0000096021FALSE00000960212024-01-302024-01-300000096021us-gaap:CommonStockMember2024-01-302024-01-30

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): January 30, 2024

_______________________

Sysco Corporation

(Exact name of registrant as specified in its charter)

_________________________

| | | | | | | | |

| Delaware | 1-06544 | 74-1648137 |

(State or Other Jurisdiction

of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

1390 Enclave Parkway, Houston, TX 77077-2099

(Address of principal executive offices) (zip code)

Registrant’s telephone number, including area code: (281) 584-1390

N/A

(Former name or former address, if changed since last report)

_________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

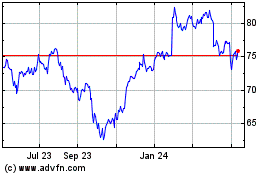

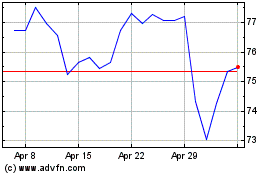

| Common stock, $1.00 Par Value | SYY | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

SECTION 2 – FINANCIAL INFORMATION

Item 2.02 Results of Operations and Financial Condition.

On January 30, 2024, Sysco Corporation (“Sysco”) issued a press release announcing its results of operations and financial condition for its second quarter of fiscal year 2024, which ended on December 30, 2023. Sysco hereby incorporates by reference herein the information set forth in its press release dated January 30, 2024 (the “Press Release”), a copy of which is attached hereto as Exhibit 99.1.

Except for the historical information contained in this report, the statements made by Sysco are forward looking statements that involve risks and uncertainties. All such statements are subject to the safe harbor created by the Private Securities Litigation Reform Act of 1995. Sysco’s future financial performance could differ significantly from the expectations of management and from results expressed or implied in the Press Release. Forward-looking statements in the Press Release are subject to certain risks and uncertainties described in the Press Release. For further information on other risk factors, please refer to the “Risk Factors” contained in Sysco’s Annual Report on Form 10-K for the fiscal year ended July 1, 2023, and subsequent reports filed with the SEC.

The information in this Item 2.02 is being furnished, not filed, pursuant to Item 2.02 of Form 8-K. Accordingly, the information in Item 2.02 of this report, including the Press Release attached hereto as Exhibit 99.1, will not be incorporated by reference into any registration statement filed by Sysco under the Securities Act of 1933, as amended, unless specifically identified therein as being incorporated therein by reference.

SECTION 9 – FINANCIAL STATEMENTS AND EXHIBITS

Item 9.01 Financial Statements and Exhibits.

(a) Financial Statements of Businesses Acquired.

Not applicable.

(b) Pro Forma Financial Information.

Not applicable.

(c) Shell Company Transactions.

Not applicable.

(d) Exhibits.

| | | | | | | | |

| Exhibit Number | | Description |

| | |

| 99.1 | | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, Sysco Corporation has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Sysco Corporation

| | | | | | | | |

Date: January 30, 2024 | By: | /s/ Gerald W. Clanton |

| | Gerald W. Clanton |

| | Vice President, Legal, Deputy General Counsel and Assistant Corporate Secretary |

| | |

SYSCO REPORTS SECOND QUARTER EPS GROWTH, DRIVEN BY INCREASING VOLUMES AND POSITIVE OPERATING LEVERAGE

HOUSTON, January 30, 2024 - Sysco Corporation (NYSE: SYY) (“Sysco” or the “company”) today announced financial results for its 13-week second fiscal quarter ended December 30, 2023.

Key financial results for the second quarter of fiscal year 2024 include the following (comparisons are to the same period in fiscal year 2023):

•Sales increased 3.7%; U.S. Foodservice volume increased 3.4%; U.S. local volumes grew 2.9%;

•Gross profit increased 4.9% to $3.5 billion;

•Operating income increased 9.2% to $700.0 million, and adjusted1 operating income increased 9.2% to $744.9 million;

•EBITDA increased 82.7% to $914.3 million, and adjusted EBITDA increased 11.6% to $927.5 million2;

•EPS3 increased 192.9% to $0.82, compared to $0.28 in the same period last year, and adjusted1 EPS increased 11.3% to $0.89;

•First half cash flow from operations increased 70.0% to $855.9 million, and free cash flow4 increased 140.5% to $527.4 million;

•The company now expects to return approximately $2.25 billion back to shareholders in fiscal year 2024, raising share repurchase expectations from $750 million to $1.25 billion; and

•Reaffirming fiscal year 2024 guidance expectations for top- and bottom-line growth.

“Second quarter results included adjusted EPS growth of over 11%, fueled by sales and volume growth, combined with positive operating leverage, as we continue to effectively manage margins. Our balanced efforts to deliver compelling top- and bottom-line growth were driven by sequential improvements in volume growth, including local performance, as well as supply chain productivity and implementation of structural cost-out actions. Sysco’s industry leading profitability, size and scale advantages, and strong balance sheet represent a position of strength. Combining our advantages with Sysco’s discipline on profitable growth, we expect to deliver strong results for the remainder of fiscal year 2024 and beyond,” said Kevin Hourican, Sysco’s President and Chief Executive Officer.

“Our second quarter operating profit included our fifth consecutive quarter of positive operating leverage, as gross profit expanded at a faster rate than operating expenses. Additionally, our balanced approach to capital allocation demonstrates the importance of investing in the business and rewarding our shareholders, all anchored by our strong balance sheet and consistent cash generation. Looking ahead, we now expect to return approximately $2.25 billion back to

1 Adjusted financial results, including adjusted operating expense, adjusted operating income (loss), adjusted earnings per share (EPS) and adjusted EBITDA, are non-GAAP financial measures that exclude certain items, which primarily include acquisition-related costs, restructuring and severance costs, and transformational project costs. Last year’s Certain Items include a pension settlement charge that resulted from the purchase of a nonparticipating single premium group annuity contract that transferred defined benefit plan obligations to an insurer, adjustments to our bad debt reserve specific to aged receivables existing prior to the COVID-19 pandemic and adjustments to a product return allowance related to COVID-related personal protection equipment inventory.

2 Earnings before interest, taxes, depreciation and amortization (EBITDA) and adjusted EBITDA are non-GAAP financial measures. Reconciliations of all non-GAAP financial measures to the nearest corresponding GAAP financial measure are included at the end of this release.

3 Earnings per share (EPS) are shown on a diluted basis, unless otherwise specified.

4 Free cash flow is a non-GAAP financial measure that represents net cash provided from operating activities less purchases of plant and equipment and includes proceeds from sales of plant and equipment. Reconciliations for all non-GAAP financial measures are included at the end of this release.

shareholders in fiscal year 2024, through meaningful share repurchases and dividends. Our positive momentum through the first half gives us confidence in reiterating our fiscal year 2024 guidance of mid-single digit sales growth to approximately $80 billion and five to ten percent adjusted EPS growth to $4.20 to $4.40,” said Kenny Cheung, Sysco’s Chief Financial Officer.

Second Quarter Fiscal Year 2024 Results (comparisons are to the same period in fiscal year 2023)

Total Sysco

Sales for the second quarter increased 3.7% to $19.3 billion.

Gross profit increased 4.9% to $3.5 billion, and gross margin increased 21 basis points to 18.2%. Product cost inflation was 1.1% at the total enterprise level, as measured by the estimated change in Sysco’s product costs, primarily in the meat and frozen categories. The increase in gross profit for the second quarter was primarily driven by higher volumes, as well as continued progress with effective management of product cost inflation and our strategic sourcing initiative.

Operating expenses increased 3.9%, driven by increased volumes and cost inflation, partially offset by improved productivity. Adjusted operating expenses increased 3.8%.

Operating income increased 9.2% to $700.0 million, and adjusted operating income increased 9.2% to $744.9 million.

U.S. Foodservice Operations

The U.S. Foodservice Operations segment results were driven by improved volumes, including positive local case performance, combined with effective margin management, resulting in continued profit growth.

Sales for the second quarter increased 3.2% to $13.5 billion. Total case volume within U.S. Foodservice grew 3.4% for the second quarter, while local case volume within U.S. Foodservice increased 2.9%.

Gross profit increased 3.4% to $2.6 billion, and gross margin increased 4 basis points to 19.1%.

Operating expenses increased 1.5%, and adjusted operating expenses increased 1.4%.

Operating income increased 7.4% to $839.0 million, and adjusted operating income increased 7.6% to $851.1 million.

International Foodservice Operations

The International Foodservice Operations segment delivered another quarter of sales and profit growth.

Sales for the second quarter increased 9.6% to $3.6 billion. On a constant currency basis5, sales for the second quarter were $3.5 billion, an increase of 6.4%. Foreign exchange rates increased both International Foodservice Operations sales by 3.2% and total Sysco sales by 0.5% during the quarter.

Gross profit increased 13.4% to $708.1 million, and gross margin increased 67 basis points to 19.7%. On a constant currency basis5, gross profit increased 9.5% to $684.0 million. Foreign exchange rates increased both International Foodservice Operations gross profit by 3.9% and total Sysco gross profit by 0.7% during the quarter.

5 Represents a constant currency adjustment, which eliminates the impact of foreign currency fluctuations on current year results. These adjusted measures are non-GAAP financial measures. Reconciliations of all non-GAAP financial measures to the nearest corresponding GAAP financial measure are included at the end of this release.

Operating expenses increased 10.3%, and adjusted operating expenses increased 11.0%. On a constant currency basis5, adjusted operating expenses increased 6.9%. Foreign exchange rates increased both International Foodservice Operations operating expenses by 4.1% and total Sysco operating expenses by 0.9% during the quarter.

Operating income increased 44.4% to $82.9 million, and adjusted operating income increased 30.1% to $102.4 million. On a constant currency basis5, adjusted operating income was $100.6 million, an increase of 27.8%. Foreign exchange rates increased both International Foodservice Operations operating income by 2.3% and total Sysco operating income by 0.2% during the quarter.

Balance Sheet, Cash Flow and Capital Spending

As of the end of the quarter, the company had a cash balance of $962.2 million.

During the first 26 weeks of fiscal year 2024, Sysco returned $705.5 million to shareholders via $199.9 million of share repurchases and $505.6 million of dividends.

Cash flow from operations was $855.9 million for the first 26 weeks of fiscal year 2024, which was an increase of $352.4 million over the prior year period.

Capital expenditures, net of proceeds from sales of plant and equipment, for the first 26 weeks of fiscal year 2024 were $328.5 million.

Free cash flow4 for the first 26 weeks of fiscal year 2024 was $527.4 million, which was an increase of $308.2 million over the prior year period.

Conference Call & Webcast

Sysco will host a conference call to review the company’s second quarter fiscal year 2024 financial results on Tuesday, January 30, 2024, at 10:00 a.m. Eastern Daylight Time. A live webcast of the call, accompanying slide presentation and a copy of this news release will be available online at investors.sysco.com.

| | | | | | | | | | | | | | | | | |

Key Highlights: |

| 13-Week Period Ended | | 26-Week Period Ended | |

| | | | | | | |

| Financial Comparison: | December 30, 2023 | | Change | | December 30, 2023 | Change | |

| GAAP: | | | | | | | |

| Sales | $19.3 billion | | 3.7% | | $38.9 billion | 3.1% | |

Gross Profit | $3.5 billion | | 4.9% | | $7.2 billion | 4.7% | |

| Gross Margin | 18.2% | | 21 bps | | 18.4% | 28 bps | |

Operating Expenses | $2.8 billion | | 3.9% | | $5.7 billion | 3.6% | |

| | | | | | | |

| Operating Income | $700.0 million | | 9.2% | | $1.5 billion | 9.1% | |

| Operating Margin | 3.6% | | 18 bps | | 3.9% | 21 bps | |

| | | | | | | |

| Net Earnings | $415.2 million | | NM | | $918.6 million | 51.4% | |

| Diluted Earnings Per Share | $0.82 | | NM | | $1.81 | 52.1% | |

| | | | | | | |

Non-GAAP (1): | | | | | | | |

| | | | | | | |

Gross Profit | $3.5 billion | | 4.9% | | $7.2 billion | 4.8% | |

| Gross Margin | 18.2% | | 21 bps | | 18.4% | 29 bps | |

| Operating Expenses | $2.8 billion | | 3.8% | | $5.6 billion | 3.4% | |

| Operating Income | $744.9 million | | 9.2% | | $1.6 billion | 9.9% | |

| Operating Margin | 3.9% | | 19 bps | | 4.1% | 25 bps | |

| EBITDA | $914.3 million | | 82.7% | | $1.9 billion | 36.1% | |

| Adjusted EBITDA | $927.5 million | | 11.6% | | $2.0 billion | 11.7% | |

| Net Earnings | $449.0 million | | 10.1% | | $990.6 million | 10.0% | |

Diluted Earnings Per Share (2) | $0.89 | | 11.3% | | $1.96 | 11.4% | |

| | | | | | | |

| Case Growth: | | | | | | | |

| U.S. Foodservice | 3.4% | | | | 2.5% | | |

| Local | 2.9% | | | | 1.3% | | |

| | | | | | | |

| Sysco Brand Sales as a % of Cases: | | | | | | | |

| U.S. Broadline | 36.8% | | -5 bps | | 37.0% | 0 bps | |

| Local | 46.9% | | 22 bps | | 47.2% | 38 bps | |

Note: |

(1) Reconciliations of all non-GAAP financial measures to the nearest respective GAAP financial measures are included at the end of this release. |

(2) Individual components in the table above may not sum to the totals due to the rounding. |

|

| NM Represents that the percentage change is not meaningful. |

| | |

| Forward-Looking Statements |

Statements made in this press release or in our earnings call for the second quarter of fiscal year 2024 that look forward in time or that express management’s beliefs, expectations or hopes are forward-looking statements under the Private Securities Litigation Reform Act of 1995. Such forward-looking statements reflect the views of management at the time such statements are made and are subject to a number of risks, uncertainties, estimates, and assumptions that may cause actual results to differ materially from current expectations. These statements include statements concerning: the implications of the COVID-19 pandemic and any expectations we may have with respect thereto; our expectations regarding future improvements in productivity; our belief that improvements in our organizational capabilities will deliver compelling outcomes in future periods; our expectations regarding improvements in international volume; our expectations that our transformational agenda will drive long-term growth; our expectations regarding the continuation of an inflationary environment; our expectations regarding improvements in the efficiency of our supply chain; our expectations regarding the impact of our Recipe for Growth strategy and the pace of progress in implementing the initiatives under that strategy; our expectations regarding Sysco’s ability to outperform the market in future periods; our expectations that our strategic priorities will enable us to grow faster than the market; our expectations regarding our efforts to reduce overtime rates and the incremental investments in hiring; our expectations regarding the expansion of our driver academy and our belief that the academy will enable us to provide upward career path mobility for our warehouse colleagues and improve colleague retention; our expectations regarding the benefits of the six-day delivery and last mile distribution models; our plans to improve the capabilities of our sales team; our plans to refine our engineering labor standards; our expectations regarding the impact of our growth initiatives and their ability to enable Sysco to consistently outperform the market; our expectations to exceed our growth target by the end of fiscal 2024; our ability to deliver against our strategic priorities; economic trends in the United States and abroad; our belief that there is further opportunity for profit in the future; our future growth, including growth in sales and earnings per share; the pace of implementation of our business transformation initiatives; our expectations regarding our balanced approach to capital allocation and rewarding our shareholders; our plans to improve colleague retention, training and productivity; our belief that our Recipe for Growth transformation is creating capabilities that will help us profitably grow for the long term; our expectations regarding our long-term financial outlook; our expectations of the effects labor harmony will have on sales and case volume, as well as mitigation expenses; our expectations for customer acquisition in the local/street space; our expectations regarding the effectiveness of our Global Support Center expense control measures; and our expectations regarding the growth and resilience of our food away from home market. |

|

| It is important to note that actual results could differ materially from those projected in such forward-looking statements based on numerous factors, including those outside of Sysco’s control. For more information concerning factors that could cause actual results to differ from those expressed or forecasted, see our Annual Report on Form 10-K for the year ended July 1, 2023, as filed with the SEC, and our subsequent filings with the SEC. We do not undertake to update our forward-looking statements, except as required by applicable law. |

About Sysco

Sysco is the global leader in selling, marketing and distributing food products to restaurants, healthcare and educational facilities, lodging establishments and other customers who prepare meals away from home. Its family of products also includes equipment and supplies for the foodservice and hospitality industries. With more than 72,000 colleagues, the company operates 334 distribution facilities worldwide and serves approximately 725,000 customer locations. For fiscal year 2023 that ended July 1, 2023, the company generated sales of more than $76 billion. Information about our Sustainability program, including Sysco’s 2023 Sustainability Report and 2023 Diversity, Equity & Inclusion Report, can be found at www.sysco.com.

For more information, visit www.sysco.com or connect with Sysco on Facebook at www.facebook.com/SyscoFoods. For important news and information regarding Sysco, visit the Investor Relations section of the company’s Internet home page at investors.sysco.com, which Sysco plans to use as a primary channel for publishing key information to its investors, some of which may contain material and previously non-public information. In addition, investors should continue to review our news releases and filings with the SEC. It is possible that the information we disclose through any of these channels of distribution could be deemed to be material information.

| | | | | | | | | | | | | | | | | | | | | | | |

Sysco Corporation and its Consolidated Subsidiaries

CONSOLIDATED RESULTS OF OPERATIONS (Unaudited)

(In Thousands, Except for Share and Per Share Data) |

| Quarter Ended | | Year Ended |

| | | |

| | Dec. 30, 2023 | | Dec. 31, 2022 | | Dec. 30, 2023 | | Dec. 31, 2022 |

| | | | | | | |

| Sales | $ | 19,287,942 | | | $ | 18,593,953 | | | $ | 38,908,396 | | | $ | 37,720,783 | |

| Cost of sales | 15,774,309 | | | 15,244,337 | | | 31,746,991 | | | 30,882,312 | |

| Gross profit | 3,513,633 | | | 3,349,616 | | | 7,161,405 | | | 6,838,471 | |

| Operating expenses | 2,813,590 | | | 2,708,793 | | | 5,657,780 | | | 5,460,847 | |

| Operating income | 700,043 | | | 640,823 | | | 1,503,625 | | | 1,377,624 | |

| Interest expense | 149,680 | | | 132,042 | | | 284,014 | | | 256,192 | |

Other expense (income), net (1) (2) | 5,245 | | | 330,305 | | | 11,885 | | | 348,054 | |

| Earnings before income taxes | 545,118 | | | 178,476 | | | 1,207,726 | | | 773,378 | |

| Income taxes | 129,876 | | | 37,260 | | | 289,092 | | | 166,594 | |

| Net earnings | $ | 415,242 | | | $ | 141,216 | | | $ | 918,634 | | | $ | 606,784 | |

| | | | | | | |

| Net earnings: | | | | | | | |

| Basic earnings per share | $ | 0.82 | | | $ | 0.28 | | | $ | 1.82 | | | $ | 1.20 | |

| Diluted earnings per share | 0.82 | | | 0.28 | | | 1.81 | | | 1.19 | |

| | | | | | | |

| Average shares outstanding | 504,312,633 | | | 507,609,696 | | | 504,719,562 | | | 507,594,137 | |

| Diluted shares outstanding | 505,929,342 | | | 510,145,794 | | | 506,499,390 | | | 510,264,473 | |

| | | | | |

(1) | Gains and losses related to the disposition of fixed assets have been recognized within operating expenses. Prior year amounts have been reclassified to conform to this presentation. |

(2) | Sysco’s second quarter of fiscal 2023 included a charge of $315.4 million in other expense related to pension settlement charges. |

| | | | | | | | | | | | | |

Sysco Corporation and its Consolidated Subsidiaries CONSOLIDATED BALANCE SHEETS (In Thousands, Except for Share Data) | | |

| | Dec. 30, 2023 | | Jul. 1, 2023 | | |

| (Unaudited) | | | | |

| ASSETS | | | | | |

| Current assets | | | | | |

| Cash and cash equivalents | $ | 962,165 | | | $ | 745,201 | | | |

| Accounts receivable, less allowances of $79,179 and $45,599 | 5,291,552 | | | 5,091,970 | | | |

| Inventories | 4,722,499 | | | 4,480,812 | | | |

| | | | | |

| Prepaid expenses and other current assets | 327,569 | | | 284,566 | | | |

| Income tax receivable | 5,815 | | | 5,815 | | | |

| Total current assets | 11,309,600 | | | 10,608,364 | | | |

| Plant and equipment at cost, less accumulated depreciation | 5,157,150 | | | 4,915,049 | | | |

| Other long-term assets | | | | | |

| Goodwill | 5,255,010 | | | 4,645,754 | | | |

| Intangibles, less amortization | 1,174,151 | | | 859,530 | | | |

| | | | | |

| Deferred income taxes | 444,180 | | | 420,450 | | | |

| Operating lease right-of-use assets, net | 824,390 | | | 731,766 | | | |

| Other assets | 576,120 | | | 640,232 | | | |

| Total other long-term assets | 8,273,851 | | | 7,297,732 | | | |

| Total assets | $ | 24,740,601 | | | $ | 22,821,145 | | | |

| | | | | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY |

| Current liabilities | | | | | |

| | | | | |

| Accounts payable | $ | 5,737,726 | | | $ | 6,025,757 | | | |

| Accrued expenses | 2,266,062 | | | 2,251,181 | | | |

| Accrued income taxes | 46,772 | | | 101,894 | | | |

| | | | | |

| Current operating lease liabilities | 119,397 | | | 99,051 | | | |

| Current maturities of long-term debt | 84,513 | | | 62,550 | | | |

| Total current liabilities | 8,254,470 | | | 8,540,433 | | | |

| Long-term liabilities | | | | | |

| Long-term debt | 12,028,122 | | | 10,347,997 | | | |

| Deferred income taxes | 303,878 | | | 302,904 | | | |

| Long-term operating lease liabilities | 737,354 | | | 656,269 | | | |

| Other long-term liabilities | 979,376 | | | 931,708 | | | |

| Total long-term liabilities | 14,048,730 | | | 12,238,878 | | | |

| Commitments and contingencies | | | | | |

| Noncontrolling interest | 33,367 | | | 33,212 | | | |

| Shareholders’ equity | | | | | |

| Preferred stock, par value $1 per share Authorized 1,500,000 shares, issued none | — | | | — | | | |

| Common stock, par value $1 per share Authorized 2,000,000,000 shares, issued 765,174,900 shares | 765,175 | | | 765,175 | | | |

| Paid-in capital | 1,877,201 | | | 1,814,681 | | | |

| Retained earnings | 11,724,251 | | | 11,310,664 | | | |

| Accumulated other comprehensive loss | (1,189,753) | | | (1,252,590) | | | |

| Treasury stock at cost, 261,472,819 and 260,062,834 shares | (10,772,840) | | | (10,629,308) | | | |

| Total shareholders’ equity | 2,404,034 | | | 2,008,622 | | | |

| Total liabilities and shareholders’ equity | $ | 24,740,601 | | | $ | 22,821,145 | | | |

| | | | | | | | | | | |

Sysco Corporation and its Consolidated Subsidiaries

CONSOLIDATED CASH FLOWS (Unaudited)

(In Thousands) |

| | 26-Week Period Ended |

| | Dec. 30, 2023 | | Dec. 31, 2022 |

| Cash flows from operating activities: | | | |

| Net earnings | $ | 918,634 | | | $ | 606,784 | |

| Adjustments to reconcile net earnings to cash provided by operating activities: | | | |

| Pension settlement charge | — | | | 315,354 | |

| Share-based compensation expense | 52,821 | | | 52,679 | |

| Depreciation and amortization | 425,465 | | | 378,949 | |

| Operating lease asset amortization | 59,127 | | | 55,884 | |

| Amortization of debt issuance and other debt-related costs | 9,117 | | | 10,315 | |

| Deferred income taxes | (28,689) | | | (123,187) | |

| Provision for losses on receivables | 29,784 | | | 9,732 | |

| | | |

| | | |

| | | |

| | | |

| Other non-cash items | (3,782) | | | 11,525 | |

| Additional changes in certain assets and liabilities, net of effect of businesses acquired: | | | |

| Increase in receivables | (25,431) | | | (87,190) | |

| Increase in inventories | (98,047) | | | (222,650) | |

| Decrease (increase) in prepaid expenses and other current assets | 3,362 | | | (8,915) | |

| Decrease in accounts payable | (404,411) | | | (390,124) | |

| Increase (decrease) in accrued expenses | 17,033 | | | (62,779) | |

| Decrease in operating lease liabilities | (64,112) | | | (57,234) | |

| (Decrease) increase in accrued income taxes | (55,123) | | | 3,108 | |

| Decrease in other assets | 21,942 | | | 22,156 | |

| Decrease in other long-term liabilities | (1,793) | | | (10,941) | |

| Net cash provided by operating activities | 855,897 | | | 503,466 | |

| Cash flows from investing activities: | | | |

| Additions to plant and equipment | (346,797) | | | (309,664) | |

| Proceeds from sales of plant and equipment | 18,347 | | | 25,493 | |

| Acquisition of businesses, net of cash acquired | (1,174,608) | | | (37,699) | |

| | | |

| Purchase of marketable securities | (1,878) | | | (14,019) | |

| Proceeds from sales of marketable securities | — | | | 11,641 | |

Other investing activities (1) | — | | | 4,840 | |

| | | |

| | | |

| | | |

| Net cash used for investing activities | (1,504,936) | | | (319,408) | |

| Cash flows from financing activities: | | | |

| Bank and commercial paper borrowings, net | 500,000 | | | 155,000 | |

| Other debt borrowings including senior notes | 1,132,475 | | | 140,024 | |

| Other debt repayments including senior notes | (187,720) | | | (57,270) | |

| | | |

| | | |

| Debt issuance costs | (13,035) | | | — | |

| | | |

| | | |

| Proceeds from stock option exercises | 57,347 | | | 47,339 | |

| | | |

| Stock repurchases | (199,947) | | | (267,727) | |

| Dividends paid | (505,588) | | | (498,323) | |

Other financing activities (2) | (5,775) | | | (46,517) | |

| Net cash provided by (used for) financing activities | 777,757 | | | (527,474) | |

| Effect of exchange rates on cash, cash equivalents and restricted cash | 905 | | | (2,314) | |

| Net increase (decrease) in cash, cash equivalents and restricted cash | 129,623 | | | (345,730) | |

| Cash, cash equivalents and restricted cash at beginning of period | 966,033 | | | 931,376 | |

| Cash, cash equivalents and restricted cash at end of period | $ | 1,095,656 | | | $ | 585,646 | |

| | | |

| | | | | | | | | | | |

| Supplemental disclosures of cash flow information: | | | |

| Cash paid during the period for: | | | |

| Interest | $ | 266,002 | | | $ | 244,530 | |

| Income taxes, net of refunds | 371,855 | | | 289,413 | |

| | | | | |

(1) | Change primarily includes proceeds from the settlement of corporate-owned life insurance policies. |

(2) | Change includes cash paid for shares withheld to cover taxes, settlement of interest rate hedges and other financing activities. |

| |

| | |

Sysco Corporation and its Consolidated Subsidiaries

Non-GAAP Reconciliation (Unaudited)

Impact of Certain Items |

|

| The discussion of our results includes certain non-GAAP financial measures, including EBITDA and adjusted EBITDA, that we believe provide important perspective with respect to underlying business trends. Other than EBITDA and free cash flow, any non-GAAP financial measures will be denoted as adjusted measures to remove (1) restructuring charges; (2) expenses associated with our various transformation initiatives; (3) severance charges; and (4) acquisition-related costs consisting of: (a) intangible amortization expense and (b) acquisition costs and due diligence costs related to our acquisitions. Our results for fiscal 2023 were also impacted by adjustments to a product return allowance pertaining to COVID-related personal protection equipment inventory, a pension settlement charge that resulted from the purchase of a nonparticipating single premium group annuity contract that transferred defined benefit plan obligations to an insurer and the reduction of bad debt expense previously recognized in fiscal 2020 due to the impact of the COVID-19 pandemic on the collectability of our pre-pandemic trade receivable balances. |

|

| The results of our operations can be impacted due to changes in exchange rates applicable in converting local currencies to U.S. dollars. We measure our results on a constant currency basis. Constant currency operating results are calculated by translating current-period local currency operating results with the currency exchange rates used to translate the financial statements in the comparable prior-year period to determine what the current-period U.S. dollar operating results would have been if the currency exchange rate had not changed from the comparable prior-year period. |

|

| Management believes that adjusting its operating expenses, operating income, net earnings and diluted earnings per share to remove these Certain Items and presenting its results on a constant currency basis provides an important perspective with respect to our underlying business trends and results. It provides meaningful supplemental information to both management and investors that (1) is indicative of the performance of the company’s underlying operations and (2) facilitates comparisons on a year-over-year basis. |

|

| Sysco has a history of growth through acquisitions and excludes from its non-GAAP financial measures the impact of acquisition-related intangible amortization, acquisition costs and due-diligence costs for those acquisitions. We believe this approach significantly enhances the comparability of Sysco’s results for fiscal year 2024 and fiscal year 2023. |

|

| Set forth on the following page is a reconciliation of sales, operating expenses, operating income, other (income) expense, net earnings and diluted earnings per share to adjusted results for these measures for the periods presented. Individual components of diluted earnings per share may not be equal to the total presented when added due to rounding. Adjusted diluted earnings per share is calculated using adjusted net earnings divided by diluted shares outstanding. |

| | | | | | | | | | | | | | | | | | | | | | | |

Sysco Corporation and its Consolidated Subsidiaries Non-GAAP Reconciliation (Unaudited) Impact of Certain Items (Dollars in Thousands, Except for Share and Per Share Data) |

| | 13-Week Period Ended Dec. 30, 2023 | | 13-Week Period Ended Dec. 31, 2022 | | Change in Dollars | | %/bps Change |

| Sales (GAAP) | $ | 19,287,942 | | | $ | 18,593,953 | | | $ | 693,989 | | | 3.7 | % |

Impact of currency fluctuations (1) | (104,758) | | | — | | | (104,758) | | | (0.5) | |

| Comparable sales using a constant currency basis (Non-GAAP) | $ | 19,183,184 | | | $ | 18,593,953 | | | $ | 589,231 | | | 3.2 | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Cost of sales (GAAP) | $ | 15,774,309 | | | $ | 15,244,337 | | | $ | 529,972 | | | 3.5 | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Gross profit (GAAP) | $ | 3,513,633 | | | $ | 3,349,616 | | | $ | 164,017 | | | 4.9 | % |

| | | | | | | |

| | | | | | | |

Impact of currency fluctuations (1) | (24,183) | | | — | | | (24,183) | | | (0.7) | |

| Comparable gross profit adjusted for Certain Items using a constant currency basis (Non-GAAP) | $ | 3,489,450 | | | $ | 3,349,616 | | | $ | 139,834 | | | 4.2 | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Gross margin (GAAP) | 18.22 | % | | 18.01 | % | | | | 21 bps |

| | | | | | | |

| | | | | | | |

Impact of currency fluctuations (1) | (0.03) | | | — | | | | | -3 bps |

| Comparable gross margin adjusted for Certain Items using a constant currency basis (Non-GAAP) | 18.19 | % | | 18.01 | % | | | | 18 bps |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Operating expenses (GAAP) | $ | 2,813,590 | | | $ | 2,708,793 | | | $ | 104,797 | | | 3.9 | % |

Impact of restructuring and transformational project costs (2) | (13,500) | | | (14,388) | | | 888 | | | 6.2 | |

Impact of acquisition-related costs (3) | (31,341) | | | (28,960) | | | (2,381) | | | (8.2) | |

Impact of bad debt reserve adjustments (4) | — | | | 1,923 | | | (1,923) | | | NM |

| | | | | | | |

| Operating expenses adjusted for Certain Items (Non-GAAP) | 2,768,749 | | | 2,667,368 | | | 101,381 | | | 3.8 | |

Impact of currency fluctuations (1) | (23,102) | | | — | | | (23,102) | | | (0.9) | |

| Comparable operating expenses adjusted for Certain Items using a constant currency basis (Non-GAAP) | $ | 2,745,647 | | | $ | 2,667,368 | | | $ | 78,279 | | | 2.9 | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Operating expense as a percentage of sales (GAAP) | 14.59 | % | | 14.57 | % | | | | 2 bps |

| Impact of certain item adjustments | (0.24) | | | (0.22) | | | | | -2 bps |

| Adjusted operating expense as a percentage of sales (Non-GAAP) | 14.35 | % | | 14.35 | % | | | | 0 bps |

| | | | | | | |

| Operating income (GAAP) | $ | 700,043 | | | $ | 640,823 | | | $ | 59,220 | | | 9.2 | % |

| | | | | | | |

Impact of restructuring and transformational project costs (2) | 13,500 | | | 14,388 | | | (888) | | | (6.2) | |

Impact of acquisition-related costs (3) | 31,341 | | | 28,960 | | | 2,381 | | | 8.2 | |

Impact of bad debt reserve adjustments (4) | — | | | (1,923) | | | 1,923 | | | NM |

| | | | | | | |

| Operating income adjusted for Certain Items (Non-GAAP) | 744,884 | | | 682,248 | | | 62,636 | | | 9.2 | |

Impact of currency fluctuations (1) | (1,081) | | | — | | | (1,081) | | | (0.2) | |

| Comparable operating income adjusted for Certain Items using a constant currency basis (Non-GAAP) | $ | 743,803 | | | $ | 682,248 | | | $ | 61,555 | | | 9.0 | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Operating margin (GAAP) | 3.63 | % | | 3.45 | % | | | | 18 bps |

| Operating margin adjusted for Certain Items (Non-GAAP) | 3.86 | % | | 3.67 | % | | | | 19 bps |

| Operating margin adjusted for Certain Items using a constant currency basis (Non-GAAP) | 3.88 | % | | 3.67 | % | | | | 21 bps |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Other expense (GAAP) | $ | 5,245 | | | $ | 330,305 | | | $ | (325,060) | | | (98.4) | % |

Impact of other non-routine gains and losses (5) | — | | | (314,878) | | | 314,878 | | | NM |

| Other expense adjusted for Certain Items (Non-GAAP) | $ | 5,245 | | | $ | 15,427 | | | $ | (10,182) | | | (66.0) | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Net earnings (GAAP) | $ | 415,242 | | | $ | 141,216 | | | $ | 274,026 | | | NM |

| | | | | | | |

Impact of restructuring and transformational project costs (2) | 13,500 | | | 14,388 | | | (888) | | | (6.2) | |

Impact of acquisition-related costs (3) | 31,341 | | | 28,960 | | | 2,381 | | | 8.2 | |

| | | | | | | | | | | | | | | | | | | | | | | |

Impact of bad debt reserve adjustments (4) | — | | | (1,923) | | | 1,923 | | | NM |

| | | | | | | |

| | | | | | | |

Impact of other non-routine gains and losses (5) | — | | | 314,878 | | | (314,878) | | | NM |

| | | | | | | |

Tax impact of restructuring and transformational project costs (6) | (3,335) | | | (3,618) | | | 283 | | | 7.8 | |

Tax impact of acquisition-related costs (6) | (7,744) | | | (7,283) | | | (461) | | | (6.3) | |

Tax impact of bad debt reserves adjustments (6) | — | | | 484 | | | (484) | | | NM |

| | | | | | | |

Tax impact of other non-routine gains and losses (6) | — | | | (79,185) | | | 79,185 | | | NM |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Net earnings adjusted for Certain Items (Non-GAAP) | $ | 449,004 | | | $ | 407,917 | | | $ | 41,087 | | | 10.1 | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Diluted earnings per share (GAAP) | $ | 0.82 | | | $ | 0.28 | | | $ | 0.54 | | | NM |

| | | | | | | |

Impact of restructuring and transformational project costs (2) | 0.03 | | | 0.03 | | | — | | | — | |

Impact of acquisition-related costs (3) | 0.06 | | | 0.06 | | | — | | | — | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Impact of other non-routine gains and losses (5) | — | | | 0.62 | | | (0.62) | | | NM |

| | | | | | | |

Tax impact of restructuring and transformational project costs (6) | (0.01) | | | (0.01) | | | — | | | — | |

Tax impact of acquisition-related costs (6) | (0.02) | | | (0.01) | | | (0.01) | | | (100.0) | |

| | | | | | | |

Tax impact of other non-routine gains and losses (6) | — | | | (0.16) | | | 0.16 | | | NM |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Diluted earnings per share adjusted for Certain Items (Non-GAAP) (7) | $ | 0.89 | | | $ | 0.80 | | | $ | 0.09 | | | 11.3 | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Diluted shares outstanding | 505,929,342 | | | 510,145,794 | | | | | |

| | | | | |

| |

(1) | Represents a constant currency adjustment, which eliminates the impact of foreign currency fluctuations on the current year results. |

| |

| |

(2) | Fiscal 2024 includes $2 million related to restructuring and severance charges and $11 million related to various transformation initiative costs, primarily consisting of changes to our business technology strategy. Fiscal 2023 includes $5 million related to restructuring and severance charges and $9 million related to various transformation initiative costs, primarily consisting of changes to our business technology strategy. |

(3) | Fiscal 2024 includes $29 million of intangible amortization expense and $2 million in acquisition and due diligence costs. Fiscal 2023 includes $26 million of intangible amortization expense and $3 million in acquisition and due diligence costs. |

(4) | Fiscal 2023 represents the reduction of bad debt charges previously taken on pre-pandemic trade receivable balances in fiscal 2020. |

(5) | Fiscal 2023 primarily represents a pension settlement charge of $315 million that resulted from the purchase of a nonparticipating single premium group annuity contract that transferred defined benefit plan obligations to an insurer. |

(6) | The tax impact of adjustments for Certain Items are calculated by multiplying the pretax impact of each Certain Item by the statutory rates in effect for each jurisdiction where the Certain Item was incurred. |

(7) | Individual components of diluted earnings per share may not equal the total presented when added due to rounding. Total diluted earnings per share is calculated using adjusted net earnings divided by diluted shares outstanding. |

| |

| |

| NM | Represents that the percentage change is not meaningful. |

| | | | | | | | | | | | | | | | | | | | | | | |

Sysco Corporation and its Consolidated Subsidiaries Non-GAAP Reconciliation (Unaudited) Impact of Certain Items (Dollars in Thousands, Except for Share and Per Share Data) |

| | 26-Week Period Ended Dec. 30, 2023 | | 26-Week Period Ended Dec. 31, 2022 | | Change in Dollars | | %/bps Change |

| Sales (GAAP) | $ | 38,908,396 | | | $ | 37,720,783 | | | $ | 1,187,613 | | | 3.1 | % |

Impact of currency fluctuations (1) | (208,824) | | | — | | | (208,824) | | | (0.5) | |

| Comparable sales using a constant currency basis (Non-GAAP) | $ | 38,699,572 | | | $ | 37,720,783 | | | $ | 978,789 | | | 2.6 | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Cost of sales (GAAP) | $ | 31,746,991 | | | $ | 30,882,312 | | | $ | 864,679 | | | 2.8 | % |

Impact of inventory valuation adjustment (2) | — | | | 2,571 | | | (2,571) | | | — | |

| Cost of sales adjusted for Certain Items (Non-GAAP) | $ | 31,746,991 | | | $ | 30,884,883 | | | $ | 862,108 | | | 2.8 | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Gross profit (GAAP) | $ | 7,161,405 | | | $ | 6,838,471 | | | $ | 322,934 | | | 4.7 | % |

Impact of inventory valuation adjustment (2) | — | | | (2,571) | | | 2,571 | | | 0.1 | |

| Gross profit adjusted for Certain Items (Non-GAAP) | 7,161,405 | | | 6,835,900 | | | 325,505 | | | 4.8 | |

Impact of currency fluctuations (1) | (50,367) | | | — | | | (50,367) | | | (0.8) | |

| Comparable gross profit adjusted for Certain Items using a constant currency basis (Non-GAAP) | $ | 7,111,038 | | | $ | 6,835,900 | | | $ | 275,138 | | | 4.0 | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Gross margin (GAAP) | 18.41 | % | | 18.13 | % | | | | 28 bps |

Impact of inventory valuation adjustment (2) | — | | | (0.01) | | | | | 1 bps |

| Gross margin adjusted for Certain Items (Non-GAAP) | 18.41 | | | 18.12 | | | | | 29 bps |

Impact of currency fluctuations (1) | (0.04) | | | — | | | | | -4 bps |

| Comparable gross margin adjusted for Certain Items using a constant currency basis (Non-GAAP) | 18.37 | % | | 18.12 | % | | | | 25 bps |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Operating expenses (GAAP) | $ | 5,657,780 | | | $ | 5,460,847 | | | $ | 196,933 | | | 3.6 | % |

Impact of restructuring and transformational project costs (3) | (33,175) | | | (26,034) | | | (7,141) | | | (27.4) | |

Impact of acquisition-related costs (4) | (62,379) | | | (58,415) | | | (3,964) | | | (6.8) | |

Impact of bad debt reserve adjustments (5) | — | | | 4,515 | | | (4,515) | | | NM |

| | | | | | | |

| Operating expenses adjusted for Certain Items (Non-GAAP) | 5,562,226 | | | 5,380,913 | | | 181,313 | | | 3.4 | |

Impact of currency fluctuations (1) | (48,940) | | | — | | | (48,940) | | | (0.9) | |

| Comparable operating expenses adjusted for Certain Items using a constant currency basis (Non-GAAP) | $ | 5,513,286 | | | $ | 5,380,913 | | | $ | 132,373 | | | 2.5 | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Operating expense as a percentage of sales (GAAP) | 14.54 | % | | 14.48 | % | | | | 6 bps |

| Impact of certain item adjustments | (0.24) | | | (0.21) | | | | | -3 bps |

| Adjusted operating expense as a percentage of sales (Non-GAAP) | 14.30 | % | | 14.27 | % | | | | 3 bps |

| | | | | | | |

| Operating income (GAAP) | $ | 1,503,625 | | | $ | 1,377,624 | | | $ | 126,001 | | | 9.1 | % |

Impact of inventory valuation adjustment (2) | — | | | (2,571) | | | 2,571 | | | NM |

Impact of restructuring and transformational project costs (3) | 33,175 | | | 26,034 | | | 7,141 | | | 27.4 | |

Impact of acquisition-related costs (4) | 62,379 | | | 58,415 | | | 3,964 | | | 6.8 | |

Impact of bad debt reserve adjustments (5) | — | | | (4,515) | | | 4,515 | | | NM |

| | | | | | | |

| Operating income adjusted for Certain Items (Non-GAAP) | 1,599,179 | | | 1,454,987 | | | 144,192 | | | 9.9 | |

Impact of currency fluctuations (1) | (1,427) | | | — | | | (1,427) | | | (0.1) | |

| Comparable operating income adjusted for Certain Items using a constant currency basis (Non-GAAP) | $ | 1,597,752 | | | $ | 1,454,987 | | | $ | 142,765 | | | 9.8 | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Operating margin (GAAP) | 3.86 | % | | 3.65 | % | | | | 21 bps |

| Operating margin adjusted for Certain Items (Non-GAAP) | 4.11 | % | | 3.86 | % | | | | 25 bps |

| Operating margin adjusted for Certain Items using a constant currency basis (Non-GAAP) | 4.13 | % | | 3.86 | % | | | | 27 bps |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Other expense (GAAP) | $ | 11,885 | | | $ | 348,054 | | | $ | (336,169) | | | (96.6) | % |

| | | | | | | | | | | | | | | | | | | | | | | |

Impact of other non-routine gains and losses (6) | — | | | (314,878) | | | 314,878 | | | NM |

Other expense adjusted for Certain Items (Non-GAAP) | $ | 11,885 | | | $ | 33,176 | | | $ | (21,291) | | | (64.2) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Net earnings (GAAP) | $ | 918,634 | | | $ | 606,784 | | | $ | 311,850 | | | 51.4 | % |

Impact of inventory valuation adjustment (2) | — | | | (2,571) | | | 2,571 | | | NM |

Impact of restructuring and transformational project costs (3) | 33,175 | | | 26,034 | | | 7,141 | | | 27.4 | |

Impact of acquisition-related costs (4) | 62,379 | | | 58,415 | | | 3,964 | | | 6.8 | |

Impact of bad debt reserve adjustments (5) | — | | | (4,515) | | | 4,515 | | | NM |

| | | | | | | |

| | | | | | | |

Impact of other non-routine gains and losses (6) | — | | | 314,878 | | | (314,878) | | | NM |

Tax impact of inventory valuation adjustment (7) | — | | | 646 | | | (646) | | | NM |

Tax impact of restructuring and transformational project costs (7) | (8,184) | | | (6,538) | | | (1,646) | | | (25.2) | |

Tax impact of acquisition-related costs (7) | (15,388) | | | (14,670) | | | (718) | | | (4.9) | |

Tax impact of bad debt reserves adjustments (7) | — | | | 1,134 | | | (1,134) | | | NM |

| | | | | | | |

| | | | | | | |

Tax impact of other non-routine gains and losses (7) | — | | | (79,075) | | | 79,075 | | | NM |

| | | | | | | |

| | | | | | | |

| Net earnings adjusted for Certain Items (Non-GAAP) | $ | 990,616 | | | $ | 900,522 | | | $ | 90,094 | | | 10.0 | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Diluted earnings per share (GAAP) | $ | 1.81 | | | $ | 1.19 | | | $ | 0.62 | | | 52.1 | % |

Impact of inventory valuation adjustment (2) | — | | | (0.01) | | | 0.01 | | | NM |

Impact of restructuring and transformational project costs (3) | 0.07 | | | 0.05 | | | 0.02 | | | 40.0 | |

Impact of acquisition-related costs (4) | 0.12 | | | 0.11 | | | 0.01 | | | 9.1 | |

Impact of bad debt reserve adjustments (5) | — | | | (0.01) | | | 0.01 | | | NM |

| | | | | | | |

| | | | | | | |

Impact of other non-routine gains and losses (6) | — | | | 0.62 | | | (0.62) | | | NM |

| | | | | | | |

Tax impact of restructuring and transformational project costs (7) | (0.02) | | | (0.01) | | | (0.01) | | | (100.0) | |

Tax impact of acquisition-related costs (7) | (0.03) | | | (0.03) | | | — | | | — | |

| | | | | | | |

| | | | | | | |

Tax impact of other non-routine gains and losses (7) | — | | | (0.15) | | | 0.15 | | | NM |

| | | | | | | |

| | | | | | | |

Diluted earnings per share adjusted for Certain Items (Non-GAAP) (8) | $ | 1.96 | | | $ | 1.76 | | | $ | 0.20 | | | 11.4 | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Diluted shares outstanding | 506,499,390 | | | 510,264,473 | | | | | |

| | | | | |

| |

(1) | Represents a constant currency adjustment which eliminates the impact of foreign currency fluctuations on the current year results. |

(2) | Fiscal 2023 represents an adjustment to a product return allowance related to COVID-related personal protection equipment inventory. |

(3) | Fiscal 2024 includes $8 million related to restructuring and severance charges and $25 million related to various transformation initiative costs, primarily consisting of changes to our business technology strategy. Fiscal 2023 includes $10 million related to restructuring and severance charges and $16 million related to various transformation initiative costs, primarily consisting of changes to our business technology strategy. |

(4) | Fiscal 2024 includes $57 million of intangible amortization expense and $5 million in acquisition and due diligence costs. Fiscal 2023 includes $52 million of intangible amortization expense and $6 million in acquisition and due diligence costs. |

(5) | Fiscal 2023 represents the reduction of bad debt charges previously taken on pre-pandemic trade receivable balances in fiscal 2020. |

(6) | Fiscal 2023 primarily includes a pension settlement charge of $315 million that resulted from the purchase of a nonparticipating single premium group annuity contract that transferred defined benefit plan obligations to an insurer. |

(7) | The tax impact of adjustments for Certain Items is calculated by multiplying the pretax impact of each Certain Item by the statutory rates in effect for each jurisdiction where the Certain Item was incurred. |

(8) | Individual components of diluted earnings per share may not add up to the total presented due to rounding. Total diluted earnings per share is calculated using adjusted net earnings divided by diluted shares outstanding. |

| |

| |

| |

| NM | Represents that the percentage change is not meaningful. |

| | | | | | | | | | | | | | | | | | | | | | | |

Sysco Corporation and its Consolidated Subsidiaries Segment Results Non-GAAP Reconciliation (Unaudited) Impact of Certain Items on Applicable Segments (Dollars in Thousands) |

| 13-Week Period Ended Dec. 30, 2023 | | 13-Week Period Ended Dec. 31, 2022 | | Change in Dollars | | %/bps Change |

| U.S. FOODSERVICE OPERATIONS | | | | | | | |

| Sales (GAAP) | $ | 13,494,443 | | | $ | 13,077,054 | | | $ | 417,389 | | | 3.2 | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Gross profit (GAAP) | 2,577,694 | | | 2,493,089 | | | 84,605 | | | 3.4 | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Gross margin (GAAP) | 19.10 | % | | 19.06 | % | | | | 4 bps |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Operating expenses (GAAP) | $ | 1,738,658 | | | $ | 1,712,121 | | | $ | 26,537 | | | 1.5 | % |

| Impact of restructuring and transformational project costs | (65) | | | (92) | | | 27 | | | 29.3 | |

Impact of acquisition-related costs (1) | (12,025) | | | (11,514) | | | (511) | | | (4.4) | |

Impact of bad debt reserve adjustments (2) | — | | | 1,658 | | | (1,658) | | | NM |

| | | | | | | |

| Operating expenses adjusted for Certain Items (Non-GAAP) | $ | 1,726,568 | | | $ | 1,702,173 | | | $ | 24,395 | | | 1.4 | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Operating income (GAAP) | $ | 839,036 | | | $ | 780,968 | | | $ | 58,068 | | | 7.4 | % |

| Impact of restructuring and transformational project costs | 65 | | | 92 | | | (27) | | | (29.3) | |

Impact of acquisition-related costs (1) | 12,025 | | | 11,514 | | | 511 | | | 4.4 | |

Impact of bad debt reserve adjustments (2) | — | | | (1,658) | | | 1,658 | | | NM |

| | | | | | | |

| Operating income adjusted for Certain Items (Non-GAAP) | $ | 851,126 | | | $ | 790,916 | | | $ | 60,210 | | | 7.6 | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| INTERNATIONAL FOODSERVICE OPERATIONS | | | | | | | |

| Sales (GAAP) | $ | 3,596,458 | | | $ | 3,282,411 | | | $ | 314,047 | | | 9.6 | % |

| | | | | | | |

| | | | | | | |

Impact of currency fluctuations (3) | (104,598) | | | — | | | (104,598) | | | (3.2) | |

| Comparable sales using a constant currency basis (Non-GAAP) | $ | 3,491,860 | | | $ | 3,282,411 | | | $ | 209,449 | | | 6.4 | % |

| | | | | | | |

| Gross profit (GAAP) | $ | 708,100 | | | $ | 624,460 | | | $ | 83,640 | | | 13.4 | % |

| | | | | | | |

| | | | | | | |

Impact of currency fluctuations (3) | (24,126) | | | — | | | (24,126) | | | (3.9) | |

| Comparable gross profit using a constant currency basis (Non-GAAP) | $ | 683,974 | | | $ | 624,460 | | | $ | 59,514 | | | 9.5 | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Gross margin (GAAP) | 19.69 | % | | 19.02 | % | | | | 67 bps |

Impact of currency fluctuations (3) | (0.10) | | | — | | | | | -10 bps |

| Comparable gross margin using a constant currency basis (Non-GAAP) | 19.59 | % | | 19.02 | % | | | | 57 bps |

| | | | | | | |

| Operating expenses (GAAP) | $ | 625,170 | | | $ | 567,047 | | | $ | 58,123 | | | 10.3 | % |

Impact of restructuring and transformational project costs (4) | (2,603) | | | (5,588) | | | 2,985 | | | 53.4 | |

Impact of acquisition-related costs (5) | (16,847) | | | (15,935) | | | (912) | | | (5.7) | |

Impact of bad debt reserve adjustments (2) | — | | | 265 | | | (265) | | | NM |

| | | | | | | |

| Operating expenses adjusted for Certain Items (Non-GAAP) | 605,720 | | | 545,789 | | | 59,931 | | | 11.0 | |

| | | | | | | |

| | | | | | | |

Impact of currency fluctuations (3) | (22,327) | | | — | | | (22,327) | | | (4.1) | |

| Comparable operating expenses adjusted for Certain Items using a constant currency basis (Non-GAAP) | $ | 583,393 | | | $ | 545,789 | | | $ | 37,604 | | | 6.9 | % |

| | | | | | | |

| Operating income (GAAP) | $ | 82,930 | | | $ | 57,413 | | | $ | 25,517 | | | 44.4 | % |

Impact of restructuring and transformational project costs (4) | 2,603 | | | 5,588 | | | (2,985) | | | (53.4) | |

Impact of acquisition-related costs (5) | 16,847 | | | 15,935 | | | 912 | | | 5.7 | |

Impact of bad debt reserve adjustments (2) | — | | | (265) | | | 265 | | | NM |

| | | | | | | |

| Operating income adjusted for Certain Items (Non-GAAP) | 102,380 | | | 78,671 | | | 23,709 | | | 30.1 | |

| | | | | | | |

| | | | | | | |

Impact of currency fluctuations (3) | (1,800) | | | — | | | (1,800) | | | (2.3) | |

| Comparable operating income adjusted for Certain Items using a constant currency basis (Non-GAAP) | $ | 100,580 | | | $ | 78,671 | | | $ | 21,909 | | | 27.8 | % |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| SYGMA | | | | | | | |

| Sales (GAAP) | $ | 1,913,715 | | | $ | 1,933,536 | | | $ | (19,821) | | | (1.0) | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Gross profit (GAAP) | 148,507 | | | 150,461 | | | (1,954) | | | (1.3) | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Gross margin (GAAP) | 7.76 | % | | 7.78 | % | | | | -2 bps |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Operating expenses (GAAP) | $ | 132,161 | | | $ | 143,614 | | | $ | (11,453) | | | (8.0) | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Operating income (GAAP) | 16,346 | | | 6,847 | | | 9,499 | | | NM |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| OTHER | | | | | | | |

| Sales (GAAP) | $ | 283,326 | | | $ | 300,952 | | | $ | (17,626) | | | (5.9) | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Gross profit (GAAP) | 73,007 | | | 77,311 | | | (4,304) | | | (5.6) | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Gross margin (GAAP) | 25.77 | % | | 25.69 | % | | | | 8 bps |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Operating expenses (GAAP) | $ | 64,620 | | | $ | 67,441 | | | $ | (2,821) | | | (4.2) | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Operating income (GAAP) | 8,387 | | | 9,870 | | | (1,483) | | | (15.0) | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| GLOBAL SUPPORT CENTER | | | | | | | |

| Gross profit (GAAP) | $ | 6,325 | | | $ | 4,295 | | | $ | 2,030 | | | 47.3 | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Operating expenses (GAAP) | $ | 252,981 | | | $ | 218,570 | | | $ | 34,411 | | | 15.7 | % |

Impact of restructuring and transformational project costs (6) | (10,832) | | | (8,708) | | | (2,124) | | | (24.4) | |

Impact of acquisition-related costs (7) | (2,469) | | | (1,511) | | | (958) | | | (63.4) | |

| | | | | | | |

| | | | | | | |

| Operating expenses adjusted for Certain Items (Non-GAAP) | $ | 239,680 | | | $ | 208,351 | | | $ | 31,329 | | | 15.0 | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Operating loss (GAAP) | $ | (246,656) | | | $ | (214,275) | | | $ | (32,381) | | | (15.1) | % |

| | | | | | | |

Impact of restructuring and transformational project costs (6) | 10,832 | | | 8,708 | | | 2,124 | | | 24.4 | |

Impact of acquisition-related costs (7) | 2,469 | | | 1,511 | | | 958 | | | 63.4 | |

| | | | | | | |

| | | | | | | |

| Operating loss adjusted for Certain Items (Non-GAAP) | $ | (233,355) | | | $ | (204,056) | | | $ | (29,299) | | | (14.4) | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| TOTAL SYSCO | | | | | | | |

| Sales (GAAP) | $ | 19,287,942 | | | $ | 18,593,953 | | | $ | 693,989 | | | 3.7 | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Gross profit (GAAP) | 3,513,633 | | | 3,349,616 | | | 164,017 | | | 4.9 | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Gross margin (GAAP) | 18.22 | % | | 18.01 | % | | | | 21 bps |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Operating expenses (GAAP) | $ | 2,813,590 | | | $ | 2,708,793 | | | $ | 104,797 | | | 3.9 | % |

Impact of restructuring and transformational project costs (4) (6) | (13,500) | | | (14,388) | | | 888 | | | 6.2 | |

Impact of acquisition-related costs (1) (5) (7) | (31,341) | | | (28,960) | | | (2,381) | | | (8.2) | |

Impact of bad debt reserve adjustments (2) | — | | | 1,923 | | | (1,923) | | | NM |

| | | | | | | |

| Operating expenses adjusted for Certain Items (Non-GAAP) | $ | 2,768,749 | | | $ | 2,667,368 | | | $ | 101,381 | | | 3.8 | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Operating income (GAAP) | $ | 700,043 | | | $ | 640,823 | | | $ | 59,220 | | | 9.2 | % |

| | | | | | | |

Impact of restructuring and transformational project costs (4) (6) | 13,500 | | | 14,388 | | | (888) | | | (6.2) | |

Impact of acquisition-related costs (1) (5) (7) | 31,341 | | | 28,960 | | | 2,381 | | | 8.2 | |

Impact of bad debt reserve adjustments (2) | — | | | (1,923) | | | 1,923 | | | NM |

| | | | | | | |

| Operating income adjusted for Certain Items (Non-GAAP) | $ | 744,884 | | | $ | 682,248 | | | $ | 62,636 | | | 9.2 | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | |

(1) | Fiscal 2024 and fiscal 2023 include intangible amortization expense and acquisition costs. |

(2) | Fiscal 2023 represents the reduction of bad debt charges previously taken on pre-pandemic trade receivable balances in fiscal 2020. |

(3) | Represents a constant currency adjustment, which eliminates the impact of foreign currency fluctuations on current year results. |

(4) | Includes restructuring costs primarily in Europe. |

(5) | Represents intangible amortization expense. |

| |

(6) | Includes various transformation initiative costs, primarily consisting of changes to our business technology strategy. |

(7) | Represents due diligence costs. |

| |

| |

| NM | Represents that the percentage change is not meaningful. |

| | | | | | | | | | | | | | | | | | | | | | | |

Sysco Corporation and its Consolidated Subsidiaries

Segment Results

Non-GAAP Reconciliation (Unaudited)

Impact of Certain Items on Applicable Segments

(Dollars in Thousands) |

| 26-Week Period Ended Dec. 30, 2023 | | 26-Week Period Ended Dec. 31, 2022 | | Change in Dollars | | %/bps Change |

| U.S. FOODSERVICE OPERATIONS | | | | | | | |

| Sales (GAAP) | $ | 27,218,242 | | | $ | 26,679,536 | | | $ | 538,706 | | | 2.0 | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Gross profit (GAAP) | 5,262,469 | | | 5,105,432 | | | 157,037 | | | 3.1 | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Gross margin (GAAP) | 19.33 | % | | 19.14 | % | | | | 19 bps |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Operating expenses (GAAP) | $ | 3,482,462 | | | $ | 3,418,753 | | | $ | 63,709 | | | 1.9 | % |

| Impact of restructuring and transformational project costs | (120) | | | (44) | | | (76) | | | NM |

Impact of acquisition-related costs (1) | (24,572) | | | (24,100) | | | (472) | | | (2.0) | |

Impact of bad debt reserve adjustments (2) | — | | | 4,250 | | | (4,250) | | | NM |

| | | | | | | |

| Operating expenses adjusted for Certain Items (Non-GAAP) | $ | 3,457,770 | | | $ | 3,398,859 | | | $ | 58,911 | | | 1.7 | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Operating income (GAAP) | $ | 1,780,007 | | | $ | 1,686,679 | | | $ | 93,328 | | | 5.5 | % |

| Impact of restructuring and transformational project costs | 120 | | | 44 | | | 76 | | | NM |

Impact of acquisition-related costs (1) | 24,572 | | | 24,100 | | | 472 | | | 2.0 | |

Impact of bad debt reserve adjustments (2) | — | | | (4,250) | | | 4,250 | | | NM |

| | | | | | | |

| Operating income adjusted for Certain Items (Non-GAAP) | $ | 1,804,699 | | | $ | 1,706,573 | | | $ | 98,126 | | | 5.7 | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| INTERNATIONAL FOODSERVICE OPERATIONS | | | | | | | |

| Sales (GAAP) | $ | 7,279,668 | | | $ | 6,566,146 | | | $ | 713,522 | | | 10.9 | % |

| | | | | | | |

| | | | | | | |

Impact of currency fluctuations (3) | (210,101) | | | — | | | (210,101) | | | (3.2) | |

| Comparable sales using a constant currency basis (Non-GAAP) | $ | 7,069,567 | | | $ | 6,566,146 | | | $ | 503,421 | | | 7.7 | % |

| | | | | | | |

| Gross profit (GAAP) | $ | 1,440,139 | | | $ | 1,273,725 | | | $ | 166,414 | | | 13.1 | % |

| | | | | | | |

| | | | | | | |

Impact of currency fluctuations (3) | (50,837) | | | — | | | (50,837) | | | (4.0) | |

| Comparable gross profit using a constant currency basis (Non-GAAP) | $ | 1,389,302 | | | $ | 1,273,725 | | | $ | 115,577 | | | 9.1 | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Gross margin (GAAP) | 19.78 | % | | 19.40 | % | | | | 38 bps |

Impact of currency fluctuations (3) | (0.13) | | | — | | | | | -13 bps |

| Comparable gross margin using a constant currency basis (Non-GAAP) | 19.65 | % | | 19.40 | % | | | | 25 bps |

| | | | | | | |

| Operating expenses (GAAP) | $ | 1,263,726 | | | $ | 1,129,332 | | | $ | 134,394 | | | 11.9 | % |

Impact of restructuring and transformational project costs (4) | (8,406) | | | (9,495) | | | 1,089 | | | 11.5 | |

Impact of acquisition-related costs (5) | (33,744) | | | (31,949) | | | (1,795) | | | (5.6) | |

Impact of bad debt reserve adjustments (2) | — | | | 265 | | | (265) | | | NM |

| | | | | | | |

| Operating expenses adjusted for Certain Items (Non-GAAP) | 1,221,576 | | | 1,088,153 | | | 133,423 | | | 12.3 | |

| | | | | | | |

| | | | | | | |

Impact of currency fluctuations (3) | (47,743) | | | — | | | (47,743) | | | (4.4) | |

| Comparable operating expenses adjusted for Certain Items using a constant currency basis (Non-GAAP) | $ | 1,173,833 | | | $ | 1,088,153 | | | $ | 85,680 | | | 7.9 | % |

| | | | | | | |

| Operating income (GAAP) | $ | 176,413 | | | $ | 144,393 | | | $ | 32,020 | | | 22.2 | % |

Impact of restructuring and transformational project costs (4) | 8,406 | | | 9,495 | | | (1,089) | | | (11.5) | |

Impact of acquisition-related costs (5) | 33,744 | | | 31,949 | | | 1,795 | | | 5.6 | |

Impact of bad debt reserve adjustments (2) | — | | | (265) | | | 265 | | | NM |

| | | | | | | |

| Operating income adjusted for Certain Items (Non-GAAP) | 218,563 | | | 185,572 | | | 32,991 | | | 17.8 | |

| | | | | | | |

| | | | | | | |

Impact of currency fluctuations (3) | (3,094) | | | — | | | (3,094) | | | (1.7) | |

| Comparable operating income adjusted for Certain Items using a constant currency basis (Non-GAAP) | $ | 215,469 | | | $ | 185,572 | | | $ | 29,897 | | | 16.1 | % |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| SYGMA | | | | | | | |

| Sales (GAAP) | $ | 3,819,729 | | | $ | 3,866,993 | | | $ | (47,264) | | | (1.2) | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Gross profit (GAAP) | 301,317 | | | 304,354 | | | (3,037) | | | (1.0) | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Gross margin (GAAP) | 7.89 | % | | 7.87 | % | | | | 2 bps |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Operating expenses (GAAP) | $ | 272,204 | | | $ | 291,810 | | | $ | (19,606) | | | (6.7) | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Operating income (GAAP) | 29,113 | | | 12,544 | | | 16,569 | | | NM |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| OTHER | | | | | | | |

| Sales (GAAP) | $ | 590,757 | | | $ | 608,108 | | | $ | (17,351) | | | (2.9) | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Gross profit (GAAP) | 150,982 | | | 158,149 | | | (7,167) | | | (4.5) | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Gross margin (GAAP) | 25.56 | % | | 26.01 | % | | | | -45 bps |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Operating expenses (GAAP) | $ | 130,772 | | | $ | 136,741 | | | $ | (5,969) | | | (4.4) | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Operating income (GAAP) | 20,210 | | | 21,408 | | | (1,198) | | | (5.6) | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| GLOBAL SUPPORT CENTER | | | | | | | |

| Gross profit (loss) (GAAP) | $ | 6,498 | | | $ | (3,189) | | | $ | 9,687 | | | NM |

Impact of inventory valuation adjustment (6) | — | | | (2,571) | | | 2,571 | | | NM |

| Gross profit (loss) adjusted for Certain Items (Non-GAAP) | $ | 6,498 | | | $ | (5,760) | | | $ | 12,258 | | | NM |

| | | | | | | |

| Operating expenses (GAAP) | $ | 508,616 | | | $ | 484,211 | | | $ | 24,405 | | | 5.0 | % |

Impact of restructuring and transformational project costs (7) | (24,649) | | | (16,495) | | | (8,154) | | | (49.4) | |

Impact of acquisition-related costs (8) | (4,063) | | | (2,365) | | | (1,698) | | | (71.8) | |

| | | | | | | |

| | | | | | | |

| Operating expenses adjusted for Certain Items (Non-GAAP) | $ | 479,904 | | | $ | 465,351 | | | $ | 14,553 | | | 3.1 | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Operating loss (GAAP) | $ | (502,118) | | | $ | (487,400) | | | $ | (14,718) | | | (3.0) | % |

Impact of inventory valuation adjustment (6) | — | | | (2,571) | | | 2,571 | | | NM |

Impact of restructuring and transformational project costs (7) | 24,649 | | | 16,495 | | | 8,154 | | | 49.4 | |

Impact of acquisition-related costs (8) | 4,063 | | | 2,365 | | | 1,698 | | | 71.8 | |

| | | | | | | |

| | | | | | | |

| Operating loss adjusted for Certain Items (Non-GAAP) | $ | (473,406) | | | $ | (471,111) | | | $ | (2,295) | | | (0.5) | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| TOTAL SYSCO | | | | | | | |

| Sales (GAAP) | $ | 38,908,396 | | | $ | 37,720,783 | | | $ | 1,187,613 | | | 3.1 | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Gross profit (GAAP) | 7,161,405 | | | 6,838,471 | | | 322,934 | | | 4.7 | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Gross margin (GAAP) | 18.41 | % | | 18.13 | % | | | | 28 bps |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Operating expenses (GAAP) | $ | 5,657,780 | | | $ | 5,460,847 | | | $ | 196,933 | | | 3.6 | % |

Impact of restructuring and transformational project costs (4) (7) | (33,175) | | | (26,034) | | | (7,141) | | | (27.4) | |

Impact of acquisition-related costs (1) (5) (8) | (62,379) | | | (58,414) | | | (3,965) | | | (6.8) | |

Impact of bad debt reserve adjustments (2) | — | | | 4,515 | | | (4,515) | | | NM |

| | | | | | | |

| Operating expenses adjusted for Certain Items (Non-GAAP) | $ | 5,562,226 | | | $ | 5,380,914 | | | $ | 181,312 | | | 3.4 | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Operating income (GAAP) | $ | 1,503,625 | | | $ | 1,377,624 | | | $ | 126,001 | | | 9.1 | % |

Impact of inventory valuation adjustment (6) | — | | | (2,571) | | | 2,571 | | | NM |

Impact of restructuring and transformational project costs (4) (7) | 33,175 | | | 26,034 | | | 7,141 | | | 27.4 | |

Impact of acquisition-related costs (1) (5) (8) | 62,379 | | | 58,414 | | | 3,965 | | | 6.8 | |

Impact of bad debt reserve adjustments (2) | — | | | (4,515) | | | 4,515 | | | NM |

| | | | | | | |

| Operating income adjusted for Certain Items (Non-GAAP) | $ | 1,599,179 | | | $ | 1,454,986 | | | $ | 144,193 | | | 9.9 | % |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | |

| |

(1) | Fiscal 2024 and fiscal 2023 include intangible amortization expense and acquisition costs. |

(2) | Fiscal 2023 represents the reduction of bad debt charges previously taken on pre-pandemic trade receivable balances in fiscal 2020. |

(3) | Represents a constant currency adjustment, which eliminates the impact of foreign currency fluctuations on current year results. |

(4) | Includes restructuring and severance costs, primarily in Europe. |

(5) | Represents intangible amortization expense. |

(6) | Fiscal 2023 represents an adjustment to a product return allowance related to COVID-related personal protection equipment inventory. |

(7) | Includes various transformation initiative costs, primarily consisting of changes to our business technology strategy. |

(8) | Represents due diligence costs. |

| |

| |

| NM | Represents that the percentage change is not meaningful. |

Sysco Corporation and its Consolidated Subsidiaries

Non-GAAP Reconciliation (Unaudited)

Free Cash Flow

(In Thousands)

Free cash flow represents net cash provided from operating activities less purchases of plant and equipment and includes proceeds from sales of plant and equipment. Sysco considers free cash flow to be a liquidity measure that provides useful information to management and investors about the amount of cash generated by the business after the purchases and sales of buildings, fleet, equipment and technology, which may potentially be used to pay for, among other things, strategic uses of cash including dividend payments, share repurchases and acquisitions. However, free cash flow may not be available for discretionary expenditures, as it may be necessary that we use it to make mandatory debt service or other payments. Free cash flow should not be used as a substitute for the most comparable GAAP financial measure in assessing the company’s liquidity for the periods presented. An analysis of any non-GAAP financial measure should be used in conjunction with results presented in accordance with GAAP. In the table that follows, free cash flow for each period presented is reconciled to net cash provided by operating activities.

| | | | | | | | | | | | | | | | | | | |

| 26-Week Period Ended Dec. 30, 2023 | | 26-Week Period Ended Dec. 31, 2022 | | 26-Week Period Change in Dollars | | |

| Net cash provided by operating activities (GAAP) | $ | 855,897 | | | $ | 503,466 | | | $ | 352,431 | | | |

| Additions to plant and equipment | (346,797) | | | (309,664) | | | (37,133) | | | |

| Proceeds from sales of plant and equipment | 18,347 | | | 25,493 | | | (7,146) | | | |

| Free Cash Flow (Non-GAAP) | $ | 527,447 | | | $ | 219,295 | | | $ | 308,152 | | | |

Sysco Corporation and its Consolidated Subsidiaries

Non-GAAP Reconciliation (Unaudited)

Impact of Certain Items on Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA)

(Dollars in Thousands)