false

0001595248

0001595248

2024-01-31

2024-01-31

UNITED STATES

--12-31

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

January 31, 2024

Date of report (Date of earliest event reported)

GENPREX, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

001-38244

|

90-0772347

|

|

(State or other jurisdiction of

incorporation or organization)

|

(Commission File Number)

|

(I.R.S. Employer

Identification Number)

|

| |

|

|

|

3300 Bee Cave Road, #650-227, Austin, TX

|

|

78746

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (512) 537-7997

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.001 per share

|

|

GNPX

|

|

The Nasdaq Capital Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b–2 of the Securities Exchange Act of 1934 (§ 240.12b–2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.03. Material Modification to Rights of Security Holders.

The information contained in Item 5.03 below is incorporated by reference into this Item 3.03.

Item 5.03. Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

On January 31, 2024, Genprex, Inc. (the “Company”) filed a Certificate of Amendment of the Amended and Restated Certificate of Incorporation of the Company with the Secretary of State of the State of Delaware (the “Certificate of Amendment”), which will effect, at 12:01 a.m. Eastern Time on February 2, 2024, a one-for-forty (1:40) reverse stock split (the “Reverse Stock Split”) of the Company’s issued and outstanding shares of common stock, par value $0.001 per share (the “Common Stock”). In connection with the Reverse Stock Split, the CUSIP number for the Common Stock will change to 372446-203.

The Company anticipates the Common Stock will begin trading on a Reverse Stock Split-adjusted basis when the market opens on February 2, 2024.

As a result of the Reverse Stock Split, every forty (40) shares of Common Stock issued and outstanding will be converted into one (1) share of Common Stock. The Reverse Stock Split will affect all stockholders uniformly and will not alter any stockholder’s percentage interest in the Company’s equity, except to the extent that the Reverse Stock Split would result in some stockholders owning a fractional share. No fractional shares will be issued in connection with the Reverse Stock Split. Stockholders who would otherwise be entitled to a fractional share of Common Stock will automatically be entitled to receive an additional fraction of a share of Common Stock to round up to the next whole share.

The Reverse Stock Split will not change the par value of the Common Stock or the authorized number of shares of Common Stock. All outstanding securities entitling their holders to purchase shares of Common Stock or acquire shares of Common Stock, including stock options and warrants, will be adjusted as a result of the Reverse Stock Split, as required by the terms of those securities.

At the Company’s special meeting of stockholders held on December 14, 2023, the Company’s stockholders granted the Company’s Board of Directors (the “Board”) the discretion to effect the Reverse Stock Split at a ratio of not less than one-for-ten (1:10) and not more than one-for-fifty (1:50), with such ratio to be determined by the Board. On January 19, 2024, the Board approved a Reverse Stock Split ratio of one-for-forty (1:40) and authorized the filing of the Certificate of Amendment.

The foregoing description of the Certificate of Amendment is a summary of the material terms thereof, does not purport to be complete and is qualified in its entirety by reference to the full text of the Certificate of Amendment, which is filed with this report as Exhibit 3.1 and is incorporated herein by reference.

Item 8.01. Oher Events.

On January 31, 2024, the Company issued a press release announcing the Reverse Stock Split described above. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

GENPREX, INC.

|

|

| |

|

|

|

|

Date: January 31, 2024

|

By:

|

/s/ Ryan Confer

|

|

| |

|

Ryan Confer

|

|

| |

|

Chief Financial Officer

(Principal Financial Officer)

|

|

Exhibit 3.1

CERTIFICATE OF AMENDMENT

OF THE

AMENDED AND RESTATED CERTIFICATE OF INCORPORATION

OF

GENPREX, INC.

Genprex, Inc. (the “Company”), a corporation duly organized and validly existing under and by virtue of the General Corporation Law of the State of Delaware (the “DGCL”);

DOES HEREBY CERTIFY AS FOLLOWS:

FIRST: That the Amended and Restated Certificate of Incorporation of the Company (as heretofore amended, the “Amended and Restated Certificate of Incorporation”) is hereby amended as follows:

Article IV of the Amended and Restated Certificate of Incorporation be and hereby is amended by adding the following after the first paragraph of Section A of Article IV:

“Upon the effectiveness (“Effective Time”) of this amendment to the Certificate of Incorporation, a one-for-forty reverse stock split (the “Reverse Split”) of the Company’s Common Stock shall become effective, pursuant to which each forty (40) shares of Common Stock outstanding and held of record by each stockholder of the Company or held in treasury by the Company immediately prior to the Effective Time (“Old Common Stock”) shall automatically, and without any action by the holder thereof, be reclassified and combined into one (1) validly issued, fully paid and non-assessable share of Common Stock (“New Common Stock”), subject to the treatment of fractional interests as described below and with no corresponding reduction in the number of authorized shares of Common Stock. The Reverse Split shall also apply to any outstanding securities or rights convertible into, or exchangeable or exercisable for, Old Common Stock and all references to such Old Common Stock in agreements, arrangements, documents and plans relating thereto or any option or right to purchase or acquire shares of Old Common Stock shall be deemed to be references to the New Common Stock or options or rights to purchase or acquire shares of New Common stock, as the case may be, after giving effect to the Reverse Split.

No fractional shares of Common Stock will be issued in connection with the Reverse Split. If, upon aggregating all of the Common Stock held by a holder of Common Stock immediately following the Reverse Split a holder of Common Stock would otherwise be entitled to a fractional share of Common Stock, the Company shall issue to such holder such fractions of a share of Common Stock as are necessary to round the number of shares of Common Stock held by such holder up to the nearest whole share.

Each holder of record of a certificate or certificates for one or more shares of the Old Common Stock shall be entitled to receive as soon as practicable, upon surrender of such certificate, a certificate or certificates representing the largest whole number of shares of New Common Stock to which such holder shall be entitled pursuant to the provisions of the immediately preceding paragraphs. Each stock certificate that, immediately prior to the Effective Time, represented shares of Old Common Stock that were issued and outstanding immediately prior to the Effective Time shall, from and after the Effective Time, automatically and without the necessity of presenting the same for exchange, represent that number of whole shares of New Common Stock after the Effective Time into which the shares formerly represented by such certificate have been reclassified, subject to adjustment for fractional shares as described above.”

SECOND: That the amendment set forth in this Certificate of Amendment was duly adopted by the Board of Directors of the Company and the stockholders of the Company in accordance with Section 242 of the DGCL.

THIRD: That said amendment will have an Effective Time of 12:01 a.m., Eastern Time, on February 2, 2024.

[Signature Page Follows]

IN WITNESS WHEREOF, the undersigned has duly executed this Certificate of Amendment on this 31st day of January, 2024.

| |

GENPREX, INC.

|

| |

|

|

| |

By:

|

/s/ Ryan Confer |

| |

Name:

|

Ryan Confer |

| |

Title:

|

Chief Financial Officer |

Exhibit 99.1

Genprex Announces 1-for-40 Reverse Stock Split Effective February 2, 2024

AUSTIN, Texas — (Jan. 31, 2024) — Genprex, Inc. (“Genprex” or the “Company”) (NASDAQ: GNPX), a clinical-stage gene therapy company focused on developing life-changing therapies for patients with cancer and diabetes, today announced that on February 2, 2024, the Company will implement a 1-for-40 reverse split of its issued and outstanding common stock, par value $0.001 per share. The reverse stock split will be effective as of 12:01 a.m. Eastern Time on February 2, 2024, and the Company’s common stock will trade on a post-split adjusted basis at the beginning of trading on the same date under the existing trading symbol “GNPX.” The CUSIP number for the Company’s common stock following the reverse stock split will be 372446-203.

The Company’s Board of Directors (the “Board”) approved implementation of the reverse stock split upon the authorization granted by the Company’s stockholders at the special meeting held on December 14, 2023, whereby the Company’s stockholders granted the Company’s Board the discretion to effect a reverse stock split at a ratio of not less than one-for-ten (1:10) and not more than one-for-fifty (1:50), with such ratio to be determined by the Board. The reverse stock split is intended to increase the market price per share of the Company’s common stock to regain compliance with the minimum bid continued listing requirement of The Nasdaq Capital Market. All outstanding securities entitling their holders to purchase shares of common stock or acquire shares of common stock of the Company, including stock options and warrants, will be adjusted as a result of the reverse stock split, as required by the terms of those securities.

As a result of the reverse stock split, every 40 shares of common stock issued and outstanding as of the effective date will be automatically combined into one share of common stock. No fractional shares will be issued as a result of the reverse stock split. Stockholders of record who would otherwise be entitled to receive a fractional share will automatically be entitled to the rounding up of the fractional share to the nearest whole share. The reverse stock split will not change the par value of the common stock or modify the rights or preferences of the common stock. Immediately after the reverse stock split becomes effective, the Company will have approximately 1.5 million shares of common stock issued and outstanding. The reverse split affects all stockholders uniformly and will not alter any stockholder’s percentage interest in the Company’s equity, except to the extent that the reverse split would result in some stockholders owning a fractional share as described above. The Company’s transfer agent, VStock Transfer, LLC, will continue to maintain the book-entry records for the Company’s common stock. Registered stockholders holding pre-split shares of the Company’s common stock electronically in book-entry form are not required to take any action to receive post-split shares. Stockholders owning shares via a broker, bank, trust or other nominee will have their positions automatically adjusted to reflect the reverse stock split, subject to such broker’s particular processes and procedures; if you hold your shares with such a broker, bank trust or other nominee and if you have questions in this regard, you are encouraged to contact your nominee.

About Genprex, Inc.

Genprex, Inc. is a clinical-stage gene therapy company focused on developing life-changing therapies for patients with cancer and diabetes. Genprex’s technologies are designed to administer disease-fighting genes to provide new therapies for large patient populations with cancer and diabetes who currently have limited treatment options. Genprex works with world-class institutions and collaborators to develop drug candidates to further its pipeline of gene therapies in order to provide novel treatment approaches. Genprex’s oncology program utilizes its systemic, non-viral Oncoprex® Nanoparticle Delivery System which encapsulates the gene-expressing plasmids using lipid nanoparticles. The resultant product is administered intravenously, where it is taken up by tumor cells that then express tumor suppressor proteins that were deficient in the tumor. The Company’s lead product candidate, Reqorsa® Immunogene Therapy (quaratusugene ozeplasmid), is being evaluated in three clinical trials as a treatment for NSCLC and SCLC. Each of Genprex’s three lung cancer clinical programs has received a Fast Track Designation from the FDA for the treatment of that patient population, and Genprex’s SCLC program has received an FDA Orphan Drug Designation. Genprex’s diabetes gene therapy approach is comprised of a novel infusion process that uses an AAV vector to deliver Pdx1 and MafA genes directly to the pancreas. In models of Type 1 diabetes, GPX-002 transforms alpha cells in the pancreas into functional beta-like cells, which can produce insulin but may be distinct enough from beta cells to evade the body’s immune system. In a similar approach, GPX-003 for Type 2 diabetes, where autoimmunity is not at play, is believed to rejuvenate and replenish exhausted beta cells.

Interested investors and shareholders are encouraged to sign up for press releases and industry updates by visiting the Company Website, registering for Email Alerts and by following Genprex on Twitter, Facebook and LinkedIn.

Cautionary Language Concerning Forward-Looking Statements

Statements contained in this press release regarding matters that are not historical facts are "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are made on the basis of the current beliefs, expectations and assumptions of management, are not guarantees of performance and are subject to significant risks and uncertainty. These forward-looking statements should, therefore, be considered in light of various important factors, including those set forth in Genprex’s reports that it files from time to time with the Securities and Exchange Commission and which you should review, including those statements under “Item 1A – Risk Factors” in Genprex’s Annual Report on Form 10-K for the year ended December 31, 2022.

Because forward-looking statements are subject to risks and uncertainties, actual results may differ materially from those expressed or implied by such forward-looking statements. Such statements include, but are not limited to, statements regarding: Genprex’s ability to advance the clinical development, manufacturing and commercialization of its product candidates in accordance with projected timelines and specifications; the timing and success of Genprex’s clinical trials and regulatory approvals; the effect of Genprex’s product candidates, alone and in combination with other therapies, on cancer and diabetes; Genprex’s future growth and financial status, including Genprex’s ability to maintain compliance with the continued listing requirements of The Nasdaq Capital Market and to continue as a going concern and to obtain capital to meet its long-term liquidity needs on acceptable terms, or at all; Genprex’s commercial and strategic partnerships, including those with its third party vendors, suppliers and manufacturers and their ability to successfully perform and scale up the manufacture of its product candidates; and Genprex’s intellectual property and licenses.

These forward-looking statements should not be relied upon as predictions of future events and Genprex cannot assure you that the events or circumstances discussed or reflected in these statements will be achieved or will occur. If such forward-looking statements prove to be inaccurate, the inaccuracy may be material. You should not regard these statements as a representation or warranty by Genprex or any other person that Genprex will achieve its objectives and plans in any specified timeframe, or at all. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. Genprex disclaims any obligation to publicly update or release any revisions to these forward-looking statements, whether as a result of new information, future events or otherwise, after the date of this press release or to reflect the occurrence of unanticipated events, except as required by law.

Genprex, Inc.

(877) 774-GNPX (4679)

GNPX Investor Relations

investors@genprex.com

GNPX Media Contact

Kalyn Dabbs

media@genprex.com

v3.24.0.1

Document And Entity Information

|

Jan. 31, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

GENPREX, INC.

|

| Current Fiscal Year End Date |

--12-31

|

| Document, Type |

8-K

|

| Document, Period End Date |

Jan. 31, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-38244

|

| Entity, Tax Identification Number |

90-0772347

|

| Entity, Address, Address Line One |

3300 Bee Cave Road

|

| Entity, Address, Address Line Two |

#650-227

|

| Entity, Address, City or Town |

Austin

|

| Entity, Address, State or Province |

TX

|

| Entity, Address, Postal Zip Code |

78746

|

| City Area Code |

512

|

| Local Phone Number |

537-7997

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

GNPX

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001595248

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

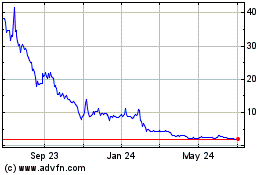

Genprex (NASDAQ:GNPX)

Historical Stock Chart

From Mar 2024 to Apr 2024

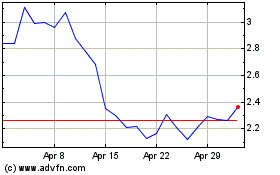

Genprex (NASDAQ:GNPX)

Historical Stock Chart

From Apr 2023 to Apr 2024