Coupang Shares Slip After Farfetch Deal

December 18 2023 - 11:38AM

Dow Jones News

By Dean Seal

Shares of Coupang fell after the company said it would acquire

the online luxury company Farfetch Holdings.

The stock was down 3.7% at $16.39. Shares are up 11%

year-to-date.

The global retailer said the Farfetch acquisition will better

position it as a leader in the personal luxury goods space and give

Farfetch access to $500 million in capital.

To effect the transaction, Coupang and the investment firm

Greenoaks Capital Partners have established a limited partnership

that will acquire Farfetch's business and assets.

Farfetch's shares sank to an all-time low last month after the

luxury group Richemont said it had no plans to invest further in

the e-commerce company. The disclosure followed speculation that

Farfetch may be taken private by its founder and chief executive,

José Neves, with support from Richemont and e-commerce giant

Alibaba.

Farfetch disclosed around that same time that it won't stand by

its previous guidance, issue new guidance or publish third-quarter

results by a Nov. 29 deadline.

After Coupang said it would buy Farfetch on Monday, Richemont

said it won't complete a planned transaction with Farfetch

involving its Yoox Net-A-Porter platform, and expects to lose out

on convertible senior notes previously issued by Farfetch.

The deal is subject to an exclusivity period through April 30,

with Farfetch set to pay a $20 million termination fee to the

limited partnership if it enters into a competing transaction

before that time.

Coupang didn't provide a timeline for when it expects the deal

to close.

Write to Dean Seal at dean.seal@wsj.com

(END) Dow Jones Newswires

December 18, 2023 11:23 ET (16:23 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

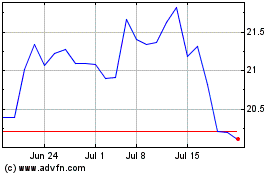

Coupang (NYSE:CPNG)

Historical Stock Chart

From Mar 2024 to Apr 2024

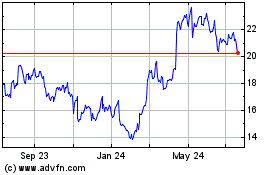

Coupang (NYSE:CPNG)

Historical Stock Chart

From Apr 2023 to Apr 2024