false

0001392694

0001392694

2023-12-27

2023-12-27

0001392694

us-gaap:CommonStockMember

2023-12-27

2023-12-27

0001392694

SURG:CommonStockPurchaseWarrantsMember

2023-12-27

2023-12-27

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities and Exchange Act of 1934

Date

of Report (Date of earliest event reported): December 27, 2023

SURGEPAYS,

INC.

(Exact

name of Registrant as specified in its charter)

| Nevada |

|

001-40992 |

|

98-0550352 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

3124

Brother Blvd, Suite 104

Bartlett

TN 38133

(Address

of principal executive offices, including zip code)

(901)

302-9587

(Registrant’s

telephone number, including area code)

Check

the appropriate box below if the 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any

of the following provisions:

| ☐ |

Written

communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)). |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

Common

Stock

|

|

SURG

|

|

The

Nasdaq Stock Market LLC

|

| Common

Stock Purchase Warrants |

|

SURGW |

|

The

Nasdaq Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item

5.02 |

Departure

of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

New

Employment Agreement with Chief Executive Officer

On

December 27, 2023, SurgePays, Inc. (the “Company”) and Mr. Kevin Brian Cox (the “Executive”) entered into an

employment agreement (the “New Employment Agreement”), whereby the Company has extended the Executive’s term of employment

through and including December 31, 2028 (the “Initial Term”) , and thereafter will automatically renew for successive consecutive

one (1) year periods until either party sends written notice to the other party of such party’s desire to terminate the Agreement

(the “Renewal Term”).

As

compensation for his services, the Company shall pay the Executive a base salary of $750,000 per year, to be increased by three (3) percent

each following year, and an annual cash bonus of $870,000. Beginning on March 1, 2024, and thereafter for a minimum of five (5) years,

the Company shall grant the Executive 500,000 (Five Hundred Thousand) Restricted Shares (the “RSAs”) (the “RSA Grant”)

pursuant to the SurgePays, Inc. 2022 Omnibus Securities and Incentive Plan (the “Plan”), where each RSA Grant shall be fully

vested upon grant. In addition to the RSA Grants, the Company shall make equity incentive grants (“Equity Incentive Grants”)

to the Executive upon the Company’s completion of milestones as set forth in the New Employment Agreement, including achieving

certain annual revenue, annual EBITDA, and Market Capitalization goals.

In

the event the Executive’s employment with the Company shall terminate, unless by termination for cause, the Executive shall

be entitled to (a) a severance payment equal to the greater of (i) two (2) years’ worth of the then-existing base salary and the

prior year’s bonus, or (ii) the base salary payable through the remaining Initial Term, and (b) retain the benefits set forth in

the New Employment Agreement for the remainder of the Initial Term or Renewal Term.

The

employment agreement entered into by the Executive and the Company on May 13, 2022, was cancelled and superseded by the New Employment

Agreement as of the effective date of the New Employment Agreement.

Item

5.02 of this Current Report on Form 8-K contains only a brief description of the material terms of and does not purport to be a complete

description of the rights and obligations of the parties to the New Employment Agreement, and such descriptions are qualified in their

entirety by reference to the full text of the New Employment Agreement, which are filed as exhibit 10.1 hereto.

| Item

9.01 |

Financial

Statements and Exhibits. |

(d)

Exhibits.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

SURGEPAYS,

INC. |

| |

|

|

| Date:

January 3, 2024 |

By: |

/s/

Anthony Evers |

| |

|

Anthony

Evers |

| |

|

Chief

Financial Officer |

Exhibit

10.1

EMPLOYMENT

AGREEMENT

This

Employment Agreement (the “Agreement”) is made and entered into as of December 27, 2023, by and between SurgePays, Inc.,

a corporation incorporated under the laws of the State of Nevada with a principal place of business at 3124 Brother Blvd., Suite 104,

Bartlett, Tennessee 38133 (the “Company”), and Kevin Brian Cox, an individual (“Executive”).

RECITALS

| |

A. |

Executive

is knowledgeable with respect to the business of the Company. |

| |

|

|

| |

B. |

Company

desires to offer employment to Executive and Executive desires to be employed by Company. |

| |

|

|

| |

C. |

Company

and Executive agree to enter into an Employment Agreement providing for the term set forth in Article I below, on the terms and conditions

herein provided. |

| |

|

|

| |

D. |

The

Employment Agreement entered into by Executive and the Company on May 13, 2022, is hereby cancelled and superseded by this Agreement

and, as of the Effective Date, is of no further force or effect. |

In

consideration of the mutual promises set forth in this Agreement the parties hereto agree as follows:

ARTICLE

I

Term

of Employment

Subject

to the provisions of Article V, and upon the terms and subject to the conditions set forth herein, the Company will employ Executive

under the terms of this Agreement for the period through and including December 31, 2028 (the “Initial Term”). The Initial

Term shall be automatically renewed for successive consecutive one (1) year periods, (each, a “Renewal Term” and the Initial

Term and any Renewal Term are collectively referred to as the “term of employment”) thereafter, unless either party sends

written notice to the other party, not more than 270 days and not less than 90 days before the end of the then-existing Initial Term

or Renewal Term, of such party’s desire to terminate the Agreement at the end of the then-existing Initial Term or Renewal Term,

in which case this Agreement will terminate at the end of the then-existing Initial Term or Renewal Term. Executive will serve the Company

during the term of employment.

ARTICLE

II

Duties

2.01

Duties and Office. During the term of employment, Executive will: (a) promote the interests, within the scope of his duties, of

the Company, and devote his full working time and efforts to the Company’s business and affairs; (b) serve as the Chief Executive

Officer of the Company; and (c) perform the duties and services consistent with the title and function of such office.

2.02

Outside Activities. Notwithstanding anything contained in clause 2.01 above to the contrary, nothing contained herein or under

law shall be construed as preventing Executive from (a) investing Executive’s personal assets in such form or manner as will not

require any services on the part of Executive in the operation or the affairs of the companies in which such investments are made and

in which his participation is solely that of an investor; (b) engaging (whether or not during normal business hours) in any other professional,

civic, or philanthropic activities, provided that Executive’s engagement does not result in a violation of his covenants under

this Section or Article VI hereof; or (c) accepting appointments to the boards of directors of other companies provided that the Board

of Directors of the Company (the “Board”) reasonably approves of such appointments and Executive’s performance of his

duties on such boards does not result in a violation of his covenants under this Section or Article VI hereof.

ARTICLE

III

Base

Salary, Bonus, Restrict Share Award, Options Award

3.01

Base Salary. Effective retroactive to January 1, 2023, the Company will compensate Executive for the duties performed by him hereunder

by payment of a base salary at the rate of $750,000 (Two Hundred Sixty-Seven Thousand Eight Hundred Dollars). Thereafter, the Base Salary

shall increase at the rate of at least three percent (3) on January 1 of each following year. Base Salary will be payable in equal semi-monthly

installments, subject to customary withholding for federal, state, and local taxes and other normal and customary withholding items.

For each additional Renewal Term, the salary will be three (3) percent increase over the previous year’s salary.

3.02

Annual Cash Bonus. Executive’s annual cash bonus for his work shall be $870,000 (Eight Hundred and Seventy Thousand Dollars).

3.03

Restricted Share Award. Beginning on March 1, 2024, and on June 1 of each year of the Initial Term or any Renewal Term thereafter

for a minimum of five (5) years, the Company shall grant Executive 500,000 (Five Hundred Thousand) Restricted Share (the “RSAs”)

(the “RSA Grant”) pursuant to the SurgePays, Inc. 2022 Omnibus Securities and Incentive Plan (the “Plan”). Each

RSA Grant shall be fully vested upon grant. The RSA Grants shall be subject to the terms of the Plan and any award agreement the Plan

requires as a condition of the RSA Grants. The RSA Grants supersede all prior equity grants to Executive. Accordingly, no further vesting

of any additional shares or options under any prior equity or option grant to Executive shall occur and Executive hereby waives any rights

to any such further vesting. For the avoidance of doubt, it is expressly stated that the Executive shall retain all ownership of, and

rights to, any equity or option grants that have been vested prior to the Effective Date. The Company will fund the expected federal

and state withholding requirements based on the vested award amount through the sale of a portion of the RSA Grant or some other mechanism

to fund the expected tax liability. An RSA Grant may be transferred, following grant, to a trust or limited liability company that qualifies

as a “Family Member” under the Plan to the extent the shares of Common Stock issued pursuant to the RSA Grant would be eligible

for registration on Form S-8. If, after the Effective Date, there is a stock split, reverse stock split, or other event described in

Article XIV of the Plan, the number of shares subject to future RSA Grants shall be proportionately adjusted as described in Article

XIV of the Plan, as determined by the Committee (as defined in the Plan).

3.04

Equity Incentive Grants In addition to the foregoing RSA Grants, the Company shall make the following equity incentive grants

(“Equity Incentive Grants”) to Executive with the following values upon the completion of the following goals. Awards may

be made in the form of fully vested Restricted Shares Awards or Options to purchase shares of Company Common Stock (“Options”).

All of the awards referred to in this Section 3.04 shall be made pursuant to the Plan, subject to approval by the Company’s shareholders

of a sufficient number of shares available for issuance under the Plan. Each goal may be met only once and only one award shall be issued

upon the meeting of a goal. The Committee, as defined in the Plan, shall make the determination, in its reasonable discretion, whether

the goals for receiving Equity Incentive Grants have been met, based upon the audited financial reports provided by the Company’s

accountants. The number of Restricted Share Awards or Options granted shall be determined by the Plan on the basis of the dollar value

of the Equity Incentive Grant divided by the average closing share price over the thirty (30) trading days preceding the date the Committee

issues a written determination that a goal was met. Option values shall be determined by the Committee in its discretion using Black-Scholes

modeling or such other methods as it reasonably determines. Executive must be employed on the date the Committee has issued a written

determination that a goal has been met in order to receive an Equity Incentive Grant. In each case, an Equity Incentive Grant shall be

issued on the last business day of the quarter in which the Committee issues a written determination that a goal has been met. An Equity

Incentive Grant under sub-sections 3.04(a),(b), and (c) herein may be transferred, following grant, to a trust or limited liability company

that qualifies as a “Family Member” under the Plan to the extent the shares of Common Stock issued pursuant to the Equity

Incentive Grant would be eligible for registration on Form S-8.

(a)

Annual Revenue Goals. As determined on a calendar year basis, the Company shall make the following Equity Incentive Grants when

the Committee issues a written determination that the following annual goals for earnings before interest, taxes, depreciation and amortization

(“EBITDA”) are met. Only one award shall be given for each threshold met and no additional award shall be made until the

next threshold is met. By way of example, if in calendar year 2024 the Company’s annual revenue is $250,000,000, Executive would

receive an award valued at $6,250,000. If in calendar year 2025, the Company’s annual revenue is $400,000,000, no additional award

will be granted. If in calendar year 2026 the Company’s annual revenue is $500,000,000, the Executive will receive an award valued

at $25,000,000 (but not an additional award of $6,250,000).

| Annual

Revenue Goal |

|

Value

of Restricted Share Awards or Options to be Awarded

|

$250,000,000

|

|

$6,250,000

|

| $500,000,000 |

|

$25,000,000 |

| 1,000,000,000 |

|

$50,000,000 |

| 2,000,000,000 |

|

$100,000,000 |

| Each

additional $1,000,000,000 |

|

$50,000,000 |

(b)

Annual EBITDA Goals. As determined on a calendar year basis, the Company shall make the following equity incentive grants when

the Committee issues a written determination that the following annual goals for earnings before interest, taxes, depreciation and amortization

(“EBITDA”) are met. Only one award shall be given for each threshold met and no additional award shall be made until the

next threshold is met.

| Annual

EBITDA Goal |

|

Value

of RSUs or Options to be Awarded

|

$50,000,000

|

|

$2,500,000

|

| $100,000,000 |

|

$5,000,000 |

| Each

additional $50,000,000 |

|

$2,500,000 |

(c)

Market Capitalization Goals. When the Committee makes a written determination that the Company’s market capitalization,

based on the closing price on a national securities exchange on 30 (thirty) consecutive trading days, exceeds the thresholds set forth

below, the Company shall make the following Equity Incentive Grants:

| Market

Capitalization Goals |

|

Value

of Restricted Share Awards or Options to be Awarded

|

$250,000,000

|

|

$25,000,000

|

| $500,000,000 |

|

$50,000,000 |

| 1,000,000,000 |

|

$100,000,000 |

| 2,000,000,000 |

|

$200,000,000 |

| Each

additional $1,000,000,000 |

|

$100,000,000 |

(d)

Stock Splits/Reverse Stock Splits. If, after the Effective Date, there is a stock split, reverse stock split, or other event described

in Article XIV of the Plan, the number of shares subject to the Equity Incentive Grants shall be proportionately adjusted as described

in Article XIV of the Plan, as determined by the Committee (as defined in the Plan).

3.05

Allowances/Perquisites. The Company’s Compensation Committee or its designee shall determine what allowances and perquisites

shall be granted to Executive, and shall describe them specifically in writing prior to Executive accepting any allowances or perquisites.

ARTICLE

IV

Benefits,

Expenses,

4.01

Health and Other Medical. Executive shall be eligible to participate in all health, medical, dental, and life insurance employee

benefits as are available from time to time to other key executive employees (and their families) of the Company, including a Life Insurance

Plan, Medical and Dental Insurance Plan, and a Long-Term Disability Plan (the “Insurance Plans”). For the term of this agreement,

the Company shall pay all premiums with respect to such Insurance Plans, provided, however, that if federal nondiscrimination

rules prohibit payment of Executive’s full health insurance premiums, the Company shall pay only the same portion of Executive’s

health care premiums as are consistent with such rules. The Company may, in its sole discretion, amend, modify, or terminate, any Insurance

Plan at any time in accordance with applicable law.

4.02

Vacation. Executive shall be entitled to Four (4) weeks of vacation and five (5) personal days per year, to be taken in such amounts

and at such times as shall be mutually convenient for Executive and the Company. Any time not taken by Executive in one year shall be

carried forward to subsequent years. If all such vacation and personal time to which Executive is entitled is not taken by Executive

before the termination of this Agreement, Executive shall be entitled to be reimbursed upon termination (for any reason) for such lost

time in accordance with the Base then in effect.

4.03

Reimbursable Expenses. The Company shall in accordance with its standard policies in effect from time to time reimburse, Executive

for all reasonable business and out-of-pocket expenses directly and integrally related to Executive’s duties and actually incurred

by him in the conduct of the business of the Company including business class air travel for flights, quality hotels and rental cars,

entertainment and similar executive expenditures, provided that Executive submits all substantiation of such expenses to the Company

on a timely basis in accordance with such standard policies. The Company shall determine in accordance with its policies and procedures

shall determine what expenses shall be reimbursed and in what amounts. Axia will perform any ministerial functions related to reimbursement

of expenses and shall have no decision making authority over what expenses are reimbursed or in what amounts, under that certain April

11, 2018, “Management & Administrative Services Agreement” between the Company and Axia.

4.04

Savings Plan. Executive will be eligible to enroll, participate, and be immediately vested, in (to the extent legally possible

and in accordance with existing Company benefit plans), all Company savings and retirement plans, including any 401(k) plans.

4.05

Life Insurance. The Company shall reimburse Executive for all premiums paid by Executive for term life insurance on his own life,

provided that such life insurance proceeds do not exceed two hundred percent (200%) of Executive’s previous year’s Base Salary.

4.06

Directors and Officers Liability Insurance. The Company will provide liability insurance coverage protecting Executive and his

estate, to the extent permitted by law, against suits by fellow employees, shareholders, and third parties, and criminal and regulatory

investigations, arising out of any alleged act or omission occurring within the course and scope of Executive’s employment with

the Company. Such insurance will be in an amount not less than $15,000,000 (Fifteen Million Dollars) in the aggregate.

ARTICLE

V

Termination

5.01

Automatic. This Agreement shall be automatically terminated upon the first to occur of the following (a) the Company’s termination

pursuant to section 5.02, (b) the Executive’s termination pursuant to section 5.03 or (c) the Executive’s death.

5.02

By the Company. This Agreement (and Executive’s employment) may be terminated by the Company upon written notice to the

Executive upon the first to occur of the following:

(a)

Disability. Upon the Executive’s Disability (as defined herein). The term “Disability” shall mean the Executive

cannot physically or mentally perform the essential functions of the position with or without reasonable accommodations for a period

of six (6) consecutive months or more.

(b)

Cause. Upon the Executive’s commission of Cause (as defined herein). The term “Cause” shall mean the following:

(i)

Any material breach by Executive of any material provision of this Agreement (including without limitation Sections 6.01 and 6.02 hereof),

upon written notice of same by the Company describing in detail the breach asserted and stating that it constitutes notice pursuant to

this Section 5.02(b)(i), which breach, if capable of being cured, has not been cured within thirty (30) days after such notice;

(ii)

Embezzlement by Executive of funds or property of the Company;

(iii)

Fraud or willful misconduct on the part of Executive in the performance of his duties as an employee of the Company, or gross negligence

on the part of Executive in the performance of his duties as an employee of the Company causing demonstrable and serious injury to the

Company, provided that the Company has given written notice of such breach which notice describes in detail the breach asserted and stating

that it constitutes notice pursuant to this Section 5.02(b)(iii), and which breach, if capable of being cured, has not been cured within

thirty (30) days after such notice; or

(iv)

A felony conviction of Executive under the laws of the United States or any state (except for any conviction based on a vicarious liability

theory and not the actual conduct of the Executive).

In

the event the Company has given written notice of Cause under Section 5.02(b)(i) or (iii), the Company may place Executive on paid leave

during the 30-day cure period and such action shall not constitute Constructive Termination under Section 5.03(b) of this Agreement.

Upon a termination for Cause, the Company shall pay Executive his Base and benefits including vacation pay through the date of termination

of employment; and Executive shall receive no severance under this Agreement.

5.03

By the Executive.

(a)

Constructive Termination. This Agreement may be terminated by the Executive upon written notice to the Company of “Change of

Control” or a “Constructive Termination” (as defined herein) by the Company. Change in Control. Upon the occurrence

of a “Change in Control” (as defined herein) of the Company. The term “Change in Control” shall mean any of the

following: (i) a replacement of more than one half of the Board of Directors of the Company from that membership of the Board of Directors

which exists as of the date hereof, (ii) sale or exchange of all or substantially all of the assets of the Company, (iii) a merger or

consolidation involving the Company where the Company is not the survivor in such merger or consolidation, (iv) a liquidation, winding

up, or dissolution of the Company, or (v) an assignment for the benefit of creditors, foreclosure sale, voluntary filing of a petition

under the Bankruptcy Reform Act of 1978, or an involuntary filing under such act which filing is not stayed or dismissed within 45 days

of filing.

(b)

Definition. The term “Constructive Termination” shall mean any of the following:

(i)

Any material breach by the Company of any material provision of this Agreement, including, without limitation, the assignment to the

Executive of duties materially inconsistent with his position specified in Section 2.01 hereof or any material breach by the Company

of such Section;

(ii)

A substantial and continued reduction in the level of support, services, staff, secretarial resources, office space, and accoutrements

below that which is reasonably necessary for the performance of Executive’s duties hereunder, consistent with that of other key

executive employees;

(iii)

a reduction in the Executive’s Base Salary (but not including any diminution related to a broader compensation reduction that is

not limited to any particular employee or executive);

(iv)

a requirement that the Executive be based anywhere other than within 50 (fifty) miles of Memphis, Tennessee; or

(iv)

a material diminution in the Executive’s title, duties, or responsibilities from those in effect on the date hereof (it being understood

that the Executive’s obligation to report to the Board and the Board’s exercise of its final authority over Company matters

shall not give rise to any such claim of diminution).

No

event shall constitute Constructive Termination unless the Executive has notified the Company in a writing specifically describing the

event which constitutes Constructive Termination within 90 (ninety) days of the condition first arising and then only if the Company

fails to cure such event within thirty (30) days after the Company’s receipt of such written notice and Executive resigns his employment

with 45 days of when he gave the Company such written notice.

5.04 Consequences

of Termination. Upon any termination of Executive’s employment with the Company for any reason, except for a termination

for Cause pursuant to Section 5.02(b), the Executive shall be entitled to (a) a payment equal to the greater of (i) two (2)

years’ worth of the then-existing Base and the last year’s Bonus or (ii) the Base payable through the remaining Initial

Term (the “Severance”), and (b) retain the benefits set forth in Article IV for the remainder of the Initial Term or

Renewal Term, as then applicable. The Severance shall be paid in a lump sum upon termination with such payments discounted by the

U.S. Treasury rate most closely comparable to the applicable time period left in the Agreement. As a condition to the

Company’s obligation to pay said Severance, Executive shall execute a comprehensive release of any and all claims that

Executive may have against the Company (excluding any claims for the Company to pay or provide Accrued Obligations and Severance)

(Release of Claims) within twenty-one (21) days of the effective date of termination of employment, and Executive shall not revoke

said release in writing within seven (7) days of execution, provided however that if the twenty-one (21) day period spans two

calendar years, payment shall be made in the second calendar year.

ARTICLE

VI

Covenants

6.01

Confidential Information. Executive shall treat as confidential and keep secret the affairs of the Company and shall not at any

time during the term of employment or for a period of five years thereafter, without the prior written consent of the Company, divulge,

furnish, or make known or accessible to, or use for the benefit of, anyone other than the Company and its subsidiaries and affiliates

any information of a confidential nature relating in any way to the business of the Company or its subsidiaries or affiliates or their

clients (“Confidential Information”) and obtained by him in the course of his employment hereunder. Provided, however,

that Confidential Information of the Company shall not include any information known or available generally to the public (other

than as a result of unauthorized disclosure by Executive).

6.02

Permitted Disclosures. Nothing in this Agreement shall be construed to prevent disclosure of Confidential Information as may be

required by applicable law or regulation, rules of any stock exchange, or pursuant to the valid order of a court of competent jurisdiction

or an authorized government agency, provided that the disclosure does not exceed the extent of disclosure required by such law, regulation,

or order. Nothing in this Agreement prohibits or restricts Executive (or Executive’s attorney) from initiating communications directly

with, responding to an inquiry from, or providing testimony before any Court, governmental entity, any other self-regulatory organization,

any other federal or state regulatory authority, or any stock exchange. Nothing in this Agreement in any way prohibits or is intended

to restrict or impede, and shall not be interpreted or understood as restricting or impeding, Executive from reporting any good faith

allegation of unlawful employment practices to any appropriate federal, state, or local government agency enforcing discrimination laws;

reporting any good faith allegation of criminal conduct to any appropriate federal, state, or local official; participating in a proceeding

with any appropriate federal, state, or local government agency enforcing discrimination laws; making any truthful statements or disclosures

required by law, regulation, or legal process.

6.03

Defend Trade Secrets Act. Notwithstanding any other provision of this Agreement, the Executive hereby is notified in accordance

with the Defend Trade Secrets Act of 2016 that the Executive will not be held criminally or civilly liable under a federal or state law

for the disclosure of a trade secret that is made in confidence to a federal, state or local government official, either directly or

indirectly, or to an attorney, and solely for the purpose of reporting or investigating a suspected violation of law; or is made in a

complaint or other document filed in a lawsuit or other proceeding, if such filing is made under seal. If the Executive files a lawsuit

for retaliation by the Company for reporting a suspected violation of law, the Executive may disclose the trade secret to the Executive’s

attorney and use the trade secret information in the court proceeding, provided that the Executive must file any document containing

the trade secret under seal, and must not disclose the trade secret, except pursuant to court order.

6.04

Company Records. All records, papers, and documents kept or made by the Executive relating to the business of the Company or its

subsidiaries or affiliates or their clients shall be and remain the property of the Company.

6.05

Non-solicitation. Following the termination of Executive’s employment hereunder for any reason except for those set forth

in section 5.03 in which event this section is inapplicable, Executive shall not for a period of twelve (12) months from such termination,

solicit any employee of the Company to leave such employ to enter the employ of Executive or of any person, firm, or Company with which

Executive is then associated (except solicitation by general means such as newspapers). During Executive’s employment with the

Company and for a period of 12 months after termination of Executive’s employment at any time and for any reason, except for those

set forth in Section 5.03 in which event this section is inapplicable, Executive shall not, directly or indirectly, solicit any person

who during any portion of the time of Executive’s employment or at the time of termination of Executive’s employment with

the Company, was a client, customer, policyholder, vendor, consultant or agent of the Company to discontinue business, in whole or in

part, with the Company. Executive further agrees that, during such time, if such a client, customer, policyholder, vendor, or consultant

or agent contacts Executive about discontinuing business with the Company or moving that business elsewhere, Executive will inform such

client, customer, policyholder, vendor, consultant or agent that he or she cannot discuss the matter further without the consent of the

Company

6.06.

Noncompetition. Executive agrees as follows, except in the event of a termination pursuant to Section 5.03, in which event this

section is inapplicable:

(a)

Executive agrees that during the term of his employment with the Company, neither he nor any of his Affiliates (Executive’s Affiliates

is defined as any legal entity in which Executive directly or indirectly owns at least a 25% interest or any entity or person which is

under the control of the Executive) will directly or indirectly compete with the Company in any way in any business in which the Company

or its Affiliates is engaged in, and that he will not act as an officer, director, employee, consultant, shareholder, lender, or agent

of any entity which is engaged in any business of the same nature as, or in competition with the businesses in which the Company is now

engaged or in which the Company becomes engaged during the term of employment; provided, however, that this Section shall not prohibit

Executive or any of his Affiliates from purchasing or holding an aggregate equity interest of up to 10% in any publicly traded business

in competition with the Company, so long as Executive and his Affiliates combined do not purchase or hold an aggregate equity interest

of more than 10%. Furthermore, Executive agrees that during the term of employment, he will not accept any board of director seat or

officer role or undertake any planning for the organization of any business activity competitive with the Company (without the approval

of the Board of Directors) and Executive will not combine or conspire with any other Executives of the Company for the purpose of the

organization of any such competitive business activity.

(b)

In order to protect the Company against the unauthorized use or the disclosure of any confidential information of the Company presently

known or hereinafter obtained by Executive during his employment under this Agreement, Executive agrees that for a period of twelve (12)

months following the termination of this Agreement for any reason, neither Executive nor any of his Affiliates, shall, directly or indirectly,

for itself or himself or on behalf of any other corporation, person, firm, partnership, association, or any other entity (whether as

an individual, agent, servant, employee, employer, officer, director, shareholder, investor, principal, consultant or in any other capacity):

(i)

engage or participate in any business, regardless of where situated, which engages in direct market competition with such businesses

being conducted by the Company during the term of employment; or

(ii)

assist or finance any person or entity in any manner or in any way inconsistent with the intents and purposes of this Agreement.

6.07.

Non-disparagement. Executive agrees that at no time during his employment by the Company or thereafter, shall he make, or cause

or assist any other person to make, any statement or other communication to any third party which impugns or attacks, or is otherwise

critical of, the reputation, business or character of the Company or any of its respective directors, officers or Executives. In addition,

the Company agrees that its Board of Director and executives will not disparage the Executive so long as the Executive separates from

the Company in good standing and abides by all terms of this agreement and signed non-disclosure and non-compete agreements. Nothing

contained herein shall be deemed to prevent the Executive from performing his duties hereunder, including but not limited to conducting

candid, internal discussions. This paragraph shall not prohibit any person from testifying truthfully in response to a lawful subpoena.

6.08

Severability. If at the time of enforcement of any provision of this Agreement, a court shall hold that the duration, scope, or

area restriction of any provision hereof is unreasonable under circumstances now or then existing, the parties hereto agree that the

maximum duration, scope, or area reasonable under the circumstances shall be substituted by the court for the stated duration, scope,

or area.

6.09

Remedies. Executive acknowledges that any breach by him of the provisions of this Article VI of this Agreement shall cause irreparable

harm to the Company and that a remedy at law for any breach or attempted breach of Article VI of this Agreement will be inadequate, and

agrees that, notwithstanding Article VIII hereof, the Company shall be entitled to exercise all remedies available to it, including specific

performance and injunctive and other equitable relief, in the case of any such breach or attempted breach.

6.10

Company Representation. The Company represents and warrants that this Agreement has been duly authorized, executed, and delivered

on behalf of the Company and that this Agreement represents the legal, valid, and binding obligation of the Company and does not conflict

with any other agreement binding on the Company.

ARTICLE

VII

Assignment

7.01

Assignment. This Agreement shall be binding upon and inure to the benefit of the successors and assigns of the Company without

relieving the Company of its obligations hereunder. Neither this Agreement nor any rights hereunder shall be assignable by Executive

and any such purported assignment by him shall be void.

ARTICLE

VIII

Entire

Agreement

8.01

Entire Agreement. This Agreement constitutes the entire understanding between the Company and Executive concerning his employment

by the Company or subsidiaries and supersedes any and all previous agreements between Executive and the Company or any of its affiliates

or subsidiaries concerning such employment, including, without limitation, the Original Employment Agreement. Each party hereto shall

pay its own costs and expenses (including legal fees) except as otherwise expressly provided herein incurred in connection with the preparation,

negotiation, and execution of this Agreement. This Agreement may not be changed orally, but only in a written instrument signed by both

parties hereto.

ARTICLE

IX

Applicable

Law. Miscellaneous

9.01

Governing Law/Venue. This Agreement shall be governed by and construed in accordance with the laws of the State of Tennessee.

All actions brought to interpret or enforce this Agreement shall be brought in courts of the State of Tennessee located in the Shelby

County, Tennessee, or in the United States District Court for the Western District of Tennessee.

9.02

Attorneys’ Fees. In addition to all other rights and benefits under this Agreement, each party agrees to reimburse the other

for, and indemnify and hold harmless such party against, all costs and expenses (including attorney’s fees) incurred by such party

(whether or not during the term of this Agreement or otherwise), if and to the extent that such party prevails on or is otherwise successful

on the merits with respect to any action, claim, or dispute relating in any manner to this Agreement or to any termination of this Agreement

or in seeking to obtain or enforce any right or benefit provided by or claimed under this Agreement, taking into account the relative

fault of each of the parties and any other relevant considerations.

9.03

Indemnity. The Company shall indemnify and hold harmless Executive to the full extent authorized or permitted by law with respect

to any claim, liability, action, or proceeding instituted or threatened against or incurred by Executive or his legal representatives

and arising in connection with Executive’s conduct or position at any time as a director, officer, employee, or agent of the Company

or any subsidiary thereof. The Company shall not change, modify, alter, or in any way limit the existing indemnification and reimbursement

provisions relating to and for the benefit of its directors and officers without the prior written consent of the Executive, including

any modification or limitation of any directors and officers’ liability insurance policy.

9.04

No Waiver. No waiver by either party hereto at any time of any breach by the other party hereto of, or compliance with, any condition

or provision of this Agreement to be performed by such other party shall be deemed a continuing waiver or a waiver of any similar or

dissimilar provisions or conditions at the same or at any prior or subsequent time. No agreements or representations, oral or otherwise,

express or implied, with respect to the subject matter hereof have been made by either party hereto which are not set forth expressly

in this Agreement.

9.05

Severability. The invalidity or unenforceability of any provision or provisions of this Agreement shall not affect the validity

or enforceability of any other provision of this Agreement, which shall remain in full force and effect.

9.06

Counterparts. This Agreement may be executed in several counterparts, each of which shall be deemed to be an original and all

of which together shall constitute one and the same instrument. Facsimile and .pdf signatures shall be considered originals for purposes

of this Agreement.

9.07

Section Heading. The section headings contained in this Agreement are inserted for reference purposes only and shall not affect

the meaning or interpretation of this Agreement.

9.08

Internal Revenue Code § 409A. This Agreement shall at all times be administered and interpreted in a manner which is consistent

with and complies with the requirements of Section 409A of the Internal Revenue Code of 1986, as amended, and the Department of Treasury

regulations and other interpretive guidance issued thereunder, including any guidance or regulations that may be issued after the effective

date of the Agreement (“Section 409A”). To the extent necessary to comply with Section 409A, the term “termination

of employment” shall mean “separation from service” as defined in Section 409A. Notwithstanding

anything in this Agreement to the contrary, if Executive is deemed by the Company at the time of Executive’s “separation

from service” to be a “specified employee” for purposes of Section 409A, to the extent delayed commencement of any

portion of the benefits to which Executive is entitled under this Agreement is required in order to avoid a prohibited distribution under

Section 409A, such portion of Executive’s benefits shall not be provided to Executive prior to the earlier of (i) the expiration

of the six-month period measured from the date of Executive’s separation from service with the Company or (ii) the date of Executive’s

death. Upon the first business day following the expiration of the applicable Section 409A period, all payments deferred pursuant to

the preceding sentence shall be paid in a lump sum to Executive (or Executive’s estate or beneficiaries), and any remaining payments

due to Executive under this Agreement shall be paid as otherwise provided herein.

[Signature

Page Follows]

IN

WITNESS WHEREOF, the parties hereto have executed this Employment Agreement as of the date first above written.

| |

Surgepays,

Inc. |

| |

|

|

| |

By: |

|

| |

Print

Name: |

Tony

Evers |

| |

Title: |

Chief

Financial Officer |

| |

|

|

| |

Executive:

|

| |

|

|

| |

|

| |

Kevin

Brian Cox |

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=SURG_CommonStockPurchaseWarrantsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

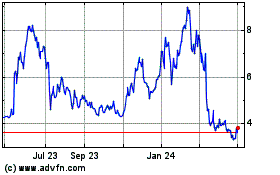

SurgePays (NASDAQ:SURG)

Historical Stock Chart

From Mar 2024 to Apr 2024

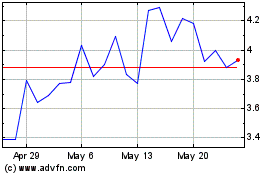

SurgePays (NASDAQ:SURG)

Historical Stock Chart

From Apr 2023 to Apr 2024