false

0000023197

COMTECH TELECOMMUNICATIONS CORP /DE/

0000023197

2024-01-22

2024-01-22

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

January 22, 2024 |

|

0-7928 |

Date of Report |

|

Commission File Number |

(Date of earliest event reported) |

|

|

(Exact name of registrant as specified in its charter)

Delaware |

|

11-2139466 |

(State or other jurisdiction of |

|

(I.R.S. Employer Identification Number) |

incorporation or organization) |

|

|

| |

68 South Service

Road, Suite 230 |

|

| |

Melville,

New York 11747 |

|

| |

(Address of Principal Executive Offices) (Zip Code) |

|

| |

|

|

| |

(631)

962-7000 |

|

| |

(Registrant’s telephone

number, including area code) |

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously

satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of exchange

on

which registered |

| Common Stock, par value $0.10 per share |

|

CMTL |

|

Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an

emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

COMTECH

TELECOMMUNICATIONS CORP /DE/

On January 22, 2024, Comtech Telecommunications

Corp. (“Comtech” or the “Company”) issued a press release announcing that funds affiliated with White Hat Capital

Partners LP and funds affiliated with Magnetar have agreed to purchase $45 million in the aggregate of a new series of convertible

preferred stock of the Company, the Series B Convertible Preferred Stock, par value $0.10 per share, titled the “Series B Convertible

Preferred Stock” (“Series B Convertible Preferred Stock”). In connection with the investment, the Company exchanged

all outstanding shares of the Company’s Series A-1 Convertible Preferred Stock, par value $0.10 per share, titled the “Series

A-1 Convertible Preferred Stock” for Series B Convertible Preferred Stock. A copy of the press release is attached hereto as Exhibit

99.1 and is incorporated herein by reference. White Hat Capital Partners LP is affiliated with Mark Quinlan, a member of the Company’s

Board of Directors.

Forward-Looking Statements

Certain statements contained herein are

forward-looking statements that involve risks, uncertainties and assumptions. If the risks or uncertainties ever materialize or the

assumptions prove incorrect, the Company’s results may differ materially from those expressed or implied by such

forward-looking statements. All statements other than statements of historical fact could be deemed forward-looking, including, but

not limited to, statements about the investment described herein and achievement of its potential benefits and the intended use of

proceeds. Risks and uncertainties that could impact these forward-looking statements include: the Company’s ability to access

capital and liquidity so that it is able to continue as a going concern; the possibility that the expected synergies and benefits

from acquisitions will not be fully realized, or will not be realized within the anticipated time periods; the risk that the

acquired businesses will not be integrated successfully; the possibility of disruption from acquisitions or dispositions, making it

more difficult to maintain business and operational relationships or retain key personnel; the risk that the Company will be

unsuccessful in implementing its “One Comtech” transformation and integration of individual businesses into two

segments; the risk that the Company will be unsuccessful in implementing a tactical shift in its Satellite and Space Communications

segment away from bidding on large commodity service contracts and toward pursuing contracts for its niche products and solutions

with higher margins; the nature and timing of the Company’s receipt of, and the Company’s performance on, new or

existing orders that can cause significant fluctuations in net sales and operating results; the timing and funding of government

contracts; adjustments to gross profits on long-term contracts; risks associated with international sales; rapid technological

change; evolving industry standards; new product announcements and enhancements; changing customer demands and or procurement

strategies; changes in prevailing economic and political conditions, including as a result of Russia’s military incursion into

Ukraine and the Israel-Hamas war; changes in the price of oil in global markets; changes in prevailing interest rates and foreign

currency exchange rates; risks associated with the Company’s legal proceedings, customer claims for indemnification, and other

similar matters; risks associated with the Company’s obligations under its credit facility and the Company’s ability to

refinance its credit facility; risks associated with the Company’s large contracts; risks associated with supply chain

disruptions; and other factors described in this and the Company’s other filings with the Securities and Exchange Commission.

The Company assumes no obligation and does not intend to update these forward-looking statements or to conform these statements to

actual results or to changes in our expectations.

| Item 9.01. |

Financial Statements and Exhibits. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

Date: January 22, 2024

| |

COMTECH TELECOMMUNICATIONS CORP. |

|

| |

|

|

|

|

| |

|

|

|

|

| |

By: |

/s/ Michael A. Bondi

|

|

| |

|

Name: |

Michael A. Bondi |

|

| |

|

Title: |

Chief Financial Officer |

|

| |

|

|

|

|

EXHIBIT 99.1

Comtech Announces $45 Million Strategic

Investment and Exchange of Convertible Preferred Stock

Investment Enhances Comtech’s Financial

Flexibility and Supports Its Strategic Initiatives in Satellite Ground Station Infrastructure and Next-Generation Terrestrial and Wireless

Solutions

MELVILLE, N.Y. -- (BUSINESS WIRE) -- January

22, 2024 -- Comtech Telecommunications Corp. (NASDAQ: CMTL) (“Comtech” or the “Company”), a leading global technology

company providing terrestrial and wireless network solutions, next-generation 911 emergency services, satellite and space communications

technologies, and cloud native capabilities, today announced a $45.0 million investment by current shareholders White Hat Capital Partners

LP (“White Hat”), an investment firm focused on sustainable value creation in technology companies serving mission-critical

applications, and funds affiliated with Magnetar, a leading alternative investment manager with over $14 billion of assets under management.

In connection with the investment, the Company exchanged all outstanding shares of Comtech’s existing convertible preferred stock

for a new series of convertible preferred stock.

This strategic investment enhances Comtech’s

financial flexibility and strengthens the Company’s ability to capitalize on its recent large contract awards and growing customer

demand for its satellite communications technologies and next-generation terrestrial and wireless solutions. Comtech expects to apply

the proceeds of this investment across a range of initiatives which not only support near-term working capital needs and general corporate

purposes, including the repayment of certain outstanding indebtedness, but also its growth prospects. The issuance of the new series of

convertible preferred stock demonstrates the continued commitment of White Hat and Magnetar, and is an important step towards the completion

of the Company’s previously announced process to refinance its existing Credit Facility and further increase its financial and operational

strength.

Mark Quinlan, who currently serves as an appointee

of White Hat and Magnetar on the Company’s Board of Directors, will retain his position on the Board. Mr. Quinlan is White

Hat’s Co-Founder and Managing Partner and has more than 20 years of experience in the technology sector. He has provided valuable

insight and experience to the Board of Directors since January 2022.

“We are grateful for this investment

and endorsement of our strategy and team by two of our existing long-term shareholders,” said Comtech’s Chairman and CEO,

Ken Peterman. “Magnetar and White Hat understand our Company, our end markets, and the potential of our One Comtech vision. With

White Hat’s investment experience within the technology sector and Magnetar’s breadth of investment experience in both private

and public markets and across asset classes and capital structures, we value their continued support and are excited to strengthen our

relationship with them at this key inflection point for the Company.”

“Under CEO Ken Peterman’s leadership,

the entire Comtech team has made incredible progress on its One Comtech transformation,” said Mr. Quinlan. “We recognize Comtech’s

potential and believe this investment further supports the Company’s commitment to developing and delivering mission-critical solutions

for its customers.”

Summary of Investment Terms

White Hat and Magnetar purchased $45.0 million

of a new series of convertible preferred stock and exchanged all outstanding shares of Comtech’s existing convertible preferred

stock for shares of the new series of convertible preferred stock. The preferred stock will be convertible into shares of Comtech common

stock at a conversion price of $7.99 per share; carries a 9.00% dividend, payable in kind, or a 7.75% dividend, payable in cash, at Comtech’s

election; and contains an optional redemption date of October 31, 2028. Further details will be included in the Company’s Current

Report on Form 8-K to be filed with the Securities and Exchange Commission. That report will describe the investment in additional detail,

including exhibits with copies of associated transaction documentation.

Paul, Weiss, Rifkind, Wharton & Garrison

LLP is serving as legal advisor to Comtech and Sidley Austin LLP is serving as legal advisor to the Special Committee of the Board of

Directors of Comtech. Willkie Farr & Gallagher LLP is serving as legal advisor to Magnetar and Schulte Roth + Zabel LLP is serving

as legal advisor to White Hat.

About Comtech

Comtech Telecommunications

Corp. is a leading global technology company providing terrestrial and wireless network solutions, next-generation 9-1-1 emergency services,

satellite and space communications technologies, and cloud native capabilities to commercial and government customers around the world.

Comtech’s unique culture of innovation and employee empowerment unleashes a relentless passion for customer success. With multiple

facilities located in technology corridors throughout the United States and around the world, Comtech leverages its global presence, technology

leadership, and decades of experience to create the world’s most innovative communications solutions. For more information, please

visit www.comtech.com.

Forward-Looking Statements

This press release contains statements that

are forward-looking in nature and involve certain significant risks and uncertainties, including with respect to the offering of securities,

the intended use of proceeds and our current expectations, initiatives, strategies or future plans. No assurance can be given that the

transaction will be completed, or that the proceeds from the offering will be used as indicated. Forward-looking statements are subject

to numerous conditions, risks, and uncertainties, many of which are beyond the control of the Company, including those identified in the

Company’s filings with the Securities and Exchange Commission. Forward-looking statements are also based on assumptions that may

not be realized and involve risks and uncertainties that could cause actual results or other events to differ materially from the expectations

and beliefs contained herein. Any forward-looking information in this press release is qualified in its entirety by the risks and uncertainties

described in Securities and Exchange Commission filings. The Company undertakes no obligation to release publicly any updates or revisions

to any forward-looking statements contained herein except as required by law.

PCMTL

###

Contacts

Investor Relations

Maria Ceriello

Investors@comtech.com

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

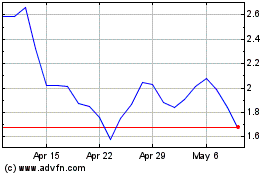

Comtech Telecommunications (NASDAQ:CMTL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Comtech Telecommunications (NASDAQ:CMTL)

Historical Stock Chart

From Apr 2023 to Apr 2024