false

0000931584

0000931584

2024-01-24

2024-01-24

0000931584

usap:CommonStockParValue0001PerShareCustomMember

2024-01-24

2024-01-24

0000931584

usap:PreferredStockPurchaseRightsCustomMember

2024-01-24

2024-01-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 24, 2024

Universal Stainless & Alloy Products, Inc.

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-39467 |

|

25-1724540 |

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(IRS Employer

Identification No.)

|

| 600 Mayer Street, Bridgeville, Pennsylvania |

|

15017 |

| (Address of principal executive offices) |

|

(Zip code) |

Registrant's telephone number, including area code: (412) 257-7600

Check the appropriate box below if the Form 8−K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2.):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a−12 under the Exchange Act (17 CFR 240.14a−12)

|

|

☐

|

Pre−commencement communications pursuant to Rule 14d−2(b) under the Exchange Act (17 CFR 240.14d−2(b))

|

|

☐

|

Pre−commencement communications pursuant to Rule 13e−4(c) under the Exchange Act (17 CFR 240.13e−4(c))

|

Securities registered pursuant to Section 12(b) of the Exchange Act:

|

Title of Each Class

|

|

Trading

Symbol

|

|

Name of Each Exchange

on Which Registered

|

|

Common Stock, par value $0.001 per share

|

|

USAP

|

|

The Nasdaq Stock Market, LLC

|

|

Preferred Stock Purchase Rights

|

|

|

|

The Nasdaq Stock Market, LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On January 24, 2024, Universal Stainless & Alloy Products, Inc. (the “Company”) issued a press release including, among other things, certain preliminary financial information for the Company’s quarter and year ended December 31, 2023. A copy of the press release is attached hereto as Exhibit 99.1.

The information in Item 2.02 of this Current Report on Form 8-K, including the attached press release, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

| |

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document).

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

UNIVERSAL STAINLESS & ALLOY PRODUCTS, INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ Steven V. DiTommaso

|

|

|

|

|

Steven V. DiTommaso

|

|

|

|

|

Vice President and Chief Financial Officer

|

|

Dated: January 24, 2024

Exhibit 99.1

| CONTACTS: |

Christopher M. Zimmer |

Steven V. DiTommaso |

June Filingeri |

| |

President and |

Vice President and |

President |

| |

Chief Executive Officer |

Chief Financial Officer |

Comm-Partners LLC |

| |

(412) 257-7604 |

(412) 257-7661 |

(203) 972-0186 |

Universal Stainless Business Update Call and Webcast Scheduled for Today, January 24th

BRIDGEVILLE, PA, January 24, 2024 – Universal Stainless & Alloy Products, Inc. (Nasdaq: USAP), as previously announced, will host a conference call to provide a business update today, Wednesday, January 24th, at 10:00 a.m. (Eastern). The call will be webcast simultaneously for all interested parties.

Today’s call is in advance of the Company’s report of financial results for the 2023 fourth quarter and full year, which it expects to provide in March 2024. The extension of the Company’s reporting schedule accommodates the late start in its annual integrated audit, as the Company's new audit firm was engaged on December 18, 2023.

Among the highlights to be discussed on today’s call, the Company plans to report that total sales for the fourth quarter of 2023 approximated a record $78 million to $80 million. That compares with $71.3 million in the 2023 third quarter and $56.2 million in the fourth quarter of 2022. Full year 2023 sales are expected to approximate a record $284 million to $286 million versus $202.1 million in 2022. Premium alloy sales for the fourth quarter of 2023 are expected to range from a record $20 million to $21 million. The Company’s top line results continued to be driven by robust demand in the aerospace market. Backlog at the end of 2023 remained at a healthy level of $318 million.

Additionally, the Company plans to report that total debt was reduced by approximately $4 million in the fourth quarter and approximately $13 million for full year 2023.

Christopher M. Zimmer, President and Chief Executive Officer, commented: “We look forward to providing an update on our markets and share certain financial metrics on today’s call, in advance of our earnings report in March.”

The financial results reported in this release are a preliminary estimate, based on information available to the Company’s management as of the date of this release, and are subject to further changes upon completion of the Company’s standard quarter and year-end closing procedures. This release does not present all necessary information for an understanding of the Company’s financial condition as of the date of this release, or its results of operations for the fourth quarter and full year ended December 31, 2023. As the Company completes its year-end financial close process and finalizes its financial statements for the full year, it will be required to make significant judgments in a number of areas. It is possible that the Company may identify items that require it to make adjustments to the preliminary financial information set forth in this release, and those changes could be material. The Company does not intend to update such financial information prior to release of its final fourth quarter and full year financial information, which it expects to provide in March 2024.

Call Dial-In Procedures:

Please Click Here to register for the conference call and obtain your dial-in number and personal PIN number in advance of the call.

The simultaneous webcast will be available on the Company’s website at www.univstainless.com, and thereafter archived on the website. Please allow 5 minutes prior to the live webcast to visit the site to download and install any necessary audio software.

About Universal Stainless & Alloy Products, Inc.

Universal Stainless & Alloy Products, Inc., established in 1994 and headquartered in Bridgeville, PA, manufactures and markets semi-finished and finished specialty steels, including stainless steel, nickel alloys, tool steel and certain other alloyed steels. The Company's products are used in a variety of industries, including aerospace, power generation, oil and gas, and heavy equipment manufacturing. More information is available at www.univstainless.com.

Forward-Looking Information Safe Harbor

Except for historical information contained herein, the statements in this release are forward-looking statements that are made pursuant to the “safe harbor” provision of the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve known and unknown risks and uncertainties that may cause the Company’s actual results in future periods to differ materially from forecasted results. Those risks include, among others, the Company’s ability to maintain its relationships with its significant customers and market segments; the Company’s response to competitive factors in its industry that may adversely affect the market for finished products manufactured by the Company or its customers; the Company’s ability to compete successfully with domestic and foreign producers of specialty steel products and products fashioned from alternative materials; changes in overall demand for the Company’s products and the prices at which the Company is able to sell its products in the aerospace industry, from which a substantial amount of its sales is derived; the Company’s ability to develop, commercialize, market and sell new applications and new products; the receipt, pricing and timing of future customer orders; the impact of changes in the Company’s product mix on the Company’s profitability; the Company’s ability to maintain the availability of raw materials and operating supplies with acceptable pricing; the availability and pricing of electricity, natural gas and other sources of energy that the Company needs for the manufacturing of its products; risks related to property, plant and equipment, including the Company’s reliance on the continuing operation of critical manufacturing equipment; the Company’s success in timely concluding collective bargaining agreements and avoiding strikes or work stoppages; the Company’s ability to attract and retain key personnel; the Company’s ongoing requirement for continued compliance with laws and regulations, including applicable safety and environmental regulations; the ultimate outcome of the Company’s current and future litigation matters; the Company’s ability to meet its debt service requirements and to comply with applicable financial covenants; risks associated with conducting business with suppliers and customers in foreign countries; public health issues, including COVID-19 and its uncertain impact on our facilities and operations and its customers and suppliers and the effectiveness of the Company’s actions taken in response to these risks; risks related to acquisitions that the Company may make; the Company’s ability to protect its information technology infrastructure against service interruptions, data corruption, cyber-based attacks or network security breaches; the impact on the Company’s effective tax rates from changes in tax rules, regulations and interpretations in the United States and other countries where it does business; and the impact of various economic, credit and market risk uncertainties. Many of these factors are not within the Company’s control and involve known and unknown risks and uncertainties that may cause the Company’s actual results in future periods to be materially different from any future performance suggested herein. Any unfavorable change in the foregoing or other factors could have a material adverse effect on the Company’s business, financial condition and results of operations. Further, the Company operates in an industry sector where securities values may be volatile and may be influenced by economic and other factors beyond the Company’s control. Certain of these risks and other risks are described in the Company’s filings with the SEC, including the Company’s Annual Report on Form 10-K for the year ended December 31, 2022, copies of which are available from the SEC or may be obtained upon request from the Company.

v3.23.4

Document And Entity Information

|

Jan. 24, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Universal Stainless & Alloy Products, Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Jan. 24, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-39467

|

| Entity, Tax Identification Number |

25-1724540

|

| Entity, Address, Address Line One |

600 Mayer Street

|

| Entity, Address, City or Town |

Bridgeville

|

| Entity, Address, State or Province |

PA

|

| Entity, Address, Postal Zip Code |

15017

|

| City Area Code |

412

|

| Local Phone Number |

257-7600

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000931584

|

| CommonStockParValue0001PerShare Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $0.001 per share

|

| Trading Symbol |

USAP

|

| Security Exchange Name |

NASDAQ

|

| PreferredStockPurchaseRights Custom [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Preferred Stock Purchase Rights

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=usap_CommonStockParValue0001PerShareCustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=usap_PreferredStockPurchaseRightsCustomMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

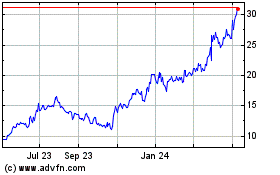

Unversal Stainless and A... (NASDAQ:USAP)

Historical Stock Chart

From Mar 2024 to Apr 2024

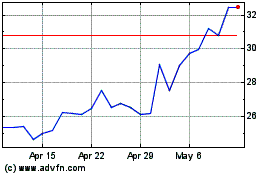

Unversal Stainless and A... (NASDAQ:USAP)

Historical Stock Chart

From Apr 2023 to Apr 2024