false 0001217234 0001217234 2024-01-09 2024-01-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): January 9, 2024

CAREDX, INC.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

|

|

| Delaware |

|

001-36536 |

|

94-3316839 |

| (State or Other Jurisdiction of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

8000 Marina Boulevard

Brisbane, California 94005

(Address of Principal Executive Offices) (Zip Code)

(415) 287-2300

Registrant’s telephone number, including area code

N/A

(Former Name, or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Exchange Act:

|

|

|

|

|

| (Title of each class) |

|

(Trading

Symbol) |

|

(Name of exchange on which registered) |

| Common Stock, $0.001 Par Value |

|

CDNA |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 2.02 |

Results of Operations and Financial Condition. |

On January 9, 2024, CareDx, Inc. (the “Company”) issued a press release announcing its preliminary financial results for the quarter and year ended December 31, 2023. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The information in this Item 2.02, including the press release attached hereto as Exhibit 99.1, is intended to be furnished under Item 2.02 and Item 9.01 of Form 8-K and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

| Item 7.01 |

Regulation FD Disclosure. |

The Company is furnishing an updated corporate presentation, attached as Exhibit 99.2 to this Current Report on Form 8-K (the “Corporate Presentation”), which the Company intends to post on the Company’s website. The Corporate Presentation is current as of January 9, 2024, and the Company disclaims any obligation to update this material in the future.

The information in this Item 7.01, including the Corporate Presentation attached hereto as Exhibit 99.2, shall not be deemed “filed” for purposes of Section 18 of the Exchange Act or otherwise subject to the liabilities of that Section, nor shall it be deemed incorporated by reference in any filing under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

| Date: January 9, 2024 |

|

CAREDX, INC. |

|

|

|

|

|

|

|

|

By: |

|

/s/ Abhishek Jain |

|

|

|

|

|

|

Abhishek Jain |

|

|

|

|

|

|

Chief Financial Officer |

Exhibit 99.1

CareDx Reports Preliminary Revenue Results for Fourth Quarter and Full Year 2023

BRISBANE, Calif. — (BUSINESS WIRE)—January 9, 2024, CareDx, Inc. (Nasdaq: CDNA) – The Transplant Company™ focused on the discovery, development, and commercialization of clinically differentiated, high-value healthcare solutions for transplant patients and caregivers –today reported preliminary

financial results for the fourth quarter and full year ended December 31, 2023.

Fourth Quarter and Full Year 2023 Highlights

| |

• |

|

Full year 2023 revenue is expected to be in the range of $279 million to $280 million, which is above

the high end of guidance for fiscal year 2023. |

| |

• |

|

Testing Services patient results grew for the second quarter in a row to approximately 39,900, an increase of 4%

as compared to the third quarter of 2023. |

| |

• |

|

Fourth quarter revenue for Testing Services is expected to be between $46 million and $47 million, a

decrease of 3% as compared to the third quarter of 2023, which included one-time items previously discussed during third quarter earnings call.1

|

| |

• |

|

Full year revenue for Patient and Digital Solutions is expected to be approximately $37 million and for

Products is expected to be approximately $33 million, up 29% and 14% year-over-year, respectively. |

| |

• |

|

Repurchased 2.8 million shares of common stock for $26 million under share buyback program.

|

| |

• |

|

Maintained a strong balance sheet, with approximately $235 million in cash and cash equivalents and

marketable securities, with no debt. |

| |

• |

|

Achieved the fifth consecutive quarter of collections at over 100% of revenue for Testing Services.

|

| |

• |

|

Supported hundreds of transplant patient advocates on Capitol Hill urging President Biden and Health and Human

Services (HHS) Secretary Becerra to restore Medicare coverage for molecular blood testing. |

Preliminary revenue for the three months

ended December 31, 2023, is expected to be between $65 million and $66 million, a decrease of approximately 3% compared with $67.2 million in the third quarter of 2023. Testing services revenue for the fourth quarter is expected

to be between $46 million and $47 million, compared with $47.8 million in the third quarter of 2023 and compared with $65.4 million in the same period in 2022. Total

AlloSure® and AlloMap® patient results provided in the fourth quarter were approximately 39,900. Patient and Digital Solutions revenue

for the fourth quarter is expected to be $9.7 million, compared to $8.4 million in the same period in 2022. Product revenue for the fourth quarter is expected to be $9.2 million, compared to $8.6 million in the same period in

2022.

Preliminary revenue for the full year ended December 31, 2023, is expected to be between

$279 million and $280 million, a decrease of approximately 13% compared with $321.8 million in 2022, primarily driven by the impact of the Medicare Billing Article on Testing Services revenue. Testing services revenue for 2023 is

expected to be between $209 million and $210 million, compared with $263.7 million in 2022. Patient and Digital Solutions revenue for 2023 is expected to be $37.2 million, compared to $28.8 million in 2022. Product revenue

for 2023 is expected to be $33.5 million, compared to $29.3 million in 2022.

Preliminary cash, cash equivalents, and marketable securities were

approximately $235 million as of December 31, 2023.

“After setting a new volume baseline in Testing Services in the third quarter of 2023,

we finished the year with upward momentum. The fourth quarter showed a second sequential quarter of patient testing volume growth,” said Alex Johnson, President of Patient and Testing Services, and a member of the Office of the Chief Executive

Officer at CareDx. “Our team continues to execute well as we advance transplant patient care.”

The preliminary financial information presented

in this press release is based on CareDx’s current expectations and may be adjusted as a result of, among other things, the completion of customary annual audit procedures. CareDx will report its fourth quarter and full year 2023 financial

results, and anticipates providing 2024 financial guidance during its earnings call for the fourth quarter of 2023.

About CareDx – The Transplant

Company

CareDx, Inc., headquartered in Brisbane, California, is a leading precision medicine solutions company focused on the discovery, development,

and commercialization of clinically differentiated, high-value healthcare solutions for transplant patients and caregivers. CareDx offers testing services, products, and digital healthcare solutions along the

pre- and post-transplant patient journey, and is the leading provider of genomics-based information for transplant patients. For more information, please visit: www.CareDx.com.

Forward Looking Statements

This press release includes

forward-looking statements, including expectations regarding CareDx’s fourth quarter and full year 2023 revenue, number of patient results, and cash, cash equivalents, and marketable securities as of December 31, 2023, its ability to

advance transplant patient care, its prospects in 2024, and its anticipation to report 2023 financial results and provide 2024 financial guidance during its earnings call for the fourth quarter of 2023. These forward-looking statements are based

upon information that is currently available to CareDx and its current expectations, speak only as of the date hereof, and are subject to

numerous risks and uncertainties, including the completion of the audit of CareDx’s 2023 financial statements, general economic and market factors, and global economic and marketplace

uncertainties, among others discussed in CareDx’s filings with the Securities and Exchange Commission (the “SEC”), including the Annual Report on Form 10-K for the fiscal year ended

December 31, 2022 filed by CareDx with the SEC on February 27, 2023, the quarterly report on Form 10-Q for the quarter ended March 31, 2023 filed by CareDx with the SEC on May 10, 2023, the

quarterly report on Form 10-Q for the quarter ended June 30, 2023 filed by CareDx with the SEC on August 8, 2023, and the quarterly report on Form 10-Q for the

quarter ended September 30, 2023 filed by CareDx with the SEC on November 8, 2023, and other reports that CareDx has filed with the SEC. Any of these may cause CareDx’s actual results, performance, or achievements to differ materially

and adversely from those anticipated or implied by CareDx’s forward-looking statements. CareDx expressly disclaims any obligation, except as required by law, or undertaking to update or revise any such forward-looking statements.

CareDx, Inc.

Media Relations

Anna Czene

818-731-2203

aczene@caredx.com

Investor Relations

Greg Chodaczek

investor@caredx.com

Reference

| 1. |

In the third quarter of 2023, MolDX covered HeartCare®

for use in heart transplant surveillance for the first 12 months post-transplant. HeartCare tests not meeting the coverage criteria were not recognized in revenues in the third quarter, post Noridian adoption of the Billing Article. Lastly, revenues

in the third quarter were positively impacted by a one-time claims settlement with a large Medicare advantage payer for outstanding claims. |

Exhibit 99.2 ™ The Transplant Company Focused on improving care

across the entire transplant patient journey Corporate Presentation January 9, 2024 Patrick G. Kidney Transplant Recipient

Safe Harbor Statement These slides and the accompanying oral

presentation contain forward-looking statements. All statements other than statements of historical fact contained in this presentation, including statements regarding the future financial position of CareDx®, Inc. (together with its

subsidiaries, “CareDx” or the “Company”), including financial targets, business strategy, and plans and objectives for future operations, are forward-looking statements. CareDx has based these forward-looking statements on

its estimates and assumptions and its current expectations and projections about future events. These forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those contained in the “Risk

Factors” section of the Company’s most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q that the Company has filed or may subsequently file with the U.S. Securities and Exchange Commission (the “SEC”). In

light of these risks, uncertainties and assumptions, the forward- looking events and circumstances discussed in this presentation are inherently uncertain and may not occur, and actual results could differ materially and adversely from those

anticipated or implied in the forward-looking statements. Accordingly, you should not rely upon forward-looking statements as predictions of future events. CareDx undertakes no obligation to update publicly or revise any forward-looking statements

for any reason after the date of this presentation or to conform these statements to actual results or to changes in CareDx’s expectations. These slides and the accompanying oral presentation contain certain non-GAAP financial measures, which

are provided to assist in an understanding of the business and performance of CareDx. These measures should always be considered only as a supplement to, and not as superior to, financial measures prepared in accordance with GAAP. Please refer to

the Appendix included in these slides for a reconciliation of the non-GAAP financial measures included in these slides and the accompanying oral presentation to the most directly comparable financial measures prepared in accordance with GAAP.

Certain data in this presentation was obtained from various external sources, and neither the Company nor its affiliates, advisers or representatives has verified such data with independent sources. Accordingly, neither the Company nor any of its

affiliates, advisers or representatives makes any representations as to the accuracy or completeness of that data or undertakes any obligation to update such data after the date of this presentation. Such data involves risks and uncertainties and is

subject to change based on various factors. The trademarks included herein are the property of the owners thereof and are used for reference purposes only. Such use should not be construed as an endorsement of the products or services of the

Company. 2

Office of the Chief Executive Officer Update Michael Goldberg, Board

Chairperson

Office of the Chief Executive Officer Update Michael Goldberg Abhishek

Jain Alex Johnson Board Chairperson Chief Financial Officer President of Patient & Testing Services • Confidence in leadership and bench strength • Strong business performance in Q3 and Q4 2023 • Search underway for new Chief

Executive Officer 4

CareDx Leadership Office of the Chief Executive Officer Michael D.

Goldberg Abhishek Jain Alexander L. Johnson BOARD CHAIRPERSON CHIEF FINANCIAL OFFICER PRESIDENT OF PATIENT & TESTING SERVICES Executive Leadership Robert N. Woodward, PhD Marica Grskovic, PhD Kashif Rathore GS Jha Stacey Follon Jeffrey A. Novack

CHIEF SCIENTIFIC OFFICER CHIEF OPERATIONS OFFICER CHIEF OF PATIENT AND SVP, CHIEF INFORMATION SENIOR VICE PRESIDENT, GENERAL COUNSEL DIGITAL SOLUTIONS OFFICER & CHIEF HEAD OF HUMAN INFORMATION SECURITY RESOURCES OFFICER 5

Transplant Vision and Growth Strategy Alex Johnson, President of Patient

& Testing Services, Office of the Chief Executive Officer

Our Vision The leading partner for the transplant ecosystem Our Mission

We are committed to improving long-term outcomes by providing innovative solutions throughout the entire transplant patient journey Patrick G. Kidney Transplant Recipient 7

CareDx Key Highlights We are in early stages of a $6B+ market

opportunity in transplant care, serving some of the 1 highest need patients in the US healthcare system Our strategy is to develop and provide best in class, reimbursed high value clinical solutions 2 to patients to extend allograft survival Our

ability to ‘go deep’ in transplant enables us to understand the unmet clinical needs in the 3 market and continue our leadership We will continue to innovate and redefine patient care with the team that brought 4 sequencing and AI

innovation to the transplant clinic We are set up to efficiently allocate capital to deliver growth and strong shareholder returns 5 8

Serving High-Cost Patient Population with Large Unmet Need Delivering

Clinical Solutions to Help Extend Allograft Survival Transplant Patients Need Opportunity to Improve Care Along Better Care Transplant Patient Journey • Among highest need patients in US healthcare system • Created market standard in

gene expression 1 profiling with AlloMap and in dd-cfDNA surveillance • Within 5 years of transplant: with AlloSure • 1 in 5 kidneys fail • 1 in 3 hearts fail • Improving clinical utility through combination of multi- •

1 in 2 lungs fail modality surveillance technologies • Next generation: • Unmet need: Balance immunosuppression & infection • Driving better patient management and adherence rejection with a robust suite of digital health tools

2 • End stage renal disease is costly: ~$37B in 2020 2 • ~6.1% of ALL Medicare expenditures in 2020 • Creating future standards for xenotransplant, and stem cell and cell transplant monitoring • Transplantation is more

cost-effective • Annual Centers for Medicaid & Medicare Services (CMS) spend on kidney transplant maintenance is less 2 than half dialysis cost 9 1.HRSA OPTN Data; 2. NIH NIDDK, United States Renal Data System (USRDS) 2022 Annual Data

Report (ADR).

CareDx Leading with Innovation for 25 Year FIRST FIRST FIRST FIRST

FIRST FIRST FIRST Gene Expression Validated Transplant Validated CareDx GEP and dd- Medicare Profiling for dd-cfDNA Center Multi-Modality AI Enabled cfDNA for Coverage for Transplant for Kidney EMR in Heart Tools Xeno Multimodality Transplant

Transplant HeartCare Transplant System 2005 2016 2019 2020 2020 2022 2023 HLA AiKidney Typing 1998 2006 2010s 2017 2020 2020 2021 2023 Founded AlloMap Built AlloSure Kidney Tx Patient App AlloSure FIRST AlloSure Lung Heart Portfolio of Medicare Home

Heart Validated Medicare Medicare HLA Typing Coverage Phlebotomy Medicare dd-cfDNA for Coverage Coverage Solutions Service Coverage Lung Transplant Source: Data on file. 10 10

CareDx Focused on $6B TAM Opportunity in Transplant TESTING SERVICES

PRODUCTS DIGITAL U.S. Global Global 1.5M+ Users ~400,000 Patients 1.5M+ Patients >1,000 Top 150 Centers perform >1,000 majority of all transplants Labs & Centers Centers & Ecosystem Robust TAM continues Post EMR & Patient

Engagement HLA Typing & Surveillance Billing Article $4B+ $1B+ $1B+ Source: Data on file. TAM does not include cell therapy. 11 11

1 A Growing Transplant Market with Potential to Double in 5-10 Years 1

Longer Term Trends Near Term Upsides Perfusion Growth Tailwinds Today Mid-single digit CMS /Kidney Care Recovery in annualized growth Choices (KCC) living donors 40K transplants of transplant incentives 2 4 annually in US market Donation After

Increased ~400K living with Opportunity: Circulatory Death utilization of transplanted solid Patients 3 years (DCD) organs 3 organ in US post-transplant from allocation who have not Xeno changes Early stages of received non- & Engineered

adoption curve invasive testing Organs 1. Internal estimates based on drivers; 2.OPTN HRSA data; 3. Data on file; 4. Based on UNOS transplant growth. Data on file. 12

CareDx Testing Services Strategy Bring next Be the generation of

partner of innovation to choice for the transplant transplant clinic centers Increase Grow adoption of reimbursement AlloMap and and coverage AlloSure through clinical data and evidence 13

CareDx Testing Services Strategy Integrated, sticky offerings across

care journey Be the Bring next Scale coverage of all partner of generation of major transplant centers choice for innovation to transplant the transplant centers Next-gen collaborations clinic for research & innovation Increase Grow adoption of

reimbursement AlloMap and and coverage AlloSure through clinical data and evidence 14

Testing Services Strategy – Increase Patient Uptake and Adoption

Bring next Be the generation of partner of innovation to choice for “Build back AlloSure the transplant transplant Kidney via new clinic centers transplant center “Billing Article” protocols Grow Increase Expand HeartCare

reimbursement adoption of with data and and coverage AlloMap and differentiation AlloSure Address unmet through clinical need in lung with data and AlloSure Lung dvidence 15

Testing Services Strategy – Expand Coverage Bring next Be the

generation of partner of innovation to choice for the transplant Add private payer Transplant clinic coverage for Centers AlloSure Kidney and HeartCare Increase Grow adoption of Publish surveillance reimbursement AlloMap and data via KOAR and

coverage AlloSure through clinical Re-engineer test data and intake and billing evidence appeals process 16

Testing Services Strategy – Innovate in Our Core Continue to

innovate at scale Bring next in core portfolio generation of Be the Expand multi- innovation to partner of modality with the transplant choice for new covered tests clinic transplant centers Scale AI and decision support Increase Grow tools adoption

of reimbursement Incubate opportunity AlloMap and and coverage in new areas, AlloSure e.g., cell therapy through clinical data and evidence 17

New Testing Services Volume Baseline Set in Second Half of 2023 Created

Platform for Growth Base Financial Model Now Assumes Continued Impact of Billing Article Billing Article successfully operationalized internally ü Systems and Ordering Updating: 90%+ Completed Q3'23 ü Center and Clinician Education: 90%+

Completed Q3'23 ü OpEx and Cost Controls: Completed Q3'23 and Q4'23 actions; efficiency opportunities continue ü Budget Planning: Assumes Billing Article becomes “Policy” with LCD finalization “Billing Article”

Timeline and LCD Next Steps Future Aug 2023 Nov 2023 March 2023 May 2023 • Billing Article • MolDX Issues • LCD Finalization • LCD Public Comment Period • 2nd Billing Article • Effective from Proposed LCD Over

March 31, 2023 18

CareDx Supporting Transplant Community Advocating Against Medicare

Rollbacks with CMS & Biden Administration Professional Society Engagement Patient Advocacy Senator Gillibrand (D-NY) speaking at Honor the Gift Press Conference held on Capitol Hill, December 5, 2023. Congressional Efforts National Media

Coverage Meetings with CMS and Contractors 19

Clinical Studies and Pipeline Innovation Robert Woodward, PhD, Chief

Scientific Officer

CareDx Continues to Build New Solutions and Key Evidence 20+ years of

unmatched evidence development for non-invasive 1 testing Multi-center study data demonstrate additional clinical scenarios 2 1,2 Society guidelines recommend use of CareDx testing services 3 Investments in multi-center studies to provide key

evidence for 4 payer coverage in 2024 and 2025 Pipeline of future launches will both complement and enhance 5 existing testing services 1. ESOT Consensus Conference Highlight Report, November 2022; 2. The International Society for Heart and Lung

Transplantation (ISHLT) Guidelines for the Care of Heart Transplant Recipients. Jnl of Heart and Lung Transplantation. December 2022. 21

Growing Evidence Supporting Clinical Utility and Adoption Products

Goals 2024 Data Sources KOAR KIDNEY OKRA Surveillance not tied to Biopsy AlloSure Kidney National Expanded For-Cause Uses Databases HEART SHORE Utility of Multimodality AlloMap Heart Single-center HeartCare Utility > 1 year AlloSure Heart

publications AlloSure Pediatrics Validation HeartCare ALAMO LUNG Expanded, Repeated Utility Single-center AlloSure Lung Surveillance Value publications 22

Guidelines and Evidence from Studies to Support Payer Coverage In

Progress: CareDx Sponsored Studies Types of Evidence to Support Coverage Name Area Centers Patients KOAR Kidney Transplant Outcomes >55 >1,700 - Improve immediate OKRA Kidney Transplant Outcomes >60 >1,900 outcomes SHORE Heart Transplant

Outcomes >60 >2,700 ALAMO Lung Transplant Outcomes 20* 500* - Improve long-term MAPLE Liver Transplant Test development and validation 30* 1,500* outcomes ACROBAT Utility for Stem Cell Transplant 11 >300 - Benefits of expanded use

earlier/later Clinical Guidelines Established post-transplant ESOT Consensus 2023 ISHLT - Test-driven Guidance – Guidelines personalized care All Organs for Heart - Health economics *Targets 23

Differentiation Through Complementary Multi-Modality Pipeline UroMap

AlloMap Kidney HistoMap Product Urine Gene Expression Profiling Blood Gene Expression Profiling Biopsy Gene Expression Profiling − Early use − Gene Expression Profiling − BK differentiation (GEP) Added Mechanism − Quantified

Method for − Urine analyte approach Differentiation − Potential type of Rejection Rejection Diagnosis − Potential type of Rejection Diagnosis Diagnosis − CMS Coverage in Process − Additional Publications − CMS

Coverage in Process − Additional Publications in 2024 Underway − Additional Analysis Process Outlook − Multimodality Studies Underway − Path to CMS Coverage Underway 24

Differentiation Through Digital Decision Support AiKidney: AlloView

Heart: AiCAV Product AiKidney: iBox − Predictive Algorithm − Cardiac Allograft with Multiple Inputs Vasculopathy (CAV) − Prognostic Algorithm Differentiation to Further Educate Diagnosis from on Rejection Risk AI-Derived Algorithm

− Leverage 2023 2024 − Wide Availability Publications − In Development Upon Publication Outlook − Further Tools Incorporation 25

Patient Journey Expansion and Moat Kashif Rathore, Chief of Digital

Health and Patient Solutions

Summary: Patient Journey Expansion and Digital Moat One Stop for

Transplant Centers Significant interest from clinicians to improve patient management using intelligence 1 and data driven solutions Digital and Patient business grew 29% in FY'23 compared to FY'22, primarily driven by 2 success of acquisitions and

contribution by SaaS revenue CareDx offers an integrated portfolio of high impact solutions with CareDx Pro 3 Our Patient and Digital services moat reinforces CareDx as the partner of choice for 4 transplant centers Continued focus on high value

Digital and Lab Testing services that extend allograft 5 survival and monitoring for patients 27

Growing Transplant Center Presence Over 70% of Organ Transplant Centers

Use One or More Digital Patient Journey Solutions* Patient Operational Lab Logistics Outcomes Management Support Management Support Quality Center 70% Penetration* Centers using 1 or more CareDx patient and digital solutions Digital Products *

Center penetration and growth opportunity based on UNOS listed transplant centers in 2023; does not include non-transplant hospitals. Data on file and as of December 31, 2023 28

Patient and Digital Solutions Moat In Transplant Center Ecosystem

Integrated Patient Care Solutions From One Company, CareDx Transplant Account Manager Lab CLIA Team Patient Care Managers TRANSPLANT Medical Science Liaison Remote Care Navigators CENTERS Field Lab Services Team Transplant Coordinator Assistants

TRANSPLANT ECOSYSTEM Laboratory 3 Operational Logistics CarePortal Patient Quality Management Support Support Management Improvement 29

CareDx Pro Provides a Seamless Transplant Center Experience Eases

Access to Digital and Testing Services Offerings Before CareDx PRO With CareDx PRO Individual product interfaces, per center One interface, per center CENTER CENTER CENTER CENTER CENTER CENTER CENTER CENTER CENTER CENTER Deployed by CENTER CENTER

over 30 New Digital Offering New Digital Offering customers …200+ centers …200+ centers Unified Single Framework Plug-and-Play 30

CareDx PRO: How it Works Once in place, any CareDx solution can be

enabled by CareDx B CareDx PRO button is placed right within clinician A CareDx PRO EMR workflow This is the EMR i.e., Epic or Cerner D Selected CareDx Solution C Appears Here Digital solutions Clinicians can open right within navigate between

clinician EMR any CareDx workflow solution (similar to navigating between software in Microsoft Office 365) 31

Financial & Operational Highlights Abhishek Jain, Chief Financial

Officer Office of the Chief Executive Officer

Preliminary Q4 and FY 2023 Financial Highlights Preliminary FY'23

revenue in the range of $279M to $280M; which is above the high end 1 of guidance for FY'23 Patient test services results grew for the second quarter in a row at approx. 39,900; an 2 increase of 4% as compared to Q3'23 Preliminary Testing Services

revenue for Q4'23 in the range of $46M and $47M, a decrease of 3% 3 1 as compared to Q3'23 which included one-time items previously discussed in Q3 earnings call Preliminary revenue for Patient and Digital Solutions for FY'23 is $37M and for

Products is $33M, 4 up approx. 29% and 14% year over year, respectively 5 Repurchased 2.8M shares of common stock in Q4'23 for $26M under share buyback program Strong balance sheet and cash position of $235M as of December 31, 2023 6 1. MolDX

covered HeartCare for use in heart transplant surveillance, effective April 1, 2023, for the first 12 months post-transplant. HeartCare tests not meeting the coverage criteria were not recognized in revenues in the third quarter, post Noridian

adoption of the Billing Article. Lastly, revenues in the 33 third quarter were positively impacted by a one-time claims settlement with a large Medicare advantage payer for outstanding claims.

FY'23 Preliminary Revenue Above High End of Guidance Solid Growth in

Products and Digital Solutions Businesses; Testing Services Impacted by Billing Article (in millions of dollars) FY'23 Preliminary Revenue Testing Services Impacted by Billing Article -13% 322 -21% ~279-280 264 ~209-210 Solid Growth in Products and

Digital Business +29% +14% 37 33 29 29 Product Patient and Digital Total Solutions & Other FY2022 FY2023 34

Billing Article Impacted Product Mix Cardiothoracic Now Represents

about 60% of Volume and over 50% in Revenues Volume Revenue 100% 100% 50% 50% 0% 0% Before After Before After Billing Article Billing Article Billing Article Billing Article Abdominal Cardiothoracic Abdominal Cardiothoracic Note: Abdominal includes

Kidney and Cardiothoracic includes Heart, Lung. 35

Testing Services Volumes Have Stabilized Post the Billing Article

Impact and Are Now Growing 60,000 Billing Article Impact 40,000 20,000 0 Q1’22 Q2’22 Q3’22 Q4’22 Q1’23 Q2’23 Q3’23 Q4’23 36 Back to Growth

Focus on Significant Commercial Payors Coverage Opportunity PAYOR MIX

100% Large Opportunity on Non- Reimbursed Tests 50% • Focus on Commercial Coverage 30% • Purpose-designed studies and analysis to gain Medicare coverage 0% • Re-engineered test intake and billing appeals Volume Revenue process

Commercial Medicare 37

Coverage Successes in FY'2023 Cardiothoracic Abdominal 7.5M 7.5M New

Lives Added NA 31.5M Expanded Coverage Added in FY ’23 Added in FY ’23 • 4 Blues Plans • 1 National • 3 Large Regional • 2 Blues Plans Expansion • 1 Large National • National 38

Cash Collection Continues to Stay Strong th Cash Collections Above

Testing Services Revenue for 5 Consecutive Quarter Ratio of Cash Collections to Revenue 120% Collected ~$17M More in Cash as Compared to FY'23 Preliminary Revenue Scaled infrastructure 100% 80% 0% FY2021 FY2022 FY2023 Q1’23 Q2’23

Q3’23 Q4’23 39

Billing Article Impact and Mitigating Actions Actions Taken in Q2/Q3:

$50-$60M 1. Swift operational implementation of Billing Article requirements and stabilization of Testing Services volumes 2. Immediate cost reductions as announced in Q2'23 of $40-$50M BILLING ARTICLE IMPACT ON ADJUSTED EBITDA Q4 and Beyond: Path

to Adjusted EBITDA Profitability/Positive Operating Cash Flow ~$100M 1. Further cost and workforce reductions undertaken in Q4’23. Focus on legal and other operating expenses 2. Profitable organic growth 3. Continued focused efforts on

collection 40

CareDx Leadership in Growing Transplant Market with a Differentiated

Financial Phenotype Large TAM & Strong Gross Strong Cash Path to Testing Services Opportunities Margins Position of Profitability Volume to Grow $235M and Positive Stabilized and Profitably GM Expansion Operating Growing Testing Services for

Products and No Debt Cashflow Volumes Digital Solutions 41

42

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

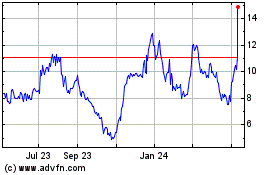

CareDx (NASDAQ:CDNA)

Historical Stock Chart

From Mar 2024 to Apr 2024

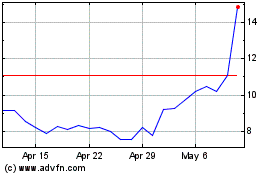

CareDx (NASDAQ:CDNA)

Historical Stock Chart

From Apr 2023 to Apr 2024