false

0000763907

0000763907

2024-02-05

2024-02-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C.

20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): February 5, 2024

First United Corporation

(Exact name of registrant as specified in

its charter)

| Maryland |

|

0-14237 |

|

52-1380770 |

| (State or other jurisdiction of |

|

(Commission file number) |

|

(IRS Employer |

| incorporation or organization) |

|

|

|

Identification No.) |

19 South Second Street, Oakland, Maryland 21550

(Address of principal

executive offices) (Zip Code)

(301) 334-9471

(Registrant’s telephone number, including area code)

N/A

(Former Name or Former

Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant

to Section 12(b) of the Act:

| Title of each class |

Trading Symbols |

Name of each exchange on which registered |

| Common Stock |

FUNC |

Nasdaq Stock Market |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange

Act of 1934 (17 CFR §240.12b-2).

Emerging growth company

¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

INFORMATION TO BE INCLUDED IN THE REPORT

Item 2.02. Results of Operation and Financial Condition.

On February 5, 2024, First United Corporation (the

“Corporation”) issued a press release describing its financial results for the three-

and twelve-month periods ended December 31, 2023. A copy of the press release is furnished herewith as Exhibit 99.1.

The information contained

in this Item 2.02 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended

(the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities

Act”), or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 7.01. Regulation FD Disclosure.

On February 5, 2024, the

Corporation published an investor presentation that discusses certain aspects of its financial results for the three- and twelve- month

periods ended December 31, 2023. A copy of the presentation is furnished herewith as Exhibit 99.2.

The information contained

in this Item 7.01 shall not be deemed “filed” for purposes of Section 18 of the Exchange Act or incorporated by reference

in any filing under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

The exhibits filed or furnished with this report

are listed in the following Exhibit Index:

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

FIRST UNITED CORPORATION |

| |

|

|

| |

|

|

| |

|

|

| Dated: February 5, 2024 |

By: |

/s/ Tonya K. Sturm |

| |

|

Tonya K. Sturm |

| |

|

Senior Vice President & CFO |

Exhibit 99.1

FIRST UNITED CORPORATION ANNOUNCES

FOURTH QUARTER 2023 EARNINGS

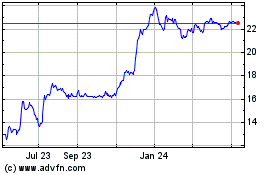

OAKLAND, MARYLAND—February 5, 2024: First

United Corporation (NASDAQ: FUNC), a bank holding company and the parent company of First United Bank & Trust (the “Bank”),

today announced earnings results for the three- and twelve-month periods ended December 31, 2023. For the year ended December 31, 2023,

consolidated net income was $15.1 million, or $2.25 per basic share and $2.24 per diluted share, compared to $25.0 million, or $3.77 per

basic share and $3.76 per diluted share, for the year ended December 31, 2022.

According to Carissa Rodeheaver, Chairman, President

and CEO, “2023 was a challenging year as we experienced industry turmoil, the impact of the rapidly increased rate environment and

strong deposit competition. Despite these challenges, we were able to limit the impact to our margin, achieve strong loan growth, maintain

strong asset quality and execute several strategic items. In the fourth quarter, we accomplished a balance sheet restructuring and announced

the consolidation of our branch network. While these strategies had a short-term impact on our fourth quarter and year-to-date earnings,

they position us well for greater efficiency and more positive ongoing future earnings. I am proud of our associates and their continued

commitment to providing customized financial solutions to our clients resulting in a strong 2023 total shareholder return of 23.6%.”

Our team has successfully assisted our customers in navigating this volatile and unpredictable financial environment.”

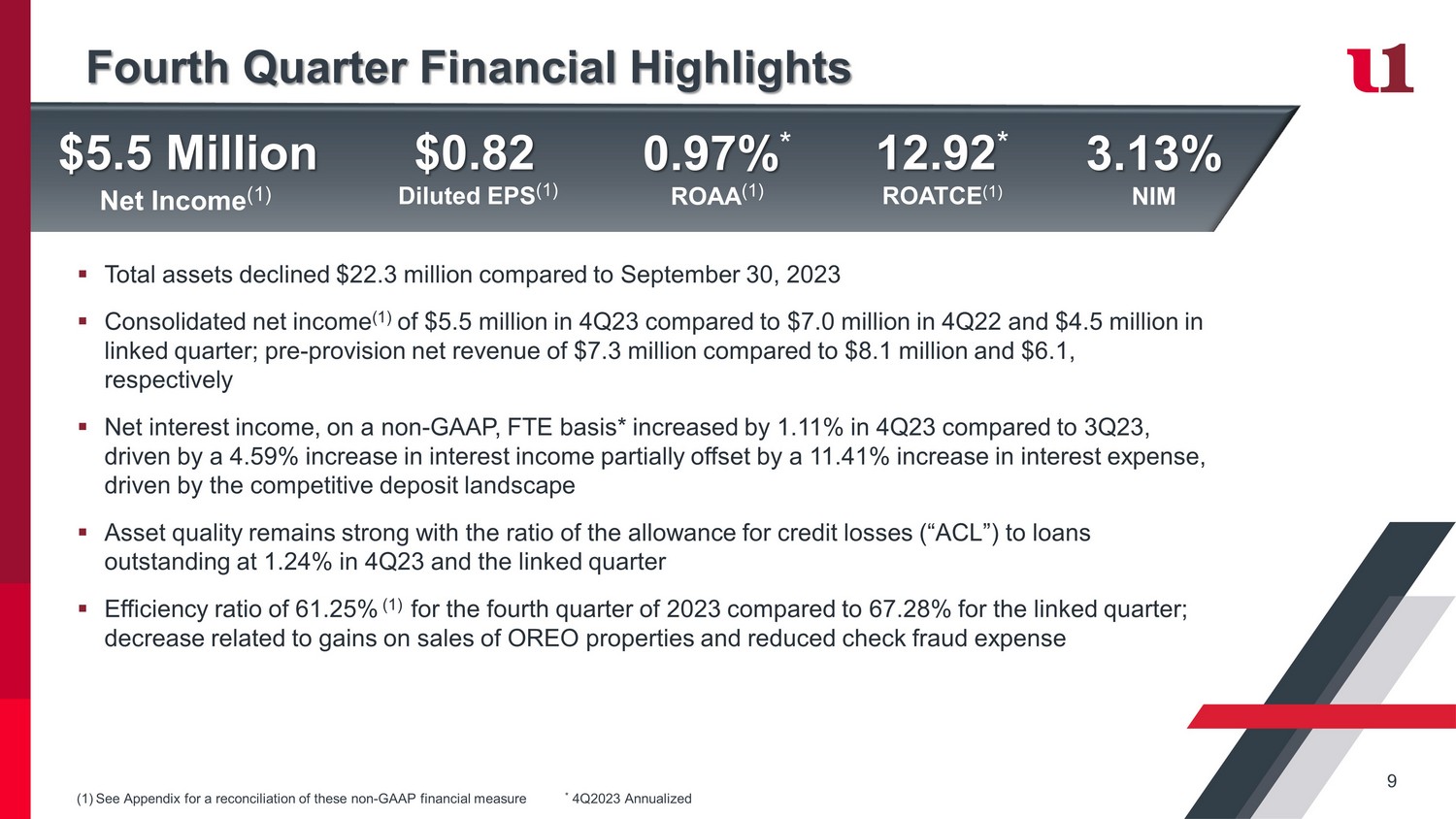

Fourth Quarter Financial Highlights:

| · | Total assets at December 31, 2023 decreased by $22.3 million, or 1.2%, when compared to September 30,

2023 and increased by $57.7 million, or 3.1%, when compared to December 31, 2022. Significant changes during the fourth quarter included: |

| o | Cash balances decreased by $30.9 million when compared to September 30, 2023 and by $24.6 million when

compared to December 31, 2022. |

| o | Investment securities decreased by $18.6 million when compared to September 30, 2023, and by $50.1 million

when compared to December 31, 2022. During the fourth quarter of 2023, the Bank made a strategic decision to restructure its balance sheet

and sold available-for-sale (“AFS”) investment securities totaling $20.4 million with a book value of $24.6 million, resulting

in pretax loss of $4.2 million and an after-tax loss of $3.2 million. |

| o | Gross loans increased by $26.6 million when compared to September 30, 2023 and by $127.2 million when

compared to December 31, 2022, as: |

| § | commercial balances increased by $19.6 million during the fourth quarter and by $70.5 million when compared

to December 31, 2022; |

| § | residential mortgage balances increased by $8.2 million during the fourth quarter and by $55.5 million

when compared to December 31, 2022; and |

| § | consumer loans decreased by $1.2 million during the fourth quarter and increased by $1.2 million when

compared to December 31, 2022. |

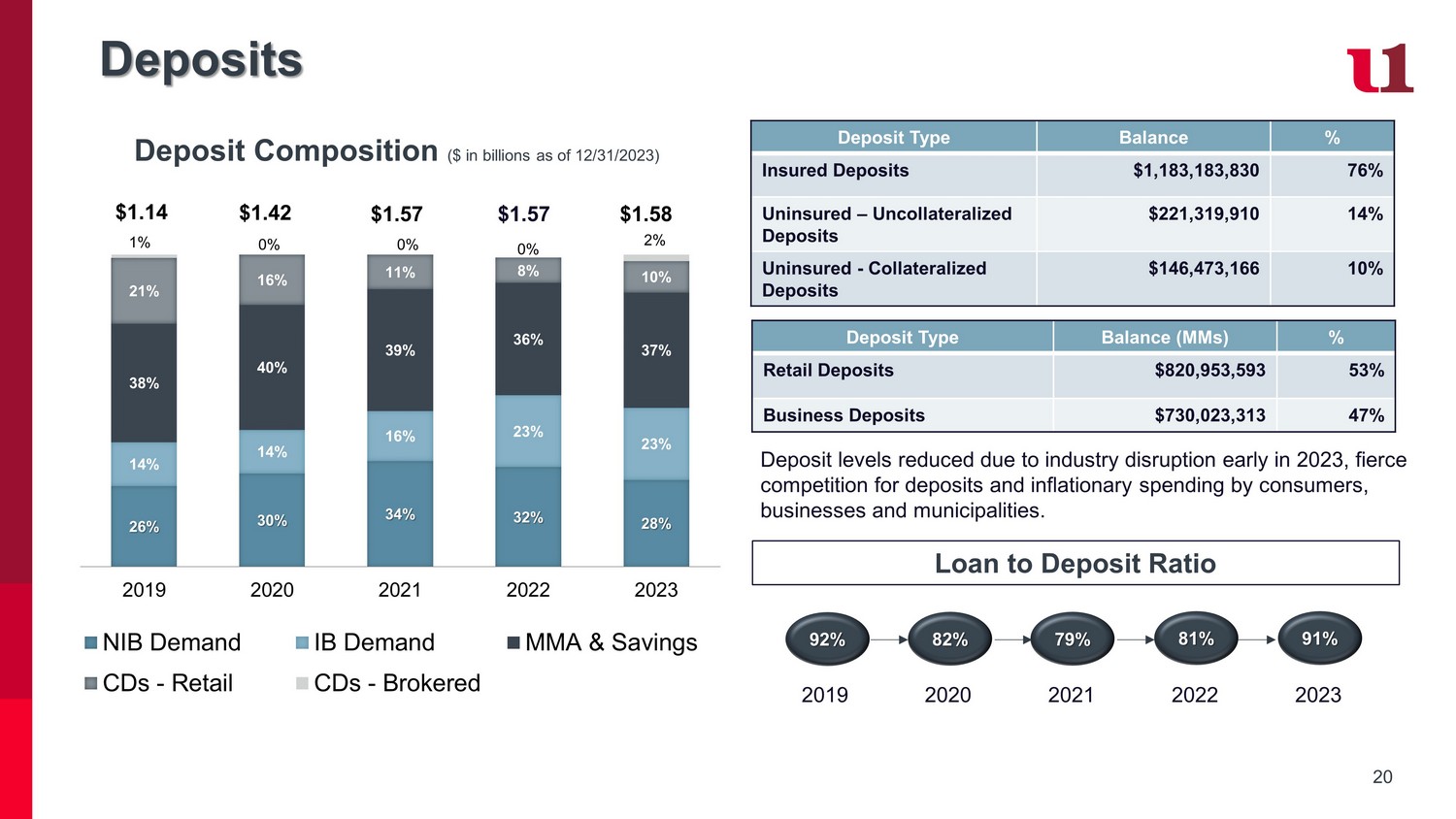

| o | Deposits decreased by $24.1 million when compared to September 30, 2023 and by $19.8 million when compared

to December 31, 2022. The Corporation had brokered deposits of $30.0 million as of December 31, 2023 compared to $60.7 million as of September

30, 2023. There were no brokered deposits at December 31, 2022. |

| o | Short-term borrowings decreased by $7.9 million when compared to September 30, 2023 and by $19.1 million

when compared to December 31, 2022. The decrease in quarterly balances was due primarily to seasonal fluctuations of municipal customer

balances in overnight investment sweep products. The decrease from December 31, 2022 was primarily related to one large municipal customer

moving approximately $12.0 million in funds from an overnight investment sweep product to a non-interest-bearing deposit product as well

as regular fluctuations in other municipal customer balances. |

| · | For the fourth quarter of 2023, consolidated net income, on a non-GAAP basis was $1.8 million, inclusive

of a $3.3 million, net of tax, securities loss and $0.5 million, net of tax, of accelerated depreciation and lease termination expenses

related to the announcement of the closure of four branches in February 2024. |

| o | Net interest margin, on a non-GAAP, fully tax equivalent (“FTE”) basis, was 3.26% for the

year ended December 31, 2023, compared to 3.56% for year ended December 31, 2022. |

| o | Net interest margin, on a non-GAAP, FTE basis, was 3.13% for the fourth quarter of 2023 compared to 3.12%

for the third quarter of 2023 and 3.63% for the fourth quarter of 2022. |

| o | Non-interest income, excluding net gains and losses, remained stable in the fourth quarter of 2023 when

compared to the third quarter of 2023 and increased by $0.3 million when compared to the fourth quarter of 2022 due to increases in wealth

management income and debit card proceeds. |

| o | Non-interest expense decreased by $0.5 million when compared to the third quarter of 2023. This decrease

was a result of a decrease of $0.5 million in net other real estate owned (“OREO”) expenses due to gains on sales of properties

during the quarter, and a decrease of $0.6 million in salaries and benefits, related to reduced health insurance costs and reversal of

accrued executive performance-based incentives. These reductions were offset by a $0.6 million increase in occupancy and equipment costs

related to the acceleration of depreciation expense and lease termination expenses associated with the branch closures. When compared

to the fourth quarter of 2022, non-interest expenses increased by $0.7 million. This increase was primarily due to the $0.6 million increase

in occupancy and equipment costs related to the branch closures, a $0.2 million increase in salaries and benefits as a result of increased

salary expense related to new hires during 2023, increased health insurance costs offset by reductions in executive incentives, a $0.3

million increase in employee benefit plan expense, and a $0.2 million increase in marketing expenses. These increases were partially offset

by a decrease of $0.6 million in net OREO expenses due to the recognition of gains on sales of properties during the fourth quarter of

2023. |

Income Statement Overview

On

a GAAP basis, net income was $1.8 million, inclusive of a $3.3 million, net of tax, loss on the sale of securities and $0.5 million, net

of tax, accelerated depreciation and lease termination expenses related to the branch closures, for the fourth quarter of 2023 compared

to $7.0 million for the fourth quarter of 2022 and $4.5 million for the third quarter of 2023. Basic and diluted net income was $0.82

per share, non-GAAP, and $0.26 per share, GAAP, for the fourth quarter of 2023, compared to basic net income of $1.05 per share and diluted

net income of $1.04 per share for the fourth quarter of 2022 and $0.67 per share for the third quarter of 2023. Exclusive of these

items, net income was $5.5 million on a non-GAAP basis.

The decrease in quarterly net income, year-over-year,

was primarily driven by a restructuring of the investment portfolio leading to the recognition of a $3.3 million, net of tax, loss in

the fourth quarter of 2023 and $0.5 million, net of tax, accelerated depreciation and lease termination expenses related to the branch

closures. Additionally, net interest income decreased by $1.0 million year-over-year as a result of the lower net interest margin. Interest

expense increased by $5.8 million year-over-year, which was partially offset by an increase in interest income of $4.8 million. The provision

for credit losses was $0.4 million for the fourth quarter of 2023 compared to a credit to the provision of $0.7 million for the fourth

quarter of 2022. Salaries and employee benefits increased by $0.2 million due to an increase of $0.1 million in health insurance costs,

as well as increased salary expense for new hires, merit increases effective April 1, 2023, partially offset by decreases in executive

incentives and stock compensation. Occupancy and equipment expenses increased by $0.6 million primarily related to the increased expenses

recognized in conjunction with the announced branch closures. Data processing expenses increased by $0.1 million, FDIC premiums increased

by $0.1 million and miscellaneous expenses increased by $0.2 million primarily attributable to increased employee benefit plan expense.

When compared to the third quarter of 2023, net

income decreased by $2.8 million due primarily to $3.3 million, net of tax, in recognized losses from the restructuring of the investment

portfolio during the fourth quarter, as previously discussed. Net interest income for the three months ended December 31, 2023 increased

by $0.2 million driven by an increase in interest income of $1.0 million, partially offset by an increase of $0.8 million in interest

expense. Provision for credit losses increased by $0.2 million due to the continued strong loan growth, which was partially offset by

the continued strong credit quality of our loan portfolio and decreased historical loss factors. Gains on the sale of residential mortgages

decreased by $0.1 million in the fourth quarter as we experienced a seasonal decline in the mortgage pipeline. Other operating income,

including debit card income and trust and brokerage fees, increased by $0.1 million quarter-over-quarter. Operating expenses decreased

by $0.5 million. Net OREO expenses decreased by $0.5 million due to gains on sales of OREO properties recognized in the fourth quarter

of 2023. Salaries and employee benefits decreased by $0.6 million primarily due to decreases in incentive compensation and health insurance

costs during the quarter. These decreases were partially offset by an increase in occupancy and equipment expenses of $0.6 million due

to increased expenses recognized in conjunction with the announced branch closures as discussed earlier.

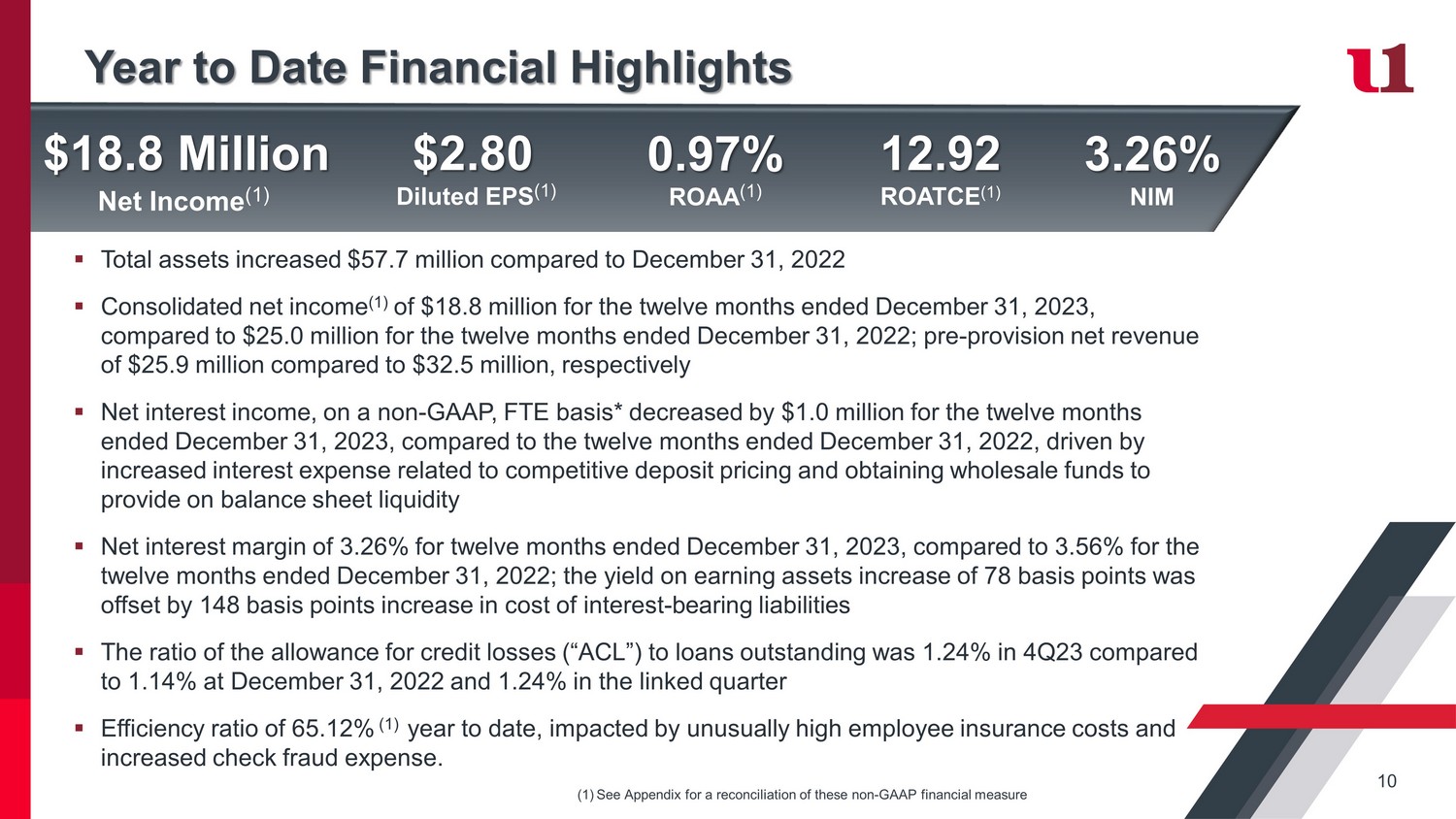

For the year ended December 31, 2023, net income

was $15.1 million on a GAAP basis, inclusive of a $3.3 million, net of tax, loss on the sale of securities and $0.5 million, net of tax,

in increased expenses related to the branch closures, and $18.8 million on a non-GAAP basis compared to GAAP and non-GAAP basis income

of $25.0 million in 2022. The year-over-year $9.9 million decrease in GAAP net income was driven by an increase in total operating expenses

of $7.1 million. Salaries and employee benefits increased by $3.4 due primarily to increased salary expense of $2.0 million related to

new hires, the competitive environment for labor and merit increases effective April 1, 2023, increased health insurance costs of $1.0

million associated with unusually high claims and decreases of $0.4 in deferred loan costs. Occupancy and equipment expense increased

by $0.7 million due primarily to accelerated depreciation and lease termination expenses associated with the announced branch closures,

data processing expense increased by $0.5 million due to the implementation of new technology, and FDIC assessments increased by $0.4

million. Other miscellaneous expenses, such as loan service fees, dues and licenses, check fraud expenses, employee benefit plan expense,

and miscellaneous expenses increased by $2.0 million and professional fees increased by $0.6 million due to the $0.8 million cash receipt

related to reimbursement of litigation expenses that was credited to expenses in 2022. Provision for credit losses increased by $2.2 million

when compared to prior year due to increased loan growth during 2023 and qualitative factors with the implementation of Accounting Standards

Update 2016-13: Financial Instruments- Credit Losses (“CECL”). Net losses on AFS securities increased by $4.2 million when

compared to prior year due to the sale of securities in the fourth quarter of 2023. Net interest income decreased by $0.8 million due

to compression of the net interest margin as experienced industry-wide during 2023. These increases were partially offset by increases

in gains on sales of mortgages of $0.3 million, service charges on deposit accounts of $0.2 million, and $0.1 million increase in debit

card income. Income taxes were down by $3.7 million when comparing the two periods due primarily to reductions in pre-tax income.

Net Interest Income and Net Interest Margin

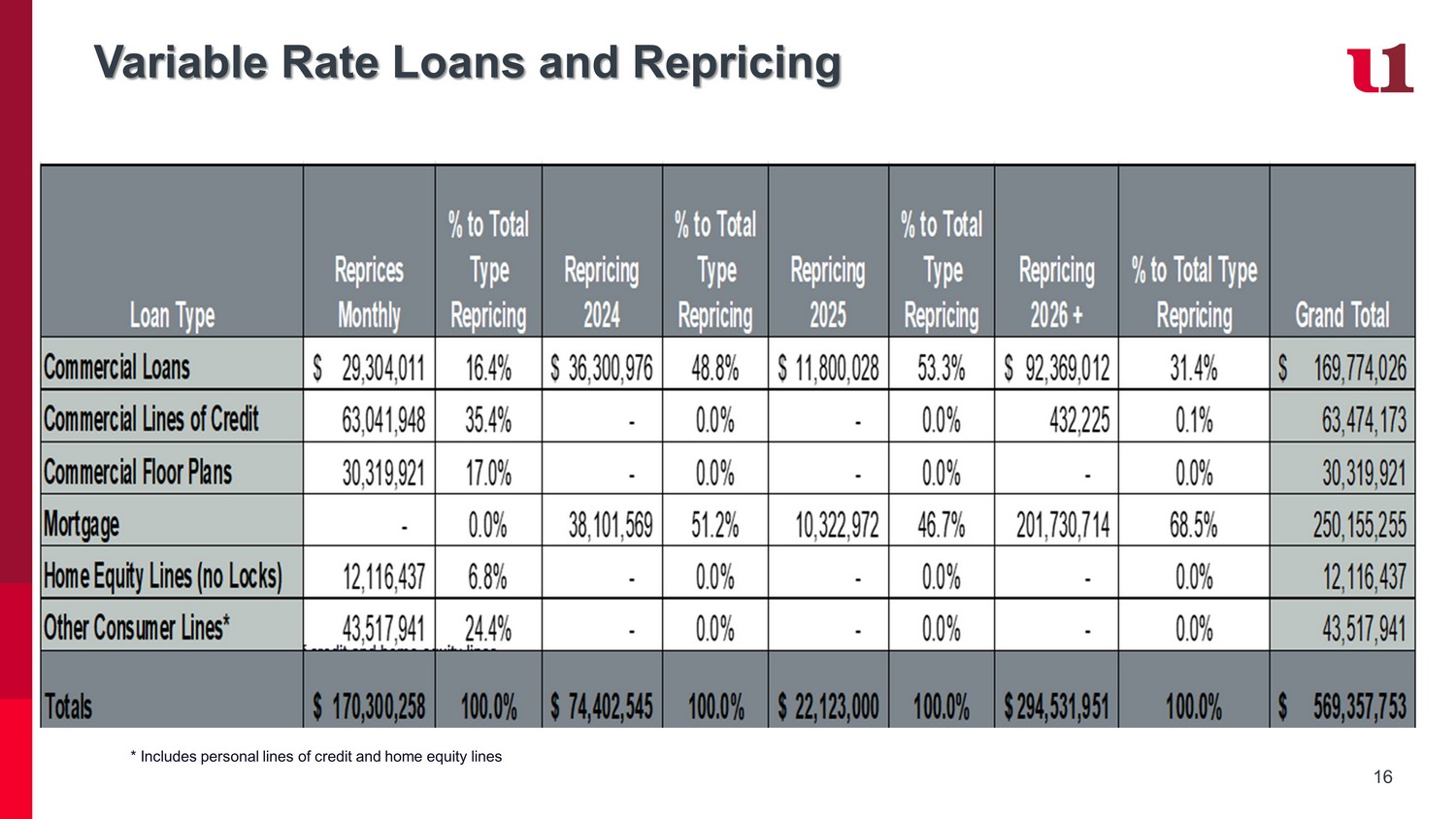

Net interest income, on a non-GAAP, FTE basis,

decreased by $1.2 million for the fourth quarter of 2023 when compared to the fourth quarter of 2022. This decrease was driven by an increase

of $5.8 million in interest expense due to an increase of 160 basis points on interest paid on deposit accounts as well as an increase

of $85.6 million in average balances of interest-bearing deposit accounts when compared to the same period of 2022. Increased deposit

pricing resulted from the continued pressure on deposits as well as a shift in the deposit portfolio mix from non-interest-bearing deposits

to interest-bearing accounts including the Insured Cash Sweep (“ICS”) product to ensure full FDIC insurance coverage. Interest

income increased by $4.7 million. Interest income on loans increased by $4.2 million due to the increase of 80 basis points in overall

yield on the loan portfolio as new loans were booked at higher rates as well as adjustable-rate loans repricing in correlation to the

rising rate environment and an increase in average balances of $116.4 million. Investment income decreased by $0.3 million primarily due

to a decrease of $22.5 million in average balances as the Corporation made the strategic decision to reinvest cash proceeds from the investment

restructure and other principal paydowns of its investments in higher yielding loans. The net interest margin for the three months ended

December 31, 2023 was 3.13% compared to 3.63% for the three months ended December 31, 2022.

Comparing the fourth quarter of 2023 to the third

quarter of 2023, net interest income, on a non-GAAP, FTE basis, increased by $0.2 million This increase was driven by an increase of $1.0

million in interest income offset by a $0.8 million increase in interest expense. Interest income on loans increased by $1.2 million related

to an overall increase of 22 basis points in yield as well as an increase of $34.6 million in average loan balances. Interest expense

on deposits increased by $0.8 million due to an increase of 21 basis points in the average rate paid and an increase in average deposit

balances of $39.3 million during the quarter. The increase in deposits was primarily driven by the increase of $47.9 million in money

market accounts, which was partially offset by a $12.3 million decrease in savings accounts as customers moved deposit balances into a

higher-yielding money market products. Additionally, brokered deposits decreased by an average balance of $12.8 million quarter-over-quarter,

as $30.1 million of brokered deposits matured in December 2023.

Comparing the year ended December 31, 2023 to

the year ended December 31, 2022, net interest income, on a non-GAAP, FTE basis, decreased by $1.1 million. Interest expense on deposits

increased by $16.0 million due to an increase in balances of $120.3 million and an increase in yield of 141 basis points. Interest expense

on long-term borrowings increased $3.5 million related to $80.0 million in Federal Home Loan Bank (“FHLB”) borrowings obtained

during the first quarter of 2023 and an increase in interest rates on variable rate trust preferred borrowings. The increased interest

expense resulted in an overall increase of 151 basis points on interest bearing liabilities. This increase was partially offset by an

increase of $18.4 million in interest income. The yield on earning assets increased 78 basis points to 4.63% in 2023 compared to 3.85%

in 2022 in correlation with the rising interest rate environment, new loans booked at higher rates as well as adjustable rate loans repricing.

The net margin was 3.26% in 2023 compared to 3.56% in 2022.

Non-Interest Income

Other operating income, including net (losses)/gains,

for the fourth quarter of 2023 decreased by $3.9 million when compared to the same period of 2022. The Corporation recognized $4.2 million

in losses related to the sale of AFS securities in the fourth quarter of 2023. Management executed the balance sheet restructuring to

reinvest lower-yielding securities to fund its strong loan demand which is expected to increase the yield on earning assets in future

quarters. These losses were partially offset by increases in service charges, wealth management income, and gains on sales of mortgages.

On a linked quarter basis, other operating income,

including net (losses)/gains, decreased by $4.3 million due primarily to the $4.2 million in losses related to the sale of AFS securities

as discussed above. In addition, gains on sales of residential mortgages decreased $0.1 million compared to the prior quarter. These decreases

were partially offset by an increase of $0.1 million in wealth management income and an increase of $0.1 million in debit card income.

Other operating income for the year ended December

31, 2023 decreased by $3.6 million when compared to 2022. The $4.2 million loss related to the sale of AFS securities in 2023 was partially

offset by a $0.2 million increase in service charges on deposit accounts, $0.1 million increase in wealth management income, and $0.3

million increase in gains on sales of residential mortgages.

Non-Interest Expense

Operating expenses increased by $0.7 million when

comparing the fourth quarter of 2023 to the fourth quarter of 2022. Occupancy and equipment expenses increased by $0.6 million related

to depreciation and lease termination expenses recognized in conjunction with announced branch closures. Salaries and employee benefits

increased by $0.2 million, marketing expenses increased by $0.2 million, FDIC premiums increased by $0.1 million, data processing expenses

increased by $0.1 million, and miscellaneous expenses increased by $0.2 million. These increases were partially offset by a $0.6 million

decrease in net OREO expenses due to gains from sales of OREO recognized during 2023.

Comparing

the fourth quarter of 2023 to the third quarter of 2023, operating expenses decreased by $0.5 million. This decrease was primarily

attributable to a $0.5 million decrease in net OREO expenses due to gains recognized in the sale of OREO properties during the fourth

quarter of 2023 and a $0.6 million decrease in salaries and employee benefits due to decreased incentive compensation and health insurance

costs. These decreases were partially offset by a $0.5 million increase in occupancy and equipment expense primarily related to depreciation

and lease termination expenses recognized in conjunction with the announced branch closures.

For

the year ended December 31, 2023, non-interest expenses increased by $7.1 million when compared to the year ended December 31, 2022. Salaries

and employee benefits increased by $3.4 due primarily to increased salary expense of $2.0 million related to new hires, the competitive

environment for labor and merit increases effective April 1, 2023, increased health insurance costs of $1.0 million associated with unusually

high claims and decreases of $0.4 in deferred loan costs. Occupancy and equipment expense increased by $0.7 million due to the expenses

related to the branch closures, data processing expense increased by $0.5 million as a result of the implementation of a new sales management

system, and FDIC assessments increased by $0.4 million. Professional fees increased by $0.6 million related to increased audit expenses

in correlation to the new CECL implementation and increased legal and professional expenses due to the receipt of an $0.8 million in proceeds

credited to expense in 2022. Other miscellaneous expenses increased by $2.0 million primarily driven by increased check fraud related

expenses of $0.5 million, increased employee benefit costs of $1.1 million, increased escrow account fees due to the rising rate environment,

miscellaneous loan fees and an increase of $0.2 million in fees associated with the ICS product.

The effective income tax rates as a percentage

of income for the years ended December 31, 2023 and December 31, 2022 were 22.7% and 24.5%, respectively. The decrease in the tax rate

for the 2023 period was primarily related to a new low-income housing tax credit investment in 2022 that began generating tax credits

during the fourth quarter of 2022. This tax credit will continue through 2032.

Balance Sheet Overview

Total assets at December 31, 2023 were $1.9 billion,

representing a $57.7 million increase since December 31, 2022. During 2023, cash and interest-bearing deposits in other banks decreased

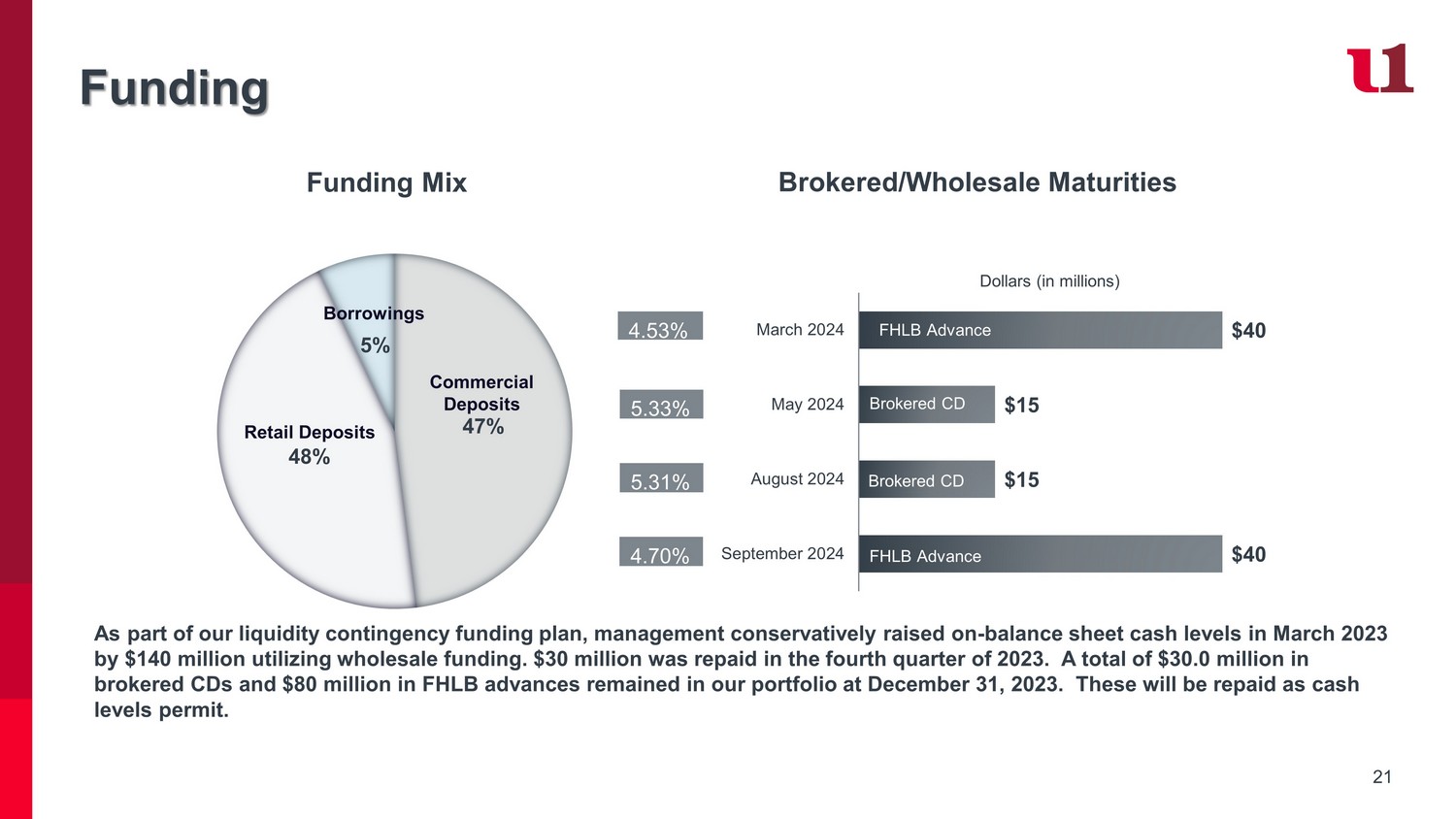

by $24.6 million. In the first quarter of 2023, management made the strategic decision to obtain $61.1 million in brokered certificates

of deposit and $80.0 million in FHLB borrowings to strengthen on-balance sheet liquidity in light of the disruption in the banking industry.

$30.0 million of the brokered deposits were repaid in September 2023 and during the third quarter, in anticipation of increasing rates,

management pre-funded the $30.7 million of brokered deposits set to mature and be repaid in the fourth quarter of 2023 at the same rate

in order to maintain cash balances and control interest expense. Total brokered deposits outstanding at December 31, 2023 were $30.0 million.

The investment portfolio decreased by $50.1 million

since December 31, 2022 driven by management’s strategic decision to restructure the balance sheet in the fourth quarter by selling

$20.4 million of AFS securities and investing the proceeds into higher yielding loans for future earnings growth. Also in the third quarter

of 2023, management opted to redeem a $17.8 million tax increment bond (“TIF”) at par to boost liquidity. Loans increased

by $127.2 million since December 31, 2022 due primarily to growth in the commercial and residential mortgage portfolios. Premises and

equipment decreased by $3.5 million primarily due to accelerated depreciation related to announced branch closures. Other assets, including

bank owned life insurance (“BOLI”) and deferred tax assets, increased by $7.0 million during 2023, as pension assets increased

by $3.2 million, deferred tax assets increased by $1.3 million, and BOLI increased by $1.3 million.

Total liabilities at December 31, 2023 were $1.7

billion, representing a $47.6 million increase since December 31, 2022. Total deposits decreased by $19.8 million since December 31, 2022.

Interest-bearing demand deposits and money market accounts increased by $23.2 million and $20.5 million, respectively, due to a shift

in the deposit portfolio mix from non-interest-bearing deposits to interest-bearing accounts including the ICS product to ensure full

FDIC insurance coverage, where balances grew by approximately $104.0 million. These increases were offset by decreases in non-interest-bearing

deposits of $78.9 million and savings accounts of $59.5 million as we saw businesses and consumers utilizing cash due to the rising rate

and inflationary environment. Total certificates of deposit increased by $75.0 million primarily due to an increase of $30.0 million in

brokered certificates of deposits and $45.0 million in retail certificates of deposit. Short-term borrowings decreased by $19.1 million

since December 31, 2022 primarily due to one municipal customer moving funds from an overnight investment product to a non-interest bearing

deposit product in 2023 as well as regular fluctuations in municipal deposit balances. Long-term borrowings increased by $80.0 million

in 2023 when compared to December 31, 2022 due to the acquisition of $80.0 million in FHLB borrowings in the first quarter of 2023.

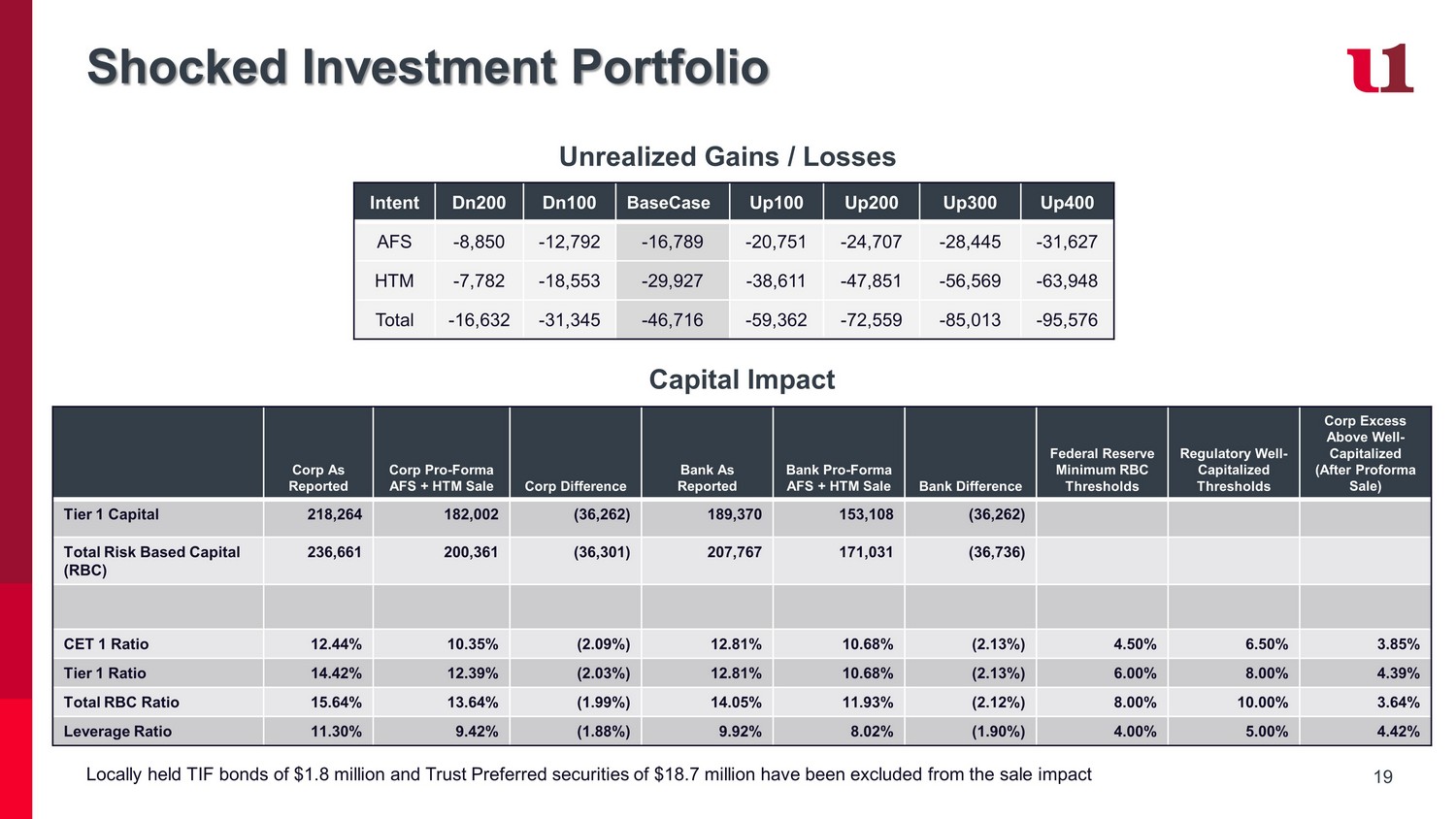

Total AFS and held-to-maturity (“HTM”)

securities totaled $311.5 million at December 31, 2023, representing a $50.1 million decrease compared to December 31, 2022. In the third

quarter of 2023, management elected to redeem $17.8 million from a non-rated municipal TIF bond at par. During December of 2023, management

made a strategic decision to restructure the balance sheet by selling sold available-for-sale (“AFS”) investment securities

totaling $20.4 million with a book value of $24.6 million, resulting in an after-tax loss of $3.2 million. The securities had a weighted

average book yield of approximately 1.3% and a weighted average life of approximately 6.65 years. The proceeds from the sale will be used

to fund loans with a conservative approximate average rate of 7.85%. The Bank projects that the earn-back period will be approximately

3.3 years. Additional decreases in the investment portfolio were primarily related to normal principal amortization. Proceeds from sales

and principal amortization during 2023 were used primarily to enhance on-balance sheet liquidity and to fund loan growth throughout the

year.

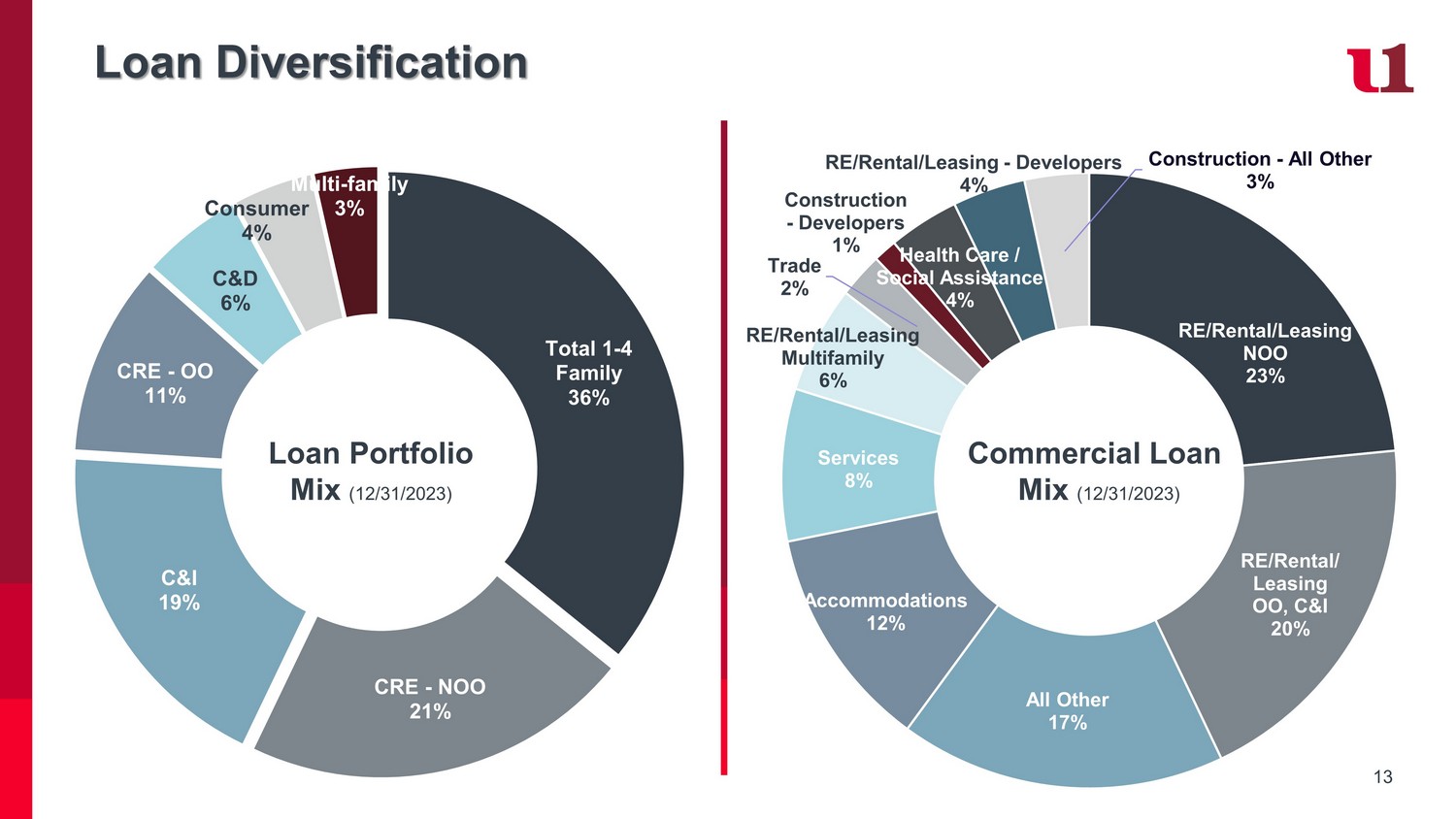

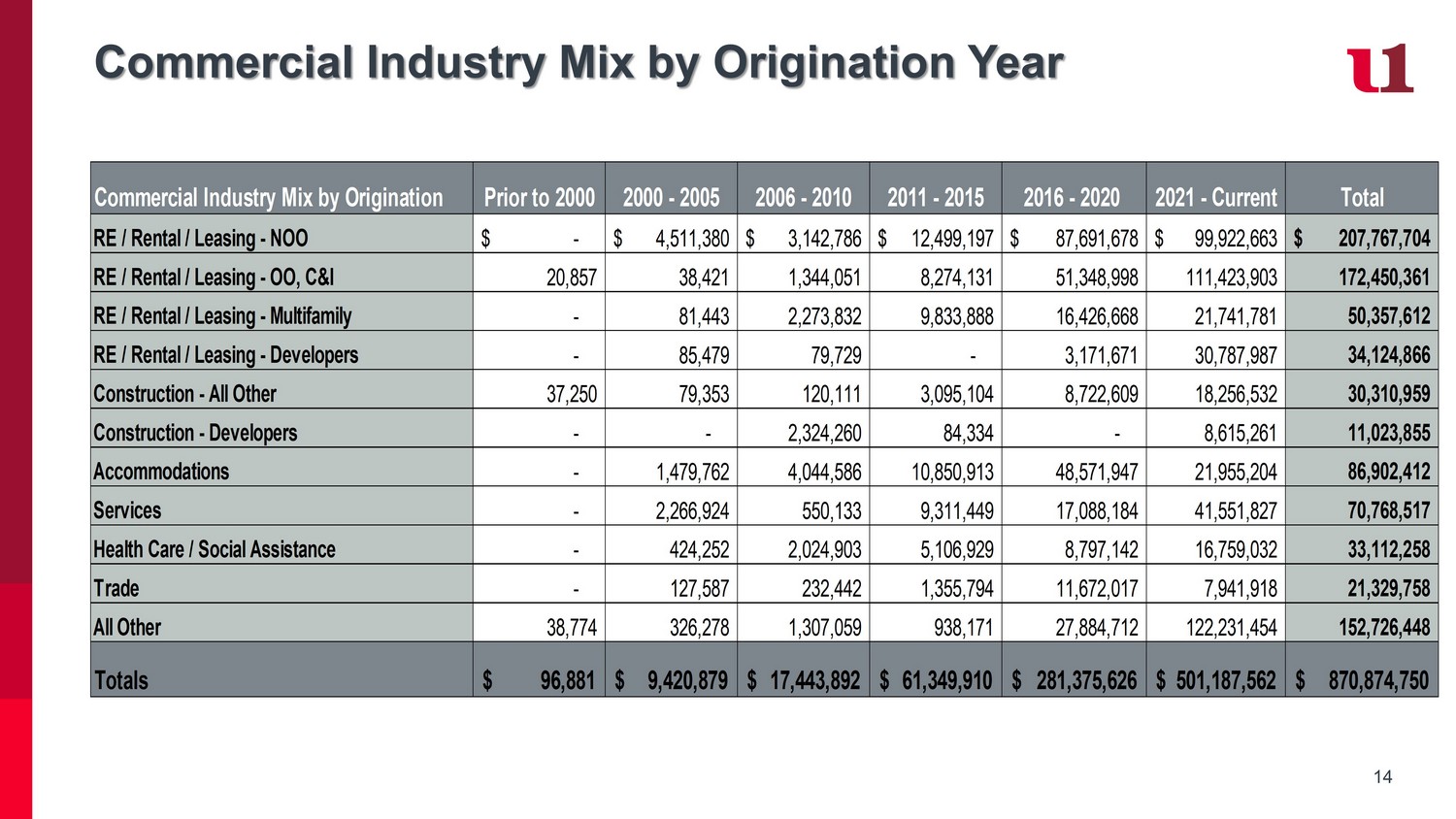

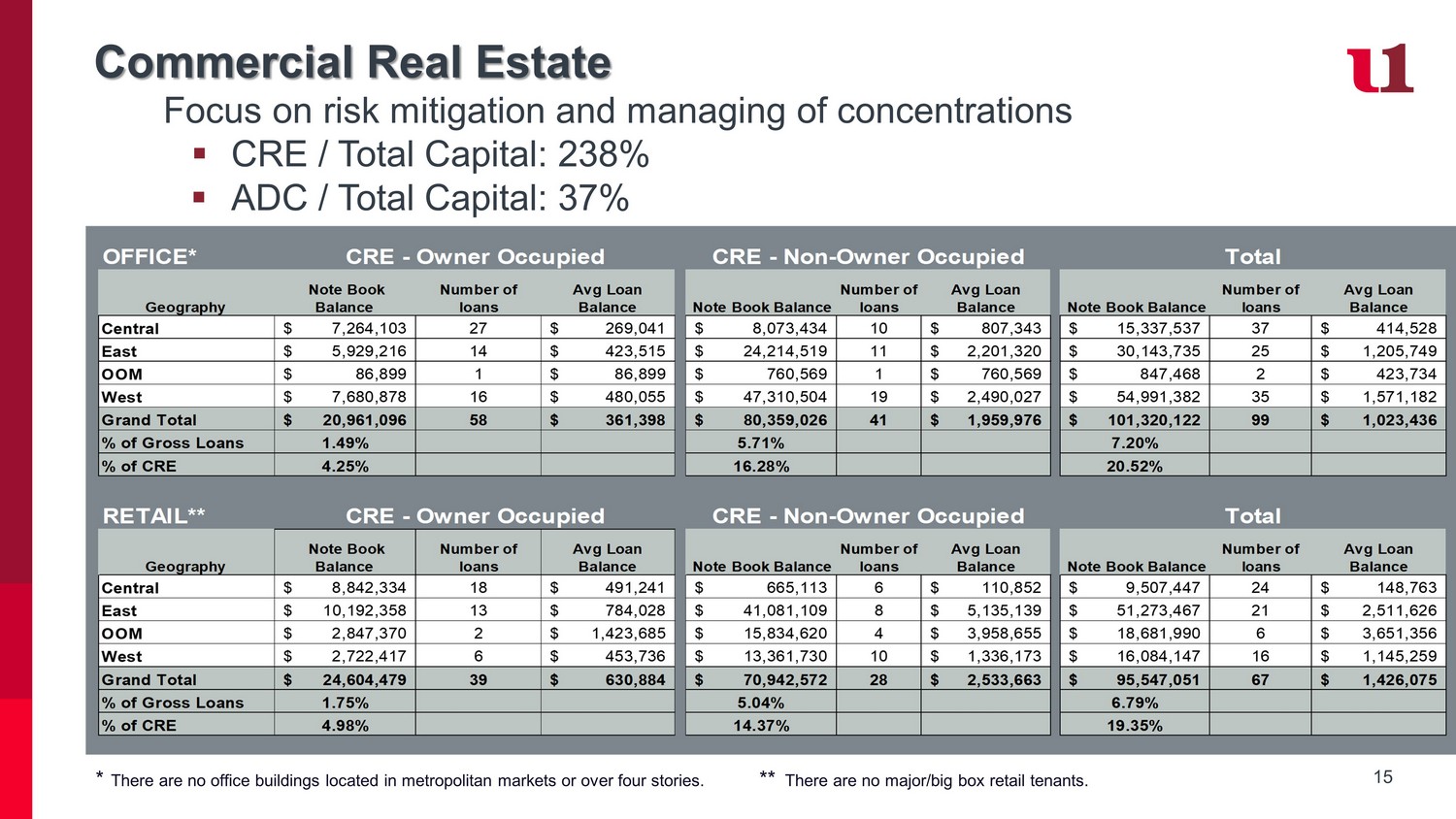

Outstanding loans of $1.4 billion at December

31, 2023 reflected growth of $127.2 million in 2023. Since December 31, 2022, commercial real estate loans increased by $34.9 million,

acquisition and development loans increased by $6.5 million and commercial and industrial loans increased by $29.2 million. Growth in

the commercial portfolios was driven by increased activity with existing clients as well as cultivating new business relationships. Residential

mortgage loans increased $55.5 million related to management’s strategic decision to book new mortgage loans at higher rates to

our in-house portfolio. The consumer loan portfolio increased slightly by $1.2 million.

New commercial loan production for the three months

ended December 31, 2023 was approximately $36.3 million. The pipeline of commercial loans as of December 31, 2023 was approximately

$22.0 million. At December 31, 2023, unfunded, committed commercial construction loans totaled approximately $29.6 million. Commercial

amortization and payoffs were approximately $151.6 million through December 31, 2023 due primarily to pay-offs of short-term commercial

loans as well as normal amortizations of the commercial loan portfolio.

New residential mortgage loan production for the

fourth quarter of 2023 was approximately $17.8 million, with most of this production comprised of in-house loans. The pipeline of

in-house, portfolio loans as of December 31, 2023 was $7.0 million. The residential mortgage production level declined in the fourth quarter

of 2023 due to the increasing interest rates and seasonality of this line of business. Unfunded commitments related to residential construction

loans totaled $17.6 million on December 31, 2023. Beginning in the second quarter of 2023, management began shifting more activity towards

the secondary market.

Total deposits at December 31, 2023 decreased

by $19.8 million when compared to December 31, 2022. In March 2023, the Corporation obtained $61.1 million in new brokered deposits. In

August 2023, the Corporation obtained $30.0 million of brokered deposits to pre-fund the maturity of a $30.4 million brokered certificate

of deposit that matured in September 2023. In December 2023, $30.6 million in brokered deposits matured and were repaid. In addition,

retail certificates of deposit increased by $45.0 million due primarily to a promotional nine-month certificate of deposit product offered

in 2023. Interest-bearing demand deposits increased by $23.2 million and money market accounts increased by $20.5 million due to a shift

in the deposit portfolio mix from non-interest-bearing accounts to interest-bearing accounts including the ICS product to ensure full

FDIC insurance. These increases were offset by decreases in non-interest-bearing deposits of $78.9 million and savings accounts of $59.5

million due to the shift to interest-bearing demand deposit accounts, two relationships having large, planned deposit withdrawals totaling

$39.5 million during 2023 to fund business activity, the effects of consumer and commercial spending and the competitive market for deposits.

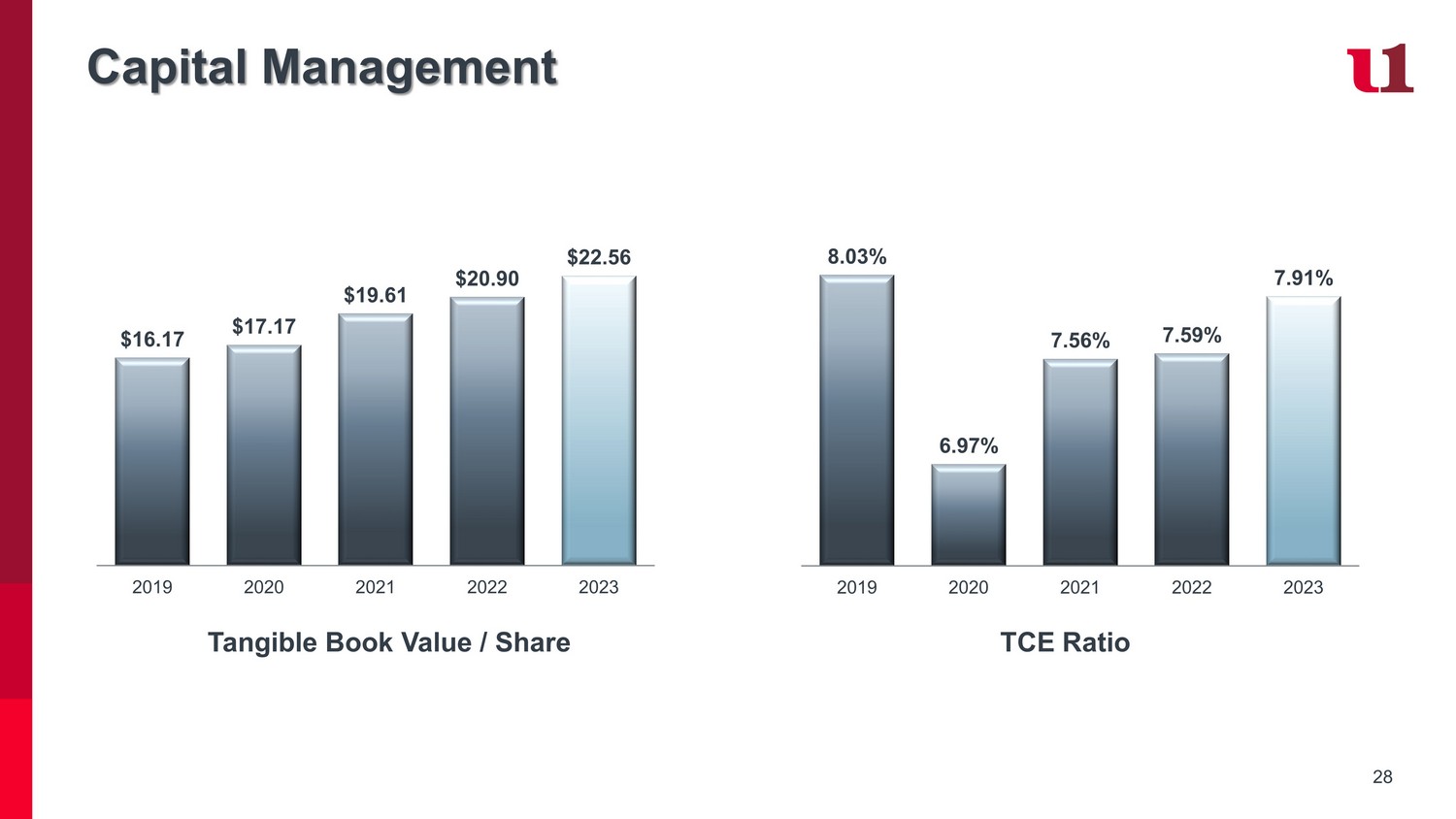

The book value of the Corporation’s common

stock was $24.38 per share at December 31, 2023 compared to $22.77 per share at December 31, 2022. At December 31, 2023, there were 6,639,888

of basic outstanding shares and 6,653,200 of diluted outstanding shares of common stock. The increase in the book value at December 31,

2023 was due to the undistributed net income of $9.6 million during 2023, which was partially offset by a decrease in shareholders’

equity of $2.2 million, net of tax, due to the adoption of CECL (Accounting Standards Codification Topic 326). Accumulated other comprehensive

income increased by $3.2 million due primarily to changes in the increased fair values of the Corporation’s available for sale investment

securities, the reduction of the Corporation’s investment portfolio from the sale of investments in the fourth quarter and pension

assets during the year. In 2023, the Corporation purchased and retired 82,098 shares of the Corporation’s common stock at an average

price of $16.79 per share pursuant to the previously announced stock repurchase program. The program, the term of which expires on August

18, 2024 unless sooner terminated or extended by the Corporation’s Board of Directors, may be further utilized as the Board and

management deem appropriate.

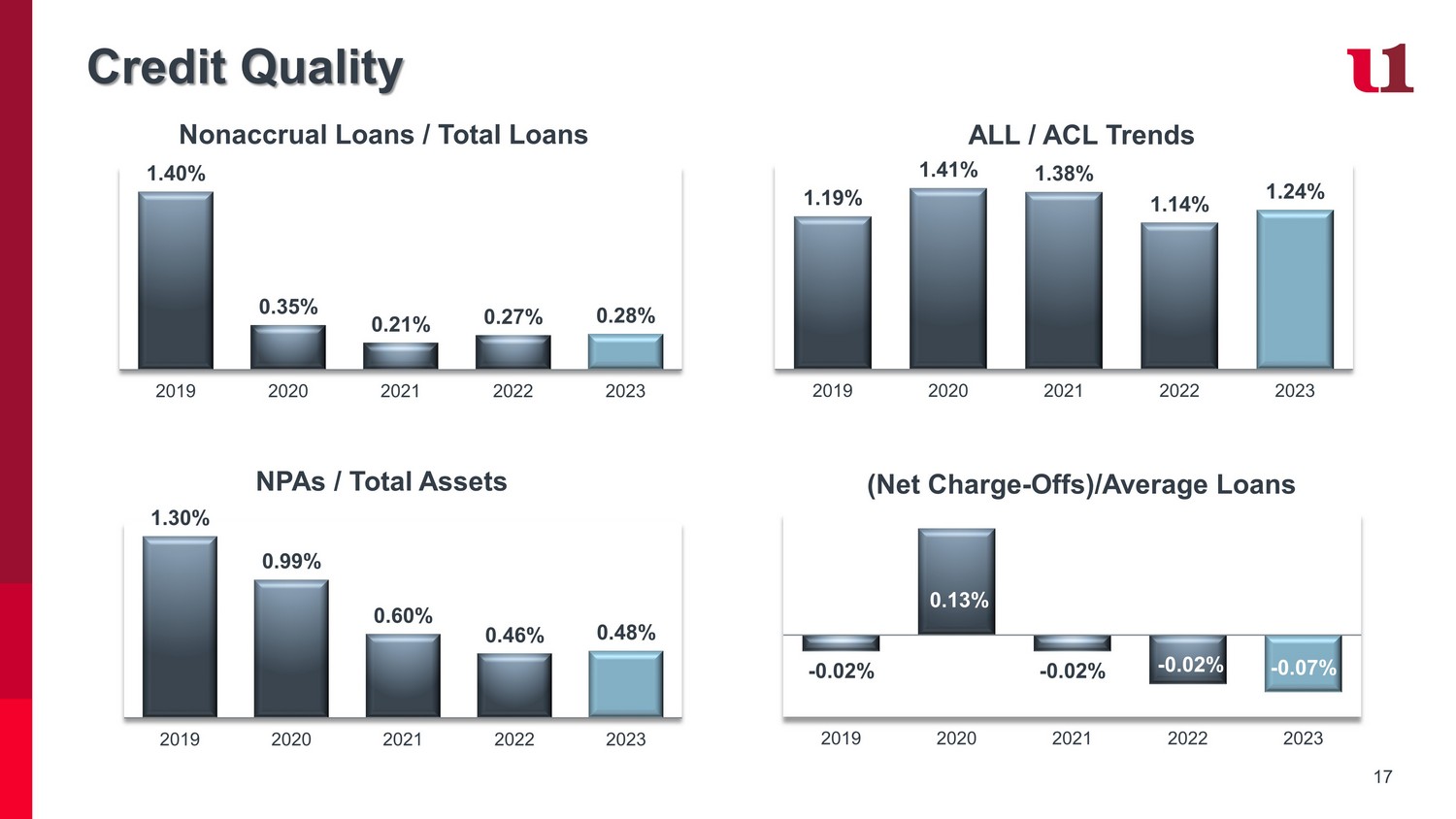

Asset Quality

On January 1, 2023, the Corporation adopted CECL,

which replaced the incurred loss impairment model with an expected loss model. As a result of the CECL adoption, the Corporation recorded

a transition adjustment of $2.2 million, net of $0.7 million in tax, to retained earnings as of January 1, 2023 for the cumulative effect

of the adoption of CECL. The Corporation recorded a $2.0 million increase to the ACL related to loans and a $0.9 million increase to the

allowance for credit losses (the “ACL”) on off balance sheet exposures.

For periods prior to the adoption of CECL, the

Corporation recognized credit losses for loans that were collectively evaluated for impairment based on an incurred loss approach, which

limited our measurement of credit losses to credit events that were estimated to have already occurred. The allowance for loan losses

(the “ALL”) under the incurred model was a valuation allowance for probable incurred losses inherent in the loan portfolio.

Management made the determination by taking into consideration historical loan loss experience, diversification of the loan portfolio,

amount of secured and unsecured loans, banking industry standards and averages, and general economic conditions. Credit losses were charged

against the ALL when the loan balance was confirmed uncollectible. Subsequent recoveries, if any, were credited to the ALL. Ultimate losses

varied from current estimates. The estimates were reviewed periodically and as adjustments became necessary, they were reported in earnings

in the periods in which they become reasonably estimable.

The

ACL was $17.5 million at December 31, 2023 compared to an ALL of $14.6 million at December 31, 2022. The provision for credit losses

was $0.4 million for the quarter ended December 31, 2023, compared to a credit to provision of $0.7 million for the quarter ended December

31, 2022. The provision expense recorded in the fourth quarter of 2023 was primarily related to strong loan growth and increases in qualitative

risk factors related to the uncertainty of the economy, inflation levels, and rising interest rates, which was partially offset by the

reduction of historical loss factors related to the strength of our overall portfolio. Net charge-offs of $0.2 million were recorded for

the quarters ended December 31, 2023 and 2022. The ratio of the ACL to loans outstanding was 1.24% at December 30, 2023 and September

30, 2023 and 1.14% at December 31, 2022.

The ratio of year-to-date net charge offs to average

loans for the year ending December 31, 2023 was an annualized 0.07%, compared to net charge offs to average loans of 0.06% for 2022. Details

of the ratio, by loan type, are shown below. Our special assets team continues to effectively collect on charged-off loans, resulting

in ongoing overall low net charge-off ratios.

Ratio of Net (Charge Offs)/Recoveries to Average Loans

| | |

12/31/2023 | | |

12/31/2022 | |

| Loan Type | |

(Charge Off) / Recovery | | |

(Charge Off) / Recovery | |

| Commercial Real Estate | |

| (0.02 | )% | |

| 0.00 | % |

| Acquisition & Development | |

| 0.01 | % | |

| 0.00 | % |

| Commercial & Industrial | |

| (0.09 | )% | |

| (0.02 | )% |

| Residential Mortgage | |

| 0.00 | % | |

| 0.03 | % |

| Consumer | |

| (1.04 | )% | |

| (1.23 | )% |

| Total Net (Charge Offs)/Recoveries | |

| (0.07 | )% | |

| (0.06 | )% |

Non-accrual loans totaled $4.0 million at December

31, 2023 and $3.5 million at December 31, 2022. OREO balances decreased by $0.2 million to $4.5 million since December 31, 2022 due to

sales of OREO properties in the fourth quarter of 2023, which was partially offset by the addition of a new OREO property during the second

quarter of 2023. OREO is comprised primarily of $4.0 for one property which has been marked to market and is currently under contract

with a targeted settlement in the second quarter of 2024.

Non-accrual

loans that have been subject to partial charge-offs totaled $0.1 million at December 31, 2023 and $0.2 million at December 31, 2022.

Loans secured by 1-4 family residential real estate properties in the process of foreclosure totaled $1.8 million at December 31,

2023. There were no loans subject to foreclosure at December 31, 2022. As a percentage of the loan portfolio, accruing loans

past due 30 days or more were 0.24% at December 31, 2023 compared to 0.27% at September 30, 2023 and 0.16% at December 31, 2022.

ABOUT FIRST UNITED CORPORATION

First

United Corporation is a Maryland corporation chartered in 1985 and a financial holding company registered with the Board of Governors

of the Federal Reserve System (the “FRB”) under the Bank Holding Company Act of 1956, as amended, that elected financial

holding company status in 2021. The Corporation’s primary business is serving as the parent company of First United Bank &

Trust, a Maryland trust company (the “Bank”), First United Statutory Trust I (“Trust I”) and First United Statutory

Trust II (“Trust II” and together with Trust I, “the Trusts”), both Connecticut statutory business trusts. The

Trusts were formed for the purpose of selling trust preferred securities that qualified as Tier 1 capital. The Bank has two consumer

finance company subsidiaries- Oak First Loan Center, Inc., a West Virginia corporation, and OakFirst Loan Center, LLC, a Maryland limited

liability company – and two subsidiaries that it uses to hold real estate acquired through foreclosure or by deed in lieu of foreclosure

– First OREO Trust, a Maryland statutory trust, and FUBT OREO I, LLC, a Maryland limited liability company. In addition, the Bank

owns 99.9% of the limited partnership interests in Liberty Mews Limited Partnership, a Maryland limited partnership formed for the purpose

of acquiring, developing and operating low-income housing units in Garrett County, Maryland (“Limited Mews”), and a 99.9%

non-voting membership interest in MCC FUBT Fund, LLC, an Ohio limited liability company formed for the purpose of acquiring, developing

and operating low-income housing units in Allegany County, Maryland (the “MCC Fund”). The Corporation’s website is

www.mybank.com.

FORWARD-LOOKING STATEMENTS

This press release contains forward-looking statements

as defined by the Private Securities Litigation Reform Act of 1995. Forward-looking statements do not represent historical facts,

but are statements about management's beliefs, plans and objectives about the future, as well as its assumptions and judgments concerning

such beliefs, plans and objectives. These statements are evidenced by terms such as "anticipate," "estimate,"

"should," "expect," "believe," "intend," and similar expressions. Although these statements

reflect management's good faith beliefs and projections, they are not guarantees of future performance and they may not prove true.

The beliefs, plans and objectives on which forward-looking statements are based involve risks and uncertainties that could cause actual

results to differ materially from those addressed in the forward-looking statements. For a discussion of these risks and uncertainties,

see the section of the periodic reports that First United Corporation files with the Securities and Exchange Commission entitled "Risk

Factors". In addition, investors should understand that the Corporation is required under generally accepted accounting principles

to evaluate subsequent events through the filing of the consolidated financial statements included in its Annual Report on Form 10-K for

the quarter ended December 31, 2023 and the impact that any such events have on our critical accounting assumptions and estimates made

as of December 31, 2023, which could require us to make adjustments to the amounts reflected in this press release.

FIRST UNITED CORPORATION

Oakland, MD

Stock Symbol : FUNC

Financial Highlights - Unaudited

| (Dollars in thousands, except per share

data) |

| | |

Three Months Ended | | |

Twelve Months Ended |

|

| | |

December 31, | | |

December 31, | | |

December 31, | | |

December 31, | |

| | |

2023 | | |

2022 | | |

2023 | | |

2022 | |

| Results of Operations: | |

| | | |

| | | |

| | | |

| | |

| Interest income | |

$ | 22,191 | | |

$ | 17,359 | | |

$ | 81,156 | | |

$ | 62,422 | |

| Interest expense | |

| 7,997 | | |

| 2,179 | | |

| 24,286 | | |

| 4,789 | |

| Net interest income | |

| 14,194 | | |

| 15,180 | | |

| 56,870 | | |

| 57,633 | |

| Provision/(credit) for credit/loan losses | |

| 419 | | |

| (736 | ) | |

| 1,620 | | |

| (627 | ) |

| Other operating income | |

| 4,793 | | |

| 4,479 | | |

| 18,331 | | |

| 17,878 | |

| Net (losses)/gains | |

| (4,184 | ) | |

| 11 | | |

| (3,862 | ) | |

| 172 | |

| Other operating expense | |

| 12,309 | | |

| 11,590 | | |

| 50,243 | | |

| 43,129 | |

| Income before taxes | |

$ | 2,075 | | |

$ | 8,816 | | |

$ | 19,476 | | |

$ | 33,181 | |

| Income tax expense | |

| 317 | | |

| 1,847 | | |

| 4,416 | | |

| 8,133 | |

| Net income | |

$ | 1,758 | | |

$ | 6,969 | | |

$ | 15,060 | | |

$ | 25,048 | |

| | |

| | | |

| | | |

| | | |

| | |

| Per share data: | |

| | | |

| | | |

| | | |

| | |

| Basic net income per share | |

$ | 0.26 | | |

$ | 1.05 | | |

$ | 2.25 | | |

$ | 3.77 | |

| Diluted net income per share | |

$ | 0.26 | | |

$ | 1.04 | | |

$ | 2.24 | | |

$ | 3.76 | |

| Dividends declared per share | |

$ | 0.20 | | |

$ | 0.18 | | |

$ | 0.80 | | |

$ | 0.63 | |

| Book value | |

$ | 24.38 | | |

$ | 22.77 | | |

| | | |

| | |

| Diluted book value | |

$ | 24.33 | | |

$ | 22.68 | | |

| | | |

| | |

| Tangible book value per share | |

$ | 22.56 | | |

$ | 20.91 | | |

| | | |

| | |

| Diluted Tangible book value per share | |

$ | 22.51 | | |

$ | 20.87 | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Closing market value | |

$ | 23.51 | | |

$ | 19.65 | | |

| | | |

| | |

| Market Range: | |

| | | |

| | | |

| | | |

| | |

| High | |

$ | 23.51 | | |

$ | 20.56 | | |

| | | |

| | |

| Low | |

$ | 16.12 | | |

$ | 16.74 | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Shares outstanding at period end: Basic | |

| 6,639,888 | | |

| 6,666,428 | | |

| | | |

| | |

| Shares outstanding at period end: Diluted | |

| 6,653,200 | | |

| 6,692,039 | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Performance ratios: (Year to Date Period End, annualized) | |

| | | |

| | | |

| | | |

| | |

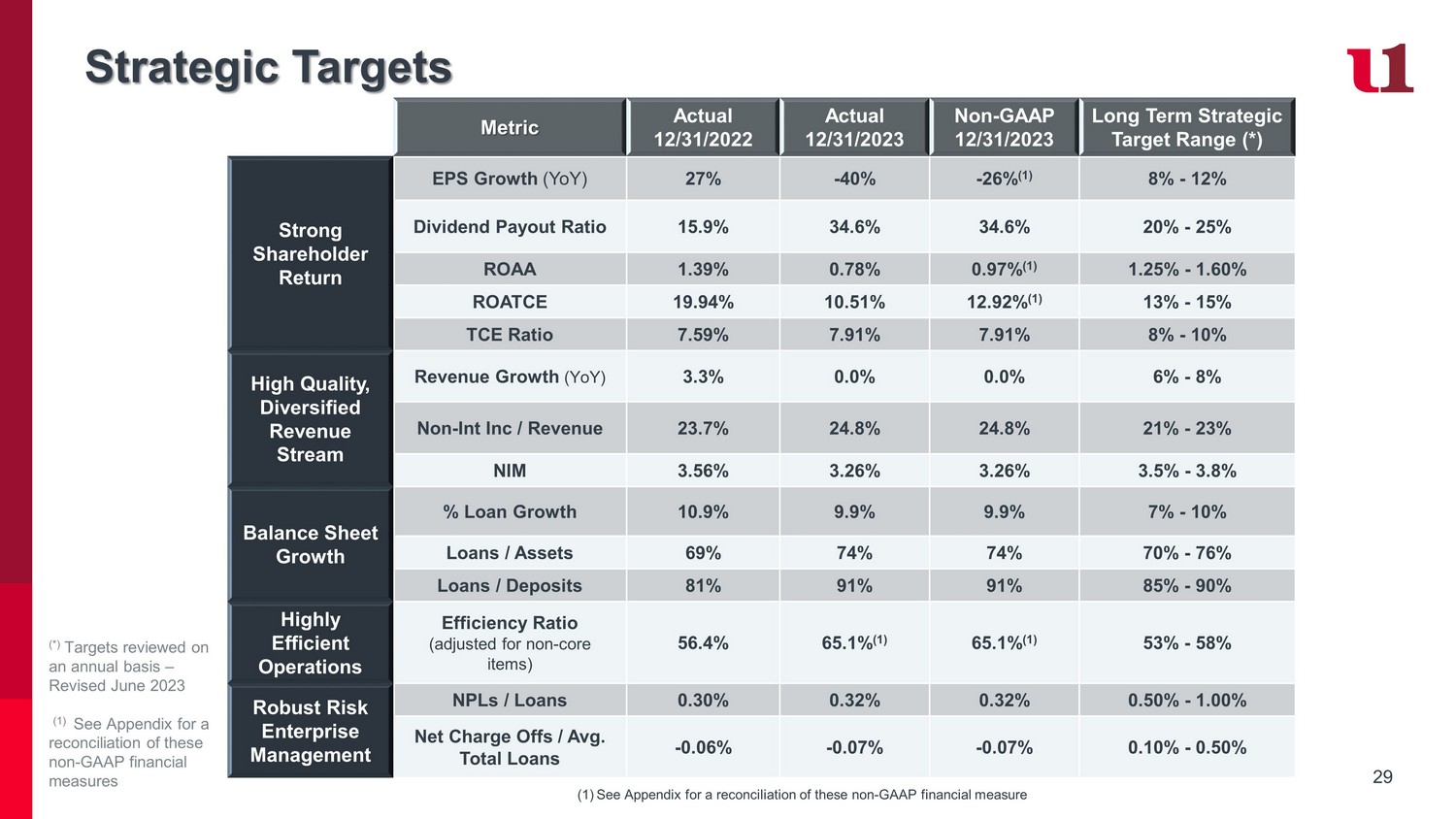

| Return on average assets | |

| 0.78 | % | |

| 1.39 | % | |

| | | |

| | |

| Return on average shareholders' equity | |

| 9.68 | % | |

| 18.19 | % | |

| | | |

| | |

| Net interest margin (Non-GAAP), includes tax exempt income of $792 and $942 | |

| 3.26 | % | |

| 3.56 | % | |

| | | |

| | |

| Net interest margin GAAP | |

| 3.22 | % | |

| 3.50 | % | |

| | | |

| | |

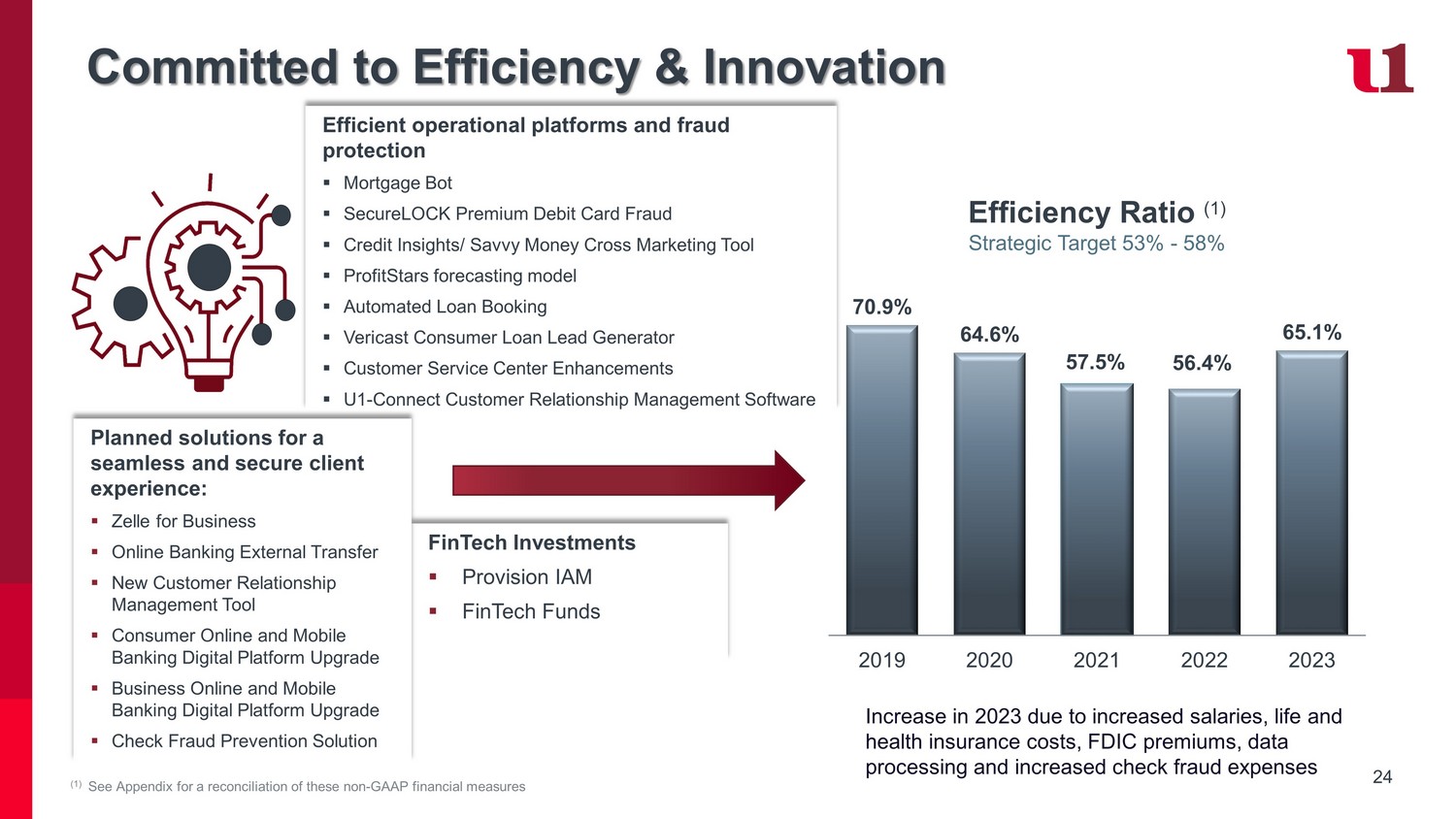

| Efficiency ratio - non-GAAP (1) | |

| 65.12 | % | |

| 56.27 | % | |

| | | |

| | |

(1) Efficiency ratio is a non-GAAP measure calculated by dividing total operating expenses by the sum of tax equivalent net interest income and other operating income, less gains/(losses) on sales of securities and/or fixed assets.

| | |

December 31, | | |

December 31 | | |

| | |

| |

| | |

2023 | | |

2022 | | |

| | |

| |

| Financial Condition at period end: | |

| | | |

| | | |

| | | |

| | |

| Assets | |

$ | 1,905,860 | | |

$ | 1,848,169 | | |

| | | |

| | |

| Earning assets | |

$ | 1,725,236 | | |

$ | 1,643,964 | | |

| | | |

| | |

| Gross loans | |

$ | 1,406,667 | | |

$ | 1,279,494 | | |

| | | |

| | |

| Commercial Real Estate | |

$ | 493,703 | | |

$ | 458,831 | | |

| | | |

| | |

| Acquisition and Development | |

$ | 77,060 | | |

$ | 70,596 | | |

| | | |

| | |

| Commercial and Industrial | |

$ | 274,604 | | |

$ | 245,396 | | |

| | | |

| | |

| Residential Mortgage | |

$ | 499,871 | | |

$ | 444,411 | | |

| | | |

| | |

| Consumer | |

$ | 61,429 | | |

$ | 60,260 | | |

| | | |

| | |

| Investment securities | |

$ | 311,466 | | |

$ | 361,548 | | |

| | | |

| | |

| Total deposits | |

$ | 1,550,977 | | |

$ | 1,570,733 | | |

| | | |

| | |

| Noninterest bearing | |

$ | 427,670 | | |

$ | 506,613 | | |

| | | |

| | |

| Interest bearing | |

$ | 1,123,307 | | |

$ | 1,064,120 | | |

| | | |

| | |

| Shareholders' equity | |

$ | 161,873 | | |

$ | 151,793 | | |

| | | |

| | |

| | |

| . | | |

| | | |

| | | |

| | |

| Capital ratios: | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Tier 1 to risk weighted assets | |

| 14.42 | % | |

| 15.06 | % | |

| | | |

| | |

| Common Equity Tier 1 to risk weighted assets | |

| 12.44 | % | |

| 12.95 | % | |

| | | |

| | |

| Tier 1 Leverage | |

| 11.30 | % | |

| 11.46 | % | |

| | | |

| | |

| Total risk based capital | |

| 15.64 | % | |

| 16.12 | % | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Asset quality: | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Net charge-offs for the quarter | |

$ | (195 | ) | |

$ | (164 | ) | |

| | | |

| | |

| Nonperforming assets: (Period End) | |

| | | |

| | | |

| | | |

| | |

| Nonaccrual loans | |

$ | 3,956 | | |

$ | 3,495 | | |

| | | |

| | |

| Loans 90 days past due and accruing | |

| 543 | | |

| 307 | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Total nonperforming loans and 90 day past due | |

$ | 4,499 | | |

$ | 3,802 | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Modified/Restructured loans | |

$ | - | | |

$ | 3,028 | | |

| | | |

| | |

| Other real estate owned | |

$ | 4,493 | | |

$ | 4,733 | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | |

| Allowance for credit losses to gross loans | |

| 1.24 | % | |

| 1.14 | % | |

| | | |

| | |

| Allowance for credit losses to non-accrual loans | |

| 441.86 | % | |

| 418.77 | % | |

| | | |

| | |

| Allowance for credit losses to non-performing assets | |

| 194.40 | % | |

| 171.48 | % | |

| | | |

| | |

| Non-performing and 90 day past due loans to total loans | |

| 0.32 | % | |

| 0.30 | % | |

| | | |

| | |

| Non-performing loans and 90 day past due loans to total assets | |

| 0.24 | % | |

| 0.21 | % | |

| | | |

| | |

| Non-accrual loans to total loans | |

| 0.28 | % | |

| 0.27 | % | |

| | | |

| | |

| Non-performing assets to total assets | |

| 0.47 | % | |

| 0.46 | % | |

| | | |

| | |

FIRST UNITED CORPORATION

Oakland, MD

Stock Symbol : FUNC

Financial Highlights - Unaudited

| | |

December 31, | | |

September 30, | | |

June 30, | | |

March 31, | | |

December 31, | | |

September 30, | | |

June 30, | | |

March 31, | |

| (Dollars in thousands, except per

share data) | |

2023 | | |

2023 | | |

2023 | | |

2023 | | |

2022 | | |

2022 | | |

2022 | | |

2022 | |

| Results of Operations: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Interest income | |

$ | 22,191 | | |

$ | 21,164 | | |

$ | 19,972 | | |

$ | 17,829 | | |

$ | 17,359 | | |

$ | 16,185 | | |

$ | 14,731 | | |

$ | 14,147 | |

| Interest expense | |

| 7,997 | | |

| 7,180 | | |

| 5,798 | | |

| 3,311 | | |

| 2,179 | | |

| 1,044 | | |

| 760 | | |

| 806 | |

| Net interest income | |

| 14,194 | | |

| 13,984 | | |

| 14,174 | | |

| 14,518 | | |

| 15,180 | | |

| 15,141 | | |

| 13,971 | | |

| 13,341 | |

| Provision/(credit) for credit/loan

losses | |

| 419 | | |

| 263 | | |

| 395 | | |

| 543 | | |

| (736 | ) | |

| (101 | ) | |

| 631 | | |

| (421 | ) |

| Other operating income | |

| 4,793 | | |

| 4,716 | | |

| 4,483 | | |

| 4,339 | | |

| 4,479 | | |

| 4,604 | | |

| 4,413 | | |

| 4,382 | |

| Net gains | |

| (4,184 | ) | |

| 182 | | |

| 86 | | |

| 54 | | |

| 11 | | |

| 96 | | |

| 13 | | |

| 52 | |

| Other operating

expense | |

| 12,309 | | |

| 12,785 | | |

| 12,511 | | |

| 12,638 | | |

| 11,590 | | |

| 10,329 | | |

| 10,630 | | |

| 10,580 | |

| Income before taxes | |

$ | 2,075 | | |

$ | 5,834 | | |

$ | 5,837 | | |

$ | 5,730 | | |

$ | 8,816 | | |

$ | 9,613 | | |

$ | 7,136 | | |

$ | 7,616 | |

| Income tax expense | |

| 317 | | |

| 1,321 | | |

| 1,423 | | |

| 1,355 | | |

| 1,847 | | |

| 2,677 | | |

| 1,708 | | |

| 1,901 | |

| Net income | |

$ | 1,758 | | |

$ | 4,513 | | |

$ | 4,414 | | |

$ | 4,375 | | |

$ | 6,969 | | |

$ | 6,936 | | |

$ | 5,428 | | |

$ | 5,715 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Per share data: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Basic net income per share | |

$ | 0.26 | | |

$ | 0.67 | | |

$ | 0.66 | | |

$ | 0.66 | | |

$ | 1.05 | | |

$ | 1.04 | | |

$ | 0.82 | | |

$ | 0.86 | |

| Diluted net income per share | |

$ | 0.26 | | |

$ | 0.67 | | |

$ | 0.66 | | |

$ | 0.65 | | |

$ | 1.04 | | |

$ | 1.04 | | |

$ | 0.82 | | |

$ | 0.86 | |

| Dividends declared per share | |

$ | 0.20 | | |

$ | 0.20 | | |

$ | 0.20 | | |

$ | 0.20 | | |

$ | 0.18 | | |

$ | 0.15 | | |

$ | 0.15 | | |

$ | 0.15 | |

| Book value | |

$ | 24.38 | | |

$ | 23.08 | | |

$ | 23.12 | | |

$ | 22.85 | | |

$ | 22.77 | | |

$ | 19.83 | | |

$ | 19.97 | | |

$ | 20.65 | |

| Diluted book value | |

$ | 24.33 | | |

$ | 23.03 | | |

$ | 23.07 | | |

$ | 22.81 | | |

$ | 22.68 | | |

$ | 19.80 | | |

$ | 19.93 | | |

$ | 20.63 | |

| Tangible book value per share | |

$ | 22.56 | | |

$ | 21.27 | | |

$ | 21.29 | | |

$ | 21.01 | | |

$ | 20.91 | | |

$ | 18.03 | | |

$ | 18.17 | | |

$ | 18.83 | |

| Diluted Tangible book value per share | |

$ | 22.51 | | |

$ | 21.22 | | |

$ | 21.25 | | |

$ | 20.96 | | |

$ | 20.87 | | |

$ | 18.00 | | |

$ | 18.14 | | |

$ | 18.82 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Closing market value | |

$ | 23.51 | | |

$ | 16.23 | | |

$ | 14.26 | | |

$ | 16.89 | | |

$ | 19.65 | | |

$ | 16.55 | | |

$ | 18.76 | | |

$ | 22.53 | |

| Market Range: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| High | |

$ | 23.51 | | |

$ | 17.34 | | |

$ | 17.01 | | |

$ | 20.41 | | |

$ | 20.56 | | |

$ | 19.27 | | |

$ | 23.80 | | |

$ | 24.50 | |

| Low | |

$ | 16.12 | | |

$ | 13.70 | | |

$ | 12.56 | | |

$ | 16.75 | | |

$ | 16.74 | | |

$ | 16.18 | | |

$ | 17.50 | | |

$ | 18.81 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Shares outstanding at period end: Basic | |

| 6,639,888 | | |

| 6,715,170 | | |

| 6,711,422 | | |

| 6,688,710 | | |

| 6,666,428 | | |

| 6,659,390 | | |

| 6,656,395 | | |

| 6,637,979 | |

| Shares outstanding at period end: Diluted | |

| 6,653,200 | | |

| 6,728,482 | | |

| 6,724,734 | | |

| 6,703,252 | | |

| 6,692,039 | | |

| 6,669,785 | | |

| 6,666,790 | | |

| 6,649,604 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Performance ratios: (Year to Date Period

End, annualized) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Return on average assets | |

| 0.78 | % | |

| 0.93 | % | |

| 0.95 | % | |

| 0.94 | % | |

| 1.39 | % | |

| 1.35 | % | |

| 1.26 | % | |

| 1.31 | % |

| Return on average shareholders' equity | |

| 9.68 | % | |

| 11.44 | % | |

| 11.43 | % | |

| 11.87 | % | |

| 18.19 | % | |

| 17.66 | % | |

| 16.25 | % | |

| 16.49 | % |

| Net interest margin (Non-GAAP), includes tax exempt income

of $76 and $241 | |

| 3.26 | % | |

| 3.30 | % | |

| 3.39 | % | |

| 3.53 | % | |

| 3.56 | % | |

| 3.53 | % | |

| 3.46 | % | |

| 3.40 | % |

| Net interest margin GAAP | |

| 3.22 | % | |

| 3.25 | % | |

| 3.34 | % | |

| 3.48 | % | |

| 3.50 | % | |

| 3.47 | % | |

| 3.40 | % | |

| 3.34 | % |

| Efficiency ratio - non-GAAP (1) | |

| 65.12 | % | |

| 66.41 | % | |

| 66.00 | % | |

| 67.02 | % | |

| 56.27 | % | |

| 51.49 | % | |

| 57.11 | % | |

| 58.81 | % |

(1)

Efficiency ratio is a non-GAAP measure calculated by dividing total operating expenses by the sum of tax equivalent net interest income

and other operating income, less gains/(losses) on sales of securities and/or fixed assets.

| | |

December 31, | | |

September 30, | | |

June 30, | | |

March 31, | | |

December 31, | | |

September 30, | | |

June 30, | | |

March 31, | |

| | |

2023 | | |

2023 | | |

2023 | | |

2023 | | |

2022 | | |

2022 | | |

2022 | | |

2022 | |

| Financial Condition at period end: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Assets | |

$ | 1,905,860 | | |

$ | 1,928,201 | | |

$ | 1,928,393 | | |

$ | 1,937,442 | | |

$ | 1,848,169 | | |

$ | 1,803,642 | | |

$ | 1,752,455 | | |

$ | 1,760,325 | |

| Earning assets | |

$ | 1,725,236 | | |

$ | 1,717,244 | | |

$ | 1,707,522 | | |

$ | 1,652,688 | | |

$ | 1,643,964 | | |

$ | 1,647,303 | | |

$ | 1,608,094 | | |

$ | 1,572,737 | |

| Gross loans | |

$ | 1,406,667 | | |

$ | 1,380,019 | | |

$ | 1,350,038 | | |

$ | 1,289,080 | | |

$ | 1,279,494 | | |

$ | 1,277,924 | | |

$ | 1,233,613 | | |

$ | 1,181,401 | |

| Commercial Real Estate | |

$ | 493,703 | | |

$ | 491,284 | | |

$ | 483,485 | | |

$ | 453,356 | | |

$ | 458,831 | | |

$ | 437,973 | | |

$ | 421,942 | | |

$ | 391,136 | |

| Acquisition and Development | |

$ | 77,060 | | |

$ | 79,796 | | |

$ | 79,003 | | |

$ | 76,980 | | |

$ | 70,596 | | |

$ | 83,107 | | |

$ | 116,115 | | |

$ | 133,031 | |

| Commercial and Industrial | |

$ | 274,604 | | |

$ | 254,650 | | |

$ | 249,683 | | |

$ | 241,959 | | |

$ | 245,396 | | |

$ | 269,004 | | |

$ | 225,640 | | |

$ | 194,914 | |

| Residential Mortgage | |

$ | 499,871 | | |

$ | 491,686 | | |

$ | 475,540 | | |

$ | 456,198 | | |

$ | 444,411 | | |

$ | 427,093 | | |

$ | 406,293 | | |

$ | 399,704 | |

| Consumer | |

$ | 61,429 | | |

$ | 62,603 | | |

$ | 62,327 | | |

$ | 60,587 | | |

$ | 60,260 | | |

$ | 60,747 | | |

$ | 63,623 | | |

$ | 62,616 | |

| Investment securities | |

$ | 311,466 | | |

$ | 330,053 | | |

$ | 350,844 | | |

$ | 357,061 | | |

$ | 361,548 | | |

$ | 366,484 | | |

$ | 373,455 | | |

$ | 385,265 | |

| Total deposits | |

$ | 1,550,977 | | |

$ | 1,575,069 | | |

$ | 1,579,959 | | |

$ | 1,591,285 | | |

$ | 1,570,733 | | |

$ | 1,511,118 | | |

$ | 1,484,354 | | |

$ | 1,507,555 | |

| Noninterest bearing | |

$ | 427,670 | | |

$ | 429,691 | | |

$ | 466,628 | | |

$ | 468,554 | | |

$ | 506,613 | | |

$ | 474,444 | | |

$ | 527,761 | | |

$ | 530,901 | |

| Interest bearing | |

$ | 1,123,307 | | |

$ | 1,145,378 | | |

$ | 1,113,331 | | |

$ | 1,122,731 | | |

$ | 1,064,120 | | |

$ | 1,036,674 | | |

$ | 956,593 | | |

$ | 976,654 | |

| Shareholders' equity | |

$ | 161,873 | | |

$ | 154,990 | | |

$ | 155,156 | | |

$ | 152,868 | | |

$ | 151,793 | | |

$ | 132,044 | | |

$ | 132,892 | | |

$ | 137,038 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Capital ratios: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Tier 1 to risk weighted assets | |

| 14.42 | % | |

| 14.60 | % | |

| 14.40 | % | |

| 14.90 | % | |

| 15.06 | % | |

| 14.40 | % | |

| 14.31 | % | |

| 14.55 | % |

| Common Equity Tier 1 to risk weighted

assets | |

| 12.44 | % | |

| 12.60 | % | |

| 12.40 | % | |

| 12.82 | % | |

| 12.95 | % | |

| 12.36 | % | |

| 12.27 | % | |

| 12.45 | % |

| Tier 1 Leverage | |

| 11.30 | % | |

| 11.25 | % | |

| 11.25 | % | |

| 11.47 | % | |

| 11.46 | % | |

| 11.23 | % | |

| 11.23 | % | |

| 10.94 | % |

| Total risk based capital | |

| 15.64 | % | |

| 15.81 | % | |

| 15.60 | % | |

| 16.15 | % | |

| 16.12 | % | |

| 15.50 | % | |

| 15.46 | % | |

| 15.71 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Asset quality: | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net (charge-offs)/recoveries for the quarter | |

$ | (195 | ) | |

$ | (83 | ) | |

$ | (398 | ) | |

$ | (245 | ) | |

$ | (164 | ) | |

$ | (89 | ) | |

$ | (179 | ) | |

$ | (244 | ) |

| Nonperforming assets: (Period End) | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Nonaccrual loans | |

$ | 3,956 | | |

$ | 3,479 | | |

$ | 2,972 | | |

$ | 3,258 | | |

$ | 3,495 | | |

$ | 1,943 | | |

$ | 2,149 | | |

$ | 2,332 | |

| Loans 90 days

past due and accruing | |

| 543 | | |

| 145 | | |

| 160 | | |

| 87 | | |

| 307 | | |

| 569 | | |

$ | 325 | | |

| 37 | |

| | |

| | | |

| | | |

| | | |

| | | |

| 0 | | |

| | | |

| | | |

| | |

| Total nonperforming

loans and 90 day past due | |

$ | 4,499 | | |

$ | 3,624 | | |

$ | 3,132 | | |

$ | 3,345 | | |

$ | 3,802 | | |

$ | 2,512 | | |

$ | 2,474 | | |

$ | 2,369 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Modified/restructured loans | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | - | | |

$ | 3,028 | | |

$ | 3,354 | | |

$ | 3,226 | | |

$ | 3,228 | |

| Other real estate owned | |

$ | 4,493 | | |

$ | 4,878 | | |

$ | 4,482 | | |

$ | 4,598 | | |

$ | 4,733 | | |

$ | 4,733 | | |

$ | 4,517 | | |

$ | 4,477 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Allowance for credit losses to gross loans | |

| 1.24 | % | |

| 1.24 | % | |

| 1.25 | % | |

| 1.31 | % | |

| 1.14 | % | |

| 1.22 | % | |

| 1.28 | % | |

| 1.29 | % |

| Allowance for credit losses to non-accrual loans | |

| 441.86 | % | |

| 492.84 | % | |

| 568.81 | % | |

| 517.83 | % | |

| 418.77 | % | |

| 799.85 | % | |

| 732.29 | % | |

| 655.75 | % |

| Allowance for credit losses to non-performing assets | |

| 194.40 | % | |

| 473.12 | % | |

| 539.79 | % | |

| 212.40 | % | |

| 171.48 | % | |

| 214.51 | % | |

| 225.10 | % | |

| 223.37 | % |

| Non-performing and 90 day past due loans to total loans | |

| 0.32 | % | |

| 0.26 | % | |

| 0.23 | % | |

| 0.26 | % | |

| 0.30 | % | |

| 0.20 | % | |

| 0.20 | % | |

| 0.20 | % |

| Non-performing loans and 90 day past due loans to total

assets | |

| 0.24 | % | |

| 0.19 | % | |

| 0.16 | % | |

| 0.17 | % | |

| 0.21 | % | |

| 0.14 | % | |

| 0.14 | % | |

| 0.13 | % |

| Non-accrual loans to total loans | |

| 0.28 | % | |

| 0.25 | % | |

| 0.22 | % | |

| 0.25 | % | |

| 0.27 | % | |

| 0.15 | % | |

| 0.17 | % | |

| 0.20 | % |

| Non-performing assets to total assets | |

| 0.47 | % | |

| 0.44 | % | |

| 0.39 | % | |

| 0.41 | % | |

| 0.46 | % | |

| 0.40 | % | |

| 0.40 | % | |

| 0.39 | % |

| (Dollars in thousands - Unaudited) | |

December 31,

2023 | | |

September 30,

2023 | | |

June 30,

2023 | | |

March 31,

2023 | | |

December 31,

2022 | |

| Assets | |

| | | |

| | | |

| | | |

| | | |

| | |

| Cash and due from banks | |

$ | 48,343 | | |

$ | 78,939 | | |

$ | 86,901 | | |

$ | 154,022 | | |

$ | 72,420 | |

| Interest bearing deposits in banks | |

| 1,410 | | |

| 1,713 | | |

| 1,650 | | |

| 1,873 | | |

| 1,895 | |

| Cash and cash equivalents | |

| 49,753 | | |

| 80,652 | | |

| 88,551 | | |

| 155,895 | | |

| 74,315 | |

| Investment securities – available for sale (at fair value) | |

| 97,169 | | |

| 114,370 | | |

| 120,085 | | |

| 123,978 | | |

| 125,889 | |

| Investment securities – held to maturity (at cost) | |

| 214,297 | | |

| 215,683 | | |

| 230,759 | | |

| 233,083 | | |

| 235,659 | |

| Restricted investment in bank stock, at cost | |

| 5,250 | | |

| 5,251 | | |

| 4,490 | | |

| 4,490 | | |

| 1,027 | |

| Loans held for sale | |

| 443 | | |

| 208 | | |

| 500 | | |

| 184 | | |

| — | |

| Loans | |

| 1,406,667 | | |

| 1,380,019 | | |

| 1,350,038 | | |

| 1,289,080 | | |

| 1,279,494 | |

| Unearned fees | |

| (340 | ) | |

| (371 | ) | |

| (327 | ) | |

| (257 | ) | |

| (174 | ) |

| Allowance for credit losses | |

| (17,480 | ) | |

| (17,146 | ) | |

| (16,905 | ) | |

| (16,871 | ) | |

| (14,636 | ) |

| Net loans | |

| 1,388,847 | | |

| 1,362,502 | | |

| 1,332,806 | | |

| 1,271,952 | | |

| 1,264,684 | |

| Premises and equipment, net | |

| 31,459 | | |

| 32,766 | | |

| 33,532 | | |

| 34,207 | | |

| 34,948 | |

| Goodwill and other intangible assets | |

| 12,103 | | |

| 12,185 | | |

| 12,268 | | |

| 12,350 | | |

| 12,433 | |

| Bank owned life insurance | |

| 47,607 | | |

| 47,282 | | |

| 46,963 | | |

| 46,652 | | |

| 46,346 | |

| Deferred tax assets | |

| 11,948 | | |

| 13,020 | | |

| 11,771 | | |

| 11,356 | | |

| 10,605 | |

| Other real estate owned, net | |

| 4,493 | | |

| 4,878 | | |

| 4,842 | | |

| 4,598 | | |

| 4,733 | |

| Operating lease asset | |

| 1,367 | | |

| 1,905 | | |

| 1,990 | | |

| 2,072 | | |

| 1,898 | |

| Accrued interest receivable and other assets | |

| 41,124 | | |

| 37,499 | | |

| 39,836 | | |

| 36,625 | | |

| 35,632 | |

| Total Assets | |

$ | 1,905,860 | | |

$ | 1,928,201 | | |

$ | 1,928,393 | | |

$ | 1,937,442 | | |

$ | 1,848,169 | |

| Liabilities and Shareholders’ Equity | |

| | | |

| | | |

| | | |

| | | |

| | |

| Liabilities: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Non-interest bearing deposits | |

$ | 427,670 | | |

$ | 429,691 | | |

$ | 466,628 | | |

$ | 468,554 | | |

$ | 506,613 | |

| Interest bearing deposits | |

| 1,123,307 | | |

| 1,145,378 | | |

| 1,113,331 | | |

| 1,122,731 | | |

| 1,064,120 | |

| Total deposits | |

| 1,550,977 | | |

| 1,575,069 | | |

| 1,579,959 | | |

| 1,591,285 | | |

| 1,570,733 | |

| Short-term borrowings | |

| 45,418 | | |

| 53,330 | | |

| 50,078 | | |

| 52,030 | | |

| 64,565 | |

| Long-term borrowings | |

| 110,929 | | |

| 110,929 | | |

| 110,929 | | |

| 110,929 | | |

| 30,929 | |

| Operating lease liability | |

| 1,556 | | |

| 2,347 | | |

| 2,443 | | |

| 2,536 | | |

| 2,373 | |

| Allowance for credit loss on off balance sheet exposures | |

| 873 | | |

| 985 | | |

| 1,089 | | |

| 1,128 | | |

| 133 | |

| Accrued interest payable and other liabilities | |

| 32,904 | | |

| 29,207 | | |

| 27,397 | | |

| 25,332 | | |

| 26,444 | |

| Dividends payable | |

| 1,330 | | |

| 1,344 | | |

| 1,342 | | |

| 1,334 | | |

| 1,199 | |

| Total Liabilities | |

| 1,743,987 | | |

| 1,773,211 | | |

| 1,773,237 | | |

| 1,784,574 | | |

| 1,696,376 | |

| Shareholders’ Equity: | |

| | | |

| | | |

| | | |

| | | |

| | |

| Common Stock – par value $0.01 per share; Authorized 25,000,000 shares; issued and outstanding 6,715,170 shares at September 30, 2023 and 6,666,428 at December 31, 2022 | |

| 66 | | |

| 67 | | |

| 67 | | |

| 67 | | |

| 67 | |

| Surplus | |

| 23,734 | | |

| 25,029 | | |

| 24,901 | | |

| 24,529 | | |

| 24,409 | |

| Retained earnings | |

| 173,900 | | |

| 173,467 | | |

| 170,298 | | |

| 167,229 | | |

| 166,343 | |

| Accumulated other comprehensive loss | |

| (35,827 | ) | |

| (43,573 | ) | |

| (40,110 | ) | |

| (38,957 | ) | |

| (39,026 | ) |

| Total Shareholders’ Equity | |

| 161,873 | | |

| 154,990 | | |

| 155,156 | | |

| 152,868 | | |

| 151,793 | |

| Total Liabilities and Shareholders’ Equity | |

$ | 1,905,860 | | |

$ | 1,928,201 | | |

$ | 1,928,393 | | |

$ | 1,937,442 | | |

$ | 1,848,169 | |

| | |

2023 | | |

2022 | |

| | |

Year

to

Date | | |

Q4 | | |

Q3 | | |

Q2 | | |

Q1 | | |

Year to

Date | | |

Q4 | | |

Q3 | | |

Q2 | | |

Q1 | |

| In thousands | |

(Unaudited) | |

| Interest income | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Interest and fees on loans | |

$ | 69,569 | | |

$ | 19,290 | | |

$ | 18,055 | | |

$ | 16,780 | | |

$ | 15,444 | | |

$ | 54,448 | | |

$ | 15,097 | | |

$ | 14,058 | | |

$ | 12,861 | | |

$ | 12,432 | |

| Interest on investment securities | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Taxable | |

| 7,173 | | |

| 1,834 | | |

| 1,792 | | |

| 1,779 | | |

| 1,768 | | |

| 6,252 | | |

| 1,719 | | |

| 1,587 | | |

| 1,540 | | |

| 1,406 | |

| Exempt from federal

income tax | |

| 714 | | |

| 53 | | |

| 123 | | |

| 268 | | |

| 270 | | |

| 1,106 | | |

| 272 | | |

| 273 | | |

| 279 | | |

| 282 | |

| Total investment income | |

| 7,887 | | |

| 1,887 | | |

| 1,915 | | |

| 2,047 | | |

| 2,038 | | |

| 7,358 | | |

| 1,991 | | |

| 1,860 | | |

| 1,819 | | |

| 1,688 | |

| Other | |

| 3,700 | | |

| 1,014 | | |

| 1,194 | | |

| 1,145 | | |

| 347 | | |

| 616 | | |

| 271 | | |

| 267 | | |

| 51 | | |

| 27 | |

| Total interest

income | |

| 81,156 | | |

| 22,191 | | |

| 21,164 | | |

| 19,972 | | |

| 17,829 | | |

| 62,422 | | |

| 17,359 | | |

| 16,185 | | |

| 14,731 | | |

| 14,147 | |

| Interest expense | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Interest on deposits | |

| 19,198 | | |

| 6,498 | | |

| 5,672 | | |

| 4,350 | | |

| 2,678 | | |

| 3,226 | | |

| 1,729 | | |

| 621 | | |

| 401 | | |

| 475 | |

| Interest on short-term borrowings | |

| 147 | | |

| 54 | | |

| 33 | | |

| 29 | | |

| 31 | | |

| 112 | | |

| 26 | | |

| 47 | | |

| 21 | | |

| 18 | |

| Interest on long-term

borrowings | |

| 4,941 | | |

| 1,445 | | |

| 1,475 | | |

| 1,419 | | |

| 602 | | |

| 1,451 | | |

| 424 | | |

| 376 | | |

| 338 | | |

| 313 | |

| Total interest

expense | |

| 24,286 | | |

| 7,997 | | |

| 7,180 | | |

| 5,798 | | |

| 3,311 | | |

| 4,789 | | |

| 2,179 | | |

| 1,044 | | |

| 760 | | |

| 806 | |

| Net interest income | |

| 56,870 | | |

| 14,194 | | |

| 13,984 | | |

| 14,174 | | |

| 14,518 | | |

| 57,633 | | |

| 15,180 | | |

| 15,141 | | |

| 13,971 | | |

| 13,341 | |

| Credit loss expense | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Loans | |

| 1,700 | | |

| 530 | | |

| 322 | | |

| 434 | | |

| 414 | | |

| (643 | ) | |

| (740 | ) | |

| (108 | ) | |

| 624 | | |

| (419 | ) |

| Debt securities held to maturity | |

| 45 | | |

| — | | |

| 45 | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | | |

| — | |

| Off balance sheet

credit exposures | |

| (125 | ) | |

| (111 | ) | |

| (104 | ) | |

| (39 | ) | |

| 129 | | |

| 16 | | |

| 4 | | |

| 7 | | |

| 7 | | |

| (2 | ) |

| Provision/(credit)

for credit/loan losses | |

| 1,620 | | |

| 419 | | |

| 263 | | |

| 395 | | |

| 543 | | |

| (627 | ) | |

| (736 | ) | |

| (101 | ) | |

| 631 | | |

| (421 | ) |

| Net

interest income after provision for loan losses | |

| 55,250 | | |

| 13,775 | | |

| 13,721 | | |