Form 424B3 - Prospectus [Rule 424(b)(3)]

February 06 2024 - 4:15PM

Edgar (US Regulatory)

Filed

Pursuant to Rule 424(b)(3)

Registration No. 333-273308

Prospectus

Supplement No. 5 to Prospectus dated October 17, 2023

Marizyme,

Inc.

Up

to 915,071,257 Shares of Common Stock

This

Prospectus Supplement No. 5 (“Prospectus Supplement No. 5”) relates to the Prospectus of Marizyme, Inc. (“we,”

“us,” “our,” or the “Company”), dated October 17, 2023 (Registration No. 333-268187) (the “Prospectus”),

relating to the resale of up to 915,071,257 shares of common stock, par value $0.001 per share (“common stock”), of the Company

that may be sold from time to time by the selling stockholders named in the Prospectus, which consist of:

| ● | 13,971,324

shares of outstanding common stock held by existing stockholders; |

| | | |

| ● | 221,939,338

shares of common stock issuable upon the conversion of the Company’s outstanding 10%

Secured Convertible Promissory Notes (the “Convertible Notes”), assuming that

all convertible debts and other liabilities under the Convertible Notes are converted into

shares of common stock, without regard to any applicable limitations or restrictions; |

| | | |

| ● | 380,986,336

shares of common stock issuable upon the exercise of the Company’s outstanding Class

C Common Stock Purchase Warrants, without regard to any applicable limitations or restrictions; |

| | | |

| ● | 66,159,434

shares of common stock issuable upon the conversion of the Company’s outstanding 15%

Original Issue Discount Unsecured Subordinated Convertible Promissory Notes (the “OID

Convertible Notes”), assuming that the OID Convertible Notes are held until maturity

and that all convertible debts and other liabilities under the OID Convertible Notes are

converted into shares of common stock, without regard to any applicable limitations or restrictions; |

| | | |

| ● | 84,546,202

shares of common stock issuable upon the exercise of the Company’s outstanding Class

E Common Stock Purchase Warrants, without regard to any applicable limitations or restrictions; |

| | | |

| ● | 80,796,202

shares of common stock issuable upon the exercise of the Company’s outstanding Class

F Common Stock Purchase Warrants, without regard to any applicable limitations or restrictions;

and |

| | | |

| ● | 66,672,421

shares of common stock issuable upon the exercise of the Company’s Placement Agent

Warrants, without regard to any applicable limitations or restrictions. |

Capitalized

terms used in this Prospectus Supplement No. 5 and not otherwise defined herein have the meanings specified in the Prospectus.

This

Prospectus Supplement No. 5 is being filed to include the information in our Current Report on Form 8-K which was filed with the Securities

and Exchange Commission (the “SEC”) on February 6, 2024.

This

Prospectus Supplement No. 5 should be read in conjunction with the Prospectus and Prospectus Supplement No. 1 filed with the SEC on October

24, 2023, Prospectus Supplement No. 2 filed with the SEC on November 16, 2023, Prospectus Supplement No. 3 filed with the SEC on November

22, 2023, and Prospectus Supplement No. 4 filed with the SEC on December 29, 2023 (the “Prior Supplements”) and is qualified

by reference to the Prospectus and the Prior Supplements, except to the extent that the information in this Prospectus Supplement No.

5 supersedes the information contained in the Prospectus and the Prior Supplements, and may not be delivered without the Prospectus and

the Prior Supplements.

Our

common stock is quoted for trading on the OTCQB tier of OTC Markets Group, Inc. (“OTCQB”) under the symbol “MRZM”.

On February 5, 2024, the last reported sale price of our common stock on the OTCQB was $0.10 per share. We have applied to list our common

stock under the symbol “MRZM” on the Nasdaq Capital Market tier operated by The Nasdaq Stock Market LLC. There can be no

guarantee that we will successfully list our common stock on the Nasdaq Capital Market. The registration of the selling stockholders’

resale of the Company’s common stock as described in the Prospectus was not conditioned upon our successful listing on the Nasdaq

Capital Market.

We

are a “smaller reporting company” under applicable federal securities laws and, as such, we have elected to comply with certain

reduced public company reporting requirements for the Prospectus and other filings.

INVESTING

IN OUR SECURITIES INVOLVES A HIGH DEGREE OF RISK. YOU SHOULD CAREFULLY READ AND CONSIDER THE RISKS DESCRIBED IN OR INCORPORATED BY REFERENCE

INTO THE “RISK FACTORS” SECTION ON PAGE 12 OF THE PROSPECTUS.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this Prospectus Supplement No. 5 is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this Prospectus Supplement No. 5 is February 6, 2024.

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): January 31, 2024

MARIZYME,

INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

000-53223 |

|

82-5464863 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

| 555

Heritage Drive, Suite 205, Jupiter, Florida |

|

33458 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

(561) 935-9955

(Registrant’s telephone number, including area code)

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| |

☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| |

☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2

of the Securities Exchange Act of 1934.

Emerging

Growth Company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Not

applicable. |

|

|

|

|

Item

5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of

Certain Officers.

On

January 31, 2024, Julie Kampf gave written notice of her resignation from the board of directors (the “Board”) of Marizyme,

Inc. (the “Company”), effective the same date. As of the same date, the independent director agreement between the Company

and Ms. Kampf, dated as of June 7, 2022, expired in accordance with its terms. Ms. Kampf’s decision to resign from the Board was

not the result of any disagreement relating to the Company’s operations, policies or practices.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, Marizyme, Inc. has duly caused this current report to be signed on its behalf

by the undersigned hereunto duly authorized.

| Date:

February 6, 2024 |

MARIZYME,

INC. |

| |

|

|

| |

By: |

/s/

David Barthel |

| |

|

David

Barthel |

| |

|

Chief

Executive Officer |

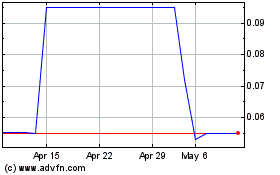

Marizyme (QB) (USOTC:MRZM)

Historical Stock Chart

From Mar 2024 to Apr 2024

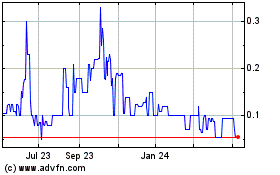

Marizyme (QB) (USOTC:MRZM)

Historical Stock Chart

From Apr 2023 to Apr 2024