Caledonia Mining Corporation Plc ("Caledonia" or the

"Company") (NYSE AMERICAN, AIM and VFEX: CMCL) is pleased to

report further encouraging results from the deep level drilling

programme at Blanket Mine which is currently evaluating the

continuity of the mineralised zones on the Blanket and Eroica ore

bodies in anticipation of delineating an increased overall

resource. These results follow the Eroica ore body drilling

results published on July 10, 2023. A total of 7,652 metres of

drilling from June 2023 to end of December 2023 indicates that the

existing Blanket and Eroica ore bodies have grades and widths which

are generally better than expected. Total drilling for 2023 was

13,280 metres.

Highlights of the results include:

|

Holes Identifier |

Orebody Name |

Orebody Intersection |

Core Length (m) |

True width (m) |

Grade (g/t) |

Orebody Intersection depth from surface (m) |

*E.O.H(m) |

|

From (m) |

To(m) |

|

ERC750EX2308 |

ERCN_FW |

350.00 |

358.40 |

8.40 |

5.80 |

4.95 |

1108.40 |

392.40 |

|

BLK 930EX2308 |

BQR_HW |

176.03 |

200.63 |

24.60 |

13.33 |

5.92 |

1130.63 |

304.25 |

|

BLK 930EX2310 |

BLK2HW |

181.30 |

217.30 |

36.00 |

16.31 |

6.12 |

1147.30 |

293.50 |

|

BLK870EX2303 |

BLK4_5 |

28.60 |

39.40 |

10.80 |

4.27 |

8.80 |

909.40 |

272.20 |

|

ARS1110EX2304 |

BQR |

3.00 |

18.00 |

15.00 |

8.22 |

3.62 |

1128.00 |

161.00 |

*End of hole depth

The complete long hole drilling results for June

2023 to December 2023 are provided in Appendix 1.

Mark Learmonth, Caledonia’s Chief Executive Officer,

commented:

“Our ongoing drilling campaign continues to

demonstrate encouraging results, further improving our confidence

in the Blanket resource. We anticipate that the positive grades and

widths will result in an increased overall resource, which in due

course should result in the extension of the existing life of the

mine. We have invested heavily in Blanket over the last seven years

to increase production capacity, resulting in a mine infrastructure

that can sustain production beyond the current production

horizon.

"Drilling is currently focussed on the Blanket

and Eroica ore bodies, where crosscuts have been mined to allow

optimal access to drill the deeper zones of the steeply-dipping ore

bodies. These results are extremely promising, and we look forward

to the next phase of drilling and to updating the market

accordingly.”

Commentary

These results, along with the outcome of further

planned exploration, will be reflected in a revised mineral

resource and mineral reserve statement which the Company expects to

publish in the second quarter of 2024 together with a revised life

of mine plan. It is anticipated that a portion of the

existing inferred mineral resources will be upgraded to measured or

indicated mineral resources together with the addition of new

inferred mineral resources. It is expected that this will result in

the existing life of mine being extended, rather than an increase

in the target annual production rate.

Drillholes at Eroica,

drilled from 750 metres below surface, have intersected the

orebodies to depths of 1,110 metres below surface, the lowest level

of main infrastructure being developed from Central Shaft.

Similarly, drillholes at Blanket from 750 metres below surface have

intersected orebodies down to 1,110 metres below surface.

Drillholes from 930 metres below surface at Blanket and from 1,110

metres below surface on AR South have intersected the orebodies

below 1,110 metres, which is encouraging for Blanket's longer-term

development.

Further data on each drill hole is set out at

Appendix 2 and pictorial representations of the holes are included

below.

Appendix 1

|

Holes Identifier |

Orebody Name |

Orebody Intersection |

Core Length (m) |

True width (m) |

Grade (g/t) |

Orebody Intersection depth fromsurface

(m) |

E.O.H (m) |

|

From(m) |

To(m) |

|

ERC750EX2307 |

ERCN_HW |

330.45 |

332.25 |

1.80 |

1.50 |

0.72 |

1082.25 |

356.25 |

|

ERC750EX2308 |

ERCN_HW |

302.60 |

306.80 |

4.20 |

3.50 |

5.97 |

1056.80 |

392.40 |

|

ERC750EX2308 |

ERCN_FW |

350.00 |

358.40 |

8.40 |

5.80 |

4.95 |

1108.40 |

392.40 |

|

ERC750EX2309 |

ERCN_HW |

304.80 |

307.80 |

3.00 |

1.66 |

3.62 |

1057.80 |

347.40 |

|

ERC750EX2310 |

ERCN_HW |

303.60 |

304.20 |

0.60 |

0.48 |

5.49 |

1054.20 |

324.50 |

|

ERC750EX2312 |

ERC _South |

|

|

Traces |

|

|

|

287.20 |

|

ERC750EX2313 |

ERC _South |

|

|

Traces |

|

|

|

279.60 |

|

BLK870EX2301 |

BLK4_5 |

38.20 |

50.20 |

12.00 |

3.58 |

5.10 |

920.20 |

287.40 |

|

BLK870EX2302 |

BLK4_5 |

34.10 |

40.10 |

6.00 |

3.92 |

7.46 |

910.10 |

272.30 |

|

BLK870EX2303 |

BLK4_5 |

28.60 |

39.40 |

10.80 |

4.27 |

8.80 |

909.40 |

272.20 |

|

BLK870EX2303 |

BLK2FW |

241.00 |

242.80 |

1.80 |

1.27 |

4.35 |

1112.80 |

275.50 |

|

BLK870EX2304 |

BLK4_5 |

26.20 |

40.60 |

14.40 |

7.74 |

4.14 |

910.60 |

275.50 |

|

BLK 930EX2301 |

BQR_HW |

148.60 |

152.80 |

4.20 |

5.12 |

2.85 |

1082.80 |

299.20 |

|

BLK 930EX2301 |

BLK3HW |

220.60 |

226.00 |

5.40 |

4.39 |

4.41 |

1156.00 |

299.20 |

|

BLK 930EX2302 |

BQR_HW |

130.60 |

133.00 |

2.40 |

1.86 |

2.42 |

1063.00 |

299.20 |

|

BLK 930EX2303 |

BQR_HW |

134.30 |

139.10 |

4.80 |

3.20 |

2.39 |

1069.10 |

233.30 |

|

BLK 930EX2304 |

BQR_HW |

205.70 |

219.50 |

13.80 |

8.32 |

3.63 |

1149.50 |

251.30 |

|

BLK 930EX2305 |

BQR_HW |

197.90 |

209.30 |

11.40 |

7.69 |

3.99 |

1139.30 |

259.30 |

|

BLK 930EX2305 |

BLK1HW |

230.30 |

255.30 |

25.00 |

16.69 |

3.16 |

1185.30 |

259.30 |

|

BLK 930EX2306 |

BQR_HW |

170.90 |

179.90 |

9.00 |

4.02 |

5.38 |

1109.90 |

275.30 |

|

BLK 930EX2306 |

BLK2HW |

181.10 |

203.30 |

22.20 |

8.18 |

3.75 |

1133.30 |

275.30 |

|

BLK 930EX2307 |

BQR_HW |

157.80 |

169.80 |

12.00 |

6.57 |

4.05 |

1099.80 |

259.30 |

|

BLK 930EX2308 |

BQR_HW |

176.03 |

200.63 |

24.60 |

13.33 |

5.92 |

1130.63 |

304.25 |

|

BLK 930EX2309 |

BQR_HW |

205.00 |

210.40 |

5.40 |

2.24 |

12.44 |

1140.40 |

287.30 |

|

BLK 930EX2310 |

BQR_HW |

165.10 |

170.50 |

5.40 |

3.01 |

10.02 |

1100.50 |

293.50 |

|

BLK 930EX2310 |

BLK2HW |

181.30 |

217.30 |

36.00 |

16.31 |

6.12 |

1147.30 |

293.50 |

|

BLK 930EX2311 |

BQR_HW |

247.90 |

261.10 |

13.20 |

6.97 |

4.28 |

1191.10 |

293.40 |

|

BLK 930EX2313 |

BQR_HW |

152.00 |

159.80 |

7.80 |

4.43 |

2.23 |

1089.80 |

312.95 |

|

BLK 930EX2313 |

BLK2HW |

202.40 |

238.40 |

36.00 |

20.56 |

2.90 |

1168.40 |

312.95 |

|

ARS1110EX2301 |

BQR |

3.00 |

9.00 |

6.00 |

4.16 |

4.23 |

1119.00 |

158.20 |

|

ARS1110EX2301 |

BLK1HW |

104.20 |

106.60 |

2.40 |

1.70 |

4.48 |

1216.60 |

158.30 |

|

ARS1110EX2302 |

BQR |

6.00 |

12.00 |

6.00 |

4.44 |

7.15 |

1122.00 |

158.30 |

|

ARS1110EX2302 |

BLK1HW |

43.80 |

61.20 |

17.40 |

12.37 |

8.76 |

1171.20 |

158.20 |

|

ARS1110EX2303 |

BQR |

6.00 |

9.00 |

3.00 |

2.09 |

8.29 |

1119.00 |

149.00 |

|

ARS1110EX2303 |

BLK1HW |

25.20 |

32.20 |

7.00 |

3.36 |

5.27 |

1142.20 |

149.00 |

|

ARS1110EX2304 |

BQR |

3.00 |

18.00 |

15.00 |

8.22 |

3.62 |

1128.00 |

161.00 |

|

ARS1110EX2304 |

BLK1HW |

65.00 |

78.80 |

13.80 |

7.15 |

6.45 |

1188.80 |

161.00 |

* ERCN_HW – Eroica North Hanging wall, ERCN_FW –

Eroica North Footwall, ERC_STH – Eroica South, BQR – Blanket Quartz

Reef, BLK1HW – Blanket 1 Hanging wall, BLK2HW – Blanket 2 Hanging

wall, BLK2FW – Blanket 2 Footwall, BLK3HW – Blanket 3 Hanging wall,

BLK4_5 – Blanket 4 and 5, ARS EXT – AR South Extension

Appendix 2

Underground exploration drill hole; azimuth, dip,

drilled length, and collar location (UTM NAD83)

|

Hole Identifier |

Azimuth(°) |

Dip(°) |

Drilled Length(m) |

UTM Easting(m) |

UTM Northing(m) |

UTM Elevation (m) |

|

ERC750EX2307 |

31 |

- 75 |

356.3 |

697 206.3 |

7 694 516.0 |

388.1 |

|

ERC750EX2308 |

89 |

- 67 |

392.4 |

697 206.0 |

7 694 516.2 |

388.2 |

|

ERC750EX2309 |

124 |

- 81 |

374.4 |

697 205.5 |

7 694 512.7 |

388.0 |

|

ERC750EX2310 |

118 |

- 65 |

324.5 |

697 206.6 |

7 694 512.0 |

388.0 |

|

ERC750EX2312 |

150 |

- 56 |

287.2 |

697 312.7 |

7 694 284.6 |

387.0 |

|

ERC750EX2313 |

141 |

- 58 |

204.6 |

697 313.2 |

7 694 285.1 |

387.1 |

|

BLK870EX2301 |

65 |

- 71 |

287.4 |

698 043.0 |

7 692 507.8 |

263.6 |

|

BLK870EX2302 |

45 |

- 69 |

272.3 |

698 043.0 |

7 692 508.0 |

263.7 |

|

BLK870EX2303 |

28 |

- 63 |

272.2 |

698 043.0 |

7 692 508.0 |

263.7 |

|

BLK870EX2304 |

12 |

- 63 |

275.2 |

698 042.2 |

7 692 508.7 |

263.6 |

|

BLK930EX2301 |

37 |

- 61 |

299.2 |

697 784.1 |

7 692 827.9 |

206.4 |

|

BLK930EX2302 |

81 |

- 61 |

275.2 |

697 784.0 |

7 692 830.2 |

206.4 |

|

BLK930EX2303 |

76 |

- 72 |

233.3 |

697 784.4 |

7 692 826.4 |

206.5 |

|

BLK930EX2304 |

28 |

- 77 |

251.3 |

697 783.2 |

7 692 829.4 |

206.5 |

|

BLK930EX2305 |

23 |

- 69 |

259.3 |

697 782.9 |

7 692 829.9 |

206.4 |

|

BLK930EX2306 |

127 |

- 74 |

275.3 |

697 784.5 |

7 692 825.4 |

206.5 |

|

BLK930EX2307 |

35 |

- 79 |

272.4 |

697 783.5 |

7 692 828.4 |

206.5 |

|

BLK930EX2308 |

122 |

- 67 |

304.3 |

697 784.8 |

7 692 825.9 |

206.3 |

|

BLK930EX2309 |

133 |

- 76 |

287.3 |

697 784.5 |

7 692 825.7 |

206.5 |

|

BLK930EX2310 |

85 |

- 86 |

293.5 |

697 784.2 |

7 692 825.8 |

206.4 |

|

BLK930EX2311 |

21 |

- 81 |

293.4 |

697 783.4 |

7 692 828.7 |

206.9 |

|

BLK930EX2313 |

25 |

- 76 |

313.0 |

697 783.2 |

7 692 829.4 |

206.5 |

|

ARS1110EX2301 |

93 |

- 64 |

158.2 |

697 765.7 |

7 693 020.3 |

25.4 |

|

ARS1110EX2302 |

54 |

- 65 |

158.3 |

697 761.5 |

7 693 022.4 |

25.2 |

|

ARS1110EX2303 |

10 |

- 46 |

149.0 |

697 765.5 |

7 693 022.3 |

25.0 |

|

ARS1110EX2304 |

125 |

- 44 |

161.0 |

697 765.7 |

7 693 019.1 |

25.8 |

Eroica Orebody – Drilling from 750 metres below

surface

Blanket Orebodies – Drilling from 930 metres below

surface

Blanket Orebodies – Drilling from 870 metres below

surface

AR South – Drilling from 1,110 metres below

surface

Enquiries:

|

Caledonia Mining Corporation Plc |

|

|

Mark LearmonthCamilla Horsfall |

Tel: +44 1534 679 800Tel: +44

7817 841 793 |

|

|

|

| |

|

| Cavendish Capital Markets

Limited (Nomad and Joint Broker)Adrian Hadden Pearl

Kellie |

Tel: +44 207 397 1965Tel: +44 131

220 9775 |

| |

|

| |

|

| Liberum Capital Limited

(Joint Broker)Scott Mathieson/Kane Collings |

Tel: +44 20 3100 2000 |

| |

|

| Camarco, Financial PR

(UK) |

|

| Gordon PooleJulia TilleyElfie

Kent |

Tel: +44 20 3757 4980 |

| |

|

| 3PPB (Financial PR, North

America) |

|

| Patrick ChidleyPaul Durham |

Tel: +1 917 991 7701Tel: +1 203

940 2538 |

| |

|

| Curate Public Relations

(Zimbabwe) |

|

| Debra Tatenda |

Tel: +263 77802131 |

| |

|

| |

Tel: +263 (242) 745

119/33/39 |

Qualified Persons

Craig James Harvey, MGSSA, MAIG, Caledonia Vice

President, Technical Services, has reviewed and approved the

scientific and technical information contained in this news

release. Craig James Harvey is a “Qualified Person” as defined by

each of (i) the Canadian Securities Administrators’ National

Instrument 43-101 - Standards of Disclosure for Mineral Projects

and (ii) sub-part 1300 of Regulation S-K of the U.S. Securities

Act.

Quality Assurance and Quality

Control

Access to Blanket Mine premises is controlled by

security personnel on the first gate. On the second gate, in

addition to security, entry is gained by biometric entry system.

Diamond drilling is performed by qualified diamond drillers under

the supervision of a diamond drill foreperson. Drilled core is

routinely brought to surface to the core shed where it is received

and laid down. A qualified geological technician performs

geotechnical logging while a qualified geologist logs the core and

marks the portions for splitting. The core is split in half along

the core axis using an electric core cutter equipped with a diamond

saw cutter. The geologist marks the sample intervals, put tickets,

insert standards and blanks. One half of the sample is put into a

plastic sample bag and sealed with cable ties. The sampling

information is entered into the database. The other half of the

core is marked with sample intervals and sample numbers and

returned to the core box and retained for future reference. The

samples are put in marked grain bags and tied with cable ties.

Transportation is by road using mine vehicle to

a SADCAS accredited testing laboratory (accreditation number

TEST-05 0030) in Kwekwe, some 330km from Blanket Mine. A delivery

note is signed as proof of dispatch.

Gold is analysed by a 50 grams fire assay with

an Atomic Absorption (AA) finish. The laboratory also has internal

quality control (“QC”) programs that include insertion of reagent

blanks, reference materials, and pulp duplicates.

Blanket Mine inserts QC samples (blanks and

reference materials) at regular intervals to monitor laboratory

performance. When results are received, the assay results are

painted against the sample numbers on the core retained.

Note: This announcement contains inside

information which is disclosed in accordance with the Market Abuse

Regulation (EU) No. 596/2014 (“MAR”) as it forms part of UK

domestic law by virtue of the European Union (Withdrawal) Act 2018

and is disclosed in accordance with the Company's obligations under

Article 17 of MAR.

Cautionary Note Concerning

Forward-Looking Information

Information and statements contained in this

news release that are not historical facts are “forward-looking

information” within the meaning of applicable securities

legislation that involve risks and uncertainties relating, but not

limited, to Caledonia’s current expectations, intentions, plans,

and beliefs. Forward-looking information can often be identified by

forward-looking words such as “anticipate”, “believe”, “expect”,

“goal”, “plan”, “target”, “intend”, “estimate”, “could”, “should”,

“may” and “will” or the negative of these terms or similar words

suggesting future outcomes, or other expectations, beliefs, plans,

objectives, assumptions, intentions or statements about future

events or performance. Examples of forward-looking information in

this news release include: planned exploration programs, focuses,

strategies, drilling targets and work, potential for further

exploration of certain areas, potential drilling results and

related expectations, costs and expenditures, including with

respect to the cost of development and production, project

economics, gold price assumptions, potential mineralization,

projected ore grades, opportunities to add near mine and further

high-grade mineral reserves and resources, expectations regarding

the mine plan, sustaining capital and value of operations and other

statements and information that is based on forecasts and

projections of future operational, geological or financial results,

estimates of amounts not yet determinable and assumptions of

management. This forward-looking information is based, in part, on

assumptions and factors that may change or prove to be incorrect,

thus causing actual results, performance or achievements to be

materially different from those expressed or implied by

forward-looking information. Such factors and assumptions include,

but are not limited to: failure to establish estimated resources

and reserves, the grade and recovery of ore which is mined varying

from estimates, success of future exploration and drilling

programs, reliability of drilling, sampling and assay data,

assumptions regarding the representativeness of mineralization

being inaccurate, success of planned metallurgical test-work,

capital and operating costs varying significantly from estimates,

delays in obtaining or failures to obtain required governmental,

environmental or other project approvals, inflation, changes in

exchange rates, fluctuations in commodity prices, delays in the

development of projects and other factors.

Exploration results that include geophysics,

sampling, and drill results on wide spacings may not be indicative

of the occurrence of a mineral deposit. Such results do not provide

assurance that further work will establish sufficient grade,

continuity, metallurgical characteristics and economic potential to

be classed as a category of mineral resource. A mineral resource

that is classified as "inferred" or "indicated" has a great amount

of uncertainty as to its existence and economic and legal

feasibility. It cannot be assumed that any or part of an "indicated

mineral resource" or "inferred mineral resource" will ever be

upgraded to a higher category of mineral resource. Investors are

cautioned not to assume that all or any part of mineral deposits in

these categories will ever be converted into proven and probable

mineral reserves.

Security holders, potential security holders and

other prospective investors should be aware that these statements

are subject to known and unknown risks, uncertainties and other

factors that could cause actual results to differ materially from

those suggested by the forward-looking statements. Such factors

include, but are not limited to: risks relating to estimates of

mineral reserves and mineral resources proving to be inaccurate,

fluctuations in gold price, risks and hazards associated with the

business of mineral exploration, development and mining, risks

relating to the credit worthiness or financial condition of

suppliers, refiners and other parties with whom the Company does

business; inadequate insurance, or inability to obtain insurance,

to cover these risks and hazards, employee relations; relationships

with and claims by local communities and indigenous populations;

political risk; risks related to natural disasters, terrorism,

civil unrest, public health concerns (including health epidemics or

outbreaks of communicable diseases such as the coronavirus

(COVID-19)); availability and increasing costs associated with

mining inputs and labour; the speculative nature of mineral

exploration and development, including the risks of obtaining or

maintaining necessary licenses and permits, diminishing quantities

or grades of mineral reserves as mining occurs; global financial

condition, the actual results of current exploration activities,

changes to conclusions of economic evaluations, and changes in

project parameters to deal with unanticipated economic or other

factors, risks of increased capital and operating costs,

environmental, safety or regulatory risks, expropriation, the

Company’s title to properties including ownership thereof,

increased competition in the mining industry for properties,

equipment, qualified personnel and their costs, risks relating to

the uncertainty of timing of events including targeted production

rate increase and currency fluctuations. Security holders,

potential security holders and other prospective investors are

cautioned not to place undue reliance on forward-looking

information. By its nature, forward-looking information involves

numerous assumptions, inherent risks and uncertainties, both

general and specific, that contribute to the possibility that the

predictions, forecasts, projections and various future events will

not occur. Caledonia undertakes no obligation to update publicly or

otherwise revise any forward-looking information whether as a

result of new information, future events or other such factors

which affect this information, except as required by law.

For a more detailed discussion of such risks and

other factors that may affect the Company’s ability to achieve the

expectations set forth in the forward-looking statements contained

in this news release, see the Company’s latest 20-F and

Management’s Discussion and Analysis, each under the heading “Risk

Factors”, available on the SEDAR website at www.sedar.com or on

EDGAR at www.sec.gov. The foregoing should be reviewed in

conjunction with the information and risk factors and assumptions

found in this news release.

This news release is not an offer of the shares

of Caledonia for sale in the United States or elsewhere. This news

release shall not constitute an offer to sell or the solicitation

of an offer to buy, nor shall there be any sale of the shares of

Caledonia, in any province, state or jurisdiction in which such

offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of such province, state

or jurisdiction.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/87aa791f-ef43-4538-9427-6aed9831ee16

https://www.globenewswire.com/NewsRoom/AttachmentNg/d810303f-4c02-4f93-8eff-03615b62fe1f

https://www.globenewswire.com/NewsRoom/AttachmentNg/7dd88873-2cc2-4bfb-b3f6-727c3ba49f7a

https://www.globenewswire.com/NewsRoom/AttachmentNg/28a5a596-8d2a-4b8a-b0a6-8ec40f81cc72

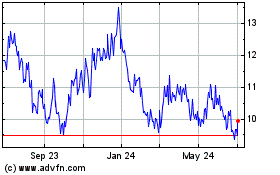

Caledonia Mining (AMEX:CMCL)

Historical Stock Chart

From Mar 2024 to Apr 2024

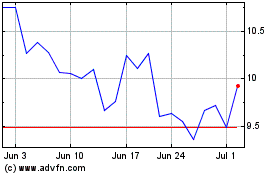

Caledonia Mining (AMEX:CMCL)

Historical Stock Chart

From Apr 2023 to Apr 2024