false

0000072444

0000072444

2024-01-16

2024-01-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 16, 2024

Vaxart, Inc.

(Exact name of registrant as specified in its charter)

| |

|

|

|

|

|

Delaware

|

|

001-35285

|

|

59-1212264

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

| |

|

|

170 Harbor Way, Suite 300, South San Francisco, California

|

|

94080

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (650) 550-3500

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading symbol

|

|

Name of each exchange on which registered

|

|

Common Stock, $0.0001 par value

|

|

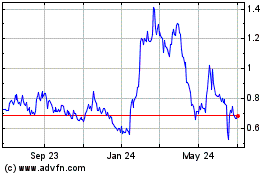

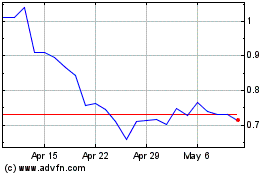

VXRT

|

|

The Nasdaq Capital Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

On January 16, 2024, Vaxart, Inc. (the “Company”) entered into a securities purchase agreement (the “Securities Purchase Agreement”) with RA Capital Healthcare Fund, L.P (“RA Capital”).

Pursuant to the Securities Purchase Agreement, RA Capital agreed to purchase, and the Company agreed to issue and sell to RA Capital 15,384,615 shares (the “Shares”) of common stock of the Company, par value $0.0001 per share (the “Common Stock”), at a price of $0.65 per share (the “Offering”). The total purchase price payable by RA Capital for the Shares is approximately $10 million. The Offering is scheduled to close on or about January 18, 2024 (the “Closing Date”), subject to customary closing conditions.

The Securities Purchase Agreement contains customary representations, warranties and agreements by the Company and customary conditions to closing, obligations of the parties and termination provisions. The representations, warranties and covenants contained in the Securities Purchase Agreement were made only for purposes of such agreement and as of specific dates, were solely for the benefit of the parties to such agreement, and may be subject to limitations agreed upon by the contracting parties.

The Offering is being made pursuant to the Company’s shelf registration statement on Form S-3 (File No. 333-270671), which was declared effective by the Securities and Exchange Commission (the “Commission”) on May 5, 2023, including the prospectus contained therein, as well as a prospectus supplement to be filed with the Commission on or before the Closing Date.

The Securities Purchase Agreement is filed as Exhibit 10.1 to this Current Report on Form 8-K and is incorporated herein by reference. The description of the Securities Purchase Agreement in this Current Report is a summary and is qualified in its entirety by the terms of the Securities Purchase Agreement.

A copy of the legal opinion and consent of Thompson Hine LLP, counsel to the Company, relating to the Offering is attached as Exhibit 5.1 to this Current Report on Form 8-K.

Item 8.01. Other Events.

On January 16, 2024, the Company issued a press release relating to the Offering. A copy of the press release is attached as Exhibits 99.1 to this Current Report and is incorporated by reference herein.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit

Number

|

Description

|

| |

|

|

5.1

|

|

| |

|

|

10.1

|

|

| |

|

|

23.1

|

|

| |

|

|

99.1

|

|

| |

|

|

104

|

Cover Page Interactive Data File (embedded within Inline XBRL document).

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

VAXART, INC.

|

| |

|

|

Dated: January 16, 2024

|

|

| |

By:

|

/s/ MICHAEL J. FINNEY

|

| |

|

Michael J. Finney, Ph.D.

|

| |

|

Interim Chief Executive Officer

|

Exhibit 5.1

January 16, 2024

Vaxart, Inc.

170 Harbor Way

Suite 300

South San Francisco, California 94080

Ladies and Gentlemen:

We have acted as counsel to Vaxart, Inc., a Delaware corporation (the “Company”), in connection with the offer and sale by the Company of 15,384,615 shares (the “Shares”) of the Company’s common stock, par value $0.0001 per share, pursuant to that certain Securities Purchase Agreement, dated January 16, 2024, by and among the Company and RA Capital Healthcare Fund, L.P. The Shares will be offered and sold pursuant to the Company’s effective Registration Statement on Form S-3 (File No. 333-270671) (the “Registration Statement”) filed with the U.S. Securities and Exchange Commission (the “Commission”) on March 17, 2023 under the Securities Act of 1933, as amended (the “Securities Act”), relating to the sale of the Shares as set forth in a prospectus supplement, dated January 16, 2024 (the “Prospectus Supplement”), supplementing the prospectus dated May 5, 2023 (the “Base Prospectus” and together with the Prospectus Supplement, the “Prospectus”). This opinion letter is furnished to you at your request to enable you to fulfill the requirements of Item 601(b)(5) of Regulation S-K in connection with the Registration Statement.

In our capacity as such counsel, we have examined originals or copies of those corporate and other records, documents, and agreements we considered appropriate, including the Company’s certificate of incorporation and bylaws (as amended to date), the Registration Statement, and the Prospectus. As to relevant factual matters, we have relied upon, among other things, factual representations we have received from the Company. In addition, we have obtained and relied upon those certificates of public officials we considered appropriate.

.

We have assumed the genuineness of all signatures, the authenticity of all documents submitted to us as originals, and the conformity with originals of all documents submitted to us as copies.

On the basis of such examination, our reliance upon the assumptions in this opinion and our consideration of those questions of law we considered relevant, and subject to the limitations and qualifications in this opinion, we are of the opinion that the Shares, when issued and sold in accordance with the Registration Statement and the Prospectus, will by validly issued, fully paid and non-assessable.

The law covered by this opinion is limited to the present Delaware General Corporation Law and the present federal law of the United States. We express no opinion as to the laws of any other jurisdiction and no opinion regarding the statutes, administrative decisions, rules, regulations, or requirements of any county, municipality, subdivision, or local authority of any jurisdiction.

We hereby consent to the filing of this letter with the Commission as an exhibit to the Company’s Current Report on Form 8-K to be filed with the Commission on January 16, 2024. We also hereby consent to the use of our name under the heading “Legal Matters” in the Prospectus Supplement. In giving this consent, we do not thereby admit that we are within the category of persons whose consent is required under Section 7 of the Securities Act or the rules and regulations of the Commission promulgated thereunder. The opinion in this letter is expressed as of the date hereof unless otherwise expressly stated, and we disclaim any undertaking to advise you of any subsequent changes in the facts stated or assumed herein or of any subsequent changes in applicable law.

Very truly yours,

/s/ Thompson Hine LLP

Thompson Hine LLP

Exhibit 10.1

SECURITIES PURCHASE AGREEMENT

This Securities Purchase Agreement (this “Agreement”) is dated as of January 16, 2024, between Vaxart, Inc., a Delaware corporation (the “Company”), and RA Capital Healthcare Fund, L.P. (the “Purchaser”).

WHEREAS, subject to the terms and conditions set forth in this Agreement and pursuant to an effective registration statement under the Securities Act (as defined below), the Company desires to issue and sell to the Purchaser, and the Purchaser, severally and not jointly, desires to purchase from the Company, securities of the Company as more fully described in this Agreement.

NOW, THEREFORE, IN CONSIDERATION of the mutual covenants contained in this Agreement, and for other good and valuable consideration the receipt and adequacy of which are hereby acknowledged, the Company and the Purchaser agree as follows:

ARTICLE I

DEFINITIONS

1.1 Definitions. In addition to the terms defined elsewhere in this Agreement, for all purposes of this Agreement, the following terms have the meanings set forth in this Section 1.1:

“Affiliate” means any Person that, directly or indirectly through one or more intermediaries, controls or is controlled by or is under common control with a Person as such terms are used in and construed under Rule 405 under the Securities Act.

“Applicable Laws” shall have the meaning ascribed to such term in Section 3.1(ff).

“Authorizations” shall have the meaning ascribed to such term in Section 3.1(ff).

“BHCA” shall have the meaning ascribed to such term in Section 3.1(dd).

“Board of Directors” means the board of directors, or any authorized committee thereof, of the Company.

“Business Day” means any day except any Saturday, any Sunday, any day which is a federal legal holiday in the United States or any day on which banking institutions in the State of New York are authorized or required by law to remain closed; provided, however, for clarification, commercial banks shall not be deemed to be authorized or required by law to remain closed due to “stay at home”, “shelter-in-place”, “non-essential employee” or any other similar orders or restrictions or the closure of any physical branch locations at the direction of any governmental authority so long as the electronic funds transfer systems (including for wire transfers) of commercial banks in the City of New York generally are open for use by customers on such day.

“Closing” means the closing of the purchase and sale of the Securities pursuant to Section 2.1.

“Closing Date” means the Trading Day on which all of the Transaction Documents have been executed and delivered by the applicable parties thereto, and all conditions precedent to (i) the Purchaser’s obligations to pay the Subscription Amount and (ii) the Company’s obligations to deliver the Securities, in each case, have been satisfied or waived, but in no event later than the second (2nd) Trading Day following the date hereof.

“Code” means the United States Internal Revenue Code of 1986, as amended.

“Commission” means the United States Securities and Exchange Commission.

“Common Stock” means the common stock of the Company, par value $0.0001 per share, and any other class of securities into which such securities may hereafter be reclassified or changed.

“Common Stock Equivalents” means any securities of the Company or the Subsidiaries which would entitle the holder thereof to acquire at any time Common Stock, including, without limitation, any debt, preferred stock, right, option, warrant or other instrument that is at any time convertible into or exercisable or exchangeable for, or otherwise entitles the holder thereof to receive, Common Stock.

“Company Counsel” means Thompson Hine LLP, with offices located at 300 Madison Avenue, 27th Floor, New York, New York 10017-6232.

“Disclosure Time” means, (i) if this Agreement is signed on a day that is not a Trading Day or after 9:25 a.m. (New York City time) and before midnight (New York City time) on any Trading Day, 9:26 a.m. (New York City time) on the Trading Day immediately following the date hereof, and (ii) if this Agreement is signed between midnight (New York City time) and 9:25 a.m. (New York City time) on any Trading Day, no later than 9:26 a.m. (New York City time) on the date hereof.

“DTC” means The Depository Trust Company.

“DWAC” shall have the meaning ascribed to such term in Section 2.2(a).

“Environmental Law” shall have the meaning ascribed to such term in Section 3.1(m).

“Evaluation Date” shall have the meaning ascribed to such term in Section 3.1(s).

“Exchange Act” means the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder.

“FCPA” means the Foreign Corrupt Practices Act of 1977, as amended, and the rules and regulations thereunder.

“Federal Reserve” shall have the meaning ascribed to such term in Section 3.1(dd).

“GAAP” shall have the meaning ascribed to such term in Section 3.1(i).

“Indebtedness” shall have the meaning ascribed to such term in Section 3.1(w).

“Intellectual Property Rights” shall have the meaning ascribed to such term in Section 3.1(p).

“Lien” means a lien, charge, mortgage, pledge, security interest, claim, right of first refusal, pre-emptive right, or other encumbrance of any kind whatsoever.

“Material Adverse Effect” shall have the meaning assigned to such term in Section 3.1(b).

“Material Permits” shall have the meaning assigned to such term in Section 3.1(o).

“Money Laundering Laws” shall have the meaning assigned to such term in Section 3.1(ee).

“OFAC” means the Office of Foreign Assets Control of the U.S. Treasury Department

“Offering” means the offering of the Securities hereunder.

“Person” means an individual or corporation, partnership, trust, incorporated or unincorporated association, joint venture, limited liability company, joint stock company, government (or an agency or subdivision thereof) or other entity of any kind.

“Per Share Purchase Price” equals $0.65, subject to adjustment for reverse and forward stock splits, stock dividends, stock combinations and other transactions of the Common Stock that occur after the date of this Agreement.

“Proceeding” means an action, claim, suit, investigation or proceeding (including, without limitation, an informal investigation or partial proceeding, such as a deposition) pending or, to the Company’s knowledge, threatened in writing against or affecting the Company, a Subsidiary or any of their respective properties before or by any court, arbitrator, governmental or administrative agency or regulatory authority (federal, state, county, local or foreign).

“Prospectus” means the prospectus included in the Registration Statement, including the information incorporated by reference therein, at the time it was declared effective by the Commission.

“Prospectus Supplement” means the supplement to the Prospectus complying with Rule 424(b) of the Securities Act containing certain supplemental information regarding the Securities and the terms of the offering of the Securities that will be filed with the Commission, including the information incorporated by reference therein, and delivered by the Company to the Purchaser on or prior to the date hereof.

“Registration Statement” means the Registration Statement on Form S-3 (File No. 333-270671) filed by the Company with the Commission and declared effective on May 5, 2023, including the information incorporated by reference therein.

“Required Approvals” shall have the meaning ascribed to such term in Section 3.1(e).

“Rule 424” means Rule 424 promulgated by the Commission pursuant to the Securities Act, as such Rule may be amended or interpreted from time to time, or any similar rule or regulation hereafter adopted by the Commission having substantially the same purpose and effect as such Rule.

“Sanctions” shall have the meaning ascribed to such term in Section 3.1(aa).

“SEC Reports” shall have the meaning ascribed to such term in Section 3.1(h).

“Securities” means the Shares.

“Securities Act” means the Securities Act of 1933, as amended, and the rules and regulations promulgated thereunder.

“Shares” means the shares of Common Stock issued or issuable to the Purchaser pursuant to this Agreement.

“Subscription Amount” means the aggregate amount to be paid for the Shares purchased hereunder as specified below the Purchaser’s name on the signature page of this Agreement and next to the heading “Subscription Amount,” in United States dollars and in immediately available funds.

“Subsidiary” and “Subsidiaries” shall have the meanings ascribed to such terms in Section 3.1(a).

“Trading Day” means a day on which The Nasdaq Capital Market is open for trading.

“Trading Market” means The Nasdaq Capital Market.

“Transaction Documents” means this Agreement, all exhibits and schedules thereto and hereto and any other documents or agreements executed in connection with the transactions contemplated hereunder.

“Transfer Agent” means American Stock Transfer & Trust Company, LLC, the current transfer agent of the Company, with a mailing address of 6201 15th Avenue, Brooklyn, New York 11219, and any successor transfer agent of the Company.

ARTICLE II

PURCHASE AND SALE

2.1 Closing. On the Closing Date, upon the terms and subject to the conditions set forth herein, the Company agrees to sell, and the Purchaser agrees to purchase 15,384,615 Shares each at the Per Share Purchase Price for an aggregate consideration of $9,999,999.75. Upon satisfaction of the covenants and conditions set forth in Sections 2.2 and 2.3, the Closing shall occur at the offices of the Company.

2.2 Deliveries.

(a) On or prior to the Closing Date, the Company shall deliver or cause to be delivered to each Purchaser the following:

(i) this Agreement duly executed by the Company;

(ii) a copy of the irrevocable instructions to the Transfer Agent instructing the Transfer Agent to deliver on an expedited basis via DTC’s Deposit and Withdrawal at Custodian system (“DWAC”) the Shares registered in the Purchaser’s name;

(iii) the Prospectus and Prospectus Supplement (which may be delivered in accordance with Rule 172 under the Securities Act);

(b) On or prior to the Closing Date, the Purchaser shall deliver or cause to be delivered to the Company the following:

(i) this Agreement duly executed by the Purchaser; and

(ii) $9,999,9999.75, which shall be made available for “Delivery Versus Payment” settlement with the Company or its designees, or in any manner reasonably satisfactory to the Company.

2.3 Closing Conditions.

(a) The obligations of the Company hereunder in connection with the Closing are subject to the following conditions being met:

(i) the accuracy in all material respects (or, to the extent representations or warranties are qualified by materiality or Material Adverse Effect, in all respects) when made and on the Closing Date of the representations and warranties of the Purchaser contained herein (unless as of a specific date therein in which case they shall be accurate as of such date);

(ii) all obligations, covenants and agreements of the Purchaser required to be performed at or prior to the Closing Date shall have been performed; and

(iii) the delivery by the Purchaser of the items set forth in Section 2.2(b) of this Agreement.

(b) The respective obligations of the Purchaser hereunder in connection with the Closing are subject to the following conditions being met:

(i) the accuracy in all material respects (or, to the extent representations or warranties are qualified by materiality or Material Adverse Effect, in all respects) when made and on the Closing Date of the representations and warranties of the Company contained herein (unless as of a specific date therein in which case they shall be accurate as of such date);

(ii) all obligations, covenants and agreements of the Company required to be performed at or prior to the Closing Date shall have been performed;

ARTICLE III

REPRESENTATIONS AND WARRANTIES

3.1 Representations and Warranties of the Company. Except as set forth in the SEC Reports, which SEC Reports shall qualify any representation or warranty made herein, the Company hereby makes the following representations and warranties to the Purchaser:

(a) Subsidiaries. All of the direct and indirect subsidiaries of the Company are set forth in the SEC Reports (each, a “Subsidiary”, and collectively, the “Subsidiaries”). The Company owns, directly or indirectly, all of the capital stock or other equity interests of each Subsidiary free and clear of any Liens, and all of the issued and outstanding shares of capital stock or equity interests, as applicable, of each Subsidiary are validly issued and are fully paid, non-assessable and free of preemptive and similar rights to subscribe for or purchase securities.

(b) Organization and Qualification. Each of the Company and the Subsidiaries is an entity duly incorporated or otherwise organized, validly existing and in good standing under the laws of the jurisdiction of its incorporation or organization, with the requisite power and authority to own and use its properties and assets and to carry on its business as currently conducted. Neither the Company nor any Subsidiary is in violation nor default of any of the provisions of its respective articles of association, certificate or articles of incorporation, bylaws or other organizational or charter documents. Each of the Company and the Subsidiaries is duly qualified to conduct business and is in good standing as a foreign corporation or other entity in each jurisdiction in which the nature of the business conducted or property owned by it makes such qualification necessary, except where the failure to be so qualified or in good standing, as the case may be, would not have or reasonably be expected to result in (i) a material adverse effect on the legality, validity or enforceability of any Transaction Document, (ii) a material adverse effect on the results of operations, properties, assets, management, stockholders’ equity, business or condition (financial or otherwise) of the Company and the Subsidiaries, taken as a whole, or (iii) a material adverse effect on the Company’s ability to perform in any material respect on a timely basis its obligations under any Transaction Document (any of (i), (ii) or (iii), “Material Adverse Effect”). No proceeding has been instituted in any jurisdiction revoking, limiting or curtailing or seeking to revoke, limit or curtail such power and authority or qualification.

(c) Authorization; Enforcement. The Company has the requisite corporate power and authority to enter into and to consummate the transactions contemplated by this Agreement and each of the other Transaction Documents and otherwise to carry out its obligations hereunder and thereunder. The execution and delivery of this Agreement and each of the other Transaction Documents by the Company and the consummation by it of the transactions contemplated hereby and thereby have been duly authorized by all necessary action on the part of the Company and no further action is required by the Company, the Board of Directors or the Company’s stockholders or others in connection herewith or therewith other than in connection with the Required Approvals.

(d) No Conflicts. The execution, delivery and performance by the Company of this Agreement, the issuance and sale of the Securities and the consummation by it of the transactions contemplated hereby do not and will not (i) conflict with or violate any provision of the Company’s or any Subsidiary’s certificate or articles of incorporation, bylaws or other organizational or charter documents, or (ii) conflict with, or constitute a default (or an event that with notice or lapse of time or both would become a default) under, result in the creation of any Lien upon any of the properties or assets of the Company or any Subsidiary, or give to others any rights of termination, amendment, anti-dilution or similar adjustments, acceleration or cancellation (with or without notice, lapse of time or both) of, any agreement, credit facility, debt or other instrument (evidencing a Company or Subsidiary debt or otherwise) or other understanding to which the Company or any Subsidiary is a party or by which any property or asset of the Company or any Subsidiary is bound or affected and is required to be filed as an exhibit to the SEC Reports, or (iii) subject to the Required Approvals, conflict with or result in a violation of any law, rule, regulation, order, judgment, injunction, decree or other restriction of any court or governmental authority, to which the Company or a Subsidiary is subject (including federal and state securities laws and regulations), or by which any property or asset of the Company or a Subsidiary is bound or affected; except in the case of each of clauses (ii) and (iii), such as would not have a Material Adverse Effect.

(e) Filings, Consents and Approvals. The Company is not required to obtain any consent, waiver, authorization or order of, give any notice to, or make any filing or registration with, any court or other federal, state (including state blue sky law), local or other governmental authority or other Person in connection with the execution, delivery and performance by the Company of this Agreement, other than: (i) the filings required pursuant to Section 4.4 of this Agreement, (ii) the filing with the Commission of the Prospectus Supplement, and (iii) application to the Trading Market for the listing of the Shares for trading thereon in the time and manner required thereby (collectively, the “Required Approvals”).

(f) Issuance of the Securities; Registration. The Shares are duly authorized and, when issued and paid for in accordance with this Agreement, will be validly issued, fully paid and nonassessable, free and clear of all Liens. The Company has reserved from its duly authorized capital stock the maximum number of shares of Common Stock issuable pursuant to this Agreement. The Company has prepared and filed the Registration Statement in conformity with the requirements of the Securities Act, which became effective on May 5, 2023, including the Prospectus, and such amendments and supplements thereto as may have been required to the date of this Agreement. The Registration Statement is effective under the Securities Act, and no stop order preventing or suspending the effectiveness of the Registration Statement or suspending or preventing the use of the Prospectus has been issued by the Commission, and no proceedings for that purpose have been instituted or, to the knowledge of the Company, are threatened by the Commission.

(g) Capitalization. The equity capitalization of the Company is as set forth in the Registration Statement and the SEC Reports as of the dates indicated therein. The Company has not issued any capital stock since its most recently filed SEC Report, other than pursuant to the exercise of stock options under the Company’s stock option plans. Except as set forth in the SEC Reports, the Company has no outstanding options, warrants, scrips or rights to subscribe to, calls or commitments of any character whatsoever relating to, or securities, rights or obligations convertible into or exercisable or exchangeable for, or giving any Person any right to subscribe for or acquire, any Common Stock, or contracts, commitments, understandings or arrangements by which the Company is or may become bound to issue additional Common Stock or Common Stock Equivalents, and no Person has any right of first refusal, pre-emptive right, right of participation, or any similar right to participate in the transactions contemplated hereby. Except as set forth in the SEC Reports, the issuance and sale of the Securities will not obligate the Company to issue Common Stock or other securities to any Person (other than the Purchaser). There are no outstanding securities or instruments of the Company with any provision that adjusts the exercise, conversion, exchange or reset price of such security or instrument upon an issuance of securities by the Company. There are no outstanding securities or instruments of the Company that contain any redemption or similar provisions, and there are no contracts, commitments, understandings or arrangements by which the Company is or may become bound to redeem an equity security of the Company. The Company does not have any stock appreciation rights or “phantom share” plans or agreements or any similar plan or agreement. Except as set forth in the SEC Reports, there are no stockholders agreements, voting agreements or other similar agreements with respect to the Company’s capital stock to which the Company is a party or, to the knowledge of the Company, between or among any of the Company’s stockholders.

(h) SEC Reports. The Company has filed all reports, schedules, forms, statements and other documents required to be filed by the Company under the Exchange Act, including pursuant to Section 13(a) or 15(d) thereof, for the twelve (12) month period through the date hereof (or such shorter period as the Company was required by law or regulation to file such material) (the foregoing materials, including the exhibits thereto and documents incorporated by reference therein, together with the Prospectus and the Prospectus Supplement, being collectively referred to herein as the “SEC Reports”) on a timely basis or has received a valid extension (or waiver from the Commission) of such time of filing and has filed any such SEC Reports prior to the expiration of any such extension.

(i) Financial Statements. The consolidated financial statements of the Company, including the notes thereto, included or incorporated by reference in the Registration Statement and the Prospectus comply in all material respects with applicable accounting requirements and the rules and regulations of the Commission with respect thereto as in effect at the time of filing. Such financial statements have been prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) applied on a consistent basis during the periods involved, except as may be otherwise specified in such financial statements or the notes thereto and except that unaudited financial statements may not contain all footnotes required by GAAP, and fairly present in all material respects the financial position of the Company and its consolidated Subsidiaries as of and for the dates thereof and the results of operations and cash flows for the periods then ended, subject, in the case of unaudited statements, to normal, immaterial, year-end audit adjustments.

(j) Litigation. Except as set forth in the SEC Reports, there is no action, suit, inquiry, notice of violation, Proceeding or investigation pending or, to the knowledge of the Company, threatened against or affecting the Company, any Subsidiary or any of their respective properties before or by any court, arbitrator, governmental or administrative agency or regulatory authority (federal, state, county, local or foreign) (collectively, an “Action”) which (i) adversely affects or challenges the legality, validity or enforceability of any of the Transaction Documents or the Securities or (ii) would, if there were an unfavorable decision, have or reasonably be expected to result in a Material Adverse Effect. Neither the Company nor any Subsidiary, nor any director or executive officer thereof, is or has been the subject of any Action involving a claim of violation of or liability under federal or state securities laws or a claim of breach of fiduciary duty, which could result in a Material Adverse Effect. There has not been, and to the knowledge of the Company, there is not pending or contemplated, any investigation by the Commission involving the Company or any current or former director or executive officer of the Company. The Commission has not issued any stop order or other order suspending the effectiveness of any registration statement filed by the Company or any Subsidiary under the Exchange Act or the Securities Act.

(k) Labor Relations. The Company and its Subsidiaries have complied with all U.S. federal, state, local and foreign laws and regulations relating to employment and employment practices, terms and conditions of employment and wages and hours, except where the failure to comply would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect.

(l) Compliance. Neither the Company nor any Subsidiary: (i) is in default under or in violation of (and no event has occurred that has not been waived that, with notice or lapse of time or both, would result in a default by the Company or any Subsidiary under), nor has the Company or any Subsidiary received notice of a claim that it is in default under or that it is in violation of, any indenture, loan or credit agreement or any other agreement or instrument to which it is a party or by which it or any of its properties is bound (whether or not such default or violation has been waived), (ii) is in violation of any judgment, decree or order of any court, arbitrator or other governmental authority or (iii) is or has been in violation of any statute, rule, ordinance or regulation of any governmental authority, including without limitation all foreign, federal, state and local laws relating to taxes, environmental protection, occupational health and safety, product quality and safety and employment and labor matters, except in each case as would not have or reasonably be expected to result in a Material Adverse Effect.

(m) Environmental Law. There has been no storage, generation, transportation, handling, use, treatment, disposal, discharge, emission, contamination, release or other activity involving any kind of hazardous, toxic or other wastes, pollutants, contaminants, petroleum products or other hazardous or toxic substances, chemicals or materials by, due to, on behalf of, or caused by the Company or any Subsidiary (or, to the Company’s knowledge, any other entity for whose acts or omissions the Company is or may be liable) upon any property now or previously owned, operated, used or leased by the Company or any Subsidiary, or upon any other property, which would be a violation of or give rise to any liability under any applicable law, rule, regulation, order, judgment, decree or permit, common law provision or other legally binding standard relating to pollution or protection of human health and the environment (“Environmental Law”), except for violations and liabilities which, individually or in the aggregate, would not have a Material Adverse Effect. The Company and each Subsidiary has all permits, authorizations and approvals required under any applicable Environmental Laws and are each in compliance with their requirements.

(n) Title to Assets. The Company and the Subsidiaries have good and marketable title in fee simple to all real property owned by them and good and marketable title in all personal property owned by them that is material to the business of the Company and the Subsidiaries, in each case free and clear of all Liens, except for (i) Liens as do not materially affect the value of such property and do not materially interfere with the use made and proposed to be made of such property by the Company and the Subsidiaries and (ii) Liens for the payment of federal, state or other taxes, for which adequate accruals or reserves have been made therefor in accordance with GAAP and the payment of which is neither delinquent nor subject to penalties. Any real property and facilities currently held under lease by the Company and the Subsidiaries are held by them under valid, subsisting and enforceable leases with which the Company and the Subsidiaries are in compliance in all material respects, except where the failure to so comply would not reasonably be expected to have a Material Adverse Effect.

(o) Regulatory Permits. The Company and the Subsidiaries possess all material certificates, authorizations and permits issued by the appropriate federal, state, local or foreign regulatory authorities necessary to conduct their respective businesses as described in the SEC Reports, except where the failure to possess such permits could not reasonably be expected to result in a Material Adverse Effect (“Material Permits”), and neither the Company nor any Subsidiary has received any notice of proceedings relating to the revocation or modification of any Material Permit.

(p) Intellectual Property. Except as set forth in the SEC Reports, to the Company’s knowledge, the Company and the Subsidiaries have, or have rights to use (or can acquire on reasonable terms), all patents, patent applications, trademarks, trademark applications, service marks, trade names, trade secrets, inventions, copyrights, licenses and other intellectual property rights and similar rights necessary or required for use in connection with their respective businesses as described in the SEC Reports and which the failure to so have could have a Material Adverse Effect (collectively, the “Intellectual Property Rights”). To the knowledge of the Company, all such Intellectual Property Rights are enforceable, and there is no existing infringement by another Person of any of the Intellectual Property Rights. The Company and its Subsidiaries have taken reasonable security measures to protect the secrecy, confidentiality and value of all of their intellectual properties, except where failure to do so would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect.

(q) Insurance. The Company and the Subsidiaries are insured by insurers of recognized financial responsibility against such losses and risks and in such amounts as are prudent and customary in the businesses in which the Company and the Subsidiaries are engaged, including, but not limited to, directors and officers insurance coverage at least equal to the aggregate Subscription Amount. Neither the Company nor any Subsidiary has any reason to believe that it will not be able to renew its existing insurance coverage as and when such coverage expires or to obtain similar coverage from similar insurers as may be necessary to continue its business without a significant increase in cost.

(r) Transactions With Affiliates and Employees. Except as set forth in the SEC Reports, none of the executive officers or directors of the Company or any Subsidiary and, to the knowledge of the Company, none of the employees of the Company or any Subsidiary is presently a party to any transaction with the Company or any Subsidiary (other than for services as employees, executive officers and directors), including any contract, agreement or other arrangement providing for the furnishing of services to or by, providing for rental of real or personal property to or from, providing for the borrowing of money from or lending of money to or otherwise requiring payments to or from any executive officer, director or such employee or, to the knowledge of the Company, any entity in which any executive officer, director, or any such employee has a substantial interest or is an officer, director, trustee, stockholder, member or partner, in each case in excess of $120,000 other than for (i) payment of salary or consulting fees for services rendered, (ii) reimbursement for expenses incurred on behalf of the Company and (iii) other employee benefits, including stock option agreements under any stock option plan of the Company.

(s) Sarbanes-Oxley; Internal Accounting Controls. The Company and the Subsidiaries are in compliance with all applicable provisions of the Sarbanes-Oxley Act of 2002, as amended, except as disclosed in the Company’s SEC Reports. The Company and the Subsidiaries maintain a system of internal accounting controls sufficient to provide reasonable assurance that: (i) transactions are executed in accordance with management’s general or specific authorizations, (ii) transactions are recorded as necessary to permit preparation of financial statements in conformity with applicable securities laws and GAAP and to maintain asset accountability, (iii) access to assets is permitted only in accordance with management’s general or specific authorization, and (iv) the recorded accountability for assets is compared with the existing assets at reasonable intervals and appropriate action is taken with respect to any differences. The Company and the Subsidiaries have established disclosure controls and procedures (as defined in Exchange Act Rules 13a-15(e) and 15d-15(e)) for the Company and the Subsidiaries and designed such disclosure controls and procedures to ensure that information required to be disclosed by the Company in the reports it files or submits under the Exchange Act is recorded, processed, summarized and reported, within the time periods specified in the Commission’s rules and forms. The Company’s certifying officers have evaluated the effectiveness of the disclosure controls and procedures of the Company and the Subsidiaries as of applicable dates specified under the Exchange Act (such date, the “Evaluation Date”). The Company presented in its most recently filed periodic report under the Exchange Act the conclusions of the certifying officers about the effectiveness of the disclosure controls and procedures based on their evaluations as of the Evaluation Date. Except as set forth in SEC Reports, since the Evaluation Date, there have been no changes in the internal control over financial reporting (as such term is defined in the Exchange Act) of the Company and the Subsidiaries that have materially affected, or is reasonably likely to materially affect, the internal control over financial reporting of the Company and the Subsidiaries.

(t) Investment Company. The Company is not, and immediately after receipt of payment for the Securities, will not be required to register as an “investment company” within the meaning of the Investment Company Act of 1940, as amended. The Company shall conduct its business in a manner so that it will not be required to register as an “investment company” subject to registration under the Investment Company Act of 1940, as amended.

(u) Registration Rights. Except as set forth in the SEC Reports, no Person has any right to cause the Company or any Subsidiary to effect the registration under the Securities Act of any securities of the Company or any Subsidiary.

(v) Listing and Maintenance Requirements. The Common Stock is registered pursuant to Section 12(b) or 12(g) of the Exchange Act, and the Company has taken no action designed to, or which to its knowledge is likely to have the effect of, terminating the registration of the Common Stock under the Exchange Act nor has the Company received any notification that the Commission is contemplating terminating such registration. The Common Stock is currently eligible for electronic transfer through the Depository Trust Company or another established clearing corporation, and the Company is current in payment of the fees to the Depository Trust Company (or such other established clearing corporation) in connection with such electronic transfer.

(w) Solvency. Based on the consolidated financial condition of the Company included in or incorporated by reference into the Registration Statement, after giving effect to the receipt by the Company of the proceeds from the sale of the Securities hereunder, (i) the fair saleable value of the Company’s assets exceeds the amount that will be required to be paid on or in respect of the Company’s existing debts and other liabilities (including known contingent liabilities) as they mature, (ii) the Company’s assets do not constitute unreasonably small capital to carry on its business as now conducted and as proposed to be conducted including its capital needs taking into account the particular capital requirements of the business conducted by the Company, consolidated and projected capital requirements and capital availability thereof, and (iii) the current cash flow of the Company, together with the proceeds the Company would receive, were it to liquidate all of its assets, after taking into account all anticipated uses of the cash, would be sufficient to pay all amounts on or in respect of its liabilities when such amounts are required to be paid. The Company does not intend to incur debts beyond its ability to pay such debts as they mature (taking into account the timing and amounts of cash to be payable on or in respect of its debt). The Company has no knowledge of any facts or circumstances which lead it to believe that it will file for reorganization or liquidation under the bankruptcy or reorganization laws of any jurisdiction within one (1) year from the Closing Date. All outstanding secured and unsecured Indebtedness of the Company or any Subsidiary, or for which the Company or any Subsidiary has commitments, is set forth in the SEC Reports. For the purposes of this Agreement, “Indebtedness” means (x) any liabilities for borrowed money or amounts owed in excess of $50,000 (other than trade accounts payable incurred in the ordinary course of business), (y) all guaranties, endorsements and other contingent obligations in respect of indebtedness of others, whether or not the same are or should be reflected in the Company’s consolidated balance sheet (or the notes thereto), except guaranties by endorsement of negotiable instruments for deposit or collection or similar transactions in the ordinary course of business; and (z) the present value of any lease payments in excess of $50,000 due under leases required to be capitalized in accordance with GAAP. Neither the Company nor any Subsidiary is in default with respect to any Indebtedness.

(x) Tax Status. Except for matters that would not, individually or in the aggregate, have or reasonably be expected to result in a Material Adverse Effect, the Company and its Subsidiaries each (i) has made or filed all United States federal, state and local income and all foreign tax returns, reports and declarations required by any jurisdiction to which it is subject, (ii) has paid all taxes and other governmental assessments and charges that are material in amount, shown or determined to be due on such returns, reports and declarations and (iii) has set aside on its books provision reasonably adequate for the payment of all material taxes for periods subsequent to the periods to which such returns, reports or declarations apply. There are no unpaid taxes in any material amount claimed to be due by the taxing authority of any jurisdiction, and the officers of the Company or of any Subsidiary know of no basis for any such claim.

(y) Foreign Corrupt Practices; Criminal Acts. Neither the Company nor any Subsidiary has (i) directly or indirectly, used any funds for unlawful contributions, gifts, entertainment or other unlawful expenses related to foreign or domestic political activity, (ii) made any unlawful payment to foreign or domestic government officials or employees or to any foreign or domestic political parties or campaigns from corporate funds, (iii) failed to disclose fully any contribution made by the Company or any Subsidiary (or made by any person acting on its behalf of which the Company is aware) which is in violation of law, or (iv) violated in any material respect any provision of FCPA.

(z) Accountants. The Company’s independent registered public accounting firm is as set forth in the SEC Reports. To the knowledge and belief of the Company, such accounting firm is a registered public accounting firm as required by the Exchange Act.

(aa) Office of Foreign Assets Control. Neither the Company nor any Subsidiary nor, to the Company's knowledge, any director, officer, agent, employee or Affiliate of the Company or any Subsidiary is currently subject to any “Sanctions,” which shall include but are not limited to any U.S. sanctions administered by the Office of Foreign Assets Control of the U.S. Treasury Department (“OFAC”), and the Company will not, directly or indirectly, use the proceeds of the Offering hereunder, or lend, contribute or otherwise make available such proceeds to any subsidiary, joint venture partner or other person or entity, for the purpose of financing the activities of any person currently subject to any Sanctions, including but not limited to U.S. sanctions administered by OFAC.

(bb) Stock Option Plans. Each stock option granted by the Company under the Company’s stock option plan, or as an inducement grant outside of a stock option plan, was granted (i) in accordance with the terms of such plan, or under its terms, respectively, and (ii) with an exercise price at least equal to the fair market value of the Common Stock on the date such stock option would be considered granted under GAAP and applicable law. No stock option granted under the Company’s stock option plan or omnibus long-term incentive plan has been backdated. The Company has not knowingly granted, and there is no and has been no Company policy or practice to knowingly grant, stock options prior to, or otherwise knowingly coordinate the grant of stock options with, the release or other public announcement of material information regarding the Company or the Subsidiaries or their financial results or prospects.

(cc) U.S. Real Property Holding Corporation. The Company is not and has never been a United States real property holding corporation within the meaning of Section 897 of the Code, and the Company shall so certify upon Purchaser’s request.

(dd) Bank Holding Company Act. Neither the Company nor any of its Subsidiaries or Affiliates is subject to the Bank Holding Company Act of 1956, as amended (the “BHCA”) and to regulation by the Board of Governors of the Federal Reserve System (the “Federal Reserve”). Neither the Company nor any of its Subsidiaries owns or controls, directly or indirectly, five percent (5%) or more of the outstanding shares of any class of voting securities or twenty-five percent (25%) or more of the total equity of a bank or any entity that is subject to the BHCA and to regulation by the Federal Reserve. Neither the Company nor any of its Subsidiaries exercises a controlling influence over the management or policies of a bank or any entity that is subject to the BHCA and to regulation by the Federal Reserve.

(ee) Money Laundering. The operations of the Company and its Subsidiaries are and have been conducted at all times in compliance with applicable financial record-keeping and reporting requirements of the Currency and Foreign Transactions Reporting Act of 1970, as amended, applicable money laundering statutes and applicable rules and regulations thereunder (collectively, the “Money Laundering Laws”), and no action, suit or proceeding by or before any court or governmental agency, authority or body or any arbitrator involving the Company or any Subsidiary with respect to the Money Laundering Laws is pending or, to the knowledge of the Company or any Subsidiary, threatened.

(ff) Regulatory. Except as described in the SEC Reports, the Company and its Subsidiaries (i) are and at all times have been in material compliance with all statutes, rules and regulations applicable to the ownership, testing, development, manufacture, packaging, processing, use, distribution, marketing, advertising, labeling, promotion, sale, offer for sale, storage, import, export or disposal of any product manufactured or distributed by the Company including, without limitation the Federal Food, Drug and Cosmetic Act (21 U.S.C. § 301 et seq.), the federal Anti-Kickback Statute (42 U.S.C. § 1320a-7b(b)), the Health Insurance Portability and Accountability Act of 1996, as amended by the Health Information Technology for Economic and Clinical Health Act of 2009, and the Patient Protection and Affordable Care Act of 2010, as amended by the Health Care and Education Affordability Reconciliation Act of 2010, the regulations promulgated pursuant to such laws, and any successor government programs and comparable state laws, regulations relating to Good Clinical Practices and Good Laboratory Practices and all other local, state, federal, national, supranational and foreign laws, manual provisions, policies and administrative guidance relating to the regulation of the Company (collectively, the “Applicable Laws”); (ii) have not received any notice from any court or arbitrator or governmental or regulatory authority or third party alleging or asserting noncompliance with any Applicable Laws or any licenses, exemptions, certificates, approvals, clearances, authorizations, permits, registrations and supplements or amendments thereto required by any such Applicable Laws (“Authorizations”); (iii) possess all material Authorizations and such Authorizations are valid and in full force and effect and are not in violation of any term of any such Authorizations; (iv) have not received written notice of any claim, action, suit, proceeding, hearing, enforcement, investigation arbitration or other action from any court or arbitrator or governmental or regulatory authority or third party alleging that any product operation or activity is in violation of any Applicable Laws or Authorizations nor is any such claim, action, suit, proceeding, hearing, enforcement, investigation, arbitration or other action threatened; (v) have not received any written notice that any court or arbitrator or governmental or regulatory authority has taken, is taking or intends to take, action to limit, suspend, materially modify or revoke any Authorizations nor is any such limitation, suspension, modification or revocation threatened; (vi) have filed, obtained, maintained or submitted all material reports, documents, forms, notices, applications, records, claims, submissions and supplements or amendments as required by any Applicable Laws or Authorizations and that all such reports, documents, forms, notices, applications, records, claims, submissions and supplements or amendments were complete and accurate on the date filed (or were corrected or supplemented by a subsequent submission); and (vii) are not a party to any corporate integrity agreements, monitoring agreements, consent decrees, settlement orders, or similar agreements with or imposed by any governmental or regulatory authority.

3.2 Representations and Warranties of the Purchaser. The Purchaser hereby represents and warrants as of the date hereof and as of the Closing Date to the Company as follows (unless as of a specific date therein, in which case they shall be accurate as of such date):

(a) Organization; Authority. The Purchaser is an entity duly incorporated or formed, validly existing and in good standing under the laws of the jurisdiction of its incorporation or formation with full right, corporate, partnership, limited liability company or similar power and authority to enter into and to consummate the transactions contemplated by the Transaction Documents and otherwise to carry out its obligations hereunder and thereunder. The execution and delivery of the Transaction Documents and performance by the Purchaser of the transactions contemplated by the Transaction Documents have been duly authorized by all necessary corporate, partnership, limited liability company or similar action, as applicable, on the part of the Purchaser. Each Transaction Document to which it is a party has been duly executed by the Purchaser, and when delivered by the Purchaser in accordance with the terms hereof or thereof, will constitute the valid and legally binding obligation of the Purchaser, enforceable against it in accordance with its terms, except: (i) as limited by general equitable principles and applicable bankruptcy, insolvency, reorganization, moratorium and other laws of general application affecting enforcement of creditors’ rights generally; (ii) as limited by laws relating to the availability of specific performance, injunctive relief or other equitable remedies; and (iii) insofar as indemnification and contribution provisions may be limited by applicable law.

(b) Informed Investment Decision. Based on the information the Purchaser has deemed appropriate, it has independently made its own analysis and decision to enter into the Transaction Documents. The Purchaser has sought its own accounting, legal and tax advice as it has considered necessary to make an informed decision with respect to its acquisition of the Securities.

(c) No Intent to Effect a Change of Control; Ownership. The Purchaser has no present intent to effect a “change of control” of the Company as such term is understood under the rules promulgated pursuant to Section 13(d) of the Exchange Act and under the rules of the Nasdaq Capital Market.

ARTICLE IV

OTHER AGREEMENTS OF THE PARTIES

4.1 Reservation of Common Stock. As of the Closing Date, the Company has reserved and shall continue to reserve and keep available at all times, free of preemptive rights, a sufficient number of shares of Common Stock for the purpose of enabling the Company to issue the Shares pursuant to this Agreement.

4.2 Furnishing of Information. Until the Purchaser no longer owns Securities, the Company covenants to timely file (or obtain extensions in respect thereof and file within the applicable grace period) all reports required to be filed by the Company after the date hereof pursuant to the Exchange Act even if the Company is not then subject to the reporting requirements of the Exchange Act.

4.3 Integration. The Company shall not sell, offer for sale or solicit offers to buy or otherwise negotiate in respect of any security (as defined in Section 2 of the Securities Act) that would be integrated with the offer or sale of the Securities for purposes of the rules and regulations of any Trading Market such that it would require shareholder approval prior to the closing of such other transaction unless shareholder approval is obtained before the closing of such subsequent transaction.

4.4 Securities Laws Disclosure; Publicity. The Company shall (a) by the Disclosure Time, issue a press release disclosing the material terms of the transactions contemplated hereby, and (b) file a Current Report on Form 8-K, including the Transaction Documents as exhibits thereto, with the Commission within the time required by the Exchange Act. From and after the issuance of such press release, the Company represents to the Purchaser that it shall have publicly disclosed all material, non-public information delivered to any of the Purchaser by the Company or any of its Subsidiaries, or any of their respective officers, directors, employees or agents in connection with the transactions contemplated by the Transaction Documents. In addition, effective upon the issuance of such press release, the Company acknowledges and agrees that any and all confidentiality or similar obligations under any agreement, whether written or oral, between the Company, any of its Subsidiaries or any of their respective officers, directors, agents, employees or Affiliates on the one hand, and any of the Purchaser or any of their Affiliates on the other hand, shall terminate. The Company and the Purchaser shall consult with each other in issuing any other press releases with respect to the transactions contemplated hereby, and neither the Company nor the Purchaser shall issue any such press release nor otherwise make any such public statement without the prior consent of the Company, with respect to any press release of the Purchaser, or without the prior consent of the Purchaser, with respect to any press release of the Company, which consent shall not unreasonably be withheld or delayed, except if such disclosure is required by law, in which case the disclosing party shall promptly provide the other party with prior notice of such public statement or communication. Notwithstanding the foregoing, the Company shall not publicly disclose the name of the Purchaser, or include the name of the Purchaser in any filing with the Commission or any regulatory agency or Trading Market, without the prior written consent of such Purchaser, except (a) as required by federal securities law in connection with the filing of final Transaction Documents with the Commission and (b) to the extent such disclosure is required by law or Trading Market regulations, in which case the Company shall provide the Purchasers with prior notice of such disclosure permitted under this clause (b).

4.5 Non-Public Information. Except with respect to the material terms and conditions of the transactions contemplated by the Transaction Documents, which shall be disclosed pursuant to Section 4.4, the Company covenants and agrees that neither it, nor any other Person acting on its behalf will provide the Purchaser or its agents or counsel with any information that constitutes, or the Company reasonably believes constitutes, material non-public information, unless prior thereto such Purchaser shall have consented to the receipt of such information and agreed with the Company to keep such information confidential. The Company understands and confirms that the Purchaser shall be relying on the foregoing covenant in effecting transactions in securities of the Company. To the extent that the Company delivers any material, non-public information to the Purchaser without such Purchaser’s consent, the Company hereby covenants and agrees that such Purchaser shall not have any duty of confidentiality to the Company, any of its Subsidiaries, or any of their respective officers, directors, agents, employees or Affiliates, or a duty to the Company, any of its Subsidiaries or any of their respective officers, directors, agents, employees or Affiliates not to trade on the basis of, such material, non-public information, provided that the Purchaser shall remain subject to applicable law. To the extent that any notice provided pursuant to any Transaction Document constitutes, or contains, material, non-public information regarding the Company or any Subsidiaries, the Company shall simultaneously file such notice with the Commission pursuant to a Current Report on Form 8-K. The Company understands and confirms that the Purchaser shall be relying on the foregoing covenant in effecting transactions in securities of the Company.

4.6 Listing of Common Stock. The Company hereby agrees to use commercially reasonable efforts to maintain the listing or quotation of the Common Stock on the Trading Market on which it is currently listed, and concurrently with the Closing, the Company shall apply to list or quote all of the Shares on such Trading Market and promptly secure the listing of all of the Shares on such Trading Market. The Company further agrees, if the Company applies to have the Common Stock traded on any other Trading Market, it will then include in such application all of the Shares, and will take such other action as is necessary to cause all of the Shares to be listed or quoted on such other Trading Market as promptly as possible. The Company will then take all action reasonably necessary to continue the listing and trading of its Common Stock on a Trading Market and will comply in all respects with the Company’s reporting, filing and other obligations under the bylaws or rules of the Trading Market. The Company agrees to maintain the eligibility of the Common Stock for electronic transfer through the Depository Trust Company or another established clearing corporation, including, without limitation, by timely payment of fees to the Depository Trust Company or such other established clearing corporation in connection with such electronic transfer.

4.7 Use of Proceeds. The Company shall use the net proceeds from the sale of the Shares hereunder as described in the Prospectus Supplement.

ARTICLE V

MISCELLANEOUS

5.1 Termination. This Agreement may be terminated by the Company or the Purchaser by written notice to the other party, if the Closing has not been consummated on or before the 30th Trading Day following the date hereof.

5.2 Fees and Expenses. Except as expressly set forth in the Transaction Documents to the contrary, each party shall pay the fees and expenses of its advisers, counsel, accountants and other experts, if any, and all other expenses incurred by such party incident to the negotiation, preparation, execution, delivery and performance of this Agreement. The Company shall pay all Transfer Agent fees (including, without limitation, any fees required for same-day processing of any instruction letter delivered by the Company and any exercise notice delivered by a Purchaser). The Company shall pay any issuance, stamp or documentary taxes (other than transfer taxes) or charges imposed by any governmental body, agency or official (other than income taxes) by reason of the issuance of Shares to the Purchaser.

5.3 Entire Agreement. The Transaction Documents, together with the exhibits and schedules thereto, and the Prospectus Supplement contain the entire understanding of the parties with respect to the subject matter hereof and thereof and supersede all prior agreements and understandings, oral or written, with respect to such matters, which the parties acknowledge have been merged into such documents, exhibits and schedules.

5.4 Notices. Any and all notices or other communications or deliveries required or permitted to be provided hereunder shall be in writing and shall be deemed given and effective on the time of transmission by electronic mail.

5.5 Amendments; Waivers. No provision of this Agreement may be waived, modified, supplemented or amended except in a written instrument signed by the Company and the Purchaser. No waiver of any default with respect to any provision, condition or requirement of this Agreement shall be deemed to be a continuing waiver in the future or a waiver of any subsequent default or a waiver of any other provision, condition or requirement hereof, nor shall any delay or omission of any party to exercise any right hereunder in any manner impair the exercise of any such right. Any amendment effected in accordance with this Section 5.5 shall be binding upon the Purchaser and the Company.

5.6 Headings. The headings herein are for convenience only, do not constitute a part of this Agreement and shall not be deemed to limit or affect any of the provisions hereof.

5.7 Successors and Assigns. This Agreement shall be binding upon and inure to the benefit of the parties and their successors and permitted assigns. No party hereto may assign this Agreement or any rights or obligations hereunder without the prior written consent of the Company and the Purchaser.

5.8 No Third-Party Beneficiaries. This Agreement is intended for the benefit of the parties hereto and their respective successors and permitted assigns and is not for the benefit of, nor may any provision hereof be enforced by, any other Person.

5.9 Governing Law. All questions concerning the construction, validity, enforcement and interpretation of the Transaction Documents shall be governed by and construed and enforced in accordance with the internal laws of the State of New York, without regard to the principles of conflicts of law thereof. Each party agrees that all legal proceedings concerning the interpretations, enforcement and defense of the transactions contemplated by this Agreement and any other Transaction Documents (whether brought against a party hereto or its respective affiliates, directors, officers, shareholders, partners, members, employees or agents) shall be commenced exclusively in the state and federal courts sitting in the City of New York. Each party hereby irrevocably submits to the exclusive jurisdiction of the state and federal courts sitting in the City of New York, Borough of Manhattan for the adjudication of any dispute hereunder or in connection herewith or with any transaction contemplated hereby or discussed herein (including with respect to the enforcement of any of the Transaction Documents), and hereby irrevocably waives, and agrees not to assert in any action or proceeding, any claim that it is not personally subject to the jurisdiction of any such court, that such action or proceeding is improper or is an inconvenient venue for such proceeding. Each party hereby irrevocably waives personal service of process and consents to process being served in any such action or proceeding by mailing a copy thereof via registered or certified mail or overnight delivery (with evidence of delivery) to such party at the address in effect for notices to it under this Agreement and agrees that such service shall constitute good and sufficient service of process and notice thereof. Nothing contained herein shall be deemed to limit in any way any right to serve process in any other manner permitted by law. If any party shall commence an action or proceeding to enforce any provisions of the Transaction Documents, then the prevailing party in such action or proceeding shall be reimbursed by the non-prevailing party for its reasonable attorneys’ fees and other costs and expenses incurred with the investigation, preparation and prosecution of such action or proceeding.

5.10 Survival. The representations and warranties contained herein shall survive the Closing and the delivery of the Securities.

5.11 Execution. This Agreement may be executed in two or more counterparts, all of which when taken together shall be considered one and the same agreement and shall become effective when counterparts have been signed by each party and delivered to each other party, it being understood that the parties need not sign the same counterpart. In the event that any signature is delivered by facsimile transmission or by e-mail delivery of a “.pdf” format data file, by other electronic signing created on an electronic platform (such as DocuSign) or by digital signing (such as Adobe Sign), such signature shall create a valid and binding obligation of the party executing (or on whose behalf such signature is executed) with the same force and effect as if such facsimile or “.pdf” signature page were an original thereof.

5.12 Severability. If any term, provision, covenant or restriction of this Agreement is held by a court of competent jurisdiction to be invalid, illegal, void or unenforceable, the remainder of the terms, provisions, covenants and restrictions set forth herein shall remain in full force and effect and shall in no way be affected, impaired or invalidated, and the parties hereto shall use their commercially reasonable efforts to find and employ an alternative means to achieve the same or substantially the same result as that contemplated by such term, provision, covenant or restriction. It is hereby stipulated and declared to be the intention of the parties that they would have executed the remaining terms, provisions, covenants and restrictions without including any of such that may be hereafter declared invalid, illegal, void or unenforceable.

5.13 Saturdays, Sundays, Holidays, etc. If the last or appointed day for the taking of any action or the expiration of any right required or granted herein shall not be a Trading Day, then such action may be taken or such right may be exercised on the next succeeding Trading Day.

5.14 Construction. The parties agree that each of them and/or their respective counsel have reviewed and had an opportunity to revise the Transaction Documents and, therefore, the normal rule of construction to the effect that any ambiguities are to be resolved against the drafting party shall not be employed in the interpretation of the Transaction Documents or any amendments thereto. In addition, each and every reference to share prices and Common Stock in any Transaction Document shall be subject to adjustment for reverse and forward stock splits, stock dividends, stock combinations and other similar transactions of the Common Stock that occur after the date of this Agreement.

5.15 WAIVER OF JURY TRIAL. IN ANY ACTION, SUIT, OR PROCEEDING IN ANY JURISDICTION BROUGHT BY ANY PARTY AGAINST ANY OTHER PARTY, THE PARTIES EACH KNOWINGLY AND INTENTIONALLY, TO THE GREATEST EXTENT PERMITTED BY APPLICABLE LAW, HEREBY ABSOLUTELY, UNCONDITIONALLY, IRREVOCABLY AND EXPRESSLY WAIVES FOREVER TRIAL BY JURY.

(Signature Pages Follow)

IN WITNESS WHEREOF, the parties hereto have caused this Securities Purchase Agreement to be duly executed by their respective authorized signatories as of the date first indicated above.

|

VAXART, INC.

|

| |

| |

|

By:

|

/S/ PHILLIP LEE

|

|

Name:

|

Phillip Lee

|

|

Title:

|

Chief Financial Officer

|

Address for Notice:

170 Harbor Way, Ste 300

South San Francisco, California 94080

Email:

Phone: (650) 550-3500

With a copy to (which shall not constitute notice):

Faith L. Charles, Esq.

300 Madison Avenue, 27th Floor

New York, New York 10017-6232

Email:

Phone: (212) 344-5680

|

RA CAPITAL HEALTHCARE FUND, L.P.

BY: RA CAPITAL HEALTHCARE FUND GP, LLC, its General Partner

|

| |

| |

|

By:

|

/S/ PETER KILCHINSKY

|

|

Name:

|

Peter Kilchinsky

|

|

Title:

|

Manager

|

Address for Notice:

C/O RA Capital Management, L.P.

200 Berkely Street, 18th Floor

Boston, Massachusetts 02116

Email:

Phone:

Exhibit 99.1

Vaxart Announces $10.0 Million Registered Direct Offering with RA Capital Management

SOUTH SAN FRANCISCO, Calif. January 16, 2024 (GLOBE NEWSWIRE) — Vaxart, Inc. (Nasdaq: VXRT) today announced that it has entered into a common stock purchase agreement with RA Capital Management for the sale of 15,384,615 shares of its common stock in a registered direct offering at an offering price of $0.65 per share.

Gross proceeds are approximately $10.0 million, before deducting expenses payable by Vaxart. Vaxart intends to use the net proceeds from the offering primarily for general corporate purposes, including working capital, operating expenses and capital expenditures.

“We appreciate the financial backing by RA Capital as we continue to progress our oral pill vaccine platform,” said Dr. Michael J. Finney, Vaxart’s Interim Chief Executive Officer. “We believe the clinical proof of data we have generated to date has validated our platform, which carries transformative potential to change how people get vaccinated globally. With this financing, we can continue to advance our programs, with the goal of bringing to market oral pill vaccine(s) that carries significant public health benefits.”

The closing of the registered direct offering is expected to occur on or about January 18, 2024, subject to the satisfaction of customary closing conditions.

The shares of common stock are being offered by Vaxart pursuant to a shelf registration statement on Form S-3. A final prospectus supplement and accompanying prospectus relating to and describing the terms of the offering will be filed with the SEC and is available on the SEC’s website at www.sec.gov.

Electronic copies of the final prospectus supplement and accompanying prospectus may be obtained when available, on the SEC’s website at http://www.sec.gov or by contacting Vaxart Investor Relations, 170 Harbor Way, Suite 300, South San Francisco, CA 94080, by email: investors@vaxart.com or by telephone: (650) 550-3500.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy any securities described herein, nor shall there be any sale of these securities in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such state or jurisdiction.

About Vaxart

Vaxart is a clinical-stage biotechnology company developing a range of oral recombinant vaccines based on its proprietary delivery platform. Vaxart vaccines are designed to be administered using pills that can be stored and shipped without refrigeration and eliminate the risk of needle-stick injury. Vaxart believes that its proprietary pill vaccine delivery platform is suitable to deliver recombinant vaccines, positioning the company to develop oral versions of currently marketed vaccines and to design recombinant vaccines for new indications. Vaxart’s development programs currently include pill vaccines designed to protect against coronavirus, norovirus, seasonal influenza, and respiratory syncytial virus (RSV), as well as a therapeutic vaccine for human papillomavirus (HPV), Vaxart’s first immune-oncology indication. Vaxart has filed broad domestic and international patent applications covering its proprietary technology and creations for oral vaccination using adenovirus and TLR3 agonists.

Note Regarding Forward-Looking Statements