false

0001566243

0001566243

2024-02-07

2024-02-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): Feb 7, 2024

Arax

Holdings Corp.

(Exact

Name of Registrant as Specified in Charter)

| Nevada |

|

333-185928 |

|

99-0376721 |

(State or other jurisdiction

of incorporation) |

|

(Commission File

Number) |

|

(IRS Employer

Identification No.) |

820

E Park Ave, Bldg. D200 Tallahassee, FL 32301

Registrant’s

telephone number, including area code: (850) 254-1161

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

| ☐ |

Written communications

pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material

pursuant to Rule 14a-12 under the Exchange Act (17 DFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

Trading

Symbol(s) |

Name

of each exchange on which

registered |

| N/A |

N/A |

N/A |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01 |

Entry

into a Material Definitive Agreement.

On

February 1, 2024 (the “Effective Date”), the Company and Darius Capital Company dba Longevity Capital Company

("Darius Capital") entered into an association to establish a Venture with the formation of a jointly owned

entity named "Newco" under a Limited Liability Company structure in accordance with the laws of the State of

Wyoming.

Pursuant

to the provisions in the Agreement, the Parties agree for Newco, to be established within thirty (30) days of the Execution

Date, which represents a joint venture between Darius Capital Company dba Longevity Capital Company and Arax Holdings

Corp., operating under the name Newco with a principal office in Seattle, WA, USA. Its primary objective involves the

development of a decentralized blockchain-based management system for valuing and managing assets, with a focus on senior

life securities and life settlement tier/level 3 assets ("Life Settlement Platform Assets"). The venture aims

to secure initial financing of $10 million, with a soft cap of $3.5 million designated for product development and operating

expenses. Over a term of thirty-six (36) months, or until mutually agreed upon events occur, Newco will be managed by

a Board comprising equal members from each party, overseeing investment relations, marketing, development, and operations,

with day-to-day operations, staffing, and financial controls overseen by appointed Managers. Both Darius Capital and Arax

Holdings will contribute intellectual property and assets as outlined in the Agreement, with provisions for additional

capital contributions and regular monthly meetings ensuring effective communication and decision-making, subject to unanimous

consent from all Parties for any amendments to the Agreement.

This

Regulatory Disclosure serves to inform stakeholders of the Material Definitive Agreement between Darius Capital Company

dba Longevity Capital Company and Arax Holdings Corp. regarding the establishment and operation of Newco. Parties have

committed to abide by the terms outlined in the Agreement to facilitate the success of Newco.

|

The

foregoing description of the Agreement does not purport to be complete and are qualified in their entirety by reference to the

full text of the Agreement, which is filed as Exhibits 99.1, to this Current Report on Form 8-K and are incorporated herein by

reference.

| Item 9.01 |

Financial Statements and Exhibits. |

(d)

Exhibits:

*

Filed herewith

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf

by the undersigned thereunto duly authorized.

| |

Arax Holdings Corp. |

| |

|

|

| |

By: |

/s/

Christopher D. Strachan |

| |

|

Christopher

D. Strachan

Chief

Financial Officer |

Dated:

February 7, 2024

Exhibit 99.1

AGREEMENT

THIS AGREEMENT (the “Agreement”)

made and entered into this 29th day of January, 2024 (the “Execution Date”),

PARTIES:

Darius Capital Company dba

Longevity Capital Company of Seattle, WA, USA, and Arax Holdings Corp. of 820 E Park Ave, Bldg. D200, Tallahassee FL 32301

(individually the “Party” and collectively the “Parties”).

BACKGROUND:

The

Parties wish to enter into an association for each party’s mutual benefit and agree to form a Venture in the of a jointly

owned Newco enterprise.

This

Agreement sets out the terms and conditions governing this Newco.

IN CONSIDERATION OF and as a condition of the Parties

entering into this Agreement and other valuable consideration, the receipt and sufficiency of which consideration is acknowledged,

the Parties agree as follows:

By this

Agreement, the Parties enter into a Newco (the “Newco”) in the form of a Limited Liability Company in accordance with

the laws of the State of Wyoming. The rights and obligations of the Members will be as stated in the applicable legislation of

the State of Wyoming (the “Act”) except as otherwise provided here. The Limited Liability Company will be formed within

thirty (30) days of the date of execution of this agreement.

The

business name of the Venture will be Newco. Newco is being used as a placeholder name..

The

exclusive purpose of the Newco and of Newco (the “Purpose”) will be to:

| a. | Create a decentralized blockchain-based management system for valuing and managing the Assets (defined below). |

| b. | The blockchain that will be used will be called: the “Core Blockchain”. |

| c. | The blockchain-based management system issues credit tokens, backed by the pools of assets assembled, to serve as a decentralized

alternative to trade finance and Letters of Credit. |

| d. | Design and develop an asset management system for senior life securities and life settlement tier/level 3 assets (“Life

Settlement Platform Assets”) as a licensed product and to be used by others or operated by the Newco as an SAAS management

tool for the Assets. |

| e. | Design and develop a reverse auction platform for senior life securities and tier/level 3 assets (“Life Settlement Platform

Assets”) |

| f. | Other activities surrounding and regarding Life Settlement Platform Assets as may be deemed of benefit to the Newco and agreed

to by all Parties. |

Initial focus of the Newco

will be to raise the capital required for development cost and first 18 months operating expenses from others with a tentative

structure of:

| a. | 18 months – 2-year term, convertible promissory note from the Newco. |

| b. | Target raise is $10MM with a soft cap of $3.5MM to commence with product development and initial operation and/or funding expenses

by Newco’s founding members. |

| c. | Convertible at holders’ sole option into their choice of Newco, or LCC, each at varying conversion pricing based on the

current fair market. |

| d. | Initial estimated conversion price based upon the pre-money valuation of i) Newco $25MM, ii) Arax $200MM, iii) LCC $32MM. |

| e. | Backed by full faith and credit of the Newco. |

| f. | If the investor requires it, ARAX could optionally guarantee the note for additional compensation of 2% of Newco per year guaranteed

outstanding, or presumably a total of 3 1/2% for 18 months or 4% for 24 months, depending on the convertible note’s terms

and conditions to be agreed by the investor and both Parties. |

| g. | Arax may choose to include limited conversion rights of LCC common stock to Arax common stock and for those notes converted

into Newco or LCC common stock. |

Initial targeted

investors for the convertible note include:

| a. | Highly qualified individuals and family offices known to John Beyer and previously approached to fund various contemplated

structures for Core USA. |

| b. | Two international trade finance industry consortiums with membership numbers in the hundreds and thousands have indicated a

positive, strong interest in the credit token, and that would allow Newco to approach the membership group for direct investment. |

| c. | Other qualified investors who are known to other Newco partners. |

The parties agree that the

Newco will attempt to create initial interest and attempt to close any such investors in a meeting. The meeting shall be attended

to by each Party to the Newco.

The duration of this Venture

(the “Term”) will begin on January 29, 2024, and continue in full force and effect for thirty-six (36) months or until

the occurrence of one of the following events:

| a. | By written agreement by all parties. |

| b. | The Parties contemplate not announcing the Newco on a public notice basis other than that required by law, regulatory rules

and regulations until Financing referred to herein is primarily committed from third parties and can be included in such. Any such

initial public announcement other than that required by law or regulation requires the written approval of both Parties. |

| c. | The renewal or extension of this Agreement. The renewal or extension of this Agreement will occur on or before thirty (30)

months from the execution of this Agreement. |

The principal office of the

business of the Venture will be located in Seattle, WA, USA, or such other place as the Parties may designate from time to time.

The initial board of Directors

(“Board”) will consist of equal members from each Party and board meetings will be scheduled and held approximately

monthly.

The Parties have appointed

John Beyer to act as manager (the “Manager Investment Relations and Marketing”) and Michael Loubser to act as manager

(the “Manager Development and Operations ‘Operations”) for the Newco with new personnel to be hired by the Newco

as is commercially reasonable.

Managers will be compensated

directly by the Newco in cash plus incentives as soon as the Soft Cap in Section 4.b ($3.5MM) above is reached. As noted in Section

25, ongoing board reviews will include progress evaluation.

Except as otherwise provided

in this Agreement, the Manager may be appointed, replaced, or removed upon unanimous consent of the Parties.

The Managers will have a

primary duty to the best interest of the Newco and not directly to any individual Party.

Conduct and actions of the

Manager will be dictated by policy and procedure established by the Board and specifically an Executive Committee consisting of

a smaller number from each partner to hold weekly calls primarily to compare actual unexpected versus budget and address any immediate

issues. Within the limits of the Purpose of the Newco and the terms of this Agreement, the Manager will have full authority to

bind the Members in all matters relating to the direction, control and management of the Venture.

The Managers described in

paragraph 2 of this section 7 will decide major issues concerning the Newco.

Except as otherwise specified

in this agreement, the duties and obligations of the Managers in relation to the Venture will include the following:

| a. | managing the day-to-day business of the Venture within the different task portfolios to be allocated by the Members. |

| b. | monitoring, analyzing and acting on all issues over which it would have express or implied authority according to this Agreement. |

| c. | all responsibilities attached to the hiring of production and administration staff, including any required labor negotiations,

and all responsibilities attached to the hiring of third-party contractors. |

| d. | The Members will appoint an independent financial controller to monitor, control, and direct the financial, business, and operational

affairs of the Newco. |

| e. | The independent financial controller will also ensure proper maintenance of accounts and financial records according to GAAP-accepted

accounting practices.

|

| Member |

Duties Description |

| Darius Capital Company dba Longevity Capital Company |

- Integrate real-time valuation engine

- Investments grade rating methodology

- Access to marketplace principals

- Policy acquisition steps delineated into process doc

- Connectors (integration) to LCC model for pool metrics and individual policy metrics

- Connectors (integration) to risk tolerance toggle |

| Arax Holdings |

- Defi platform – auction platform for tender

- Traffic platform – underwriting of trade deals/bridging.

- Fractionalizing/token Ping exchange listing per 1)

- Insure Tech – credit insurance performance bonds. |

Each Party to this Agreement will be

responsible for their respective duties as follows: Duties of Parties may be amended, from time to time, by decision of the Parties

provided that each Party’s interests are not impacted except with the unanimous consent of each Party to this Agreement.

10. Capital Contributions

| Member |

Contribution Description |

| Darius Capital Company dba Longevity Capital Company |

a. Other:

License of IP Intellectual Property,

with approximate amount of

$10,000,000.00 |

| Arax Holdings |

a. Other:

License of IP Intellectual Property,

b. with

an approximate amount of

c. $10,000,000.00 |

| Joint as a result of the Newco |

d. Other:

Acquired Goodwill,

e. with

an approximate amount of

f. $5,000,000.00 |

Each of the Parties to this

Agreement has contributed or will contribute via non-exclusive license to the capital of the Newco, in cash or property in agreed

upon value, as follows (the “Capital Contribution”): Each Party to this Agreement will contribute their respective

Capital Contributions fully and on time. Each of the two Parties will contribute via non-exclusive license its intellectual property

and know-how to the Newco, but the intention is that all IP will remain the property of the individual Party, and the only assets

of Newco will be specifically agreed derivative products as described in Section 3 herein.

The parties shall each be

initially issued an equal number or percentage of ownership in the Newco. No Party will have the right to demand or withdraw any

portion of their capital contribution without the express written consent of the remaining Parties.

The Parties will not be personally

liable for the return of all or part of the Capital Contributions of a Party, except as otherwise provided in this Agreement.

11. Additional Capital

Capital Contributions may

be amended from time to time, according to the requirements of the Newco, by decision of the Managers of the Newco only. Where

Parties’ interests are impacted, as example but not limited to Section 4. f herein, additional capital contributions (the

“Additional Capital Contributions”) must have the unanimous consent of the Managers of the Newco.

Any advance of money to the

Venture by any Party to this Agreement in excess of the amounts provided for in this Agreement or subsequently agreed to as an

Additional Capital Contribution will be deemed a debt due from the Newco rather than an increase in Capital Contribution of the

Party. This liability will be repaid with interest at such rates and times to be determined by a majority of the Parties and of

the Managers of the Newco. This liability will not entitle the lending Party to a greater voting power unless agreed by all Parties.

Such debts may have preference or priority over any other payments to Parties as may be determined by unanimous consent of the

Parties and as noted in Section 12 herein.

12. Capital Accounts

An individual capital account

will be maintained for each Party, and their initial Capital Contribution will be credited to this account. Any additional, approved

contributions to the Newco’s capital made by a Party will be credited to that Party’s individual Capital Account. It

is intended that each Party may expend its individual capital on consultants, wages and other costs on behalf of the Newco prior

to the financing in Section 4 being completed. Provided that it is approved by all Parties, any such cost will be reimbursed as

soon as practicable to the Party, and the ongoing cost will move to a direct expense of the Newco thereafter.

13. Interest on Capital

No borrowing charge or loan

interest will be due or payable to any Party to this Agreement on any Capital Contribution or on their Capital Account despite

any disproportion that may from time to time arise among the Capital Accounts of the Parties.

14. Books of Account

Accurate and complete books

of account of the transactions of the Newco will be kept in accordance with generally accepted accounting principles (GAAP) and

at all reasonable times will be available and open to inspection and examination by any Party to this Agreement. The books and

records of the Newco will reflect all the Newco’s transactions and will be appropriate and adequate for the business conducted

by the Newco.

15. Banking and Venture

Funds

The funds of the Newco will

be placed in such investments and holding bank accounts as will be designated by each Party to this Agreement. Newco funds will

be held in the name of the Newco and will not be commingled with those of any other person or entity. In order for funds to be

withdrawn from the bank (via check, wire, or any other means of disbursement or payment), a signature from John Beyer and Michael

Loubser will be required for each transaction. Additionally, funds will be transferred from time to time from the Holding Bank

Accounts to the operating account of Newco in order to fund the agreed budget. Such transfers will require the approval of both

managers, John Beyer and Michael Loubser.

16. Member Meetings

Regular monthly meetings

will be held by each Party to this Agreement parallel with Newco Board Meetings. Minutes of the meetings will be maintained on

file.

Any Party to this Agreement

can call a special meeting to resolve urgent issues that require a vote and that cannot wait for the next regularly scheduled meeting.

When calling a special meeting, all Parties to this Agreement must be provided with reasonable notice. Where a special meeting

has been called, the meeting will be restricted to the specific purpose for which the meeting was called.

All meetings will be held

at a time and in a reasonable, convenient, and practical location considering the situation of all Parties.

Any vote required by the

Party will be determined such that each Party to this Agreement receives one vote carrying equal weight.

17. Amendments

This Agreement may be amended

only with the unanimous consent of all Parties to this Agreement.

18. Admitting a new

Member

New Members may be admitted

into the Newco only with the unanimous consent of the existing Parties to this Agreement. The new Member agrees to be bound by

all the covenants, terms, and conditions of this Agreement, inclusive of all current and future amendments. Further, a new Member

will execute such necessary or required documents for this admission. Any new Member will receive a business interest in the Newco

as determined by all other Parties to this Agreement.

19. Dissociation of

a Member

Where a Party is in breach

of this Agreement and that Party has not remedied the breach on notice from the Newco and after a reasonable period then the remaining

Parties will have the right to terminate this Agreement with regard to that individual defaulting Party (an “Involuntary

Withdrawal”) and take whatever action necessary to protect the interests of the Newco.

If the Newco is harmed as

the result of an individual Party’s action or failure to act, then that individual Party will be liable for that harm. If

more than one Party is at fault, they will be jointly and severally liable for that harm.

Each Party will indemnify

the remaining Parties against all losses, costs and claims that may arise if the Newco is terminated due to a breach of the Agreement

by that Party.

If a Party is placed in bankruptcy

or withdraws voluntarily from the Newco, or if there is an Operation of Law against a Party to this Agreement, the other Parties

will be entitled to proceed as if the Party had breached this Agreement.

Distribution of any amount

owing to a dissociated Party will be made according to the percentage of ownership as described in the Valuation of Interest or

as otherwise may be agreed in writing.

20. Dissolution of

the Newco

The Newco will be dissolved,

and its assets liquidated in the event of any of the following:

| a. | the Term expires and is not extended; |

| b. | a unanimous vote by the Managers to dissolve the Venture; |

| c. | on satisfaction of the Purpose; |

| d. | loss or incapacity through any means of substantially all of the Venture’s assets; or |

| e. | where only one Party remains. |

21. Liquidation

On dissolution, the Newco

will be liquidated promptly and within a reasonable time.

On the liquidation of the

Newco assets, distribution of any amounts to Parties will be made in proportion to their respective capital accounts or as otherwise

may be agreed in writing.

22. Valuation of Interest

In the absence of a written

agreement setting a value, the value of the Newco will be determined based on the fair market value appraisal of all Newco assets

(less liabilities) in accordance with generally accepted accounting principles (GAAP) by an independent accounting firm agreed

to by all Parties to this Agreement. An appraiser will be appointed within a reasonable period of the date of withdrawal or dissolution.

The results of the appraisal will be binding on all Parties. A withdrawing Party’s interest will be based on the proportion

of their respective capital account less any outstanding liabilities a Party may have to the Venture. The intent of this section

is to ensure the survival of the Newco despite the withdrawal of any individual Party.

No allowance will be made

for goodwill, trade name, patents or other intangible assets, except where those assets have been reflected on the Newco books

immediately prior to valuation.

23. Transfer of Member

Interest

The rights and obligations

of a Party are not unique to this Newco and may be assigned without the consent of the remaining Parties to this Agreement.

24. Force Majeure

A Member will be free of

liability to the Newco where the Party is prevented from executing their obligations under this Agreement in whole or in part due

to force majeure where the Party has communicated the circumstance of that event to any and all other Parties and taken any and

all appropriate action to mitigate that event. Force majeure will include, but not be limited to, earthquakes, typhoon, flood,

fire, and war or any other unforeseen and uncontrollable event.

25. Duty of Loyalty

Provided a Party has the

consent of the other Party, the Parties to this Agreement and their respective affiliates may have interests in businesses other

than the Newco. Neither the Newco nor any other Party will have any rights to the assets, income or profits of any such business,

venture or transaction. Any and all businesses, ventures or transactions with any appearance of conflict of interest must be fully

disclosed to all other Parties. Failure to disclose any potential conflicts of interest will be deemed an Involuntary Withdrawal

by the offending Party and may be treated accordingly by the remaining Parties.

In accordance with the foregoing,

the Parties to this agreement acknowledge and consent that the Managers have inherent potential conflicts as a directors and officers

of Member Longevity Capital Company and as former and current director and consultants of affiliated entities Core Decentralized

Technologies and Member Arax Holdings Corp.

Managers will be appointed

by the Members on a contractual basis as independent officers and contractors of Newco. Contractors will be initially remunerated

at $250,000.00 per annum as soon as the Soft Cap investment is reached per Section 4._b above.

26. Confidentiality

All matters relating to this

Agreement and the Newco will be treated by the Parties to this Agreement as confidential and no Party will disclose or allow to

be disclosed any Newco matter or matters, directly or indirectly, to any third party without the prior written approval of all

Parties to this Agreement, or that legally required by regulatory body, except where the information properly comes into the public

domain.

This section will survive

indefinitely after the expiration or termination of this Agreement or dissolution of the Newco.

27. Language

The Parties to this Agreement

expressly state that the English language is to be the language of choice for this Agreement and all other notices and agreements

required by the Newco.

28. Insurance

The Newco will insure all

its assets against loss where reasonable and standard practice in the industry.

29. Indemnification

Each Party to this Agreement

will be indemnified and held harmless by the Newco from any and all harm or damages of any nature relating to the Party’s

participation in Newco affairs except where such harm or damages results from gross negligence or willful misconduct on the part

of the Party.

30. Liability

No Party to this Agreement

will be liable to the Venture or to any other Party to this Agreement for any error in judgment or any act or failure to act where

made in good faith. The Party will be liable for any and all acts or failures to act resulting from gross negligence or willful

misconduct.

31. Liability Insurance

The Newco may acquire insurance

on behalf of any Party, employee, agent or other person engaged in the business interest of the Newco against any liability asserted

against them or incurred by them while acting in good faith on behalf of the Newco.

32. Covenant of Good

Faith

The Parties to this Agreement

will use their best efforts, fairly and in good faith to facilitate the success of the Newco.

33. Newco Property

Where allowed by statute, title to all Newco property, including

intellectual property, will remain in the name of the Newco. Where this type of Newcos is not recognized by statute as separate

legal entities, Newco property, including intellectual property, will be held in the name of one or more of the Parties to this

Agreement.

(a) To the extent they

relate to, or result from, directly or indirectly, the actual or anticipated operations of Arax, LCC or any of its affiliates,

or the activities of Newco in the course and scope of its services, Newco hereby agrees that all patents, trademarks, copyrights,

trade secrets, and other intellectual property rights, all inventions, whether or not patentable, and any product, drawing, design,

recording, writing, literary work or other author’s work, in any other tangible form developed in whole or in part by Newco

during the term of this Agreement, or otherwise developed, purchased or acquired by Arax, LCC or any of its affiliates (“Intellectual

Property”), shall be the exclusive property, free of charge, of the Parties or such affiliate.

(b) Newco will hold all

Intellectual Property in trust for the Parties and will deliver all Intellectual Property in Newco’s possession or control

to the Parties upon request and, in any event, at the end of Newco’s agreement with Arax and LCC.

(c) Newco shall assign

and does hereby assign to the Parties all property rights that Newco may now or hereafter have in the Intellectual Property. As

part of Newco’s obligations under this Agreement, Newco shall take such action, including, but not limited to, the execution,

acknowledgment, delivery, and assistance in the preparation of documents, and the giving of testimony, as may be requested by the

Parties to evidence, transfer, vest or confirm the Parties right, title and interest in the Intellectual Property.

(d) Newco will not contest

the validity of any invention, any copyright, any trademark or any mask work registration owned by or vesting in each Party or

any of its affiliates under this Agreement.

(e) To the maximum extent

permitted by law, Intellectual Property shall be Proprietary Information, as defined herein.

(f) The Parties will have

a non-exclusive right to the Intellectual Property in Newco’s possession or control, and no party may exclude the other party

from use of Newco’s Intellectual Property provided that it does not conflict or hinder the commercial purpose of Newco as

stated in Section 3, specifically Life Settlement Platform Tier 3 Assets above herein and as may be amended time to time by mutual

agreement of the Parties.

34. Jurisdiction

The Parties to this Agreement

submit to the jurisdiction of the courts of the State of California for the enforcement of this Agreement and for any arbitration

award or decision arising from this Agreement.

35. Warranties

All Parties to this Agreement

represent and warrant that they have all authority, licenses and permits to execute and perform this Agreement and their obligations

under this Agreement and that the representative of each Party has been fully authorized to execute this Agreement.

Each Party to this Agreement

represents and warrants that this Agreement is not in violation of any and all agreements and constitutional documents of the individual

Party.

36.Definitions

For the purpose of this Agreement,

the following terms are defined as follows:

“Capital Contributions”

The capital contribution to the Newco actually made by the Parties, including property, cash and any additional capital contributions

made.

“Majority Vote”

A Majority Vote is any amount greater than one-half of the authorized votes.

“Operation of Law”

The Operation of Law means rights or duties that are cast upon a party by the law, without any act or agreement on the part

of the individual including but not limited to an assignment for the benefit of creditors, a divorce, or a bankruptcy.

“Soft Cap”

refers to the minimum amount that Newco needs to raise. If Newco is unable to raise that amount, the Venture may be terminated

and all the collected funds returned to the respective investors.

37. Miscellaneous

This Venture is termed a

contractual Newco and will not constitute a partnership. Parties will provide services to one another on an arms’ length

basis while remaining independent business entities. There will be no pooling of profits and losses. Each Party is responsible

only for its own actions and no Party is an agent for any other Party. Parties will not be jointly or severally liable for the

actions of the other Parties.

Time is of the essence in

this Agreement.

This Agreement may be executed

in counterparts. Facsimile signatures are binding and are considered to be original signatures.

Headings are inserted for

the convenience of the Parties only and are not to be considered when interpreting this Agreement. Words in the singular mean and

include the plural and vice versa. Words in the masculine gender include the feminine gender and vice versa. Words in the neuter

gender include the masculine gender and the feminine gender and vice versa.

If any term, covenant, condition

or provision of this Agreement is held by a court of competent jurisdiction to be invalid, void or unenforceable, it is the Parties’

intent that such provision be reduced in scope by the court only to the extent deemed necessary by that court to render the provision

reasonable and enforceable and the remainder of the provisions of this Agreement will in no way be affected, impaired or invalidated

as a result.

This Agreement contains the

entire agreement between the Parties. All negotiations and understandings have been included in this Agreement. Statements or representations

which may have been made by any Party in the negotiation stages of this Agreement may in some way be inconsistent with this final

written Agreement. All such statements are declared to be of no value in this Agreement. Only the written terms of this Agreement

will bind the Parties.

This Agreement and the terms

and conditions contained in this Agreement apply to and are binding upon the Parties’ successors, assigns, executors, administrators,

beneficiaries, and representatives.

Any notices or delivery required

here will be deemed completed when hand-delivered, delivered by an agent, or seven (7) days after being placed in the post, postage

prepaid, to the Parties at the addresses contained in this Agreement or as the Parties may later designate in writing.

All of the rights, remedies,

and benefits provided by this Agreement will be cumulative and will not be exclusive of any other such rights, remedies and benefits

allowed by law.

IN

WITNESS WHEREOF the Parties have duly affixed their signatures under hand and seal on this _____ day of _________________,

_________.

| |

|

|

|

Darius Capital Company

dba Longevity Capital Company (Party) |

|

|

|

|

|

|

Per:_________________________ (SEAL)

Chief Executive Officer

_____________________

Michael Lasky, Member of the Board |

|

|

| |

|

|

| Arax Holdings (Party) |

|

|

|

|

|

| Per:_________________________ (SEAL) |

|

|

| |

|

|

|

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

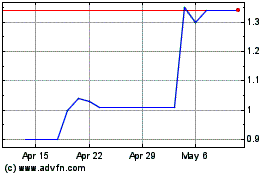

Arax (PK) (USOTC:ARAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Arax (PK) (USOTC:ARAT)

Historical Stock Chart

From Apr 2023 to Apr 2024