FALSE000122338900012233892023-12-182023-12-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): December 18, 2023

CONN’S, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-34956 | 06-1672840 |

(State or other jurisdiction of

incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | | |

2445 Technology Forest Blvd., Suite 800, The Woodlands, TX | 77381 |

| (Address of principal executive offices) | (Zip Code) |

Registrant’s telephone number, including area code: (936) 230-5899

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol | Name of Each Exchange on Which Registered |

| Common Stock, par value $0.01 per share | CONN | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act o

Item 2.02. Results of Operations and Financial Condition.

On December 18, 2023, Conn’s, Inc. issued a press release reporting its third quarter fiscal year 2024 financial results. A copy of the press release is furnished herewith as Exhibit 99.1 and is incorporated herein by reference.

None of the information contained in Item 2.02 or Exhibit 99.1 of this Form 8-K shall be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), and none of it shall be incorporated by reference in any filing under the Securities Act of 1933, as amended (the "Securities Act"). Furthermore, this report will not be deemed an admission as to the materiality of any information in the report that is required to be disclosed solely by Regulation FD.

Item 7.01 Regulation FD Disclosure.

On December 18, 2023, the Company issued a press release announcing the transaction with W.S. Badcock LLC. A copy of the press release is furnished as Exhibit 99.2 to this Current Report on Form 8-K and is incorporated herein by reference.

None of the information contained in Item 7.01 or Exhibit 99.2 of this Form 8-K shall be deemed to be “filed” for the purposes of Section 18 of the Exchange Act and none of it shall be incorporated by reference in any filing under the Securities Act. Furthermore, this report will not be deemed an admission as to the materiality of any information in the report that is required to be disclosed solely by Regulation FD.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | | | | | | | | | | |

| Exhibit No. | | Description | | |

| 99.1* | | | | |

| 99.2* | | | | |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL) | | |

* Furnished herewith

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | CONN’S, INC. |

| Date: | December 18, 2023 | By: | /s/ Timothy Santo |

| | Name: | Timothy Santo |

| | Title: | Interim Chief Financial Officer |

Exhibit 99.1

Conn’s, Inc. Reports Third Quarter Fiscal Year 2024 Financial Results

THE WOODLANDS, Texas, December 18, 2023 - Conn’s, Inc. (NASDAQ: CONN) (“Conn’s” or the “Company”), a specialty retailer of home goods, including furniture and mattresses, appliances, and consumer electronics, today announced its financial results for the quarter ended October 31, 2023.

“We remain focused on pursuing strategic priorities aimed at turning around our retail performance and better serving our core credit constrained customers. I am pleased with the progress we made during the third quarter as we experienced strong year-over-year growth in credit applications and eCommerce sales. Despite the progress we are making, our third-quarter performance continued to reflect persistent industry headwinds and challenging economic conditions,” stated Norm Miller, President and Chief Executive Officer.

“Today we also announced the transaction with W.S. Badcock Corporation LLC (“Badcock”), a leading home furnishings company in the Southeast U.S. The transaction with Badcock combines two complementary 120+ year old businesses, with similar product categories, payment solutions and customer profiles. In addition, the transaction immediately strengthens Conn’s financial position by creating a leading home goods retailer with approximately $1.85 billion in retail sales across strong urban and rural markets in the southern U.S. The Badcock transaction represents one of the most significant events in Conn’s history, which we believe creates a clear path for Conn’s to deliver strong financial returns over the coming years,” concluded Mr. Miller.

Third Quarter Financial Highlights as Compared to the Prior Fiscal Year Period (Unless Otherwise Noted):

•Total consolidated revenue declined 12.8% to $280.1 million, due to a 14.1% decline in total net sales, and a 9.6% reduction in finance charges and other revenues;

•Same store sales decreased 15.0%, which is the fourth quarter of sequential improvement and a 1,200 basis point improvement from last year’s third quarter;

•eCommerce sales increased 51.0% to $26.3 million compared to $17.4 million in the prior year;

•Retail gross margin increased to 33.5% from 33.2% in the prior year;

•Credit applications increased by 40.6% year-over-year to the highest growth rate in the past five years, and;

•Reported a net loss of $2.11 per diluted share, compared to a net loss of $1.04 per diluted share for the same period last fiscal year.

Third Quarter Results

Net loss for the three months ended October 31, 2023 was $51.3 million, or $2.11 per diluted share, compared to net loss for the three months ended October 31, 2022 of $24.8 million, or $1.04 per diluted share or adjusted net loss of $18.6 million, or $0.78 per diluted share. On a non-GAAP basis, adjusted net loss for the three months ended October 31, 2023 was $49.2 million, or $2.03 per diluted share, which excludes charges and credits from professional fees related to corporate transactions. This compares to adjusted net loss for the three months ended October 31, 2022 of $18.6 million, or $0.78 per diluted shares

Retail Segment Third Quarter Results

Retail revenues were $221.4 million for the three months ended October 31, 2023 compared to $254.6 million for the three months ended October 31, 2022, a decrease of $33.2 million or 13.0%. The decrease in retail revenue was primarily driven by a decrease in same store sales of 15.0%. The decrease in same store sales resulted from lower discretionary spending for home-related products following several periods of excess consumer liquidity resulting in the acceleration of sales. The decrease in same store sales was partially offset by new store growth.

For the three months ended October 31, 2023, retail segment operating loss was $24.8 million compared to retail segment operating loss of $17.7 million for three months ended October 31, 2022. The decrease in retail segment operating income was primarily due to a decrease in revenue as described above, and higher selling, general and administrative costs ("SG&A"). This increase was partially offset by an improvement in retail gross margin.

Retail gross margin for the three months ended October 31, 2023 was 33.5%, an increase of 30.0 basis points from 33.2% for the three months ended October 31, 2022. The increase in retail gross margin was primarily driven by a more profitable product mix and normalizing freight costs. The increase was partially offset by the deleveraging of fixed distribution costs.

SG&A for the retail segment during the three months ended October 31, 2023 was $97.2 million compared to $94.2 million for the three months ended October 31, 2022. The increase was primarily due to an increase in occupancy from new stores, partially offset by a decline in variable costs and a decline in labor costs resulting from cost savings initiatives.

The following table presents net sales and changes in net sales by category:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended October 31, | | | | | | Same Store |

| (dollars in thousands) | 2023 | | % of Total | | 2022 | | % of Total | | Change | | % Change | | % Change |

| Furniture and mattress | $ | 74,406 | | | 33.7 | % | | $ | 79,927 | | | 31.4 | % | | $ | (5,521) | | | (6.9) | % | | (9.1) | % |

| Home appliance | 79,622 | | | 36.1 | | | 102,884 | | | 40.4 | | | (23,262) | | | (22.6) | | | (23.8) | |

| Consumer electronics | 25,146 | | | 11.4 | | | 31,911 | | | 12.5 | | | (6,765) | | | (21.2) | | | (23.5) | |

| Home office | 9,539 | | | 4.3 | | | 8,630 | | | 3.4 | | | 909 | | | 10.5 | | | 6.3 | |

| Other | 13,918 | | | 6.3 | | | 9,824 | | | 4.0 | | | 4,094 | | | 41.7 | | | 64.0 | |

| Product sales | 202,631 | | | 91.8 | | | 233,176 | | | 91.7 | | | (30,545) | | | (13.1) | | | (14.5) | |

Repair service agreement commissions (1) | 15,938 | | | 7.2 | | | 18,804 | | | 7.4 | | | (2,866) | | | (15.2) | | | (15.9) | |

| Service revenues | 2,288 | | | 1.0 | | | 2,378 | | | 0.9 | | | (90) | | | (3.8) | | | |

| Total net sales | $ | 220,857 | | | 100.0 | % | | $ | 254,358 | | | 100.0 | % | | $ | (33,501) | | | (13.2) | % | | (15.0) | % |

(1) The total change in sales of repair service agreement commissions includes retrospective commissions, which are not reflected in the change in same store sales.

Credit Segment Third Quarter Results

Credit revenues were $61.5 million for the three months ended October 31, 2023 compared to $66.6 million for the three months ended October 31, 2022, a decrease of $5.1 million or 7.7%. The decrease in credit revenue was primarily due to a 5.0% decrease in the average outstanding balance of the customer accounts receivable portfolio as well as a decline in insurance commissions.

Provision for bad debts increased to $39.0 million for the three months ended October 31, 2023 from $34.8 million for the three months ended October 31, 2022, an overall change of $4.2 million. The year-over-year increase was primarily driven by an increase in the allowance for bad debts reserve of $6.1 million offset by a decrease in net charge-offs of $2.1 million during the three months ended October 31, 2023 compared to the three months ended October 31, 2022. The increase was the result of a portfolio mix shift offset by a smaller carrying value.

Credit segment operating loss was $13.4 million for the three months ended October 31, 2023, compared to operating loss of $0.3 million for the three months ended October 31, 2022. The decrease was primarily due to the increase in the provision for bad debts and the decrease in credit revenue.

Additional information on the credit portfolio and its performance may be found in the Customer Accounts Receivable Portfolio Statistics table included within this press release and in the Company’s Form 10-Q for the quarter ended October 31, 2023, to be filed with the Securities and Exchange Commission on December 18, 2023 (the “Third Quarter Form 10-Q”).

Store and Facilities Update

The Company opened one new standalone store during the third quarter of fiscal year 2024 bringing the total store count to 176 in 15 states. During fiscal year 2024, the Company has opened eight standalone stores and anticipates opening one more standalone store during the remainder of the fiscal year.

Liquidity and Capital Resources

On August 17, 2023, the Company completed an ABS transaction resulting in the issuance and sale of $273.7 million aggregate principal amount of Class A, Class B and Class C Notes secured by customer accounts receivables and restricted cash held by a consolidated VIE, which resulted in net proceeds of $266.2 million, net of debt issuance costs.

As of October 31, 2023, the Company had $144.2 million of immediately available borrowing capacity under its $650.0 million revolving credit facility. In addition, the Company had $50.0 million of borrowing capacity available under the Delayed Draw Term Loan resulting in a total immediately available borrowing capacity of $194.2 million. The Company also had $5.6 million of unrestricted cash available for use.

Conference Call Information

The Company will host a conference call on December 19, 2023, at 10 a.m. CT / 11 a.m. ET, to discuss its three months ended October 31, 2023 financial results. Participants can join the call by dialing 877-451-6152 or 201-389-0879. The conference call will also be broadcast simultaneously via webcast on a listen-only basis. A link to the earnings release, webcast and third quarter fiscal year 2024 conference call presentation will be available at ir.conns.com.

Replay of the telephonic call can be accessed through December 26, 2023 by dialing 844-512-2921 or 412-317-6671 and Conference ID: 13740585.

About Conn’s, Inc.

Conn's HomePlus (NASDAQ: CONN) is a specialty retailer of home goods, including furniture and mattresses, appliances and consumer electronics. With 176 stores across 15 states and online at Conns.com, our approximately 4,000 employees strive to help all customers create a home they love through access to high-quality products, next-day delivery and personalized payment options, including our flexible, in-house credit program. Additional information can be found by visiting our investor relations website at https://ir.conns.com and social channels (@connshomeplus on Twitter, Instagram, Facebook and LinkedIn).

This press release contains forward-looking statements within the meaning of the federal securities laws, including, but not limited to, the Private Securities Litigation Reform Act of 1995, that involve risks and uncertainties. Such forward-looking statements include statements regarding benefits of the proposed transaction, integration plans and expected synergies, anticipated future financial and operating performance and results, including estimates for growth, business strategy, plans, goals, and objectives. Statements containing the words “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “project,” “should,” “predict,” “will,” “potential,” or the negative of such terms or other similar expressions are generally forward-looking in nature and not historical facts. Such forward-looking statements are based on our current expectations. We can give no assurance that such statements will prove to be correct, and actual results may differ materially. A wide variety of potential risks, uncertainties, and other factors could materially affect our ability to achieve the results either expressed or implied by our forward-looking statements, including, but not limited to: our ability to integrate the W.S. Badcock business, the possibility that our shareholders may not approve the issuance of non-voting common stock required for conversion of the preferred stock issued in connection with the transaction, the risk that any announcement relating to the transaction could have adverse effects on the market price of Conn’s common stock, the risk that the transaction and its announcement could have an adverse effect on our ability to retain customers and retain and hire key personnel and maintain relationships with suppliers and customers, our ability to achieve synergies, our inability to operate the combined company as effectively and efficiently as expected, the condition of the W.S. Badcock business being materially worse than the condition we expect it to be in and/or including unanticipated liabilities, our inability to achieve the intended benefits of the transaction for any other reason, general economic conditions impacting our customers or potential customers; our ability to execute periodic securitizations of future originated customer loans on favorable terms; our ability to continue existing customer financing programs or to offer new customer financing programs; changes in the delinquency status of our credit portfolio; unfavorable developments in ongoing litigation; increased regulatory oversight; higher than anticipated net charge-offs in the credit portfolio; the success of our planned opening of new stores; expansion of our eCommerce business; technological and market developments and sales trends for our major product offerings; our ability to manage effectively the selection of our major product offerings; our ability to protect against cyber-attacks or data security breaches and to protect the integrity and security of individually identifiable data of our customers and employees; our ability to fund our operations, capital expenditures, debt repayment and expansion from cash flows from operations, borrowings from our Revolving Credit Facility or our Delayed Draw Term Loan; and proceeds from accessing debt or equity markets; the effects of epidemics or pandemics, including the COVID-19 pandemic; and other risks detailed in Part I, Item 1A, Risk Factors, in our Annual Report on Form 10-K for the fiscal year ended January 31, 2023 and other reports filed with the Securities and Exchange Commission. If one or more of these or other risks or uncertainties materialize (or the consequences of such a development changes), or should our underlying assumptions prove incorrect, actual outcomes may vary materially from those reflected in our forward-looking statements. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. We disclaim any intention or obligation to update publicly or revise such statements, whether as a result of new information, future events or otherwise, or to provide periodic updates or guidance. All forward-looking statements attributable to us, or to persons acting on our behalf, are expressly qualified in their entirety by these cautionary statements.

CONN-G

S.M. Berger & Company

Andrew Berger (216) 464-6400

CONN’S, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(unaudited)

(amounts in thousands, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

October 31, | | Nine Months Ended

October 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Revenues: | | | | | | | |

| Total net sales | $ | 218,452 | | | $ | 254,358 | | | $ | 684,644 | | | $ | 806,133 | |

| Finance charges and other revenues | 61,678 | | | 66,842 | | | 186,962 | | | 201,519 | |

| Total revenues | 280,130 | | | 321,200 | | | 871,606 | | | 1,007,652 | |

| Costs and expenses: | | | | | | | |

| Cost of goods sold | 146,362 | | | 169,842 | | | 448,280 | | | 530,942 | |

| Selling, general and administrative expense | 131,032 | | | 126,243 | | | 395,244 | | | 389,169 | |

| Provision for bad debts | 39,123 | | | 35,104 | | | 101,334 | | | 77,059 | |

| Charges and credits, net | 2,071 | | | 8,006 | | | 1,264 | | | 6,522 | |

| Total costs and expenses | 318,588 | | | 339,195 | | | 946,122 | | | 1,003,692 | |

| Operating (loss) income | (38,458) | | | (17,995) | | | (74,516) | | | 3,960 | |

| Interest expense | 22,448 | | | 11,478 | | | 55,614 | | | 23,807 | |

| Loss before income taxes | (60,906) | | | (29,473) | | | (130,130) | | | (19,847) | |

| Benefit for income taxes | (9,609) | | | (4,634) | | | (9,936) | | | (3,358) | |

| Net loss | $ | (51,297) | | | $ | (24,839) | | | $ | (120,194) | | | $ | (16,489) | |

| Net loss per share: | | | | | | | |

| Basic | $ | (2.11) | | | $ | (1.04) | | | $ | (4.97) | | | $ | (0.68) | |

| Diluted | $ | (2.11) | | | $ | (1.04) | | | $ | (4.97) | | | $ | (0.68) | |

| Weighted average common shares outstanding: | | | | | | | |

| Basic | 24,262 | | | 23,911 | | | 24,196 | | | 24,173 | |

| Diluted | 24,262 | | | 23,911 | | | 24,196 | | | 24,173 | |

CONN’S, INC. AND SUBSIDIARIES

CONDENSED RETAIL SEGMENT FINANCIAL INFORMATION

(unaudited)

(dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

October 31, | | Nine Months Ended

October 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Revenues: | | | | | | | |

| Product sales | $ | 202,631 | | | $ | 233,176 | | | $ | 631,862 | | | $ | 738,598 | |

| Repair service agreement commissions | 15,938 | | | 18,804 | | | 51,600 | | | 60,256 | |

| Service revenues | 2,288 | | | 2,378 | | | 6,720 | | | 7,279 | |

| Total net sales | 220,857 | | | 254,358 | | | 690,182 | | | 806,133 | |

| Finance charges and other | 497 | | | 270 | | | 1,512 | | | 815 | |

| Total revenues | 221,354 | | | 254,628 | | | 691,694 | | | 806,948 | |

| Costs and expenses: | | | | | | | |

| Cost of goods sold | 146,772 | | | 169,842 | | | 450,576 | | | 530,942 | |

| Selling, general and administrative expense | 97,212 | | | 94,240 | | | 294,457 | | | 288,306 | |

| Provision for bad debts | 122 | | | 261 | | | 321 | | | 848 | |

| Charges and credits, net | 2,071 | | | 8,006 | | | 1,264 | | | 6,522 | |

| Total costs and expenses | 246,177 | | | 272,349 | | | 746,618 | | | 826,618 | |

| Operating loss | $ | (24,823) | | | $ | (17,721) | | | $ | (54,924) | | | $ | (19,670) | |

| Retail gross margin | 33.5 | % | | 33.2 | % | | 34.7 | % | | 34.1 | % |

| Selling, general and administrative expense as percent of revenues | 43.9 | % | | 37.0 | % | | 42.6 | % | | 35.7 | % |

| Operating margin | (11.2) | % | | (7.0) | % | | (7.9) | % | | (2.4) | % |

| Store count: | | | | | | | |

| Beginning of period | 175 | | 163 | | 168 | | 158 |

| Opened | 1 | | 2 | | 8 | | 7 |

| End of period | 176 | | 165 | | 176 | | 165 |

| | | | | | | |

CONN’S, INC. AND SUBSIDIARIES

CONDENSED CREDIT SEGMENT FINANCIAL INFORMATION

(unaudited)

(amounts in thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

October 31, | | Nine Months Ended

October 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Revenues: | | | | | | | |

| Finance charges and other revenues | $ | 61,528 | | | $ | 66,572 | | | $ | 186,406 | | | $ | 200,704 | |

| Costs and expenses: | | | | | | | |

| Cost of goods sold | $ | 1,854 | | | — | | | 2,548 | | | — | |

| Selling, general and administrative expense | 34,070 | | | 32,003 | | | 101,537 | | | 100,863 | |

| Provision for bad debts | 39,001 | | | 34,843 | | | 101,013 | | | 76,211 | |

| Total costs and expenses | 74,925 | | | 66,846 | | | 205,098 | | | 177,074 | |

| Operating (loss) income | (13,397) | | | (274) | | | (18,692) | | | 23,630 | |

| Interest expense | 22,539 | | | 11,478 | | | 55,598 | | | 23,807 | |

| Loss before income taxes | $ | (35,936) | | | $ | (11,752) | | | $ | (74,290) | | | $ | (177) | |

| Selling, general and administrative expense as percent of revenues | 55.4 | % | | 48.1 | % | | 54.5 | % | | 50.3 | % |

| Selling, general and administrative expense as percent of average outstanding customer accounts receivable balance (annualized) | 13.9 | % | | 12.4 | % | | 13.7 | % | | 12.7 | % |

| Operating margin | (21.8) | % | | (0.4) | % | | (10.0) | % | | 11.8 | % |

CONN’S, INC. AND SUBSIDIARIES

CUSTOMER ACCOUNTS RECEIVABLE PORTFOLIO STATISTICS

(unaudited)

| | | | | | | | | | | |

| As of October 31, |

| 2023 | | 2022 |

Weighted average credit score of outstanding balances (1) | 615 | | | 613 | |

| Average outstanding customer balance | $ | 2,661 | | | $ | 2,541 | |

Balances 60+ days past due as a percentage of total customer portfolio carrying value (2)(3) | 11.0 | % | | 12.2 | % |

Re-aged balance as a percentage of total customer portfolio carrying value (2)(3) | 18.1 | % | | 16.5 | % |

Carrying value of account balances re-aged more than six months (in thousands)(3) | $ | 34,563 | | | $ | 31,521 | |

| Allowance for bad debts and uncollectible interest as a percentage of total customer accounts receivable portfolio balance | 17.4 | % | | 18.2 | % |

Percent of total customer accounts receivable portfolio balance represented by no-interest option receivables | 36.2 | % | | 33.0 | % |

(1)Credit scores exclude non-scored accounts.

(2)Accounts that become delinquent after being re-aged are included in both the delinquency and re-aged amounts.

(3)Carrying value reflects the total customer accounts receivable portfolio balance, net of deferred fees and origination costs, the allowance for no-interest option credit programs and the allowance for uncollectible interest.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

October 31, | | Nine Months Ended

October 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Total applications processed | 333,622 | | | 231,526 | | | 968,571 | | | 756,611 | |

Weighted average origination credit score of sales financed (1) | 623 | | | 621 | | | 621 | | | 620 | |

| Percent of total applications approved and utilized | 18.8 | % | | 23.8 | % | | 20 | % | | 22.4 | % |

| Average income of credit customer at origination | $ | 53,600 | | | $ | 50,900 | | | $ | 52,300 | | | $ | 50,600 | |

| Percent of retail sales paid for by: | | | | | | | |

| In-house financing, including down payments received | 61.1 | % | | 54.0 | % | | 60.8 | % | | 51.9 | % |

| Third-party financing | 14.7 | % | | 17.6 | % | | 14.7 | % | | 18.2 | % |

| Third-party lease-to-own option | 8.6 | % | | 7.2 | % | | 8.2 | % | | 7.1 | % |

| | 84.4 | % | | 78.8 | % | | 83.7 | % | | 77.2 | % |

CONN’S, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands)

| | | | | | | | | | | |

| October 31, 2023 | | January 31, 2023 |

| |

| Assets | (unaudited) | | |

| Current Assets: | | | |

| Cash and cash equivalents | $ | 5,562 | | | $ | 19,534 | |

| Restricted cash | 41,430 | | | 40,837 | |

| Customer accounts receivable, net of allowances | 424,940 | | | 421,683 | |

| Other accounts receivable | 52,020 | | | 56,887 | |

| Inventories | 231,814 | | | 240,783 | |

| Income taxes receivable | 40,933 | | | 38,436 | |

| Prepaid expenses and other current assets | 11,496 | | | 12,937 | |

| Total current assets | 808,195 | | | 831,097 | |

| Long-term portion of customer accounts receivable, net of allowances | 355,092 | | | 389,054 | |

| Property and equipment, net | 214,770 | | | 218,956 | |

| Operating lease right-of-use assets | 335,423 | | | 262,104 | |

| Other assets | 12,912 | | | 15,004 | |

| Total assets | $ | 1,726,392 | | | $ | 1,716,215 | |

| Liabilities and Stockholders’ Equity | | | |

| Current liabilities: | | | |

| Short-term debt and current finance lease obligations | $ | 7,934 | | | $ | 937 | |

| Accounts payable | 66,540 | | | 71,685 | |

| Accrued expenses | 91,823 | | | 82,619 | |

| Operating lease liability - current | 60,303 | | | 53,208 | |

| Other current liabilities | 12,668 | | | 13,912 | |

| Total current liabilities | 239,268 | | | 222,361 | |

| Operating lease liability - non current | 403,531 | | | 331,109 | |

| Long-term debt and finance lease obligations | 673,472 | | | 636,079 | |

| Deferred tax liability | 1,952 | | | 2,041 | |

| Other long-term liabilities | 17,601 | | | 22,215 | |

| Total liabilities | 1,335,824 | | | 1,213,805 | |

| Stockholders’ equity | 390,568 | | | 502,410 | |

| Total liabilities and stockholders’ equity | $ | 1,726,392 | | | $ | 1,716,215 | |

CONN’S, INC. AND SUBSIDIARIES

NON-GAAP RECONCILIATIONS

(unaudited)

(amounts in thousands, except per share amounts)

Basis for presentation of non-GAAP disclosures:

To supplement the Condensed Consolidated Financial Statements, which are prepared and presented in accordance with accounting principles generally accepted in the United States of America (“GAAP”), the Company also provides the following non-GAAP financial measures: retail segment adjusted operating loss, adjusted net loss, adjusted net loss per diluted share and net debt as a percentage of the portfolio balance. These non-GAAP financial measures are not meant to be considered as a substitute for, or superior to, comparable GAAP measures and should be considered in addition to results presented in accordance with GAAP. They are intended to provide additional insight into our operations and the factors and trends affecting the business. Management believes these non-GAAP financial measures are useful to financial statement readers because (1) they allow for greater transparency with respect to key metrics we use in our financial and operational decision making and (2) they are used by some of our institutional investors and the analyst community to help them analyze our operating results.

RETAIL SEGMENT ADJUSTED OPERATING LOSS | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

October 31, | | Nine Months Ended

October 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Retail segment operating loss, as reported | $ | (24,823) | | | $ | (17,721) | | | $ | (54,924) | | | $ | (19,670) | |

| Adjustments: | | | | | | | |

Store closure (1) | — | | | — | | | 2,340 | | | — | |

Asset sale (2) | — | | | — | | | (3,147) | | | — | |

Lease termination (3) | — | | | — | | | — | | | (1,484) | |

Employee severance (4) | — | | | 8,006 | | | — | | | 8,006 | |

Professional fees (5) | 2,071 | | | — | | | 2,071 | | | — | |

| Retail segment operating loss, as adjusted | $ | (22,752) | | | $ | (9,715) | | | $ | (53,660) | | | $ | (13,148) | |

(1)Represents store closure costs due to the impairment of assets associated with the decision to end the store-within-a-store test with Belk, Inc.

(2)Represents a gain related to the sale of a single store location, net of asset disposal costs.

(3)Represents a gain on the termination of a lease.

(4)Represents severance costs related to a change in the executive management team.

(5)Represents professional fees costs related to corporate transactions.

ADJUSTED NET LOSS AND ADJUSTED NET LOSS INCOME PER DILUTED SHARE

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

October 31, | | Nine Months Ended

October 31, |

| 2023 | | 2022 | | 2023 | | 2022 |

| Net loss, as reported | $ | (51,297) | | | $ | (24,839) | | | $ | (120,194) | | | $ | (16,489) | |

| Adjustments: | | | | | | | |

Store closure (1) | — | | | — | | | 2,340 | | | — | |

Asset sale (2) | — | | | — | | | (3,147) | | | — | |

Lease termination (3) | — | | | — | | | — | | | (1,484) | |

Employee severance (4) | — | | | 8,006 | | | — | | | 8,006 | |

Professional fees (5) | 2,071 | | | — | | | 2,071 | | | — | |

Tax impact of adjustments(6) | — | | | (1,809) | | | — | | | (1,472) | |

| Net loss, as adjusted | $ | (49,226) | | | $ | (18,642) | | | $ | (118,930) | | | $ | (11,439) | |

| Weighted average common shares outstanding - Diluted | 24,262 | | | 23,911 | | | 24,196 | | | 24,173 | |

| Net loss per share: | | | | | | | |

| As reported | $ | (2.11) | | | $ | (1.04) | | | $ | (4.97) | | | $ | (0.68) | |

| As adjusted | $ | (2.03) | | | $ | (0.78) | | | $ | (4.92) | | | $ | (0.47) | |

(1)Represents store closure costs due to the impairment of assets associated with the decision to end the store-within-a-store test with Belk, Inc.

(2)Represents a gain related to the sale of a single store location, net of asset disposal costs.

(3)Represents a gain on the termination of a lease.

(4)Represents severance costs related to a change in the executive management team.

(5)Represents professional fees costs related to corporate transactions.

(6)Represents the tax effect of the adjusted items based on the applicable statutory tax rate including the impact of the valuation allowance.

NET DEBT

| | | | | | | | | | | |

| October 31, |

| 2023 | | 2022 |

| Debt, as reported | | | |

| Current finance lease obligations and other | $ | 7,934 | | $ | 919 | |

| Long-term debt and finance lease obligations | 673,472 | | 591,673 | |

| Total debt | 681,406 | | 592,592 |

| Cash, as reported | | | |

| Cash and cash equivalents | $ | 5,562 | | $ | 8,433 | |

| Restricted Cash | 41,430 | | 45,503 | |

| Total cash | 46,992 | | 53,936 |

| Net debt | $ | 634,414 | | $ | 538,656 |

| Ending portfolio balance, as reported | $ | 979,149 | | $ | 1,032,800 |

| Net debt as a percentage of the portfolio balance | 64.8 | % | | 52.2 | % |

Exhibit 99.2

Conn’s, Inc. Announces the Transformative Transaction with W.S. Badcock LLC

•Accelerates growth opportunities by combining two complementary businesses with similar product categories, payment solutions and customer profiles

•Combines Conn’s in-house credit platform and expertise with Badcock’s existing financing capabilities

•Increases scale and expands Conn’s presence across the southeastern U.S., creating one of the largest home goods retailers with 550+ stores across 15 states and approximately $1.85 billion in revenue

•Strengthens financial profile with over $50 million of expected cost synergies on a run-rate basis in 18 months and enhances Conn’s balance sheet by adding approximately $125 million of incremental liquidity and extending debt maturities by three years

•Names Norm Miller President and CEO of the combined company

THE WOODLANDS, Texas, December 18, 2023 - Conn’s, Inc. (NASDAQ: CONN) (“Conn’s” or the “Company”), a specialty retailer of home goods, including furniture and mattresses, appliances, and consumer electronics, today announced that it has consummated a transaction that has resulted in W.S. Badcock LLC (“Badcock”), a leading home furnishings company in the southeastern U.S., becoming a wholly-owned subsidiary of the Company. The all-stock transaction was unanimously approved by Conn’s Board of Directors. Conn’s also announced that Norman L. Miller has been named President and CEO of Conn’s, Inc. Mr. Miller has served as a Conn’s Board Member since September 2015 and as interim President and CEO since October 2022. He previously served as Conn’s President and CEO from September 2015 to August 2021 and Executive Chairman from August 2021 until April 2022.

Founded in 1904, Badcock operates nearly 380 stores in eight southeastern states comprised of 65+ corporate locations and 310+ independent dealer owned stores. The stores are branded “Badcock Home Furniture & more” and provide customers with furniture, appliances, bedding, electronics, home office equipment, accessories, and seasonal items. Badcock offers customers affordable payment plans, including Badcock Easy Purchase, an in-house payment solution. Mitchell Stiles, President and COO of Badcock, will lead Badcock and report to Conn’s CEO, Norm Miller.

“Today’s announcement represents one of the most significant events in the Company’s over 120-year history,” said Bob Martin, Conn’s lead independent director. “The combination immediately positions Conn’s as a leading home goods retailer across the southern U.S. It also supports our existing strategic growth priorities by providing our unmatched payment options, leading eCommerce capabilities, and premium shopping experience to more customers. In addition, on behalf of Conn’s Board of Directors, I am pleased to announce that Norm Miller has been named President and CEO of the combined company. Norm is a proven leader, who previously led Conn’s to multiple record setting years of profitable growth. The Badcock transaction significantly enhances Conn’s scale allowing us to leverage a powerful infrastructure and deliver strong financial returns for many years to come.”

The transaction brings together two highly complementary companies with significant reach across 15 states and powered by best-in-class payment offerings, compelling eCommerce capabilities, and a premium shopping experience. The combined company is expected to have annual revenue of approximately $1.85 billion across 240+ corporate owned stores and 310+ dealer locations, with eCommerce sales of approximately $125 million. Conn’s will become a top-20 furniture and mattress retailer in the U.S. according to Furniture Today’s latest top 100 list. In addition, Conn’s will now provide last-mile delivery to over 92% of the population that resides in the 15 states in which it operates. The combined company will also have a credit portfolio of $1.1 billion, projected to generate approximately $364 million in annual finance charges and other revenue. Management expects to realize over $50 million in run-rate cost savings from the Badcock transaction in 18 months, with further upside expected in the future, supported by improved procurement, logistics, general and administrative, and corporate expenses as well as credit optimization opportunities.

Norm Miller, President and CEO of Conn’s, said, “Today's announcement transforms Conn’s into a leading home goods retailer that is expected to have $1.85 billion in revenue across strong urban and rural markets in the southern U.S. We believe the combination of these two complementary businesses will produce significant value as we pursue credit driven revenue growth strategies, enhance Badcock’s in-house credit offering, and leverage a more diverse and larger organization. For over 120 years, both Conn’s and Badcock have provided customers with home goods they want, at prices they love, with affordable

payment solutions. We look forward to building on this legacy by leveraging Conn’s capabilities, expertise, and innovation to support greater opportunities for our combined communities, customers, dealers, and employees. As a result, we are confident this combination will produce significant long-term value for all of our shareholders.”

Mitchell Stiles, President and COO of Badcock, said, “Conn’s and Badcock share complementary business models, histories, and customers, and the expected revenue and cost synergies are extremely powerful. The enhanced scale of the combined company creates one of the largest home goods retailers in the southern U.S. We believe both our dealer and corporate owned stores will benefit from Conn’s customer centric culture, best-in-class payment solutions, expanded product assortment, and leading eCommerce platform. On behalf of everyone at Badcock, I look forward to working with Norm and his team as we integrate the two companies and drive long-term, profitable growth.”

Transaction Details

The transaction was consummated as an all-stock deal with Conn’s issuing 1,000,000 of its non-voting senior preferred shares convertible into a to-be issued class of non-voting common, subject to shareholder vote, representing 49.99% of Conn’s outstanding common stock after giving effect to the stock issuance and assuming the conversion of such preferred shares into non-voting common stock. The transaction was unanimously approved by the Board of Directors of both Conn’s and Franchise Group and the creation and issuance of the non-voting common shares is subject to approval of Conn’s shareholders in accordance with NASDAQ listing rules and Conn’s charter. Shareholders of Conn’s, holding in excess of 40% of the outstanding common stock, have signed voting agreements to approve the stock issuance and related matters. Upon shareholder approval of the creation and issuance of the class of non-voting common shares, Conn’s expects to have approximately 49 million shares outstanding comprised of both voting and non-voting common shares.

Advisors

Stephens Inc. and Deutsche Bank Securities Inc. served as financial advisors and Sidley Austin LLP served as legal counsel to Conn’s. JP Morgan Securities LLC served as financial advisor and Willkie Farr & Gallagher LLP served as legal counsel to Franchise Group and W.S. Badcock LLC.

Conference Call Details

Conn’s will host a conference call to discuss the transaction and review its fiscal 2024 third quarter financial results at 11:00 a.m. (ET) tomorrow, December 19, 2023. Participants can join the call by dialing 877-451-6152 or 201-389-0879. The conference call will also be broadcast simultaneously via webcast on a listen-only basis. A link to the release, webcast and presentation slides are available at ir.conns.com.

Replay of the telephonic call can be accessed through December 26, 2023, by dialing 844-512-2921 or 412-317-6671 and using the Conference ID: 13740585.

About Conn’s, Inc.

Conn's HomePlus (NASDAQ: CONN) is a specialty retailer of home goods, including furniture and mattresses, appliances and consumer electronics. With 175+ stores across 15 states and online at Conns.com, our approximately 4,000 employees strive to help all customers create a home they love through access to high-quality products, next-day delivery and personalized payment options, including our flexible, in-house credit program. Additional information can be found by visiting our investor relations website at https://ir.conns.com and social channels (@connshomeplus on Twitter, Instagram, Facebook and LinkedIn).

About Badcock Home Furniture & more

W.S. Badcock LLC is a Southeastern home furnishings company headquartered in Mulberry, FL. Founded in 1904, its branded Badcock Home Furniture & more retail chain has grown to nearly 380 corporate and associate dealer stores across eight states. Badcock offers furniture, appliances, bedding, electronics, home office furnishing, accessories and seasonal items while providing payment plans just right for its customers. For more information, visit www.badcock.com.

Additional Information and Where to Find It

This communication may be deemed to be solicitation material in respect of obtaining approval of the stockholders of Conn’s, Inc. (the “Company”) of the proposed transactions (the “Stockholder Approval”). In connection with obtaining the Stockholder Approval, the Company will file with the Securities and Exchange Commission (the “SEC”) and furnish to the Company’s stockholders a proxy statement and other relevant documents. This communication does not constitute a solicitation of any vote or approval. BEFORE MAKING ANY VOTING DECISION, THE COMPANY’S STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT IN ITS ENTIRETY WHEN IT BECOMES AVAILABLE AND ANY OTHER DOCUMENTS TO BE FILED THE SEC IN CONNECTION WITH THE STOCKHOLDER APPROVAL OR INCORPORATED BY REFERENCE IN THE PROXY STATEMENT BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTION.

Stockholders will be able to obtain free copies of the proxy statement and other documents containing important information about the Company once such documents are filed with the SEC, through the website maintained by the SEC at http://www.sec.gov.

Participants in the Solicitation

The Company and its executive officers, directors, other members of management and employees may be deemed, under SEC rules, to be participants in the solicitation of proxies from the Company’s shareholders with respect to the proposed transaction. Information regarding the executive officers and directors of the Company is set forth in its definitive proxy statement for its 2023 annual meeting filed with the SEC on April 13, 2023, as amended. More detailed information regarding the identity of potential participants, and their direct or indirect interests, by securities holdings or otherwise, will be set forth in the proxy statement and other materials to be filed with the SEC in connection with the proposed transaction.

This press release contains forward-looking statements within the meaning of the federal securities laws, including, but not limited to, the Private Securities Litigation Reform Act of 1995, that involve risks and uncertainties. Such forward-looking statements include statements regarding benefits of the proposed merger, integration plans and expected synergies, anticipated future financial and operating performance and results, including estimates for growth, business strategy, plans, goals, and objectives. Statements containing the words “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “project,” “should,” “predict,” “will,” “potential,” or the negative of such terms or other similar expressions are generally forward-looking in nature and not historical facts. Such forward-looking statements are based on our current expectations. We can give no assurance that such statements will prove to be correct, and actual results may differ materially. A wide variety of potential risks, uncertainties, and other factors could materially affect our ability to achieve the results either expressed or implied by our forward-looking statements, including, but not limited to: our ability to integrate the W.S. Badcock business, the possibility that our shareholders may not approve the issuance of non-voting common stock required for conversion of the preferred stock issued in connection with the merger, the risk that any announcement relating to the merger could have adverse effects on the market price of Conn’s common stock, the risk that the merger and its announcement could have an adverse effect on our ability to retain customers and retain and hire key personnel and maintain relationships with suppliers and customers, our ability to achieve cost-cutting synergies, our inability to operate the combined company as effectively and efficiently as expected, general economic conditions impacting our customers or potential customers; our ability to execute periodic securitizations of future originated customer loans on favorable terms; our ability to continue existing customer financing programs or to offer new customer financing programs; changes in the delinquency status of our credit portfolio; unfavorable developments in ongoing litigation; increased regulatory oversight; higher than anticipated net charge-offs in the credit portfolio; the success of our planned opening of new stores; expansion of our eCommerce business; technological and market developments and sales trends for our major product offerings; our ability to manage effectively the selection of our major product offerings; our ability to protect against cyber-attacks or data security breaches and to protect the integrity and security of individually identifiable data of our customers and employees; our ability to fund our operations, capital expenditures, debt repayment and expansion from cash flows from operations, borrowings from our Revolving Credit Facility or our Delayed Draw Term Loan; and proceeds from accessing debt or equity markets; the effects of epidemics or pandemics, including the COVID-19 pandemic; and other risks detailed in Part I, Item 1A, Risk Factors, in our Annual Report on Form 10-K for the fiscal year ended January 31, 2023 and other reports filed with the Securities and Exchange Commission. If one or more of these or other risks or uncertainties materialize (or the consequences of such a development changes), or should our underlying assumptions prove incorrect, actual outcomes may vary materially from those reflected in our forward-looking statements. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. We disclaim any intention or obligation to update publicly or revise such statements, whether as a result of new information, future events or otherwise, or to provide periodic updates or guidance. All forward-looking statements attributable to us, or to persons acting on our behalf, are expressly qualified in their entirety by these cautionary statements.

CONN-G

S.M. Berger & Company

Andrew Berger (216) 464-6400

v3.23.4

Cover

|

Dec. 18, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Dec. 18, 2023

|

| Entity Registrant Name |

CONN’S, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-34956

|

| Entity Tax Identification Number |

06-1672840

|

| Entity Address, City or Town |

The Woodlands,

|

| Entity Address, Postal Zip Code |

77381

|

| City Area Code |

936

|

| Local Phone Number |

230-5899

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

CONN

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001223389

|

| Entity Address, State or Province |

TX

|

| Entity Address, Address Line Two |

Suite 800,

|

| Entity Address, Address Line One |

2445 Technology Forest Blvd.,

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

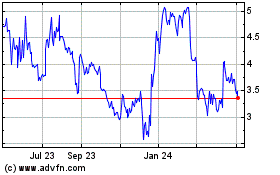

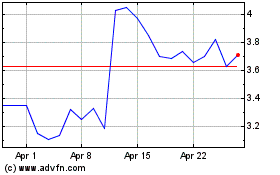

Conns (NASDAQ:CONN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Conns (NASDAQ:CONN)

Historical Stock Chart

From Apr 2023 to Apr 2024