false000112480400011248042024-01-052024-01-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): January 05, 2024 |

VERADIGM INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-35547 |

36-4392754 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

222 Merchandise Mart |

|

Chicago, Illinois |

|

60654 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 800 334-8534 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.01 per share |

|

MDRX |

|

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On January 10, 2024, Veradigm Inc., a Delaware corporation (the “Company”), issued a press release regarding certain estimated, unaudited financial information relating to the fiscal 2023 reporting period (collectively, the “Financial Information”). The Financial Information is contained in the press release attached hereto as Exhibit 99.1, and such press release is incorporated herein by reference.

The Financial Information is preliminary, and final results for fiscal year 2023 may change. These preliminary results are based upon the Company’s estimates and are subject to completion of the Company’s financial closing procedures. In addition, these preliminary results have not been audited by our independent registered public accounting firm. The provided summary of Financial Information is not a comprehensive statement of the Company’s financial results for fiscal 2023.

The information furnished pursuant to this Item 2.02 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

On January 5, 2023, the Company received a notice of noncompliance (the “Notice”) from The Nasdaq Stock Market LLC (“Nasdaq”) indicating that, as a result of the Company’s not holding an annual meeting of stockholders within the one-year period following its fiscal year ended on December 31, 2022, the Company was not in compliance with Nasdaq Listing Rule 5620(a), which requires companies listing common stock to hold an annual meeting of stockholders no later than one year after the end of the company’s fiscal year (the “Annual Meeting Deficiency”). As previously disclosed, the Company has received prior notices of noncompliance from Nasdaq relating to the Company’s noncompliance with Nasdaq Listing Rule 5250(c)(1), and the Nasdaq Hearings Panel (the “Panel”) previously issued a decision granting the Company’s request for continued listing on The Nasdaq Stock Market, subject to the Company demonstrating compliance with Nasdaq Listing Rule 5250(c)(1) on or before February 27, 2024, and certain other conditions, including the achievement of various interim milestones (the “Panel Decision”). While the Notice has no immediate effect on the listing of the Company’s common stock on The Nasdaq Stock Market, the Notice indicates that the Annual Meeting Deficiency serves as an additional basis for delisting. The Notice also provides that the Panel will consider the Annual Meeting Deficiency in its decision regarding the Company’s continued listing on The Nasdaq Stock Market. The Company plans to present its views with respect to the Annual Meeting Deficiency to the Panel in writing by January 12, 2024, as requested by the Panel in the Notice, and to hold an annual meeting of stockholders as soon as possible after it becomes timely in its financial statement reporting. The Company also plans to file its Form 10-K for the fiscal year ended December 31, 2022 and its Form 10-Qs for the fiscal quarters ended March 31, 2023, June 30, 2023 and September 30, 2023 as soon as possible; however, no assurance can be given as to the definitive date on which such periodic reports will be filed or on which an annual meeting of stockholders will be held.

Item 7.01 Regulation FD Disclosure.

On January 10, 2024, the Company will present at the 2024 J.P. Morgan Healthcare conference. A copy of the Company’s presentation is attached hereto as Exhibit 99.2 and is incorporated herein by reference. The Company intends to use this presentation at other investor conferences.

The information furnished pursuant to this Item 7.01 shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or incorporated by reference in any filing under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 8.01 Other Information.

The Company previously disclosed an ongoing independent investigation by the Audit Committee of the Board of Directors of the Company that relates to the Company’s financial reporting, internal controls over financial reporting and disclosure controls (the “Audit Committee Investigation”). To date, the potential adjustments to the Company’s previously issued financial statements prepared in accordance with US generally accepted accounting principles that have been identified as a result of the Audit Committee Investigation are non-cash items relating to the timing of certain impairments and accrual amounts. However, the investigation remains ongoing, and additional adjustments may be identified.

The Company has voluntarily disclosed to the Staff of the U.S. Securities and Exchange Commission (the “SEC”) information concerning the Audit Committee Investigation. The Company is cooperating with the SEC regarding this matter.

On November 22, 2023, the Company and certain of its former officers were named as defendants in a putative securities class action captioned Erwin v. Veradigm Inc. et al., No. 1:23-cv-16205, which is pending in the United States District Court for the Northern District of Illinois (the “Class Action Lawsuit”). The complaint for the Class Action Lawsuit alleges violations of Section 10(b) of the Exchange Act and Rule 10b-5 promulgated thereunder, and Section 20(a) of the Exchange Act based on allegedly false and

misleading statements and omissions in connection with the Company’s previously disclosed revenue misstatements resulting from certain internal control failures. An amended complaint was filed on January 5, 2024, adding allegations related to the previously disclosed Nasdaq process and previously announced management changes. The plaintiffs in the Class Action Lawsuit seek compensatory damages. The Company intends to vigorously defend this matter.

The Audit Committee Investigation, the Class Action Lawsuit, the SEC investigation, and any future litigation or investigation relating to the Audit Committee Investigation, the Company’s previously disclosed revenue misstatements or other related matters may give rise to risks and uncertainties that could adversely affect the Company’s business, results of operations and financial condition. Such risks and uncertainties include, but are not limited to, adverse effects of the Audit Committee Investigation and associated remediation steps that have been taken and may be taken in the future, including on the Company’s timeline for filing its delinquent periodic reports and resuming compliance with Nasdaq Listing Rule 5250(c)(1) and Nasdaq Listing Rule 5620(a); the potential identification of additional deficiencies in internal controls over financial reporting or disclosure controls and procedures or additional adjustments and the impact of any such deficiencies or adjustments; uncertainty as to the scope of inquiry, timing and ultimate findings by the SEC; the costs and expenses of the Audit Committee Investigation, the Class Action Lawsuit and the SEC investigation, including legal fees and possible monetary penalties or damages in the event of any adverse outcomes; the risk of additional potential litigation or regulatory actions arising from these matters; and potential reputational damage that the Company may suffer as a result of these matters.

The SEC has a broad range of civil sanctions available should it commence an enforcement action, including injunctive relief, disgorgement, fines, penalties or an order to take remedial action. The imposition of any of these sanctions, fines or remedial measures could have a material adverse effect on the Company’s business, results of operation and financial condition. Furthermore, the outcome of the Class Action Lawsuit and any other future litigation is necessarily uncertain. The Company has expended significant costs in connection with the restatement of its financial statements and the Audit Committee Investigation, and the Company could be required to expend additional significant resources for all of the matters referenced in this Item 8.01 and in the defense of existing or future litigation or any future investigations, and the Company may not prevail in any litigation or investigation.

Disclosure Regarding Forward-Looking Information

This Current Report on Form 8-K and the exhibits attached hereto contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to, statements regarding the Company’s strategic priorities, growth opportunities and commitments, the Company’s beliefs and expectations relating to the filing of its delinquent periodic reports and the holding of an annual meeting of stockholders and the Company’s intentions with respect to cooperation with the SEC and defense of the Class Action Lawsuit. These forward-looking statements are based on the current beliefs and expectations of the Company’s management with respect to future events, only speak as of the date that they are made and are subject to significant risks and uncertainties. Such statements can be identified by the use of words such as “future,” “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “predicts,” “will,” “would,” “could,” “continue,” “can,” “may,” “look forward,” “aim,” “hopes,” and similar terms, although not all forward-looking statements contain such words or expressions. Actual results could differ significantly from those set forth in the forward-looking statements.

Important factors that may cause actual results to differ materially from those in the forward-looking statements, in addition to the risks identified in this Form 8-K, include, but are not limited to, a further material delay in the Company’s financial reporting or ability to hold an annual meeting of stockholders, including as a result of the recently-announced leadership changes, an inability to timely prepare restated financial statements, unanticipated factors or factors that the Company currently believes will not cause delay, the impacts of the Audit Committee Investigation, including on the Company’s remediation efforts and preparation of financial statements or other factors that could cause additional delay or adjustments, the possibility that the ongoing review may identify additional errors and material weaknesses or other deficiencies in the Company’s accounting practices, the likelihood that the control deficiencies identified or that may be identified in the future will result in additional material weaknesses in the Company’s internal control over financial reporting, the Company being delisted if the Company is unable to regain compliance with Nasdaq Listing Rule 5250(c)(1) and Nasdaq Listing Rule 5620(a) or meet any of the interim milestones imposed by the Panel Decision, the possibility that the Company subsequently fails to remain in compliance with Nasdaq Listing Rule 5250(c)(1) or Nasdaq Listing Rule 5620(a) or experiences violations of additional Nasdaq Listing Rules, the possibility that the Nasdaq Listing and Hearing Review Council reviews the Panel Decision or that the Panel revises the Panel Decision in light of the Annual Meeting Deficiency, and other factors contained in the “Risk Factors” section and elsewhere in the Company’s filings with the SEC from time to time, including, but not limited to, its Annual Report on Form 10-K and its Quarterly Reports on Form 10-Q. The Company does not undertake to update any forward-looking statements to reflect changed assumptions, the impact of circumstances or events that may arise after the date of the forward-looking statements, or other changes over time, except as required by law.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

VERADIGM INC. |

|

|

|

|

Date: |

January 10, 2024 |

By: |

/s/ Eric Jacobson |

|

|

|

Eric Jacobson

Senior Vice President, Deputy General Counsel

and Corporate Secretary

|

Exh. 99.1

New Veradigm Leadership Provides Outlook on Business and

Strategy, and Refreshed Financial Estimates for Fiscal 2023

CHICAGO – January 10, 2024 – The new leadership team at Veradigm Inc. (NASDAQ: MDRX),a leading provider of healthcare data and technology solutions, has provided refreshed estimated, unaudited ranges of financial information for fiscal 2023. Dr. Shih-Yin Ho, Interim CEO, and Lee Westerfield, Interim CFO, will discuss Veradigm’s mission, business and operations, and innovation strategy, as well as its estimated financial information for fiscal 2023, at the J.P. Morgan Healthcare Conference on Wednesday, January 10, 2024 at 11:15 AM PST.

Management currently estimates the following unaudited ranges of financial information for fiscal 2023:

•Revenue on a GAAP basis is estimated between $608 million and $622 million. Estimated revenue includes a favorable customer litigation settlement, contributing approximately $16 million on a GAAP basis that reflects services provided over prior years.

•Adjusted EBITDA(1) is estimated between $122 million and $135 million. Such range, now excludes approximately $16 million favorable customer litigation settlement and certain other legal settlements that were previously included in prior Adjusted EBITDA guidance as of September 18, 2023.

•GAAP Net Income from continuing operations is estimated between $49 million and $58 million.

•Non-GAAP diluted earnings per share(1) is estimated between $0.79 and $0.88. GAAP diluted earnings per share is estimated between $0.39 and $0.46.

•Net Cash is estimated to exceed $232 million as of December 31, 2023, comprised of Cash and cash equivalents, which is expected to exceed $440 million, and Debt of $208 million that consists solely of the principal amount of the 2019 convertible notes; our senior secured credit facility remains undrawn.

(1) Please refer to the “Explanation of Non-GAAP Financial Measures” section.

“The state of Veradigm is fundamentally healthy. Its financials rest on a solid foundation that is evident in its net cash position and its high-quality mix of recurring subscription revenue. We believe our fiscal health enables us to invest in strategic opportunities for growth, product initiatives for margin expansion, and share repurchases for returns to shareholders – all in all, fulfilling our mission to address unmet client needs for healthtech and to elevate ROI and shareholder value.

“Along with our CEO Dr. Shih-Yin Ho and President & Chief Commercial Officer Tom Langan, I see a team committed to driving accelerated growth, delivering products that our customers value. I lead a finance and accounting team of professionals, and we are committed to fostering a robust financial controls environment, and striving to report timely and useful financials to shareholders.

“Our estimated financial information that we announced today reflects a renewal of those commitments. We look forward to sharing more about our financial position and long-term strategy,” said Lee Westerfield, Interim Chief Financial Officer.

The J.P Morgan Healthcare Conference webcast and presentation will be available in the investor section of the company's website at investor.veradigm.com

|

|

|

|

|

|

|

|

|

|

Table 1 |

Veradigm Inc. |

Bridge of Guidance issued September 18, 2023 to Estimated Range issued January 10, 2024 |

(In millions, except earnings per share) |

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

Guidance issued September 18, 2023 |

|

Variance |

|

|

Estimated Range January 10, 2024 |

|

|

|

|

|

|

|

|

|

|

|

|

Revenue (a) |

|

$615 - $635 |

|

($7) - ($13) |

|

|

$608 - $622 |

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA (b) |

|

$160 - $170 |

|

($35) - ($38) |

|

|

$122 - $135 |

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP Earnings per share (c) |

$0.80 - $0.90 |

|

($0.01) - ($0.02) |

|

|

$0.79 - $0.88 |

|

|

(a) Revenue variance reflects provider segment revenue shortfall. Estimated Range of revenue, on a GAAP basis, includes a favorable customer litigation settlement contributing approximately $16 million that reflects services provided over prior years. |

(b) Adjusted EBITDA variance reflects Revenue variance, certain favorable and unfavorable legal settlements, including the customer litigation settlement described above, and additional personnel expense accruals. The $16 million favorable customer litigation settlement and certain other legal settlements were previously reflected in the Company’s Adjusted EBITDA guidance issued on September 18, 2023. The Company’s exclusion of these items from its estimated range of Adjusted EBITDA is a change in the Company’s policy regarding the presentation of this measure. |

(c) Non-GAAP Earnings per share variance reflects Revenue and Adjusted EBITDA variances, favorable upside in other income and interest income. |

|

|

|

|

|

|

Table 2 |

Veradigm Inc. |

Reconciliation of Non-GAAP Financial Information - Estimated Adjusted EBITDA Range |

(In millions) |

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

Estimated Low End |

|

Estimated High End |

|

GAAP Net Income from Continuing Operations |

|

$49 |

|

$58 |

|

Plus: |

|

|

|

|

|

Interest (income)/expense, net |

|

($17) |

|

($17) |

|

Other (income)/expense |

|

($13) |

|

($13) |

|

Depreciation and amortization |

|

$49 |

|

$49 |

|

Income tax (benefit)/provision |

|

$16 |

|

$19 |

|

Stock-based compensation expense |

|

$14 |

|

$14 |

|

Transaction and other |

|

$25 |

|

$26 |

|

Adjusted EBITDA |

|

$122 |

|

$135 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Table 3 |

Veradigm Inc. |

Reconciliation of Non-GAAP Financial Information - Estimated Non-GAAP Earnings Per Share Range |

(In millions, except earnings per share) |

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

Estimated Low End |

|

Estimated High End |

|

GAAP Net Income from Continuing Operations |

|

$49 |

|

$58 |

|

Plus: |

|

|

|

|

|

Tax rate alignment |

|

($11) |

|

($11) |

|

Acquisition-related amortization |

|

$14 |

|

$14 |

|

Stock-based compensation expense |

|

$14 |

|

$14 |

|

Transaction and other |

|

$19 |

|

$20 |

|

Non-GAAP Net Income |

|

$86 |

|

$96 |

|

|

|

|

|

|

|

Non-GAAP effective tax rate |

|

24% |

|

24% |

|

|

|

|

|

|

|

Weighted shares outstanding - diluted |

|

124.7 |

|

124.7 |

|

Less the net effect of convertible notes and note hedges |

|

(15.6) |

|

(15.6) |

|

Non-GAAP Weighted shares outstanding - diluted |

|

109.1 |

|

109.1 |

|

|

|

|

|

|

|

Net Income (loss) per share - diluted |

|

$0.39 |

|

$0.46 |

|

Non-GAAP Net Income (loss) per share - diluted |

|

$0.79 |

|

$0.88 |

|

About Veradigm®

Veradigm is a healthcare technology company that drives value through its unique combination of platforms, data, expertise, connectivity, and scale. The Veradigm Network features a dynamic community of solutions and partners providing advanced insights, technology, and data-driven solutions for the healthcare provider, payer, and biopharma markets. For more information about how Veradigm is fulfilling its mission of Transforming Health, Insightfully, visit www.veradigm.com, or find Veradigm on LinkedIn, Facebook, Twitter, and YouTube.

For more information contact:

Investors:

Jenny Gelinas

312-506-1237

jenny.gelinas@veradigm.com

Media:

Concetta Rasiarmos

312-447-2466

concetta.rasiarmos@veradigm.com

© 2024 Veradigm Inc. and/or its affiliates. All Rights Reserved.

Disclaimer and Forward-Looking Statement Information

The estimated financial results contained in this press release are preliminary, and final results for fiscal year 2023 may change. These preliminary results are based upon our estimates and are subject to completion of our financial closing procedures. In addition, these preliminary results have not been audited by our independent registered public accounting firm. This summary of recent results is not a comprehensive statement of our financial results for fiscal 2023.

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to, statements regarding the Company’s strategic priorities, growth opportunities and commitments. These forward-looking statements are based on the current beliefs and expectations of the Company’s management with respect to future events, only speak as of the date that they are made and are subject to significant risks and uncertainties. Such statements can be identified by the use of words such as “future,” “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “predicts,” “will,” “would,” “could,” “continue,” “can,” “may,” “look forward,” “aim,” “hopes,” and similar terms, although not all forward-looking statements contain such words or expressions. Actual results could differ significantly from those set forth in the forward-looking statements.

Important factors that may cause actual results to differ materially from those in the forward-looking statements, in addition to the risks identified in the Form 8-K accompanying this press release, include, but are not limited to, a further material delay in the Company’s financial reporting or ability to hold an annual meeting of shareholders,

including as a result of the recently-announced leadership changes, an inability to timely prepare restated financial statements, unanticipated factors or factors that the Company currently believes will not cause delay, the impacts of the previously disclosed, ongoing independent investigation by the Audit Committee of the Board of Directors of the Company that relates to the Company’s financial reporting, internal controls over financial reporting and disclosure controls, including on the Company’s remediation efforts and preparation of financial statements or other factors that could cause additional delay or adjustments, the possibility that the ongoing review may identify additional errors and material weaknesses or other deficiencies in the Company’s accounting practices, the likelihood that the control deficiencies identified or that may be identified in the future will result in additional material weaknesses in the Company’s internal control over financial reporting, the Company being delisted if the Company is unable to regain compliance with Nasdaq Listing Rule 5250(c)(1) and Nasdaq Listing Rule 5620(a) or meet any of the interim milestones imposed by the Nasdaq Hearings Panel (the “Panel”) in its decision, the possibility that the Company subsequently fails to remain in compliance with Nasdaq Listing Rule 5250(c)(1) or Nasdaq Listing Rule 5620(a) or experiences violations of additional Nasdaq Listing Rules, the possibility that the Nasdaq Listing and Hearing Review Council reviews the Panel’s decision or that the Panel revises its decision in light of the Company’s failure to hold an annual meeting in the time period required by Nasdaq Listing Rule 5620(a) and other factors contained in the “Risk Factors” section and elsewhere in the Company’s filings with the SEC from time to time, including, but not limited to, its Annual Report on Form 10-K and its Quarterly Reports on Form 10-Q. The Company does not undertake to update any forward-looking statements to reflect changed assumptions, the impact of circumstances or events that may arise after the date of the forward-looking statements, or other changes over time, except as required by law.

Explanation of Non-GAAP Financial Measures

Veradigm reports its financial results in accordance with U.S. generally accepted accounting principles, or GAAP. To supplement this information, Veradigm presents Adjusted EBITDA and non-GAAP diluted earnings per share, which are considered non-GAAP financial measures under Section 101 of Regulation G under the Securities Exchange Act of 1934, as amended. The definitions of these non-GAAP financial measures are presented below:

•Adjusted EBITDA is a non-GAAP financial measure and consists of GAAP net income/(loss) from continuing operations, and adjusts for: interest (income)/expense,net; other (income)/expense; depreciation and amortization; stock-based compensation expense; and transaction and other costs. Reconciliation to GAAP net income/(loss) from operations are found in Table 2 within this press release.

•Non-GAAP diluted earnings per share consist of non-GAAP net income, as defined below, divided by non-GAAP diluted weighted shares outstanding, as defined below, during the applicable period.

•Non-GAAP net income attributable to Veradigm Inc. consists of GAAP net income/(loss) from continuing operations and adds back acquisition-related amortization; stock-based compensation expense; and transaction and other costs. Non-GAAP net income measure would also include a GAAP to non-GAAP tax rate alignment adjustment.

•Non-GAAP diluted weighted shares outstanding consists of diluted weighted shares outstanding, as reported, less the dilutive impact of 0.875% convertible notes due to the intent to settle the principal in cash and shares to be delivered at settlement by the convertible note hedge.

Acquisition-Related Amortization. Acquisition-related amortization expense is a non-cash expense arising primarily from the acquisition of intangible assets in connection with acquisitions or investments. Veradigm excludes acquisition-related amortization expense from non-GAAP gross profit, non-GAAP operating income, non-GAAP net income, and Adjusted EBITDA because it believes (i) the amount of such expenses in any specific period may not directly correlate to the underlying performance of Veradigm business operations and (ii) such expenses can vary significantly between periods because of new acquisitions and full amortization of previously acquired intangible assets. Investors should note that the use of these intangible assets contributed to revenue in the periods presented and will contribute to future revenue generation, and the related amortization expense will recur in future periods.

Stock-Based Compensation Expense. Stock-based compensation expense is a non-cash expense arising from the grant of stock-based awards. Veradigm excludes stock-based compensation expense from non-GAAP gross profit, non-GAAP operating income, non-GAAP net income and Adjusted EBITDA because it believes (i) the amount of such expenses in any specific period may not directly correlate to the underlying performance of Veradigm business operations and (ii) such expenses can vary significantly between periods as a result of the timing and valuation of grants of new stock-based awards, including grants in connection with acquisitions. Investors should note that stock-based compensation is a key incentive offered to employees whose efforts contributed to the operating results in the periods presented and are expected to contribute to operating results in future periods, and such expense will recur in future periods.

Transaction and Other Costs. Transaction and other costs relate to certain favorable and unfavorable legal settlements, investigations, restatement-related accounting and legal advisory services and other charges incurred in connection with activities that are considered not reflective of our core business. Veradigm excludes transaction and other costs, in whole or in part, from non-GAAP gross profit, non-GAAP operating income, non-GAAP net income and Adjusted EBITDA because it believes (i) the amount of such expenses in any specific period may not directly correlate to the underlying performance of Veradigm business operations and (ii) such expenses can vary significantly between periods.

Non-Cash Charges to Interest Expense and Other. Non-cash charges to interest expense include the amortization of the fair value of the conversion option embedded in the 0.875% convertible notes issued by Veradigm during the fourth quarter of 2019. Other includes certain other income and expense and impairments on long-term investments.

Tax Rate Alignment. Tax rate alignment aligns the applicable period’s effective tax rate to the expected annual non-GAAP effective tax rate.

Management also believes that non-GAAP diluted earnings per share and Adjusted EBITDA provide useful supplemental information to management and investors regarding the underlying performance of Veradigm’s business operations. Acquisition-related amortization, stock-based compensation expense and transaction and other costs recorded in accordance with GAAP can make it difficult to make meaningful comparisons of the underlying operations of the business without considering the non-GAAP adjustments provided and discussed herein.

Management also uses this information internally for forecasting and budgeting, as it believes that these measures are indicative of core operating results. In addition, management may use non-GAAP diluted earnings per share and Adjusted EBITDA to measure achievement under Veradigm’s stock and cash incentive compensation plans. Note, however, that non-GAAP diluted earnings per share and Adjusted EBITDA are performance measures only, and they do not provide any measure of cash flow or liquidity. Non-GAAP financial measures are not in accordance with, or an alternative for, measures of financial performance prepared in accordance with GAAP and may be different from non-GAAP measures used by other companies. Non-GAAP measures have limitations in that they do not reflect all of the amounts associated with Veradigm’s results of operations as determined in accordance with GAAP. Investors and potential investors are encouraged to review the definitions and reconciliations of non-GAAP financial measures with GAAP financial measures contained within this press release.

As noted above, the estimated non-GAAP financial measures and GAAP financial measures in this press release are preliminary, and final results for fiscal year 2023 may change. These preliminary results are based upon our estimates and are subject to completion of our financial closing procedures. In addition, these preliminary results have not been audited by our independent registered public accounting firm. This summary of recent results is not a comprehensive statement of our financial results for fiscal 2023.

JP Morgan �Healthcare Conference Building for the Future January 10, 2024 Exh. 99.2

Disclaimer & Forward-Looking Statements The estimated financial results contained in this presentation are preliminary, and final results for fiscal year 2023 may change. These preliminary results are based upon our estimates and are subject to completion of our financial closing procedures. In addition, these preliminary results have not been audited by our independent registered public accounting firm. This summary of recent results is not a comprehensive statement of our financial results for fiscal 2023. This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to, statements regarding the Company’s strategic priorities, growth opportunities and commitments. These forward-looking statements are based on the current beliefs and expectations of the Company’s management with respect to future events, only speak as of the date that they are made and are subject to significant risks and uncertainties. Such statements can be identified by the use of words such as “future,” “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “predicts,” “will,” “would,” “could,” “continue,” “can,” “may,” “look forward,” “aim,” “hopes,” and similar terms, although not all forward-looking statements contain such words or expressions. Actual results could differ significantly from those set forth in the forward-looking statements. Important factors that may cause actual results to differ materially from those in the forward-looking statements, in addition to the risks identified in the Form 8-K accompanying this presentation, include, but are not limited to, a further material delay in the Company’s financial reporting or ability to hold an annual meeting of shareholders, including as a result of the recently-announced leadership changes, an inability to timely prepare restated financial statements, unanticipated factors or factors that the Company currently believes will not cause delay, the impacts of the previously disclosed, ongoing independent investigation by the Audit Committee of the Board of Directors of the Company that relates to the Company’s financial reporting, internal controls over financial reporting and disclosure controls, including on the Company’s remediation efforts and preparation of financial statements or other factors that could cause additional delay or adjustments, the possibility that the ongoing review may identify additional errors and material weaknesses or other deficiencies in the Company’s accounting practices, the likelihood that the control deficiencies identified or that may be identified in the future will result in additional material weaknesses in the Company’s internal control over financial reporting, the Company being delisted if the Company is unable to regain compliance with Nasdaq Listing Rule 5250(c)(1) and Nasdaq Listing Rule 5620(a) or meet any of the interim milestones imposed by the Nasdaq Hearings Panel (the “Panel”) in its decision, the possibility that the Company subsequently fails to remain in compliance with Nasdaq Listing Rule 5250(c)(1) or Nasdaq Listing Rule 5620(a) or experiences violations of additional Nasdaq Listing Rules, the possibility that the Nasdaq Listing and Hearing Review Council reviews the Panel’s decision or that the Panel revises its decision in light of the Company’s failure to hold an annual meeting in the time period required by Nasdaq Listing Rule 5620(a) and other factors contained in the “Risk Factors” section and elsewhere in the Company’s filings with the SEC from time to time, including, but not limited to, its Annual Report on Form 10-K and its Quarterly Reports on Form 10-Q. The Company does not undertake to update any forward-looking statements to reflect changed assumptions, the impact of circumstances or events that may arise after the date of the forward-looking statements, or other changes over time, except as required by law. Copyright ©2024 Veradigm® | All rights reserved 2

Agenda Introduction Leadership Team Financials Business Update

Our Mission At Veradigm we are transforming health, insightfully PAYER LIFE SCIENCES PROVIDER Veradigm is a healthcare technology and analytics company spanning across the three pillars of healthcare Differentiators are our connectivity, scale, and expertise Copyright ©2024 Veradigm® | All rights reserved 4

Leadership Team Copyright ©2024 Veradigm® | All rights reserved 5

Refreshed Executive Team Driving Veradigm Forward Dr. Shih-Yin Ho Interim CEO Lee Westerfield Interim CFO Former Pfizer eHealth executive & CEO of multiple startups in data and healthtech Veradigm Board member Deep expertise in healthtech product innovation & transformation Vision & expertise to accelerate growth in the next generation of healthcare tech CFO with track record scaling & maturing healthtech & SaaS firms Expertise fostering financial controls & profitable growth Previous tenure serving as internet & media sell side equity analyst

Financials Copyright ©2024 Veradigm® | All rights reserved 7

SEC Filing Status Update Copyright ©2024 Veradigm® | All rights reserved 8

Stable & �Recurring Consistently Profitable Solid Capital Foundation Financial Profile The Financial State of Veradigm is Fundamentally Sound Revenue Net Cash Adjusted EBITDA �and Adjusted EPS For further information, please refer to the Appendix.

Revenue, F2023 Estimates High Quality Revenue Mix with a Majority Recurring Revenue Please see disclaimer & forward-looking statements and appendix for more information. Provider, �Stable Majority Recurring Revenue Payer & Life Sciences, Moderate Growth $608M�to �$622M 2022 2023 Growth by Segment

$122M�to�$135M Adjusted EBITDA and EPS, F2023 Estimates�Steady Profitability Adjusted EBITDA $0.79�to�$0.88 Adjusted EPS, Non-GAAP Basis Please see disclaimer & forward-looking statements and appendix for more information.

Multiple Alternatives Share Repurchase Margin Expansion�Invest in Product and Cloud Infrastructure Accelerate Growth�Tech-Forward�Strategic Acquisitions Net Cash, F2023 Estimates�Clean Balance Sheet Enables Alternatives to Elevate ROI & TEV $440M+ Convertible Notes, $208M�Senior Facility, Undrawn Cash & Cash Equivalents Debt Net Cash $232M+

Business Update Copyright ©2024 Veradigm® | All rights reserved 13

Business Update Veradigm Business & Growth Drivers The Veradigm Advantage Our Unique Position to Lead Next Generation Health Intelligence Product Platforms Scalable, High-Quality Data Assets Provider, Payer and Life Sciences Customer Footprint Healthcare Ecosystem Expertise Leveraging AI Technology to Drive Value

We empower our clients with trusted data, insights, and solutions to help improve health outcomes and reduce costs for the patients they serve PAYER LIFE SCIENCES/RESEARCH PHYSICIANS/PROVIDERS Veradigm’s established technology platforms & solutions place it at the intersection of the three pillars of healthcare PROVIDER FOOTPRINT SCALABLE DATA POINT-OF-CARE CONNECTIVITY Driving Value With: Copyright ©2024 Veradigm® | All rights reserved 15

Unique Ability to Drive Efficiencies; Enhance Decision Making at the Point of Care Scale Workflow Connectivity Analytics Core Veradigm Assets Proprietary Data Registries Healthcare IT Partners The Veradigm Advantage Large-Scale, High-Quality Data &

Market Trends Driving Veradigm’s Growth Key stakeholder markets are converging around value-based care, and so is Veradigm Move to outpatient and ambulatory care Changing �interoperability �standards Payers need data to drive value-based purchasing Dynamic regulatory environment Expanding use of real-world data Life sciences needs health economics & clinical trial support GROWTH DRIVERS Uniquely Positioned to Leverage Convergence of Healthcare Market & the Transition to Value-Based Care

For the last 20 years, Veradigm has built a unique and valuable dataset in healthcare, positioning the company to become the health intelligence leader for the next century of care Veradigm sits at the intersection of large-scale, high-quality data that spans clinical and claims But there is more…

Strategically Positioned to Capitalize on AI & Lead the Next Generation of Health Intelligence Products Our established platforms & solutions sit at the center of the three pillars of healthcare Our data capture spans large provider footprint to create high-value, scalable data assets Our data connectivity across the healthcare ecosystem combined with our healthcare expertise delivers high-value analytics Payer Life Sciences/Research Physicians/Providers 400K+ Providers 200M+ Patients Veradigm Network

Veradigm is positioned to be at the center of the largest platform shift ever in healthcare and life sciences because we have the data lead AI is turning Veradigm’s data assets into data opportunities by putting its platform at center of the care continuum of the future We can lead ethically to support care and research that benefits humanity EHR/ EMR

Strategy Meets the Future Q2 2022 Veradigm announces reorganization and focus on life sciences & payer markets Q1 2023 New Board appointments with industry & transformation business expertise Q2 2023 Strategy developed to harvest & monetize data, analytics, and AI for Veradigm’s data assets Q3 2023 Initial pilots with key partners, internal talent development, and early small acquisitions to accelerate AI capabilities Q4 2023 Appointment of Dr. Yin Ho and Lee Westerfield to assess, guide and lead

= developing Leveraging AI Capabilities to Build Product Lines of Differentiated Data & Health Intelligence Products Strategy Expand scope of data capture to fulfill product of wholistic Health Intelligence Provider EHR & EMR Data Assets Patient Data Capture Other Novel Clinical Data Sources AI-Enabled Data Analytic Capability Health Intelligence Analytics Suite Data Sales Research Life Sci Clinical Research Real World Evidence Payers Today Tomorrow Data Sources Capabilities = existing = opportunity

2024 2025 2026 Supporting Current Customers and Accelerating Data Sales Value-Added Analytics Platform HCLS Intelligence Data Platform Leading with Data, AI Tech, Insights to Bring High Value Products to Providers, Payers & Life Sciences + = Ecosystem of Base Models Veradigm Data Actionable Insights & Real Intelligence

Appendix Copyright ©2024 Veradigm® | All rights reserved 25

Non-GAAP Financial Measures Veradigm reports its financial results in accordance with U.S. generally accepted accounting principles, or GAAP. To supplement this information, Veradigm presents Adjusted EBITDA and non-GAAP diluted earnings per share, which are considered non-GAAP financial measures under Section 101 of Regulation G under the Securities Exchange Act of 1934, as amended. The definitions of these non-GAAP financial measures are presented below: Adjusted EBITDA is a non-GAAP financial measure and consists of GAAP net income/(loss) from continuing operations, and adjusts for: interest (income)/expense,net; other (income)/expense; depreciation and amortization; stock-based compensation expense; and transaction and other costs. Reconciliation to GAAP net income/(loss) from operations are found in Table 2 within this presentation. Non-GAAP diluted earnings per share consist of non-GAAP net income, as defined below, divided by non-GAAP diluted weighted shares outstanding, as defined below, during the applicable period. Non-GAAP net income attributable to Veradigm Inc. consists of GAAP net income/(loss) from continuing operations and adds back acquisition-related amortization; stock-based compensation expense; and transaction and other costs. Non-GAAP net income measure would also include a GAAP to non-GAAP tax rate alignment adjustment. Non-GAAP diluted weighted shares outstanding consists of diluted weighted shares outstanding, as reported, less the dilutive impact of 0.875% convertible notes due to the intent to settle the principal in cash and shares to be delivered at settlement by the convertible note hedge. Management also believes that non-GAAP diluted earnings per share and Adjusted EBITDA provide useful supplemental information to management and investors regarding the underlying performance of Veradigm’s business operations. Acquisition-related amortization, stock-based compensation expense and transaction and other costs recorded in accordance with GAAP can make it difficult to make meaningful comparisons of the underlying operations of the business without considering the non-GAAP adjustments provided and discussed herein. Management also uses this information internally for forecasting and budgeting, as it believes that these measures are indicative of core operating results. In addition, management may use non-GAAP diluted earnings per share and Adjusted EBITDA to measure achievement under Veradigm’s stock and cash incentive compensation plans. Note, however, that non-GAAP diluted earnings per share and Adjusted EBITDA are performance measures only, and they do not provide any measure of cash flow or liquidity. Non-GAAP financial measures are not in accordance with, or an alternative for, measures of financial performance prepared in accordance with GAAP and may be different from non-GAAP measures used by other companies. Non-GAAP measures have limitations in that they do not reflect all of the amounts associated with Veradigm’s results of operations as determined in accordance with GAAP. Investors and potential investors are encouraged to review the definitions and reconciliations of non-GAAP financial measures with GAAP financial measures contained within this presentation. As noted above, the estimated non-GAAP financial measures and GAAP financial measures in this presentation are preliminary, and final results for fiscal year 2023 may change. These preliminary results are based upon our estimates and are subject to completion of our financial closing procedures. In addition, these preliminary results have not been audited by our independent registered public accounting firm. This summary of recent results is not a comprehensive statement of our financial results for fiscal 2023.

Non-GAAP Financial Measures Acquisition-Related Amortization. Acquisition-related amortization expense is a non-cash expense arising primarily from the acquisition of intangible assets in connection with acquisitions or investments. Veradigm excludes acquisition-related amortization expense from non-GAAP gross profit, non-GAAP operating income, non-GAAP net income, and Adjusted EBITDA because it believes (i) the amount of such expenses in any specific period may not directly correlate to the underlying performance of Veradigm business operations and (ii) such expenses can vary significantly between periods because of new acquisitions and full amortization of previously acquired intangible assets. Investors should note that the use of these intangible assets contributed to revenue in the periods presented and will contribute to future revenue generation, and the related amortization expense will recur in future periods. Stock-Based Compensation Expense. Stock-based compensation expense is a non-cash expense arising from the grant of stock-based awards. Veradigm excludes stock-based compensation expense from non-GAAP gross profit, non-GAAP operating income, non-GAAP net income and Adjusted EBITDA because it believes (i) the amount of such expenses in any specific period may not directly correlate to the underlying performance of Veradigm business operations and (ii) such expenses can vary significantly between periods as a result of the timing and valuation of grants of new stock-based awards, including grants in connection with acquisitions. Investors should note that stock-based compensation is a key incentive offered to employees whose efforts contributed to the operating results in the periods presented and are expected to contribute to operating results in future periods, and such expense will recur in future periods. Transaction and Other Costs. Transaction and other costs relate to certain favorable and unfavorable legal settlements, investigations, restatement-related accounting and legal advisory services and other charges incurred in connection with activities that are considered not reflective of our core business. Veradigm excludes transaction and other costs, in whole or in part, from non-GAAP gross profit, non-GAAP operating income, non-GAAP net income and Adjusted EBITDA because it believes (i) the amount of such expenses in any specific period may not directly correlate to the underlying performance of Veradigm business operations and (ii) such expenses can vary significantly between periods. Non-Cash Charges to Interest Expense and Other. Non-cash charges to interest expense include the amortization of the fair value of the conversion option embedded in the 0.875% convertible notes issued by Veradigm during the fourth quarter of 2019. Other includes certain other income and expense and impairments on long-term investments. Tax Rate Alignment. Tax rate alignment aligns the applicable period’s effective tax rate to the expected annual non-GAAP effective tax rate.

Bridge: Prior Guidance to Current Estimated Range Revenue variance reflects provider segment revenue shortfall. Estimated Range of revenue, on a GAAP basis, includes a favorable customer litigation settlement contributing approximately $16 million that reflects services provided over prior years. Adjusted EBITDA variance reflects Revenue variance, certain favorable and unfavorable legal settlements, including the customer litigation settlement described above, and additional personnel expense accruals. The $16 million favorable customer litigation settlement and certain other legal settlements were previously reflected in the Company’s Adjusted EBITDA guidance issued on September 18, 2023. The Company’s exclusion of these items from its estimated range of Adjusted EBITDA is a change in the Company’s policy regarding the presentation of this measure. Non-GAAP Earnings per share variance reflects Revenue and Adjusted EBITDA variances, favorable upside in other income and interest income.

Reconciliation: Estimated Adjusted EBITDA Range

Reconciliation: Estimated Non-GAAP Earnings Per Share Range

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

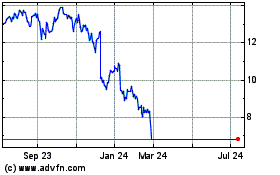

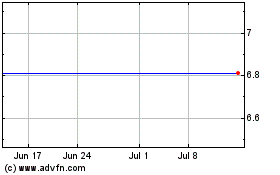

Veradigm (NASDAQ:MDRX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Veradigm (NASDAQ:MDRX)

Historical Stock Chart

From Apr 2023 to Apr 2024