Filed

Pursuant to Rule 424(b)(5)

Registration

No. 333-273110

(To

the Prospectus dated November 3, 2023)

2,678,571

Shares of

Common

Stock

SURGEPAYS,

INC.

We

are offering 2,678,571 shares of our common stock, par value $0.001 per share, in this offering pursuant to this prospectus supplement

and the accompanying prospectus. The public offering price for each share of common stock is $5.60.

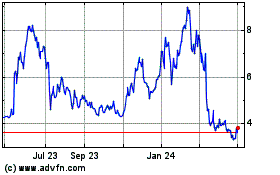

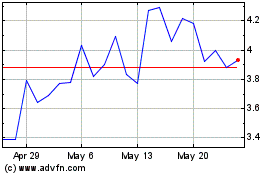

Our

common stock is listed on the Nasdaq Capital Market under the symbol “SURG.” On January 17, 2024, the last reported

sale price of our common stock was $6.60 per share.

As

of the date of this prospectus supplement, the aggregate market value of our outstanding common stock held by non-affiliates was $66,152,018

based on 14,263,702 shares of outstanding common stock, of which 8,602,343 shares are held by non-affiliates and 5,661,359 shares are

held by affiliates, and a per share price of $7.69 per share, the closing price of our common stock on January 9, 2024, which is the

highest closing sale price of our common stock on NASDAQ within the prior 60 days. As of the date of this prospectus supplement, we have

not offered and sold any shares of our common stock pursuant to General Instruction I.B.6 to Form S-3 during the 12 calendar month period

that ends on and includes the date hereof. Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell securities in

a public primary offering with a value exceeding more than one-third of our “public float”, or approximately $22,050,673

as of the date hereof (the market value of our common stock held by our non-affiliates) in any 12-month period so long as our public

float remains below $75,000,000.

| | |

Per

Share | | |

Total | |

| Public offering price | |

$ | 5.60 | | |

$ | 14,999,997.60 | |

| Underwriting discounts and commissions (1)(2) | |

$ | 0.392 | | |

$ | 1,049,999.83 | |

| Proceeds, before expenses, to us (2) | |

$ | 5.208 | | |

$ | 13,949,997.77 | |

| (1) | We

have agreed to reimburse the underwriter for certain expenses. See “Underwriting”

on page S-7 of this prospectus supplement for additional disclosures regarding underwriting

discounts, commissions and estimated offering expenses. |

| (2) | If

the representative exercises the option in full, the total underwriting discounts will be

$1,207,499.55, and the total proceeds to us, before expenses, will be $16,042,494.05. |

We

have granted the underwriters an option to purchase up to an additional 401,785 shares of common stock from us at the public offering

price, less the underwriting discounts and commissions, within 45 days from the date of this prospectus supplement to cover over-allotments,

if any.

Investing

in our common stock involves a high degree of risk. See “Risk Factors” beginning on page S-4 of

this prospectus supplement and on page 5 of the accompanying prospectus and under similar headings in other documents

filed after the date hereof and incorporated by reference into this prospectus supplement and the accompanying prospectus for a

discussion of information that should be considered in connection with an investment in our common stock.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

underwriter expects to deliver the shares of common stock to the purchasers on or about January 22, 2024, subject to customary

closing conditions.

Titan

Partners Group

a

division of American Capital Partners

The

date of this prospectus supplement is January 17, 2024.

TABLE

OF CONTENTS

Prospectus

Supplement

Prospectus

ABOUT

THIS PROSPECTUS SUPPLEMENT

This

document is part of the registration statement on Form S-3 that we filed with the Securities and Exchange Commission, or the SEC, using

a “shelf” registration process (Registration File No. 333-273110) and consists of two parts. The first part is the prospectus

supplement, including the documents incorporated by reference, which describes the specific terms of this offering. The second part,

the accompanying prospectus, including the documents incorporated by reference, provides more general information. Before you invest,

you should carefully read this prospectus supplement, the accompanying prospectus, all information incorporated by reference herein and

therein, as well as the additional information described under “Where You Can Find More Information” of this prospectus

supplement. These documents contain information you should consider when making your investment decision. This prospectus supplement

may add, update or change information contained in the accompanying prospectus. To the extent there is a conflict between the information

contained in this prospectus supplement, on the one hand, and the information contained in the accompanying prospectus or any document

incorporated by reference therein filed prior to the date of this prospectus supplement, on the other hand, you should rely on the information

in this prospectus supplement. If any statement in one of these documents is inconsistent with a statement in another document having

a later date — for example, a document filed after the date of this prospectus supplement and incorporated by reference in this

prospectus supplement and the accompanying prospectus — the statement in the document having the later date modifies or supersedes

the earlier statement.

You

should rely only on the information contained or incorporated by reference in this prospectus supplement, the accompanying prospectus

and in any free writing prospectuses we may provide to you in connection with this offering. We have not, and the underwriters have not,

authorized any other person to provide you with any information that is different. If anyone provides you with different or inconsistent

information, you should not rely on it. We are offering to sell, and seeking offers to buy, shares of our common stock only in jurisdictions

where offers and sales are permitted. The distribution of this prospectus supplement and the offering of the common stock in certain

jurisdictions may be restricted by law. Persons outside the United States who come into possession of this prospectus supplement must

inform themselves about, and observe any restrictions relating to, the offering of the common stock and the distribution of this prospectus

supplement outside the United States. This prospectus supplement does not constitute, and may not be used in connection with, an offer

to sell, or a solicitation of an offer to buy, any securities offered by this prospectus supplement by any person in any jurisdiction

in which it is unlawful for such person to make such an offer or solicitation.

We

further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document

that is incorporated by reference in the accompanying prospectus were made solely for the benefit of the parties to such agreement, including,

in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation,

warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly,

such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

When

we refer to “SurgePays,” “we,” “our,” “us” and the “Company” in this prospectus,

we mean SurgePays, Inc., unless otherwise specified. When we refer to “you,” we mean the potential investors of the common

stock offered hereby.

CAUTIONARY

STATEMENTS REGARDING FORWARD-LOOKING INFORMATION

The

information included or incorporated by reference into this prospectus supplement and the accompanying prospectus contains forward-looking

statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or Securities Act, and Section 21E of the Securities

Exchange Act of 1934, as amended, or Exchange Act. These forward-looking statements that relate to future events or our future financial

performance and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity,

performance or achievements to differ materially from any future results, levels of activity, performance or achievements expressed or

implied by these forward-looking statements. Words such as, but not limited to, “believe,” “expect,” “anticipate,”

“estimate,” “intend,” “plan,” “targets,” “likely,” “aim,” “will,”

“would,” “could,” and similar expressions or phrases identify forward-looking statements. We have based these

forward-looking statements largely on our current expectations and future events and financial trends that we believe may affect our

financial condition, results of operation, business strategy and financial needs. Actual results may differ materially from those expressed

or implied in such forward-looking statements as a result of various factors. We do not undertake, and we disclaim, any obligation to

update any forward-looking statements or to announce any revisions to any of the forward-looking statements, except as required by law.

Forward-looking statements include, but are not necessarily limited to, those relating to:

| |

● |

our

expectations related to the use of proceeds from this offering; |

| |

● |

our

need for, and ability to raise, additional capital; |

| |

● |

the

acceptance and approval of regulatory filings; |

| |

● |

our

current or prospective collaborators’ compliance or non-compliance with their obligations under our agreements with them; |

| |

● |

business

disruption and related risks resulting from the recent pandemic of the novel coronavirus 2019 (COVID-19); and |

| |

● |

other

factors discussed elsewhere in this prospectus supplement, the accompanying prospectus or the documents incorporated by reference

herein and therein. |

We

urge you to consider these factors before investing in our common stock. The forward-looking statements included in this prospectus supplement,

the accompanying prospectus and any other offering material, or in the documents incorporated by reference into this prospectus supplement,

the accompanying prospectus and any other offering material, are made only as of the date of the prospectus supplement, the accompanying

prospectus, any other offering material or the incorporated document. For more detail on these and other risks, please see “Risk

Factors” in this prospectus supplement, the accompanying prospectus as well as the documents incorporated herein by reference,

which are described under “Where You Can Find More Information” and “Information Incorporated by Reference”

in this prospectus supplement.

PROSPECTUS

SUPPLEMENT SUMMARY

The

following information below is only a summary of more detailed information included elsewhere in, or incorporated by reference in, this

prospectus supplement and the accompanying prospectus, and should be read together with the information contained or incorporated by

reference in other parts of this prospectus supplement and the accompanying prospectus. This summary highlights selected information

about us and this offering. This summary may not contain all of the information that may be important to you. Before making a decision

to invest in our common stock, you should read carefully all of the information contained in or incorporated by reference into this prospectus

supplement and the accompanying prospectus, including the information set forth under the caption “Risk Factors”

in this prospectus supplement and the accompanying prospectus as well as the documents incorporated herein by reference, which are

described under “Where You Can Find More Information” and “Information Incorporated by Reference”

in this prospectus supplement.

Our

Company

SurgePays,

Inc., incorporated in Nevada on August 18, 2006, is a financial technology and telecom company focused on providing essential services

to the underbanked community. The Company’s wireless subsidiaries, SurgePhone and Torch Wireless, provide mobile broadband, voice

and SMS text messaging to more than 250,000 low-income subsidized and direct retail prepaid customers nationwide. The Company’s

blockchain fintech platform utilizes a suite of financial and prepaid products to convert corner stores into tech-hubs for underbanked

neighborhoods.

SurgePhone

Wireless and Torch Wireless

SurgePhone

and Torch Wireless, wholly owned subsidiaries of SurgePays, are mobile virtual network operators (MVNO) licensed by the Federal Communications

Commission (the “FCC”) to provide subsidized access to quality internet through mobile broadband services to consumers qualifying

under the federal guidelines of the Affordable Connectivity Program (the “ACP”). The ACP (the successor program, as of March

1, 2022 to the Emergency Broadband Benefit program) provides SurgePhone and Torch up to a $100 reimbursement for the cost of each tablet

device distributed and a $30 per customer, per month subsidy for mobile broadband (internet connectivity) services. SurgePhone and Torch

combined are licensed to offer subsidized mobile broadband to all fifty states.

SurgePays

Fintech (ECS Business)

We

refer to the collective operations of ECS Prepaid, LLC, a Missouri limited liability company, Electronic Check Services, Inc., a Missouri

corporation, and Central States Legal Services, Inc., a Missouri corporation, as “Surge Fintech.” This was previously referred

to as the “ECS Business.”

Surge

Fintech has been a financial technology tech and wireless top-up platform for over 15 years. Through a series of transactions between

October 2019 and January 2020, we acquired the ECS Business primarily for the favorable ACH banking relationship and a fintech transactions

platform processing over 20,000 transactions a day at approximately 8,000 independently owned convenience stores. The platform serves

as the proven backbone for wireless top-up transactions and wireless product aggregation for the SurgePays nationwide network.

Surge

Blockchain

Surge

Blockchain Software is a back-office marketplace (accessed through the SurgePays fintech portal for convenience stores) offering wholesale

consumable goods direct to convenience stores who are transacting on the SurgePays Fintech platform. The wholesale e-commerce platform

is easily accessed through the secure app interface – similar to a website. We believe what makes this sales platform unique is

that it also offers the merchant the ability to order wholesale consumable goods at a significant discount from traditional distributors

with one touch ease. We are able to sell products at a significant discount by using on demand Direct Store Delivery (DSD). Our platform

is connected directly to manufactures, who ship products direct to the store while cutting out the middleman. The goal of the SurgePays

Portal is to leverage the competitive advantage and efficiencies of e-commerce to provide as many commonly sold consumable products as

possible to convenience stores, corner markets, bodegas, and supermarkets while increasing profit margins for these stores.

LogicsIQ,

Inc.

LogicsIQ,

Inc. is a lead generation and case management solutions company primarily serving law firms in the mass tort industry. LogicsIQ’s

CRM “Intake Logics” facilitates the entire life cycle of converting a lead into a signed retainer client integrated into

the law firms case management software. Our proven strategy of delivering cost-effective retained cases to our attorney and law firm

clients means those clients are better able to manage their media and advertising budgets and reach targeted audiences more quickly and

effectively when utilizing our proprietary data driven analytics dashboards. Our ability to deliver transparent results through our integrated

Business Intelligence (B.I.) dashboards has bolstered our reputation as an industry leader in the mass tort client acquisition field.

ShockWave

CRM™

SurgePays

acquired the Software as a Service (SaaS) Customer Relationship Management (CRM) and Billing System software platform “MVNO Cloud

Services” on June 7, 2022. Payment for the software consisted of $300,000 in cash, of which $100,000 was paid in June 2022, and

the remaining $200,000 in July 2022. Additionally, the Company issued 85,000 shares of Common Stock having a fair value of $411,400 ($4.84/share),

based upon the quoted closing trading price. SurgePays has rebranded the software as ShockWave CRM.

ShockWave

is an end-to-end cloud-based SaaS offering an Omnichannel CRM, billing system and carrier integrations specific to the telecommunication

and broadband industry. Some of these services include sales agent management, device and SIM inventory management, order processing

and provisioning, retail Point of Service (POS) activations and payments, customer service management, retention tools, billing, and

payments.

Centercom

Since

2019, we have owned a 40% equity interest in Centercom Global, S.A. de C.V. (“Centercom”). Centercom is a bilingual operations

center providing the Company with sales support, customer service, IT infrastructure design, graphic media, database programming, software

development, revenue assurance, lead generation, and other various operational back-office services. Centercom is based in El Salvador.

Competition

There

are many competitors in the prepaid wireless and mobile broadband industry. We feel what makes SurgePhone different is we are a grassroots

company with our products placed in convenience stores where the underbanked shop. We can offer prepaid wireless and financial services,

through these stores, at a lower price to customers since we own the transaction software processing the activations and top-ups.

Many

of our current and potential competitors are well established and have longer operating histories, significantly greater financial and

operational resources, and name recognition than we have. Most traditional convenience store distributors are companies that have been

in business for over 50 years and utilize the historical “manufacturing plant to truck to warehouse to truck to store” logistics

model. However, we believe that with our diverse product line, better efficiencies resulting in lower wholesale cost of goods sold, we

have the ability to obtain a large market share and continue to generate sales growth and compete in the industry. We believe, in some

cases, we will be able to partner with our competition through integration and compensate them for helping us grow due to the uniqueness

of the suite of products we offer and the additional revenue stores can unlock. The principal competitive factors in all our product

markets are technical features, quality, availability, price, customer support, and distribution coverage. The relative importance of

each of these factors varies depending on the region. We believe using our direct store distribution model nationwide will open significant

opportunities for growth.

The

markets in which we operate can be generally categorized as highly competitive. In order to maximize our competitive advantages, we continue

to expand our product portfolio to capitalize on market trends, changes in technology and new product releases. Based on available data

for our served markets, we estimate that our market share of the convenience store sales business at this time is less than 1%. A substantial

acquisition would be necessary to meaningfully and rapidly change our market share percentage.

Distributors

generally do not have a broad set of product and service offerings or capabilities, and no single distributor currently provides all

the top selling consumables while offering products and services to enhance the lifestyle of the underbanked such as prepaid wireless,

gift cards, bill payment and reloadable debit cards. We believe this creates a significant opportunity for a dynamic paradigm shift to

a nationwide wholesale e-commerce platform.

Recent

Developments

Clearline

Asset Acquisition

On

January 5, 2024, the Company closed an asset purchase agreement to acquire ClearLine Mobile, Inc’s. (“ClearLine Mobile”)

software development and point-of-sale equipment and operations. The consideration to be paid by the Company for Clearline Mobile’s

assets consisted of an upfront payment of $100,000 at the signing of the Purchase Agreement, a payment at closing of the Purchase Agreement

of $800,000, a payment due 90 days after the closing of an additional $800,000, and a final payment due 180 days after the closing of

an additional $800,000, for a total consideration of $2,500,000.

Corporate

Information

Our

executive offices are located at 3124 Brother Blvd, Suite 410, Bartlett, TN 38133, and our telephone number is (800) 760-9689. Our website

is www.surgepays.com. Our website and the information contained in, or accessible through, our website will not be deemed to be incorporated

by reference into this prospectus and does not constitute part of this prospectus.

THE

OFFERING

The

following summary contains basic information about this offering. The summary is not intended to be complete. You should read the full

text and more specific details contained elsewhere in this prospectus supplement.

| Issuer |

|

SurgePays,

Inc. |

| |

|

|

| Common

stock outstanding prior to the Offering |

|

14,263,702 |

| |

|

|

| Common

stock offered by us |

|

2,678,571

shares at a purchase price of $5.60 per share. |

| |

|

|

| Over-allotment

option |

|

We

have granted to the underwriters the option, exercisable for 45 days from the date of this prospectus supplement, to purchase up

to 401,785 additional shares of common stock to cover over-allotments, if any. |

| |

|

|

Common

stock to be outstanding after

this

offering (1) |

|

16,942,273

shares. If the underwriters’ over-allotment option is exercised

in full, the total number of shares of common stock outstanding immediately after this offering would be 17,344,058 shares. |

| |

|

|

| NASDAQ

common stock symbol |

|

“SURG” |

| |

|

|

| Use

of proceeds |

|

We

intend to use the net proceeds from this offering for payment of the remaining balance for the acquisition of Clearline Mobile,

repayment of the notes held by our chief executive officer and for working capital and general corporate purposes. Please see

“Use of Proceeds.” |

| |

|

|

| Risk

factors |

|

This

investment involves a high degree of risk. Please see “Risk Factors” and other information included or incorporated

by reference in this prospectus supplement and the accompanying prospectus for a discussion of certain factors you should carefully

consider before deciding to invest in shares of our common stock. |

| (1) |

The

number of shares outstanding after this offering is based on 14,263,702 shares of common stock outstanding on January 17,

2024. The number of shares of common stock to be outstanding after this offering assumes no exercise of the underwriter’s over-allotment

option to purchase additional shares of common stock and excludes the following as of January 17, 2024: |

| |

● |

5,573,753

shares issuable upon the exercise of outstanding warrants with a weighted average exercise price of $5.62 per share; |

| |

● |

126,377

shares issuable upon the exercise of outstanding options with a weighted average exercise price of $9.73 per share; and |

| |

● |

3,342,895

shares reserved for future issuances under our equity incentive plans. |

RISK

FACTORS

An

investment in our common stock involves a significant degree of risk. Before you invest in our common stock, you should carefully consider

the risk factors included in, or incorporated by reference into, this prospectus supplement and the accompanying prospectus, as updated

by our subsequent filings under the Exchange Act, together with all of the other information included in this prospectus, any prospectus

supplement and the documents we incorporate by reference, in evaluating an investment in our common stock. Any of these risks and uncertainties

could have a material adverse effect on our business, financial condition, cash flows and results of operations. If that occurs, the

trading price of our common stock could decline materially and you could lose all or part of your investment. The risks described in

this prospectus supplement and the accompanying prospectus are not the only risks we face. Additional risks and uncertainties not currently

known to us or that we currently deem to be immaterial also may materially and adversely affect our business, financial condition and/or

operating results. Past financial and operational performance may not be a reliable indicator of future performance and historical trends

should not be used to anticipate results or trends in future periods. Please also read carefully the section above entitled “Cautionary

Statement Regarding Forward-Looking Information”.

RISKS

RELATED TO OUR BUSINESS

The

United States Government’s dissolution or reduction of the Affordable Connectivity Program (“ACP”) could have a substantial

adverse effect on our current and planned business operations.

We

currently derive a substantial amount of our revenue from reimbursement payments under the ACP. While the White House and

FCC strongly support the program and additionally, the program garners bipartisan support in the United State Congress,

as displayed recently in a bipartisan funding legislation, without action, the program might expire in May 2024. As of the date hereof,

there is no guarantee that the United States Government will renew the ACP or for how long. If the renewal of the program is delayed,

or if the ACP is allowed to expire, it is a possibility that Federal or state governmental agencies could also reduce or delay reimbursement

payments, forcing carriers to continue to provide minimum services and at a reduced reimbursement rate, which may have a material adverse

effect on our business, financial condition, and operating results.

RISKS

RELATED TO THIS OFFERING

We

have broad discretion in determining how to use the proceeds from this offering and we cannot assure you that we will be successful in

spending the proceeds in ways that increase our profitability or market value, or otherwise yield favorable returns.

We

plan to utilize net proceeds of this offering for payment of the remaining balance for the acquisition of Clearline Mobile, repayment

of the notes held by our chief executive officer and for working capital and general corporate purposes. Nevertheless, we will have

broad discretion in determining specific expenditures. You will be entrusting your funds to our management, upon whose judgment you must

depend, with limited information concerning the purposes to which the funds will ultimately be applied. We may not be successful in spending

the proceeds of this offering in ways which increase our profitability or market value, or otherwise yield favorable returns.

If

you purchase shares of our common stock sold in this offering, you will experience immediate and substantial dilution in the net tangible

book value of your shares. In addition, we may issue additional shares of common stock in the future which may result in additional dilution

to common stockholders.

After

giving effect to the sale of shares of our common stock in this offering at a price of $5.60 per share for aggregate gross proceeds

to us of approximately $15,000,000, and after deducting commissions and estimated offering expenses payable by us, but giving

no effect to the exercise of the over-allotment option, purchasers of our common stock in this offering will incur immediate dilution

of $3.52 per share of common stock in the as adjusted net tangible book value of the common stock they acquire. For a more detailed

discussion of the foregoing, please see the section entitled “Dilution” below. To the extent outstanding stock options

or warrants are exercised, there will be further dilution to new investors.

Future

issuances or sales, or the potential for future issuances or sales, of our common stock may cause the trading price of our securities

to decline and could impair our ability to raise capital through subsequent equity offerings.

In

order to raise additional capital, we may in the future offer and issue additional shares of our common stock or other securities convertible

into or exchangeable for our common stock. We cannot assure you that we will be able to sell shares or other securities in any offering

at a price per share that is equal to or greater than the price per share paid by investors in previous offerings, and investors purchasing

shares or other securities in the future could have rights superior to existing stockholders. The price per share at which we sell additional

shares of our common stock or other securities convertible into or exchangeable for our common stock in future transactions may be higher

or lower than the price per share in previous offerings. Further, we may choose to raise additional capital due to market conditions

or strategic considerations, even if we believe we have sufficient funds for our current or future operating plans. In addition, the

exercise of outstanding stock options and warrants or the settlement of outstanding restricted stock units would result in further dilution

of your investment.

Because

we do not currently intend to declare cash dividends on our shares of common stock in the foreseeable future, stockholders must rely

on appreciation of the value of our common stock for any return on their investment.

We

have never paid cash dividends on our common stock. We currently intend to retain any future earnings to fund the development and growth

of our business. Additionally, our ability to pay dividends is limited by restrictions on our ability to pay dividends and make certain

other restricted payments under the terms of our term loan. Accordingly, while payment of dividends rests within the discretion of our

board of directors, no cash dividends on our common shares have been declared or paid by us and we have no intention of paying any such

dividends in the foreseeable future. Any return to investors is expected to come, if at all, only from potential increases in the price

of our common stock.

USE

OF PROCEEDS

We

estimate that the net proceeds of this offering, after deducting estimated underwriting discounts and commissions and estimated offering

expenses, will be approximately $13,730,000 million (or approximately $15,882,500 if the underwriters exercise in full

the over-allotment option to purchase up to additional shares). We will have broad discretion in the use of the net proceeds from the

sale of the shares of common stock offered under this prospectus supplement. We presently intend to use the net proceeds from the sale

of our shares of common stock for payment of the remaining balance for the acquisition of Clearline Mobile, repayment of the notes held

by our chief executive officer and for working capital and general corporate purposes. In addition, we may pursue selective mergers and

acquisitions in the future that we believe are accretive to the business, although no such acquisitions have been identified as of the

date of this Prospectus Supplement. We reserve the right, however, to use the net proceeds from this offering for any proper corporate

purpose as determined by our board of directors.

Pending

our use of the net proceeds from this offering, we intend to invest the net proceeds in a variety of capital preservation investments,

including short-term, investment grade, interest bearing instruments and U.S. government securities.

CAPITALIZATION

The

following table sets forth our cash and cash equivalents and capitalization as of September 30, 2023:

| |

● |

on

an actual basis; |

| |

● |

on

an as adjusted basis to give effect to the sale of shares of common stock in this offering at the public offering price of $5.60

per share, after deducting underwriting discounts and commissions and other estimated offering expenses payable by us, but giving

no effect to the exercise of the over-allotment option |

This

capitalization table should be read in conjunction with Management’s Discussion and Analysis of Financial Condition and Results

of Operations and our consolidated financial statements and related notes included in our Quarterly Report on Form 10-Q for the quarterly

period ended September 30, 2023 and other financial information included and incorporated by reference in this prospectus supplement.

| | |

Actual (unaudited) | | |

As

Adjusted (unaudited) | |

| | |

| | |

| |

| Cash and cash equivalents | |

$ | 12,731,449 | | |

$ | 26,461,447 | |

| | |

| | | |

| | |

| Total Long-Term Debt | |

$ | 4,543,418 | | |

$ | 4,543,418 | |

| Common stock, authorized 500,000,000 shares, $0.001 par value; 14,343,261

shares, 1,349,169 shares and shares, issued and outstanding, actual and

as adjusted as of September 30, 2023 | |

$ | 14,344 | | |

$ | 17,023 | |

| Additional paid-in capital | |

$ | 41,889,886 | | |

$ | 56,887,205 | |

| Accumulated deficit | |

| (18,207,472 | ) | |

| (18,207,472 | ) |

| Total shareholders’ equity | |

$ | 23,696,758 | | |

$ | 38,696,756 | |

| Total capitalization | |

$ | 28,240,176 | | |

$ | 43,240,174 | |

Unless

otherwise indicated, the above table assumes no exercise of the underwriters’ over-allotment option and the number of shares of

our common stock to be outstanding immediately after this offering is based on 14,343,261 shares of our common stock outstanding as of

September 30, 2023, but excludes the following as of such date:

| |

● |

5,573,753

shares issuable upon the exercise of outstanding warrants with a weighted average exercise price of $5.62 per share; |

| |

● |

126,377

shares issuable upon the exercise of outstanding options with a weighted average exercise price of $9.73 per share; and |

| |

● |

3,447,167

shares reserved for future issuance under our equity incentive plans. |

DIVIDEND

POLICY

We

have not declared or paid any cash dividends on our common stock, and we do not anticipate declaring or paying cash dividends for the

foreseeable future. We are not subject to any legal restrictions respecting the payment of dividends, except that we may not pay dividends

if the payment would render us insolvent. Any future determination as to the payment of cash dividends on our common stock will be at

the discretion of our board of directors and will depend on our financial condition, operating results, capital requirements and other

factors that the board of directors considers to be relevant.

DILUTION

A

purchaser of shares of our common stock in this offering will be diluted immediately to the extent of the difference between the public

offering price per share and the as adjusted net book value per share of our common stock upon the closing of this offering. Our historical

net tangible book value per share of common stock as of September 30, 2023, was $21,553,655, or approximately $1.51 per share of outstanding

common stock, based on 14,343,261 shares of common stock outstanding as of September 30, 2023. Net tangible book value per share of our

common stock is determined at any date by subtracting total liabilities from the amount of total tangible assets, and dividing this amount

by the number of shares of common stock deemed to be outstanding as of that date.

After

giving effect to the sale of shares of our common stock at the public offering price of $5.60 per share in this offering, but

giving no effect to the possible exercise of the over-allotment option, our as adjusted net tangible book value of our common stock as

of September 30, 2023 would have been approximately $35,283,653, or approximately $2.08 per share of outstanding common

stock. This amount represents an immediate increase in net tangible book value of $0.57 per share of our common stock to our existing

common stockholders and an immediate dilution of $3.52 per share of our common stock to new investors purchasing common stock

in this offering, as illustrated in the following table:

| Public offering price per share | |

| | | |

$ | 5.60 | |

| Net tangible book value

per share of common stock before this offering as of September 30, 2023 | |

$ | 1.51 | | |

| | |

| Increase in net tangible

book value per share of common stock attributable to this offering | |

$ | 0.57 | | |

| | |

| As adjusted net tangible book value per

share of common stock after giving effect to this offering | |

| | | |

$ | 2.08 | |

| Dilution per share

of common stock to new investors in this offering | |

| | | |

$ | 3.52 | |

The

foregoing table does not take into account further dilution to new investors that could occur upon the exercise of outstanding options

or warrants having a per share exercise price less than the share per common stock offering price to the public in this offering.

The

foregoing table assumes no exercise of the underwriters’ over-allotment option and excludes the following as of September 30, 2023:

| |

● |

5,573,753

shares issuable upon the exercise of outstanding warrants with a weighted average exercise price of $5.62 per share; |

| |

● |

126,377

shares issuable upon the exercise of outstanding options with a weighted average exercise price of $9.73 per share; and |

| |

● |

3,447,167

shares reserved for future issuance under our equity incentive plans. |

DESCRIPTION

OF SECURITIES WE ARE OFFERING

A

description of the common stock we are offering pursuant to this prospectus supplement is set forth under the heading “Description

of Capital Stock,” starting on page 5 of the accompanying prospectus. As of January 12, 2024, we had 14,263,702 shares of common

stock outstanding.

UNDERWRITING

We

intend to enter into an underwriting agreement with Titan Partners Group LLC, a division of American Capital Partners, LLC (the “Underwriter”),

with respect to the securities subject to this offering. Subject to certain conditions, we have agreed to sell to the Underwriter such

securities listed next to its name in the below table at the public offering price less the underwriting discounts and commissions set

forth on the cover page of this prospectus.

| Underwriter | |

Number

of Shares of Common

Stock | |

| Titan Partners

Group LLC, a division of American Capital Partners, LLC | |

| 2,678,571 | |

| | |

| | |

| Total | |

| 2,678,571 | |

The

underwriting agreement will provide that the obligations of the Underwriter to pay for and accept delivery of the securities offered

by this prospectus are subject to the approval of certain legal matters by its legal counsel and certain other conditions. The Underwriter

is obligated to take and pay for all of the securities if any of the securities are taken. The Underwriter is not, however, required

to take or pay for securities covered by the over-allotment option described below.

Over-Allotment

Option

We

have granted to the Underwriter an option, exercisable no later than 45 calendar days after the date of the closing of this offering,

to purchase up to an additional 401,785 shares of Common Stock (15% of shares sold in this Offering).

Discounts

and Commissions

The

following table summarizes the underwriting discounts and commissions and proceeds, before expenses, to us assuming both no exercise

and full exercise by the Underwriter of the over-allotment option:

| | |

Per

Share | | |

Total

Without Over-Allotment Option | | |

Total

With Over-Allotment Option | |

| Public offering price | |

$ | 5.60 | | |

$ | 14,999,997.60 | | |

$ | 17,249,993.60 | |

| Underwriting discounts and

commissions (7.0%) | |

$ | 0.392 | | |

$ | 1,049,999.83 | | |

$ | 1,207,499.55 | |

| Proceeds to us, before fees

and expenses | |

$ | 5.208 | | |

$ | 13,949,997.77 | | |

$ | 16,042,494.05 | |

We

have also agreed to indemnify the underwriters against certain liabilities, including civil liabilities under the Securities Act or to

contribute to payments that the underwriters may be required to make in respect of those liabilities.

We

will be also responsible for and will pay all expenses relating to the offering, including, without limitation, (1) any filing fees relating

to the registration of the Securities to be sold in the Offering with the Securities and Exchange Commission (the “Commission”);

(2) any filing fees associated with the review of an Offering by FINRA; (3) all fees and expenses relating to the listing of the Securities

on any U.S. national exchange (the “Exchanges”); (4) all fees, expenses and disbursements relating to the registration, qualification

or exemption of the Securities under the securities or “blue sky” laws of such U. S. states and foreign jurisdictions as

the Company and the Underwriter together determine; (5) the costs of all mailing and printing of the offering documents, including, without

limitation, any underwriting or placement agent agreement, any agreement among underwriters, any selected dealers’ agreement, any

underwriter’s questionnaire, custody agreement and power of attorney relating to any selling stockholders, any registration statement,

prospectus, prospectus supplement, private placement memorandum or similar information document, and all amendments, supplements and

exhibits thereto, all in as many copies as the Underwriter may reasonably deem necessary; (6) the costs of preparing, printing and delivering

certificates representing the Securities; (7) the costs for “tombstones” and/or other commemorative items, (8) fees and expenses,

if any, of the transfer agent for the Securities and of any escrow agent appointed to hold investor’s funds in connection with

the Offering, (9) stock transfer and/or stamp taxes, if any, payable upon the transfer of the Securities from the Company to the Representative

or the purchasers thereof; (10) the fees and expenses of the Company’s legal counsel and other agents and representatives; and

(11) the reasonable and documented fees and expenses of Underwriter’s legal counsel and other fees incurred by the Representative

not to exceed $60,000. The Company has paid to the Representative an advance in the amount of $25,000.

We

estimate the total expenses payable by us for this offering to be approximately $1,270,000, which amount includes (i) the underwriting

discount of approximately $1,050,000, (ii) reimbursement of the accountable expenses of $60,000 and (iii) other

estimated Company expenses of approximately $160,000, which includes legal, accounting, printing costs and various fees associated

with the registration of our securities.

Determination

of Offering Price

Prior

to this offering, there has only been a limited public market for our Common Stock. The public offering price of the shares of Common

Stock in this Offering will be determined by negotiation between us and the Underwriter. The principal factors considered in determining

the public offering price of the Common Stock included:

| |

● |

the

information in this prospectus and otherwise available to the underwriters, including our financial information; |

| |

● |

the

history and the prospects for the industry in which we compete; |

| |

● |

the

ability of our management; |

| |

● |

the

prospects for our future earnings; |

| |

● |

the

present state of our development and our current financial condition; |

| |

● |

the

general condition of the economy and the securities markets in the United States at the time of this offering; |

| |

● |

the

recent market prices of, and the demand for, publicly traded securities of generally comparable companies; and |

| |

● |

other

factors as were deemed relevant. |

We

cannot assure you that the public offering price will correspond to the price at which the shares will trade in the public market following

this offering or that an active trading market for the shares will develop or continue after this offering.

Lock-Up

Agreements

Our

officers and directors have agreed to enter into customary “lock-up” agreements in favor of the Representative pursuant to

which such persons and entities agreed for a period starting from the date of this Prospectus Supplement and continuing until ninety

(90) days after the date of the Final Prospectus Supplement, that they shall neither offer, issue, sell, contract to sell, encumber,

grant any option for the sale of or otherwise dispose of any securities of the Company without the prior written consent of the Representative,

subject to certain exceptions.

Company

Standstill

The

Company has agreed that, for a period of ninety (90) days from the date of the underwriting agreement, without the prior written consent

of the Underwriter, subject to certain exceptions, it will not (a) offer, pledge, sell, contract to sell, sell any option or contract

to purchase, purchase any option or contract to sell, grant any option, right or warrant to purchase, lend, or otherwise transfer or

dispose of, directly or indirectly, any shares of capital stock of the Company or any securities convertible into or exercisable or exchangeable

for shares of capital stock of the Company; (b) file or cause to be filed any registration statement with the Commission relating to

the offering of any shares of capital stock of the Company or any securities convertible into or exercisable or exchangeable for shares

of capital stock of the Company other than on a registration statement on Form S-8; or (c) complete any offering of debt securities of

the Company, other than entering into a line of credit with a traditional bank or (d) enter into any swap or other arrangement that transfers

to another, in whole or in part, any of the economic consequences of ownership of capital stock of the Company, whether any such transaction

described in clause (a), (b), (c) or (d) above is to be settled by delivery of shares of capital stock of the Company or such other securities,

in cash or otherwise.

Price

Stabilization, Short Positions and Penalty Bids

In

connection with this offering, the Underwriter may engage in transactions that stabilize, maintain or otherwise affect the price of our

Common Stock. Specifically, the Underwriter may over-allot in connection with this offering by selling more shares of Common Stock than

are set forth on the cover page of this prospectus. This creates a short position in our Common Stock for its own account. The short

position may be either a covered short position or a naked short position. In a covered short position, the number of shares of Common

Stock over-allotted by the Underwriter is not greater than the number of shares of our Common Stock that they may purchase in the over-allotment

option. In a naked short position, the number of shares of our Common Stock involved is greater than the number of shares of Common Stock

in the over-allotment option. To close out a short position, the Underwriter may elect to exercise all or part of the over-allotment

option. The Underwriter may also elect to stabilize the price of our Common Stock or reduce any short position by bidding for, and purchasing,

our Common Stock in the open market.

The

Underwriter may also impose a penalty bid. This occurs when a particular underwriter or dealer repays selling concessions allowed to

it for distributing a security in this offering because the underwriter repurchases that security in stabilizing or short covering transactions.

Finally,

the Underwriter may bid for, and purchase, shares of our Common Stock in market making transactions, including “passive”

market making transactions as described below.

These

activities may stabilize or maintain the market price of our Common Stock at a price that is higher than the price that might otherwise

exist in the absence of these activities. The Underwriter is not required to engage in these activities and may discontinue any of these

activities at any time without notice.

In

connection with this offering, the Underwriter and selling group members, if any, or their affiliates may engage in passive market making

transactions in our Common Stock immediately prior to the commencement of sales in this offering, in accordance with Rule 103 of Regulation

M under the Exchange Act. Rule 103 generally provides that:

| |

● |

a

passive market maker may not effect transactions or display bids for our Common Stock in excess of the highest independent bid price

by persons who are not passive market makers; |

| |

● |

net

purchases by a passive market maker on each day are generally limited to 30% of the passive market maker’s average daily trading

volume in our Common Stock during a specified two-month prior period or 200 shares, whichever is greater, and must be discontinued

when that limit is reached; and |

| |

● |

passive

market making bids must be identified as such. |

Electronic

Distribution

A

prospectus in electronic format may be made available on a website maintained by the Underwriter. The Underwriter may agree to allocate

a number of shares to underwriters for sale to their online brokerage account holders. Internet distributions will be allocated by the

Underwriter to underwriters that may make internet distributions on the same basis as other allocations. In connection with the offering,

the Underwriter or syndicate members may distribute prospectuses electronically. No forms of electronic prospectus other than prospectuses

that are printable as Adobe® PDF will be used in connection with this offering.

Other

than the prospectus in electronic format, the information on any underwriter’s website and any information contained in any other

website maintained by an underwriter is not part of the prospectus or the registration statement of which this prospectus forms a part,

has not been approved and/or endorsed by us or any underwriter in its capacity as underwriter and should not be relied upon by investors.

Affiliations

The

Underwriter and its affiliates may provide, from time to time, investment banking and financial advisory services to us in the ordinary

course of business, for which they may receive customary fees and commissions.

Foreign

Regulatory Restrictions on Purchase of our Shares

We

have not taken any action to permit a public offering of our shares outside the United States or to permit the possession or distribution

of this prospectus outside the United States. People outside the United States who come into possession of this prospectus must inform

themselves about and observe any restrictions relating to this offering of our shares and the distribution of this prospectus outside

the United States.

Indemnification

We

have agreed to indemnify the Underwriter against liabilities relating to the offering arising under the Securities Act and the Exchange

Act and to contribute to payments that the Underwriter may be required to make for these liabilities.

LEGAL

MATTERS

Unless

otherwise indicated in the applicable prospectus supplement, the validity of the securities offered by this prospectus will be passed

upon for us by Ellenoff Grossman & Schole LLP, New York, New York. Sichenzia Ross Ference Carmel LLP, New York, New York, is representing

the underwriters.

EXPERTS

Our

consolidated balance sheets as of December 31, 2022 and 2021 and the related consolidated statements of operations, stockholders’

equity (deficit), and cash flows for each of those two years and incorporated by reference in the registration statement of which this

prospectus supplement is a part have been audited by Rodefer Moss & Co, PLLC, independent registered public accounting firm, as indicated

in their report with respect thereto, and have been so included in reliance upon the report of such firm given on their authority as

experts in accounting and auditing.

WHERE

YOU CAN FIND MORE INFORMATION

We

file annual, quarterly and other reports, proxy statements and other information with the SEC. The SEC maintains a website at www.sec.gov

that contains reports, proxy and information statements, and other information regarding issuers such as our company that file electronically

with the SEC.

Our

corporate website address is www.surgepays.com. We make available free of charge, through the Investor section of our website,

annual reports on Form 10-K, quarterly reports on Form 10-Q and current reports on Form 8-K and amendments to those reports filed or

furnished pursuant to Section 13(a) or 15(d) of the Exchange Act as soon as reasonably practicable after we electronically file such

material with, or furnish it to, the SEC.

INFORMATION

INCORPORATED BY REFERENCE

The

SEC allows us to incorporate by reference the information we file with them, which means that we can disclose important information to

you by referring you to those documents. The information incorporated by reference is considered to be part of this prospectus supplement,

and later information filed with the Securities and Exchange Commission will update and supersede this information. We incorporate by

reference the documents listed below that we have previously filed with the SEC, except that information furnished under Item 2.02 or

Item 7.01 of our Current Reports on Form 8-K or any other filing where we indicate that such information is being furnished and not filed

under the Exchange Act, is not deemed to be filed and not incorporated by reference herein:

| |

● |

our

Annual Report on Form 10-K for the year ended December 31, 2022 as filed with the SEC on March 30, 2023; |

| |

|

|

| |

● |

our

Quarterly Reports on Form 10-Q for the periods ended March 31, 2023, June 30, 2023, and September 30, 2023, as filed on May 11, 2023,

August 10, 2023, and November 14, 2023, respectively; |

| |

|

|

| |

● |

our

Current Reports on Form 8-K as filed with the SEC on January 11, 2023, March 13, 2023, October 4, 2023, October 18, 2023, January 3, 2024, January 9, 2024 and January 12, 2024; |

| |

|

|

| |

● |

our

definitive proxy statement on Schedule 14A as filed with the SEC on August 15, 2023; and |

| |

|

|

| |

● |

The

description of our common stock, par value $0.001 per share (the “Common Stock”) and warrants with an exercise price

of $4.73 (the “Tradeable Warrants”) contained in our Registration Statement on Form 8-A, filed with the SEC on November

1, 2021, as updated by “Description of the Registrant’s Securities Registered Pursuant to Section 12 of the Securities

Exchange Act of 1934” filed as Exhibit 4.4 to our Annual Report on Form 10-K for the fiscal year ended December 31, 2021, and

any amendment or report filed for the purpose of updating such description. |

We

also incorporate by reference into this prospectus supplement additional documents that we may file with the SEC under Sections 13(a),

13(c), 14 or 15(d) of the Exchange Act prior to the completion or termination of the offering, including all such documents we may file

with the SEC after the date of the initial registration statement and prior to the effectiveness of the registration statement, but excluding

any information deemed furnished and not filed with the SEC. Any statements contained in a previously filed document incorporated by

reference into this prospectus supplement is deemed to be modified or superseded for purposes of this prospectus supplement to the extent

that a statement contained in this prospectus supplement, or in a subsequently filed document also incorporated by reference herein,

modifies or supersedes that statement.

This

prospectus supplement may contain information that updates, modifies or is contrary to information in one or more of the documents incorporated

by reference in this prospectus supplement. You should rely only on the information incorporated by reference or provided in this prospectus

supplement. We have not authorized anyone else to provide you with different information. You should not assume that the information

in this prospectus supplement is accurate as of any date other than the date of this prospectus supplement or the date of the documents

incorporated by reference in this prospectus supplement.

We

will provide to each person, including any beneficial owner, to whom this prospectus supplement is delivered, upon written or oral request,

at no cost to the requester, a copy of any and all of the information that is incorporated by reference in this prospectus supplement.

You may request a copy of these filings, at no cost to you, by telephoning us or by writing us at the following address:

3124

Brother Blvd, Suite 410

Bartlett,

TN 38133

Telephone:

901-302-9587

You

may also access the documents incorporated by reference in this prospectus supplement through our website at www.surgepays.com. The reference

to our website is an inactive textual reference only and, except for the specific incorporated documents listed above, no information

available on or through our website shall be deemed to be incorporated in this prospectus supplement, the accompanying prospectus or

the registration statement of which it forms a part.

PROSPECTUS

SURGEPAYS,

INC.

$100,000,000

Common

Stock

Preferred

Stock

Debt

Securities

Warrants

Rights

Units

We

may offer and sell up to $100 million in the aggregate of the securities identified above from time to time in one or more offerings.

This prospectus provides you with a general description of the securities.

Each

time we offer and sell securities, we will provide a supplement to this prospectus that contains specific information about the offering

and the amounts, prices and terms of the securities. The supplement may also add, update or change information contained in this prospectus

with respect to that offering. You should carefully read this prospectus and the applicable prospectus supplement before you invest in

any of our securities.

We

may offer and sell the securities described in this prospectus and any prospectus supplement to or through one or more underwriters,

dealers and agents, or directly to purchasers, or through a combination of these methods. If any underwriters, dealers or agents are

involved in the sale of any of the securities, their names and any applicable purchase price, fee, commission or discount arrangement

between or among them will be set forth, or will be calculable from the information set forth, in the applicable prospectus supplement.

See the sections of this prospectus entitled “About this Prospectus” and “Plan of Distribution” for more information.

No securities may be sold without delivery of this prospectus and the applicable prospectus supplement describing the method and terms

of the offering of such securities.

INVESTING

IN OUR SECURITIES INVOLVES RISKS. SEE THE “RISK FACTORS” ON PAGE 5 and the risk factors in our most recent

Annual Report on Form 10-K, which is incorporated by reference herein, as well as in any other recently filed quarterly or current reports

and, if any, in the relevant prospectus supplement. We urge you to carefully read this prospectus and the accompanying prospectus

supplement, together with the documents we incorporate by reference, describing the terms of these securities before investing.

The

aggregate market value of our outstanding common stock held by non-affiliates is $44,633,252 based on 14,228,202 shares of outstanding

common stock, of which 5,661,359 are held by affiliates, and a per share price of $5.21 based on the closing sale price of our

common stock on August 30, 2023. Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell our common stock in a

public primary offering with a value exceeding more than one-third of our public float in any 12-month period so long as our public float

remains below $75,000,000. We have not offered any securities pursuant to General Instruction I.B.6. of Form S-3 during the prior 12

calendar month period that ends on and includes the date of this prospectus.

Our

common stock and warrants are listed on the Nasdaq Capital Market under the symbols “SURG” and “SURGW”.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed

upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The

date of this prospectus is October 23, 2023.

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement on Form S-3 that we filed with the U.S. Securities and Exchange Commission, or

the SEC, using a “shelf” registration process. By using a shelf registration statement, we may sell securities from time

to time and in one or more offerings up to a total dollar amount of $100 million as described in this prospectus. Each time that we offer

and sell securities, we will provide a prospectus supplement to this prospectus that contains specific information about the securities

being offered and sold and the specific terms of that offering. The prospectus supplement may also add, update or change information

contained in this prospectus with respect to that offering. If there is any inconsistency between the information in this prospectus

and the applicable prospectus supplement, you should rely on the prospectus supplement. Before purchasing any securities, you should

carefully read both this prospectus and the applicable prospectus supplement, together with the additional information described under

the heading “Where You Can Find More Information; Incorporation by Reference.”

We

have not authorized any other person to provide you with different information. If anyone provides you with different or inconsistent

information, you should not rely on it. We will not make an offer to sell these securities in any jurisdiction where the offer or sale

is not permitted. You should assume that the information appearing in this prospectus and the applicable prospectus supplement to this

prospectus is accurate as of the date on its respective cover, and that any information incorporated by reference is accurate only as

of the date of the document incorporated by reference, unless we indicate otherwise. Our business, financial condition, results of operations

and prospects may have changed since those dates.

When

we refer to “SurgePays,” “we,” “our,” “us” and the “Company” in this prospectus,

we mean SurgePays, Inc., unless otherwise specified. When we refer to “you,” we mean the holders of the applicable series

of securities.

WHERE

YOU CAN FIND MORE INFORMATION; INCORPORATION BY REFERENCE

Available

Information

We file annual,

quarter and periodic reports, proxy statements and other information with the SEC using the SEC’s EDGAR system. The

SEC maintains a web site that contains reports, proxy and information statements and other information about issuers, such as us, who

file electronically with the SEC. The address of that website is http://www.sec.gov.

Our

website address is https://surgepays.com. The information on our website, however, is not, and should not be deemed to be, a part of

this prospectus.

This

prospectus and any prospectus supplement are part of a registration statement that we filed with the SEC and do not contain all of the

information in the registration statement. The full registration statement may be obtained from the SEC or us, as provided below. Forms

of the documents establishing the terms of the offered securities are or may be filed as exhibits to the registration statement. Statements

in this prospectus or any prospectus supplement about these documents are summaries and each statement is qualified in all respects by

reference to the document to which it refers. You should refer to the actual documents for a more complete description of the relevant

matters. You may inspect a copy of the registration statement through the SEC’s website, as provided above.

Incorporation

by Reference

We

are “incorporating by reference” in this prospectus certain documents we file with the SEC, which means that we can disclose

important information to you by referring you to those documents. The information in the documents incorporated by reference is

considered to be part of this prospectus. Statements contained in documents that we file with the SEC and that are incorporated by reference

in this prospectus will automatically update and supersede information contained in this prospectus, including information in previously

filed documents or reports that have been incorporated by reference in this prospectus, to the extent the new information differs from

or is inconsistent with the old information. We have filed or may file the following documents with the SEC and they are incorporated

herein by reference as of their respective dates of filing.

| ● |

Our

Annual Report on Form 10-K for the year ended December 31, 2022, filed with the SEC on March 30, 2023; |

| |

|

| ● |

Our

Quarterly Report on Form 10-Q for the period ended March 31, 2023, filed with the SEC on

May 11, 2023

|

| |

|

| ● |

Our Quarterly Report on Form 10-Q

for the period ended June 30, 2023, filed with the SEC on August 10, 2023; |

| |

|

| ● |

Our

Current Reports on Form 8-K filed with the SEC on January

11, 2023, March

13, 2023 and October 4, 2023; and |

| |

|

| ● |

The

description of our common stock, par value $0.001 per share (the “Common Stock”) and warrants with an exercise price

of $4.73 (the “Tradeable Warrants”) contained in our Registration Statement on Form 8-A, filed with the SEC on November

1, 2021, as updated by “Description of the Registrant’s Securities Registered Pursuant to Section 12 of the Securities

Exchange Act of 1934” filed as Exhibit 4.4 to our Annual Report on Form 10-K for the fiscal year ended December 31, 2021, and

any amendment or report filed for the purpose of updating such description. |

All documents that we

filed with the SEC pursuant to Sections 13(a), 13(c), 14, and 15(d) of the Exchange Act subsequent to the date of this registration statement

and prior to the filing of a post-effective amendment to this registration statement that indicates that all securities offered under

this prospectus have been sold, or that deregisters all securities then remaining unsold, will be deemed to be incorporated in this registration

statement by reference and to be a part hereof from the date of filing of such documents.

Any statement contained

in a document incorporated or deemed to be incorporated by reference in this prospectus shall be deemed modified, superseded or replaced

for purposes of this prospectus to the extent that a statement contained in this prospectus, or in any subsequently filed document that

also is deemed to be incorporated by reference in this prospectus, modifies, supersedes or replaces such statement. Any statement so

modified, superseded or replaced shall not be deemed, except as so modified, superseded or replaced, to constitute a part of this prospectus.

None of the information that we disclose under Items 2.02 or 7.01 of any Current Report on Form 8-K or any corresponding information,

either furnished under Item 9.01 or included as an exhibit therein, that we may from time to time furnish to the SEC will be incorporated

by reference into, or otherwise included in, this prospectus, except as otherwise expressly set forth in the relevant document. Subject

to the foregoing, all information appearing in this prospectus is qualified in its entirety by the information appearing in the documents

incorporated by reference.

You

may request a free copy of any of the documents incorporated by reference in this prospectus (other than exhibits, unless they are specifically

incorporated by reference in the documents) by writing or telephoning us at the following address:

3124

Brother Blvd, Suite 410

Bartlett,

TN 38133

Telephone:

901-302-9587

Exhibits

to the filings will not be sent, however, unless those exhibits have specifically been incorporated by reference in this prospectus and

any accompanying prospectus supplement and the information in our website is not a part of this prospectus and is not incorporated

by reference.

THE

COMPANY

Business

Overview

SurgePays,

Inc., incorporated in Nevada on August 18, 2006, is a technology and telecom company focused on the underbanked and underserved

communities. SurgePhone and Torch Wireless provide subsidized mobile broadband to over 250,000 low-income subscribers nationwide. SurgePays

fintech platform empowers clerks at thousands of convenience stores to provide a suite of prepaid wireless and financial products to

underbanked customers.

About

SurgePays, Inc.

SurgePays,

Inc. is a financial technology and telecom company focused on providing these essential services to the underbanked community. The Company’s

wireless subsidiaries provide mobile broadband, voice and SMS text messaging to both subsidized and direct retail prepaid customers.

The Company’s blockchain fintech platform utilizes a suite of financial and prepaid products to convert corner stores into tech-hubs

for underbanked neighborhoods.

SurgePhone

Wireless and Torch Wireless

SurgePhone

and Torch, wholly owned subsidiaries of SurgePays, are mobile virtual network operators (MVNO) licensed by the Federal Communications

Commission (the “FCC”) to provide subsidized access to quality internet through mobile broadband services to consumers qualifying

under the federal guidelines of the Affordable Connectivity Program (the “ACP”). The ACP (the successor program, as of March

1, 2022 to the Emergency Broadband Benefit program) provides SurgePhone and Torch up to a $100 reimbursement for the cost of each tablet

device distributed and a $30 per customer, per month subsidy for mobile broadband (internet connectivity) services. SurgePhone and Torch

combined are licensed to offer subsidized mobile broadband to all fifty states.

SurgePays

Fintech (ECS Business)

We

refer to the collective operations of ECS Prepaid, LLC, a Missouri limited liability company, Electronic Check Services, Inc., a Missouri

corporation, and Central States Legal Services, Inc., a Missouri corporation, as “Surge Fintech.” This was previously referred

to as the “ECS Business.”

Surge

Fintech has been a financial technology tech and wireless top-up platform for over 15 years. Through a series of transactions between

October 2019 and January 2020, we acquired the ECS Business primarily for the favorable ACH banking relationship and a fintech transactions

platform processing over 20,000 transactions a day at approximately 8,000 independently owned convenience stores. The platform serves

as the proven backbone for wireless top-up transactions and wireless product aggregation for the SurgePays nationwide network.

Surge

Blockchain

Surge

Blockchain Software is a back-office marketplace (accessed through the SurgePays fintech portal for convenience stores) offering wholesale

consumable goods direct to convenience stores who are transacting on the SurgePays Fintech platform. The wholesale e-commerce platform

is easily accessed through the secure app interface – similar to a website. We believe what makes this sales platform unique is

that it also offers the merchant the ability to order wholesale consumable goods at a significant discount from traditional distributors

with one touch ease. We are able to sell products at a significant discount by using on demand Direct Store Delivery (DSD). Our platform

is connected directly to manufactures, who ship products direct to the store while cutting out the middleman. The goal of the SurgePays

Portal is to leverage the competitive advantage and efficiencies of e-commerce to provide as many commonly sold consumable products as

possible to convenience stores, corner markets, bodegas, and supermarkets while increasing profit margins for these stores.

LogicsIQ,

Inc.

LogicsIQ,

Inc. is a lead generation and case management solutions company primarily serving law firms in the mass tort industry. LogicsIQ’s

CRM “Intake Logics” facilitates the entire life cycle of converting a lead into a signed retainer client integrated into

the law firms case management software. Our proven strategy of delivering cost-effective retained cases to our attorney and law firm

clients means those clients are better able to manage their media and advertising budgets and reach targeted audiences more quickly and

effectively when utilizing our proprietary data driven analytics dashboards. Our ability to deliver transparent results through our integrated

Business Intelligence (B.I.) dashboards has bolstered our reputation as an industry leader in the mass tort client acquisition field.

ShockWave

CRM™

SurgePays

acquired the Software as a Service (SaaS) Customer Relationship Management (CRM) and Billing System software platform “MVNO Cloud

Services” on June 7, 2022. S Payment for the software consisted of $300,000 in cash, of which $100,000 was paid in June 2022, and

the remaining $200,000 in July 2022. Additionally, the Company issued 85,000 shares of Common Stock having a fair value of $411,400 ($4.84/share),

based upon the quoted closing trading price. SurgePays has rebranded the software as ShockWave CRM.

ShockWave

is an end-to-end cloud-based SaaS offering an Omnichannel CRM, billing system and carrier integrations specific to the telecommunication

and broadband industry. Some of these services include sales agent management, device and SIM inventory management, order processing