Form 8-K - Current report

January 29 2024 - 7:55AM

Edgar (US Regulatory)

false000093313600009331362024-01-292024-01-29

SECURITIES AND

EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): January 29, 2024

Mr. Cooper Group Inc.

(Exact Name of Registrant as Specified in Charter)

|

Delaware

|

|

001-14667

|

|

91-1653725

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

8950 Cypress Waters Blvd.

Coppell, TX 75019

(Address of Principal Executive Offices, and Zip Code)

469-549-2000

Registrant’s Telephone Number, Including Area Code

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

| |

☐

|

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

☐

|

Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

☐

|

Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.01 par value per share

|

COOP

|

The Nasdaq Stock Market

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or

Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

|

Item 2.02

|

Results of Operations and Financial Condition.

|

Selected Preliminary Unaudited Financial Information

In connection with a contemplated financing transaction, Mr. Cooper Group Inc. (the “Company”) disclosed the following preliminary results for 4Q’23.

|

●

|

Pretax income was $69 million and pretax operating income was $151 million, which excludes $27 million in one-time charges related to our

previously disclosed cyber incident and other adjustments

|

|

●

|

Book value per share and tangible book value per share increased to $66.29 and $63.67

|

|

●

|

The Company incurred a mark-to-market loss of $41 million on the MSR portfolio, net of hedge gains, equivalent to a realized hedge ratio of 81%

|

|

●

|

Servicing portfolio grew to $992 billion and including pending transactions is expected to reach $1.1 trillion in first quarter

|

|

●

|

Servicing generated pretax income of $184 million and pretax operating income of $229 million

|

|

●

|

Originations generated pretax income of $9 million and pretax operating income of $10 million on $2.7 billion in fundings

|

|

●

|

The Company ended the quarter with TNW/assets of 29% and available liquidity of $2.4 billion, consisting of $572 million in unrestricted cash and

$1.85 billion in unused lines

|

|

●

|

MSR 60+ day delinquencies continued to decline, reaching the lowest level in our history as a public company, 1.3% as of December 31, 2023

|

Reconciliation of Non-GAAP Financial Measures

The Company utilizes non-GAAP financial measures as the measures provide additional information to assist investors in understanding and assessing the

Company’s and its business segments’ ongoing performance and financial results, as well as assessing prospects for future performance. The adjusted operating financial measures facilitate a meaningful analysis and allow more accurate comparisons of

the Company’s ongoing business operations because they exclude items that may not be indicative of or are unrelated to the Company’s and its business segments’ core operating performance, and are better measures for assessing trends in its

underlying businesses. These notable items are consistent with how management views the Company’s businesses. Management uses these non-GAAP financial measures in making financial, operational and planning decisions and evaluating the Company’s and

its business segment’s ongoing performance.

We define pretax operating income as pretax income adjusted to exclude mark-to-market changes in fair value of MSRs, intangible amortization and other

adjustments. The following table reconciles the differences between pretax income, the most comparable GAAP measure, to pretax operating income.

| |

|

Three months ended December 31, 2023

|

|

|

Three months ended December 31, 2022

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in millions)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pretax income (loss)

|

|

$

|

184

|

|

|

$

|

9

|

|

|

$

|

(124

|

)

|

|

$

|

69

|

|

|

$

|

98

|

|

|

$

|

(14

|

)

|

|

$

|

(94

|

)

|

|

$

|

(10

|

)

|

|

Other mark-to-market

|

|

|

41

|

|

|

|

—

|

|

|

|

—

|

|

|

|

41

|

|

|

|

58

|

|

|

|

—

|

|

|

|

—

|

|

|

|

58

|

|

|

Accounting items / other

|

|

|

2

|

|

|

|

1

|

|

|

|

36

|

|

|

|

39

|

(a)

|

|

|

3

|

|

|

|

12

|

|

|

|

18

|

|

|

|

33

|

(b)

|

|

Intangible amortization

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pretax operating income (loss)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a)

|

Adjustments included $27 million costs related to our previously disclosed cyber incident, $8 million deal costs associated with the Roosevelt and Home Point acquisitions, $2 million severance

charge and $2 million equity loss related to Sagent. |

(b)

|

Adjustments included $23 million charge due to severance and property consolidation and $10 million loss associated with equity investments. |

The following table reconciles the differences between total stockholders’ equity, the most comparable GAAP measure, to tangible book value per share.

| |

|

|

|

| |

|

|

|

|

|

|

|

(in millions except value per share data)

|

|

|

|

|

|

|

|

Total stockholders’ equity

|

|

$

|

4,282

|

|

|

$

|

4,057

|

|

|

Goodwill

|

|

|

(141

|

)

|

|

|

(120

|

)

|

|

Intangible assets

|

|

|

|

|

|

|

|

|

|

Tangible book value

|

|

|

|

|

|

|

|

|

|

Ending shares of common stock outstanding

|

|

|

64.6

|

|

|

|

69.3

|

|

|

Book value per share

|

|

$

|

66.29

|

|

|

$

|

58.57

|

|

|

Tangible book value per share

|

|

$

|

63.67

|

|

|

$

|

56.72

|

|

The Company's audited financial statements for the year ended December 31, 2023 are not yet available. Accordingly, these preliminary financial and

operating results are an estimate and subject to the completion of the Company's financial closing and other procedures and finalization of the Company's consolidated financial statements for the year ended December 31, 2023, including the

completion of the audit of the Company's financial statements. Accordingly, actual financial and operating results that will be reflected in the Company's Annual Report on Form 10-K for the year ended December 31, 2023, including its audited

financial statements, when they are completed and publicly disclosed may differ from these preliminary results. The information furnished within this Item 2.02 shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act

of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any other filing under the Securities Act of 1933, as amended ("the Securities Act"), or the

Exchange Act, except as expressly set forth by specific reference in such a filing.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to

be signed on its behalf by the undersigned hereunto duly authorized.

| |

Mr. Cooper Group Inc.

|

| |

|

|

| |

|

|

Date: January 29, 2024

|

|

|

|

|

By:

|

/s/ Kurt Johnson

|

| |

|

Kurt Johnson

Executive Vice President & Chief Financial Officer

|

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

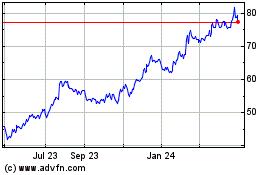

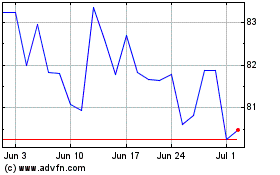

Mr Cooper (NASDAQ:COOP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Mr Cooper (NASDAQ:COOP)

Historical Stock Chart

From Apr 2023 to Apr 2024