11 | | | 7 | | | (10) | |

| Net increase (decrease) in cash and cash equivalents | 145 | | | 411 | | | (3) | | | 97 | |

| Cash and cash equivalents at the beginning of the period | 1,406 | | | 690 | | | 1,554 | | | 1,004 | |

| Cash and cash equivalents at the end of the period | $ | 1,551 | | | $ | 1,101 | | | $ | 1,551 | | | $ | 1,101 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Non-cash operating, investing and financing activities: | | | | | | | |

| | | | | | | |

| Non-cash additions in property and equipment | 18 | | | 1 | | | 18 | | | 1 | |

| Non-cash additions in intangible assets | 9 | | | — | | | 47 | | | — | |

| Non-cash additions in operating lease right of use assets | 5 | | | 4 | | | 18 | | | 6 | |

| Non-cash additions of operating lease liabilities | 5 | | | 4 | | | 18 | | | 6 | |

| Non-cash additions to equity investments from conversion of certain receivables | 5 | | | — | | | 9 | | | — | |

| Non-cash distributions to shareholders | — | | | — | | | 12 | | | — | |

| Non-cash withholding tax on vested shares | 63 | | | — | | | 63 | | | — | |

| Non-cash reclassification of share-based compensation costs | — | | | — | | | 343 | | | — | |

Key Financial and Operating Metrics

We use the following key performance indicators and non-GAAP financial measures to analyze our business performance and financial forecasts and to develop strategic plans, which we believe provide useful information to the market to aid in understanding and evaluating our results of operations in the same manner as our management team. Certain judgments and estimates are inherent in our processes to calculate these metrics. These key performance indicators and non-GAAP financial measures are presented for supplemental informational purposes only, should not be considered a substitute for financial information presented in accordance with GAAP, and may differ from similarly titled metrics or measures presented by other companies.

The following table sets forth a summary of the key financial and operating metrics:

| | | | | | | | | | | | | | | | | | | | | | | |

| (in millions, except for Number of Arm-based Chips, Number of extant Arm Total Access and Arm Flexible Access licenses, and Total number of employees and engineers) | Three Months Ended December 31, | | Nine Months Ended December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Total revenue | $ | 824 | | | $ | 724 | | | $ | 2,305 | | | $ | 2,046 | |

License and other revenue | 354 | | 299 | | 1,017 | | 745 |

| Royalty revenue | 470 | | 425 | | 1,288 | | 1,301 |

| Operating income | 134 | | 244 | | 89 | | 721 |

| Non-GAAP operating income (1) | 338 | | 289 | | 991 | | 784 |

| Net income from continuing operations | 87 | | 182 | | 82 | | 521 |

| Non-GAAP net income (1) | 305 | | 225 | | 931 | | 639 |

| Net cash provided by operating activities | 310 | | 411 | | 423 | | 256 |

| Non-GAAP free cash flow (1) | 251 | | 387 | | 270 | | 152 |

| Non-GAAP free cash flow TTM (1) | 724 | | 445 | | | | |

| | | | | | | |

| Operating metrics: | | | | | | | |

| Number of Arm-based chips reported as shipped (billions) | 7.7 | | 7.9 | | 21.6 | | 22.7 |

| | | | | | | |

| | | | | As of |

| Operating metrics: | | | | | December 31,

2023 | | December 31,

2022 |

| Cumulative number of Arm-based chips reported as shipped (billions) | | | | | 280.3 | | 250.2 |

| Number of extant Arm Total Access licenses (2) | | | | | 27 | | 15 |

| Number of extant Arm Flexible Access licenses (2) | | | | | 218 | | 205 |

| Annualized contract value | | | | | $ | 1,160 | | | $ | 1,009 | |

| Remaining performance obligation | | | | | $ | 2,433 | | | $ | 1,758 | |

| Total number of employees (at end of period) | | | | | 6,870 | | 5,781 |

| Total number of engineers | | | | | 5,520 | | 4,589 |

| Total number of non-engineers | | | | | 1,350 | | 1,192 |

(1) Non-GAAP operating income, Non-GAAP net income from continuing operations and Non-GAAP free cash flow are non-GAAP financial measures. For more information regarding our use of these measures and a reconciliation of these measures to the most directly comparable GAAP financial measures, see “—GAAP to Non-GAAP Reconciliation” below.

(2) As of the last day of the applicable period.

Total revenue

Our major product offerings consists of the following:

License and other revenue

•Intellectual property license — We generally license IP under non-exclusive license agreements that provide usage rights for specific applications for a finite or perpetual term. These licenses are made available electronically to address the customer-specific business requirements. These arrangements generally have distinct performance obligations that consist of transferring the licensed IPs, version extensions of architecture IP or releases of IPs, and support services. Support services consist of a stand-ready obligation to provide technical support, patches, and bug fixes over the support term. Revenue allocated to the IP license is recognized at a point in time upon the delivery or beginning of license term, whichever is later. Revenue allocated to distinct version extensions of architecture IP or releases of IP, excluding when-and-if-available minor updates over support term, are recognized at a point in time upon the delivery or beginning of license term, whichever is later.

Certain license agreements provide customers with the right to access a library of current and future IPs on an unlimited basis over the contractual period depending on the terms of the applicable contract. These licensing arrangements represent stand-ready obligations in that the delivery of the underlying IPs is within the control of the customer and the extent of use in any given period does not diminish the remaining performance obligations. The contract consideration related to these arrangements is recognized ratably over the term of the contract in line with when the control of the performance obligations is transferred.

•Software sales, including development systems — Sales of software, including development systems, which are not specifically designed for a given license (such as off-the-shelf software), are recognized upon delivery when control has been transferred and customer can begin to use and benefit from the license.

•Professional services — Services (such as training and professional and design services) that we provide, which are not essential to the functionality of the IP, are separately stated and priced in the contract and accounted for separately. Training revenue is recognized as services are performed. Revenue from professional and design services are recognized over time using the input method based on engineering labor hours expended to date relative to the estimated total effort required. For such professional and design services, we have an enforceable right to payment for performance completed to date, which includes a reasonable profit margin and the performance of such services do not create an asset with an alternative use.

•Support and maintenance — Support and maintenance is a stand-ready obligation to the customer that is both provided and consumed simultaneously. Revenue is recognized on a straight-line basis over the period for which support and maintenance is contractually agreed pursuant to the license.

Royalty revenue

For certain IP license agreements, royalties are collected on products that incorporate our IP. Royalties are recognized on an accrual basis in the quarter in which the customer ships their products, based on our technology that it contains. This estimation process for the royalty revenue accrual is based off of customer sales which occur using estimates from sales trends and judgment for several key attributes, including industry estimates of expected shipments, the mix of products sold, the percentage of markets using our products, and average selling price. Adjustments to revenue are required in subsequent periods to reflect changes in estimates as new information becomes available, primarily resulting from actual amounts subsequently reported by the licensees.

Number of Arm-based chips reported as shipped - for the period and cumulative

Each quarter, most of our customers, and those contracted through Arm China, furnish us (directly or via Arm China) with royalty reports setting forth the actual number of Arm-powered chips they shipped in the immediately preceding quarter. Royalty reports received in the 12-month period from April 1 to March 31 of each year relate to chip shipments made in the period from January 1 to December 31 of each year. We also perform various procedures to assess customer data related to royalties for reasonableness, and our license agreements generally include rights for us to audit the books and records of our customers to verify certain types of customer data.

We consider the number of chips reported as shipped by our customers as a key performance indicator because it represents the acceptance of our products by companies who use chips in their products (e.g., our customers’ customers). The number

of chips shipped also provides insight into chip pricing and volumes in different end markets, which helps inform our pricing models and competitive positioning.

The cumulative number of Arm-based chips reported as shipped are from inception to date. This figure includes our customers' adjustments on the number of Arm-based chips reported as shipped in prior periods. We consider the cumulative number of Arm-based chips reported as shipped by our customers as a key performance indicator because it represents the scale of expansion of Arm-based products.

Number of extant Arm Total Access and Arm Flexible Access licenses

Each quarter, we track the number of extant Arm Total Access and Arm Flexible Access licenses with our customers, and those contracted through Arm China. We believe that, over time, many of our customers will transition to either an Arm Total Access or Arm Flexible Access license to access our products. This transition enables us and our customers to focus less on contract negotiations and more on how our products can be deployed in our customers’ future chips.

We consider the number of extant Arm Total Access and Arm Flexible Access licenses as key performance indicators as they represent the increasing collaboration between us and our customers, which could be a leading indicator to more chips being designed with our products and, accordingly, more recurring royalty revenue in the future, improving our long-term market share.

Annualized contract value ("ACV")

Each quarter, we track the ACV relating to licensing agreements signed with our customers and those contracted through Arm China per the aggregate license fee as shared under the IPLA. We define ACV as the total annualized committed fees, excluding any potential future royalty revenue, for all signed agreements deemed to be active through the last day of each applicable reporting period. Arm Total Access agreements and ALAs are deemed to be active for, and annualized over, the number of years in the contract. Any other license agreements, including single use and limited use licenses issued under an Arm Flexible Access agreement or TLA, are deemed to be active for, and annualized over, three years based on the historical licensing patterns of our customers. The aggregate license fee shared by Arm China is also deemed to be active for, and annualized over, three years.

ACV is an operational metric based on committed fees, excluding royalties, not recognized revenue, and therefore is not reconcilable to, nor a substitute for, revenue reported under GAAP. However, we consider ACV to be a key operational metric that we use to track existing licensing commitments with our customers. Bookings of new licenses and recognized revenue may fluctuate materially from quarter to quarter due to customer buying patterns, timing of subscription renewals and as a function of contract duration. As a result, we believe ACV provides an additional understanding of our business performance and long-term trends.

Remaining performance obligations ("RPO")

RPO represents the transaction price allocated to performance obligations that are unsatisfied, or partially unsatisfied, which includes unearned revenue and amounts that will be invoiced and recognized as revenue in future periods.

Arm has elected to exclude potential future royalty receipts from the disclosure of RPO. Revenue recognition occurs upon delivery or beginning of license term, whichever is later.

Non-GAAP financial measures

In addition to our results determined in accordance with GAAP, we utilize and present financial measures that are not calculated and presented in accordance with GAAP. Our non-GAAP financial measures include non-GAAP cost of sales, non-GAAP gross profit, non-GAAP gross profit margin, non-GAAP research and development, non-GAAP selling, general and administrative, non-GAAP operating expense, non-GAAP operating income, non-GAAP operating profit margin, non-GAAP income (loss) from equity investments, net, non-GAAP interest income, net, non-GAAP other non-operating income (loss), net, non-GAAP income before income taxes, net, non-GAAP net income, non-GAAP basic and diluted net income per share attributable to ordinary shareholders, free cash flow, and free cash flow TTM. We believe these non-GAAP financial measures provide useful information to investors and others in understanding and evaluating our results of operations, as well as provide a useful measure for period-to-period comparisons of our business performance. Moreover, we have included these non-GAAP financial measures because they are key measurements used by our management

internally to make operating decisions, including those related to analyzing operating expenses, evaluating performance, and performing strategic planning and annual budgeting. We believe that the presentation of our non-GAAP financial measures, when viewed holistically, is helpful to investors in assessing the consistency and comparability of our performance in relation to prior periods and facilitates comparisons of our financial performance relative to our competitors, particularly with respect to competitors that present similar non-GAAP financial measures in addition to their GAAP results.

Non-GAAP financial measures are presented for supplemental information purposes only, should not be considered a substitute for financial information presented in accordance with GAAP, and may not align with similar financial measures presented by our competitors, which may limit the ability of investors to assess our performance relative to certain peer companies.

Non-GAAP financial measures presented herein exclude acquisition-related intangible asset amortization, share-based compensation cost associated with equity awards where our intent is to issue equity upon vesting (in lieu of cash settlement), costs associated with disposal activities, impairment of long-lived assets, restructuring and related costs, public company readiness costs, other operating income (expenses), net, (income) loss from equity method investments, and income tax effect on non-GAAP adjustments. We exclude these items from our non-GAAP financial measures because they are non-cash in nature, or because the amount and timing of these items is unpredictable and not driven by core results of operations, which renders comparisons with prior periods and competitors less meaningful.

Investors should consider non-GAAP financial measures alongside other financial performance measures, including operating income, net income and our other GAAP results. For more information regarding our use of these measures and a reconciliation to the most directly comparable GAAP financial measure, see “—GAAP to Non-GAAP Reconciliation.”

Arm Holdings plc

GAAP to Non-GAAP Reconciliation

(Unaudited)

The following is a reconciliation of GAAP to Non-GAAP results:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, 2023 |

| (in millions, except share and per share amounts) | | GAAP Results | Acquisition-related intangible asset amortization | Share-based compensation cost (equity settled) (1)(2)(3) | Public company readiness costs | Other operating income (expenses), net | Costs associated with disposal activities | | Restructuring and related costs | | (Income) loss from equity method investments, net | Income tax effect on non-GAAP adjustments | Non-GAAP Results |

| Total revenue | | $ | 824 | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | | $ | — | | | $ | — | | $ | — | | $ | 824 | |

| Cost of sales | | (36) | | 1 | | 8 | | — | | — | | — | | | — | | | — | | — | | (27) | |

| Gross profit | | 788 | | 1 | | 8 | | — | | — | | — | | | — | | | — | | — | | 797 | |

| Gross profit margin | | 95.6 | % | | | | | | | | | | | 96.7 | % |

| Operating expenses: | | | | | | | | | | | | | |

| Research and development | | (432) | | — | | 139 | | — | | — | | — | | | — | | | — | | — | | (293) | |

| Selling, general and administrative | | (216) | | — | | 49 | | 1 | | — | | — | | | — | | | — | | — | | (166) | |

| | | | | | | | | | | | | |

| Disposal, restructuring and other operating expenses, net | | (6) | | — | | — | | — | | 6 | | — | | | — | | | | | — | |

Total operating expense (4) | | (654) | | — | | 188 | | 1 | | 6 | | — | | | — | | | — | | — | | (459) | |

| Operating income (loss) | | 134 | | 1 | | 196 | | 1 | | 6 | | — | | | — | | | — | | — | | 338 | |

| Operating profit margin | | 16.3 | % | | | | | | | | | | | 41.0 | % |

| Income (loss) from equity investments, net | | (1) | | — | | — | | — | | | — | | | — | | | 1 | | — | | — | |

| Interest income, net | | 28 | | — | | — | | — | | | — | | | — | | | — | | — | | 28 | |

| Other non-operating income (loss), net | | (15) | | — | | — | | — | | | — | | | — | | | — | | — | | (15) | |

| Income (loss) before income taxes | | 146 | | 1 | | 196 | | 1 | | 6 | | — | | | — | | | 1 | | — | | 351 | |

| Income tax benefit (expense) | | (59) | | — | | — | | — | | | — | | | — | | | — | | 13 | | (46) | |

| Net income (loss) | | $ | 87 | | $ | 1 | | $ | 196 | | $ | 1 | | $ | 6 | | $ | — | | | $ | — | | | $ | 1 | | $ | 13 | | $ | 305 | |

| Net income (loss) per share attributable to ordinary shareholders | | | | | | | | | | | | | |

| Basic | | $ | 0.08 | | | | | | | | | | | | $ | 0.30 | |

| Diluted | | $ | 0.08 | | | | | | | | | | | | $ | 0.29 | |

| Weighted average ordinary shares outstanding | | | | | | | | | | | | | |

| Basic | | 1,026,894,266 | | | | | | | | | | | 1,026,894,266 |

| Diluted | | 1,048,888,489 | | | | | | | | | | | 1,048,888,489 |

(1) Total share-based compensation cost, including both cash and equity settled awards, was $199 million for the three months ended December 31, 2023.

(4) GAAP total operating expenses and non-GAAP total operating expenses include $23 million employer taxes related to equity-classified awards, net of the research and development tax credit associated with these taxes.

Arm Holdings plc

GAAP to Non-GAAP Reconciliation (continued)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, 2022 |

| (in millions, except share and per share amounts) | | GAAP Results | Acquisition-related intangible asset amortization | Share-based compensation cost (equity settled) (1)(2)(3) | Public company readiness costs | Other operating income (expenses), net | Costs associated with disposal activities | | Restructuring and related costs | | (Income) loss from equity method investments, net | Income tax effect on non-GAAP adjustments | Non-GAAP Results |

| Total revenue | | $ | 724 | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | | $ | — | | | $ | — | | $ | — | | $ | 724 | |

| Cost of sales | | (29) | | 1 | | 1 | | — | | — | | — | | | — | | | — | | — | | (27) | |

| Gross profit | | 695 | | 1 | | 1 | | — | | — | | — | | | — | | | — | | — | | 697 | |

| Gross profit margin | | 96.0 | % | | | | | | | | | | | 96.3 | % |

| Operating expenses: | | | | | | | | | | | | | |

| Research and development | | (286) | | — | | 16 | | — | | — | | — | | | — | | | — | | — | | (270) | |

| Selling, general and administrative | | (163) | | — | | 13 | | 12 | | — | | — | | | — | | | — | | — | | (138) | |

| | | | | | | | | | | | | |

| Disposal, restructuring and other operating expenses, net | | (2) | | — | | — | | — | | — | | 2 | | | — | | | | | — | |

| Total operating expense | | (451) | | — | | 29 | | 12 | | — | | 2 | | | — | | | — | | — | | (408) | |

| Operating income (loss) | | 244 | | 1 | | 30 | | 12 | | — | | 2 | | | — | | | — | | — | | 289 | |

| Operating profit margin | | 33.7 | % | | | | | | | | | | | 39.9 | % |

| Income (loss) from equity investments, net | | (6) | | — | | — | | — | | | — | | | — | | | 6 | | — | | — | |

| Interest income, net | | 13 | | — | | — | | — | | | — | | | — | | | — | | — | | 13 | |

| Other non-operating income (loss), net | | (23) | | — | | — | | — | | | — | | | — | | | — | | — | | (23) | |

| Income (loss) before income taxes | | 228 | | 1 | | 30 | | 12 | | — | | 2 | | | — | | | 6 | | — | | 279 | |

| Income tax (expense) benefit | | (46) | | — | | — | | — | | | — | | | — | | | — | | (8) | | (54) | |

| Net income (loss) | | $ | 182 | | $ | 1 | | $ | 30 | | $ | 12 | | $ | — | | $ | 2 | | | $ | — | | | $ | 6 | | $ | (8) | | $ | 225 | |

| Net income (loss) per share attributable to ordinary shareholders | | | | | | | | | | | | | |

| Basic | | $ | 0.18 | | | | | | | | | | | | $ | 0.22 | |

| Diluted | | $ | 0.18 | | | | | | | | | | | | $ | 0.22 | |

| Weighted average ordinary shares outstanding | | | | | | | | | | | | | |

| Basic | | 1,025,234,000 | | | | | | | | | | | 1,025,234,000 |

| Diluted | | 1,027,918,937 | | | | | | | | | | | 1,027,918,937 |

(1) Total share-based compensation cost, including both cash and equity settled awards, was $103 million for the three months ended December 31, 2022. For non-GAAP purposes, we adjust for those awards that are liability-classified pre-IPO but will be equity settled after IPO. Liability-classified awards are remeasured at the end of each reporting period through the date of settlement to ensure that the expense recognized for each award is equivalent to the amount to be paid in cash or equity settled after the initial public offering.

Arm Holdings plc

GAAP to Non-GAAP Reconciliation (continued)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Nine Months Ended December 31, 2023 |

| (in millions, except share and per share amounts) | | GAAP Results | Acquisition-related intangible asset amortization | Share-based compensation cost (equity settled) (1)(2)(3) | Public company readiness costs | Other operating income (expenses), net | Costs associated with disposal activities | | Restructuring and related costs | | (Income) loss from equity method investments, net | Income tax effect on non-GAAP adjustments | Non-GAAP Results |

| Total revenue | | $ | 2,305 | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | | $ | — | | | $ | — | | $ | — | | $ | 2,305 | |

| Cost of sales | | (113) | | 3 | | 33 | | — | | — | | — | | | — | | | — | | — | | (77) | |

| Gross profit | | 2,192 | | 3 | | 33 | | — | | — | | — | | | — | | | — | | — | | 2,228 | |

| Gross profit margin | | 95.1 | % | | | | | | | | | | | 96.7 | % |

| Operating expenses: | | | | | | | | | | | | | |

| Research and development | | (1,395) | | — | | 578 | | — | | — | | — | | | — | | | — | | — | | (817) | |

| Selling, general and administrative | | (702) | | — | | 240 | | 42 | | — | | — | | | — | | | — | | — | | (420) | |

| | | | | | | | | | | | | |

| Disposal, restructuring and other operating expenses, net | | (6) | | — | | — | | — | | 6 | | — | | | — | | | — | | | — | |

Total operating expense (4) | | (2,103) | | — | | 818 | | 42 | | 6 | | — | | | — | | | — | | — | | (1,237) | |

| Operating income (loss) | | 89 | | 3 | | 851 | | 42 | | 6 | | — | | | — | | | — | | — | | 991 | |

| Operating profit margin | | 3.9 | % | | | | | | | | | | | 43.0 | % |

| Income (loss) from equity investments, net | | (13) | | — | | — | | — | | — | | — | | | — | | | 13 | | — | | — | |

| Interest income, net | | 80 | | — | | — | | — | | — | | — | | | — | | | — | | — | | 80 | |

| Other non-operating income (loss), net | | (2) | | — | | — | | — | | — | | — | | | — | | | — | | — | | (2) | |

| Income (loss) before income taxes | | 154 | | 3 | | 851 | | 42 | | 6 | | — | | | — | | | 13 | | — | | 1,069 | |

| Income tax benefit (expense) | | (72) | | — | | — | | — | | | — | | | — | | | — | | (66) | | (138) | |

| Net income (loss) | | $ | 82 | | $ | 3 | | $ | 851 | | $ | 42 | | $ | 6 | | $ | — | | | $ | — | | | $ | 13 | | $ | (66) | | $ | 931 | |

| Net income (loss) per share attributable to ordinary shareholders | | | | | | | | | | | | | |

| Basic | | $ | 0.08 | | | | | | | | | | | | $ | 0.91 | |

| Diluted | | $ | 0.08 | | | | | | | | | | | | $ | 0.90 | |

| Weighted average ordinary shares outstanding | | | | | | | | | | | | | |

| Basic | | 1,025,815,812 | | | | | | | | | | | 1,025,815,812 |

| Diluted | | 1,040,163,454 | | | | | | | | | | | 1,040,163,454 |

(1) Total share-based compensation cost, including both cash and equity settled awards, was $875 million for the nine months ended December 31, 2023. For non-GAAP purposes, we adjust for those awards that are liability-classified pre-IPO but will be equity settled after IPO. Liability-classified awards are remeasured at the end of each reporting period through the date of settlement to ensure that the expense recognized for each award is equivalent to the amount to be paid in cash or equity settled after the initial public offering.

(4) GAAP total operating expenses and non-GAAP total operating expenses include $26 million employer taxes related to equity-classified awards, net of the research and development tax credit associated with these taxes.

Arm Holdings plc

GAAP to Non-GAAP Reconciliation (continued)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Nine Months Ended December 31, 2022 |

| (in millions, except share and per share amounts) | | GAAP Results | Acquisition-related intangible asset amortization | Share-based compensation cost (equity settled) (1)(2)(3) | Public company readiness costs | Other operating income (expenses), net | Costs associated with disposal activities | | Restructuring and related costs | | (Income) loss from equity method investments, net | Income tax effect on non-GAAP adjustments | Non-GAAP Results |

| Total revenue | | $ | 2,046 | | $ | — | | $ | — | | $ | — | | $ | — | | $ | — | | | $ | — | | | $ | — | | $ | — | | $ | 2,046 | |

| Cost of sales | | (79) | | 4 | | 1 | | — | | — | | — | | | — | | | — | | — | | (74) | |

| Gross profit | | 1,967 | | 4 | | 1 | | — | | — | | — | | | — | | | — | | — | | 1,972 | |

| Gross profit margin | | 96.1 | % | | | | | | | | | | | 96.4 | % |

| Operating expenses: | | | | | | | | | | | | | |

| Research and development | | (752) | | — | | 15 | | — | | — | | — | | | — | | | — | | — | | (737) | |

| Selling, general and administrative | | (488) | | — | | 6 | | 33 | | — | | — | | | — | | | — | | — | | (449) | |

| | | | | | | | | | | | | |

| Disposal, restructuring and other operating expenses, net | | (6) | | — | | — | | — | | — | | 3 | | | 1 | | | — | | — | | (2) | |

| Total operating expense | | (1,246) | | — | | 21 | | 33 | | — | | 3 | | | 1 | | | — | | — | | (1,188) | |

| Operating income (loss) | | 721 | | 4 | | 22 | | 33 | | — | | 3 | | | 1 | | | — | | — | | 784 | |

| Operating profit margin | | 35.2 | % | | | | | | | | | | | 38.3 | % |

| Income (loss) from equity investments, net | | (80) | | — | | — | | — | | — | | — | | | — | | | 80 | | — | | — | |

| Interest income, net | | 21 | | — | | — | | — | | — | | — | | | — | | | — | | — | | 21 | |

| Other non-operating income (loss), net | | 4 | | — | | — | | — | | — | | — | | | — | | | — | | — | | 4 | |

| Income (loss) before income taxes | | 666 | | 4 | | 22 | | 33 | | — | | 3 | | | 1 | | | 80 | | — | | 809 | |

| Income tax (expense) benefit | | (145) | | — | | — | | — | | | — | | | — | | | — | | (25) | | (170) | |

| Net income (loss) | | $ | 521 | | $ | 4 | | $ | 22 | | $ | 33 | | $ | — | | $ | 3 | | | $ | 1 | | | $ | 80 | | $ | (25) | | $ | 639 | |

| Net income (loss) per share attributable to ordinary shareholders | | | | | | | | | | | | | |

| Basic | | $ | 0.51 | | | | | | | | | | | | $ | 0.62 | |

| Diluted | | $ | 0.51 | | | | | | | | | | | | $ | 0.62 | |

| Weighted average ordinary shares outstanding | | | | | | | | | | | | | |

| Basic | | 1,025,234,000 | | | | | | | | | | | 1,025,234,000 |

| Diluted | | 1,026,956,431 | | | | | | | | | | | 1,026,956,431 |

(1) Total share-based compensation cost, including both cash and equity settled awards, was $162 million for the nine months ended December 31, 2022. For non-GAAP purposes, we adjust for those awards that are liability-classified pre-IPO but will be equity settled after IPO. Liability-classified awards are remeasured at the end of each reporting period through the date of settlement to ensure that the expense recognized for each award is equivalent to the amount to be paid in cash or equity settled after the initial public offering.

Arm Holdings plc

GAAP to Non-GAAP Reconciliation (continued)

(Unaudited)

(2) A summary of share-based compensation cost recognized on the Condensed Consolidated Income Statements is as follows: | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Nine Months Ended December 31, |

| (in millions) | | 2023 | | 2022 | | 2023 | | 2022 |

| Cost of sales | | $ | 8 | | | $ | 4 | | | $ | 34 | | | $ | 7 | |

| Research and development | | 142 | | | 65 | | | 594 | | | 103 | |

| Selling, general and administrative | | 49 | | | 34 | | | 247 | | | 52 | |

| Total | | $ | 199 | | | $ | 103 | | | $ | 875 | | | $ | 162 | |

(3) A summary of share-based compensation liability-classified cost recognized on the Condensed Consolidated Income Statements is as follows: | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Nine Months Ended December 31, |

| (in millions) | | 2023 | | 2022 | | 2023 | | 2022 |

| Cost of sales | | $ | — | | | $ | 3 | | | $ | 1 | | | $ | 6 | |

| Research and development | | 3 | | | 49 | | | 16 | | | 88 | |

| Selling, general and administrative | | — | | | 21 | | | 7 | | | 46 | |

| Total | | $ | 3 | | | $ | 73 | | | $ | 24 | | | $ | 140 | |

The following is a reconciliation of Non-GAAP free cash flow to Net cash provided by operating activities, the most directly comparable GAAP cash flow measure:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Nine Months Ended December 31, |

| (in millions) | | 2023 | | 2022 | | 2023 | | 2022 |

| Net cash provided by operating activities | | $ | 310 | | | $ | 411 | | | $ | 423 | | | $ | 256 | |

| Adjusted for: | | | | | | | | |

| Purchases of property and equipment | | (21) | | | (10) | | | (81) | | | (48) | |

| Purchases of intangible assets | | (30) | | | (3) | | | (43) | | | (25) | |

| Payment of intangible asset obligations | | (8) | | | (11) | | | (29) | | | (31) | |

| Non-GAAP free cash flow | | $ | 251 | | | $ | 387 | | | $ | 270 | | | $ | 152 | |

Forward-Looking Statements

This shareholder letter contains forward-looking statements that reflect our plans, beliefs, expectations and current views with respect to, among other things, future events and financial performance. Our actual results could differ materially from the forward-looking statements included herein. Statements regarding our future and projections relating to revenue, cost of sales expenses, costs, income (loss), and potential growth opportunities are typical of such statements. Factors that could cause or contribute to such differences include, but are not limited to, those discussed in “Risk Factors” in our IPO Prospectus.

The following contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, relating to our operations, results of operations and other matters that are based on our current expectations, estimates, assumptions and projections. Forward-looking statements are based on our management’s beliefs and assumptions and on information currently available to our management. In some cases, you can identify forward-looking statements by the words “may,” “might,” “will,” “could,” “would,” “should,” “expect,” “is/are likely to,” “intend,” “plan,” “objective,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “target,” “continue” and “ongoing,” or the negative of these terms or other comparable terminology intended to identify statements about the future. The forward-looking statements and opinions are based upon current expectations and, while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements involve known and unknown risks, uncertainties and other important factors that may cause our actual results, levels of activity, performance or achievements to be materially different from the information expressed or implied by these forward-looking statements. We caution that you should not place undue reliance on any of our forward-looking statements. We undertake no obligation to update forward-looking statements to reflect developments or information obtained after the date hereof and disclaim any obligation to do so except as required by applicable laws.

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFiscal period values are FY, Q1, Q2, and Q3. 1st, 2nd and 3rd quarter 10-Q or 10-QT statements have value Q1, Q2, and Q3 respectively, with 10-K, 10-KT or other fiscal year statements having FY.

| Name: |

dei_DocumentFiscalPeriodFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fiscalPeriodItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThis is focus fiscal year of the document report in YYYY format. For a 2006 annual report, which may also provide financial information from prior periods, fiscal 2006 should be given as the fiscal year focus. Example: 2006.

| Name: |

dei_DocumentFiscalYearFocus |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gYearItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

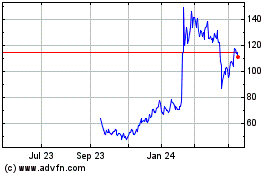

ARM (NASDAQ:ARM)

Historical Stock Chart

From Mar 2024 to Apr 2024

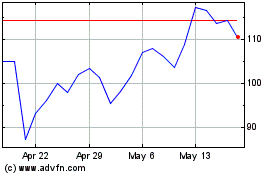

ARM (NASDAQ:ARM)

Historical Stock Chart

From Apr 2023 to Apr 2024