Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

January 29 2024 - 11:09AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C.

FORM 6-K

REPORT OF

FOREIGN PRIVATE ISSUER

Pursuant to Rule 13a-16 or

15d-16

under the Securities Exchange Act of 1934

For the month of January 2024

COMMISSION FILE NUMBER: 001-33373

CAPITAL PRODUCT PARTNERS L.P.

(Translation of registrant’s name into English)

3 Iassonos

Street

Piraeus, 18537 Greece

(Address of principal executive offices)

Indicate by check mark whether

the Registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☑

Form 40-F ☐

Attached as Exhibit I hereto is a copy of the press release of Capital

Product Partners L.P. announcing the common unit cash distribution for the fourth quarter of 2023 ended December 31, 2023.

Exhibit I to this report

on Form 6-K is hereby incorporated by reference into the registrant’s Registration Statement on Form F-3 (File

No. 333-274680).

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

CAPITAL PRODUCT PARTNERS L.P. |

|

|

|

| Dated: January 29, 2024 |

|

|

|

By: Capital GP L.L.C., its general partner |

|

|

|

|

|

|

|

|

|

|

/s/ Gerasimos (Jerry) Kalogiratos |

|

|

|

|

|

|

Name: Gerasimos (Jerry) Kalogiratos |

|

|

|

|

|

|

Title: Chief Executive Officer of Capital GP L.L.C. |

Exhibit I

Capital Product Partners L.P. Announces Cash Distribution

January 25, 2024

ATHENS, GREECE, January 25, 2024

(GLOBE NEWSWIRE) — Capital Product Partners L.P. (NASDAQ: CPLP) today announced that its board of directors has declared a cash distribution of $0.15 per common unit for the fourth quarter of 2023 ended December 31, 2023.

The fourth quarter common unit cash distribution will be paid on February 13, 2024 to common unit holders of record on February 6, 2024.

About Capital Product Partners L.P.

Capital Product

Partners L.P. (NASDAQ: CPLP), a Marshall Islands limited partnership, is an international owner of ocean-going vessels. CPLP currently owns 24 high specification vessels, including nine latest generation LNG/Cs, 12

Neo-Panamax container vessels and three Panamax container vessels. In addition, CPLP has agreed to acquire nine additional latest generation LNG/Cs to be delivered between the second quarter of 2024 and the

first quarter of 2027.

For more information about the Partnership, please visit: www.capitalpplp.com.

Forward-Looking Statements

The statements in this press

release that are not historical facts may be forward-looking statements (as such term is defined in Section 21E of the Securities Exchange Act of 1934, as amended). These forward-looking statements involve risks and uncertainties that could

cause the stated or forecasted results to be materially different from those anticipated. Unless required by law, we expressly disclaim any obligation to update or revise any of these forward-looking statements, whether because of future events, new

information, a change in our views or expectations, to conform them to actual results or otherwise. We assume no responsibility for the accuracy and completeness of the forward-looking statements. We make no prediction or statement about the

performance of our common units.

CPLP-F

Contact Details:

Capital GP L.L.C.

Jerry Kalogiratos

CEO

Tel. +30 (210) 4584 950

E-mail: j.kalogiratos@capitalpplp.com

Capital GP L.L.C.

Nikos Kalapotharakos

CFO

Tel. +30 (210) 4584 950

E-mail: n.kalapotharakos@capitalmaritime.com

Investor Relations / Media

Nicolas Bornozis

Capital Link, Inc. (New York)

Tel. +1-212-661-7566

E-mail: cplp@capitallink.com

Source: Capital Product Partners L.P.

2

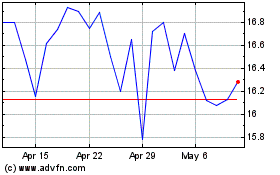

Capital Product Partners (NASDAQ:CPLP)

Historical Stock Chart

From Mar 2024 to Apr 2024

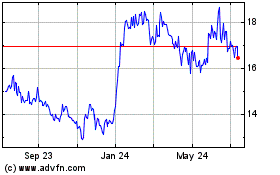

Capital Product Partners (NASDAQ:CPLP)

Historical Stock Chart

From Apr 2023 to Apr 2024