| Filed by NorthView Acquisition Corp.

pursuant to Rule 425 under the Securities Act of 1933,

as

amended and deemed filed pursuant to

Rule 14a-12 under the Securities Exchange Act of 1934,

as amended

Subject Company: NorthView Acquisition

Corp.

(Commission File No. 001- 41177)

Date: January 29, 2024

|

NASDAQ: PFSA (NVAC) Q1 2024 INVESTOR PRESENTATION ”Leading the marriage of personal healthcare and AI - led real - time technology”

NASDAQ: PFSA (NVAC) DISCLAIMER AND SAFE HARBOR STATEMENT 2 This presentation (the “Presentation”) contains confidential information and is solely being made available on a confidential basis, and subject to the following provisions to a limited number of selected persons and/or institutions (each a “Recipient“ together the “Recipients“) with a view to assist the Recipients in making their own evaluating a potential transaction (the “Potential Transaction”) involving Profusa, Inc. (“Profusa” or the “Company”) and NorthView Acquisition Corp. (“NorthView”) and for no other purpose. No Investment Advice; No Offer or Solicitation The Presentation is not intended to form the basis of any investment decision and should not be considered as a recommendation by Profusa, H.C. Wainwright (“Wainwright”) or any of their respective officers, directors, employees, shareholders, affiliates, representatives, advisors or agents (each a “Profusa Person”) in relation to the Potential Transaction. The Presentation does not contain all information necessary for investment decisions or any decision to acquire an interest in Profusa and has not been independently verified. In making its investment decisions, any Recipient should rely on their own examination of Profusa and is recommended to commission its own appropriate legal, tax, financial and other professional advisors. The Presentation is not a prospectus. This Presentation and any oral statements made in connection with this Presentation do not constitute or form an offer, solicitation of an offer, invitation, recommendation or inducement to purchase or subscribe for any securities in Profusa or in connection with the Potential Transaction; do not constitute the solicitation of any vote, consent or approval in any jurisdiction in connection with the Potential Transaction or any related transactions; nor shall there be any sale, issuance or transfer of any securities, in each case in any jurisdiction where, or to any person to whom, such offer, solicitation or sale may be unlawful under the laws of such jurisdiction. Any offer to sell securities will be made only pursuant to a definitive Subscription Agreement and will be made in reliance on an exemption from registration under the Securities Act of 1933, as amended, for offers and sales of securities that do not involve a public offering. Neither all nor any part of the Presentation shall form the basis of, or be relied upon in connection with, or act as an inducement to enter into, any contract or commitment. NorthView and Profusa reserve the right to withdraw or amend for any reason any offering and to reject any Subscription Agreement for any reason. The communication of this Presentation is restricted by law; it is not intended for distribution to, or use by any person in, any jurisdiction where such distribution or use would be contrary to local law or regulation. The Recipients represent that they are able to receive the Presentation without contravention of any registration requirements or other legal restrictions in the jurisdiction in which they reside or conduct business. Confidentiality The information contained herein has been supplied by Profusa and is provided pursuant to the binding terms and conditions set forth in the separate confidentiality undertaking already executed prior to receipt of the Presentation (the “Confidentiality Undertaking“). By accepting, reviewing, or reading this Presentation, each Recipient reviewing the Presentation acknowledges by its acceptance of the Presentation (i) that it is familiar with the terms of the Confidentiality Undertaking; (ii) that the Presentation is Confidential Information (as defined in the Confidentiality Undertaking); and (iii) that it is expressly bound by the terms of the Confidentiality Undertaking whether or not such Recipient has executed the Confidentiality Undertaking. This Presentation supersedes and replaces all previous oral or written communications by Profusa, NorthView, or any of their advisors with other interested parties relating to the subject matter hereof. The Presentation is intended for the confidential use of the designated Recipient only in connection with the Potential Transaction and may not be reproduced, divulged or used for any other purpose without the express written consent of Profusa or Wainwright. Profusa and Wainwright reserve the right to require the return of this Presentation at any time in accordance with the Confidentiality Undertaking. In no circumstances will Profusa, Wainwright or any Profusa Person be responsible for any costs or expenses incurred by any Recipient in connection with any investigation or evaluation of Profusa or for any other costs or expenses incurred in connection with the Potential Transaction. No Representations or Warranties; Use of Data; Limit of Liability No representation, or warranty, express or implied, is made by Profusa, Wainwright or any Profusa Person as to the accuracy, adequacy or completeness of the information in the Presentation, and no person may rely on the information contained in this Presentation. No information contained in the Presentation or any other written or oral communication transmitted or made available to a Recipient is, or shall be relied upon as, a promise or representation, whether as to the past or future, and no liability will attach, except as provided in a definitive share purchase agreement when, as and if it is executed, and subject to such limitations as may be provided in such agreement. In furnishing the Presentation, Profusa and Wainwright undertake no obligation to provide the Recipient with access to any additional information, to update or revise the Presentation or to correct any inaccuracies herein that may become apparent. The information contained in the Presentation is subject to change or amendment without notice. The information contained in the Presentation is selective and does not purport to contain all the information the prospective purchasers may desire in deciding whether or not to offer to acquire a stake in Profusa. Profusa will continue to be conducted in such manner as Profusa sees fit, whether within or outside the ordinary course of business. Any data on past performance or modeling contained herein is not an indication as to future performance. Industry and market data used in this Presentation have been obtained from third - party industry publications and sources as well as from research reports prepared for other purposes. Neither NorthView nor Profusa has independently verified the data obtained from these sources and cannot assure you of the reasonableness of any assumptions used by these sources or the data’s accuracy or completeness. To the fullest extent permitted by law, in no circumstances will Profusa or NorthView or any of their respective subsidiaries, stockholders, affiliates, representatives, partners, directors, officers, employees, advisers or agents be responsible or liable for any direct, indirect or consequential loss or loss of profit arising from the use of this Presentation, its contents, its omissions, reliance on the information contained within it or on opinions communicated in relation thereto or otherwise arising in connection therewith. Trademarks NorthView and Profusa own or have rights to various trademarks, service marks and trade names that they use in connection with the operation of their respective businesses This Presentation also contains trademarks, service marks, trade names and copyrights of third parties, which are the property of their respective owners. The use or display of third parties’ trademarks, service marks, trade names or products in this Presentation is not intended to, and does not imply, a relationship with NorthView or Profusa, or an endorsement or sponsorship by or of NorthView or Profusa. Solely for convenience, the trademarks, service marks, trade names and copyrights referred to in this Presentation may appear without the TM, SM, ® or © symbols, but such references are not intended to indicate, in any way, that NorthView, Profusa, or the any third party will not assert, to the fullest extent under applicable law, their rights or the right of the applicable licensor to these trademarks, service marks, trade names and copyrights. Use of Projections This Presentation contains projected financial information with respect to Profusa, namely revenue, cost of goods sold, and gross margin 2022E - 2025E. Such projected financial information constitutes forward - looking information, and is for illustrative purposes only and should not be relied upon as necessarily being indicative of future results The projections, estimates and targets in this Presentation are forward looking - statements that are based on assumptions that are inherently subject to significant uncertainties and contingencies, many of which are beyond NorthView’s and Profusa’s control. See “Forward Looking Statements” above. While all projections, estimates and targets are necessarily speculative, NorthView and Profusa believe that the preparation of prospective financial information involves increasingly higher levels of uncertainty the further out the projection, estimate or target extends from the date of preparation. The assumptions and estimates underlying the projected, expected or target results are inherently uncertain and are subject to a wide variety of significant business, economic, regulatory, competitive, technological, and other risks and uncertainties that could cause actual results to differ materially from those contained in such projections, estimates and targets. The inclusion of projections, estimates and targets in this Presentation should not be regarded as an indication that NorthView and Profusa, or their representatives, considered or consider the financial projections, estimates and targets to be a reliable prediction of future events. Neither the independent auditors of NorthView nor the independent registered public accounting firm of Profusa has audited, reviewed, compiled or performed any procedures with respect to the projections for the purpose of their inclusion in this Presentation, and accordingly, neither of them expressed an opinion or provided any other form of assurance with respect thereto for the purpose of this Presentation. Important Information for Investors and Stockholders The Potential Transaction will be submitted to stockholders of NorthView for their consideration. NorthView and Profusa will prepare a registration statement on Form S 4 (the “Registration Statement”) to be filed with the SEC, which will include preliminary and definitive proxy statements to be distributed to NorthView’s stockholders in connection with NorthView’s solicitation for proxies for the vote by NorthView’s shareholders in connection with the Potential Transaction and other matters as described in the Registration Statement, as well as the prospectus relating to the offer of the securities to be issued to Profusa’s shareholders in connection with the completion of the Potential Transaction. After the Registration Statement has been filed and declared effective, NorthView will mail a definitive proxy statement and other relevant documents to its stockholders as of the record date established for voting on the Potential Transaction. NorthView’s stockholders and other interested persons are advised to read, once available, the preliminary proxy statement/prospectus and any amendments thereto and, once available, the definitive proxy statement/prospectus, in connection with NorthView’s solicitation of proxies for its special meeting of stockholders to be held to approve, among other things, the Potential Transaction, because these documents will contain important information about NorthView, Profusa and the Potential Transaction. Stockholders may also obtain a copy of the preliminary or definitive proxy statement, once available, as well as other documents filed with the SEC regarding the Potential Transaction and other documents filed with the SEC by NorthView, without charge, at the SEC’s website located at www sec gov. NorthView and Profusa and their respective directors and executive officers, under SEC rules, may be deemed to be participants in the solicitation of proxies of NorthView’s shareholders in connection with the Potential Transaction. Investors and security holders may obtain more detailed information regarding the names and interests in the Potential Transaction of NorthView’s directors and officers in NorthView’s filings with the SEC, including NorthView’s registration statement on Form S - 1, which was originally filed with the SEC on October 19, 2021, and in the Registration Statement, once filed. Stockholders, potential investors and other interested persons should read the Registration Statement carefully when it becomes available before making any voting or investment decisions This Presentation is not a substitute for the Registration Statement or for any other document that NorthView may file with the SEC in connection with the Potential Transaction. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. INVESTMENT IN ANY SECURITIES DESCRIBED HEREIN HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORITY NOR HAS ANY AUTHORITY PASSED UPON OR ENDORSED THE MERITS OF THE OFFERING OR THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE. H.C. Wainwright has been appointed exclusive financial advisor to Profusa in connection with the Potential Transaction. All communications, inquiries, and requests for information relating to the Potential Transaction should be addressed to one of the representatives of H.C. Wainwright.

NASDAQ: PFSA (NVAC) WHO WE ARE 3 Profusa, Inc. is a commercial - stage company located in the Bay Area that has invested almost $100M over 10 years developing a new generation of bio - engineered sensors that empower the real - time monitoring of body chemistry. THREE ADVANCED PLATFORMS: TISSUE OXYGEN MONITORING CONTINUOUS GLUCOSE MONITORING DATA MANAGEMENT

NASDAQ: PFSA (NVAC) 4 KEY INVESTMENT HIGHLIGHTS • O 2 product validated and approved in EU for 2023 commercial launch • CGM product data compelling: seeking EU and US approvals • APAC Joint Venture with Tasly Pharma provides royalty stream and commercial access to large Asian markets • Low COGS and distribution/commercialization costs with > 60% contribution expected • $10 million in cash sufficient for next 24 months and important milestones • Mission driven executives with proven track records of success

NASDAQ: PFSA (NVAC) OUR TECHNOLOGY MODEL 5 Profusa Cloud Low maintenance, cost effective, AI adaptive personal health management platform Low - cost novel subcontainous biologically compatible hydrogel micro - sensor 9+ months functionality INJECTABLE HYDROGEL MICRO - SENSOR REUSABLE OPTICAL READER AND DATA MANAGEMENT Continuous monitoring and data management of various body chemicals PERSONALIZED CLINICAL INSIGHTS Low - cost optoelectronic reader, reusable at the cost of an on - body adhesive AI and Machine Learning enables personalized clinical insights

NASDAQ: PFSA (NVAC) 6 HOW AI DRIVES OUR DIGITAL HEALTHCARE TECHNOLOGY • Machine learning to create algorithms for enhanced monitoring • Accounting for variations of the tissue composition for continuous accuracy while still using the single injectable sensor • Multiple calculations around other physical variables and fluctuations with regard to creating accurate oxygen and glucose measurements • Providing real - time comparison across data sets LUMEE PRODUCT PORTFOLIO DATA PLATFORM • Pairing ongoing measurements with potential coach scenarios in order to optimize recommendations • Accounting for the regular changes and fluctuations to be expected with continuous monitoring to provide both stable reporting and coaching data • Compilation of both individual data sets and data sets across any given network to be able to provide real - time statistical data • Machine discernment between privacy - protected data and useable data across any given network

NASDAQ: PFSA (NVAC) PROFUSA 3 SPECIFIC GROWTH PLATFORMS Transformative Technology with Significant Commercial Opportunities OXYGEN PLATFORM: GLUCOSE PLATFORM: DATA PLATFORM: • Enables remote monitoring • Mass - adoption potential due to cost advantage • Wide - ranging applications • True enablement of “data revolution” in health care • Simultaneous sensing of multiple analytes • AI Integration for coaching and reporting 7 • CE approved • Near - term product revenue • Address clinical need in wound care • KOL support in EU and US • Expandable to extend to home remote monitoring • Compelling clinical data • Clear regulatory pathway • Significant COGs leverage • Defined manufacturing process • Clinical need for continuous glucose monitoring >270 days • Large, high - growth global market potential Platform Opportunity >500 Million Users in Glucose, Oxygen (US/EU) Other opportunities: Lactate, CO 2 , Sodium, Ethanol Clinical - Grade Real - Time Data; Long - Term Usability; Simple Deployment; Cost Advantage; Substantial Support from DARPA and NIH

NASDAQ: PFSA (NVAC) CE - MARKED LUMEE TM CONTINUOUS TISSUE OXYGEN MONITORING 8 Charger

NASDAQ: PFSA (NVAC) Lumee TM OXYGEN PROVIDES REAL - TIME INSIGHTS DURING SURGERY VALIDATES PROFUSA TECHNOLOGY PLATFORM 9 Lumee Oxygen Index [ - ] Remove Sheath Baseline Therapeutic Interventions Note (1): J. Vasc. Surg., June 2015, Volume 61:6, 1501 - 10 Lumee Oxygen Platform reports local tissue oxygen levels during PAD surgical intervention as well as post - operatively for 28 days , and posed a low risk to patients during the study (1) • Actual case data • Intra - operative GPS • Data for real - time decisions • Enables in - home monitoring

NASDAQ: PFSA (NVAC) OXYGEN MARKET OPPORTUNITY 10 LARGE UNMET NEED • Monitoring of compromised tissue, such as peripheral artery disease that results in narrowing of blood vessels and reduced blood flow to the lower limbs – >$1.5bn market with ~3m patients • Chronic wounds (diabetic ulcers, pressure sores) that do not heal properly – >$5bn market with 12 - 15m patients • Critical limb ischemia – >$4bn market with ~7m patients • Lack of decision support: ⎼ Decisions largely based on clinical experience ⎼ Clinicians need a tool to provide objective information about perfusion EUROPEAN MARKET OVERVIEW AND COMMERCIALIZATION PRIORITIES Sources: French official registries, German Statistical Office, German Federal Joint Committee, Italian Ministry of Health/old research reports Expected growth : Millenium reports EU 300,000 procedures / year Top 3 markets in size • Germany ~110 k/ y • France ~60k/ y • Italy ~50k/ y Tier 1 Tier 2 Important markets in size and / or KOL presence • Austria • Benelux • Switzerland • Greece Tier I countries Tier II countries A LARGE AND DYNAMIC EUROPEAN ENDOVASCULAR TREATMENT OF 300 K PROCEDURES IN 2018 (Estimated CAGR of 6% in the 5 next years)

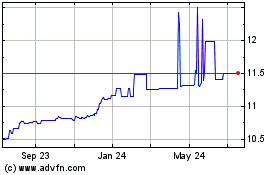

NASDAQ: PFSA (NVAC) DATA RICH, ACCESSIBLE, LOW - COST CGM FOR ALL 11 Profusa Cloud Reader Profusa’s CGM Solution Current CGM Pain Points x Overcomes foreign body response: > 270 days functionality New sensor required every 10 – 14 days x Simple hypodermic needle injection of sensor 180 - day solution requires surgical implant x High margin, low cost : ($900/year at >80% GM potential) (2) Up to $4,500 annual cost (1) x T1D through Health and Wellness patients >500 million TAM Cost effective for intensively managed patients only (1) https:// www.healthline.com/diabetesmine/new - medtronic - stand - alone - cgm - guardian - connect#cost (2) Profusa internal modeling According to Strategic Market Research, the CGM market is expected to grow from $6B to $16B by 2030 LUMEE Glucose

NASDAQ: PFSA (NVAC) 12 LUMEE GLUCOSE CLINICAL TRIAL DEMONSTRATED SAFETY & FUNCTIONALITY • Clinical trial evaluated the safety and functionality of the glucose platform, sensor, reader and AI platform ⎼ 4 Clinical sites ⎼ Two European clinical sites • Two Asian clinical sites • 54 Subjects enrolled • 108 Sensors injected; 398 study visits completed • 745 Glucose traces collected; >18,000 paired reference points • Top line results: MARD (1) 10 - 12%; functionality >270 days: safety profile met (1) Current development data processing and algorithm

NASDAQ: PFSA (NVAC) DIFFERENTIATED, BEST - IN - CLASS CGM SOLUTION 13 Insertion apparatus Insertion apparatus Surgical insertion and removal Simple injection – hypodermic needle Sensor Functional Lifetime (days) Deployment Method Dexcom Medtronic Abbott Senseonics • Current CGM market share mostly in intensively managed type 1 and 2 patients – opportunity to disrupt large, established market with TAM expansion opportunity Source: https:// www.dexcom.com/en - us/faqs/can - i - restart - dexcom - g6 - sensor - after - 10 - days; https:// www.medtronic.com/ca - en/diabetes/home/support/product - support/cgm - sensors.html FreeStyle Libre 14 day System | CGM Diabetes Monitor; Senseonics Announces FDA Approval of the Eversense® E3 Continuous Glucose Monitoring System for Use for Up to 6 months; Provides 2022 Business Outlook – Senseonics 270 180 14 10 7 Insertion apparatus

NASDAQ: PFSA (NVAC) REDEFINING >500M TAM FROM “CAN YOU AFFORD IT” TO “DO YOU NEED IT?” 14 Current CGM TAM Profusa TAM • Established benefit of CGM across diabetes spectrum • Woefully under - penetrated opportunity >1.5M CGM users >71M Diagnosed 107M At - risk patient monitoring (5) ≈27M Diagnosed (US/EU) prediabetes patients (5) Population >500M At - risk Chronic Patients (6) T1D (1) 3M T2D (1) 82M >$2,100 (2) CGM >$600 (3) Glucometer/ test strips >$600 (4) Coaching (1) JPM 2018 CGM Market Report; (2) CDC; (3) U.S. Census, Healthline Eurostat (2) SVBLeerink, June 3, 2021 Dexcom analyst report – 2020 revenues and patients (3) https:// www.goodrx.com/classes/medical - supplies - and - devices/should - you - be - subscribing - to - have - your - test - strips - delivered - %20Note%20this%20is%20U.S (4) SVBLeerink April 29, 2021 Teledoc/Livongo analyst report (sum of annual price all LVGO coaching offerings) (5) Valbiotis Report, 2019, CDC, (6) US Census Bureau, Eurostat (2021 figures)

NASDAQ: PFSA (NVAC) COMMERCIALIZATION STRATEGY – LUMEE TM GLUCOSE & OXYGEN (EU/US) 15 Profusa Commercial Team (Manage JV, Partner & Distributor Performance) COMMERCIAL PARTNERS Oxygen • High Volume Hospital Centers • Ambulatory Centers & Doctors’ Offices Glucose • Diabetes Centers, Endocrinology Practices • T1, T2, Prediabetics, Wellness DISTRIBUTION STRATEGY • Handle warehousing and logistics • “Localization” of product and offering • Local marketing program • Order - to - cash management • Account identification and maintenance for growth • Oxygen EU go - to - market strategy focused on serving the top 6 markets that comprise ~20% of TAM • Low COGS and low - touch use case uniquely align to APAC market requirements • Outsourced, low - cost/capex = higher margin profile ESTABLISH APAC JV • Credible large operating partner in Tasly Pharma • Key APAC markets coverage (Greater China, ASEAN, Australia) • Singapore - based JV entity • Royalty - bearing license provide revenue stream • 60/40 ownership retain significant equity for PFSA US/EU MARKETS APAC MARKETS

NASDAQ: PFSA (NVAC) ANTICIPATED MILESTONES, CATALYSTS 16 2024 2025 2026 Program Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Lumee TM Glucose Lumee TM Oxygen Q1 Q2 Human Validation Data Published Human Pivotal Studies US/EU/Asia CE/FDA Submission Process Glucose Commercialization & Revenues EU Commercialization and Revenues US Pivotal FDA Submission Process US Oxygen Revenues Funding at Close Thru Mid - 2025

NASDAQ: PFSA (NVAC) USE OF PROCEEDS 17 $8M - 10M Lumee TM Glucose ~$2.5 - 3M Lumee TM Oxygen ~$0.5 - 1M Operations Support ~$5 - 6M Clinical studies and regulatory submission Commercial partnerships and EU distribution EU/US commercial operational capabilities Commercial - readiness preparation Future product development US Pivotal study and FDA submission process Working capital

NASDAQ: PFSA (NVAC) MISSION DRIVEN EXECUTIVE MANAGEMENT 18 Ben Hwang Ph . D . , – Chairman, CEO From his early exposure as an undergraduate research fellow at the lab of Leroy Hood at Caltech, where the automated DNA sequencer was developed, to bringing cutting edge life sciences tools to the market at Life Technologies Corp . (acquired by Thermo Fisher Scientific, Inc . ), Ben has seen first - hand the transformative impact that science and technology have to change our world . Bill McMillan – Co - founder, CSO & Head of Research Bill was the initial driving force behind Profusa, he built the company road map, enlisted top talent & secured seed funding . A co - inventor of Profusa’s biologically integrated sensor & optical reader, Bill is a biotech pioneer whose career has spanned more than three decades in the development of next - generation diagnostic, medical device technologies and products, the last 20 years as an entrepreneur . Fred Knechtel – Chief Financial Officer (after completion of business combination) Fred is a seasoned public company CFO with over 35 years of executive management experience in life sciences, industrials, consumer products and aerospace industries. He has been integral in multiple merger & acquisition transactions & business integrations along with capital raising activities including IPOs, PIPEs and debt offerings. Fred has also been responsible for multiple operations leadership and project management roles. Phil Constantinou, – Head of Software & Data Science Phil comes to Profusa with 25 years of experience leading software organizations. Most recently he led the software, data science, and product teams at Sano, which created a non - invasive continuous glucose monitor for consumers. He’s also launched consumer electronics projects with revolutionary optics, computer vision, and user experience. Kerstin Rebrin, M.D., Ph.D., – VP of Medical Affairs & Clinical Development Kerstin is responsible for developing & executing Profusa’s Medical & Clinical strategies. Dr. Rebrin is a seasoned physician - scientist with clinical & research experience in the field of diabetes & other metabolic diseases. She is known for her pioneering artificial pancreas research with introducing continuous glucose sensing & therapy algorithms based on glucose monitoring for various routes of insulin delivery.

VALUE PROPOSITION – DE - RISKED TECHNOLOGY 19 • Potential to change industry standard functionality from 14 to 90 days and eventually >270 days • ~10 years and ~$100M invested in developing technology. More than 88 global issued and 79 pending patents • Clinical (human data) and third - party validation (DARPA and NIH >$30M non - dilutive grants) • A proprietary and robust group of device platforms that integrate best - in - class technology LARGE GLOBAL MARKETS DIFFERENTIATED & VALIDATED TECHNOLOGY FINANCIALS DE - RISKED BY HUMAN DATA • Approved Lumee TM Oxygen product in EU; est. late 2024 launch • Defined regulatory pathways for US FDA approval • Human safety and efficacy data for CGM NASDAQ: PFSA (NVAC) • Market opportunity >500M users in glucose, oxygen (US/EU); other opportunities: lactate, CO 2 , sodium, ethanol • Low - cost, solution that effectively addresses medical challenge of foreign object rejection and enhances potential for Asian market • AI opportunity further expands market potential • Commercial partnership strategy yields low cost - of - sales path to revenue • Low fixed cost footprint – outsourced, defined manufacturing process = low capex • Structural platform cost advantage yields margin and cash flow • $10M min cash required to reach product milestones

NASDAQ: PFSA (NVAC) 24.9% 56.3% 18.9% 27.7% 54.2% 18.2% TRANSACTION OVERVIEW 20 PRO FORMA COMMON OWNERSHIP ILLUSTRATIVE SOURCES AND USES 1 ILLUSTRATIVE PRO FORMA VALUATION 0% Redemptions 46% Redemptions Public holders Profusa holders SPAC sponsor 155.0 155.0 Profusa Shareholder Equity Rollover 9.3 5.0 Trust 1.0 1.0 PIPE 4.4 4.4 APAC JV Total Sources 165.4 169.7 Redemption Scenarios 46% 0% Profusa Shareholder Equity Rollover Cash to Balance Sheet Estimated Cash Transaction Expenses $155.0 $5.3 $5.1 $155.0 $9.5 $5.1 Total Uses $165.4 $169.7 Redemption Price (x) PF Shares outstanding (mm) $10.00 27.5 $10.00 28.6 Pro Forma Equity Value 275.4 286.1 (+) Estimated Net Debt at Closing ( - ) New Cash to Balance Sheet 0.0 5.3 0.0 9.5 Pro Forma Enterprise Value 270.1 276.6 ( 1 ) Does not include Company or earnout of 3 . 9 million shares (One - quarter of earn out shares due upon each occurrence of (i) stock price at or above $ 12 . 50 for 20 out of 30 consecutive trading days (time period : 18 - month to 2 - year anniversary post close) (ii) stock price at or above $ 14 . 50 for 20 out of 30 consecutive trading days (time period : 360 - day to 2 - year anniversary of close) (iii) close of JV and license agreement and $ 6 million gross payment (iv) company revenue $ 73 . 1 m for FY 2024 . ) Redemption Scenarios 46% 0%

NASDAQ: PFSA (NVAC) 21 KEY INVESTMENT HIGHLIGHTS - SUMMARY • Valuation aligned with significant upside potential • Compelling multi - product platform with 2024 revenue • Access to Asian market – Tasley JV and license/royalty agreement • Global TAM with high margin potential • AI driven capabilities attractive to the capture of multi - vertical application opportunities • Light capital requirements sufficient for next 24 months to achieve key value - inflection milestones

22 Investor & Media Relations: CORE IR Bret Shapiro brets@coreir.com NASDAQ: PFSA (NVAC)

NASDAQ: PFSA (NVAC) 23 APPENDIX & RISK FACTORS

NASDAQ: PFSA (NVAC) RISK FACTORS Carefully consider the following risk factors, among others that will be contained in (or coordinated by reference into) the proxy statement / prospectus, related to Profusa’s business, reputation, financial condition, results of operations, revenue and the future prospects if the business combination is consummated . The risks presented below are some of the general risks to the business and operations of Profusa and NorthView following completion of the Business Combination . You should carry out your own diligence and consult with your own financial and legal advisors concerning the risks and suitability of an investment in any offering before making an investment decision . Risks relating to the business of Profusa and NorthView will be more fully disclosed in future documents filed or furnished with the SEC . The risks presented in such filings will be consistent with those that would be required for a public company in SEC filings and may differ significantly from and be more extensive than those presented below . These risk factors are not exhaustive, and investors are encouraged to perform their own investigation with respect to the business financial condition and prospectus of Profusa and NorthView following the completion of the Business Combination . Profusa may face additional risks and uncertainties that are not presently known to it, or that it currently deems immaterial, which may also impair Profusa’s business or financial condition . RISKS RELATED TO PROFUSA AND ITS INDUSTRY Profusa has a history of significant losses, which it expects to continue, and Profusa may not be able to achieve or sustain profitability. If Profusa is unable to advance its product candidates through clinical development, obtain regulatory approval and ultimately commercialize its product candidates, or experiences significant delays in doing so, Profusa’s business will be materially harmed. The results of preclinical studies and early clinical trials are not always predictive of future results. Any product candidate that Profusa advances in clinical trials, may not achieve favorable results in later clinical trials, if any, or receive marketing approval in the United States. If third - party payors do not provide adequate coverage and reimbursement for the use of Profusa’s products, if approved, Profusa’s revenue will be negatively impacted. Profusa is dependent upon third - party manufacturers and suppliers, and in some cases a limited number of suppliers, making Profusa vulnerable to supply shortages, loss or degradation in performance of the suppliers and price fluctuations, which could harm Profusa’s business. Profusa may not be successful in its efforts to enter into collaborations, distribution agreements or strategic alliances for the development and commercialization of its current or future product candidates. If Profusa is unable to establish sales, marketing and distribution capabilities, either on its own or in collaboration with third parties, Profusa may not be successful in commercializing any of its product candidates, if approved.

NASDAQ: PFSA (NVAC) RISK FACTORS (CONT’D) RISKS RELATED TO PROFUSA AND ITS INDUSTRY (Cont’d) Profusa faces substantial competition, which may result in others discovering, developing or commercializing products more quickly or marketing them more successfully than Profusa. If Profusa fails to develop additional product candidates, its commercial opportunity could be limited. Profusa may face product liability claims that could be costly, divert management’s attention and harm Profusa’s reputation. Profusa may in the future become involved in lawsuits to protect or enforce Profusa’s intellectual property, which could be expensive and time consuming, and ultimately unsuccessful, and could result in the diversion of significant resources, thereby hindering Profusa’s ability to effectively commercialize its existing or future products. If Profusa fails to retain its key executives or recruit and hire new employees, Profusa’s operations and financial results may be adversely affected while it attracts other highly qualified personnel. RISKS RELATED TO NORTHVIEW AND THE BUSINESS COMBINATION Our independent registered public accounting firm’s report contains an explanatory paragraph that expresses substantial doubt about our ability to continue as a “going concern.” We may issue our shares to investors in connection with our business combination at a price that is less than the prevailing market price of our shares at that time. The ability of our public stockholders to exercise redemption rights with respect to a large number of our shares could increase the probability that our business combination would be unsuccessful and that you would have to wait for liquidation in order to redeem your stock. We may not be able to complete our business combination within the prescribed time frame, in which case we would cease all operations except for the purpose of winding up and we would redeem our public shares and liquidate. Our initial stockholders, directors, executive officers, advisors and their affiliates may elect to purchase shares from public stockholders, which may influence a vote on a proposed business combination and reduce the public “float” of our common stock.

NASDAQ: PFSA (NVAC) RISK FACTORS (CONT’D) RISKS RELATED TO NORTHVIEW AND THE BUSINESS COMBINATION (Cont’d) If a stockholder fails to receive notice of our offer to redeem our public shares in connection with our business combination, or fails to comply with the procedures for tendering its shares, such shares may not be redeemed . You will not be entitled to protections normally afforded to investors of many other blank check companies . Our management may not be able to maintain control of the target business after our business combination . We cannot provide assurance that, upon loss of control of the target business, new management will possess the skills, qualifications or abilities necessary to profitably operate such business . We do not have a specified maximum redemption threshold, except that in no event will we redeem our public shares in an amount that would cause our net tangible assets to be less than $ 5 , 000 , 001 both immediately before and after the consummation of our business combination . The absence of such a redemption threshold may make it possible for us to complete our business combination even if a substantial majority of our stockholders do not agree . We may be unable to obtain additional financing to complete our business combination or to fund the operations and growth of the target business, which could compel us to restructure or abandon the business combination . Subsequent to the completion of our business combination, we may be required to take write - downs or write - offs, restructuring and impairment or other charges that could have a significant negative effect on our financial condition, results of operations and our stock price, which could cause you to lose some or all of your investment . We may issue notes or other debt securities, or otherwise incur substantial debt, to complete our business combination, which may adversely affect our leverage and financial condition and thus negatively impact the value of our stockholders’ investment in us . Past performance by our management team may not be indicative of future performance of an investment in us . We are dependent upon our executive officers and directors and their departure could adversely affect our ability to operate . Our ability to successfully effect our business combination and to be successful thereafter will be totally dependent upon the efforts of our key personnel, some of whom may join us following our business combination . The loss of key personnel could negatively impact the operations and profitability of our post - combination business .

NASDAQ: PFSA (NVAC) RISK FACTORS (CONT’D) RISKS RELATED TO NORTHVIEW AND THE BUSINESS COMBINATION (Cont’d) Our executive officers and directors allocate their time to other businesses thereby causing conflicts of interest in their determination as to how much time to devote to our affairs . This conflict of interest could have a negative impact on our ability to complete our business combination . Certain of our executive officers and directors are now, and all of them may in the future become, affiliated with entities engaged in business activities similar to those intended to be conducted by us following our business combination and, accordingly, may have conflicts of interest in determining to which entity a particular business opportunity should be presented . Our executive officers, directors, security holders and their respective affiliates may have competitive pecuniary interests that conflict with our interests . NorthView’s initial stockholders, including our sponsor, executive officers and directors, will lose their entire investment in us and their right to be reimbursed for their out - of - pocket expenses if a business combination is not completed, a conflict of interest may have existed in determining whether the business combination is appropriate . You will not have any rights or interests in funds from the trust account, except under certain limited circumstances . To liquidate your investment, therefore, you may be forced to sell your public shares, rights, or warrants, potentially at a loss . Because each unit contains one - half of one redeemable warrant, and only a whole warrant may be exercised, the units may be worth less than units of other blank check companies . NASDAQ may delist our securities from trading on its exchange, which could limit investors’ ability to make transactions in our securities and subject us to additional trading restrictions . If third parties bring claims against us, the proceeds held in the trust account could be reduced and the per - share redemption amount received by stockholders may be less than $ 10 . 10 per share . A provision of our warrant agreement may make it more difficult for us to consummate our business combination . Our directors may decide not to enforce the indemnification obligations of our sponsor, resulting in a reduction in the amount of funds in the trust account available for distribution to our public stockholders .

NASDAQ: PFSA (NVAC) RISK FACTORS (CONT’D) RISKS RELATED TO NORTHVIEW AND THE BUSINESS COMBINATION (Cont’d) If, after we distribute the proceeds in the trust account to our public stockholders, we file a bankruptcy petition or an involuntary bankruptcy petition is filed against us that is not dismissed, a bankruptcy court may seek to recover such proceeds, and the members of our board of directors may be viewed as having breached their fiduciary duties to our creditors, thereby exposing the members of our board of directors and us to claims of punitive damages . If, before distributing the proceeds in the trust account to our public stockholders, we file a bankruptcy petition or an involuntary bankruptcy petition is filed against us that is not dismissed, the claims of creditors in such proceeding may have priority over the claims of our stockholders and the per - share amount that would otherwise be received by our stockholders in connection with our liquidation may be reduced . Our stockholders may be held liable for claims by third parties against us to the extent of distributions received by them upon redemption of their shares . We are not registering the shares of common stock issuable upon exercise of the warrants under the Securities Act or any state securities laws at this time, and such registration may not be in place when an investor desires to exercise warrants, thus precluding such investor from being able to exercise its warrants except on a cashless basis and potentially causing such warrants to expire worthless . The grant of registration rights to our initial stockholders and holders of our private placement warrants may make it more difficult to complete our business combination, and the future exercise of such rights may adversely affect the market price of our common stock . We may issue additional shares of common stock or preferred stock to complete our business combination or under an employee incentive plan after completion of our business combination, and any such issuances would dilute the interest of our stockholders and likely present other risks . In order to effectuate an initial business combination, blank check companies have, in the recent past, amended various provisions of their charters and modified governing instruments . We cannot assure you that we will not seek to amend our amended and restated certificate of incorporation or governing instruments in a manner that will make it easier for us to complete our business combination that our stockholders may not support . Our initial stockholders control a substantial interest in us and thus may exert a substantial influence on actions requiring a stockholder vote, potentially in a manner that you do not support . We may amend the terms of the rights in a manner that may be adverse to holders of rights with the approval by the holders of at least 65 % of the then outstanding rights .

NASDAQ: PFSA (NVAC) RISK FACTORS (CONT’D) RISKS RELATED TO NORTHVIEW AND THE BUSINESS COMBINATION (Cont’d) We may amend the terms of the warrants in a manner that may be adverse to holders of public warrants with the approval by the holders of at least 65 % of the then outstanding public warrants . We may redeem your unexpired warrants prior to their exercise at a time that is disadvantageous to you, thereby making your warrants worthless . Our rights and warrants may have an adverse effect on the market price of our common stock and make it more difficult to effectuate our business combination . Provisions in our amended and restated certificate of incorporation and Delaware law may inhibit a takeover of us, which could limit the price investors might be willing to pay in the future for our common stock and could entrench management . Provisions in our amended and restated certificate of incorporation and Delaware law may have the effect of discouraging lawsuits against our directors and officers . We are a newly formed company with no operating history and no revenues, and you have no basis on which to evaluate our ability to achieve our business objective . If we are deemed to be an investment company under the Investment Company Act, we may be required to institute burdensome compliance requirements and our activities may be restricted, which may make it difficult for us to complete our business combination . Changes in laws or regulations, or a failure to comply with any laws and regulations, may adversely affect our business, investments and results of operations . We are an emerging growth company within the meaning of the Securities Act, and we intend to take advantage of certain exemptions from disclosure requirements available to emerging growth companies, which could make our securities less attractive to investors and may make it more difficult to compare our performance with other public companies . Compliance obligations under the Sarbanes - Oxley Act may make it more difficult for us to effectuate our business combination, require substantial financial and management resources, and increase the time and costs of completing an acquisition .

NorthView Acquisition (NASDAQ:NVAC)

Historical Stock Chart

From Mar 2024 to Apr 2024

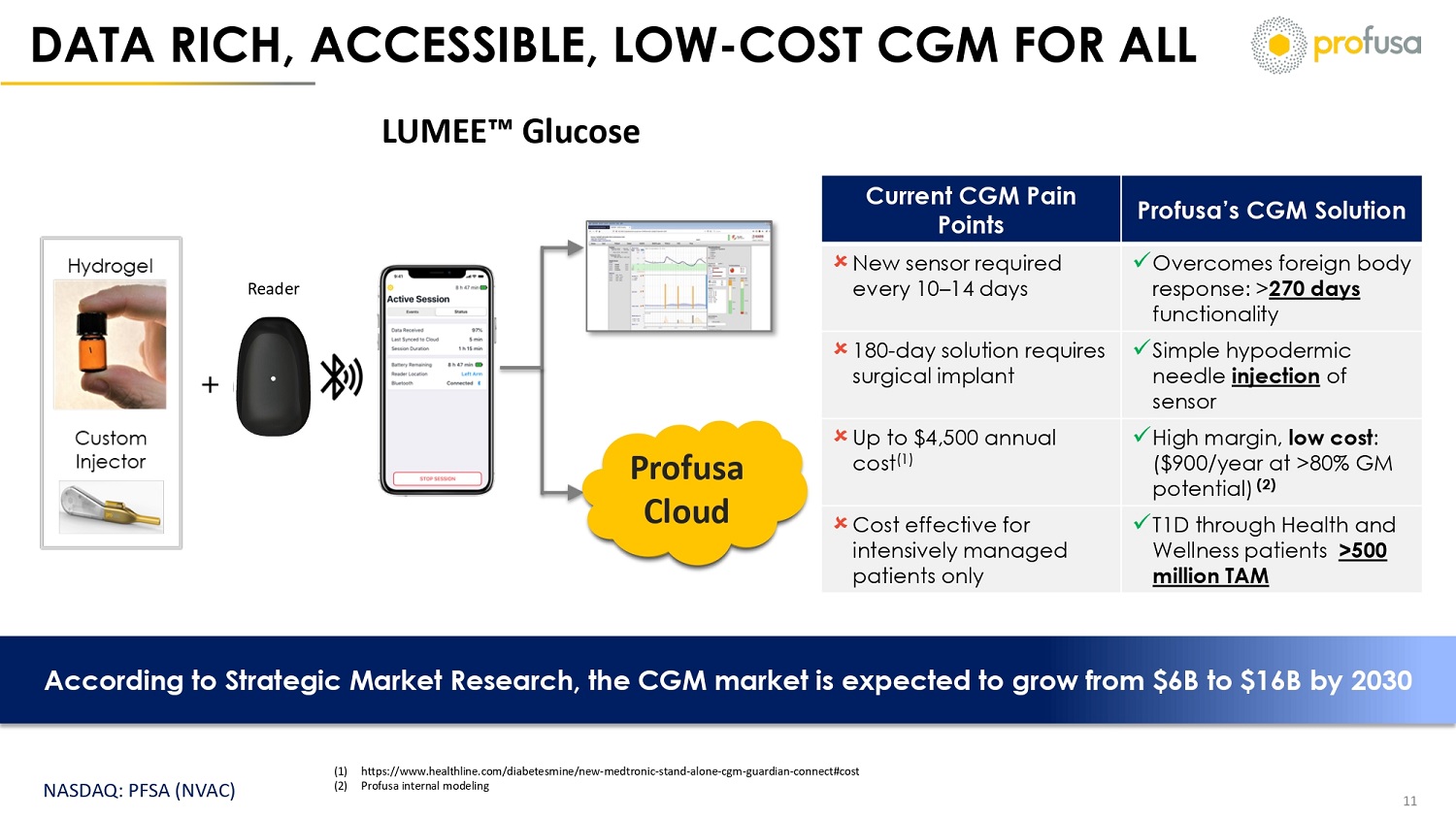

NorthView Acquisition (NASDAQ:NVAC)

Historical Stock Chart

From Apr 2023 to Apr 2024