U.S. index futures show a decline in Wednesday’s pre-market

trading, a direct reaction to the performance of the Nasdaq

Composite, which faced its most challenging session since October

in the previous session.

At 05:10 AM, the Dow Jones futures (DOWI:DJI) fell 75 points, or

0.20%. The S&P 500 futures fell 0.25% and the Nasdaq-100

futures retreated 0.44%. The yield on 10-year Treasury notes was at

3.978%.

In the commodities market, West Texas Intermediate crude oil for

February fell 0.68%, to $69.90 per barrel. Brent crude for March

fell 0.62%, close to $75.42 per barrel. Iron ore with a 62%

concentration, traded on the Dalian exchange, rose 2.83%, to

$142.38 per ton.

On Wednesday’s economic agenda, investors await, at 10:00 AM,

the JOLTS report released by the Department of Labor for November,

with an LSEG projection of 8.850 million job openings. At the same

time, the ISM will publish the ISM index of industrial sector

activity for December, with an LSEG forecast of 47.1. The minutes

of the last monetary policy meeting of the Federal Open Market

Committee (Fomc), held between December 12 and 13, will be released

at 2:00 PM by the Federal Reserve.

European markets had a mixed opening on Wednesday. The Stoxx 600

fluctuated between losses and gains, falling 0.5% in the morning.

Food and beverage stocks rose, while construction stocks fell.

Danish Maersk (TG:DP4B) saw an increase after

pausing routes in the Red Sea. Meanwhile, inflation in Turkey

reached 64.8%. Asian markets fell, affected by downgrades of major

technology companies, especially chip manufacturers. In Japan, the

stock exchange remains closed for a market holiday.

U.S. stocks fell on Tuesday, with the Nasdaq leading the decline

due to weakness in technology stocks. The Dow Jones recovered

slightly, while the S&P 500 also fell. Apple

(NASDAQ:AAPL) saw a sharp drop following a downgrade in rating by

Barclays. Some traders were absent due to the New Year’s holiday.

Semiconductor and airline sectors also experienced notable

declines, while health, pharmaceutical, and biotechnology stocks

showed strength.

Wall Street Corporate Highlights for Today

Apple (NASDAQ:AAPL) – Apple’s shares fell 3.6%

on Tuesday to a seven-week low after Barclays

(NYSE:BCS) downgraded its rating due to concerns of weak demand in

2024 for products like iPhone and Mac. This drop reflects the

highest number of negative recommendations in two years. The

company, which has a significant weight in the S&P 500, faces

demand challenges and competition, particularly in China, and

growing concerns about its services business.

AMD (NASDAQ:AMD), Intel

(NASDAQ:INTC), ASML (NASDAQ:ASML),

Nvidia (NASDAQ:NVDA) – On Tuesday, the

semiconductor sector faced a broad sell-off, with the VanEck

Semiconductor ETF dropping 3.4% in one day, after all its 25

components recorded declines. This follows an exceptional year in

2023, when the ETF rose 72.3%, its best performance since 2003.

Advanced Micro Devices led the declines with a 6% drop, followed by

Intel with 4.9%, after a 90.1% rise in 2023. ASML Holding saw a

5.3% drop due to export restrictions. In contrast, Nvidia had the

best performance in 2023, with a 238.9% increase, but fell 2.8% on

the day.

Lattice (NASDAQ:LSCC) – Benchmark recommended

buying Lattice shares due to underperformance compared to peers in

the semiconductor industry. Analyst David Williams raised the

target price to $95, citing a positive outlook for the Avant

product line. Although shares fell after a disappointing forecast

in October, the analyst is optimistic about future growth. Lattice

shares rose 5% in 12 months, lagging behind the iShares

Semiconductor ETF, which gained 61%.

Palantir Technologies (NYSE:PLTR) – Palantir

will hold a board meeting in Tel Aviv next week as a gesture of

solidarity with Israel during the conflict with Hamas. The data

analytics company states its work in the region is vital and will

continue. They have had a presence in Israel for over a decade,

with an office in Tel Aviv.

MicroStrategy (NASDAQ:MSTR) – Michael Saylor,

the largest public Bitcoin holder, is selling about $216 million in

MicroStrategy shares, the company he co-founded. The shares were

acquired through options and are part of a previously announced

plan. MicroStrategy, which increased its Bitcoin holdings to over

$8 billion, continues to attract investors interested in Bitcoin

exposure, despite possible approval of Bitcoin ETFs in the U.S.

MicroStrategy’s shares rose 372% last year.

Electric Vehicles – Due to new battery supply

rules, many electric vehicles, including the Nissan Leaf, Tesla

Cybertruck All-Wheel Drive, some Tesla

(NASDAQ:TSLA) Model 3 models, and the Chevrolet Blazer EV, lost

eligibility for tax credits of up to $7,500 in the U.S. The U.S.

Treasury implemented these rules to reduce the electric vehicle

supply chain’s dependence on China. The number of models eligible

for tax credits dropped from 43 to 19. Manufacturers like

Nissan (USOTC:NSANY) and General

Motors (NYSE:GM) are adjusting their supply chains to

regain eligibility for tax credits.

Tesla (NASDAQ:TSLA) – In the fourth quarter of

2023, Tesla set a record with 494,989 electric vehicle deliveries,

exceeding expectations and meeting its annual target, but not

reaching the internal annual goal of 2 million, delivering 1.8

million in total. China’s BYD surpassed Tesla with 526,409 vehicles

delivered in the quarter and 3.02 million for the year. Despite

facing competition and regulatory challenges, Tesla led sales in

Norway for the third consecutive year, with electric vehicles

representing 82.4% of new vehicle sales in the country. In Sweden,

Tesla overcame union challenges, increasing its registrations to

1,789 new vehicles in December and raising its market share to

6.1%.

Rivian (NASDAQ:RIVN) – Rivian Automotive

delivered 13,972 vehicles in the fourth quarter of 2023, 10% below

the previous quarter and below market expectations of 14,430 units.

Intense competition and high interest rates in the U.S. impacted

demand, resulting in a drop in the company’s shares on Tuesday.

Rivian produced 17,541 vehicles in the last quarter, surpassing the

annual target of 54,000.

Ryanair (NASDAQ:RYAAY) – Ryanair reported that

online travel agents, including Booking.com

(NASDAQ:BKNG), Kiwi, and Kayak, ceased selling its flights since

early December due to legal and regulatory pressure. The airline

anticipates a 1-2% reduction in occupancy in the short term in

December and January but does not expect a significant impact on

annual traffic volume or net profit projection.

American Airlines (NASDAQ:AAL), Delta

Air Lines (NYSE:DAL), United Airlines

(NASDAQ:UAL), Southwest Airlines (NYSE:LUV) –

Airlines for America, representing major airlines such as American,

Delta, United, and Southwest, requested more efforts from U.S.

transportation authorities to balance commercial and private air

traffic and address air traffic controller shortages. They

emphasized the need to minimize delays and cancellations,

especially during holidays. The FAA acknowledged the controller

shortage but indicated it is taking steps to recruit and train more

personnel.

Chevron (NYSE:CVX) – Chevron plans to take

non-cash charges of $3.5 to $4 billion in the fourth quarter of

2023, mainly related to oil and gas production in California and

asset abandonment in the Gulf of Mexico. The impairment in

California is due to regulatory challenges, while in the Gulf of

Mexico, it is related to decommissioning costs for previously sold

offshore properties. Chevron will continue operating the affected

assets for many years.

HSBC (NYSE:HSBC) – HSBC’s subsidiary, HSBC

Continental Europe, completed the sale of its retail banking

business in France to Crédit Commercial de France, owned by the My

Money Group, on January 1st. The My Money Group, backed by

Cerberus, will have assets above $33.11 billion and a solid

solvency position. The deal, initially proposed in June 2021 for

one euro, further strengthens My Money Group’s financial position.

Additionally, HSBC will launch the international payments app Zing

to compete with fintechs like Revolut and Wise, initially in the

UK, with plans for global expansion. The app will be accessible to

non-HSBC clients and seeks a share in the international payments

market. HSBC aims to compete with fintechs in mobile banking

services, and the news caused a drop in Wise (LSE:WISE) shares.

JPMorgan Chase (NYSE:JPM) – JPMorgan’s shares

reached a new record on Tuesday, surpassing the highest level set

in October 2021. The largest U.S. bank had a solid performance last

year, rising 27%, outperforming its rivals and raising its market

capitalization to about $500 billion. Despite the strong run, the

expected return potential is about 3% this year, according to

analysts.

Morgan Stanley (NYSE:MS) – In December 2023,

global long-term funds unloaded Chinese stocks at the fastest pace

of the year, with net outflows of $3.8 billion, as reported by

Morgan Stanley. This was due to investor redemptions and portfolio

diversification. China and Hong Kong underperformed in major global

indices in 2023, impacted by geopolitical risks and a slow economic

recovery. Morgan Stanley also noted a realignment of European fund

managers’ positions on China, contrasting with the more bullish

stance of hedge funds at the end of the year.

Alibaba (NYSE:BABA) – In 2023, Alibaba

repurchased 897.9 million of its shares, spending $9.5 billion, in

both the U.S. and Hong Kong markets. After this buyback program,

the remaining authorized amount until March 2025 is $11.7 billion.

The company noted a net reduction of 3.3% in its outstanding

shares, considering the issuance of shares for its Employee Stock

Ownership Plan (ESOP).

Abercrombie & Fitch (NYSE:ANF) – In 2023,

Abercrombie & Fitch’s shares saw an impressive increase of

285%, even outperforming companies like Nvidia (NASDAQ:NVDA) and

Meta Platforms (NASDAQ:META) in the S&P 500. This marked a

turnaround after struggles in 2022 due to supply chain issues and

inflation. However, analysts express concerns that the current

success may be hard to sustain, with risks of reversal of gains and

the cyclicality of fashion.

Hasbro (NASDAQ:HAS) – Hasbro’s shares faced

turbulence in early 2024, due to D.A. Davidson’s downgrade amid

concerns about the future of the toy industry. The analyst

downgraded the rating to “Neutral” and lowered the target price

from $60 to $53, citing uncertainty over growth. Hasbro cut almost

20% of its workforce due to lower-than-expected toy sales in 2023,

raising concerns about dividends and debt. The shares fell 17% in

12 months.

Bloomin’ Brands (NASDAQ:BLMN) – Bloomin’ Brands

has appointed David George and Jon Sagal from Starboard to its

Board of Directors as part of a cooperation agreement. Starboard

holds approximately 9.7% of the company’s shares. The Board has

also formed an Operational Committee to drive corporate and

operational improvements. The agreement has been filed with the

SEC. Financial advisors include BofA Securities, and legal advisors

include Wachtell, Lipton, Rosen & Katz for Bloomin’ Brands and

Olshan Frome Wolosky LLP for Starboard.

Moderna (NASDAQ:MRNA) – Moderna’s shares jumped

on Tuesday after Oppenheimer upgraded its rating to “Outperform.”

CEO Stéphane Bancel reaffirmed the sales growth target for 2025,

driven by the expected launch of RSV vaccines and a combined

flu/Covid vaccine. Despite a 45% drop in 2023, Moderna expects to

break even financially in 2026 and projects $4 billion in revenue

in 2024 from its vaccines.

IQVIA (NYSE:IQV) – A U.S. court upheld the

Federal Trade Commission’s (FTC) decision to block IQVIA’s

acquisition of DeepIntent, citing concerns over competition in the

healthcare advertising sector. The FTC argued that the merger would

increase prices for consumers and harm patients. Judge Edgar Ramos

supported the FTC, stating that the acquisition could substantially

harm competition. IQVIA expressed disappointment with the decision

and is evaluating its options.

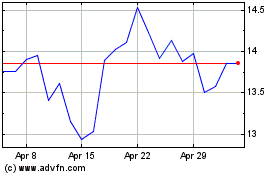

American Airlines (NASDAQ:AAL)

Historical Stock Chart

From Mar 2024 to Apr 2024

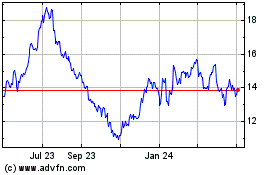

American Airlines (NASDAQ:AAL)

Historical Stock Chart

From Apr 2023 to Apr 2024