true

AmendmentDescription 1

0001417926

0001417926

2023-12-27

2023-12-27

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K/A

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES

EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): December 27, 2023

INVO

BIOSCIENCE, INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-39701 |

|

20-4036208 |

(State

or other jurisdiction

of

incorporation) |

|

(Commission

File

Number) |

|

(IRS

Employer

Identification

No.) |

5582

Broadcast Court

Sarasota,

Florida 34240

(Address

of principal executive offices)

(Zip

Code)

Registrant’s

telephone number, including area code: (978) 878-9505

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Common

Stock, $0.0001 par value |

|

INVO |

|

The

Nasdaq Stock Market LLC |

| (Title

of Each Class) |

|

(Trading

Symbol) |

|

(Name

of Each Exchange on Which Registered) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (CFR §230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (CFR §240.12b-2 of this chapter). Emerging growth company

☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

EXPLANATORY

NOTE

INVO

Bioscience, Inc. (the “Company”) is filing this Form 8-K/A to its Current Report on Form 8-K as originally filed with

the Securities and Exchange Commission on January 3, 2024 (the “Original Filing”), solely to correctly identify the

number of shares of the Company’s Series A Preferred Stock that NAYA Biosciences, Inc. agreed to purchase from the Company pursuant

to that certain securities purchase agreement, dated December 29, 2023 (the “SPA”). The Original Filing inadvertently

referenced the number of such shares as being 400,000 instead of the 1,000,000 shares agreed to in the SPA. No other changes have been

made from the Original Filing.

Item

1.01 Entry into a Material Definitive Agreement.

Second

Amendment to Agreement and Plan of Merger

On

December 27, 2023, INVO Bioscience, Inc., a Nevada corporation

(the “Company”) entered into second amendment (“Second Amendment”) to the previously announced

agreement and plan of merger (the “Merger Agreement”) by and among the Company, INVO Merger Sub, Inc. (“Merger

Sub”), and NAYA Biosciences, Inc., a Delaware corporation (“NAYA”).

Pursuant

to the Second Amendment, the parties agreed to extend the end date (the date by which either the Company or NAYA may terminate the Merger

Agreement, subject to certain exceptions) of the merger contemplated by the Merger Agreement (the “Merger”) to April

30, 2024. The parties further agreed to modify the closing condition for an interim private offering from a private offering of shares

of Company common stock at a price that is a premium to the market price of the Company common

stock in an estimated amount of $5,000,000 or more of gross proceeds to a private offering of the Company’s preferred stock

at a price per share of $5.00 per share in an amount equal to at least $2,000,000 to the Company, plus an additional amount as may be

required prior to closing of the Merger to be determined in good faith by the parties to adequately support the Company’s fertility

business activities per an agreed forecast, as well as for a period of twelve (12) months post-closing including a catch-up on the Company’s

past due accrued payables still outstanding. The parties further agreed to the following schedule (the “Minimum Interim Pipe

Schedule”) for the initial $2,000,000: (1) $500,000 no later than December 29, 2023, (2) $500,000 no later than January 19,

2024, (3) $500,000 no later than February 2, 2024, and (4) $500,000 no later than February 16, 2024. The parties also further agreed

to modify the covenant of the parties regarding the interim private offering to require NAYA to consummate the interim private offering

before the closing of the Merger; provided, however, if the Company does not receive the initial gross proceeds pursuant to the Minimum

Interim Pipe Schedule, the Company shall be free to secure funding from third parties to make up for short falls on reasonable terms

under SEC and Nasdaq regulations.

The

foregoing description of the Second Amendment does not purport to be complete and is qualified in its entirety by reference to the Second

Amendment, which is attached hereto as Exhibit 2.1 and is incorporated herein by reference.

Securities

Purchase Agreement

On

December 29, 2023, the Company entered into a securities

purchase agreement (the “SPA”) with NAYA for NAYA’s purchase of 1,000,000 shares of the Company’s Series

A Preferred Stock at a purchase price of $5.00 per share. The parties agreed that NAYA’s purchases will be made in tranches in

accordance with the Minimum Interim Pipe Schedule. The SPA contains customary representations,

warranties and covenants of the Company and NAYA.

As

of January 3, 2024, the Company had yet to receive the $500,000 due on December 29, 2023, and expects this amount to close later this

week.

The

foregoing description of the SPA does not purport to be complete and is qualified in its entirety by reference to the SPA, which is attached

hereto as Exhibit 10.1 and is incorporated herein by reference.

Convertible

Note Extension

In

January and March 2023, the Company issued $410,000 of convertible notes (the “Convertible Notes”) with a maturity

date of December 31, 2023. The Convertible Notes were issued with fixed conversion prices of $10.00 (for the $275,000 issued in January

2023) and $12.00 (for the $135,000 issued in March 2023) and (ii) 5-year warrants (the “Q1 2023 Warrants”) to purchase

19,375 shares of Common Stock at an exercise price of $20.00.

The

Convertible Notes may be amended with the written consent of the Company and the holders of a majority of the outstanding principal of

the Convertible Notes (the “Required Holders”); provided that, no such amendment, without the written consent of each

Convertible Note holder, may (i) reduce the principal amount or interest rate or change the method of computation of interest (including

with respect to the amount of cash) in the Convertible Notes, (ii) change the percentage of the outstanding principal amount of the Convertible

Notes required to consent to any such amendment or (iii) amend Section 9 (Modifications) of the Convertible Note.

As

of December 27, 2023, the Company secured written consent by the Required Holders for the Convertible Note maturity date to be extended

to June 30, 2024. As an incentive for the Required Holders to approve the extension, the Company agreed to lower both the Convertible

Note fixed conversion price and the Q1 2023 Warrant exercise price to $2.25. The maturity date extension and the conversion and exercise

price reduction applies to all Convertible Notes.

Item

3.02 Unregistered Sale of Equity Securities.

The

information set forth in Item 1.01 is incorporated herein by reference. The Company is offering the Series A Preferred Stock pursuant

to an exemption from registration under Section 4(a)(2) of the Securities Act of 1933, as amended.

Item

8.01 Other Events.

On

August 10, 2023, the Company’s CEO, Steve Shum, and CFO, Andrea Goren, voluntarily agreed to temporarily reduce the annual base

salary under their employment agreements from $260,000 and $215,000, respectively, to $105,000 (the “Temporary Salary Reductions”).

The Temporary Salary Reductions took effect on August 16, 2023. As of January 1, 2024, the salary for the Company’s CEO and CFO

reverted to the amount reflected in their respective employment agreements.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

| Exhibit |

|

Description |

| |

|

|

| 2.1 |

|

Second Amendment to Agreement and Plan of Merger by and among INVO Bioscience, Inc., INVO Merger Sub, Inc., and NAYA Biosciences, Inc. dated December 27, 2023, filed as Exhibit 2.1 to our Current Report on Form 8-K filed with the Securities and Exchange Commission on January 3, 2024 and incorporated herein by reference. |

| |

|

|

| 10.1 |

|

Securities Purchase Agreement by and between INVO Bioscience, Inc. and NAYA Biosciences, Inc. dated as of December 29, 2023, filed as Exhibit 10.1 to our Current Report on Form 8-K filed with the Securities and Exchange Commission on January 3, 2024 and incorporated herein by reference. |

| |

|

|

| 104 |

|

Cover

Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Date:

January 10, 2024

| |

INVO

BIOSCIENCE, INC. |

| |

|

|

| |

By: |

/s/

Steven Shum |

| |

|

Steven

Shum |

| |

|

Chief

Executive Officer |

v3.23.4

| X |

- DefinitionDescription of changes contained within amended document.

| Name: |

dei_AmendmentDescription |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:stringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

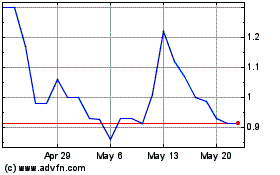

INVO BioScience (NASDAQ:INVO)

Historical Stock Chart

From Mar 2024 to Apr 2024

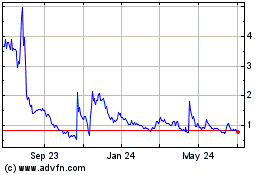

INVO BioScience (NASDAQ:INVO)

Historical Stock Chart

From Apr 2023 to Apr 2024