Form SC TO-I/A - Tender offer statement by Issuer: [Amend]

January 31 2024 - 6:07AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE TO

(Amendment No. 3)

(RULE 14d-100)

TENDER OFFER STATEMENT UNDER SECTION 14(d)(1) OR 13(e)(1)

OF THE SECURITIES EXCHANGE ACT OF 1934

VNET Group, Inc.

(Name of Subject Company (Issuer))

VNET Group, Inc.

(Name of Filing Person (Issuer))

0.00% Convertible Senior Notes due 2026

(Title of Class of Securities)

90138V AB3

(CUSIP Number of Class of Securities)

Qiyu Wang

Chief Financial Officer

VNET Group, Inc.

Guanjie Building, Southeast 1st Floor 10# Jiuxianqiao East Road

Chaoyang District

Beijing, 100016

The People’s Republic of China

Phone: (86) 10 8456-2121

Facsimile: (86) 10 8456-4234

with copy to:

James C. Lin, Esq.

Gerhard Radtke, Esq.

Davis Polk & Wardwell

c/o 19th Floor, The Hong Kong Club Building

3A Chater Road

Central, Hong Kong

(852) 2533 3300

(Name, address and telephone number of person authorized to receive notices and communications on behalf of the filing person)

☐

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer.

Check the appropriate boxes below to designate any transactions to which the statement relates:

☐

third-party tender offer subject to Rule 14d-1.

☒

issuer tender offer subject to Rule 13e-4.

☐

going-private transaction subject to Rule 13e-3.

☐

amendment to Schedule 13D under Rule 13d-2.

Check the following box if the filing is a final amendment reporting the results of the tender offer: ☒

If applicable, check the appropriate box(es) below to designate the appropriate rule provision(s) relied upon:

☐

Rule 13e-4(i) (Cross-Border Issuer Tender Offer)

☐

Rule 14d-1(d) (Cross-Border Third-Party Tender Offer)

INTRODUCTORY STATEMENT

This Amendment No. 3 (this “Amendment No. 3”) further amends and supplements the Tender Offer Statement on Schedule TO that was initially filed with the U.S. Securities and Exchange Commission (the “Commission”) by VNET Group, Inc. (the “Company”) on December 28, 2023, as subsequently amended and supplemented by the Amendment No. 1 filed with the Commission on January 16, 2024 and the Amendment No. 2 filed with the Commission on January 24, 2024 (as so amended and supplemented, the “Schedule TO”) to purchase for cash on the Repurchase Date, at the option of the Holders, the Company’s 0.00% Convertible Senior Notes due 2026 (the “Notes”), upon the terms and subject to the conditions set forth in the Repurchase Right Notice to Holders of the Notes, dated as of December 28, 2023 (together with any amendments or supplements thereto, the “Repurchase Right Notice”), filed as Exhibit (a)(1) to the Schedule TO.

Except as otherwise set forth in this Amendment No. 3, the information set forth in the Schedule TO remains unchanged and is incorporated herein by reference to the extent relevant to the items in this Amendment No. 3. Capitalized terms used but not defined herein shall have the meanings ascribed to them in the Schedule TO.

This Amendment No. 3 further amends and supplements the Schedule TO as set forth below and constitutes the final amendment to the Schedule TO. This Amendment No. 3 is intended to satisfy the disclosure requirements of Rule 13e-4(c)(4) under the Securities Exchange Act of 1934, as amended.

ITEM 11. ADDITIONAL INFORMATION.

Item 11 of the Schedule TO is hereby amended and supplemented to include the following information:

The Repurchase Right expired at 5:00 p.m. (New York City time) on Tuesday, January 30, 2024 (the “Repurchase Expiration Time”). The Company has been advised by Citibank, N.A., as the Paying Agent, that pursuant to the terms of the Repurchase Right, US$600,000,000 aggregate principal amount of the Notes were validly surrendered for repurchase and not withdrawn as of the Repurchase Expiration Time. The Company has accepted all of the surrendered Notes for repurchase pursuant to the terms of the Repurchase Right and has transmitted the Repurchase Price in the aggregate amount of US$600,000,000 to the Paying Agent for distribution to the Holders that had exercised their Repurchase Right. Following settlement of the Repurchase Price, all the Notes will be cancelled and there will be no outstanding Notes.

ITEM 12. EXHIBITS.

| |

(a)

Exhibits.

|

|

| |

(a)(1)*

|

|

|

|

|

| |

(a)(1)(A)*

|

|

|

|

|

| |

(a)(1)(B)*

|

|

|

|

|

| |

(a)(5)(A)*

|

|

|

|

|

| |

(a)(5)(B)†

|

|

|

|

|

| |

(b)(1)*

|

|

|

CNH200,000,000 Term Facility Agreement (with increase option), dated January 15, 2024 among the Company, VNET Group Limited, CNCB (Hong Kong) Investment Limited, as original lender, and CNCB (Hong Kong) Investment Limited, as arranger, facility agent and security agent.

|

|

| |

(d)(1)*

|

|

|

|

|

| |

(d)(2)*

|

|

|

|

|

| |

(d)(3)*

|

|

|

|

|

| |

(d)(4)*

|

|

|

|

|

| |

(d)(5)*

|

|

|

|

|

| |

(g)

|

|

|

Not applicable.

|

|

| |

(h)

|

|

|

Not applicable.

|

|

| |

(b)

Filing Fee Exhibit.

|

|

| |

†

|

|

|

|

|

*

Previously filed.

†

Filed herewith.

EXHIBIT INDEX

| |

Exhibit No.

|

|

|

Description

|

|

| |

(a)(1)*

|

|

|

|

|

| |

(a)(1)(A)*

|

|

|

|

|

| |

(a)(1)(B)*

|

|

|

|

|

| |

(a)(5)(A)*

|

|

|

|

|

| |

(a)(5)(B)†

|

|

|

|

|

| |

(b)(1)*

|

|

|

CNH200,000,000 Term Facility Agreement (with increase option), dated January 15, 2024 among the Company, VNET Group Limited, CNCB (Hong Kong) Investment Limited, as original lender, and CNCB (Hong Kong) Investment Limited, as arranger, facility agent and security agent.

|

|

| |

(d)(1)*

|

|

|

|

|

| |

(d)(2)*

|

|

|

|

|

| |

(d)(3)*

|

|

|

|

|

| |

(d)(4)*

|

|

|

|

|

| |

(d)(5)*

|

|

|

|

|

| |

(b)†

|

|

|

|

|

*

Previously filed.

†

Filed herewith.

SIGNATURE

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

VNET Group, Inc.

By:

/s/ Qiyu Wang

Name:

Qiyu Wang

Title:

Chief Financial Officer

Dated: January 31, 2024

Exhibit (a)(5)(B)

VNET Announces the Results of the Repurchase

Right Offer for Its 0.00% Convertible Senior Notes due 2026

BEIJING,

January 31, 2024 —VNET Group, Inc. (Nasdaq: VNET) (“VNET” or the “Company”), a leading carrier- and cloud-neutral

internet data center services provider in China, today announced the results of its previously announced repurchase right offer relating

to its 0.00% Convertible Senior Notes due 2026 (CUSIP No. 90138V AB3) (the “Notes”). The repurchase right offer expired at

5:00 p.m. (New York City time) on Tuesday, January 30, 2024. Based on information from Citibank, N.A. as the paying agent for the Notes,

US$600,000,000 aggregate principal amount of the Notes were validly surrendered and not withdrawn prior to the expiration of the

repurchase right offer. The aggregate cash purchase price of these Notes is US$600,000,000. The Company has accepted all of the surrendered Notes

for repurchase and forward cash in payment of the same to the paying agent for distribution to the applicable holders.

Materials filed with the SEC will be available electronically without

charge at the SEC’s website, http://www.sec.gov. Documents filed with the SEC may also be obtained without charge at the Company’s

website, https://ir.vnet.com/.

About VNET

VNET Group, Inc. is a leading carrier- and cloud-neutral internet data

center services provider in China. VNET provides hosting and related services, including IDC services, cloud services, and business VPN

services to improve the reliability, security, and speed of its customers’ internet infrastructure. Customers may locate their servers

and equipment in VNET’s data centers and connect to China’s internet backbone. VNET operates in more than 30 cities throughout

China, servicing a diversified and loyal base of over 7,000 hosting and related enterprise customers that span numerous industries ranging

from internet companies to government entities and blue-chip enterprises to small- to mid-sized enterprises.

Safe Harbor Statement

This announcement contains forward-looking statements. These forward-looking statements are made under the “safe

harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. These statements can be identified by terminology

such as “will,” “expects,” “anticipates,” “future,” “intends,” “plans,”

“target,” “believes,” “estimates” and similar statements. Among other things, quotations from management

in this announcement as well as VNET’s strategic and operational plans contain forward-looking statements. VNET may also make written

or oral forward-looking statements in its reports filed with, or furnished to, the U.S. Securities and Exchange Commission, in its annual

reports to shareholders, in press releases and other written materials and in oral statements made by its officers, directors or employees

to third parties. Statements that are not historical facts, including statements about VNET’s beliefs and expectations, are forward-looking

statements. Forward-looking statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ

materially from those contained in any forward-looking statement, including but not limited to the following: VNET’s goals and strategies;

VNET’s liquidity conditions; VNET’s expansion plans; the expected growth of the data center services market; expectations

regarding demand for, and market acceptance of, VNET’s services; VNET’s expectations regarding keeping and strengthening its

relationships with customers; VNET’s plans to invest in research and development to enhance its solution and service offerings;

and general economic and business conditions in the regions where VNET provides solutions and services. Further information regarding

these and other risks is included in VNET’s reports filed with, or furnished to, the U.S. Securities and Exchange Commission. All

information provided in this press release is as of the date of this press release, and VNET undertakes no duty to update such information,

except as required under applicable law.

Investor Relations Contact:

Xinyuan Liu

Tel: +86 10 8456 2121

Email: ir@vnet.com

Exhibit (b)

Calculation of Filing Fee Tables

Schedule TO

(Form Type)

VNET Group, Inc.

(Name of Issuer)

Table 1 – Transaction

Valuation

| | |

Transaction

Valuation | | |

Fee Rate | | |

Amount of

Filing Fee | |

| Fees to Be Paid | |

| – | | |

| | | |

| – | |

| Fees Previously Paid | |

| $600,000,000 | (1) | |

| 0.01476 | %(2) | |

$ | 88,560 | (2) |

| Total Transaction Valuation | |

$ | 600,000,000 | | |

| | | |

| | |

| Total Fees Due for Filing | |

| | | |

| | | |

$ | 88,560 | (2) |

| Total Fees Previously Paid | |

| | | |

| | | |

$ | 88,560 | (2) |

| Total Fee Offsets | |

| | | |

| | | |

| – | |

| Net Fee Due | |

| | | |

| | | |

| – | |

| (1) | Calculated solely for purposes of determining the filing fee. The purchase price of the 0.00% Convertible Senior Notes due 2026 (the

“Notes”), as described herein, is US$1,000 per US$1,000 principal amount outstanding. As of December 28, 2023, there was US$600,000,000

aggregate principal amount of Notes outstanding, resulting in an aggregate maximum purchase price of US$600,000,000. |

| (2) | The filing fee of $88,560 was previously paid in connection with the filing of the Tender Offer Statement on Schedule TO on December

28, 2023 by VNET Group, Inc. (File No. 005-86326). The amount of the filing fee was calculated in accordance with Rule 0-11 of the Securities

Exchange Act of 1934, as amended, and equals $147.60 for each US$1,000,000 of the value of the transaction. |

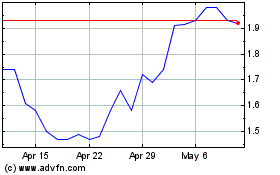

VNET (NASDAQ:VNET)

Historical Stock Chart

From Mar 2024 to Apr 2024

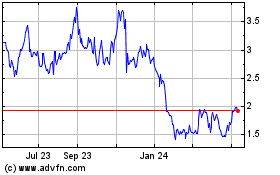

VNET (NASDAQ:VNET)

Historical Stock Chart

From Apr 2023 to Apr 2024