0000064803false00000648032024-02-072024-02-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

| | | | | |

| Date of Report (Date of earliest event reported): | February 7, 2024 |

CVS HEALTH CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-01011 | 05-0494040 |

| (State or other jurisdiction of incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

One CVS Drive, Woonsocket, Rhode Island 02895

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (401) 765-1500

Former name or former address, if changed since last report: N/A

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

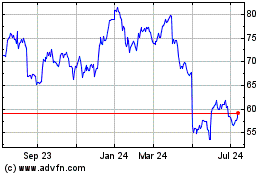

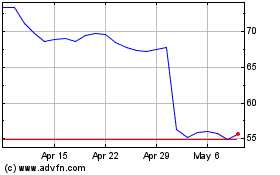

| Common Stock, par value $0.01 per share | CVS | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| | | | | |

| Emerging growth company | ☐ |

| |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

Section 2 - Financial Information

Item 2.02 Results of Operations and Financial Condition.

On February 7, 2024, CVS Health Corporation issued a press release announcing results for the three months and full year ended December 31, 2023. A copy of that press release is furnished herewith as Exhibit 99.1 and hereby incorporated in this Item 2.02 by reference.

The information in this Current Report on Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (as amended, the “Exchange Act”) or otherwise subject to the liabilities of that Section, and shall not be or be deemed to be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing.

Section 9 - Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

The exhibits to this Current Report on Form 8-K are as follows:

INDEX TO EXHIBITS

| | | | | | | | |

| | |

| 99.1 | |

| | |

| 104 | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | |

| | | CVS HEALTH CORPORATION |

| | | |

| Date: | February 7, 2024 | By: | /s/ Thomas F. Cowhey |

| | | Thomas F. Cowhey |

| | | Executive Vice President and Chief Financial Officer |

| | | |

Exhibit 99.1

Exhibit 99.1 | | | | | | | | |

CVS HEALTH REPORTS FOURTH QUARTER AND FULL-YEAR 2023 RESULTS |

WOONSOCKET, RHODE ISLAND, February 7, 2024 - CVS Health Corporation (NYSE: CVS) today announced operating results for the three months and year ended December 31, 2023. |

| | | | | | | | |

| FOURTH QUARTER HIGHLIGHTS | | KEY FINANCIAL DATA |

•Total revenues increased to $93.8 billion, up 11.9% compared to prior year

•GAAP diluted EPS of $1.58 and Adjusted EPS of $2.12

•Total revenues increased to $357.8 billion, up 10.9% compared to prior year

•GAAP diluted EPS of $6.47 and Adjusted EPS of $8.74

•Generated cash flow from operations of $13.4 billion

| | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, |

| In millions, except per share amounts | 2023 | | 2022 | | Change |

Total revenues | $ | 93,813 | | | $ | 83,846 | | | $ | 9,967 | |

| Operating income | 3,373 | | | 3,659 | | | (286) | |

Adjusted operating income (1) | 4,227 | | | 4,079 | | | 148 | |

| Diluted earnings per share | $ | 1.58 | | | $ | 1.77 | | | $ | (0.19) | |

Adjusted EPS (2) | $ | 2.12 | | | $ | 2.04 | | | $ | 0.08 | |

| | | | | |

Note: Financial information as of and for the three months and year ended December 31, 2022 throughout this press release has been revised to conform with certain current period financial statement changes as described on page 16. |

| |

2024 FULL-YEAR GUIDANCE |

Upon finalizing the medical cost trend analysis for the fourth quarter of 2023 and recognizing potential implications for elevated medical cost trends in 2024, the Company has: •Revised GAAP diluted EPS guidance to at least $7.06 from at least $7.26 •Revised Adjusted EPS guidance to at least $8.30 from at least $8.50 •Revised cash flow from operations guidance to at least $12.0 billion from at least $12.5 billion |

| | | | | |

CEO Commentary | “With a focus on delivering care and value, we had a strong fourth quarter and full year in 2023 as we build a world of health around every consumer. We will continue to drive affordable access to care when, where, and how people want, while we improve transparency throughout the health care system.” -Karen S. Lynch, CVS Health President and CEO |

Announced CVS CostVantageTM, which evolves our pharmacy reimbursement model and brings greater transparency and simplicity to the system. CVS CostVantage will define the drug cost and related reimbursement using a simplified formula built on the cost of the drug, a set markup and a fee that reflects the care and value of pharmacy services. CVS Pharmacy plans to launch CVS CostVantage to commercial payors in 2025.

Introduced CVS Caremark TrueCostTM, a model innovation that offers client pricing reflecting the true net cost of prescription drugs, with visibility into administrative fees. Simplified pricing will allow members to have stable access to the Company’s national pharmacy network. CVS Caremark plans to launch CVS Caremark TrueCost in 2025.

Launched CVS HealthspireTM, the new name for the Health Services segment, which includes Caremark, CordavisTM, Oak Street Health, Signify Health and MinuteClinic®. CVS Healthspire will continue to focus on integration across the Company’s assets to deliver connected patient care, pharmacy benefits and innovative provider support solutions. Announced a 10% increase to the quarterly shareholder dividend, which became effective with the February 1, 2024 dividend distribution. Returned $3.1 billion to shareholders through dividends in 2023.

Investor Contact: Larry McGrath | Senior Vice President Business Development and Investor Relations | (800) 201-0938

Media Contact: Ethan Slavin | Executive Director Corporate Communications | (860) 273-6095

The Company presents both GAAP and non-GAAP financial measures in this press release to assist in the comparison of the Company’s past financial performance with its current financial performance. See “Non-GAAP Financial Information” beginning on page 11 and endnotes beginning on page 24 for explanations of non-GAAP financial measures presented in this press release. See pages 13 through 15 and page 23 for reconciliations of each non-GAAP financial measure used in this release to the most directly comparable GAAP financial measure.

Consolidated fourth quarter and full-year results

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | |

| Three Months Ended

December 31, | | Year Ended

December 31, |

| In millions, except per share amounts | 2023 | | 2022 | | Change | | 2023 | | 2022 | | Change |

Total revenues | $ | 93,813 | | | $ | 83,846 | | | $ | 9,967 | | | $ | 357,776 | | | $ | 322,467 | | | $ | 35,309 | |

| Operating income | 3,373 | | | 3,659 | | | (286) | | | 13,743 | | | 7,954 | | | 5,789 | |

Adjusted operating income (1) | 4,227 | | | 4,079 | | | 148 | | | 17,534 | | | 18,037 | | | (503) | |

| Net income | 2,047 | | | 2,332 | | | (285) | | | 8,368 | | | 4,327 | | | 4,041 | |

| Diluted earnings per share | $ | 1.58 | | | $ | 1.77 | | | $ | (0.19) | | | $ | 6.47 | | | $ | 3.26 | | | $ | 3.21 | |

Adjusted EPS (2) | $ | 2.12 | | | $ | 2.04 | | | $ | 0.08 | | | $ | 8.74 | | | $ | 9.03 | | | $ | (0.29) | |

For the three months and year ended December 31, 2023 compared to the prior year:

•Total revenues increased 11.9% and 10.9%, respectively, driven by growth across all segments.

•Operating income decreased 7.8% in the three months ended December 31, 2023 compared to the prior year primarily due to $193 million of acquisition-related transaction and integration costs recorded in the current year and the absence of a pre-tax gain of $250 million on the sale of the Company’s wholly-owned subsidiary bswift LLC (“bswift”) recorded in the prior year. These decreases were partially offset by the increases in adjusted operating income described below.

•Operating income increased 72.8% for the year ended December 31, 2023 compared to the prior year primarily due to the absence of $5.8 billion of opioid litigation charges and a $2.5 billion loss on assets held for sale related to the write-down of the Company’s Omnicare® long-term care business (“LTC business”), both of which were recorded in the prior year. These increases were partially offset by $507 million of restructuring charges and $487 million of acquisition-related transaction and integration costs recorded in the current year, the absence of pre-tax gains of $250 million on the sale of bswift and $225 million on the sale of PayFlex Holdings, Inc. (“PayFlex”) recorded in the prior year, as well as the decreases in adjusted operating income described below.

•Adjusted operating income increased 3.6% in the three months ended December 31, 2023 compared to the prior year primarily driven by increases in the Pharmacy & Consumer Wellness, Health Services and Corporate/Other segments, partially offset by a decline in the Health Care Benefits segment. Adjusted operating income decreased 2.8% in the year ended December 31, 2023 compared to the prior year primarily driven by decreases in the Health Care Benefits and Pharmacy & Consumer Wellness segments, partially offset by increases in the Health Services and Corporate/Other segments. See pages 3 through 5 for additional discussion of adjusted operating income performance of the Company’s segments. •Interest expense increased $138 million, or 25.0%, and $371 million, or 16.2%, respectively, due to higher debt in the three months and year ended December 31, 2023 to fund the acquisitions of Signify Health, Inc. (“Signify Health”) and Oak Street Health, Inc. (“Oak Street Health”).

•The effective income tax rate in the fourth quarter decreased to 24.3% compared to 26.0% in the prior year primarily due to the impact of certain discrete tax items in the fourth quarter of 2023. The effective income tax rate for the full year decreased to 25.1% compared to 25.9% in the prior year primarily due to the absence of certain nondeductible legal charges and basis differences on the sale of bswift and PayFlex in 2022. These decreases were partially offset by the absence of the impact of certain discrete tax items concluded in the year ended December 31, 2022.

Health Care Benefits segment

The Health Care Benefits segment offers a full range of insured and self-insured (“ASC”) medical, pharmacy, dental and behavioral health products and services. The segment results for the three months and years ended December 31, 2023 and 2022 were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Year Ended

December 31, |

| In millions, except percentages | 2023 | | 2022 | | Change | | 2023 | | 2022 | | Change |

| Total revenues | $ | 26,726 | | $ | 23,019 | | $ | 3,707 | | $ | 105,646 | | $ | 91,350 | | $ | 14,296 |

| | | | | | | | | | | |

Adjusted operating income (1) | 676 | | 913 | | (237) | | 5,577 | | 6,338 | | (761) |

Medical benefit ratio (“MBR”) (3) | 88.5 | % | | 85.8 | % | | 2.7 | % | | 86.2 | % | | 83.8 | % | | 2.4 | % |

Medical membership (4) | | | | | | | 25.7 | | | 24.4 | | | 1.3 | |

•Total revenues increased 16.1% and 15.6% for the three months and year ended December 31, 2023, respectively, compared to the prior year driven by growth across all product lines.

•Adjusted operating income decreased 26.0% for the three months ended December 31, 2023 compared to the prior year primarily driven by growth in the individual exchange business, including the related impact of seasonality, and increased utilization in Medicare Advantage. These decreases were partially offset by higher net investment income in the three months ended December 31, 2023 compared to the prior year.

•Adjusted operating income decreased 12.0% for the year ended December 31, 2023 compared to the prior year primarily driven by increased utilization in Medicare Advantage when compared with pandemic influenced utilization levels in the prior year, as well as incremental investments in the business, including investments in service capabilities and member experience. These decreases were partially offset by higher net investment income in the year ended December 31, 2023 compared to the prior year.

•The MBR increased from 85.8% to 88.5% in the three months ended December 31, 2023 compared to the prior year and increased from 83.8% to 86.2% in the year ended December 31, 2023 compared to the prior year. These increases were primarily driven by increased utilization in Medicare Advantage, including outpatient and supplemental benefits, when compared with pandemic influenced utilization levels in the prior year, as well as Commercial and Medicaid trends returning to normalized levels, consistent with pricing expectations.

•Medical membership as of December 31, 2023 of 25.7 million remained relatively consistent compared with September 30, 2023, as declines in the Medicaid product line were largely offset by increases in the Commercial and Medicare product lines.

•Medical membership as of December 31, 2023 of 25.7 million increased 1.3 million members compared with December 31, 2022, reflecting increases in the Commercial and Medicare product lines, including an increase of 1.3 million members related to the individual exchange business within the Commercial product line. These increases were partially offset by a decline in the Medicaid product line, primarily attributable to the resumption of Medicaid redeterminations following the expiration of the public health emergency in May 2023.

•The segment experienced favorable development of prior-periods’ health care cost estimates in its Government Services and Commercial businesses during the three months ended December 31, 2023, primarily attributable to 2023 performance.

•Prior years’ health care costs payable estimates developed favorably by $675 million during the year ended December 31, 2023. This development is reported on a basis consistent with the prior years’ development reported in the health care costs payable table in the Company’s annual audited financial statements and does not directly correspond to an increase in 2023 operating results.

See the supplemental information on page 18 for additional information regarding the performance of the Health Care Benefits segment.

Health Services segment

The Health Services segment provides a full range of pharmacy benefit management (“PBM”) solutions, delivers health care services in its medical clinics, virtually, and in the home, and offers provider enablement solutions. The segment results for the three months and years ended December 31, 2023 and 2022 were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Year Ended

December 31, |

| In millions | 2023 | | 2022 | | Change | | 2023 | | 2022 | | Change |

| Total revenues | $ | 49,146 | | | $ | 43,769 | | | $ | 5,377 | | | $ | 186,843 | | | $ | 169,576 | | | $ | 17,267 | |

| | | | | | | | | | | |

Adjusted operating income (1) | 1,860 | | | 1,785 | | | 75 | | | 7,312 | | | 6,781 | | | 531 | |

Pharmacy claims processed (5) (6) | 600.8 | | | 600.2 | | | 0.6 | | | 2,344.3 | | | 2,335.1 | | | 9.2 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

•Total revenues increased 12.3% and 10.2% for the three months and year ended December 31, 2023, respectively, compared to the prior year primarily driven by pharmacy drug mix, growth in specialty pharmacy, brand inflation and the acquisitions of Oak Street Health and Signify Health. These increases were partially offset by continued pharmacy client price improvements.

•Adjusted operating income increased 4.2% and 7.8% for the three months and year ended December 31, 2023, respectively, compared to the prior year primarily driven by improved purchasing economics, including increased contributions from the products and services of the Company’s group purchasing organization, as well as growth in specialty pharmacy, including increased contributions from specialty generics. These increases were partially offset by continued pharmacy client price improvements.

•Pharmacy claims processed increased slightly on a 30-day equivalent basis for the three months and year ended December 31, 2023 compared to the prior year primarily driven by net new business and increased utilization. These increases were largely offset by the impact of a Medicaid customer contract change that occurred during the second quarter of 2023 and a decrease in COVID-19 vaccinations.

See the supplemental information on page 19 for additional information regarding the performance of the Health Services segment.

Pharmacy & Consumer Wellness segment

The Pharmacy & Consumer Wellness segment dispenses prescriptions in its retail pharmacies and through its infusion operations, provides ancillary pharmacy services including pharmacy patient care programs, diagnostic testing and vaccination administration, and sells a wide assortment of health and wellness products and general merchandise. The segment also provides pharmacy services to long-term care facilities and pharmacy fulfillment services to support the Health Services segment’s specialty and mail order pharmacy offerings. The segment results for the three months and years ended December 31, 2023 and 2022 were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Year Ended

December 31, |

| In millions | 2023 | | 2022 | | Change | | 2023 | | 2022 | | Change |

| Total revenues | $ | 31,185 | | | $ | 28,715 | | | $ | 2,470 | | | $ | 116,763 | | | $ | 108,596 | | | $ | 8,167 | |

| | | | | | | | | | | |

Adjusted operating income (1) | 2,027 | | | 1,847 | | | 180 | | | 5,963 | | | 6,531 | | | (568) | |

Prescriptions filled (5) (6) | 431.5 | | | 423.4 | | | 8.1 | | | 1,649.1 | | | 1,625.4 | | | 23.7 | |

•Total revenues increased 8.6% and 7.5% for the three months and year ended December 31, 2023, respectively, compared to the prior year primarily driven by pharmacy drug mix, increased prescription volume, brand inflation and increased contributions from vaccinations. These increases were partially offset by the impact of recent generic introductions, continued pharmacy reimbursement pressure, a decrease in store count and decreased contributions from COVID-19 over-the-counter (“OTC”) test kits and diagnostic testing.

•Adjusted operating income increased 9.7% for the three months ended December 31, 2023 compared to the prior year primarily driven by improved drug purchasing, increased contributions from vaccinations, increased prescription volume and lower operating expenses. These increases were partially offset by continued pharmacy reimbursement pressure.

•Adjusted operating income decreased 8.7% for the year ended December 31, 2023 compared to the prior year primarily driven by continued pharmacy reimbursement pressure and decreased COVID-19 vaccinations and diagnostic testing. These decreases were partially offset by the increased prescription volume described above, improved generic drug purchasing and lower operating expenses in the year ended December 31, 2023.

•Prescriptions filled increased 1.9% and 1.5% on a 30-day equivalent basis for the three months and year ended December 31, 2023, respectively, compared to the prior year primarily driven by increased utilization, partially offset by a decrease in COVID-19 vaccinations and the decrease in store count.

See the supplemental information on page 20 for additional information regarding the performance of the Pharmacy & Consumer Wellness segment.

2024 Full-year guidance

The Company revised its full-year 2024 GAAP diluted EPS guidance to at least $7.06 from at least $7.26 and its full-year 2024 Adjusted EPS guidance to at least $8.30 from at least $8.50. The Company also revised its full-year 2024 cash flow from operations guidance to at least $12.0 billion from at least $12.5 billion.

The Company’s guidance revision follows a review of its recently finalized medical cost trend analysis for the fourth quarter of 2023 and the potential implications for elevated medical cost trends in 2024. Additional details of the guidance revision can be found in the Q4 2023 Earnings Presentation that can be found on the Investor Relations section of the CVS Health website at http://investors.cvshealth.com.

The adjustments between full-year 2024 GAAP diluted EPS and Adjusted EPS include amortization of intangible assets, acquisition-related integration costs and the corresponding income tax benefit or expense related to the items excluded from adjusted income attributable to CVS Health.

Teleconference and webcast

The Company will be holding a conference call today for investors at 8:00 a.m. (Eastern Time) to discuss its fourth quarter and full-year results. An audio webcast of the call will be broadcast simultaneously for all interested parties through the Investor Relations section of the CVS Health website at http://investors.cvshealth.com. This webcast will be archived and available on the website for a one-year period following the conference call.

About CVS Health

CVS Health is the leading health solutions company, delivering care like no one else can. We reach more people and improve the health of communities across America through our local presence, digital channels and over 300,000 dedicated colleagues – including more than 40,000 physicians, pharmacists, nurses and nurse practitioners. Wherever and whenever people need us, we help them with their health – whether that’s managing chronic diseases, staying compliant with their medications or accessing affordable health and wellness services in the most convenient ways. We help people navigate the health care system – and their personal health care – by improving access, lowering costs and being a trusted partner for every meaningful moment of health. And we do it all with heart, each and every day. Follow @CVSHealth on social media.

Cautionary statement concerning forward-looking statements

The Private Securities Litigation Reform Act of 1995 provides a safe harbor for forward-looking statements made by or on behalf of CVS Health Corporation. Statements in this press release that are forward-looking include, but are not limited to, Ms. Lynch’s quotation, the information under the headings “2024 Full-year guidance” and “In the spotlight” and the information included in the reconciliations and endnotes. By their nature, all forward-looking statements are not guarantees of future performance or results and are subject to risks and uncertainties that are difficult to predict and/or quantify. Actual results may differ materially from those contemplated by the forward-looking statements due to the risks and uncertainties described in our Securities and Exchange Commission (“SEC”) filings, including those set forth in the Risk Factors section and under the heading “Cautionary Statement Concerning Forward-Looking Statements” in our most recently filed Annual Report on Form 10-K, our Quarterly Reports on Form 10-Q for the quarterly periods ended March 31, 2023, June 30, 2023 and September 30, 2023 and our Current Reports on Form 8-K.

You are cautioned not to place undue reliance on CVS Health’s forward-looking statements. CVS Health’s forward-looking statements are and will be based upon management’s then-current views and assumptions regarding future events and operating performance, and are applicable only as of the dates of such statements. CVS Health does not assume any duty to update or revise forward-looking statements, whether as a result of new information, future events, uncertainties or otherwise.

- Tables Follow -

CVS HEALTH CORPORATION

Condensed Consolidated Statements of Operations

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Year Ended

December 31, |

| In millions, except per share amounts | 2023 | | 2022 | | 2023 | | 2022 |

| Revenues: | | | | | | | |

| Products | $ | 65,154 | | | $ | 59,657 | | | $ | 245,138 | | | $ | 226,616 | |

| Premiums | 25,075 | | | 21,436 | | | 99,192 | | | 85,330 | |

| Services | 3,316 | | | 2,430 | | | 12,293 | | | 9,683 | |

| Net investment income | 268 | | | 323 | | | 1,153 | | | 838 | |

| Total revenues | 93,813 | | | 83,846 | | | 357,776 | | | 322,467 | |

| Operating costs: | | | | | | | |

| Cost of products sold | 57,419 | | | 51,728 | | | 217,098 | | | 196,892 | |

| Health care costs | 22,518 | | | 18,259 | | | 86,247 | | | 71,073 | |

| Restructuring charges | — | | | — | | | 507 | | | — | |

| Opioid litigation charges | — | | | 99 | | | — | | | 5,803 | |

| Loss on assets held for sale | — | | | 12 | | | 349 | | | 2,533 | |

| | | | | | | |

| | | | | | | |

| Operating expenses | 10,503 | | | 10,089 | | | 39,832 | | | 38,212 | |

| Total operating costs | 90,440 | | | 80,187 | | | 344,033 | | | 314,513 | |

| Operating income | 3,373 | | | 3,659 | | | 13,743 | | | 7,954 | |

| Interest expense | 690 | | | 552 | | | 2,658 | | | 2,287 | |

| | | | | | | |

| Other income | (22) | | | (43) | | | (88) | | | (169) | |

| Income before income tax provision | 2,705 | | | 3,150 | | | 11,173 | | | 5,836 | |

| Income tax provision | 658 | | | 818 | | | 2,805 | | | 1,509 | |

| | | | | | | |

| | | | | | | |

| Net income | 2,047 | | | 2,332 | | | 8,368 | | | 4,327 | |

| Net (income) loss attributable to noncontrolling interests | (1) | | | 2 | | | (24) | | | (16) | |

| Net income attributable to CVS Health | $ | 2,046 | | | $ | 2,334 | | | $ | 8,344 | | | $ | 4,311 | |

| | | | | | | |

| Net income per share attributable to CVS Health: | | | | | | | |

| | | | | | | |

| | | | | | | |

| Basic | $ | 1.59 | | | $ | 1.78 | | | $ | 6.49 | | | $ | 3.29 | |

| Diluted | $ | 1.58 | | | $ | 1.77 | | | $ | 6.47 | | | $ | 3.26 | |

| Weighted average shares outstanding: | | | | | | | |

| | | | | | | |

| | | | | | | |

| Basic | 1,288 | | | 1,310 | | | 1,285 | | | 1,312 | |

| Diluted | 1,293 | | | 1,319 | | | 1,290 | | | 1,323 | |

| Dividends declared per share | $ | 0.605 | | | $ | 0.55 | | | $ | 2.42 | | | $ | 2.20 | |

CVS HEALTH CORPORATION

Condensed Consolidated Balance Sheets

(Unaudited)

| | | | | | | | | | | |

| At December 31, |

| In millions | 2023 | | 2022 |

| Assets: | | | |

| Cash and cash equivalents | $ | 8,196 | | | $ | 12,945 | |

| Investments | 3,259 | | | 2,778 | |

| Accounts receivable, net | 35,227 | | | 27,276 | |

| Inventories | 18,025 | | | 19,090 | |

| Assets held for sale | — | | | 908 | |

| Other current assets | 3,151 | | | 2,636 | |

| Total current assets | 67,858 | | | 65,633 | |

| Long-term investments | 23,019 | | | 21,096 | |

| Property and equipment, net | 13,183 | | | 12,873 | |

| Operating lease right-of-use assets | 17,252 | | | 17,872 | |

| Goodwill | 91,272 | | | 78,150 | |

| Intangible assets, net | 29,234 | | | 24,803 | |

| Separate accounts assets | 3,250 | | | 3,228 | |

| Other assets | 4,660 | | | 4,620 | |

| Total assets | $ | 249,728 | | | $ | 228,275 | |

| | | |

| Liabilities: | | | |

| Accounts payable | $ | 14,897 | | | $ | 14,838 | |

| Pharmacy claims and discounts payable | 22,874 | | | 19,423 | |

| Health care costs payable | 12,049 | | | 10,142 | |

| Policyholders’ funds | 1,326 | | | 1,500 | |

| Accrued expenses | 22,189 | | | 18,745 | |

| Other insurance liabilities | 1,141 | | | 1,089 | |

| Current portion of operating lease liabilities | 1,741 | | | 1,678 | |

| Short-term debt | 200 | | | — | |

| Current portion of long-term debt | 2,772 | | | 1,778 | |

| Liabilities held for sale | — | | | 228 | |

| Total current liabilities | 79,189 | | | 69,421 | |

| Long-term operating lease liabilities | 16,034 | | | 16,800 | |

| Long-term debt | 58,638 | | | 50,476 | |

| Deferred income taxes | 4,311 | | | 4,016 | |

| Separate accounts liabilities | 3,250 | | | 3,228 | |

| Other long-term insurance liabilities | 5,459 | | | 5,835 | |

| Other long-term liabilities | 6,211 | | | 6,730 | |

| Total liabilities | 173,092 | | | 156,506 | |

| | | |

| Shareholders’ equity: | | | |

| Preferred stock | — | | | — | |

| Common stock and capital surplus | 48,992 | | | 48,193 | |

| Treasury stock | (33,838) | | | (31,858) | |

| Retained earnings | 61,604 | | | 56,398 | |

| Accumulated other comprehensive loss | (297) | | | (1,264) | |

| Total CVS Health shareholders’ equity | 76,461 | | | 71,469 | |

| Noncontrolling interests | 175 | | | 300 | |

| Total shareholders’ equity | 76,636 | | | 71,769 | |

| Total liabilities and shareholders’ equity | $ | 249,728 | | | $ | 228,275 | |

CVS HEALTH CORPORATION

Condensed Consolidated Statements of Cash Flows

(Unaudited)

| | | | | | | | | | | |

| Year Ended

December 31, |

| In millions | 2023 | | 2022 |

| Cash flows from operating activities: | | | |

| Cash receipts from customers | $ | 345,464 | | | $ | 313,662 | |

| Cash paid for inventory, prescriptions dispensed and health services rendered | (208,848) | | | (189,766) | |

| Insurance benefits paid | (84,097) | | | (69,728) | |

| Cash paid to other suppliers and employees | (34,735) | | | (32,662) | |

| Interest and investment income received | 1,584 | | | 1,026 | |

| Interest paid | (2,418) | | | (2,239) | |

| Income taxes paid | (3,524) | | | (4,116) | |

| Net cash provided by operating activities | 13,426 | | | 16,177 | |

| | | |

| Cash flows from investing activities: | | | |

| Proceeds from sales and maturities of investments | 7,729 | | | 6,729 | |

| Purchases of investments | (9,043) | | | (7,746) | |

| Purchases of property and equipment | (3,031) | | | (2,727) | |

| | | |

| Acquisitions (net of cash and restricted cash acquired) | (16,612) | | | (139) | |

Proceeds from sale of subsidiaries (net of cash and restricted cash sold of $2,854 in 2022) | — | | | (1,249) | |

| Other | 68 | | | 85 | |

| Net cash used in investing activities | (20,889) | | | (5,047) | |

| | | |

| Cash flows from financing activities: | | | |

| Commercial paper borrowings (repayments), net | 200 | | | — | |

| Proceeds from issuance of short-term loan | 5,000 | | | — | |

| Repayment of short-term loan | (5,000) | | | — | |

| Proceeds from issuance of long-term debt | 10,898 | | | — | |

| Repayments of long-term debt | (3,166) | | | (4,211) | |

| | | |

| Repurchase of common stock | (2,012) | | | (3,500) | |

| Dividends paid | (3,132) | | | (2,907) | |

| Proceeds from exercise of stock options | 277 | | | 551 | |

| Payments for taxes related to net share settlement of equity awards | (181) | | | (370) | |

| Other | (201) | | | (79) | |

| Net cash provided by (used in) financing activities | 2,683 | | | (10,516) | |

| | | |

| Net increase (decrease) in cash, cash equivalents and restricted cash | (4,780) | | | 614 | |

| Cash, cash equivalents and restricted cash at the beginning of the period | 13,305 | | | 12,691 | |

| Cash, cash equivalents and restricted cash at the end of the period | $ | 8,525 | | | $ | 13,305 | |

CVS HEALTH CORPORATION

Condensed Consolidated Statements of Cash Flows

(Unaudited)

| | | | | | | | | | | |

| Year Ended

December 31, |

| In millions | 2023 | | 2022 |

| Reconciliation of net income to net cash provided by operating activities: | | | |

| Net income | $ | 8,368 | | | $ | 4,327 | |

| Adjustments required to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation and amortization | 4,366 | | | 4,224 | |

| Loss on assets held for sale | 349 | | | 2,533 | |

| | | |

| | | |

| | | |

| Stock-based compensation | 588 | | | 447 | |

| Gain on sale of subsidiaries | — | | | (475) | |

| | | |

| Deferred income taxes | (676) | | | (2,029) | |

| Other noncash items | 416 | | | 332 | |

| Change in operating assets and liabilities, net of effects from acquisitions: | | | |

| Accounts receivable, net | (6,260) | | | (2,971) | |

| Inventories | 1,233 | | | (1,435) | |

| Other assets | (510) | | | (491) | |

| Accounts payable and pharmacy claims and discounts payable | 3,618 | | | 4,260 | |

| Health care costs payable and other insurance liabilities | 394 | | | 992 | |

| Other liabilities | 1,540 | | | 6,463 | |

| Net cash provided by operating activities | $ | 13,426 | | | $ | 16,177 | |

Non-GAAP Financial Information

The Company uses non-GAAP financial measures to analyze underlying business performance and trends. The Company believes that providing these non-GAAP financial measures enhances the Company’s and investors’ ability to compare the Company’s past financial performance with its current performance. These non-GAAP financial measures are provided as supplemental information to the financial measures presented in this press release that are calculated and presented in accordance with GAAP. Non-GAAP financial measures should not be considered a substitute for, or superior to, financial measures determined or calculated in accordance with GAAP. The Company’s definitions of its non-GAAP financial measures may not be comparable to similarly titled measures reported by other companies.

Non-GAAP financial measures such as consolidated adjusted operating income, adjusted earnings per share (“EPS”) and adjusted income attributable to CVS Health exclude from the relevant GAAP metrics, as applicable: amortization of intangible assets and other items, if any, that neither relate to the ordinary course of the Company’s business nor reflect the Company’s underlying business performance. Effective January 1, 2023, the Company’s non-GAAP financial measures also exclude the impact of net realized capital gains or losses, described in further detail below. Prior period financial information throughout this press release has been revised to conform with the current period presentation.

For the periods covered in this press release, the following items are excluded from the non-GAAP financial measures described above, as applicable, because the Company believes they neither relate to the ordinary course of the Company’s business nor reflect the Company’s underlying business performance:

•The Company’s acquisition activities have resulted in the recognition of intangible assets as required under the acquisition method of accounting which consist primarily of trademarks, customer contracts/relationships, covenants not to compete, technology, provider networks and value of business acquired. Definite-lived intangible assets are amortized over their estimated useful lives and are tested for impairment when events indicate that the carrying value may not be recoverable. The amortization of intangible assets is reflected in the condensed consolidated statements of operations in operating expenses within each segment. Although intangible assets contribute to the Company’s revenue generation, the amortization of intangible assets does not directly relate to the underwriting of the Company’s insurance products, the services performed for the Company’s customers or the sale of the Company’s products or services. Additionally, intangible asset amortization expense typically fluctuates based on the size and timing of the Company’s acquisition activity. Accordingly, the Company believes excluding the amortization of intangible assets enhances the Company’s and investors’ ability to compare the Company’s past financial performance with its current performance and to analyze underlying business performance and trends. Intangible asset amortization excluded from the related non-GAAP financial measure represents the entire amount recorded within the Company’s GAAP financial statements, and the revenue generated by the associated intangible assets has not been excluded from the related non-GAAP financial measure. Intangible asset amortization is excluded from the related non-GAAP financial measure because the amortization, unlike the related revenue, is not affected by operations of any particular period unless an intangible asset becomes impaired or the estimated useful life of an intangible asset is revised.

•The Company’s net realized capital gains and losses arise from various types of transactions, primarily in the course of managing a portfolio of assets that support the payment of insurance liabilities. Net realized capital gains and losses are reflected in the condensed consolidated statements of operations in net investment income (loss) within each segment. These capital gains and losses are the result of investment decisions, market conditions and other economic developments that are unrelated to the performance of the Company’s business, and the amount and timing of these capital gains and losses do not directly relate to the underwriting of the Company’s insurance products, the services performed for the Company’s customers or the sale of the Company’s products or services. Accordingly, the Company believes excluding net realized capital gains and losses enhances the Company’s and investors’ ability to compare the Company’s past financial performance with its current performance and to analyze underlying business performance and trends.

•During the three months and year ended December 31, 2023, the acquisition-related transaction and integration costs relate to the acquisitions of Signify Health and Oak Street Health. The acquisition-related transaction and

integration costs are reflected in the Company’s condensed consolidated statements of operations in operating expenses within the Corporate/Other segment.

•During the year ended December 31, 2023, the restructuring charges include severance and employee-related costs, asset impairment charges and a stock-based compensation charge. During the second quarter of 2023, the Company developed an enterprise-wide restructuring plan intended to streamline and simplify the organization, improve efficiency and reduce costs. In connection with the development of this plan and the recently completed acquisitions of Signify Health and Oak Street Health, the Company also conducted a strategic review of its various transformation initiatives and determined that it would terminate certain initiatives. The restructuring charges are reflected within the Corporate/Other segment.

•During the three months and years ended December 31, 2023 and 2022, the office real estate optimization charges primarily relate to the abandonment of leased real estate and the related right-of-use assets and property and equipment in connection with the planned reduction of corporate office real estate space in response to the Company’s new flexible work arrangement. The office real estate optimization charges are reflected in the Company’s condensed consolidated statements of operations in operating expenses within the Health Care Benefits, Corporate/Other and Health Services segments.

•During the year ended December 31, 2023 and the three months and year ended December 31, 2022, the loss on assets held for sale relates to the LTC reporting unit within the Pharmacy & Consumer Wellness segment. During 2022, the Company determined that its LTC business was no longer a strategic asset and committed to a plan to sell it, at which time the LTC business met the criteria for held-for-sale accounting and its net assets were accounted for as assets held for sale. The carrying value of the LTC business was determined to be greater than its estimated fair value less costs to sell and, accordingly, the Company recorded a loss on assets held for sale during the third quarter of 2022. As of December 31, 2022, the net assets of the LTC business continued to meet the criteria for held-for-sale accounting and during the fourth quarter of 2022, an incremental loss on assets held for sale was recorded to write down the carrying value of the LTC business to its estimated fair value less costs to sell. During the first quarter of 2023, an additional loss on assets held for sale was recorded to write down the carrying value of the LTC business to the Company’s best estimate of the ultimate selling price which reflected its estimated fair value less costs to sell. As of September 30, 2023, the Company determined the LTC business no longer met the criteria for held-for-sale accounting and, accordingly, the net assets associated with the LTC business were reclassified to held and used at their respective fair values. During the year ended December 31, 2022, the loss on assets held for sale also relates to the Company’s international health care business domiciled in Thailand (“Thailand business”), which was included in the Commercial Business reporting unit in the Health Care Benefits segment. The sale of the Thailand business closed in the second quarter of 2022, and the ultimate loss on the sale was not material.

•During the three months and year ended December 31, 2022, the opioid litigation charges relate to agreements to resolve substantially all opioid claims against the Company by certain states and governmental entities. The opioid litigation charges are reflected within the Corporate/Other segment.

•During the three months and year ended December 31, 2022, the gain on divestiture of subsidiary represents the pre-tax gain on the sale of bswift, which the Company sold in November 2022. During the year ended December 31, 2022, the gain on divestiture of subsidiaries also includes the pre-tax gain on the sale of PayFlex, which the Company sold in June 2022. The gains on divestitures are reflected as a reduction of operating expenses in the Company’s condensed consolidated statement of operations within the Health Care Benefits segment.

•The corresponding tax benefit or expense related to the items excluded from adjusted income attributable to CVS Health and Adjusted EPS above. The nature of each non-GAAP adjustment is evaluated to determine whether a discrete adjustment should be made to the adjusted income tax provision. The Company’s adjusted income tax provision also excludes the impact of certain discrete tax items concluded in the year ended December 31, 2022.

See endnotes (1) and (2) on page 24 for definitions of non-GAAP financial measures. Reconciliations of each non-GAAP financial measure to the most directly comparable GAAP financial measure are presented on pages 13 through 15 and page 23.

Reconciliations of Non-GAAP Financial Measures to the Most Directly Comparable GAAP Financial Measures

Adjusted Operating Income

(Unaudited)

The following are reconciliations of consolidated operating income (GAAP measure) to consolidated adjusted operating income, as well as reconciliations of segment GAAP operating income (loss) to segment adjusted operating income (loss):

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, 2023 |

| In millions | Health Care

Benefits | | Health

Services | | Pharmacy &

Consumer

Wellness | | Corporate/

Other | | | | Consolidated

Totals |

| Operating income (loss) (GAAP measure) | $ | 266 | | | $ | 1,710 | | | $ | 1,961 | | | $ | (564) | | | | | $ | 3,373 | |

| | | | | | | | | | | |

| Amortization of intangible assets | 294 | | | 149 | | | 65 | | | 1 | | | | | 509 | |

| Net realized capital losses | 106 | | | — | | | 1 | | | 45 | | | | | 152 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Acquisition-related transaction and integration costs | — | | | — | | | — | | | 193 | | | | | 193 | |

| | | | | | | | | | | |

| Office real estate optimization charges | 10 | | | 1 | | | — | | | (11) | | | | | — | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Adjusted operating income (loss) (1) | $ | 676 | | | $ | 1,860 | | | $ | 2,027 | | | $ | (336) | | | | | $ | 4,227 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, 2022 |

| In millions | Health Care

Benefits | | Health

Services | | Pharmacy &

Consumer

Wellness | | Corporate/

Other | | | | Consolidated

Totals |

| Operating income (loss) (GAAP measure) | $ | 758 | | | $ | 1,742 | | | $ | 1,767 | | | $ | (608) | | | | | $ | 3,659 | |

| | | | | | | | | | | |

| Amortization of intangible assets | 295 | | | 41 | | | 68 | | | 1 | | | | | 405 | |

| Net realized capital losses | 13 | | | — | | | — | | | 24 | | | | | 37 | |

| Office real estate optimization charges | 97 | | | 2 | | | — | | | 18 | | | | | 117 | |

| Loss on assets held for sale | — | | | — | | | 12 | | | — | | | | | 12 | |

| Opioid litigation charges | — | | | — | | | — | | | 99 | | | | | 99 | |

| Gain on divestiture of subsidiary | (250) | | | — | | | — | | | — | | | | | (250) | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Adjusted operating income (loss) (1) | $ | 913 | | | $ | 1,785 | | | $ | 1,847 | | | $ | (466) | | | | | $ | 4,079 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended December 31, 2023 |

| In millions | Health Care

Benefits | | Health

Services | | Pharmacy &

Consumer

Wellness | | Corporate/

Other | | | | Consolidated

Totals |

| Operating income (loss) (GAAP measure) | $ | 3,949 | | | $ | 6,842 | | | $ | 5,349 | | | $ | (2,397) | | | | | $ | 13,743 | |

| | | | | | | | | | | |

| Amortization of intangible assets | 1,177 | | | 465 | | | 260 | | | 3 | | | | | 1,905 | |

| Net realized capital losses | 402 | | | — | | | 5 | | | 90 | | | | | 497 | |

| Acquisition-related transaction and integration costs | — | | | — | | | — | | | 487 | | | | | 487 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Restructuring charges | — | | | — | | | — | | | 507 | | | | | 507 | |

| Office real estate optimization charges | 49 | | | 5 | | | — | | | (8) | | | | | 46 | |

| Loss on assets held for sale | — | | | — | | | 349 | | | — | | | | | 349 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Adjusted operating income (loss) (1) | $ | 5,577 | | | $ | 7,312 | | | $ | 5,963 | | | $ | (1,318) | | | | | $ | 17,534 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended December 31, 2022 |

| In millions | Health Care

Benefits | | Health

Services | | Pharmacy &

Consumer

Wellness | | Corporate/

Other | | | | Consolidated

Totals |

| Operating income (loss) (GAAP measure) | $ | 5,270 | | | $ | 6,612 | | | $ | 3,560 | | | $ | (7,488) | | | | | $ | 7,954 | |

| | | | | | | | | | | |

| Amortization of intangible assets | 1,180 | | | 167 | | | 435 | | | 3 | | | | | 1,785 | |

| Net realized capital losses | 225 | | | — | | | 44 | | | 51 | | | | | 320 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Office real estate optimization charges | 97 | | | 2 | | | — | | | 18 | | | | | 117 | |

| Loss on assets held for sale | 41 | | | — | | | 2,492 | | | — | | | | | 2,533 | |

| Opioid litigation charges | — | | | — | | | — | | | 5,803 | | | | | 5,803 | |

| Gain on divestiture of subsidiaries | (475) | | | — | | | — | | | — | | | | | (475) | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Adjusted operating income (loss) (1) | $ | 6,338 | | | $ | 6,781 | | | $ | 6,531 | | | $ | (1,613) | | | | | $ | 18,037 | |

Adjusted Earnings Per Share

(Unaudited)

The following are reconciliations of net income attributable to CVS Health to adjusted income attributable to CVS Health and calculations of GAAP diluted EPS and Adjusted EPS:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, 2023 | | Three Months Ended

December 31, 2022 |

| In millions, except per share amounts | Total

Company | | Per

Common

Share | | Total

Company | | Per

Common

Share |

| Net income attributable to CVS Health (GAAP measure) | $ | 2,046 | | | $ | 1.58 | | | $ | 2,334 | | | $ | 1.77 | |

| | | | | | | |

| | | | | | | |

| Amortization of intangible assets | 509 | | | 0.39 | | | 405 | | | 0.31 | |

| Net realized capital losses | 152 | | | 0.12 | | | 37 | | | 0.03 | |

| Acquisition-related transaction and integration costs | 193 | | | 0.15 | | | — | | | — | |

| | | | | | | |

| Office real estate optimization charges | — | | | — | | | 117 | | | 0.09 | |

| Loss on assets held for sale | — | | | — | | | 12 | | | 0.01 | |

| Opioid litigation charges | — | | | — | | | 99 | | | 0.08 | |

| Gain on divestiture of subsidiary | — | | | — | | | (250) | | | (0.19) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Tax impact of non-GAAP adjustments | (162) | | | (0.12) | | | (68) | | | (0.06) | |

| | | | | | | |

| | | | | | | |

Adjusted income attributable to CVS Health (2) | $ | 2,738 | | | $ | 2.12 | | | $ | 2,686 | | | $ | 2.04 | |

| | | | | | | |

| Weighted average diluted shares outstanding | | | 1,293 | | | | | 1,319 | |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended

December 31, 2023 | | Year Ended

December 31, 2022 |

| In millions, except per share amounts | Total

Company | | Per

Common

Share | | Total

Company | | Per

Common

Share |

| | | | | | | |

| | | | | | | |

| Net income attributable to CVS Health (GAAP measure) | $ | 8,344 | | | $ | 6.47 | | | $ | 4,311 | | | $ | 3.26 | |

| | | | | | | |

| Amortization of intangible assets | 1,905 | | | 1.48 | | | 1,785 | | | 1.35 | |

| Net realized capital losses | 497 | | | 0.38 | | | 320 | | | 0.24 | |

| Acquisition-related transaction and integration costs | 487 | | | 0.38 | | | — | | | — | |

| Restructuring charges | 507 | | | 0.39 | | | — | | | — | |

| Office real estate optimization charges | 46 | | | 0.04 | | | 117 | | | 0.09 | |

| Loss on assets held for sale | 349 | | | 0.27 | | | 2,533 | | | 1.91 | |

| Opioid litigation charges | — | | | — | | | 5,803 | | | 4.39 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Gain on divestiture of subsidiaries | — | | | — | | | (475) | | | (0.36) | |

| Tax impact of non-GAAP adjustments | (863) | | | (0.67) | | | (2,453) | | | (1.85) | |

| | | | | | | |

| | | | | | | |

Adjusted income attributable to CVS Health (2) | $ | 11,272 | | | $ | 8.74 | | | $ | 11,941 | | | $ | 9.03 | |

| | | | | | | |

| Weighted average diluted shares outstanding | | | 1,290 | | | | | 1,323 | |

| | | | | | | |

Supplemental Information

(Unaudited)

The Company’s segments maintain separate financial information, and the Company’s chief operating decision maker (the “CODM”) evaluates the segments’ operating results on a regular basis in deciding how to allocate resources among the segments and in assessing segment performance. The CODM evaluates the performance of the Company’s segments based on adjusted operating income. Adjusted operating income is defined as operating income (GAAP measure) excluding the impact of amortization of intangible assets and other items, if any, that neither relate to the ordinary course of the Company’s business nor reflect the Company’s underlying business performance as further described in endnote (1). Effective for the first quarter of 2023, adjusted operating income also excludes the impact of net realized capital gains or losses. The Company uses adjusted operating income as its principal measure of segment performance as it enhances the Company’s ability to compare past financial performance with current performance and analyze underlying business performance and trends.

Segment financial information as of and for the three months and year ended December 31, 2022 has been revised to conform with current period presentation for the following items:

•Effective for the first quarter of 2023, the Company realigned the composition of its segments to correspond with changes made to its operating model and how the business is managed. As a result of this realignment, the Company formed a new Health Services segment, which in addition to providing a full range of PBM solutions, also delivers health care services in the Company’s medical clinics, virtually, and in the home, as well as provider enablement solutions. In addition, the Company created a new Pharmacy & Consumer Wellness segment, which includes its retail and long-term care pharmacy operations and related pharmacy services, as well as its retail front store operations. This segment will also provide pharmacy fulfillment services to support the Health Services segment’s specialty and mail order pharmacy offerings. The Company also discontinued its former segment reporting practice for activity under its Maintenance Choice® program as described in Note (b) of the table on page 17. Following this segment realignment, the Company’s four reportable segments are: Health Care Benefits, Health Services, Pharmacy & Consumer Wellness and Corporate/Other.

•Effective January 1, 2023, the Company adopted a new accounting standard related to the accounting for long-duration insurance contracts using a modified retrospective transition method. Refer to Note 1 ‘‘Significant Accounting Policies’’ in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 for further information regarding the adoption of this accounting standard.

•Effective January 1, 2023, the Company’s non-GAAP financial measures exclude the impact of net realized capital gains or losses, described in further detail on page 11.

The impact of these items on segment financial information for the three months and year ended December 31, 2022 is reflected in the “Adjustments” lines of the table on page 17.

The following is a reconciliation of financial measures of the Company’s segments to the consolidated totals:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| In millions | Health Care

Benefits | | Health

Services (a) | | Pharmacy &

Consumer

Wellness | | Corporate/

Other | | Intersegment

Eliminations (b) | | Consolidated

Totals |

| Three Months Ended | | | | | | | | | | | |

| December 31, 2023 | | | | | | | | | | | |

| Total revenues | $ | 26,726 | | | $ | 49,146 | | | $ | 31,185 | | | $ | 75 | | | $ | (13,319) | | | $ | 93,813 | |

| | | | | | | | | | | |

Adjusted operating income (loss) (1) | 676 | | | 1,860 | | | 2,027 | | | (336) | | | — | | | 4,227 | |

| December 31, 2022 | | | | | | | | | | | |

Total revenues, as

previously reported | $ | 23,033 | | | $ | 43,747 | | | $ | 28,184 | | | $ | 152 | | | $ | (11,270) | | | $ | 83,846 | |

| Adjustments | (14) | | | 22 | | | 531 | | | — | | | (539) | | | — | |

| Total revenues, as adjusted | $ | 23,019 | | | $ | 43,769 | | | $ | 28,715 | | | $ | 152 | | | $ | (11,809) | | | $ | 83,846 | |

| | | | | | | | | | | |

| Adjusted operating income (loss), as previously reported | $ | 858 | | | $ | 1,988 | | | $ | 1,840 | | | $ | (508) | | | $ | (172) | | | $ | 4,006 | |

| Adjustments | 55 | | | (203) | | | 7 | | | 42 | | | 172 | | | 73 | |

Adjusted operating income (loss), as adjusted (1) | $ | 913 | | | $ | 1,785 | | | $ | 1,847 | | | $ | (466) | | | $ | — | | | $ | 4,079 | |

| | | | | | | | | | | |

| Year Ended | | | | | | | | | | | |

| December 31, 2023 | | | | | | | | | | | |

| Total revenues | $ | 105,646 | | | $ | 186,843 | | | $ | 116,763 | | | $ | 451 | | | $ | (51,927) | | | $ | 357,776 | |

| | | | | | | | | | | |

Adjusted operating income (loss) (1) | 5,577 | | | 7,312 | | | 5,963 | | | (1,318) | | | — | | | 17,534 | |

| December 31, 2022 | | | | | | | | | | | |

Total revenues, as

previously reported | $ | 91,409 | | | $ | 169,236 | | | $ | 106,594 | | | $ | 530 | | | $ | (45,302) | | | $ | 322,467 | |

| Adjustments | (59) | | | 340 | | | 2,002 | | | — | | | (2,283) | | | — | |

| Total revenues, as adjusted | $ | 91,350 | | | $ | 169,576 | | | $ | 108,596 | | | $ | 530 | | | $ | (47,585) | | | $ | 322,467 | |

| | | | | | | | | | | |

| Adjusted operating income (loss), as previously reported | $ | 5,984 | | | $ | 7,356 | | | $ | 6,705 | | | $ | (1,785) | | | $ | (728) | | | $ | 17,532 | |

| Adjustments | 354 | | | (575) | | | (174) | | | 172 | | | 728 | | | 505 | |

Adjusted operating income (loss), as adjusted (1) | $ | 6,338 | | | $ | 6,781 | | | $ | 6,531 | | | $ | (1,613) | | | $ | — | | | $ | 18,037 | |

_____________________________________________

(a)Total revenues of the Health Services segment include approximately $3.0 billion and $2.8 billion of retail co-payments for the three months ended December 31, 2023 and 2022, respectively, and $13.7 billion and $12.6 billion of retail co-payments for the years ended December 31, 2023 and 2022, respectively.

(b)Intersegment revenue eliminations relate to intersegment revenue generating activities that occur between the Health Care Benefits segment, the Health Services segment, and/or the Pharmacy & Consumer Wellness segment. Prior to January 1, 2023, intersegment adjusted operating income eliminations occurred when members of the Health Services segment’s clients enrolled in Maintenance Choice elected to pick up maintenance prescriptions at one of the Company’s retail pharmacies instead of receiving them through the mail. When this occurred, both the Health Services and Pharmacy & Consumer Wellness segments recorded the adjusted operating income on a stand-alone basis. Effective January 1, 2023, the adjusted operating income associated with such transactions is reported only in the Pharmacy & Consumer Wellness segment, therefore no adjusted operating income elimination is required.

Supplemental Information

(Unaudited)

Health Care Benefits segment

The following table summarizes the Health Care Benefits segment’s performance for the respective periods:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Change |

| Three Months Ended

December 31, | | Year Ended

December 31, | | Three Months Ended

December 31,

2023 vs 2022 | | Year Ended

December 31,

2023 vs 2022 |

| In millions, except percentages and basis points (“bps”) | 2023 | | 2022 | | 2023 | | 2022 | | $ | | % | | $ | | % |

| Revenues: | | | | | | | | | | | | | | | |

| Premiums | $ | 25,065 | | $ | 21,426 | | $ | 99,144 | | $ | 85,274 | | $ | 3,639 | | | 17.0 | % | | $ | 13,870 | | | 16.3 | % |

| Services | 1,452 | | 1,395 | | 5,737 | | 5,600 | | 57 | | | 4.1 | % | | 137 | | | 2.4 | % |

| Net investment income | 209 | | 198 | | 765 | | 476 | | 11 | | | 5.6 | % | | 289 | | | 60.7 | % |

| Total revenues | 26,726 | | 23,019 | | 105,646 | | 91,350 | | 3,707 | | | 16.1 | % | | 14,296 | | | 15.6 | % |

| Health care costs | 22,175 | | 18,373 | | 85,504 | | 71,473 | | 3,802 | | | 20.7 | % | | 14,031 | | | 19.6 | % |

MBR (Health care costs as a % of premium revenues) (3) | 88.5 | % | | 85.8 | % | | 86.2 | % | | 83.8 | % | | 270 | | bps | | 240 | | bps |

| Loss on assets held for sale | $ | — | | | $ | — | | | $ | — | | | $ | 41 | | | $ | — | | | — | % | | $ | (41) | | | (100.0) | % |

| Operating expenses | 4,285 | | 3,888 | | 16,193 | | 14,566 | | 397 | | | 10.2 | % | | 1,627 | | | 11.2 | % |

| Operating expenses as a % of total revenues | 16.0 | % | | 16.9 | % | | 15.3 | % | | 15.9 | % | | | | | | | | |

| Operating income | $ | 266 | | $ | 758 | | $ | 3,949 | | $ | 5,270 | | $ | (492) | | | (64.9) | % | | $ | (1,321) | | | (25.1) | % |

| Operating income as a % of total revenues | 1.0 | % | | 3.3 | % | | 3.7 | % | | 5.8 | % | | | | | | | | |

Adjusted operating income (1) | $ | 676 | | $ | 913 | | $ | 5,577 | | $ | 6,338 | | $ | (237) | | | (26.0) | % | | $ | (761) | | | (12.0) | % |

| Adjusted operating income as a % of total revenues | 2.5 | % | | 4.0 | % | | 5.3 | % | | 6.9 | % | | | | | | | | |

| Premium revenues (by business): | | | | | | | | | | | | | | | |

| Government | $ | 17,414 | | $ | 15,762 | | $ | 70,094 | | $ | 63,141 | | $ | 1,652 | | | 10.5 | % | | $ | 6,953 | | | 11.0 | % |

| Commercial | 7,651 | | 5,664 | | 29,050 | | 22,133 | | 1,987 | | | 35.1 | % | | 6,917 | | | 31.3 | % |

The following table summarizes the Health Care Benefits segment’s medical membership for the respective periods:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| December 31, 2023 | | September 30, 2023 | | December 31, 2022 |

| In thousands | Insured | | ASC | | Total | | Insured | | ASC | | Total | | Insured | | ASC | | Total |

Medical membership: (4) | | | | | | | | | | | | | | | | | |

| Commercial | 4,252 | | | 14,087 | | | 18,339 | | | 4,198 | | | 14,075 | | | 18,273 | | | 3,136 | | | 13,896 | | | 17,032 | |

| Medicare Advantage | 3,460 | | | — | | | 3,460 | | | 3,438 | | | — | | | 3,438 | | | 3,270 | | | — | | | 3,270 | |

| Medicare Supplement | 1,343 | | | — | | | 1,343 | | | 1,352 | | | — | | | 1,352 | | | 1,363 | | | — | | | 1,363 | |

| Medicaid | 2,073 | | | 444 | | | 2,517 | | | 2,173 | | | 452 | | | 2,625 | | | 2,234 | | | 497 | | | 2,731 | |

| Total medical membership | 11,128 | | | 14,531 | | | 25,659 | | | 11,161 | | | 14,527 | | | 25,688 | | | 10,003 | | | 14,393 | | | 24,396 | |

| | | | | | | | | | | | | | | | | |

| Supplemental membership information: | | | | | | | | | | | | | | |

| Medicare Prescription Drug Plan (standalone) | 6,081 | | | | | | | 6,092 | | | | | | | 6,128 | |

The following table summarizes the Health Care Benefits segment’s days claims payable for the respective periods:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | |

| December 31, 2023 | | September 30, 2023 | | June 30, 2023 | | March 31, 2023 | | December 31, 2022 |

Days Claims Payable (7) | 45.9 | | | 50.3 | | | 46.9 | | | 48.1 | | | 51.3 | |

Supplemental Information

(Unaudited)

Health Services segment

The following table summarizes the Health Services segment’s performance for the respective periods:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Change |

| Three Months Ended

December 31, | | Year Ended

December 31, | | Three Months Ended

December 31,

2023 vs 2022 | | Year Ended

December 31,

2023 vs 2022 |

| In millions, except percentages | 2023 | | 2022 | | 2023 | | 2022 | | $ | | % | | $ | | % |

| Revenues: | | | | | | | | | | | | | | | |

| Products | $ | 47,237 | | $ | 43,197 | | $ | 180,608 | | $ | 167,019 | | $ | 4,040 | | | 9.4 | % | | $ | 13,589 | | | 8.1 | % |

| Services | 1,910 | | 572 | | 6,236 | | 2,557 | | 1,338 | | | 233.9 | % | | 3,679 | | | 143.9 | % |

| Net investment income (loss) | (1) | | — | | (1) | | — | | (1) | | | (100.0) | % | | (1) | | | (100.0) | % |

| Total revenues | 49,146 | | 43,769 | | 186,843 | | 169,576 | | 5,377 | | | 12.3 | % | | 17,267 | | | 10.2 | % |

| Cost of products sold | 45,999 | | 41,463 | | 175,424 | | 160,738 | | 4,536 | | | 10.9 | % | | 14,686 | | | 9.1 | % |

| Health care costs | 612 | | — | | 1,607 | | — | | 612 | | | 100.0 | % | | 1,607 | | | 100.0 | % |

Gross profit (8) | 2,535 | | 2,306 | | 9,812 | | 8,838 | | 229 | | | 9.9 | % | | 974 | | | 11.0 | % |

Gross margin (Gross profit as a % of total revenues) (8) | 5.2 | % | | 5.3 | % | | 5.3 | % | | 5.2 | % | | | | | | | | |

| Operating expenses | $ | 825 | | $ | 564 | | $ | 2,970 | | $ | 2,226 | | $ | 261 | | | 46.3 | % | | $ | 744 | | | 33.4 | % |

| Operating expenses as a % of total revenues | 1.7 | % | | 1.3 | % | | 1.6 | % | | 1.3 | % | | | | | | | | |

| Operating income | $ | 1,710 | | $ | 1,742 | | $ | 6,842 | | $ | 6,612 | | $ | (32) | | | (1.8) | % | | $ | 230 | | | 3.5 | % |

| Operating income as a % of total revenues | 3.5 | % | | 4.0 | % | | 3.7 | % | | 3.9 | % | | | | | | | | |

Adjusted operating income (1) | $ | 1,860 | | $ | 1,785 | | $ | 7,312 | | $ | 6,781 | | $ | 75 | | | 4.2 | % | | $ | 531 | | | 7.8 | % |

| Adjusted operating income as a % of total revenues | 3.8 | % | | 4.1 | % | | 3.9 | % | | 4.0 | % | | | | | | | | |

| Revenues (by distribution channel): | | | | | | | | | | | | | | | |

Pharmacy network (9) | $ | 29,668 | | $ | 26,610 | | $ | 112,718 | | $ | 102,968 | | $ | 3,058 | | | 11.5 | % | | $ | 9,750 | | | 9.5 | % |

Mail & specialty (10) | 17,614 | | 16,556 | | 67,992 | | 63,825 | | 1,058 | | | 6.4 | % | | 4,167 | | | 6.5 | % |

| Other | 1,865 | | 603 | | 6,134 | | 2,783 | | 1,262 | | | 209.3 | % | | 3,351 | | | 120.4 | % |

| Net investment income (loss) | (1) | | — | | (1) | | — | | (1) | | | (100.0) | % | | (1) | | | (100.0) | % |

Pharmacy claims processed: (5) (6) (a) | 600.8 | | 600.2 | | 2,344.3 | | 2,335.1 | | 0.6 | | | 0.1 | % | | 9.2 | | | 0.4 | % |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Generic dispensing rate: (6) (11) (b) | 86.2 | % | | 86.4 | % | | 87.6 | % | | 87.4 | % | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

_____________________________________________

(a)Excluding the impact of COVID-19 vaccinations, pharmacy claims processed increased 0.3% and 1.0% on a 30-day equivalent basis for the three months and year ended December 31, 2023, respectively, compared to the prior year.

(b)Excluding the impact of COVID-19 vaccinations, the Health Services segment’s total generic dispensing rate was 87.1% and 87.5% in the three months ended December 31, 2023 and 2022, respectively, and 87.9% and 88.3% in the years ended December 31, 2023 and 2022, respectively.

Supplemental Information

(Unaudited)

Pharmacy & Consumer Wellness segment

The following table summarizes the Pharmacy & Consumer Wellness segment’s performance for the respective periods:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Change |

| Three Months Ended

December 31, | | Year Ended

December 31, | | Three Months Ended

December 31,

2023 vs 2022 | | Year Ended

December 31,

2023 vs 2022 |

| In millions, except percentages | 2023 | | 2022 | | 2023 | | 2022 | | $ | | % | | $ | | % |

| Revenues: | | | | | | | | | | | | | | | |

| Products | $ | 30,534 | | $ | 27,726 | | $ | 113,976 | | $ | 104,878 | | $ | 2,808 | | | 10.1 | % | | $ | 9,098 | | | 8.7 | % |

| Services | 652 | | 989 | | 2,792 | | 3,762 | | (337) | | | (34.1) | % | | (970) | | | (25.8) | % |

| Net investment income (loss) | (1) | | — | | (5) | | (44) | | (1) | | | (100.0) | % | | 39 | | | 88.6 | % |

| Total revenues | 31,185 | | 28,715 | | 116,763 | | 108,596 | | 2,470 | | | 8.6 | % | | 8,167 | | | 7.5 | % |

| Cost of products sold | 24,146 | | 21,651 | | 91,447 | | 82,063 | | 2,495 | | | 11.5 | % | | 9,384 | | | 11.4 | % |

Gross profit (8) | 7,039 | | 7,064 | | 25,316 | | 26,533 | | (25) | | | (0.4) | % | | (1,217) | | | (4.6) | % |

Gross margin (Gross profit as a % of total revenues) (8) | 22.6 | % | | 24.6 | % | | 21.7 | % | | 24.4 | % | | | | | | | | |

| Loss on assets held for sale | $ | — | | $ | 12 | | | $ | 349 | | $ | 2,492 | | | $ | (12) | | | (100.0) | % | | $ | (2,143) | | | (86.0) | % |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Operating expenses | 5,078 | | 5,285 | | 19,618 | | 20,481 | | (207) | | | (3.9) | % | | (863) | | | (4.2) | % |

| Operating expenses as a % of total revenues | 16.3 | % | | 18.4 | % | | 16.8 | % | | 18.9 | % | | | | | | | | |

| Operating income | $ | 1,961 | | $ | 1,767 | | $ | 5,349 | | $ | 3,560 | | $ | 194 | | | 11.0 | % | | $ | 1,789 | | | 50.3 | % |

| Operating income as a % of total revenues | 6.3 | % | | 6.2 | % | | 4.6 | % | | 3.3 | % | | | | | | | | |

Adjusted operating income (1) | $ | 2,027 | | $ | 1,847 | | $ | 5,963 | | $ | 6,531 | | $ | 180 | | | 9.7 | % | | $ | (568) | | | (8.7) | % |

| Adjusted operating income as a % of total revenues | 6.5 | % | | 6.4 | % | | 5.1 | % | | 6.0 | % | | | | | | | | |

| Revenues (by major goods/service lines): | | | | | | | | | | | | | | | |

| Pharmacy | $ | 24,740 | | $ | 21,984 | | $ | 92,111 | | $ | 83,480 | | $ | 2,756 | | | 12.5 | % | | $ | 8,631 | | | 10.3 | % |

| Front Store | 5,861 | | 6,150 | | 22,458 | | 22,780 | | (289) | | | (4.7) | % | | (322) | | | (1.4) | % |

| Other | 585 | | 581 | | 2,199 | | 2,380 | | 4 | | | 0.7 | % | | (181) | | | (7.6) | % |

| Net investment income (loss) | (1) | | — | | (5) | | (44) | | (1) | | | (100.0) | % | | 39 | | | 88.6 | % |

Prescriptions filled (5) (6) (a) | 431.5 | | 423.4 | | 1,649.1 | | 1,625.4 | | 8.1 | | | 1.9 | % | | 23.7 | | | 1.5 | % |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

Same store sales increase (decrease): (12) | | | | | | | | | | | | | | | |

| Total | 11.3 | % | | 7.8 | % | | 10.7 | % | | 9.1 | % | | | | | | | | |

| Pharmacy | 15.5 | % | | 9.1 | % | | 13.6 | % | | 9.5 | % | | | | | | | | |

| Front Store | (3.1) | % | | 3.5 | % | | 0.3 | % | | 7.8 | % | | | | | | | | |

Prescription volume (6) | 4.4 | % | | 3.1 | % | | 3.9 | % | | 4.0 | % | | | | | | | | |

Generic dispensing rate (6) (11) (b) | 86.6 | % | | 85.9 | % | | 88.4 | % | | 87.4 | % | | | | | | | | |

_____________________________________________

(a)Excluding the impact of COVID-19 vaccinations, prescriptions filled increased 2.2% and 2.5% on a 30-day equivalent basis for the three months and year ended December 31, 2023, respectively, compared to the prior year.

(b)Excluding the impact of COVID-19 vaccinations, the Pharmacy & Consumer Wellness segment’s total generic dispensing rate was 88.1% and 87.6% in the three months ended December 31, 2023 and 2022, respectively, and 89.0% in both the years ended December 31, 2023 and 2022.

Supplemental Information

(Unaudited)

Corporate/Other segment

The following table summarizes the Corporate/Other segment’s performance for the respective periods:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | Change |

| Three Months Ended

December 31, | | Year Ended

December 31, | | Three Months Ended

December 31,

2023 vs 2022 | | Year Ended

December 31,

2023 vs 2022 |

| In millions, except percentages | 2023 | | 2022 | | 2023 | | 2022 | | $ | | % | | $ | | % |

| Revenues: | | | | | | | | | | | | | | | |

| Premiums | $ | 10 | | | $ | 10 | | | $ | 48 | | | $ | 56 | | | $ | — | | | — | % | | $ | (8) | | | (14.3) | % |

| Services | 4 | | | 17 | | | 9 | | | 68 | | | (13) | | | (76.5) | % | | (59) | | | (86.8) | % |

| Net investment income | 61 | | | 125 | | | 394 | | | 406 | | | (64) | | | (51.2) | % | | (12) | | | (3.0) | % |

| Total revenues | 75 | | | 152 | | | 451 | | | 530 | | | (77) | | | (50.7) | % | | (79) | | | (14.9) | % |

| Cost of products sold | — | | | 11 | | | 1 | | | 42 | | | (11) | | | (100.0) | % | | (41) | | | (97.6) | % |

| Health care costs | 47 | | | 45 | | | 210 | | | 249 | | | 2 | | | 4.4 | % | | (39) | | | (15.7) | % |

| Restructuring charges | — | | | — | | | 507 | | | — | | | — | | | — | % | | 507 | | | 100.0 | % |

| Opioid litigation charges | — | | | 99 | | | — | | | 5,803 | | | (99) | | | (100.0) | % | | (5,803) | | | (100.0) | % |

| Operating expenses | 592 | | | 605 | | | 2,130 | | | 1,924 | | | (13) | | | (2.1) | % | | 206 | | | 10.7 | % |

| Operating loss | (564) | | | (608) | | | (2,397) | | | (7,488) | | | 44 | | | 7.2 | % | | 5,091 | | | 68.0 | % |

Adjusted operating loss (1) | (336) | | | (466) | | | (1,318) | | | (1,613) | | | 130 | | | 27.9 | % | | 295 | | | 18.3 | % |

Supplemental Information

(Unaudited)

The following table shows the components of the change in the consolidated health care costs payable during the years ended December 31, 2023 and 2022:

| | | | | | | | | | | |

| Year Ended

December 31, |

| In millions | 2023 | | 2022 |

| Health care costs payable, beginning of period | $ | 10,142 | | | $ | 8,678 | |

| Less: Reinsurance recoverables | 5 | | | 8 | |

Less: Impact of discount rate on long-duration insurance reserves (a) | 8 | | | — | |

| Health care costs payable, beginning of period, net | 10,129 | | | 8,670 | |

| Acquisition, net | 1,098 | | | — | |

| | | |

| Add: Components of incurred health care costs | | | |

| Current year | 86,639 | | | 71,399 | |

Prior years (b) | (685) | | | (654) | |

Total incurred health care costs (c) | 85,954 | | | 70,745 | |

| Less: Claims paid | | | |

| Current year | 75,529 | | | 61,640 | |

| Prior years | 9,585 | | | 7,646 | |

| Total claims paid | 85,114 | | | 69,286 | |

| | | |

| Health care costs payable, end of period, net | 12,067 | | | 10,129 | |

| Add: Reinsurance recoverables | 5 | | | 5 | |

Add: Impact of discount rate on long-duration insurance reserves (a) | (23) | | | 8 | |

| Health care costs payable, end of period | $ | 12,049 | | | $ | 10,142 | |

_____________________________________________

(a)Reflects the difference between the current discount rate and the locked-in discount rate on long-duration insurance reserves which is recorded within accumulated other comprehensive loss on the condensed consolidated balance sheets. Refer to Note 1 ‘‘Significant Accounting Policies’’ in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 for further information related to the adoption of the long-duration insurance contracts accounting standard.

(b)Negative amounts reported for incurred health care costs related to prior years result from claims being settled for amounts less than originally estimated.

(c)Total incurred health care costs for the years ended December 31, 2023 and 2022 in the table above exclude $83 million and $79 million, respectively, of health care costs recorded in the Health Care Benefits segment that are included in other insurance liabilities on the condensed consolidated balance sheets and $210 million and $249 million, respectively, of health care costs recorded in the Corporate/Other segment that are included in other insurance liabilities on the condensed consolidated balance sheets.

Adjusted Earnings Per Share Guidance

(Unaudited)