UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A INFORMATION

Proxy

Statement Pursuant to Section 14(a) of

the

Securities Exchange Act of 1934

(Amendment

No. )

| Filed

by the Registrant ☒ |

| Filed

by a Party other than the Registrant ☐ |

| Check

the appropriate box: |

| |

| ☒ |

Preliminary

Proxy Statement |

| ☐ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ |

Definitive

Proxy Statement |

| ☐ |

Definitive

Additional Materials |

| ☐ |

Soliciting

Material Pursuant to §240.14a-12 |

| SAVE

FOODS, INC. |

| (Name

of Registrant as Specified In Its Charter) |

| |

| |

| (Name

of Person(s) Filing Proxy Statement, if other than the Registrant) |

| Payment

of Filing Fee (Check the appropriate box): |

| |

| ☒ |

No

fee required. |

| ☐ |

Fee

computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| ☐ |

Fee

paid previously with preliminary materials. |

SAVE

FOODS, INC.

January

__, 2024

Dear

Stockholder:

You

are cordially invited to attend the special meeting of stockholders of Save Foods, Inc. (the “Company”) to be held at 2:30

p.m., Israel time (9:30 a.m. EST), on February ___, 2024, at the offices of the Company’s legal counsel, The Crone Law Group, P.C.,

located at HaArba’a Street 28, South Tower, 19th floor, Tel Aviv 6473925, Israel.

In

order to facilitate your attendance at the special meeting, we strongly encourage you to advise David Palach, our chief executive officer,

by email at david@savefoods.co or telephone at +972-54-721-5315 if you plan to attend the meeting prior to 11:59 p.m., Israel time (4:59

p.m. EST), on January __, 2024, so that we can timely provide your name to building security. In the event that you do not advise us

ahead of time that you will be attending the special meeting, we encourage you to arrive at the meeting no later than 2:00 p.m., Israel

time (9:00 a.m. EST), in order to ensure that you are able to pass through security prior to the start of the meeting.

Your

vote is very important, regardless of the number of shares of our voting securities that you own. I encourage you to vote by telephone,

over the Internet, or by marking, signing, dating and returning your proxy card so that your shares will be represented and voted at

the special meeting, whether or not you plan to attend. If you attend the special meeting, you will, of course, have the right to revoke

the proxy and vote your shares in person.

If

your shares are held in the name of a broker, trust, bank or other intermediary, and you receive notice of the special meeting through

your broker or through another intermediary, please vote or return the materials in accordance with the instructions provided to you

by such broker or other intermediary, or contact your broker directly in order to obtain a proxy issued to you by your intermediary holder

to attend the meeting and vote in person. Failure to do so may result in your shares not being eligible to be voted by proxy at the meeting.

On

behalf of the board of directors, I urge you to submit your proxy as soon as possible, even if you currently plan to attend the meeting

in person.

Thank

you for your support of our company.

| |

Sincerely, |

| |

|

| |

/s/

Amitay Weiss |

| |

Amitay

Weiss |

| |

Chairman |

SAVE

FOODS, INC.

HaPardes

134 (Meshek Sander), Neve Yarak, 4994500 Israel (347) 468 9583

NOTICE

OF SPECIAL MEETING OF STOCKHOLDERS

To

Be Held on February ___, 2024

The

Special Meeting of Stockholders (the “Special Meeting”) of Save Foods, Inc., a Nevada corporation (the “Company”),

will be held at 2:30 p.m., Israel time (9:30 a.m. EST), on February ____, 2024, at the offices of the Company’s legal counsel,

The Crone Law Group, P.C., located at HaArba’a Street 28, South Tower, 19th floor, Tel Aviv 6473925, Israel.

We

will consider and act on the following items of business at the Special Meeting:

| |

(1) |

To

approve an amendment to the Articles of Incorporation of the Company, implementing the change of

name of the Company from “Save Foods, Inc.” to “N2OFF, Inc.” (the “Name Change Proposal”); |

| |

|

|

| |

(2) |

To

approve the issuance of 20% or more of our issued and outstanding shares of common stock pursuant to the terms of the Standby Equity

Purchase Agreement (the “Purchase Agreement”), dated December 22, 2023, between the Company and YA II PN, Ltd. so that

such issuances are made in accordance with Nasdaq Marketplace Rule 5635(d) (the “Nasdaq 20% Share Issuance Proposal”);

and |

| |

|

|

| |

(3) |

Such

other business as may properly come before the Special Meeting. |

Stockholders

are referred to the Proxy Statement accompanying this notice for more detailed information with respect to the matters to be considered

at the Special Meeting. After careful consideration, THE BOARD OF DIRECTORS OF THE COMPANY UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR”

the Name Change Proposal (Proposal 1); and FOR the approval of the Nasdaq 20% Share Issuance Proposal (Proposal 2).

The

board of directors has fixed the close of business on January 2, 2024, as the record date (the “Record Date”). Only holders

of record of shares of our common stock as of the Record Date are entitled to receive notice of, and to vote at, the Special Meeting

or at any postponement(s) or adjournment(s) thereof. A complete list of registered stockholders entitled to vote at the Special

Meeting will be available for inspection at the office of the Company during regular business hours for the 10 calendar days prior to

and during the Special Meeting.

YOUR

VOTE AND PARTICIPATION IN THE COMPANY’S AFFAIRS ARE IMPORTANT.

If

your shares are registered in your name, even if you plan to attend the Special Meeting or any postponement or adjournment of the

Special Meeting in person, we request that you vote by telephone, over the Internet, or by completing, signing and mailing your proxy

card to ensure that your shares will be represented at the Special Meeting.

If

your shares are held in the name of a broker, trust, bank or other intermediary, and you receive notice of the Special Meeting through

your broker or through another intermediary, please vote online, by telephone or by completing and returning the voting instruction form

in accordance with the instructions provided to you by such broker or other intermediary, or contact your broker directly in order to

obtain a proxy issued to you by your intermediary holder to attend the Special Meeting and vote in person. Failure to do any of the foregoing

may result in your shares not being eligible to be voted at the Special Meeting.

| |

By

Order of the Board of Directors, |

| |

|

| |

/s/

Amitay Weiss |

| |

Amitay

Weiss |

| |

Chairman |

| |

|

| January

__, 2024 |

|

SAVE

FOODS, INC.

PROXY

STATEMENT

FOR

SPECIAL

MEETING OF STOCKHOLDERS

To

Be Held On February ____, 2024

Unless

the context otherwise requires, references in this Proxy Statement to “we,” “us,” “our,” the “Company,”

or “Save Foods” refer to Save Foods, Inc., a Nevada corporation, and its direct and indirect subsidiaries. In addition, unless

the context otherwise requires, references to “stockholders” are to the holders of our voting securities, which consist of

our common stock, par value $0.0001 per share (the “Common Stock”).

The

accompanying proxy is solicited by the board of directors on behalf of Save Foods, Inc., a Nevada corporation, to be voted at the special

meeting of stockholders of the Company (the “Special Meeting”) to be held on February ____, 2024, at the time and place and

for the purposes set forth in the accompanying Notice of Special Meeting of Stockholders (the “Notice”) and at any postponement(s)

or adjournment(s) of the Special Meeting. This Proxy Statement and accompanying form of proxy are expected to be first sent or given

to stockholders on or about January __, 2024.

The

executive office of the Company is located at, and the mailing address of the Company is, HaPardes 134 (Meshek Sander), Neve Yarak, 4994500

Israel.

IMPORTANT

NOTICE REGARDING THE AVAILABILITY OF PROXY

MATERIALS

FOR

THE

SPECIAL STOCKHOLDER MEETING TO BE HELD ON FEBRUARY ___, 2024:

This

Proxy Statement and form of proxy are being made available to stockholders beginning approximately January ____, 2024. These documents

are also included in our filings with the Securities and Exchange Commission (“SEC”), which you can access electronically

at the SEC’s website at http://www.sec.gov and on the Company’s website at https://savefoods.co. A complete list of

the stockholders entitled to vote at the Special Meeting will be available for inspection for any purpose germane to the Special Meeting

ten days prior to the Special Meeting at the Company’s offices at HaPardes 134 (Meshek Sander), Neve Yarak, Israel, 4994500 during

ordinary business hours.

ABOUT

THE SPECIAL MEETING

What

is a proxy?

A

proxy is another person whom you legally designate to vote your stock. If you designate someone as your proxy in a written document,

that document is also called a “proxy” or a “proxy card.” If you are a street name holder, you must obtain a

proxy from your broker or intermediary in order to vote your shares in person at the Special Meeting.

What

is a proxy statement?

A

proxy statement is a document that regulations of the SEC require that we give to you when we ask you to sign a proxy card to vote your

stock at the Special Meeting.

What

is the purpose of the Special Meeting?

At

our Special Meeting, stockholders will act upon the matters outlined in the Notice, including the following:

| |

(1) |

To

approve an amendment to the Articles of Incorporation of the Company, implementing the change of name of the Company from “Save

Foods, Inc.” to “N2OFF, Inc.” (the “Name Change Proposal”); |

| |

|

|

| |

(2) |

To

approve the issuance of 20% or more of our issued and outstanding shares of Common Stock pursuant to the terms of the Standby Equity

Purchase Agreement (the “Purchase Agreement”) dated December 22, 2023, by and between the Company and YA II PN, Ltd.

so that such issuances are made in accordance with Nasdaq Marketplace Rule 5635(d) (the “Nasdaq 20% Share Issuance Proposal”);

and |

| |

|

|

| |

(3) |

Such

other business as may properly come before the Special Meeting. |

What

is “householding” and how does it affect me?

With

respect to eligible stockholders who share a single address, we may send only one Proxy Statement to that address unless we receive instructions

to the contrary from any stockholder at that address. This practice, known as “householding,” is designed to reduce our printing

and postage costs. However, if a stockholder of record residing at such address wishes to receive a separate notice or proxy statement

in the future, he or she may contact Save Foods, Inc., HaPardes 134 (Meshek Sander), Neve Yarak, 4994500 Israel, Attn: David Palach,

chief executive officer, or via email to david@savefoods.co or telephone at +972-54-721-5315. Eligible stockholders of record receiving

multiple copies of our Notice and Proxy Statement can request householding by contacting us in the same manner. Stockholders who

own shares through a bank, broker or other intermediary can request householding by contacting the intermediary.

We

hereby undertake to deliver promptly, upon written or oral request, a copy of the Notice or Proxy Statement to a stockholder at a shared

address to which a single copy of the document was delivered. Requests should be directed to David Palach, our chief executive officer,

at the address or telephone number set forth above.

What

should I do if I receive more than one set of voting materials?

You

may receive more than one set of voting materials, including multiple proxy cards or voting instruction forms. For example, if you hold

your shares in more than one brokerage account, you may receive a separate voting instruction form for each brokerage account in which

you hold shares. Similarly, if you are a stockholder of record and also hold shares in a brokerage account, you will receive a proxy

card for shares held in your name and a voting instruction form for shares held in street name. Please follow the directions provided

in the Notice and in each proxy card or voting instruction form you receive to ensure that all your shares are voted.

What

is the record date and what does it mean?

The

record date to determine the stockholders entitled to notice of and to vote at the Special Meeting is the close of business on January

2, 2024 (the “Record Date”). The Record Date is established by the board of directors as required by Nevada law. On the Record

Date, _______ shares of Common Stock were issued and outstanding.

Who

is entitled to vote at the Special Meeting?

Holders

of Common Stock at the close of business on the Record Date may vote at the Special Meeting.

What

are the voting rights of the stockholders?

On

each matter to be voted upon at the Special Meeting, you have one vote for each share of Common Stock you own as of the Record Date.

What

is the quorum requirement?

A

majority of the shares entitled to vote, present in person or represented by proxy, at the Special Meeting is necessary to constitute

a quorum to transact business. If a quorum is not present or represented at the Special Meeting, the holders of voting stock representing

a majority of the voting power present at the Special Meeting or the presiding officer may adjourn the Special Meeting from time to time

without notice or other announcement until a quorum is present or represented.

What

is the difference between a stockholder of record and a “street name” holder?

If

your shares are registered directly in your name with Securities Transfer Corporation, our stock transfer agent, you are considered the

stockholder of record with respect to those shares. The Notice has been sent directly to you by us.

If

your shares are held in a stock brokerage account or by a bank or other intermediary, the intermediary is considered the record holder

of those shares. You are considered the beneficial owner of those shares, and your shares are held in “street name.” A notice,

and Proxy Statement, along with a voting instruction form, have been forwarded to you by your intermediary. As the beneficial owner,

you have the right to direct your intermediary concerning how to vote your shares by using the voting instruction form they included

in the mailing or by following their instructions for voting.

What

is a broker non-vote?

Broker

non-votes occur when a beneficial owner of shares held in “street name” does not give instructions to the broker or nominee

holding the shares as to how to vote on matters deemed “non-routine.” Generally, if shares are held in street name, the beneficial

owner of the shares is entitled to give voting instructions to the broker or nominee holding the shares.

If

the beneficial owner does not provide voting instructions, the broker or nominee can still vote the shares with respect to matters that

are considered to be “routine,” but not with respect to “non-routine” matters. In the event that a broker, bank,

or other agent indicates on a proxy that it does not have discretionary authority to vote certain shares on a non-routine proposal, then

those shares will be treated as broker non-votes.

The

proposals described in this Proxy Statement are both considered “routine” matters. Accordingly, your broker has discretionary

authority to vote your shares with respect to the Name Change Proposal (Proposal 1) and the Nasdaq 20% Share Issuance Proposal (Proposal

2), even if you do not provide your broker with specific instructions on that proposal.

How

do I vote my shares?

Your

vote is very important to us. Whether or not you plan to attend the Special Meeting, please vote by proxy in accordance with the instructions

on your proxy card or voting instruction form (from your broker or other intermediary). There are three convenient ways of submitting

your vote:

| |

● |

By

Telephone or Internet – All record holders can vote by touchtone telephone from the United States using the toll-free

telephone number on the proxy card, or over the Internet (at www.proxyvote.com), using the procedures and instructions described

on the proxy card. “Street name” holders may vote by telephone or Internet if their bank, broker or other intermediary

makes those methods available, in which case the bank, broker or other intermediary will enclose the instructions with the proxy

materials. The telephone and Internet voting procedures are designed to authenticate stockholders’ identities, to allow stockholders

to vote their shares, and to confirm that their instructions have been recorded properly. |

| |

|

|

| |

● |

In

Person – All record holders may vote in person at the Special Meeting. “Street

name” holders may vote in person at the Special Meeting if their bank, broker or other

intermediary has furnished a legal proxy. If you are a “street name” holder and

would like to vote your shares by proxy, you will need to ask your bank, broker or other

intermediary to furnish you with an intermediary issued proxy. You will need to bring the

intermediary issued proxy with you to the Special Meeting and hand it in with a signed ballot

that will be provided to you at the Special Meeting. You will not be able to vote your shares

without an intermediary issued proxy. Note that a broker letter that identifies you as a

stockholder is not the same as an intermediary issued proxy.

|

| |

● |

By

Written Proxy or Voting Instruction Form – All record holders can vote by written proxy card, if they have requested

to receive printed proxy materials. If you are a “street name” holder and you request to receive printed proxy materials,

you will receive a voting instruction form from your bank, broker or other intermediary. |

The

board of directors has appointed David Palach, chief executive officer, to serve as proxy for the Special Meeting.

If

you complete and sign the proxy card but do not provide instructions for one or more of the proposals, then the designated proxies will

or will not vote your shares as to those proposals, as described under “What if I do not specify how I want my shares voted?”

below. We do not anticipate that any other matters will come before the Special Meeting, but if any other matters properly come before

the Special Meeting, then the designated proxy will vote your shares in accordance with applicable law and his judgment.

If

you hold your shares in “street name,” and complete the voting instruction form provided by your broker or other intermediary

except with respect to one or more of the proposals, then, your broker has discretionary authority to vote your shares with respect to

the Name Change Proposal (Proposal 1) and the Nasdaq 20% Share Issuance Proposal (Proposal 2), even if you do not provide your broker

with specific instructions on that proposal. See “What is a broker non-vote?” above.

Even

if you currently plan to attend the Special Meeting, we recommend that you vote by telephone or Internet or return your proxy card or

voting instructions as described above so that your votes will be counted if you later decide not to attend the Special Meeting or are

unable to attend.

Who

counts the votes?

A

representative of Broadridge Financial Solutions, Inc., our inspector of election, will tabulate and certify the votes.

What

are my choices when voting?

With

respect to the Name Change Proposal (Proposal 1) and the Nasdaq 20% Share Issuance Proposal (Proposal 2), stockholders may vote for the

proposal, against the proposal, or abstain from voting on the proposal.

What

are the board of directors’ recommendations on how I should vote my shares?

The

board of directors recommends that you vote your shares FOR the Name Change Proposal and FOR the Nasdaq 20% Share Issuance

Proposal.

What

if I do not specify how I want my shares voted?

If

you are a record holder who returns a completed, executed proxy card that does not specify how you want to vote your shares on one or

more proposals, the proxy will vote your shares for each proposal as to which you provide no voting instructions, and such shares will

be voted FOR the Name Change Proposal and FOR the Nasdaq 20% Share Issuance Proposal.

If

you are a street name holder and do not provide voting instructions on one or more proposals, your bank, broker or other intermediary

may be unable to vote those shares. See “What is a broker non-vote?” above.

Can

I change my vote?

Yes.

If you are a record holder, you may revoke your proxy at any time by any of the following means:

| |

● |

Attending

the Special Meeting and voting in person. Your attendance at the Special Meeting will not by itself revoke a proxy. You must vote

your shares by ballot at the Special Meeting to revoke your proxy. |

| |

|

|

| |

● |

Voting

again by telephone or over the Internet (only your latest telephone or Internet vote submitted prior to the Special Meeting will

be counted). |

| |

|

|

| |

● |

If

you requested and received written proxy materials, completing and submitting a new valid proxy bearing a later date. |

| |

|

|

| |

● |

Giving

written notice of revocation to the Company addressed to David Palach, chief executive officer, at the Company’s address above,

which notice must be received before noon, Eastern Standard time on _____ __, 2024. |

If

you are a street name holder, your bank, broker or other intermediary should provide instructions explaining how you may change or revoke

your voting instructions.

What

percentage of the vote is required to approve each proposal?

Assuming

the presence of a quorum:

| |

● |

Proposal

1 – pursuant to Nevada Revised Statutes Section 78.390, stockholders holding at least a majority of the voting power must

approve an amendment to the Articles of Incorporation. Since the name change of the Company requires an amendment to the Articles

of Incorporation, a majority of the shares issued and outstanding must approve the Name Change Proposal (Proposal 1). Abstentions

and broker non-votes, which are not considered “votes cast,” will have no effect on the outcome of the Name Change Proposal. |

| |

|

|

| |

● |

Proposal

2- pursuant to Section 5635 of the Nasdaq Rules, the Nasdaq 20% Share Issuance Proposal requires approval by a majority of votes

cast. Abstentions and broker non-votes, which are not considered “votes cast,” will have no effect on the outcome of

the Nasdaq 20% Share Issuance Proposal. |

Do

I have any dissenters’ or appraisal rights with respect to any of the matters to be voted on at the Special Meeting?

No.

Under Nevada Revised Statutes stockholders are not entitled to any appraisal rights or similar rights of dissenters with respect to the

matters to be voted on at the Special Meeting.

What

are the solicitation expenses and who pays the cost of this proxy solicitation?

Our

board of directors is asking for your proxy and we will pay all of the costs of asking for stockholder proxies. We will reimburse brokerage

houses and other custodians, intermediaries and fiduciaries for their reasonable out-of-pocket expenses for forwarding solicitation material

to the beneficial owners of Common Stock and collecting voting instructions. We may use officers and employees of the Company to ask

for proxies.

Are

there any other matters to be acted upon at the Special Meeting?

Management

does not intend to present any business at the Special Meeting for a vote other than the matters set forth in the Notice and has no information

that others will do so. If other matters requiring a vote of the stockholders properly come before the Special Meeting, it is the intention

of the person named in the accompanying form of proxy to vote the shares represented by the proxies held by him in accordance with applicable

law and his judgment on such matters.

Where

can I find voting results?

Voting

results will be tabulated and certified by the inspector of elections appointed for the Special Meeting, who will separately tabulate

affirmative and negative votes, abstentions, and broker non-votes. The Company expects to publish the voting results in a Current Report

on Form 8-K, which it expects to file with the SEC within four business days following the Special Meeting.

Who

can help answer my questions?

The

information provided above in this “Question and Answer” format is for your convenience only and is merely a summary of the

information contained in this Proxy Statement. We urge you to carefully read this entire Proxy Statement, including the documents we

refer to in this Proxy Statement. If you have any questions, or need additional material, please feel free to contact David Palach, our

chief executive officer, by email at david@savefoods.co or telephone at +972-54-721-5315.

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The

table below provides information regarding the beneficial ownership of our Common Stock as of the

date of this Proxy Statement of (i) each of our current directors, (ii) our

Chief Executive Officer and any other executive officer earning at least $100,000 during 2023, (iii)

all of our current directors and executive officers as a group, and (iv) each person (or group of affiliated persons) known to us who

owns more than 5% of our outstanding Common Stock.

The

beneficial ownership of our Common Stock is determined in accordance with the rules of the SEC. Under these rules, a person is deemed

to be a beneficial owner of a security if that person directly or indirectly has or shares voting power, which includes the power to

vote or to direct the voting of the security, or investment power, which includes the power to dispose of or to direct the disposition

of the security. The person is also deemed to be a beneficial owner of any security of which that person has a right to acquire beneficial

ownership within 60 days. Under the SEC rules, more than one person may be deemed to be a beneficial owner of the same securities, and

a person may be deemed to be a beneficial owner of securities as to which he or she may not have any pecuniary interest.

Beneficial

ownership as set forth below is based on our review of our record stockholders list and public ownership reports filed by certain stockholders

of the Company and may not include certain securities held in brokerage accounts or beneficially owned by the stockholders described

below.

The

percentage of shares of Common Stock beneficially owned is based on 2,955,490 shares of Common Stock outstanding as of December 29,

2023.

Unless

otherwise indicated below, each person has sole voting and investment power with respect to the shares beneficially owned and the address

for each beneficial owner listed in the table below is c/o Save Foods, Inc., HaPardes 134 (Meshek Sander), Neve Yarak, 4994500 Israel.

| Owner | |

Number of Shares Beneficially Owned | | |

Percentage Beneficially Owned | |

| 5% or more stockholders: | |

| | | |

| | |

Yaaran Investments Ltd.(1) 7 Harsit Street, Sheary-Tikva, Israel | |

| 223,008 | | |

| 7.55 | % |

Plantify Foods, Inc.(2)

2264 East 11th Avenue

Vancouver, V5N1Z6, British Columbia, Canada | |

| 166,340 | | |

| 5.63 | % |

| Directors: | |

| | | |

| | |

| Amitai Weiss | |

| 100,000 | | |

| 3.38 | % |

| Eliahou Arbib | |

| 14,500 | | |

| * | |

| Udi Kalifi | |

| 18,546 | | |

| * | |

| Israel Berenshtein | |

| 14,500 | | |

| * | |

| Ronen Rosenbloom | |

| 14,500 | | |

| * | |

| Liat Sidi | |

| - | | |

| * | |

| Asaf Itzhaik | |

| - | | |

| * | |

| Executive Officers: | |

| | | |

| | |

| David Palach | |

| 100,000 | | |

| 3.38 | % |

| Lital Barda | |

| 42,857 | | |

| 1.45 | % |

| Dan Sztybel | |

| 17,802(3) | | |

| 1.22 | % |

| All directors and executive officers as a group (10 persons) | |

| 322,705 | | |

| 10.92 | % |

| * |

Less

than 1%. |

| |

|

| (1) |

Shamuel

Yannay, chief executive officer of Yaaran Investments Ltd. (“Yaaran”) has sole voting and dispositive power over shares

owned by Yaaran. |

| (2) |

Gabi

Kabazo, chief financial officer of Plantify Foods, Inc. has sole voting and dispositive power over shares owned by Plantify

Foods, Inc. |

| (3) |

Includes

options to purchase 10,205 shares of Common Stock, which are currently exercisable or will become exercisable within 60 days of December

29, 2023. |

PROPOSAL

1: NAME CHANGE

Overview

The

Company operates through its two majority-owned Israeli subsidiaries, Save Foods Ltd., which focuses on post-harvest treatments in fruit

and vegetables to control and prevent pathogen contamination, significantly reduce the use of hazardous chemicals, and prolong fresh

produce’s shelf life; and Nitrousink, Ltd., incorporated in August 2023, which contributes to tackling greenhouse gas emissions,

by offering a pioneering solution to mitigate N2O (nitrous oxide) emissions, a potent greenhouse gas with 265 times the global warming

impact of carbon dioxide. The Company, through Nitrousink Ltd., aims to promote agricultural practices that are both environmentally

friendly and economically viable and to become a global leader in this field by collaborating with or acquiring other companies in this

field that create innovative solutions and tools to solve other aspects of global warming’s impact of carbon dioxide. In addition,

the Company has a 23% ownership in Plantify Foods Inc., a Canadian-based food tech company focused on the development

and production of clean-label, plant-based food products.

Our

board of directors has determined that it is in the best interest of the Company and its stockholders to amend the Company’s Articles

of Incorporation, to change the Company’s name from “Save Foods, Inc.” to “N2OFF, Inc.” which our board

of directors believes will better reflect the Company’s current focus on finding environmentally friendly and economically viable

solutions that mitigate N20 emissions. On December 20, 2023, the board of directors approved, by unanimous written consent, the amendment

to the Company’s Articles of Incorporation, to change the name of the Company from “Save Foods, Inc.” to “N2OFF,

Inc.” and recommends that stockholders approve the Name Change Proposal. A form of the proposed Certificate of Amendment to the

Articles of Incorporation is attached to this Proxy Statement as Annex A. This form will be attached to the standard form of Certificate

of Amendment prepared by the office of the Secretary of State of the State of Nevada.

Consequences

of Non-Approval

If

our stockholders fail to approve the Name Change Proposal, we will not have the right to file the proposed Certificate of Amendment to

our Articles of Incorporation, which is required to change the name of the Company under the Nevada Revised Statutes.

Vote

Required

Approval

of the Name Change Proposal requires an affirmative vote of a majority of the total votes cast at the Special Meeting. Abstentions and

broker non-votes have the same effect as a vote “AGAINST” the Name Change Proposal.

Board

Recommendation

The

board of directors unanimously recommends a vote FOR the approval of the Name Change Proposal (Proposal 1).

|

PROPOSAL

2: APPROVAL OF ISSUANCE OF SECURITIES IN A NON-PUBLIC OFFERING

To

approve the issuance of 20% or more of our issued and outstanding shares of Common Stock pursuant to the terms of the Standby Equity

Purchase Agreement (the “Purchase Agreement”), dated December 22, 2023, between the Company and YA II PN, Ltd. so that such

issuances are made in accordance with Nasdaq Listing Rule 5635 of the Nasdaq Capital Market (the “Nasdaq 20% Share Issuance Proposal”).

Background

and Overview

Our

Common Stock is currently listed on The Nasdaq Stock Market LLC and, as such, we are subject to Nasdaq Marketplace Rules (the “Nasdaq

Listing Rules”). We are seeking stockholder approval of the Nasdaq 20% Share Issuance Proposal in order to comply with Nasdaq Rule

5635.

Under

Nasdaq Rule 5635, stockholder approval is required for a transaction involving the sale, issuance or potential issuance by an issuer

of Common Stock (or securities convertible into or exercisable for Common Stock) in connection with a transaction other than a public

offering at a price less than the minimum price (the “Nasdaq Minimum Price”) which either alone or together with sales by

our officers, directors or substantial stockholders of the Company equals 20% or more of the Common Stock or 20% or more of the voting

power outstanding before the issuance. Nasdaq Minimum Price means a price that is the lower of: (i) the Nasdaq Official Closing Price

(as reflected on Nasdaq.com) immediately preceding the signing of a binding agreement to issue such Common Stock; or (ii) the average

Nasdaq Official Closing Price of the Common Stock (as reflected on Nasdaq.com) for the five trading days immediately preceding the signing

of a binding agreement. Stockholder approval of the Nasdaq 20% Share Issuance Proposal will constitute stockholder approval for purposes

of Nasdaq Listing Rule 5635.

On

December 22, 2023, the Company entered into a Standby Equity Purchase Agreement (the “Purchase Agreement”) with YA II PN,

Ltd. (the “Investor”), pursuant to which the Investor has agreed to purchase up to $20 million shares of Common Stock over

the course of 36 months after the date of the Purchase Agreement. The price of shares to be issued under the Purchase Agreement will

be 94% of the lowest volume weighted average price (the “VWAP”) of the Company’s Common Stock for the three trading

days immediately following the delivery of each Advance notice by the Company (the “Pricing Period”). Each issuance and sale

by the Company to the Investor under the Purchase Agreement (an “Advance”) is subject to a maximum amount equal to the greater

of 100% of the Daily Traded Amount (being the product obtained by multiplying the daily trading volume of the Company’s Common

Stock, as reported by Bloomberg L.P., by the VWAP for such trading day) during the five trading days immediately preceding an Advance

notice or $500,000 in Common Stock.

With

respect to each Advance, the Company has the option to notify the Investor of a minimum acceptable price (“MAP”) by specifying

the amount within an Advance notice. During any trading day within a Pricing Period, two conditions will trigger an automatic reduction

to the amount of the Advance by one third: either (i) the VWAP of the Common Stock is below the MAP specified in the Advance notice,

or (ii) when no VWAP is available (each such day, an “Excluded Day”). On each Excluded Day, an automatic one third reduction

is applied to the specified Advance amount in the Advance notice and that day will be excluded from the Pricing Period.

Each

Advance is subject to certain limitations, including that the Investor cannot purchase any shares that would result in it beneficially

owning more than 4.99% of the Company’s outstanding shares of Common Stock at the time of an Advance or acquiring more than 19.99%

of the Company’s outstanding shares of Common Stock as of the date of the Purchase Agreement (the “Exchange Cap”).

The Exchange Cap will not apply under certain circumstances, including, where the Company has obtained stockholder approval to issue

in excess of the Exchange Cap in accordance with the rules of Nasdaq or such issuances do not require stockholder approval under Nasdaq’s

“minimum price rule.”

The

Purchase Agreement will terminate automatically on the earlier of December 22, 2027 or when the Investor has purchased an aggregate of

$20 million of the Company’s shares of Common Stock. The Company has the right to terminate the Purchase Agreement upon five trading

days’ prior written notice to the Investor.

In

connection with and subject to the satisfaction of certain conditions set forth in the Purchase Agreement, upon the request of the Company,

the Investor will pre-advance to the Company up to $3,000,000 of the $20,000,000 commitment amount (a “Pre-Advance”), with

each Pre-Advance to be evidenced by a promissory note (each, a “Note”). The request by the Company for such Pre-Advance may

only be made after the approval of the stockholders of the transactions contemplated by the Purchase Agreement, and each Pre-Advance

will be advanced in whole or in part by the Investor. The Company can request $1,500,000 (half of the amount of the Pre-Advance) at any

time until the earlier of (i) 120 days following December 22, 2023, and (ii) the effective date of the registration statement. The balance

can be requested after the effectiveness of the registration statement until 60 days after such effectiveness. Each Pre-Advance made

to the Company will be subject to a 3% discount to the amount equal to each Note. Each Note accrues interest on the outstanding principal

balance at the rate of 8% per annum. The Company is required to pay, on a monthly basis, one tenth of the outstanding principal amount

of each Note, together with accrued and unpaid interest, either (i) in cash or (ii) by submitting an Advance notice pursuant to the Purchase

Agreement and selling the Investor shares, or any combination of (i) or (ii) as determined by the Company. The initial repayment is due

60 days after the issuance of a Note, followed by subsequent payments due every 30 days after the previous payment. Unless otherwise

agreed to by the Investor, any funds received by the Company pursuant to the Purchase Agreement for the sale of shares will first be

used to satisfy any payments due under an outstanding Note.

The

conditions that must be satisfied prior to the Investor advancing the Company funds pursuant to the terms of a Note include obtaining

stockholder approval of the transactions contemplated by the Purchase Agreement, the delivery by the Company to the Investor of a request

to lend funds pursuant to a Note prior to [_], 2025, no events occurring which could have a material adverse effect on the Company and

other conditions customary of financings of this nature.

The

Company paid a subsidiary of the Investor a structuring fee in the amount of $10,000 and issued the Investor 110,554 shares of Common

Stock (the “Commitment Shares”) as a commitment fee. The Company and the Investor made certain representations and warranties

to each other that are customary for transactions similar to this one, subject to specified exceptions and qualifications. Each of the

Company and the Investor also agreed to indemnify the other. Each of the Company and the Investor also agreed to indemnify the other.

The

Purchase Agreement and the Note were filed as exhibits 10.1 and 4.1, respectively, to the Current Report on Form 8-K filed by the Company

with the SEC on December 26, 2023.

The

Company has committed to file a registration statement covering the shares issuable to the Investor pursuant to the terms of the Purchase

Agreement and the Commitment Shares.

Until

the registration statement is declared effective by the SEC, the Company will not submit any advance requests from the Investor and the

Investor is not required to purchase any shares until such time.

We

cannot predict the market price of the Common Stock at any future date. Under certain circumstances, it is possible that we may need

to issue shares of Common Stock to the Investor at a price that is less than the Nasdaq Minimum Price, which may result in an issuance

equal to 20% or more of the Common Stock outstanding before the issuance. Accordingly, we must obtain stockholder approval in order to

comply with the Nasdaq Listing Rules and to satisfy the conditions of the Purchase Agreement.

Consequences

of Non-Approval

If

our stockholders fail to approve the Nasdaq 20% Share Issuance Proposal, we will not have the right to request advances of up to $20,000,000

from the Investor. If our stockholders fail to approve the Nasdaq 20% Share Issuance Proposal, we will not be entitled to require the

Investor to purchase shares under the terms of the Purchase Agreement.

Effect

on Current Stockholders

The

issuance of shares of Common Stock to the Investor pursuant to the terms of the Purchase Agreement, including any shares that may be

issued below the Nasdaq Minimum Price, would result in an increase in the number of shares of Common Stock outstanding, and our stockholders

will incur dilution of their percentage ownership. Because the number of shares of Common Stock that may be issued to the Investor pursuant

to the Purchase Agreement is determined based on the market price at the time of issuance, the exact magnitude of the dilutive effect

cannot be conclusively determined. However, the dilutive effect may be material to our current stockholders.

Our

ability to successfully implement our business plans and ultimately generate value for our stockholders is dependent upon our ability

to raise capital and satisfy our ongoing business needs.

Vote

Required

Approval

of the Nasdaq 20% Share Issuance Proposal requires an affirmative vote of a majority of the total votes cast at the Special Meeting.

Abstentions and broker non-votes have the same effect as a vote “AGAINST” the Nasdaq 20% Share Issuance Proposal.

Board

Recommendation

The

board of directors recommends a vote FOR the approval of the Nasdaq 20% Share Issuance Proposal (Proposal 2).

|

OTHER

BUSINESS

The

board of directors does not intend to bring any other matters before the Special Meeting and knows of no other matters to be brought

before the Special Meeting. If, however, any other business should properly come before the Special Meeting, the person named in the

accompanying proxy will vote the proxy in accordance with applicable law and as he may deem appropriate in their discretion, unless directed

by the proxy to do otherwise.

Interest

of Certain Persons in or Opposition to Matters to Be Acted Upon:

(a) No

officer or director of the Company has any substantial interest in the matters to be acted upon, other than his or her role as an officer

or director of, or as a stockholder of, the Company.

(b) No

director of the Company has informed us that he or she intends to oppose the action taken by the Company set forth in this Proxy Statement.

ANNEX

A

FORM

OF CERTIFICATE OF AMENDMENT

OF

ARTICLES

OF INCORPORATION

OF

SAVE

FOODS, INC.

Save

Foods, Inc. (the “Corporation”), a corporation organized and existing under the laws of the State of Nevada, does

hereby certify that:

1.

Resolutions were duly adopted by the board of directors of the Corporation setting forth this proposed Amendment to the Articles of Incorporation

and declaring said amendment to be advisable and calling for the consideration and approval thereof at a meeting of the stockholders

of the Corporation.

2.

The Articles of Incorporation of the Corporation are hereby amended by deleting the first paragraph of ARTICLE I in its entirety and

inserting the following in lieu thereof:

“The

name of the Corporation is N2OFF, Inc.” (the “Corporation”).”

3.

Pursuant to the resolution of the board of directors, a special meeting of the stockholders of the Company was duly called and held upon

notice in accordance with Section 78.320 of the Nevada Revised Statutes at which meeting the necessary number of shares as required by

statute were voted in favor of the foregoing amendment.

4.

The foregoing amendment was duly adopted in accordance with the provisions of the Nevada Revised Statutes.

SAVE

FOODS, INC.

HAPARDES

134 (MESHEK SANDER),

NEVE

YARAK, 4994500 ISRAEL

(347)

468-9583

PROXY

FOR SPECIALMEETING OF STOCKHOLDERS

TO

BE HELD ON FEBRUARY _____, 2024

THIS

PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS

The

undersigned hereby constitutes and appoints David Palach as the true and lawful attorney, agent and proxy of the undersigned, with full

power of substitution to represent and to vote, on behalf of the undersigned, all shares of common stock of Save Foods, Inc. (the

“Company”) held of record in the name of the undersigned at the close of business on January 2, 2024, at the Special Meeting

of Stockholders (the “Meeting”) to be held at the offices of the Company’s legal counsel, The Crone Law Group, P.C.

located at HaArba’a Street 28, South Tower, 19th floor, Tel Aviv 6473925, Israel, and at any and all adjournments or

postponements thereof, on the matters listed on the reverse side, which are more fully described in the Notice of Special Meeting of

Stockholders of the Company and Proxy Statement relating to the Meeting.

The

undersigned hereby revokes any and all proxies heretofore given with respect to the vote at the Meeting.

This

proxy, when properly executed, will be voted in the manner directed herein by the undersigned. If no direction is made with respect to

any proposal, this proxy will be voted FOR each proposal, in accordance with the recommendations of the Company’s board of directors.

(Continued

and to be signed on the reverse side)

SPECIAL

MEETING OF STOCKHOLDERS OF

SAVE

FOODS, INC.

FEBRUARY

___, 2024

VOTE

BY MAIL (Mark, sign, date and mail your proxy card in the postage-paid, return-addressed envelope we have provided)

THE

BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” EACH PROPOSAL LISTED BELOW.

PLEASE

SIGN, DATE AND RETURN PROMPTLY IN THE ENCLOSED ENVELOPE. PLEASE MARK YOUR VOTE IN BLUE OR BLACK INK AS SHOWN HERE [X]

| |

|

|

|

FOR |

|

AGAINST |

|

ABSTAIN |

|

| |

1. |

To

approve an amendment to the Articles of Incorporation of the Company implementing the change of the name of the Company from “Save

Foods, Inc.” to “N2OFF, Inc.” |

|

☐ |

|

☐ |

|

☐ |

|

| |

|

|

|

|

|

|

|

|

|

| |

2. |

To

approve the issuance of 20% or more of the issued and outstanding shares of common stock of the Company pursuant to the terms of

the Standby Equity Purchase Agreement (the “Purchase Agreement”), dated December 22, 2023, between the Company and YA

II PN, Ltd. so that such issuances are made in accordance with Nasdaq Marketplace Rule 5635(d) |

|

☐ |

|

☐ |

|

☐ |

|

| |

|

|

|

|

|

|

|

|

|

| Signature

of stockholder |

|

|

|

Date |

|

|

Signature

of stockholder |

|

|

Date |

|

| Note: |

Please

sign exactly as your name or names appear on this Proxy. When shares are held jointly, each owner should sign. When signing as executor,

administrator, attorney, trustee or guardian, please give full title as such. If the signer is a corporation, please sign full corporate

name by a duly authorized officer, giving full title as such. If the signer is a partnership, please sign in partnership name by

authorized person. |

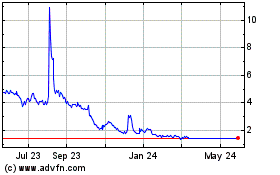

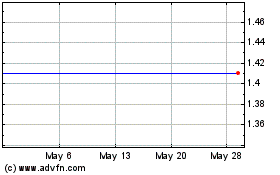

Save Foods (NASDAQ:SVFD)

Historical Stock Chart

From Apr 2024 to May 2024

Save Foods (NASDAQ:SVFD)

Historical Stock Chart

From May 2023 to May 2024