UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of December 2023

Commission File Number: 001-34661

Newegg Commerce, Inc.

(Translation of registrant’s name in English)

17560 Rowland Street, City of Industry, CA

91748

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form

40-F ☐

Q3 2023 Results

On December 22, 2023, Newegg

Commerce, Inc. (the “Company” or “Newegg”) issued a press release announcing its financial results for the nine

months ended September 30, 2023, along with revised guidance for 2023. A copy of the press release is attached hereto as Exhibit 99.1

and incorporated herein by reference.

INDEX TO EXHIBITS

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

Newegg Commerce, Inc. |

| |

|

|

| December 22, 2023 |

By: |

/s/ Robert Chang |

| |

|

Robert Chang |

| |

|

Chief Financial Officer |

3

Exhibit 99.1

Newegg Announces Q3 2023 Results

CITY OF INDUSTRY, Calif., December 22, 2023

– Newegg Commerce, Inc. (NASDAQ: NEGG), a leading global technology e-commerce retailer, today announced results for the

nine months ended September 30, 2023, and revised guidance for the year ending December 31, 2023.

“While we continued to experience lower-than-expected

results in the third quarter due to challenging macroeconomic conditions and declining consumer demand, I am excited to share the launch

of several new initiatives underway, including the development of new sales channels through Walmart.com and TikTok Shop, our renewed

focus on systems and finished good categories, and the expansion of our U.S. marketplace efforts,” said Newegg CEO Anthony Chow.

“I am also proud of our continued progress in streamlining operations, an example of which includes our implementation of Geek+

autonomous robots to enhance warehouse operational efficiency. Further, we are beginning to see some positive momentum for Black Friday,

Cyber Monday and holiday shopping during the fourth quarter, which we hope to carry into the new year.”

“Finally, I am pleased to have announced our

inaugural $10.0 million share repurchase program last month, which we intend to use opportunistically to enhance shareholder value.”

Newegg

Chief Accounting Officer Christina Ching added, “We have started to see some moderation in the rate of decline in our business

in the second half as a result of momentum from our Black Friday and Cyber Monday sales period.”

“Our team has moved swiftly to realize SG&A

savings in response to declining demand this year, and I am pleased with our progress thus far in achieving substantial year-over-year

savings. As a result of various one-time reduction expenses, we expect to see the full benefit of these initiatives in 2024. Separately,

our full year projections were negatively impacted by a combination of external factors, including one-time product shortages and delayed

product launch cycles, particularly in the GPU category.”

“We remain keenly focused on maintaining healthy inventory turnover

and a strong cash position. Our current average inventory turnover is 40 days, and we have reduced total inventory levels from $156 million,

as of December 31, 2022, to $142 million as of September 30, 2023. Furthermore, as of September 30, 2023, we had $54 million in cash on

hand and no outstanding balance under our revolving credit facility.”

2023 Q3 Financial Highlights

| |

● |

Net sales decreased 16.0% to $1,040.8 million for the nine months ended September 30, 2023, compared to $1,239.7 million for the nine months ended September 30, 2022. |

| |

● |

GMV (defined below) decreased 20.2% to $1,265.0 million for the nine months ended September 30, 2023, compared to $1,585.0 million for the nine months ended September 30, 2022. |

| |

● |

Gross profit decreased 24.7% to $118.1 million for the nine months ended September 30, 2023, compared to $156.9 million for the nine months ended September 30, 2022. |

| |

● |

Net loss was $44.0 million for the nine months ended September 30, 2023, compared to $27.4 million for the nine months ended September 30, 2022. |

| |

● |

Adjusted EBITDA (defined below) decreased to $(17.0) million for the nine months ended September 30, 2023, compared to $(4.5) million for the nine months ended September 30, 2022. |

2023 Updated Full Year Guidance

The Company currently expects to achieve the following

financial performance for the current year ending December 31, 2023:

| |

● |

Net sales to be between $1.42 billion and $1.47 billion. |

| |

● |

GMV to be between $1.78 billion and $1.83 billion. |

| |

● |

Gross profit to be between $160.0 million and $165.0 million. |

| |

● |

Net loss to be between $56.0 million and $60.0 million. |

| |

● |

Adjusted EBITDA to be between $(21.0) million and $(25.0) million. |

Mr. Chow added, “We remain optimistic about

the future of the business. We continue to innovate in important areas, such as social media and social sharing. As a key partner of TikTok

Shop, we have substantially enhanced our social media presence and reach within the key Gen Z demographic. We also launched an innovative

social sharing sales channel, Group Buy, in November. Group Buy is our daily deal offer that requires a minimum number of customers to

register online each day in order to unlock an attractive deal. Group Buy is designed to encourage customers to share daily deals through

social media in order to generate group excitement and attract additional traffic to our site. We believe these types of forward-looking

initiatives continue to set Newegg apart in the e-commerce market.”

About Newegg

Newegg

Commerce, Inc. (NASDAQ: NEGG), founded in 2001 and based in the City of Industry, California, is a leading global online retailer for

PC hardware, consumer electronics, gaming peripherals, home appliances, automotive and lifestyle technology. Newegg also serves businesses’

e-commerce needs with marketing, supply chain, and technical solutions in a single platform. For more information, please visit Newegg.com.

Follow Newegg on X (formerly Twitter), TikTok, Instagram, Facebook,

YouTube, Twitch and Discord.

Non-GAAP Financial Information

This press release presents certain “non-GAAP”

financial measures. The components of these non-GAAP measures are computed by using amounts that are determined in accordance with accounting

principles generally accepted in the United States of America (“GAAP”). A reconciliation of non-GAAP financial measures used

in this press release to their nearest comparable GAAP financial measures is included in the schedules attached hereto.

The Company provides certain guidance on a non-GAAP

basis but is unable to provide a reconciliation to the most directly comparable GAAP financial measure without unreasonable efforts, as

the Company cannot predict some elements that are included in such directly comparable GAAP financial measure. These elements could have

a material impact on the Company’s reported GAAP results for the guidance period.

GMV

The Company defines gross merchandise value, or

GMV, as the total dollar value of products sold on its websites and third-party marketplace platforms, directly to customers and by its

Marketplace sellers through Newegg Marketplace, net of returns, discounts, taxes, and cancellations. GMV also includes the services fees

charged through its Newegg Partner Services (“NPS”) in rendering services for its third-party logistics (“3PL”),

shipped-by-Newegg (“SBN”), staffing and media ad services, as well as the sales made by its Asia subsidiaries.

Adjusted EBITDA

Newegg calculates Adjusted EBITDA as net income/loss,

excluding stock-based compensation expense, depreciation and amortization expense, interest income, net, income tax (benefit) provision,

gain/loss from warrants liabilities, gain/loss from sales of investment, impairment of equity investment, and loss (income) from equity

investment.

Newegg believes that exclusion of certain expenses

in calculating Adjusted EBITDA facilitates operating performance comparisons on a period-to-period basis and excludes items that it does

not consider to be indicative of its core operating performance. Accordingly, Newegg believes that Adjusted EBITDA provides useful information

to investors and others in understanding and evaluating its operating results in the same manner as its management and board of directors.

Adjusted EBITDA has limitations as an analytical

tool, and you should not consider it in isolation or as a substitute for analysis of Newegg’s results as reported under GAAP. Some

of these limitations are: although depreciation and amortization are non-cash charges, the assets being depreciated and amortized may

have to be replaced in the future, and Adjusted EBITDA does not reflect cash capital expenditure requirements for such replacements or

for new capital expenditure requirements; Adjusted EBITDA does not reflect changes in, or cash requirements for, working capital needs;

Adjusted EBITDA does not consider the potentially dilutive impact of stock-based compensation; Adjusted EBITDA does not reflect tax payments

that may represent a reduction in cash available to Newegg; and other companies, including companies in our industry, may calculate Adjusted

EBITDA differently, which reduces its usefulness as a comparative measure. Because of these limitations, you should consider Adjusted

EBITDA alongside other financial performance measures, including various cash flow metrics, operating profit and Newegg’s other

GAAP results.

Cautionary Statement Concerning Forward-Looking Statements

This news

release includes “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements give our current expectations, opinion,

belief or forecasts of future events and performance. A statement identified by the use of forward-looking words including “will,”

“may,” “expects,” “projects,” “anticipates,” “plans,” “believes,”

“estimate,” “should,” and certain other statements about the future may be deemed forward-looking statements.

Although Newegg believes that the expectations reflected in such forward-looking statements are reasonable at the time given, these statements

involve risks and uncertainties that may cause actual future activities and results to be materially different from those suggested or

described in this news release. These risks and uncertainties include changes in global economic and geopolitical conditions, fluctuations

in customer demand and spending, inflation, interest rates and global supply chain constraints. Investors

are cautioned that any forward-looking statements are not guarantees of future performance and actual results or developments may differ

materially from those projected. The forward-looking statements in this press release are made as of the date hereof. The Company takes

no obligation to update or correct its own forward-looking statements, except as required by law, or those prepared by third parties that

are not paid for by the Company. The Company’s SEC filings are available at http://www.sec.gov.

Contact

Newegg Commerce, Inc.:

Investor Relations

ir@newegg.com

NEWEGG COMMERCE, INC.

Consolidated Balance Sheets

(In thousands, except par value) (Unaudited)

| | |

September 30,

2023 | | |

December 31, 2022 | |

| Assets | |

| | |

| |

| Current assets: | |

| | |

| |

| Cash and cash equivalents | |

$ | 54,006 | | |

$ | 122,559 | |

| Restricted cash | |

| 1,137 | | |

| 947 | |

| Accounts receivable, net | |

| 51,582 | | |

| 83,517 | |

| Inventories, net | |

| 142,303 | | |

| 156,016 | |

| Income taxes receivable | |

| 989 | | |

| 5,173 | |

| Prepaid expenses | |

| 9,265 | | |

| 16,999 | |

| Other current assets | |

| 3,514 | | |

| 5,611 | |

| Total current assets | |

| 262,796 | | |

| 390,822 | |

| | |

| | | |

| | |

| Property and equipment, net | |

| 62,793 | | |

| 45,075 | |

| Noncurrent deferred tax assets | |

| 2,789 | | |

| 868 | |

| Investment at cost | |

| 2,250 | | |

| 11,250 | |

| Right of use assets, net | |

| 78,493 | | |

| 84,161 | |

| Other noncurrent assets | |

| 9,397 | | |

| 9,919 | |

| Total assets | |

$ | 418,518 | | |

$ | 542,095 | |

| | |

| | | |

| | |

| Liabilities and Equity | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Accounts payable | |

$ | 143,301 | | |

$ | 207,147 | |

| Accrued liabilities | |

| 30,806 | | |

| 51,003 | |

| Deferred revenue | |

| 15,970 | | |

| 31,028 | |

| Line of credit | |

| 7,157 | | |

| 6,056 | |

| Current portion of long-term debt | |

| 259 | | |

| 269 | |

| Lease liabilities – current | |

| 12,868 | | |

| 14,265 | |

| Total current liabilities | |

| 210,361 | | |

| 309,768 | |

| | |

| | | |

| | |

| Long-term debt, less current portion | |

| 1,154 | | |

| 1,404 | |

| Income taxes payable | |

| 739 | | |

| 739 | |

| Lease liabilities – noncurrent | |

| 70,047 | | |

| 74,838 | |

| Other liabilities | |

| 417 | | |

| 124 | |

| Total liabilities | |

| 282,718 | | |

| 386,873 | |

| | |

| | | |

| | |

| Stockholders’ Equity | |

| | | |

| | |

| Common Stock, $0.021848 par value; unlimited shares authorized; 380,128 and 376,660 shares issued and outstanding as of September 30, 2023, and December 31, 2022, respectively | |

| 8,305 | | |

| 8,230 | |

| Additional paid-in capital | |

| 258,362 | | |

| 232,776 | |

| Notes receivable – related party | |

| (15,189 | ) | |

| (15,189 | ) |

| Accumulated other comprehensive income | |

| 43 | | |

| 1,114 | |

| Accumulated deficit | |

| (115,721 | ) | |

| (71,709 | ) |

| Total stockholders’ equity | |

| 135,800 | | |

| 155,222 | |

| Total liabilities and stockholders’ equity | |

$ | 418,518 | | |

$ | 542,095 | |

NEWEGG COMMERCE, INC.

Consolidated Statements of Operations

(In thousands, unaudited)

| | |

Nine Months Ended

September 30, | |

| | |

2023 | | |

2022 | |

| Net sales | |

$ | 1,040,819 | | |

$ | 1,239,698 | |

| Cost of sales | |

| 922,692 | | |

| 1,082,774 | |

| Gross profit | |

| 118,127 | | |

| 156,924 | |

| Selling, general, and administrative expenses | |

| 171,550 | | |

| 198,425 | |

| Loss from operations | |

| (53,423 | ) | |

| (41,501 | ) |

| Interest income | |

| 1,740 | | |

| 700 | |

| Interest expense | |

| (909 | ) | |

| (573 | ) |

| Other income, net | |

| 559 | | |

| 4,744 | |

| Gain from sales of investment | |

| 5,060 | | |

| 1,669 | |

| Change in fair value of warrants liabilities | |

| 25 | | |

| 979 | |

| Loss before provision for income taxes | |

| (46,948 | ) | |

| (33,982 | ) |

| Benefit from income taxes | |

| (2,936 | ) | |

| (6,625 | ) |

| Net loss | |

$ | (44,012 | ) | |

$ | (27,357 | ) |

NEWEGG COMMERCE, INC.

Consolidated Statements of Cash Flows

(In thousands) (Unaudited)

| | |

Nine Months Ended

September 30, | |

| | |

2023 | | |

2022 | |

| Cash flows from operating activities: | |

| | |

| |

| Net loss | |

$ | (44,012 | ) | |

$ | (27,357 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Depreciation and amortization | |

| 9,655 | | |

| 7,944 | |

| Allowance for expected credit losses | |

| 37 | | |

| 679 | |

| Allowance for related party receivable | |

| - | | |

| (25 | ) |

| Provision for obsolete and excess inventory | |

| 3,387 | | |

| 6,495 | |

| Stock-based compensation | |

| 25,881 | | |

| 24,395 | |

| Gain from sales of investment | |

| (5,060 | ) | |

| (1,669 | ) |

| Change in fair value of warrant liabilities | |

| (25 | ) | |

| (979 | ) |

| Loss on disposal of property and equipment | |

| 218 | | |

| 435 | |

| Unrealized loss on marketable securities | |

| - | | |

| 55 | |

| Deferred income taxes | |

| (1,942 | ) | |

| (6,653 | ) |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| 31,772 | | |

| 6,714 | |

| Inventories | |

| 10,332 | | |

| 90,894 | |

| Prepaid expenses | |

| 7,725 | | |

| 5,731 | |

| Other assets | |

| 12,253 | | |

| (2,371 | ) |

| Accounts payable | |

| (63,842 | ) | |

| (76,527 | ) |

| Accrued liabilities and other liabilities | |

| (26,589 | ) | |

| (33,339 | ) |

| Deferred revenue | |

| (15,063 | ) | |

| (15,713 | ) |

| Net cash used in operating activities | |

| (55,273 | ) | |

| (21,291 | ) |

| Cash flows from investing activities: | |

| | | |

| | |

| Payments to acquire property and equipment | |

| (28,756 | ) | |

| (8,610 | ) |

| Proceeds on disposal of property and equipment | |

| 60 | | |

| 1 | |

| Proceeds from sales of investment | |

| 14,060 | | |

| 5,419 | |

| Net cash used in investing activities | |

| (14,636 | ) | |

| (3,190 | ) |

| Cash flows from financing activities: | |

| | | |

| | |

| Borrowings under line of credit | |

| 27,502 | | |

| 46,211 | |

| Repayments under line of credit | |

| (26,098 | ) | |

| (45,757 | ) |

| Repayments of long-term debt | |

| (199 | ) | |

| (209 | ) |

| Proceeds from exercise of stock options | |

| 1,163 | | |

| 2,366 | |

| Payments for employee taxes related to stock-based compensation | |

| (628 | ) | |

| — | |

| Net cash provided by financing activities | |

| 1,740 | | |

| 2,611 | |

| Foreign currency effect on cash, cash equivalents and restricted cash | |

| (194 | ) | |

| 641 | |

| Net decrease in cash, cash equivalents and restricted cash | |

| (68,363 | ) | |

| (21,229 | ) |

| Cash, cash equivalents and restricted cash: | |

| | | |

| | |

| Beginning of period | |

| 123,506 | | |

| 104,330 | |

| End of period | |

$ | 55,143 | | |

$ | 83,101 | |

Schedule 1

Reconciliation of Net Sales to GMV

| | |

For the Nine Months Ended

September 30, | |

| | |

2023 | | |

2022 | |

| | |

(in millions) | |

| Net Sales | |

$ | 1,040.8 | | |

$ | 1,239.7 | |

| Adjustments: | |

| | | |

| | |

| GMV - Marketplace | |

| 278.5 | | |

| 409.3 | |

| Marketplace Commission | |

| (25.5 | ) | |

| (37.7 | ) |

| Deferred Revenue | |

| (10.5 | ) | |

| (12.1 | ) |

| Other | |

| (18.3 | ) | |

| (14.2 | ) |

| GMV | |

$ | 1,265.0 | | |

$ | 1,585.0 | |

Schedule 2

Reconciliation of Net Loss to Adjusted EBITDA

| | |

For the Nine Months Ended

September 30, | |

| | |

2023 | | |

2022 | |

| | |

(in millions) | |

| Net loss | |

$ | (44.0 | ) | |

$ | (27.4 | ) |

| Adjustments: | |

| | | |

| | |

| Stock-based compensation expenses | |

| 25.9 | | |

| 24.4 | |

| Interest income, net | |

| (0.8 | ) | |

| (0.1 | ) |

| Income tax benefit | |

| (2.9 | ) | |

| (6.6 | ) |

| Depreciation and amortization | |

| 9.9 | | |

| 7.9 | |

| Gain from sales of investment | |

| (5.1 | ) | |

| (1.7 | ) |

| Gain from change in fair value of warrants liabilities | |

| — | | |

| (1.0 | ) |

| Adjusted EBITDA | |

$ | (17.0 | ) | |

$ | (4.5 | ) |

8

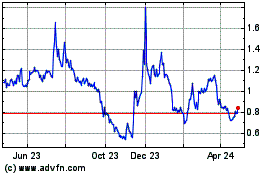

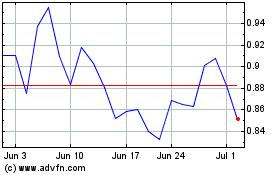

Newegg Commerce (NASDAQ:NEGG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Newegg Commerce (NASDAQ:NEGG)

Historical Stock Chart

From Apr 2023 to Apr 2024