As filed with the Securities and Exchange Commission

on February 5, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM F-3

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

Rail Vision Ltd.

(Exact name of registrant as specified in its

charter)

Not Applicable

(Translation of Registrant’s Name into English)

| Israel |

|

7372 |

|

Not

Applicable |

(State or other jurisdiction

of

incorporation or organization) |

|

(Primary Standard Industrial

Classification Code Number) |

|

(I.R.S. Employer

Identification No.) |

Shahar Hania

Chief Executive Officer

15 Ha’Tidhar St

Ra’anana, 4366517 Israel

Tel: +972- 9-957-7706

(Address, including zip code, and telephone number,

including area code, of Registrant’s principal executive offices)

Puglisi & Associates

850 Library Avenue, Suite 204

Newark, Delaware

(302) 738-6680

(302) 738-7210 (facsimile)

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

Copies to:

David Huberman,

Esq.

Gary Emmanuel, Esq.

Greenberg Traurig, P.A.

One Azrieli Center

Round Tower, 30th floor

132 Menachem Begin Rd

Tel Aviv 6701101

Tel: +972 3-636-6000 |

Ron Soulema,

Adv.

Gal Rahav, Adv.

Shibolet Law Firm

4 Yitzhak Sadeh St.

Tel-Aviv 6777504, Israel

Tel: +972-3-3075000 |

Approximate date of commencement of proposed

sale to the public: From time to time after the effective date of this Registration Statement.

If the only securities being registered on this

Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered on

this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following

box. ☒

If this Form is filed to register additional

securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act

registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective amendment filed

pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of

the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement pursuant

to General Instruction I.C. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant

to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment to

a registration statement filed pursuant to General Instruction I.C. filed to register additional securities or additional classes of

securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares its

financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition

period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B) of the Securities

Act. ☐

| † |

The term “new or

revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting

Standards Codification after April 5, 2012. |

The Registrant hereby amends this Registration

Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which

specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities

Act of 1933 or until this Registration Statement shall become effective on such date as the Securities and Exchange Commission, acting

pursuant to said Section 8(a), may determine.

The information in

this prospectus is not complete and may be changed. The selling shareholders may not sell these securities until the registration statement

filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell securities and it is not soliciting

an offer to buy securities in any state where the offer or sale is not permitted.

Subject

to Completion, Dated February 5, 2024

PRELIMINARY PROSPECTUS

8,885,503 Ordinary

Shares

RAIL VISION LTD.

This prospectus relates to

the resale, from time to time, by the selling shareholders identified in this prospectus, or the selling shareholders, of up to 8,885,503

ordinary shares, par value NIS 0.08 per share, as further described below under “Our Company — Recent Financings —

Private Placement (January 2024)” consisting of (i) 1,651,458 ordinary shares held by the selling shareholders, (ii) 1,394,999

ordinary shares issuable upon the exercise of pre-funded warrants held by the selling shareholders, or the January 2024 PIPE Pre-Funded

Warrants, that were issued in the January 2024 PIPE (as defined below), (iii) 4,569,688 ordinary shares issuable upon the exercise of

ordinary share warrants held by the selling shareholders, or the January 2024 PIPE Ordinary Share Warrants and together with the January

2024 PIPE Pre-Funded Warrants, the January 2024 PIPE Warrants, in the January 2024 PIPE, (iv) 507,743 ordinary shares issuable upon the

exercise of a pre-funded warrant held by a selling shareholder, or the Facility Conversion Pre-Funded Warrant, issued upon a conversion

of the January 2024 Conversion Loan Amount (as defined below) and (v) 761,615 ordinary shares issuable upon the exercise of an ordinary

share warrant held by a selling shareholder, or the Facility Conversion Ordinary Share Warrant and together with the Facility Conversion

Pre-Funded Warrant, the Facility Conversion Warrants, issued upon a conversion of the January 2024 Conversion Loan Amount.

The selling shareholders

are identified in the table on page 9. No ordinary shares or January 2024 PIPE Warrants are being registered hereunder for sale by

us. While we will not receive any proceeds from the sale of the ordinary shares by the selling shareholders, we will receive cash proceeds

equal to the total exercise price of the January 2024 PIPE Warrants if the selling shareholders do not exercise such warrants on a cashless

basis, if and when exercised. The exercise prices of the January 2024 PIPE Pre-Funded Warrants and the January 2024 PIPE Ordinary Share

Warrants are $0.0001 and $0.98475 per ordinary share, respectively, in each case, subject to certain adjustments and certain anti-dilution

protection therein. See “Use of Proceeds.” The selling shareholders may sell all or a portion of the ordinary shares from

time to time in market transactions through any market on which our ordinary shares are then traded, in negotiated transactions or otherwise,

and at prices and on terms that will be determined by the then prevailing market price or at negotiated prices directly or through a

broker or brokers, who may act as agent or as principal or by a combination of such methods of sale. See “Plan of Distribution.”

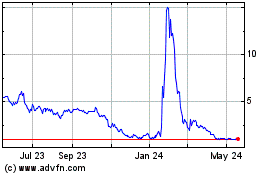

Our ordinary shares are listed

on the Nasdaq Capital Market, or Nasdaq, under the symbol “RVSN.” On February 2, 2024, the last 2024 PIPE sale price of our

ordinary shares was $11.84 per share. We do not intend to apply for listing of the January 2024 PIPE Warrants on any securities

exchange or other nationally recognized trading system.

We are an emerging growth

company, as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act, and are subject to reduced public company reporting

requirements.

Investing in the securities

involves a high degree of risk. See “Risk Factors” beginning on page 5 of this prospectus and in the documents incorporated

by reference into this for a discussion of information that should be considered in connection with an investment in the ordinary shares.

Neither the Securities

and Exchange Commission nor any state or other securities commission has approved or disapproved of these securities or determined if

this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus

is , 2024

TABLE OF CONTENTS

You

should rely only on the information contained in this prospectus, including information incorporated by reference herein, and any free

writing prospectus prepared by or on behalf of us or to which we have referred you. Neither we nor the selling shareholders have authorized

anyone to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely

on it. This prospectus does not constitute an offer to sell, or a solicitation of an offer to purchase, the securities offered by this

prospectus in any jurisdiction to or from any person to whom or from whom it is unlawful to make such offer tor solicitation of an offer

in such jurisdiction. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of

delivery of this prospectus or any sale of our securities.

For

investors outside of the United States: We and the selling shareholders have not done anything that would permit this offering or possession

or distribution of this prospectus in any jurisdiction where action for that purpose is required, other than in the United States. You

are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus.

In this prospectus, “we,” “us,” “our,” the “Company” and “Rail Vision” refer

to Rail Vision Ltd., an Israeli corporation.

Our

reporting currency and functional currency is the U.S. dollar. Unless otherwise expressly stated or the context otherwise requires, references

in this prospectus to “dollars” or “$” mean U.S. dollars, and references to “NIS” are to New Israeli

Shekels. All references to “shares” and “ordinary shares” in this prospectus refer to ordinary shares of

Rail Vision Ltd. par value NIS 0.08 per share.

We are incorporated under

Israeli law and, under the rules of the U.S. Securities and Exchange Commission, or the SEC, we are currently eligible for treatment

as a “foreign private issuer.” As a foreign private issuer, we are not required to file periodic reports and financial statements

with the SEC as frequently or as promptly as domestic registrants whose securities are registered under the Securities Exchange Act of

1934, as amended, or the Exchange Act.

On November 15, 2023, we

effected a reverse share split of our ordinary shares at the ratio of 8:1. Unless the context expressly dictates otherwise, all references

to share and per share amounts referred to herein reflect the reverse share split.

INDUSTRY AND MARKET DATA

This prospectus includes

statistical, market and industry data and forecasts which we obtained from publicly available information and independent industry publications

and reports that we believe to be reliable sources. These publicly available industry publications and reports generally state that they

obtain their information from sources that they believe to be reliable, but they do not guarantee the accuracy or completeness of the

information. Although we are responsible for all of the disclosures contained in this prospectus, including such statistical, market

and industry data, we have not independently verified any of the data from third-party sources, nor have we ascertained the underlying

economic assumptions relied upon therein. In addition, while we believe the market opportunity information included in this prospectus

is generally reliable and is based on reasonable assumptions, such data involves risks and uncertainties, including those discussed under

the heading “Risk Factors.”

PRESENTATION OF FINANCIAL INFORMATION

Our financial statements

were prepared in accordance with generally accepted accounting principles in the United States, or U.S. GAAP. We present our consolidated

financial statements in U.S. dollars. Our fiscal year ends on December 31 of each year. Certain figures included in this prospectus have

been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables may not be an arithmetic aggregation of

the figures that precede them.

TRADEMARKS AND TRADENAMES

We own or have rights to

trademarks, service marks and trade names that we use in connection with the operation of our business, including our corporate name,

logos and website names. Other trademarks, service marks and trade names appearing in this prospectus are the property of their respective

owners. Solely for convenience, some of the trademarks, service marks and trade names referred to in this prospectus are listed without

the ® and ™ symbols, but we will assert, to the fullest extent under applicable law, our rights to our

trademarks, service marks and trade names.

OUR COMPANY

We are a development stage

technology company that is seeking to revolutionize railway safety and the data-related market. We believe we have developed cutting

edge, AI based, industry-leading detection technology specifically designed for railways, with investments from Knorr-Bremse AG, or Knorr-Bremse,

a world-class rail system manufacturer. We have developed our railway detection and systems to save lives, increase efficiency, and dramatically

reduce expenses for the railway operator. We believe that our technology will significantly increase railway safety around the world,

while creating significant benefits and adding value for everyone who relies on the train ecosystem: from passengers using trains for

transportation to companies that use railways to deliver goods and services. In addition, we believe that our technology has the potential

to advance the revolutionary concept of autonomous trains into a practical reality.

The

increasing electrification and automation of railways and trains are two key factors that are driving growth in the transportation market.

Autonomous trains are integrated with advanced systems to provide improved control over the train for stopping, departing and movement

between train stations – for example the operators are aiming to increase the density on a given track that’s to say more

trains per kilometer. From everyday passengers to train operators, there is a rising demand for safe, secure, and efficient transport

systems. Additionally, various technological advancements, such as the integration of the Internet of Things, or IoT, and artificial

intelligence, or AI, solutions into railway detection systems, are market categories expected to grow in the coming years. These technologies

aid in improving the overall operational efficiency and maintaining freight operations and systems.

Autonomous

trains operations, or ATO, also known as driverless trains, are operated automatically without any human intervention, and are monitored

from the control station when communication is available. In case of any obstacle incurred in the route, the obstacle detection system

commands the train to stop and in parallel a message is sent to operational control center and to the attendant on the train if any,

to further command the train. Owing to increase in traffic congestion on road network, the need for smart and frequent trains has boosted

the growth of the global market. According to Global Market Insights, the autonomous train market was valued at $8.0 billion in 2022,

and is projected to reach $15.1 billion by 2032, growing at a CAGR of 6.4% from 2023 to 2032. We believe that our advanced obstacle

detection is a crucial component in ATO.

Since

our founding in April 2016, we have developed unique railway detection technology for railway safety, based on image processing and deep

leaning technologies that provide early warnings to train driver of hazards on and around the railway track, including during severe

weather and in all lighting conditions. Our unique system uses special high resolution cameras to identify objects up to 2,000 meters

away for mainline application and up to 200m for switch yard application, along with a computer unit that uses AI machine learning algorithms

to analyze the images, identify objects on or near the tracks, and warn the train driver of the obstacle and potential danger.

Our

railway detection system includes different types of cameras, including optics, visible light spectrum cameras (video) and thermal cameras

that transmit data to a ruggedized on-board computer which is designed to be suitable for the rough environment of a train’s locomotive.

Our railway detection and classification system includes an image-processing and machine-learning algorithm that processes the data for

identifying potential hazards on and around the track. These algorithms are designed to identify and classify objects such as people,

animals, vehicles, signs, signals along the track, and anomalies. Our railway detection system actively classifies objects by severity

to determine if an alarm should be signaled to the train driver. These data collection and classification capabilities can be extended

to further use-cases such as predictive maintenance and big-data analyses.

We

believe that our technology demonstrates capabilities and results that are better than existing solutions. Most of the currently available

safety solutions for the railway industry focus on stationary systems in dedicated hazardous locations, such as at level track crossings

and passenger train stations, among others. At these dedicated locations, different technologies are used for detecting obstacles that

are on the vicinity of level crossing tracks, and usually include different cameras and radars. The problem with this type of solution

is that the train is only monitored at specific points in the railroad junction, leaving the vast majority of the railway unprotected.

In addition, even when detected something on the level crossing tracks, the message has to be transmitted in a way that the driver would

be able to react on time. In recognition of the limitations of existing solutions, we integrate a collision avoidance system using long-range

real-time AI and electro-optics technologies on trains that is designed to address this unmet need. as well as providing solutions to

most of the challenges train operators face during transit such as collisions, derailments and other accidents caused by obstacles on

tracks, or poor infrastructure

Recent Financings

Private Placement (January 2024)

On January 18, 2024, we entered

into a binding term sheet directly with a global investment firm, or the Lead Investor, for the purchase and sale in a private placement,

or the January 2024 PIPE, of units, or the Units, consisting of (i) one of our ordinary shares and/or pre-funded warrants to purchase

our ordinary shares and (ii) one and a half warrants to purchase our ordinary shares to the Lead Investor and other investors, collectively,

the Investors, who are named as the selling shareholders in this registration statement, of a minimum of $2.5 million of Units and up

to a maximum of $3 million of Units. The January 2024 PIPE closed on January 31, 2024 following the execution of definitive documentation

between us and the Investors.

In the January 2024 PIPE,

the Investors purchased $3.0 million of Units consisting of (A) (i) 1,651,458 of ordinary shares and/or (ii) January 2024 PIPE Pre-Funded

Warrants to purchase up to 1,394,999 ordinary shares and (B) January 2024 PIPE Ordinary Share Warrants to purchase up to 4,569,688 ordinary

shares. The purchase price per Unit is $0.98475. The January 2024 PIPE Pre-Funded Warrants are immediately exercisable at an exercise

price of $0.0001 per ordinary share, subject to certain adjustments and certain anti-dilution protection set forth therein, and will

not expire until exercised in full. The January 2024 PIPE Ordinary Share Warrants are exercisable upon issuance at an exercise price

of $0.98475 per ordinary share, subject to certain adjustments and certain anti-dilution protection set forth therein, and have a 5.5-year

term from the issuance date.

In connection with the closing

of the January 2024 PIPE, we exercised our conversion right pursuant to the Facility Agreement (as defined below) to convert $500,000

of the Credit Facility (as defined below) as a portion of the January 2024 Conversion Loan Amount (as defined below). Following such

conversion, we issued to the Lender (as defined below) (i) the Facility Conversion Pre-Funded Warrant to purchase up to 507,743 ordinary

shares and (ii) the Facility Conversion Ordinary Share Warrant to purchase up to 761,615 ordinary shares. The Facility Conversion Pre-Funded

Warrant and the Facility Conversion Common Warrant are in substantially the same form and on substantially the same terms as the January

2024 PIPE Pre-Funded Warrant and January 2024 PIPE Ordinary Share Warrant, respectively. See “Our Company — Recent Financings

— Execution of Credit Facility Agreement and Issuance of Warrant (January 2024)” for additional information.

In connection with the January

2024 PIPE, we undertook to file this registration statement with the SEC to register the resale by the selling shareholders of the ordinary

shares issued in the January 2024 PIPE and the ordinary shares underlying the January 2024 PIPE Warrants and the Facility Conversion

Warrants.

Execution of Credit Facility Agreement

and Issuance of Warrant (January 2024)

On January 9, 2024, we entered

into a facility agreement, or the Facility Agreement, for a $6 million credit facility, or the Credit Facility, and an additional amount

up to $3 million, subject to certain conditions, or the Additional Loans, with a global investment firm, or the Lender, who was also

an Investor in the January 2024 PIPE.

The Credit Facility, which

has an initial term of 10 months, accrues interest at a rate of 8% per annum, and the first payment of $1.5 million was drawn down upon

execution of the Facility Agreement and the remaining amount may be drawn down in eight equal installments as of March 7, 2024.

After the Credit Facility

is exhausted, we may draw down the Additional Loans in an aggregate amount up to $3 million. The Additional Loans include two initial

installments of up to $750,000, and two additional installments of up to $750,000, the latter of which are subject to certain conditions.

The Additional Loans will accrue interest at a rate of 12% per annum.

In the event that we enter

into an alternate credit facility on more favorable terms, the Lender’s funding obligations under the Credit Facility shall decrease

with respect to the amount actually received by us under such alternate credit facility. The Lender’s financing obligations shall

terminate in the event we draw down $7.5 million or more pursuant to an alternate credit facility or closes one or more equity financing

transaction in an aggregate amount of at least $5 million.

Until we close one or more

equity financing transactions in an aggregate amount of at least $5 million (including the conversion of the Credit Facility), we have

the right to convert into ordinary share up to $1.5 million, including accrued interest, of a loan extended or to be extended to us by

the Lender, or the January 2024 Conversion Loan Amount, in connection with and in the framework of a financing transaction of ours on

the date that follows the date upon which we notify the Lender of such financing transaction, which conversion will occur upon the same

terms. As of the date hereof, we have converted $500,000 of the Credit Facility as a portion of the January 2024 Conversion Loan Amount.

See “Our Company — Recent Financings — Private Placement (January 2024)” for additional information.

In addition, the loan, together

with accrued interest, must be repaid at a rate of 30% of the gross proceeds of any equity financing transactions consummated by us during

the term of the Credit Facility, which meet a minimum threshold aggregate amount (initially, $5,000,000 and increasing by an additional

$500,000 for each month during the term) until the loan is repaid in full. The repayment of the Credit Facility shall be on the last

day of each calendar month during which the sources for repayment specified above were actually received by us. The loan may be prepaid

early without any penalty.

As part of the Facility Agreement,

we issued a warrant, or the January 2024 Facility Warrant, to the Lender to purchase 2,419,354 of our ordinary shares representing an

aggregate exercise amount of $7.5 million, with a per share exercise price of $3.10, subject to certain adjustments and certain anti-dilution

protection, representing a 150% premium of the closing share price of our ordinary shares on January 5, 2024. The January 2024 Facility

Warrant is immediately exercisable upon issuance and has a term of 5 years from the date of issuance. Following the closing of the January

2024 PIPE, the exercise price of the January 2024 Facility Warrant was adjusted to the effective price per ordinary share in the January

2024 PIPE, or the January 2024 Facility Warrant Adjusted Exercise Price, and the number of ordinary shares issuable upon the exercise

of the January 2024 Facility Warrant was also adjusted, or the January 2024 Facility Warrant Adjusted Shares, such that the product of

the January 2024 Facility Warrant Adjusted Exercise Price and the January 2024 Facility Warrant Adjusted Shares is equal to an aggregate

exercise amount of $7.5 million.

In connection with and as

a condition to the Credit Facility, each of Shmuel Donnerstein, Inbal Kreiss and Keren Aslan tendered their resignations from our board

of directors (the “Board”), and the Board appointed Amitay Weiss and Hila Kiron-Revach to the Board, to serve until our next

annual general meeting of shareholders.

Cashless Exercise

of Warrants (January 2024)

As

of January 31, 2024, investors from our Private Placement (as defined below) from May 2023 exercised 493,424 Concurrent Warrants on a

cashless basis. As a result of the cashless exercise, we issued 181,002 ordinary shares to such investors.

Registered Direct

Offering and Concurrent Private Placement of Warrants (May 2023)

On May 10, 2023, we entered

into definitive securities purchase agreements with investors for the purchase and sale of 493,421 ordinary shares, at a purchase price

of $6.08 per unit in a registered direct offering, or the Registered Direct Offering. In a concurrent private placement, or the Private

Placement, we also agreed to issue to the same investors a total of warrants to purchase an aggregate of 493,424 ordinary shares, or

the Concurrent Warrants, at an exercise price of $6.72 per ordinary share. The Concurrent Warrants will be exercisable upon issuance

and will have a 5-year term from the initial issuance date. The transactions closed on May 11, 2023.

As of January 31, 2024, investors

from the Private Placement exercised 493,424 Concurrent Warrants on a cashless basis. As a result of the cashless exercise, we issued

181,002 ordinary shares to such investors. See “Our Company — Recent Financings — Cashless Exercise of Warrants

(January 2024)” for additional information.

Private Placement

of Ordinary Shares and Warrants (May 2023)

In an additional concurrent

private placement with the Registered Direct Offering and Private Placement, or the KB Private Placement, we entered into a definitive

securities purchase agreement for the purchase and sale of an aggregate of 493,421 ordinary shares and 5-year term common warrants to

purchase an aggregate of 493,421 ordinary shares, or the KB Warrants, at a purchase price of $6.08 per unit, to Knorr-Bremse Rail Vehicle

Systems, part of Knorr-Bremse, which is our largest shareholder. Knorr-Bremse is the global market leader for braking systems and a leading

supplier of other mission-critical systems for rail and commercial vehicles. The KB Warrants are exercisable at $6.72 per ordinary share.

The KB Private Placement closed on June 21, 2023, following approval of such transaction by our shareholders.

Reverse Share Split

On

November 15, 2023, we effected a reverse share split of our ordinary shares at the ratio of 1-for-8, such that each eight (8) ordinary

shares, par value NIS 0.01 per share, were consolidated into one (1) ordinary share, par value NIS 0.08. The first date when our ordinary

shares began trading on Nasdaq after implementation of the reverse split was November 15, 2023. Unless indicated otherwise by the context,

all ordinary share, option, warrant and per share amounts as well as share prices appearing in this prospectus have been adjusted to

give retroactive effect to the reverse share split for all periods presented.

Corporate Information

We

are a corporation based in Ra’anana and were incorporated in Israel. Our principal executive offices are located at 15 Hatidhar

St. Ra’anana, 4366517 Israel. Our telephone number in Israel is +972-9-957-7706. Our website address is http://www.railvision.io/.

The information contained on, or that can be accessed through, our website is not part of this prospectus. We have included our website

address in this prospectus solely as an inactive textual reference.

THE OFFERING

| Ordinary shares

currently outstanding |

|

6,733,480 ordinary

shares (assumes the exercise in full of the January 2024 PIPE Pre-Funded Warrants and the Facility Conversion Pre-Funded Warrants,

but no exercise of the January 2024 PIPE Ordinary Share Warrants or the Facility Conversion Ordinary Share Warrant). |

| |

|

|

| Ordinary shares offered

by the selling shareholders |

|

Up to 8,885,503 ordinary

shares consisting of (i) 1,651,458 ordinary shares issued in the January 2024 PIPE, (ii) up to 1,394,999 ordinary shares issuable

upon the exercise of the January 2024 PIPE Pre-Funded Warrants, (iii) up to 4,569,688 ordinary shares issuable upon the exercise

of the January 2024 PIPE Ordinary Share Warrants (iv) 507,743 ordinary shares issuable upon the exercise of the Facility Conversion

Pre-Funded Warrant and (v) 761,615 ordinary shares issuable upon the exercise of the Facility Conversion Ordinary Share Warrant.

|

| |

|

|

| Ordinary shares to be outstanding assuming exercise

of the January 2024 PIPE Warrants and the Facility Conversion Warrants |

|

12,064,783 ordinary shares.

|

| |

|

|

| Use of proceeds:

|

|

We will not receive any

proceeds from the sale of the ordinary shares by the selling shareholders. All net proceeds from the sale of the ordinary shares

covered by this prospectus will go to the selling shareholders. However, we will receive cash proceeds equal to the total exercise

price of the January 2024 PIPE Warrants that are exercised. We intend to use the proceeds from the exercise of the January

2024 PIPE Warrants for research and development, including completion of our existing systems and continued development of new products,

marketing, advertising and pre-commercialization activities and the remainder for working capital and general corporate purposes,

and possible in-licensing of additional intellectual property. See “Use of Proceeds.” |

| |

|

|

| Risk factors: |

|

You should read the “Risk

Factors” section starting on page 5 of this prospectus, and “Item 3. - Key Information – D. Risk Factors”

in our Annual Report on Form 20-F for the year ended December 31, 2022, or the 2022 Annual Report, incorporated by reference herein,

and other information included or incorporated by reference in this prospectus for a discussion of factors to consider carefully

before deciding to invest in our securities. |

| |

|

|

| Nasdaq symbol: |

|

“RVSN.” |

Unless otherwise stated,

all information in this prospectus, is based on 6,733,480 ordinary shares (assumes the exercise in full of the January 2024 PIPE Pre-Funded

Warrants and the Facility Conversion Pre-Funded Warrants, but no exercise of the January 2024 PIPE Ordinary Share Warrants or the Facility

Conversion Ordinary Share Warrant) ordinary shares outstanding as of February 2, 2024, and does not include the following as of that

date:

| |

● |

288,745 ordinary shares

reserved for issuance under our Amended Share Option Plan, of which options to purchase 265,816 ordinary shares were outstanding

as of such date at a weighted average exercise price of $16.38, of which 157,394 were vested as of such date; |

| |

● |

1,192,619 ordinary shares

issuable upon the exercise of warrants, at a weighted average exercise price of $19.57 (including the Concurrent Warrants and the

KB Warrants); |

| |

● |

5,331,303 ordinary shares

issuable upon the exercise of the January 2024 PIPE Ordinary Share Warrants and Facility Conversion Ordinary Share Warrant, at an

exercise price of $0.98475; and |

| |

● |

2,419,355 ordinary shares

issuable upon the exercise of the January 2024 Facility Warrant, at an exercise price of $3.10 (subject to certain adjustments and

certain anti-dilution protection as a result of the January 2024 PIPE). |

Unless otherwise indicated,

all information in this prospectus assumes or gives effect to:

| |

● |

no exercise of the warrants

or options, as described above; and |

| |

● |

a reverse share split of

the Company’s ordinary shares at the ratio of 8:1 effected on November 15, 2023, and the customary adjustments to our outstanding

options and warrants. |

RISK FACTORS

You should carefully consider

the risks described below and the risks described in our 2022 Annual Report which are incorporated by reference herein, as well as the

financial or other information included in this prospectus or incorporated by reference in this prospectus, including our consolidated

financial statements and the related notes, before you decide to buy our securities. The risks and uncertainties described below are

not the only risks facing us. We may face additional risks and uncertainties not currently known to us or that we currently deem to be

immaterial. Any of the risks described below, and any such additional risks, could materially adversely affect our business, financial

condition or results of operations. In such case, you may lose all or part of your original investment.

The sale of a substantial

number of our ordinary shares in the public market, including resale of the shares issued to the selling shareholders, could adversely

affect the prevailing market price for our ordinary shares.

We are registering for resale

up to 8,885,503 of our ordinary shares issued in the January 2024 PIPE to the selling shareholders and issuable to the selling shareholders

pursuant to January 2024 PIPE Warrants and the Facility Conversion Warrants. Sales of substantial amounts of shares of our ordinary shares

in the public market, or the perception that such sales might occur, could adversely affect the market price of our ordinary shares,

and the market value of our other securities. We cannot predict if and when the selling shareholders may sell such shares in the public

markets. Furthermore, in the future, we may issue additional ordinary shares or other equity or debt securities exercisable for, or convertible

into, our ordinary shares. Any such issuances could result in substantial dilution to our existing shareholders and could cause our share

price to decline.

Security, political and economic instability in the Middle East

may harm our business.

Our executive office is located

in Ra’anana, Israel. In addition, certain of our key employees, officers and directors are residents of Israel. Accordingly, political,

economic and military conditions in the Middle East may affect our business directly. Since the establishment of the State of Israel

in 1948, a number of armed conflicts have occurred between Israel and its neighboring countries and terrorist organizations active in

the region, including Hamas (an Islamist militia and political group in the Gaza Strip) and Hezbollah (an Islamist militia and political

group in Lebanon).

In particular, in October

2023, Hamas terrorists infiltrated Israel’s southern border from the Gaza Strip and conducted a series of attacks on civilian and

military targets. Hamas also launched extensive rocket attacks on the Israeli population and industrial centers located along Israel’s

border with the Gaza Strip and in other areas within the State of Israel. These attacks resulted in thousands of deaths and injuries,

and Hamas additionally kidnapped many Israeli civilians and soldiers. Following the attack, Israel’s security cabinet declared

war against Hamas and commenced a military campaign against Hamas and these terrorist organizations in parallel continued rocket and

terror attacks. As a result of the events of October 7, 2023, the Israeli government declared that the country was at war and the Israeli

military began to call-up reservists for active duty. Five (5) of our full-time and part-time employees were called up for reserve service,

none of whom perform critical functions. Military service call ups that result in absences of personnel from us for an extended period

of time may materially and adversely affect our business, prospects, financial condition and results of operations.

Since

the war broke out on October 7, 2023, our operations have not been adversely affected by this situation, and we have not experienced

disruptions to our business operations. As such, our product and business development activities remain on track. However, the intensity

and duration of Israel’s current war against Hamas is difficult to predict at this stage, as are such war’s economic implications

on our business and operations and on Israel’s economy in general, and we continue to monitor the situation closely and examine

the potential disruptions that could adversely affect our operations.

Additionally, political uprisings,

social unrest and violence in various countries in the Middle East, including Israel’s neighbor Syria, have affected the political

stability of those countries. This instability may lead to deterioration of the political relationships that exist between Israel and

certain countries and have raised concerns regarding security in the region and the potential for armed conflict. In addition, Iran has

threatened to attack Israel. Iran is also believed to have a strong influence among the Syrian government, Hamas and Hezbollah. These

situations may potentially escalate in the future into more violent events which may affect Israel and us. These situations, including

conflicts which involved missile strikes against civilian targets in various parts of Israel have in the past negatively affected business

conditions in Israel.

Any hostilities involving

Israel or the interruption or curtailment of trade between Israel and its present trading partners could have a material adverse effect

on our business. The political and security situation in Israel may result in parties with whom we have contracts claiming that they

are not obligated to perform their commitments under those agreements pursuant to force majeure provisions. These or other Israeli political

or economic factors could harm our operations and product development. Any hostilities involving Israel or the interruption or curtailment

of trade between Israel and its present trading partners could adversely affect our operations and could make it more difficult for us

to raise capital. We could experience disruptions if acts associated with such conflicts result in any serious damage to our facilities.

Furthermore, several countries, as well as certain companies and organizations, continue to restrict business with Israel and Israeli

companies, which could have an adverse effect on our business and financial condition. Our business interruption insurance may not adequately

compensate us for losses, if at all, that may occur as a result of an event associated with a security situation in the Middle East,

and any losses or damages incurred by us could have a material adverse effect on our business.

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and elsewhere,

including in our 2022 Annual Report incorporated by reference herein, and other information included or incorporated by reference in

this prospectus, contains forward-looking statements concerning our business, operations and financial performance and condition, as

well as our plans, objectives and expectations for our business operations and financial performance and condition. Any statements contained

herein that are not statements of historical facts may be deemed to be forward-looking statements. In some cases, you can identify forward-looking

statements by terminology such as “aim,” “anticipate,” “assume,” “believe,” “contemplate,”

“continue,” “could,” “due,” “estimate,” “expect,” “goal,” “intend,”

“may,” “objective,” “plan,” “predict,” “potential,” “positioned,”

“seek,” “should,” “target,” “will,” “would,” and other similar expressions

that are predictions of or indicate future events and future trends, or the negative of these terms or other comparable terminology.

These forward-looking statements include, but are not limited to, statements about:

| |

● |

our lack of operating history; |

| |

● |

our current and future

capital requirements; |

| |

● |

our ability to manufacture,

market and sell our products and to generate revenues; |

| |

● |

our ability to maintain

our relationships with key partners and grow relationships with new partners; |

| |

● |

our ability to maintain

or protect the validity of our U.S. and other patents and other intellectual property; |

| |

● |

our ability to launch and

penetrate markets in new locations and new market segments; |

| |

● |

our ability to retain key

executive members and hire additional personnel; |

| |

● |

our ability to maintain

and expand intellectual property rights; |

| |

● |

interpretations of current

laws and the passages of future laws; |

| |

● |

our ability to achieve

greater regulatory compliance needed in existing and new markets; |

| |

● |

the overall demand for

passenger and freight transport; |

| |

● |

our ability to achieve

key performance milestones in our planned operational testing; |

| |

● |

our ability to establish

adequate sales, marketing and distribution channels; |

| |

● |

acceptance of our business

model by investors; |

| |

● |

security, political and

economic instability in the Middle East that could harm our business, including due to the current war between Israel and Hamas;

and |

| |

● |

those factors referred

to in our 2022 Annual Report incorporated by reference herein in “Item 3. Key Information – D. Risk Factors,” “Item

4. Information on the Company,” and “Item 5. Operating and Financial Review and Prospects,” as well as in our 2022

Annual Report generally, which is incorporated by reference into this prospectus. |

Forward-looking statements

are based on our management’s current expectations, estimates, forecasts and projections about our business and the industry in

which we operate and our management’s beliefs and assumptions, and are not guarantees of future performance or development and

involve known and unknown risks, uncertainties and other factors that are in some cases beyond our control. As a result, any or all of

our forward-looking statements in this prospectus may turn out to be inaccurate. Important factors that may cause actual results to differ

materially from current expectations include, among other things, those listed under “Risk Factors” and elsewhere in this

prospectus. Potential investors are urged to consider these factors carefully in evaluating the forward-looking statements.

The forward-looking statements

included in this prospectus speak only as of the date of this prospectus. Although we believe that the expectations reflected in the

forward-looking statements are reasonable, we cannot guarantee that future results, levels of activity, performance and events and circumstances

reflected in the forward-looking statements will be achieved or will occur. Except as required by law, we assume no obligation to update

or revise these forward-looking statements for any reason, even if new information becomes available in the future. You should, however,

review the factors and risks we describe in the reports we will file from time to time with the SEC after the date of this prospectus.

See “Where You Can Find More Information.”

capitalization

The

following table sets forth our cash and cash equivalents and our capitalization as of June 30, 2023:

| |

● |

on an actual basis; and |

| |

● |

on an as adjusted basis

to give further effect to the (i) issuance and sale of 3,046,457 ordinary shares and/or January 2024 PIPE Pre-Funded Warrants and

4,569,688 associated January 2024 PIPE Ordinary Share Warrants in the January 2024 PIPE at a purchase price of $0.98475 per ordinary

share, as if such issuance and sale had occurred on June 30, 2023 and no exercise of January 2024 Facility Warrants, and (ii) the

receipt of the first installment of the Credit Facility in the amount of $1.5 million, as if such installment had occurred on June

30, 2023, (iii) the issuance of 181,002 ordinary shares as a result of cash-less exercise of 493,424 of the Concurrent Warrants,

as if the exercise had occurred on June 30, 2023 and (iv) the conversion of $500,000 of the Credit Facility as a portion of the January

2024 Conversion Loan Amount and the issuance of the Facility Conversion Warrants, as if such conversion and issuance had occurred

on June 30, 2023. |

The information in this table

should be read in conjunction with and is qualified by reference to such financial information and other financial information incorporated

by reference into this prospectus.

| | |

As of June 30, 2023 | |

| U.S. dollars in thousands | |

Actual | | |

As

Adjusted (1) | |

| Cash and cash equivalents | |

$ | 8,192 | | |

| 12,639 | |

| | |

| | | |

| | |

| Shareholders’ equity: | |

| | | |

| | |

| Ordinary shares | |

| 68 | | |

| 144 | |

| Additional paid in capital | |

| 68,571 | | |

| 69,844 | |

| | |

| | | |

| | |

| Accumulated deficit | |

| (60,649 | ) | |

| (60,649 | ) |

| Total shareholders’ equity | |

| 7,990 | | |

| 9,339 | |

| Total capitalization | |

| 7,990 | | |

| 9,339 | |

| (1) |

The as adjusted ordinary shares and additional paid-in capital includes an amount of $1.4 million (gross before issuance costs) which is 40% of the total offering ($3.5 million) allocated to the ordinary shares and January 2024 PIPE Pre-Funded Warrants and Facility Conversion Pre-Funded Warrant which are being accounted as equity instruments. The January 2024 PIPE Ordinary Share Warrants as well as the January 2024 Facility Warrants and Facility Conversion Ordinary Share Warrant are being accounted for as liabilities. |

USE

OF PROCEEDS

We will not receive any proceeds

from the sale of the ordinary shares by the selling shareholders. All net proceeds from the sale of the ordinary shares covered by this

prospectus will go to the selling shareholders. However, we will receive cash proceeds equal to the total exercise price of the January

2024 PIPE Warrants and the Facility Conversion Warrants that are exercised.

We intend to use the proceeds

from the exercise of the January 2024 PIPE Warrants and the Facility Conversion Warrants for research and development, including completion

of our existing systems and continued development of new products, marketing, advertising and pre-commercialization activities and the

remainder for working capital and general corporate purposes, and possible in-licensing of additional intellectual property.

The amounts and schedule

of our actual expenditures will depend on multiple factors including the progress of our ongoing tests with train operators, the status

and results of the tests, the pace of our partnering efforts in regards to manufacturing and commercialization and the overall regulatory

environment. Therefore, our management will retain broad discretion over the use of the proceeds from the exercise of the January 2024

PIPE Warrants. We may ultimately use such proceeds for different purposes than what we currently intend. Pending any ultimate use of

any portion of the proceeds from this offering, if the anticipated proceeds will not be sufficient to fund all the proposed purposes,

our management will determine the order of priority for using the proceeds, as well as the amount and sources of other funds needed.

Pending

our use of the net proceeds from this offering, we may invest the net proceeds in a variety of capital preservation investments, including

short-term, investment grade, interest bearing instruments and U.S. government securities.

SELLING SHAREHOLDERS

The ordinary shares being

offered by the selling shareholders are those issued to the seller shareholders and those issuable to the selling shareholders upon the

exercise of the January 2024 PIPE Warrants and Facility Conversion Warrants in the January 2024 PIPE. For additional information regarding

the issuance of the ordinary shares, the January 2024 PIPE Warrants and the Facility Conversion Warrants in the January 2024 PIPE, see

“Our Company — Recent Financings — Private Placement (January 2024)” above. We are registering the ordinary

shares in order to permit the selling shareholders to offer the ordinary shares for resale from time to time.

The table below lists the

selling shareholders and other information regarding the beneficial ownership of the ordinary shares by each of the selling shareholders.

The second column lists the number of ordinary shares beneficially owned by the selling shareholders, based on its ownership of the ordinary

shares and ordinary shares issuable upon the exercise of the January 2024 PIPE Warrants and the Facility Conversion Warrants, as of February

2, 2024, assuming exercise of the warrants held by the selling shareholders on that date, without regard to any limitations on exercises.

The third column lists the ordinary shares being offered by this prospectus by the selling shareholders.

In accordance with the

terms of a registration rights provision in a registration rights agreement entered into between us and the selling shareholders in connection

with the January 2024 PIPE, this prospectus generally covers the resale of the sum of (i) the number of ordinary shares issued to the

selling shareholders in the January 2024 PIPE and (ii) the maximum number of ordinary shares issuable upon the exercise of the January

2024 PIPE Warrants and Facility Conversion Warrants, determined as if the outstanding January 2024 PIPE Warrants and Facility Conversion

Warrants were exercised in full as of the trading day immediately preceding the date this registration statement was initially filed

with the SEC, each as of the trading day immediately preceding the applicable date of determination and all subject to adjustment as

provided in such warrants, without regard to any limitations on the exercise of the January 2024 PIPE Warrants and the Facility Conversion

Warrants.

Under the terms of the

January 2024 PIPE Warrants and the Facility Conversion Warrants, the selling shareholders may not exercise the January 2024 PIPE Warrants

or the Facility Conversion Warrants to the extent such exercise would cause such selling shareholders, together with its affiliates,

to beneficially own a number of ordinary shares which would exceed 4.99% or 9.99% of our then outstanding ordinary shares following such

exercise, excluding for purposes of such determination ordinary shares not yet issuable upon exercise of the warrants which have not

been exercised. The number of ordinary shares does not reflect this limitation. The fourth and fifth columns list the amount of ordinary

shares owned after the offering, by number of ordinary shares and percentage of outstanding ordinary shares, assuming in both cases the

sale of all of the ordinary shares offered by the selling shareholders pursuant to this prospectus, and without regard to any limitations

on conversions or exercises. The selling shareholders may sell all, some or none of its ordinary shares in this offering. See “Plan

of Distribution.”

| Name of Selling Shareholder |

|

Number of

Ordinary Shares

Beneficially Owned

Prior to Offering |

|

|

Maximum

Number of

Ordinary Shares

to be

Sold Pursuant to

this Prospectus |

|

|

Number of

Ordinary Shares

Beneficially Owned

After Offering |

|

|

Percentage of

Ordinary

Shares

Owned

After the

Offering |

|

| L.I.A. Pure Capital Ltd. |

|

|

4,983,457 |

(1) |

|

|

2,564,103 |

(2) |

|

|

2,419,354 |

(3) |

|

|

20.1 |

% |

| YA II PN, LTD. |

|

|

3,173,395 |

(4) |

|

|

3,173,395 |

(4) |

|

|

- |

|

|

|

- |

|

| Lytton-Kambara Foundation |

|

|

1,269,358 |

(5) |

|

|

1,269,358 |

(5) |

|

|

- |

|

|

|

- |

|

| Eliyahu Zamir |

|

|

190,403 |

(6) |

|

|

190,403 |

(6) |

|

|

- |

|

|

|

- |

|

| Ronen Fatal |

|

|

101,584 |

(7) |

|

|

101,584 |

(7) |

|

|

- |

|

|

|

- |

|

| CapitaLink LTD |

|

|

253,873 |

(8) |

|

|

253,873 |

(8) |

|

|

- |

|

|

|

- |

|

| Itamar David |

|

|

126,935 |

(9) |

|

|

126,935 |

(9) |

|

|

- |

|

|

|

- |

|

| Amir Uziel Economic Consultant Ltd |

|

|

126,935 |

(10) |

|

|

126,935 |

(10) |

|

|

- |

|

|

|

- |

|

| E.G Europe Properties Ltd |

|

|

126,935 |

(11) |

|

|

126,935 |

(11) |

|

|

- |

|

|

|

- |

|

| David Masasa |

|

|

507,743 |

(12) |

|

|

507,743 |

(12) |

|

|

- |

|

|

|

- |

|

| M.R.M. MERHAVIT HOLDINGS AND MANAGEMENT LTD. |

|

|

444,275 |

(13) |

|

|

444,275 |

(13) |

|

|

- |

|

|

|

- |

|

| (1) |

Consists of (A) in connection with the January 2024 PIPE, (i) 225,000 ordinary shares issued in the January 2024 PIPE, (ii) 292,898 ordinary shares issuable upon the exercise of January 2024 PIPE Pre-Funded Warrants, (iii) 776,847 ordinary shares issuable upon the exercise of January 2024 PIPE Ordinary Share Warrants, (iv) 507,743 ordinary shares issuable upon the exercise of the Facility Conversion Pre-Funded Warrant and (v) 761,615 ordinary shares exercisable upon the exercise of the Facility Conversion Ordinary Share Warrant and (B) in connection with the Facility Agreement, 2,419,354 ordinary shares issuable upon the exercise of the January 2024 Facility Warrant (subject to certain adjustments and certain anti-dilution protection follow the closing of the January 2024 PIPE). Kfir Silberman is the officer, sole director, chairman of the board of directors and controlling shareholder of L.I.A. Pure Capital Ltd., and its address is 20 Raoul Wallenberg Street, Tel Aviv, Israel 6971916. |

| (2) |

Consists of (i) 225,000 ordinary shares issued in the January 2024 PIPE and (ii) 292,898 ordinary shares issuable upon the exercise of January 2024 PIPE Pre-Funded Warrants, (iii) 776,847 ordinary shares issuable upon the exercise of January 2024 PIPE Ordinary Share Warrants, (iv) 507,743 ordinary shares issuable upon the exercise of the Facility Conversion Pre-Funded Warrant and (v) 761,615 ordinary shares exercisable upon the exercise of the Facility Conversion Ordinary Share Warrant. |

| (3) |

Consists of in connection with the Facility Agreement, 2,419,354 ordinary shares issuable upon the exercise of the January 2024 Facility Warrant (subject to certain adjustments and certain anti-dilution protection follow the closing of the January 2024 PIPE). |

| (4) |

Consists of (i) 225,000 ordinary shares issued in the January 2024 PIPE, (ii) 1,044,358 ordinary shares issuable upon the exercise of January 2024 PIPE Pre-Funded Warrants, (iii) 1,904,037 ordinary shares issuable upon the exercise of January 2024 PIPE Ordinary Share Warrants. YA II PN, LTD. (“YA”) is a fund managed by Yorkville Advisors Global, LP or Yorkville LP. Yorkville Advisors Global II, LLC or Yorkville LLC is the General Partner of Yorkville LP. All investment decisions for YA are made by Yorkville LLC’s President and Managing Member, Mr. Mark Angelo. The business address of YA is 1012 Springfield Avenue, Mountainside, NJ 07092. |

| (5) |

Consists of (i) 450,000 ordinary shares issued in the January 2024 PIPE, (ii) 57,743 ordinary shares issuable upon the exercise of January 2024 PIPE Pre-Funded Warrants, (iii) 761,615 ordinary shares issuable upon the exercise of January 2024 PIPE Ordinary Share Warrants. Laurence Lytton is the control of the Lytton -Kambara Foundation. The address of the Lytton -Kambara Foundation is 467 Central Park West, 17-A, New York, New York 10025. |

| (6) |

Consists of (i) 76,161 ordinary shares issued in the January 2024 PIPE and (ii) 114,242 ordinary shares issuable upon the exercise of January 2024 PIPE Ordinary Share Warrants. The address for Eliyahu Zamir is 5 A.D. Gordon Street, Rishon LeZion, Israel. |

| (7) |

Consists of (i) 40,619 ordinary shares issued in the January 2024 PIPE and (ii) 60,929 ordinary shares issuable upon the exercise of January 2024 PIPE Ordinary Share Warrants. The address of Ronen Fatal is 112 Rokah Street, Ramat Gan Israel. |

| (8) |

Consists of (i) 101,549 ordinary shares issued in the January 2024 PIPE and (ii) 152,324 ordinary shares issuable upon the exercise of January 2024 PIPE Ordinary Share Warrants. Lavi Krasney is the control person of CapitaLinkLtd. The address for CapitaLinkLtd. 20 Raoul Wallenberg Street, Tel-Aviv Israel. |

| (9) |

Consists of (i) 50,774 ordinary shares issued in the January 2024 PIPE and (ii) 76,161 ordinary shares issuable upon the exercise of January 2024 PIPE Ordinary Share Warrants. The address of Itamar David is 601-283 Davie Street, Vancouver BC V6B5T6. |

| (10) |

Consists of (i) 50,774 ordinary shares issued in the January 2024 PIPE and (ii) 76,161 ordinary shares issuable upon the exercise of January 2024 PIPE Ordinary Share Warrants. Amir Uziel is the control person of Amir Uziel Economic Consultant Ltd. The address of Amir Uziel Economic Consultant Ltd is 20 Raoul Wallenberg Street, Tel-Aviv Israel. |

| (11) |

Consists of (i) 50,774 ordinary shares issued in the January 2024 PIPE and (ii) 76,161 ordinary shares issuable upon the exercise of January 2024 PIPE Ordinary Share Warrants. Eyal Gohar is the control person of E.G Europe Properties Ltd. The address of E.G Europe Properties Ltd is 9 Arie Discenchik Street, Tel Aviv, Israel. |

| (12) |

Consists of (i) 203,097 ordinary shares issued in the January 2024 PIPE and (ii) 304,646 ordinary shares issuable upon the exercise of January 2024 PIPE Ordinary Share Warrants. The address of David Masasa is 17 Monash Street, Tel Aviv, Israel. |

| (13) |

Consists of (i) 177,710 ordinary shares issued in the January 2024 PIPE and (ii) 266,565 ordinary shares issuable upon the exercise of January 2024 PIPE Ordinary Share Warrants. Moti Menashe is the control person of M.R.M. MERHAVIT HOLDINGS AND MANAGEMENT LTD. The address of M.R.M. MERHAVIT HOLDINGS AND MANAGEMENT LTD. is 31 Sokolov Street, Ramat Gan, Israel. |

PLAN OF DISTRIBUTION

The selling shareholders

of the securities and any of their donees, pledgees, transferees, distributees, assignees and other successors-in-interest may, from

time to time, sell any or all of their securities covered hereby on the principal trading market or any other stock exchange, market

or trading facility on which the securities are traded or in private transactions. These sales may be at fixed or negotiated prices.

A selling shareholder may use any one or more of the following methods when selling securities:

| |

● |

ordinary

brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| |

|

|

| |

● |

block

trades in which the broker-dealer will attempt to sell the securities as agent but may position and resell a portion of the block

as principal to facilitate the transaction; |

| |

|

|

| |

● |

purchases

by a broker-dealer as principal and resale by the broker-dealer for its account; |

| |

|

|

| |

● |

an

exchange distribution in accordance with the rules of the applicable exchange; |

| |

|

|

| |

● |

privately

negotiated transactions; |

| |

|

|

| |

● |

settlement

of short sales; |

| |

|

|

| |

●

|

in

transactions through broker-dealers that agree with the selling shareholders to sell a specified number of such securities at a stipulated

price per security; |

| |

|

|

| |

● |

through

the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; |

| |

|

|

| |

● |

a

combination of any such methods of sale; or |

| |

|

|

| |

● |

any

other method permitted pursuant to applicable law. |

The selling shareholders

may also sell securities under Rule 144 or any other exemption from registration under the Securities Act, if available, rather than

under this prospectus.

Broker-dealers engaged

by the selling shareholders may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions or

discounts from the selling shareholders (or, if any broker-dealer acts as agent for the purchaser of securities, from the purchaser)

in amounts to be negotiated, but, except as set forth in a supplement to this Prospectus, in the case of an agency transaction not in

excess of a customary brokerage commission in compliance with FINRA Rule 2121; and in the case of a principal transaction a markup or

markdown in compliance with FINRA Rule 2121.

In connection with the

sale of the securities or interests therein, the selling shareholders may enter into hedging transactions with broker-dealers or other

financial institutions, which may in turn engage in short sales of the securities in the course of hedging the positions they assume.

The selling shareholders may also sell securities short and deliver these securities to close out their short positions, or loan or pledge

the securities to broker-dealers that in turn may sell these securities. The selling shareholders may also enter into option or other

transactions with broker-dealers or other financial institutions or create one or more derivative securities which require the delivery

to such broker-dealer or other financial institution of securities offered by this prospectus, which securities such broker-dealer or

other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The selling shareholders

and any broker-dealers or agents that are involved in selling the securities may be deemed to be “underwriters” within the

meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents

and any profit on the resale of the securities purchased by them may be deemed to be underwriting commissions or discounts under the

Securities Act. Each selling shareholder has informed us that it does not have any written or oral agreement or understanding, directly

or indirectly, with any person to distribute the securities.

We are required to pay

certain fees and expenses incurred by us incident to the registration of the securities. We have agreed to indemnify the selling shareholders

against certain losses, claims, damages and liabilities, including liabilities under the Securities Act.

We agreed to keep this

prospectus effective until the earlier of (i) the date on which the securities may be resold by the selling shareholders without registration

and without regard to any volume or manner-of-sale limitations by reason of Rule 144, without the requirement for us to be in compliance

with the current public information under Rule 144 under the Securities Act or any other rule of similar effect or (ii) all of the securities

have been sold pursuant to this prospectus or Rule 144 under the Securities Act or any other rule of similar effect. The resale securities

will be sold only through registered or licensed brokers or dealers if required under applicable state securities laws. In addition,

in certain states, the resale securities covered hereby may not be sold unless they have been registered or qualified for sale in the

applicable state or an exemption from the registration or qualification requirement is available and is complied with.

Under applicable rules

and regulations under the Exchange Act, any person engaged in the distribution of the resale securities may not simultaneously engage

in market making activities with respect to the ordinary shares for the applicable restricted period, as defined in Regulation M, prior

to the commencement of the distribution. In addition, the selling shareholders will be subject to applicable provisions of the Exchange

Act and the rules and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of the ordinary

shares by the selling shareholders or any other person. We will make copies of this prospectus available to the selling shareholders

and have informed them of the need to deliver a copy of this prospectus to each purchaser at or prior to the time of the sale (including

by compliance with Rule 172 under the Securities Act).

LEGAL MATTERS

Certain legal matters concerning

this offering will be passed upon for us by Greenberg Traurig, P.A., Tel Aviv, Israel. Certain legal matters with respect to the legality

of the issuance of the securities offered by this prospectus will be passed upon for us by Shibolet & Co. Law Firm, Tel Aviv, Israel.

EXPERTS

The financial statements of Rail Vision Ltd. as of December 31, 2022

and 2021, and for each of the years in the period ended on December 31, 2022, incorporated by reference in this Prospectus, have been

audited by Brightman Almagor Zohar & Co., an independent registered public accounting firm in the Deloitte Global Network, as stated

in its report. Such financial statements are incorporated by reference in reliance upon the report of such firm given their authority

as experts in accounting and audit.

EXPENSES

The following are the estimated

expenses related to the filing of the registration statement of which this prospectus forms a part, all of which will be paid by us.

With the exception of the SEC registration fee, all amounts are estimates and may change:

| SEC registration fee | |

$ | 15,214 | |

| Legal fees and expenses | |

| 30,000 | |

| Accounting fees and expenses | |

| 5,000 | |

| Miscellaneous | |

| 3,286 | |

| Total | |

$ | 53,500 | |

INCORPORATION OF CERTAIN INFORMATION BY REFERENCE

The SEC allows us to “incorporate

by reference” the information we file with it, which means that we can disclose important information to you by referring you to

those documents. The information incorporated by reference is considered to be part of this prospectus and information we file later

with the SEC will automatically update and supersede this information. The documents we are incorporating by reference as of their respective

dates of filing are:

| |

● |

Annual Report on Form 20-F

for the year ended December 31, 2022, filed on March 23, 2023; |

| |

● |

our Reports of Foreign

Private Issuer on Form 6-K filed on May

11, 2023, May 12,

2023, May 15, 2023, May

31, 2023, June 9,

2023, June 20, 2023, June

21, 2023, August 18,

2023, September 14,

2023, October 12, 2023, October

16, 2023, October 17,

2023, October 31,

2023, November 13,

2023, November 24,

2023, December 1,

2023, December 11,

2023, December 18,

2023, January 9,

2024, January 12,

2024, January 17,

2024, January 19,

2024 and January 22,

2024, January 30,

2024, January 31,

2024, January 31,

2024, February 2,

2024 and February 5, 2024 (to the extent expressly incorporated by reference into our effective registration statements filed by

us under the Securities Act); and |

| |

● |

the description our ordinary

shares, which is contained in our registration statement on Form 8-A filed with the SEC pursuant to the Exchange Act on March

25, 2022 (File No. 001-41334), as amended by Exhibit 2.1 to our Annual Report on Form 20-F for the year ended December 31, 2022,

and including any further amendment or report filed for the purpose of updating such description. |

All subsequent annual reports

filed by us pursuant to the Exchange Act on Form 20-F prior to the termination of an offering shall be deemed to be incorporated by reference

to this prospectus and to be a part hereof from the date of filing of such documents. We may also incorporate part or all of any Form

6-K subsequently submitted by us to the SEC prior to the termination of an offering by identifying in such Forms 6-K that they, or certain

parts of their contents, are being incorporated by reference herein, and any Forms 6-K so identified shall be deemed to be incorporated

by reference in this prospectus and to be a part hereof from the date of submission of such documents. Any statement contained in a document

incorporated or deemed to be incorporated by reference herein shall be deemed to be modified or superseded for purposes of this prospectus

to the extent that a statement contained herein or in any other subsequently filed document which also is incorporated or deemed to be

incorporated by reference herein modifies or supersedes such statement. Any such statement so modified or superseded shall not be deemed,

except as so modified or superseded, to constitute a part of this prospectus.

The information we incorporate

by reference is an important part of this prospectus, and later information that we file with the SEC will automatically update and supersede

the information contained in this prospectus.

We will provide you without

charge, upon your written or oral request, a copy of any of the documents incorporated by reference in this prospectus, other than exhibits

to such documents which are not specifically incorporated by reference into such documents. Please direct your written or telephone requests

to us at: Rail Vision Ltd., 15 Hatidhar St. Ra’anana, 4366517 Israel. Attention: Ofer Naveh, Chief Financial Officer, telephone

number: + +972-9-957-7706.

WHERE YOU CAN FIND ADDITIONAL INFORMATION

This prospectus is part of

a registration statement on Form F-3 that we filed with the SEC relating to the securities offered by this prospectus, which includes

additional information. You should refer to the registration statement and its exhibits for additional information. Whenever we make

reference in this prospectus to any of our contracts, agreements or other documents, the references are not necessarily complete and

you should refer to the exhibits attached to the registration statement for copies of the actual contract, agreements or other document.

We are subject to the informational

requirements of the Exchange Act applicable to foreign private issuers. We, as a “foreign private issuer,” are exempt from

the rules under the Exchange Act prescribing certain disclosure and procedural requirements for proxy solicitations, and our officers,

directors and principal shareholders are exempt from the reporting and “short-swing” profit recovery provisions contained

in Section 16 of the Exchange Act, with respect to their purchases and sales of shares. In addition, we are not required to file annual,

quarterly and current reports and financial statements with the SEC as frequently or as promptly as U.S. companies whose securities are

registered under the Exchange Act.

You can review our SEC filings

and the registration statement by accessing the SEC’s internet site at http://www.sec.gov. We maintain a corporate website at http://railvision.io/.

Information contained on, or that can be accessed through, our website does not constitute a part of this prospectus. We have included

our website address in this prospectus solely as an inactive textual reference.

ENFORCEABILITY OF CIVIL LIABILITIES

We

are incorporated under the laws of the State of Israel. Service of process upon us and upon our directors and officers and the Israeli

experts named in the registration statement of which this prospectus forms a part, all or a substantial majority of whom reside outside

of the United States, may be difficult to obtain within the United States. Furthermore, because substantially all of our assets and all

of our directors and officers are located outside of the United States, any judgment obtained in the United States against us or any

of our directors and officers may not be collectible within the United States.

We

have been informed by our legal counsel in Israel, Shibolet & Co., that it may be difficult to assert U.S. securities law claims

in original actions instituted in Israel. Israeli courts may refuse to hear a claim based on a violation of U.S. securities laws because

Israel is not the most appropriate forum to bring such a claim. In addition, even if an Israeli court agrees to hear a claim, it may

determine that Israeli law and not U.S. law is applicable to the claim. If U.S. law is found to be applicable, the content of applicable