0000773141false00007731412024-01-302024-01-300000773141us-gaap:CommonStockMember2024-01-302024-01-300000773141mdc:SeniorNotesSixPercentDueJanuary2043Member2024-01-302024-01-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

_________________________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of Earliest Event Reported): January 30, 2024

M.D.C. Holdings, Inc. | | | | | | | | |

| (Exact name of registrant as specified in its charter) | |

| | | | | | | | |

| Delaware | 1-8951 | 84-0622967 |

(State or other

jurisdiction of

incorporation) | (Commission file number) | (I.R.S. employer

identification no.) |

4350 South Monaco Street, Suite 500, Denver, Colorado 80237 | | | | | | | | |

| (Address of principal executive offices) (Zip code) | |

Registrant’s telephone number, including area code: (303) 773-1100

Not Applicable | | | | | | | | |

| (Former name or former address, if changed since last report) | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $.01 par value | | MDC | | New York Stock Exchange |

| 6% Senior Notes due January 2043 | | MDC 43 | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 2.02. RESULTS OF OPERATIONS AND FINANCIAL CONDITION

On January 30, 2024, M.D.C. Holdings, Inc. issued a press release reporting its results of operations for the fourth quarter and full year ended December 31, 2023. A copy of the press release is furnished as Exhibit 99.1 to this Current Report.

The information in Item 2.02 of this Current Report, including the press release, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (“Exchange Act”), or otherwise subject to the liabilities of that section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act except as expressly set forth by specific reference in such filing.

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits

| | | | | | | | |

| Exhibit Number | | Description |

| | |

| 99.1 | | |

| | |

| 104 | | Cover Page Interactive Data file (formatted in Inline XBRL) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

_________________________________

| | | | | | | | | | | | | | |

| | M.D.C. HOLDINGS, INC. | |

| | | | |

| Dated: | January 30, 2024 | By: | /s/ Joseph H. Fretz | |

| | | Joseph H. Fretz | |

| | | Vice President, Secretary and Corporate Counsel | |

News Release

M.D.C. HOLDINGS ANNOUNCES 2023 FOURTH QUARTER AND FULL YEAR RESULTS

DENVER, COLORADO, Tuesday, January 30, 2024. M.D.C. Holdings, Inc. (NYSE: MDC), announced results for the quarter and full year ended December 31, 2023. As previously announced on January 18, 2024, MDC has entered into a definitive agreement to be acquired by a wholly-owned subsidiary of Sekisui House in an all-cash transaction (the "Merger"). Consummation of the Merger is subject to shareholder approval, regulatory approval and completion of other customary closing conditions.

About MDC

M.D.C. Holdings, Inc. was founded in 1972. MDC's homebuilding subsidiaries, which operate under the name Richmond American Homes, have helped more than 240,000 homebuyers achieve the American Dream since 1977. One of the largest homebuilders in the nation, MDC is committed to quality and value that is reflected in each home its subsidiaries build. The Richmond American companies have operations in Alabama, Arizona, California, Colorado, Florida, Idaho, Maryland, Nevada, New Mexico, Oregon, Pennsylvania, Tennessee, Texas, Utah, Virginia and Washington. Mortgage lending, insurance and title services are offered by the following MDC subsidiaries, respectively: HomeAmerican Mortgage Corporation, American Home Insurance Agency, Inc. and American Home Title and Escrow Company. M.D.C. Holdings, Inc. stock is traded on the New York Stock Exchange under the symbol “MDC.” For more information, visit www.mdcholdings.com.

Forward-Looking Statements

Any statements regarding our business, financial condition, results of operation, cash flows, strategies and prospects, may constitute "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results, performance or achievements of MDC to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such factors include, among other things, (1) general economic conditions, changes in consumer confidence, inflation or deflation and employment levels; (2) changes in business conditions experienced by MDC, including cancellation rates, net home orders, home gross margins, land and home values and subdivision counts; (3) changes in interest rates, mortgage lending programs and the availability of credit; (4) changes in the market value of MDC’s investments in marketable securities; (5) uncertainty in the mortgage lending industry, including repurchase requirements associated with HomeAmerican Mortgage Corporation’s sale of mortgage loans (6) the relative stability of debt and equity markets; (7) competition; (8) the availability and cost of land and other raw materials used by MDC in its homebuilding operations; (9) the availability and cost of performance bonds and insurance covering risks associated with our business; (10) shortages and the cost of labor; (11) weather related slowdowns and natural disasters; (12) slow growth initiatives; (13) building moratoria; (14) governmental regulation, including orders addressing the COVID-19 pandemic, the interpretation of tax, labor and environmental laws; (15) terrorist acts and other acts of war; (16) changes in energy prices; and (17) other factors over which MDC has little or no control. Additional information about the risks and uncertainties applicable to MDC's business is contained in MDC's Form 10-K for the year ended December 31, 2023, which is scheduled to be filed with the Securities and Exchange Commission today. All forward-looking statements are made as of their date, and the risk that actual results will differ materially from expectations expressed will increase with the passage of time. MDC undertakes no duty to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise. However, any further disclosures made on related subjects in our subsequent filings, releases or webcasts should be consulted.

Contact: Derek R. Kimmerle

Vice President and Chief Accounting Officer

1-866-424-3395

IR@mdch.com

M.D.C. HOLDINGS, INC.

Consolidated Statements of Operations and Comprehensive Income

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Year Ended

December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | |

| (Dollars in thousands, except per share amounts) |

| Homebuilding: | | | | | | | |

| Home sale revenues | $ | 1,309,760 | | | $ | 1,487,279 | | | $ | 4,520,296 | | | $ | 5,586,264 | |

| Home cost of sales | (1,062,125) | | | (1,170,989) | | | (3,684,487) | | | (4,214,379) | |

| Inventory impairments | (2,200) | | | (92,800) | | | (29,700) | | | (121,875) | |

| Total cost of sales | (1,064,325) | | | (1,263,789) | | | (3,714,187) | | | (4,336,254) | |

| Gross profit | 245,435 | | | 223,490 | | | 806,109 | | | 1,250,010 | |

| Selling, general and administrative expenses | (126,862) | | | (131,797) | | | (429,894) | | | (536,395) | |

| Interest and other income | 21,755 | | | 7,046 | | | 73,567 | | | 10,843 | |

| Other income (expense), net | (637) | | | (4,258) | | | 350 | | | (32,991) | |

| Homebuilding pretax income | 139,691 | | | 94,481 | | | 450,132 | | | 691,467 | |

| | | | | | | |

| Financial Services: | | | | | | | |

| Revenues | 36,696 | | | 32,262 | | | 122,570 | | | 131,723 | |

| Expenses | (16,712) | | | (16,887) | | | (62,942) | | | (71,327) | |

| Other income (expense), net | 4,603 | | | 3,364 | | | 16,345 | | | 7,991 | |

| Financial services pretax income | 24,587 | | | 18,739 | | | 75,973 | | | 68,387 | |

| | | | | | | |

| Income before income taxes | 164,278 | | | 113,220 | | | 526,105 | | | 759,854 | |

| Provision for income taxes | (44,771) | | | (33,444) | | | (125,100) | | | (197,715) | |

| Net income | $ | 119,507 | | | $ | 79,776 | | | $ | 401,005 | | | $ | 562,139 | |

| | | | | | | |

| Other comprehensive income net of tax: | | | | | | | |

| Unrealized gain related to available-for-sale debt securities | $ | (40) | | | $ | — | | | $ | 51 | | | $ | — | |

| Other comprehensive income | (40) | | | — | | | 51 | | | — | |

| Comprehensive income | $ | 119,467 | | | $ | 79,776 | | | $ | 401,056 | | | $ | 562,139 | |

| | | | | | | |

| Earnings per share: | | | | | | | |

| Basic | $ | 1.60 | | | $ | 1.11 | | | $ | 5.42 | | | $ | 7.87 | |

| Diluted | $ | 1.56 | | | $ | 1.08 | | | $ | 5.29 | | | $ | 7.67 | |

| | | | | | | |

| Weighted average common shares outstanding: | | | | | | | |

| Basic | 74,216,586 | | | 71,646,237 | | | 73,505,508 | | | 71,035,558 | |

| Diluted | 76,126,163 | | | 73,179,135 | | | 75,357,965 | | | 72,943,844 | |

| | | | | | | |

| Dividends declared per share | $ | 0.55 | | | $ | 0.50 | | | $ | 2.10 | | | $ | 2.00 | |

M.D.C. HOLDINGS, INC.

Consolidated Balance Sheets

(Unaudited)

| | | | | | | | | | | |

| December 31,

2023 | | December 31,

2022 |

| | | |

| (Dollars in thousands, except

per share amounts) |

| ASSETS | | | |

| Homebuilding: | | | |

| Cash and cash equivalents | $ | 1,475,964 | | | $ | 696,075 | |

| Restricted cash | 4,094 | | | 3,143 | |

| Marketable securities | — | | | 443,712 | |

| Trade and other receivables | 119,004 | | | 116,364 | |

| Inventories: | | | |

| Housing completed or under construction | 1,881,268 | | | 1,722,061 | |

| Land and land under development | 1,419,778 | | | 1,793,718 | |

| Total inventories | 3,301,046 | | | 3,515,779 | |

| Property and equipment, net | 82,218 | | | 63,730 | |

| Deferred tax assets, net | 38,830 | | | 49,252 | |

| Prepaids and other assets | 76,036 | | | 70,007 | |

| Total homebuilding assets | 5,097,192 | | | 4,958,062 | |

| Financial Services: | | | |

| Cash and cash equivalents | 162,839 | | | 17,877 | |

| Marketable securities | 78,250 | | | 117,388 | |

| Mortgage loans held-for-sale, net | 258,212 | | | 229,513 | |

| Other assets | 34,592 | | | 40,432 | |

| Total financial services assets | 533,893 | | | 405,210 | |

| Total Assets | $ | 5,631,085 | | | $ | 5,363,272 | |

| LIABILITIES AND EQUITY | | | |

| Homebuilding: | | | |

| Accounts payable | $ | 114,852 | | | $ | 109,218 | |

| Accrued and other liabilities | 326,478 | | | 383,406 | |

| Revolving credit facility | 10,000 | | | 10,000 | |

| Senior notes, net | 1,483,404 | | | 1,482,576 | |

| Total homebuilding liabilities | 1,934,734 | | | 1,985,200 | |

| Financial Services: | | | |

| Accounts payable and accrued liabilities | 113,485 | | | 110,536 | |

| Mortgage repurchase facility | 204,981 | | | 175,752 | |

| Total financial services liabilities | 318,466 | | | 286,288 | |

| Total Liabilities | 2,253,200 | | | 2,271,488 | |

| Stockholders' Equity | | | |

| Preferred stock, $0.01 par value; 25,000,000 shares authorized; none issued or outstanding | — | | | — | |

| Common stock, $0.01 par value; 250,000,000 shares authorized; 74,661,479 and 72,585,596 issued and outstanding at December 31, 2023 and December 31, 2022, respectively | 747 | | | 726 | |

| Additional paid-in-capital | 1,824,434 | | | 1,784,173 | |

| Retained earnings | 1,552,653 | | | 1,306,885 | |

| Accumulated other comprehensive income | 51 | | | — | |

| Total Stockholders' Equity | 3,377,885 | | | 3,091,784 | |

| Total Liabilities and Stockholders' Equity | $ | 5,631,085 | | | $ | 5,363,272 | |

M.D.C. HOLDINGS, INC.

Consolidated Statement of Cash Flows

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Year Ended

December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | |

| (Dollars in thousands) |

| Operating Activities: | | | | | | | |

| Net income | $ | 119,507 | | | $ | 79,776 | | | $ | 401,005 | | | $ | 562,139 | |

| Adjustments to reconcile net income to net cash provided by (used in) operating activities: | | | | | | | |

| Stock-based compensation expense | 9,110 | | | 10,637 | | | 23,468 | | | 60,985 | |

| Depreciation and amortization | 7,683 | | | 7,088 | | | 25,553 | | | 27,751 | |

| Inventory impairments | 2,200 | | | 92,800 | | | 29,700 | | | 121,875 | |

| Project abandonment costs | 918 | | | 4,371 | | | (45) | | | 33,129 | |

| | | | | | | |

| Amortization of discount of marketable debt securities | (4,809) | | | (3,208) | | | (29,673) | | | (4,290) | |

| | | | | | | |

| Deferred income tax expense | 7,800 | | | (27,130) | | | 10,408 | | | (31,310) | |

| Net changes in assets and liabilities: | | | | | | | |

| Trade and other receivables | (22,993) | | | (2,463) | | | 21,986 | | | (21,784) | |

| Mortgage loans held-for-sale, net | (93,958) | | | (38,680) | | | (28,699) | | | 53,016 | |

| Housing completed or under construction | 39,035 | | | 505,348 | | | (163,877) | | | 186,265 | |

| Land and land under development | (106,658) | | | (75,662) | | | 349,783 | | | (95,402) | |

| Prepaids and other assets | (789) | | | 39,786 | | | (3,886) | | | 31,736 | |

| Accounts payable and accrued liabilities | (18,565) | | | (30,970) | | | (74,093) | | | (18,464) | |

| Net cash provided by (used in) operating activities | (61,519) | | | 561,693 | | | 561,630 | | | 905,646 | |

| | | | | | | |

| Investing Activities: | | | | | | | |

| Purchases of marketable securities | (77,979) | | | (365,684) | | | (1,166,412) | | | (656,810) | |

| Maturities of marketable securities | 430,000 | | | 100,000 | | | 1,679,000 | | | 100,000 | |

| | | | | | | |

| Purchases of property and equipment | (28,265) | | | (7,646) | | | (43,145) | | | (29,075) | |

| Net cash provided by (used in) investing activities | 323,756 | | | (273,330) | | | 469,443 | | | (585,885) | |

| | | | | | | |

| Financing Activities: | | | | | | | |

| Advances on mortgage repurchase facility, net | 59,511 | | | (20,462) | | | 29,229 | | | (80,548) | |

| | | | | | | |

| | | | | | | |

| Dividend payments | (41,065) | | | (35,632) | | | (155,237) | | | (142,417) | |

| Payments of deferred debt issuance costs | (36) | | | — | | | (36) | | | — | |

| Issuance of shares under stock-based compensation programs, net | (39) | | | 28,385 | | | 20,773 | | | 16,840 | |

| Net cash provided by (used in) financing activities | 18,371 | | | (27,709) | | | (105,271) | | | (206,125) | |

| | | | | | | |

| Net increase in cash, cash equivalents and restricted cash | 280,608 | | | 260,654 | | | 925,802 | | | 113,636 | |

| Cash, cash equivalents and restricted cash: | | | | | | | |

| Beginning of period | 1,362,289 | | | 456,441 | | | 717,095 | | | 603,459 | |

| End of period | $ | 1,642,897 | | | $ | 717,095 | | | $ | 1,642,897 | | | $ | 717,095 | |

| | | | | | | |

| Reconciliation of cash, cash equivalents and restricted cash: | | | | | | | |

| Homebuilding: | | | | | | | |

| Cash and cash equivalents | $ | 1,475,964 | | | $ | 696,075 | | | $ | 1,475,964 | | | $ | 696,075 | |

| Restricted cash | 4,094 | | | 3,143 | | | 4,094 | | | 3,143 | |

| Financial Services: | | | | | | | |

| Cash and cash equivalents | 162,839 | | | 17,877 | | | 162,839 | | | 17,877 | |

| Total cash, cash equivalents and restricted cash | $ | 1,642,897 | | | $ | 717,095 | | | $ | 1,642,897 | | | $ | 717,095 | |

New Home Deliveries

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, |

| 2023 | | 2022 | | % Change |

| Homes | | Home Sale

Revenues | | Average

Price | | Homes | | Home Sale

Revenues | | Average

Price | | Homes | | Home

Sale

Revenues | | Average Price |

| | | | | | | | | | | | | | | | | |

| (Dollars in thousands) |

| West | 1,397 | | | $ | 778,410 | | | $ | 557.2 | | | 1,308 | | | $ | 756,109 | | | $ | 578.1 | | | 7 | % | | 3 | % | | (4) | % |

| Mountain | 561 | | | 336,220 | | | 599.3 | | | 756 | | | 492,850 | | | 651.9 | | | (26) | % | | (32) | % | | (8) | % |

| East | 442 | | | 195,130 | | | 441.5 | | | 490 | | | 238,320 | | | 486.4 | | | (10) | % | | (18) | % | | (9) | % |

| Total | 2,400 | | | $ | 1,309,760 | | | $ | 545.7 | | | 2,554 | | | $ | 1,487,279 | | | $ | 582.3 | | | (6) | % | | (12) | % | | (6) | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended December 31, |

| 2023 | | 2022 | | % Change |

| Homes | | Home Sale

Revenues | | Average

Price | | Homes | | Home Sale

Revenues | | Average

Price | | Homes | | Home

Sale

Revenues | | Average Price |

| | | | | | | | | | | | | | | | | |

| (Dollars in thousands) |

| West | 4,821 | | | $ | 2,624,373 | | | $ | 544.4 | | | 5,234 | | | $ | 3,024,056 | | | $ | 577.8 | | | (8) | % | | (13) | % | | (6) | % |

| Mountain | 2,028 | | | 1,267,586 | | | 625.0 | | | 2,616 | | | 1,689,376 | | | 645.8 | | | (22) | % | | (25) | % | | (3) | % |

| East | 1,379 | | | 628,337 | | | 455.6 | | | 1,860 | | | 872,832 | | | 469.3 | | | (26) | % | | (28) | % | | (3) | % |

| Total | 8,228 | | | $ | 4,520,296 | | | $ | 549.4 | | | 9,710 | | | $ | 5,586,264 | | | $ | 575.3 | | | (15) | % | | (19) | % | | (5) | % |

Net New Orders

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, |

| 2023 | | 2022 | | % Change |

| Homes | | Dollar

Value | | Average Price 1 | | Monthly Absorption Rate 2 | | Homes | | Dollar Value | | Average Price 1 | | Monthly Absorption Rate 2 | | Homes | | Dollar Value | | Average Price | | Monthly

Absorption

Rate |

| | | | | | | | | | | | | | | | | | | | | | | |

| (Dollars in thousands) |

| West | 827 | | | $ | 457,532 | | | $ | 553.2 | | | 1.96 | | 155 | | | $ | 67,710 | | | $ | 436.8 | | | 0.39 | | 434 | % | | 576 | % | | 27 | % | | 406 | % |

| Mountain | 372 | | | 219,867 | | | 591.0 | | | 2.29 | | (37) | | | (25,924) | | | 700.6 | | | (0.24) | | N/A | | N/A | | N/A | | N/A |

| East | 316 | | | 138,770 | | | 439.1 | | | 2.79 | | 72 | | | 32,649 | | | 453.5 | | | 0.64 | | 339 | % | | 325 | % | | (3) | % | | 333 | % |

| Total | 1,515 | | | $ | 816,169 | | | $ | 538.7 | | | 2.17 | | 190 | | | $ | 74,435 | | | $ | 391.8 | | | 0.29 | | 697 | % | | 996 | % | | 38 | % | | 660 | % |

1 Gross order average selling price for the three months ended December 31, 2023 decreased approximately 2% year-over-year to $543,000.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year Ended December 31, |

| 2023 | | 2022 | | % Change |

| Homes | | Dollar

Value | | Average

Price | | Monthly Absorption Rate 2 | | Homes | | Dollar Value | | Average Price | | Monthly Absorption Rate 2 | | Homes | | Dollar Value | | Average Price | | Monthly

Absorption

Rate |

| | | | | | | | | | | | | | | | | | | | | | | |

| (Dollars in thousands) |

| West | 4,202 | | | $ | 2,399,987 | | | $ | 571.2 | | | 2.51 | | 2,909 | | | $ | 1,735,202 | | | $ | 596.5 | | | 2.01 | | 44 | % | | 38 | % | | (4) | % | | 25 | % |

| Mountain | 1,657 | | | 1,004,360 | | | 606.1 | | | 2.50 | | 1,157 | | | 788,734 | | | 681.7 | | | 1.85 | | 43 | % | | 27 | % | | (11) | % | | 35 | % |

| East | 1,285 | | | 578,427 | | | 450.1 | | | 2.85 | | 978 | | | 489,946 | | | 501.0 | | | 2.25 | | 31 | % | | 18 | % | | (10) | % | | 27 | % |

| Total | 7,144 | | | $ | 3,982,774 | | | $ | 557.5 | | | 2.57 | | 5,044 | | | $ | 3,013,882 | | | $ | 597.5 | | | 2.02 | | 42 | % | | 32 | % | | (7) | % | | 27 | % |

2 Calculated as total net new orders in period ÷ average active communities during period ÷ number of months in period

Active Subdivisions

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | Average Active Subdivisions |

| Active Subdivisions | | Three Months Ended | | Year Ended |

| December 31, | | % | | December 31, | | % | | December 31, | | % |

| 2023 | | 2022 | | Change | | 2023 | | 2022 | | Change | | 2023 | | 2022 | | Change |

| West | 138 | | | 134 | | | 3 | % | | 141 | | | 133 | | | 5 | % | | 140 | | | 120 | | | 17 | % |

| Mountain | 53 | | | 53 | | | — | % | | 54 | | | 51 | | | 6 | % | | 55 | | | 52 | | | 6 | % |

| East | 35 | | | 38 | | | (8) | % | | 38 | | | 37 | | | 1 | % | | 38 | | | 36 | | | 6 | % |

| Total | 226 | | | 225 | | | — | % | | 233 | | | 222 | | | 5 | % | | 233 | | | 208 | | | 12 | % |

Backlog

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| December 31, |

| 2023 | | 2022 | | % Change |

| Homes | | Dollar

Value | | Average

Price | | Homes | | Dollar

Value | | Average

Price | | Homes | | Dollar

Value | | Average

Price |

| | | | | | | | | | | | | | | | | |

| (Dollars in thousands) |

| West | 1,272 | | | $ | 789,317 | | | $ | 620.5 | | | 1,891 | | | $ | 1,049,805 | | | $ | 555.2 | | | (33) | % | | (25) | % | | 12 | % |

| Mountain | 344 | | | 237,154 | | | 689.4 | | | 715 | | | 515,460 | | | 720.9 | | | (52) | % | | (54) | % | | (4) | % |

| East | 274 | | | 130,524 | | | 476.4 | | | 368 | | | 187,629 | | | 509.9 | | | (26) | % | | (30) | % | | (7) | % |

| Total | 1,890 | | | $ | 1,156,995 | | | $ | 612.2 | | | 2,974 | | | $ | 1,752,894 | | | $ | 589.4 | | | (36) | % | | (34) | % | | 4 | % |

Homes Completed or Under Construction (WIP lots)

| | | | | | | | | | | | | | | | | |

| | December 31, | | % |

| | 2023 | | 2022 | | Change |

| Unsold: | | | | | |

| Completed | 339 | | | 396 | | | (14) | % |

| Under construction | 2,709 | | | 1,063 | | | 155 | % |

| Total unsold started homes | 3,048 | | | 1,459 | | | 109 | % |

| Sold homes under construction or completed | 1,812 | | | 2,756 | | | (34) | % |

| Model homes under construction or completed | 542 | | | 555 | | | (2) | % |

| Total homes completed or under construction | 5,402 | | | 4,770 | | | 13 | % |

Lots Owned and Optioned (including homes completed or under construction)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | December 31, 2023 | | December 31, 2022 | | |

| | Lots

Owned | | Lots

Optioned | | Total | | Lots

Owned | | Lots

Optioned | | Total | | Total

% Change |

| West | 9,957 | | | 1,186 | | | 11,143 | | | 12,667 | | | 687 | | | 13,354 | | | (17) | % |

| Mountain | 5,038 | | | 1,088 | | | 6,126 | | | 5,398 | | | 1,561 | | | 6,959 | | | (12) | % |

| East | 3,004 | | | 2,142 | | | 5,146 | | | 3,534 | | | 1,455 | | | 4,989 | | | 3 | % |

| Total | 17,999 | | | 4,416 | | | 22,415 | | | 21,599 | | | 3,703 | | | 25,302 | | | (11) | % |

Selling, General and Administrative Expenses

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2023 | | 2022 | | Change | | 2023 | | 2022 | | Change |

| | | | | | | | | | | |

| (Dollars in thousands) |

| General and administrative expenses | $ | 62,665 | | | $ | 66,614 | | | $ | (3,949) | | | $ | 203,878 | | | $ | 292,349 | | | $ | (88,471) | |

General and administrative expenses as a percentage of home sale revenues | 4.8 | % | | 4.5 | % | | 30 bps | | 4.5 | % | | 5.2 | % | | -70 bps |

| Marketing expenses | $ | 26,199 | | | $ | 25,308 | | | $ | 891 | | | $ | 96,807 | | | $ | 103,330 | | | $ | (6,523) | |

Marketing expenses as a percentage of home sale revenues | 2.0 | % | | 1.7 | % | | 30 bps | | 2.1 | % | | 1.8 | % | | 30 bps |

| Commissions expenses | $ | 37,998 | | | $ | 39,875 | | | $ | (1,877) | | | $ | 129,209 | | | $ | 140,716 | | | $ | (11,507) | |

Commissions expenses as a percentage of home sale revenues | 2.9 | % | | 2.7 | % | | 20 bps | | 2.9 | % | | 2.5 | % | | 40 bps |

| Total selling, general and administrative expenses | $ | 126,862 | | | $ | 131,797 | | | $ | (4,935) | | | $ | 429,894 | | | $ | 536,395 | | | $ | (106,501) | |

Total selling, general and administrative expenses as a percentage of home sale revenues | 9.7 | % | | 8.9 | % | | 80 bps | | 9.5 | % | | 9.6 | % | | -10 bps |

| | | | | | | | | | | |

| | | | | | | | | | | |

Capitalized Interest

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

December 31, | | Year Ended

December 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | |

| (Dollars in thousands) |

| Homebuilding interest incurred | $ | 17,515 | | | $ | 17,419 | | | $ | 69,901 | | | $ | 69,450 | |

| Less: Interest capitalized | (17,515) | | | (17,419) | | | (69,901) | | | (69,450) | |

| Homebuilding interest expensed | $ | — | | | $ | — | | | $ | — | | | $ | — | |

| | | | | | | |

| Interest capitalized, beginning of period | $ | 65,428 | | | $ | 63,583 | | | $ | 59,921 | | | $ | 58,054 | |

| Plus: Interest capitalized during period | 17,515 | | | 17,419 | | | 69,901 | | | 69,450 | |

| Less: Previously capitalized interest included in home and land cost of sales | (18,284) | | | (21,081) | | | (65,163) | | | (67,583) | |

| Interest capitalized, end of period | $ | 64,659 | | | $ | 59,921 | | | $ | 64,659 | | | $ | 59,921 | |

Cover

|

Jan. 30, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 30, 2024

|

| Entity Registrant Name |

M.D.C. Holdings, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

1-8951

|

| Entity Tax Identification Number |

84-0622967

|

| Entity Address, Address Line One |

4350 South Monaco Street

|

| Entity Address, Address Line Two |

Suite 500

|

| Entity Address, City or Town |

Denver

|

| Entity Address, State or Province |

CO

|

| Entity Address, Postal Zip Code |

80237

|

| City Area Code |

303

|

| Local Phone Number |

773-1100

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000773141

|

| Amendment Flag |

false

|

| Common Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, $.01 par value

|

| Trading Symbol |

MDC

|

| Security Exchange Name |

NYSE

|

| Senior Notes, 6%, Due January 2043 [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

6% Senior Notes due January 2043

|

| Trading Symbol |

MDC 43

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=mdc_SeniorNotesSixPercentDueJanuary2043Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

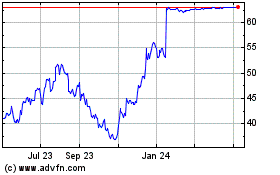

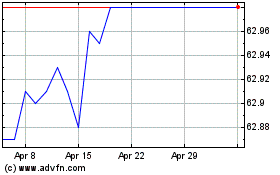

M D C (NYSE:MDC)

Historical Stock Chart

From Mar 2024 to Apr 2024

M D C (NYSE:MDC)

Historical Stock Chart

From Apr 2023 to Apr 2024