0000008947false00000089472023-12-202023-12-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

December 20, 2023

Date of Report (Date of earliest event reported)

AZZ Inc.

(Exact name of Registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Texas | | 1-12777 | | 75-0948250 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

One Museum Place, Suite 500

3100 West 7th Street

Fort Worth, Texas 76107

(Address of principal executive offices) (Zip Code)

(817) 810-0095

(Registrant’s telephone number, including area code)

Not applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common Stock | | AZZ | | New York Stock Exchange |

Indicate by check mark whether the Registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 1.01 | Entry into a Material Definitive Agreement. |

Second Amendment to Credit Agreement

On December 20, 2023, AZZ Inc. (the "Company") entered into the Second Amendment to its existing Credit Agreement referenced below with Citibank, N.A. (“Citi”), as Administrative Agent and Collateral Agent and the requisite lenders (the "Second Amendment"). The Second Amendment amends the Credit Agreement dated as of May 13, 2022 by and among Citi, as Administrative Agent and Collateral Agent, the lenders party thereto from time to time and the Company's subsidiaries party thereto and as amended by that certain First Amendment dated August 17, 2023 (the "Credit Agreement").

The Second Amendment (a) decreased the interest rate margin applicable to the Revolving Credit Loans from 425 basis points to margin ranging from 275 basis points to 350 basis points subject to leverage ratio step-down; (b) reduced the interest rate further by eliminating SOFR loan credit spread adjustment; and (c) reduced the Commitment Fee applicable to the Revolving Credit Loans by 125 basis points, subject to pricing grid.

Each of the capitalized terms in the preceding sentence shall have the meanings given to such terms in the Credit Agreement.

This summary of the Second Amendment does not purport to be complete and is subject to, and is qualified in its entirety by, reference to all the terms of the Second Amendment, a copy of which is attached hereto as Exhibit 10.1 and incorporated herein by reference.

| | | | | |

| Item 2.03 | Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

The information set forth in Item 1.01 with respect to the Second Amendment is incorporated by reference in this Item 2.03.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

| | | | | |

| Exhibit | Description |

| 10.1 | |

| 99.1 | |

104 | Cover Page Interactive Date File (embedded with the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| AZZ Inc. |

| Date: December 21, 2023 |

By: /s/ Tara D. Mackey |

| Tara D. Mackey

Chief Legal Officer and Secretary |

SECOND AMENDMENT

This SECOND AMENDMENT, dated as of December 20, 2023 (this “Agreement”), to that certain CREDIT AGREEMENT, dated as of May 13, 2022 (as amended by that certain First Amendment, dated as of August 17, 2023, and as further amended, restated, amended and restated, supplemented or otherwise modified from time to time prior to the date hereof, the “Existing Credit Agreement”), among AZZ INC., a Texas corporation (the “Company”), the Subsidiaries of the Company party hereto, the LENDERS party hereto, the L/C ISSUERS and SWINGLINE LENDERS party hereto and CITIBANK, N.A., as Administrative Agent and Collateral Agent (the “Administrative Agent”) (capitalized terms used but not defined herein have the meaning provided in the Amended Credit Agreement (as defined below)).

W I T N E S S E T H

WHEREAS, pursuant to the Existing Credit Agreement, the Initial Revolving Credit Lenders hold Initial Revolving Credit Commitments on the terms and subject to the conditions set forth therein;

WHEREAS, the Company has requested that the Existing Credit Agreement be amended (the Existing Credit Agreement as amended by this Agreement, the “Amended Credit Agreement”) to provide for (a) the reduction of the Applicable Rate applicable to the Initial Revolving Credit Commitments and (b) modification of certain other provisions in the Existing Credit Agreement, as provided herein;

WHEREAS, each Initial Revolving Credit Lender has agreed to the terms of this Agreement upon the effectiveness of this Agreement on the Second Amendment Effective Date;

WHEREAS, each of Citi (as defined below), Wells Fargo (as defined below), Barclays Bank PLC (“Barclays”), U.S. Bank National Association, (“U.S. Bank”) and CIBC (as defined below), have been appointed as joint lead arrangers and joint bookrunners in connection with this Agreement (Citi, Wells Fargo, Barclays, U.S. Bank and CIBC, collectively, the “Arrangers”; as used herein, (a) “Citi” means Citibank, N.A., Citigroup Global Markets Inc., Citicorp USA, Inc., Citicorp North America, Inc. and/or any of their affiliates as Citi shall determine to be appropriate, (b) “Wells Fargo” means Wells Fargo Securities, LLC, Wells Fargo Bank, N.A. and/or any of their affiliates as Wells Fargo shall determine to be appropriate and (c) “CIBC” shall mean CIBC Bank USA, Canadian Imperial Bank of Commerce, New York Branch, CIBC World Markets Corp. and/or any of their affiliates as CIBC shall determine to be appropriate).

NOW, THEREFORE, the parties hereto agree as follows:

SECTION 1. Amendment of the Existing Credit Agreement. Effective as of the Second Amendment Effective Date, the Existing Credit Agreement is hereby amended as follows:

(a) The following definitions are added in the appropriate alphabetical order to Section 1.01 of the Existing Credit Agreement:

“Second Amendment” shall mean that certain Second Amendment, dated as of the Second Amendment Effective Date, among the Loan Parties, the Initial Revolving Credit Lenders and the Administrative Agent.

“Second Amendment Effective Date” means December 20, 2023.

(b) Clause (a) of the definition of “Applicable Rate” is hereby amended and restated in its entirety to read as follows:

“(a)(i) with respect to any Revolving Credit Loan, (A) at any time prior to the Second Amendment Effective Date, (w) for any Adjusted Term SOFR Loan, 4.25% per annum, (x) for

any Canadian Term Rate Loan, 4.25% per annum, (y) for any Base Rate Loan, 3.25% per annum and (z) for any Canadian Prime Rate Loan, 3.25% per annum and (B) at any time on or following the Second Amendment Effective Date, the rate per annum set forth in the below table based upon the First Lien Net Leverage Ratio shall apply:

| | | | | | | | | | | |

| Category | First Lien Net Leverage Ratio | Adjusted Term SOFR Loans and Canadian Term Rate Loans | Base Rate Loans and Canadian Prime Rate Loans |

| Category 1 | Greater than 4.00 to 1.00 | 3.50% | 2.50% |

| Category 2 | Less than or equal to 4.00 to 1.00 but greater than 3.50 to 1.00 | 3.25% | 2.25% |

| Category 3 | Less than or equal to 3.50 to 1.00 but greater than 3.00 to 1.00 | 3.00% | 2.00% |

| Category 4 | Less than or equal to 3.00 to 1.00 | 2.75% | 1.75% |

; and

(ii) with respect to any Initial Term Loan, (A) at any time prior to the First Amendment Effective Date, (w) for any Adjusted Term SOFR Loan, 4.25% per annum, (x) for any Canadian Term Rate Loan, 4.25% per annum, (y) for any Base Rate Loan, 3.25% per annum and (z) for any Canadian Prime Rate Loan, 3.25% per annum and (B) at any time on or following the First Amendment Effective Date, (w) for any Adjusted Term SOFR Loan, 3.75% per annum, (x) for any Canadian Term Rate Loan, 3.75% per annum, (y) for any Base Rate Loan, 2.75% per annum and (z) for any Canadian Prime Rate Loan, 2.75% per annum,”

(c) Clause (c) of the definition of “Applicable Rate” is hereby amended and restated in its entirety to read as follows:

“(c) with respect to the Commitment Fees, (i) at any time prior to the Second Amendment Effective Date, if the First Lien Net Leverage Ratio for the most recently ended Test Period is (x) greater than 4.00 to 1.00, 0.50% per annum, (y) equal to or less than 4.00 to 1.00 but greater than 3.50 to 1.00, 0.375% per annum and (z) less than or equal to 3.50 to 1.00, 0.25% per annum and (ii) at any time on or following the Second Amendment Effective Date, if the First Lien Net Leverage Ratio for the most recently ended Test Period is (x) greater than 4.00 to 1.00, 0.375% per annum and (y) equal to or less than 4.00 to 1.00, 0.25% per annum;

(d) The final paragraph of the definition of “Applicable Rate” is hereby amended and restated in its entirety to read as follows:

“Any increase or decrease in the Applicable Rate resulting from a change in the First Lien Net Leverage Ratio shall become effective as of the first Business Day immediately following the date a Compliance Certificate is delivered or required to be delivered pursuant to Section 7.02(a); provided, that, if financial statements are not delivered when required pursuant to Section 7.01(a) or (b), as applicable, the “Applicable Rate” for (x) Revolving Credit Loans shall be as set forth in Category 1 of the table above and (y) Commitment Fees shall be as set forth in clause (c)(ii)(x) above; provided, further, that the “Applicable Rate” in effect as of the Second Amendment Effective Date shall be determined by reference to the most recently delivered Compliance Certificate prior to such date.”

(e) Clause (a) of the definition of “Term SOFR Adjustment” is amended and restated in its entirety as follows:

“(a) any Revolving Loan, a percentage per annum equal to 0.00%”.

SECTION 2. [Reserved].

SECTION 3. [Reserved].

SECTION 4. Conditions to Effectiveness of Agreement. The amendment of the Existing Credit Agreement and associated provisions set forth herein shall become effective as of the first date on which the following occur or have been waived in accordance with Section 11.01 of the Existing Credit Agreement (the “Second Amendment Effective Date”):

(a) The Administrative Agent shall have received duly executed counterparts of this Agreement from (A) the Company and each Guarantor, (B) each Initial Revolving Credit Lender, (C) the Administrative Agent, (D) each L/C Issuer and (E) each Swingline Lender.

(b) The Administrative Agent shall have received a customary closing certificate from a secretary, assistant secretary or similar officer or authorized representative of each Loan Party certifying as to (i) resolutions duly adopted by the board of directors (or equivalent governing body) of each such Loan Party authorizing the execution, delivery and performance of this Agreement, as applicable, (ii) the accuracy and completeness of copies of the certificate or articles of incorporation, continuation, amalgamation, association or organization (or memorandum of association or other equivalent thereof) of each such Loan Party certified by the relevant authority of the jurisdiction of organization of each such Loan Party and copies of the by-laws or operating, management, partnership, shareholders or similar agreement of each such Loan Party and that such documents or agreements have not been amended (except as otherwise attached to such certificate and certified therein as being the only amendments thereto as of such date), (iii) incumbency (to the extent applicable) and specimen signatures of each officer, director or authorized representative executing any Loan Document on behalf of each such Loan Party and (iv) the good standing (or subsistence or existence) of each such Loan Party from the Secretary of State (or similar official) of the state or other jurisdiction of such Loan Party’s organization (to the extent relevant and available in the jurisdiction of organization of such Loan Party).

(c) The Administrative Agent shall have received (x) certified copies of the certificate or articles of incorporation (or comparable organizational document), including all amendments thereto, of each Loan Party as in effect on the Second Amendment Effective Date, certified as of a recent date by the Secretary of State (or comparable authority) of the jurisdiction of its organization and (y) a certificate as to the good standing of each Loan Party as of a recent date, from such Secretary of State (or comparable authority).

(d) The Administrative Agent shall have received a certificate from a financial officer of the Company substantially in the form of Exhibit D to the Existing Credit Agreement, to the effect that, immediately before and after giving effect to the transactions contemplated hereby, the Company and its Subsidiaries, taken as a whole, are Solvent.

(e) The Administrative Agent shall have received the executed customary legal opinion of Baker & McKenzie LLP, as counsel to the Company.

(f) The representations and warranties made in this Agreement shall be true and correct (i) in the case of such representations and warranties qualified or modified as to materiality in the text thereof, in all respects and (ii) otherwise, in all material respects. The Administrative Agent shall have received a customary certificate from a Responsible Officer of the Company.

(g) The Company shall have paid to the Administrative Agent immediately available funds in an aggregate amount equal to (A) all fees and other amounts due and payable by the Company on or prior to the Second Amendment Effective Date pursuant to this Agreement or as separately agreed by the

Company and certain of the Arrangers and (B) invoiced (with reasonable details) out of pocket expenses of the Administrative Agent and the Arrangers relating hereto (including those of counsel to the Administrative Agent and the Arrangers) subject to the terms of the engagement letter with the Arrangers and the Borrower relating to the amendment contemplated hereby, and to the extent invoiced 2 business days prior to the Second Amendment Effective Date.

(h) The Company shall have paid to the Administrative Agent, for the account of each Initial Revolving Credit Lender, the following amounts in immediately available funds in Dollars: (i) an amendment fee equal to 0.075% of the Initial Revolving Credit Commitments of such Initial Revolving Credit Lender on the Second Amendment Effective Date and (ii) all other accrued and unpaid interest and fees (if any) in respect of the Revolving Loans outstanding on the Second Amendment Effective Date through but excluding the Second Amendment Effective Date and all other amounts payable in respect thereof (including amounts payable under the Existing Credit Agreement, as applicable), in each case, which shall not be refundable once paid.

(i) To the extent requested at least five Business Days prior to the Second Amendment Effective Date, the Lenders shall have received (i) all documentation and other information required by bank regulatory authorities under applicable “know-your-customer” and anti-money laundering rules and regulations, including, without limitation, the Patriot Act, and (ii) a Beneficial Ownership Certification in relation to the Company that qualifies as a “legal entity customer” under the Beneficial Ownership Regulation, in each case, at least 2 Business Days prior to the Second Amendment Effective Date.

The Administrative Agent shall notify the Company and the Initial Revolving Credit Lenders of the Second Amendment Effective Date, and such notice shall be conclusive and binding absent manifest error.

For purposes of determining compliance with the conditions specified above, each Lender party to this Agreement shall be deemed to have consented to, approved or accepted or to be satisfied with each document or other matter required hereunder to be consented to or approved by or acceptable or satisfactory to such Person unless an officer of the Administrative Agent responsible for the transactions contemplated by the Loan Documents shall have received written notice from such Person prior to the Second Amendment Effective Date specifying its objection thereto.

SECTION 5. Representations and Warranties. The Company hereby represents and warrants to the Administrative Agent and each Lender on the Second Amendment Effective Date that:

(a) This Agreement has been duly authorized, executed and delivered by the Company and constitutes a legal, valid and binding obligation of the Company, enforceable against the Company in accordance with its terms, subject to applicable bankruptcy, insolvency, reorganization, moratorium or other laws affecting creditors’ rights generally and subject to general principles of equity, regardless of whether considered in a proceeding in equity or at law.

(b) The representations and warranties of each Loan Party set forth in the Loan Documents are true and correct (i) in the case of the representations and warranties qualified or modified as to materiality in the text thereof, in all respects and (ii) otherwise, in all material respects, in each case on and as of the Second Amendment Effective Date, except in the case of any such representation and warranty that expressly relates to an earlier date, in which case such representation and warranty shall be so true and correct, or true and correct in all material respects, as applicable, on and as of such earlier date.

(c) No Default or Event of Default has occurred and is continuing or would result from the transactions provided for in this Agreement.

SECTION 6. Effects on Loan Documents; No Novation. (a) Except as expressly set forth herein, this Agreement shall not alter, modify, amend or in any way affect any of the terms, conditions, obligations, covenants or agreements contained in the Existing Credit Agreement, the Amended Credit Agreement or

any other Loan Document, all of which shall continue to be in full force and effect and are hereby in all respects ratified and confirmed.

(b) Except as expressly set forth herein, the execution, delivery and effectiveness of this Agreement shall not operate as a waiver of any right, power or remedy of any Lender or the Administrative Agent under any of the Loan Documents, nor constitute a waiver of any provision of the Loan Documents or in any way limit, impair or otherwise affect the rights and remedies of the Administrative Agent or the Lenders under the Loan Documents. Nothing herein shall be deemed to entitle the Company or any other Loan Party to a consent to, or a waiver, amendment, modification or other change of, any of the terms, conditions, obligations, covenants or agreements contained in the Amended Credit Agreement or any other Loan Document in similar or different circumstances.

(c) On and after the Second Amendment Effective Date, each reference in the Amended Credit Agreement to “this Agreement”, “hereunder”, “hereof”, “herein” or words of like import, and each reference to the “Credit Agreement”, “thereunder”, “thereof”, “therein” or words of like import in any other Loan Document, shall be deemed a reference to the Amended Credit Agreement. The Company and the other parties hereto acknowledge and agree that this Agreement shall constitute a Loan Document for all purposes of the Existing Credit Agreement, the Amended Credit Agreement and the other Loan Documents.

(d) Neither this Agreement nor the effectiveness of the Amended Credit Agreement shall extinguish the obligations for the payment of money outstanding under the Existing Credit Agreement or discharge or release the Lien or priority of any Collateral Document or any other security therefor or any guarantee thereof. Nothing herein contained shall be construed as a substitution or novation of the Obligations outstanding under the Existing Credit Agreement or the Collateral Documents or instruments guaranteeing or securing the same, which shall remain in full force and effect, except as may be expressly modified hereby. Nothing expressed or implied in this Agreement, the Amended Credit Agreement or any other document contemplated hereby or thereby shall be construed as a release or other discharge of any Loan Party under any Loan Document from any of its obligations and liabilities thereunder.

SECTION 7. [Reserved].

SECTION 8. [Reserved].

SECTION 9. Further Assurances. The Company agrees to do, execute, acknowledge, deliver, record, re-record, file, re-file, register and re-register any and all such further acts, deeds, certificates, assurances and other instruments as the Administrative Agent or Collateral Agent may reasonably require from time to time in order to implement the provisions of this Agreement.

SECTION 10. APPLICABLE LAW, JURISDICTION, WAIVER OF JURY TRIAL. THE PROVISIONS OF SECTIONS 11.16 AND 11.18 OF THE EXISTING CREDIT AGREEMENT ARE HEREBY INCORPORATED BY REFERENCE HEREIN, MUTATIS MUTANDIS.

SECTION 11. Counterparts. This Agreement may be executed in any number of counterparts and by different parties hereto in separate counterparts, each of which when so executed shall be deemed to be an original and all of which taken together shall constitute one and the same agreement. Delivery of an executed counterpart of a signature page to this Agreement by telecopier or email shall be effective as delivery of a manually executed counterpart of this Agreement. The words “execution,” “signed,” “signature,” and words of like import in this Agreement shall be deemed to include electronic signatures or the keeping of records in electronic form, each of which shall be of the same legal effect, validity or enforceability as a manually executed signature or the use of a paper-based recordkeeping system, as the case may be, to the extent and as provided for in any applicable law, including the Federal Electronic Signatures in Global and National Commerce Act, the New York State Electronic Signatures and Records Act, or any other similar state laws based on the Uniform Electronic Transactions Act.

SECTION 12. Notices. All notices, requests and demands to or upon the respective parties hereto shall be given in the manner, and become effective, as set forth in Section 11.02 of the Amended Credit Agreement.

SECTION 13. Reaffirmation. By signing this Agreement, each Loan Party party hereto hereby confirms that, as of the Second Amendment Effective Date, the obligations of the Loan Parties under the Amended Credit Agreement and the other Loan Documents (i) are entitled to the benefits of the guarantees and Liens set forth or created in the Existing Credit Agreement, the Collateral Documents and each other Loan Documents, (ii) constitute “Obligations” or other similar term for purposes of (and as defined in, as applicable) the Existing Credit Agreement, the Collateral Documents and all other Loan Documents, and (iii) except as expressly set forth herein, the Collateral Documents and the other Loan Documents are, and shall continue to be, in full force and effect and are hereby ratified and confirmed in all respects. Each Loan Party party hereto hereby ratifies and confirms that, as of the Second Amendment Effective Date, all Liens granted, conveyed or assigned to the Administrative Agent or Collateral Agent, as applicable, by such Person pursuant to any Loan Document to which it is a party remain in full force and effect, are not released or reduced, and continue to secure full payment and performance of the Obligations. Each Loan Party other than the Company acknowledges and agrees that (i) notwithstanding the conditions to effectiveness set forth in this Agreement, such Loan Party is not required by the terms of the Existing Credit Agreement or any other Loan Document to consent to this Agreement and (ii) nothing in the Existing Credit Agreement, the Amended Credit Agreement, this Agreement or any other Loan Document shall be deemed to require the consent of such Loan Party to any future amendment, consent or waiver of the terms of the Amended Credit Agreement.

[Remainder of page intentionally left blank.]

IN WITNESS WHEREOF, the parties hereto have caused this Agreement to be duly executed and delivered by their respective proper and duly authorized officers as of the day and year first above written.

AZZ INC., as the Company,

By: /s/ Philip A. Schlom

Name: Philip A. Schlom

Title: Senior Vice President and Chief Financial Officer

GUARANTORS:

AAA GALVANIZING - CHELSEA, LLC

AAA GALVANIZING - HAMILTON, LLC

ARKGALV, LLC

AZZ GALVANIZING - BRISTOL LLC

AZZ GALVANIZING – CHATTANOOGA LLC

AZZ GALVANIZING - LOUISIANA LLC

AZZ GALVANIZING – NASHVILLE LLC

AZZ SURFACE TECHNOLOGIES – TAMPA LLC

GULF COAST GALVANIZING, LLC

NORTH AMERICAN GALVANIZING COMPANY, LLC

WITT GALVANIZING - MUNCIE, LLC

WITT GALVANIZING - PLYMOUTH, LLC

AAA GALVANIZING – DIXON, INC.

AAA GALVANIZING – JOLIET, INC.

AAA GALVANIZING – PEORIA, INC.

AAA GALVANIZING – WINSTED, INC.

ARIZONA GALVANIZING, INC.

AUTOMATIC PROCESSING INCORPORATED

AZTEC MANUFACTURING – WASKOM LLC

AZTEC MANUFACTURING LLC

AZZ GALVANIZING – KENNEDALE, LLC

AZZ GALVANIZING – NEBRASKA, LLC

AZZ GALVANIZING – RENO, LLC

AZZ GALVANIZING – ROCKFORD LLC

AZZ GALVANIZING – SAN ANTONIO, LLC

AZZ GALVANIZING – SOUTH CAROLINA LLC

AZZ GALVANIZING AND PLATING – MILWAUKEE LLC

AZZ GROUP LLC

AZZ SURFACE TECHNOLOGIES – CROWLEY LLC

AZZ SURFACE TECHNOLOGIES – GAINESVILLE LLC

AZZ SURFACE TECHNOLOGIES – GARLAND SOUTH LLC

AZZ SURFACE TECHNOLOGIES – ROWLETT LLC

AZZ SURFACE TECHNOLOGIES – TERRELL LLC

INTERNATIONAL GALVANIZERS LLC

NAGALV-OHIO, INC.

ROGERS GALVANIZING COMPANY – KANSAS CITY

WITT GALVANIZING – CINCINNATI, LLC

ZALK STEEL & SUPPLY CO.

PRECOAT MEZZANINE LLC

PRECOAT METALS CORP.

MIDWEST METAL COATINGS, LLC

PRECOAT METAL COATINGS LLC

By: /s/ Philip A. Schlom

Name: Philip A. Schlom

Title: Vice President and Treasurer

[SIGNATURE PAGE TO THE SECOND AMENDMENT]

CITIBANK, N.A., as the Administrative Agent, the Collateral Agent, Initial Revolving Lender, L/C Issuer and Swingline Lender

By: /s/ Ivan Davey

Name: Ivan Davey

Title: Director

[SIGNATURE PAGE TO THE SECOND AMENDMENT]

WELLS FARGO BANK, N.A., as an Initial Revolving Credit Lender and L/C Issuer

By: /s/ Heather Hoopingarner

Name: Heather Hoopingarner

Title: Director

[SIGNATURE PAGE TO THE SECOND AMENDMENT]

BANK OF AMERICA, N.A., as an Initial Revolving Credit Lender and L/C Issuer

By: /s/ Desaree Lopez

Name: Desaree Lopez

Title: Senior Vice President

[SIGNATURE PAGE TO THE SECOND AMENDMENT]

BARCLAYS BANK PLC, as an Initial Revolving Credit Lender and L/C Issuer

By: /s/ Warren Veech III

Name: Warren Veech III

Title: Vice President

[SIGNATURE PAGE TO THE SECOND AMENDMENT]

CIBC BANK USA, as an Initial Revolving Credit Lender and L/C Issuer

By: /s/ Kathleen L. Padilla

Name: Kathleen L. Padilla

Title: Managing Director

[SIGNATURE PAGE TO THE SECOND AMENDMENT]

U.S. BANK NATIONAL ASSOCIATION, INC., as an Initial Revolving Credit Lender and L/C Issuer

By: /s/ Vijay Sachdev

Name: Vijay Sachdev

Title: Senior Vice President

[SIGNATURE PAGE TO THE SECOND AMENDMENT]

AZZ Inc. Announces Successful Repricing of Senior Secured Revolver Credit Agreement in Leverage-Neutral Transaction

December 21, 2023 – FORT WORTH, TX - AZZ Inc. (NYSE: AZZ), the leading independent provider of hot-dip galvanizing and coil coating solutions in North America, today announced the successful repricing of its $400 million Senior Secured Revolver due May 2027. The repricing reduces AZZ’s interest rate margin on its Senior Secured Revolver across all leveraged-based pricing tiers, which range from SOFR + 275 to 350 basis points and opening up at SOFR + 300 basis points. In addition, AZZ successfully removed the Credit Spread Adjustment (“CSA”) of 10 basis points from the Senior Secured Revolver. The repricing will result in significantly lower interest costs through the maturity of the facility.

Philip Schlom, Chief Financial Officer commented, “We are pleased to announce the successful completion of our revolver repricing. Upon closing, AZZ will immediately achieve a 125-basis point reduction in our Senior Secured Revolver borrowing rate and an additional savings of 10 basis points on all borrowings under the facility from the removal of the CSA. There were no other changes to the existing credit agreement. Since acquiring Precoat Metals in May 2022, AZZ has reduced its principal balance and interest rate on its Term Loan B, and the Company will continue to focus on lowering its net debt to EBITDA leverage ratio to our targeted range of below 3.0 times.”

About AZZ Inc.

AZZ Inc. is the leading independent provider of hot-dip galvanizing and coil coating solutions to a broad range of end-markets. Collectively, our business segments provide sustainable, unmatched metal coating solutions that enhance the longevity and appearance of buildings, products and infrastructure that are essential to everyday life.

Safe Harbor Statement

Certain statements herein about our expectations of future events or results constitute forward-looking statements for purposes of the safe harbor provisions of The Private Securities Litigation Reform Act of 1995. You can identify forward-looking statements by terminology such as "may," "could," "should," "expects," "plans," "will," "might," "would," "projects," "currently," "intends," "outlook," "forecasts," "targets," "anticipates," "believes," "estimates," "predicts," "potential," "continue," or the negative of these terms or other comparable terminology. Such forward-looking statements are based on currently available competitive, financial, and economic data and management’s views and assumptions regarding future events. Such forward-looking statements are inherently uncertain, and investors must recognize that actual results may differ from those expressed or implied in the forward-looking statements. Forward-looking statements speak only as of the date they are made and are subject to risks that could cause them to differ materially from

actual results. Certain factors could affect the outcome of the matters described herein. This press release may contain forward-looking statements that involve risks and uncertainties including, but not limited to, changes in customer demand for our products and services, including demand by the construction markets, the industrial markets, and the metal coatings markets. We could also experience additional increases in labor costs, components and raw materials including zinc and natural gas, which are used in our hot-dip galvanizing process; supply-chain vendor delays; customer requested delays of our products or services; delays in additional acquisition opportunities; an increase in our debt leverage and/or interest rates on our debt, of which a significant portion is tied to variable interest rates; availability of experienced management and employees to implement AZZ’s growth strategy; a downturn in market conditions in any industry relating to the products we inventory or sell or the services that we provide; economic volatility, including a prolonged economic downturn or macroeconomic conditions such as inflation or changes in the political stability in the United States and other foreign markets in which we operate; acts of war or terrorism inside the United States or abroad; and other changes in economic and financial conditions. AZZ has provided additional information regarding risks associated with the business, including in Part I, Item 1A. Risk Factors, in AZZ's Annual Report on Form 10-K for the fiscal year ended February 28, 2023, and other filings with the SEC, available for viewing on AZZ's website at www.azz.com and on the SEC's website at www.sec.gov. You are urged to consider these factors carefully when evaluating the forward-looking statements herein and are cautioned not to place undue reliance on such forward-looking statements, which are qualified in their entirety by this cautionary statement. These statements are based on information as of the date hereof and AZZ assumes no obligation to update any forward-looking statements, whether as a result of new information, future events, or otherwise.

Investor Relations and Company Contact:

David Nark, Senior Vice President of Marketing, Communications, and Investor Relations

AZZ Inc.

(817) 810-0095

www.azz.com

Investor Contact:

Sandy Martin / Phillip Kupper

Three Part Advisors

(214) 616-2207

www.threepa.com

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

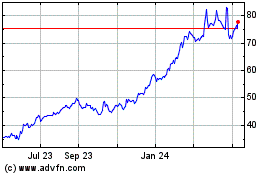

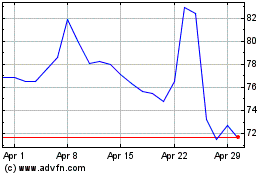

AZZ (NYSE:AZZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

AZZ (NYSE:AZZ)

Historical Stock Chart

From Apr 2023 to Apr 2024