false

0001006028

0001006028

2023-12-14

2023-12-14

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): December 14, 2023

PURE

BIOSCIENCE, INC.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-14468 |

|

33-0530289 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

771

Jamacha Rd., #512

El Cajon, California |

|

92019 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

9669

Hermosa Avenue

Rancho Cucamonga, California |

|

91730 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

(Former

name or former address, if changed since last report)

Registrant’s

telephone number, including area code: (619) 596-8600

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act: None

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

2.02. Results of Operations and Financial Condition.

On

December 14, 2023, PURE Bioscience, Inc. (the “Company”) issued a press release announcing financial results for the fiscal

quarter ended October 31, 2023 and related information. A copy of the press release is attached as Exhibit 99.1.

The

information in this Item 2.02 is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities

Exchange Act of 1934 or otherwise subject to the liabilities of that Section. The information in this Item 2.02 shall not be incorporated

by reference into any registration statement or other document filed with the Securities and Exchange Commission.

Item

9.01. Financial Statements and Exhibits.

(d)

Exhibits

| * |

Exhibit

99.1 is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act

of 1934 or otherwise subject to the liabilities of that Section, nor shall it be incorporated by reference into any registration

statement or other document filed with the Securities and Exchange Commission. |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

PURE BIOSCIENCE, INC. |

| |

|

|

| Dated: December 14, 2023 |

By: |

/s/ Robert F. Bartlett |

| |

|

Robert F. Bartlett |

| |

|

Chief Executive Officer |

EXHIBIT

INDEX

Exhibit

99.1

PURE

Bioscience Reports Fiscal First Quarter 2024

Financial

Results

Update

on Business and PURE’s SDC-Based Antimicrobial Food Safety Solutions

El

Cajon, CA (December 14, 2023) – PURE Bioscience, Inc. (OTCQB: PURE) (“PURE,” the “Company” or “we”),

creator of the patented non-toxic silver dihydrogen citrate (SDC) antimicrobial, today reported financial results for the fiscal

first quarter ended October 31, 2023.

Summary

of Results – Fiscal First Quarter Operations

| |

● |

Net

product sales were $718,000 and $467,000 for the fiscal first quarters ended October 31, 2023 and 2022, respectively. The increase

of $251,000 was attributable to increased sales across our distribution and end-user network. |

| |

● |

Net

loss for the fiscal first quarter ended October 31, 2023 was $735,000, compared to $993,000 for the fiscal first quarter ended October

31, 2022. |

| |

● |

Net

loss, excluding share-based compensation, for the fiscal first quarter ended October 31, 2023 was $655,000, compared to $909,000

for the fiscal first quarter ended October 31, 2022. |

| |

● |

Net

loss per share was ($0.01) for the fiscal first quarter ended October 31, 2023, compared to ($0.01) for the fiscal first quarter

ended October 31, 2022. |

Robert

Bartlett, Chief Executive Officer, said, “As indicated by our Q1 revenue our sales initiatives are beginning to pay off. Our product

revenue increased $251,000 against the first quarter of the prior year and over $100,000 compared with Q4 of our last fiscal year. As

the world begins to look for alternatives to traditional toxic chemistries, more are turning to PURE’s innovative solutions,”

concluded Bartlett.

Business

Update

While

remaining committed to and increasing revenue by bringing unique solutions to the industry, our team remains focused on the following:

| |

● |

Customer

first approach. Servicing the customer with site visits has allowed our team to gain trust with plant management. In-person

meetings provide a great opportunity to collaborate with our customers to ensure we meet their unique food safety sanitization challenges. |

| |

● |

Corporate

engagement. Regular meetings with key corporate leadership has allowed the Company to calibrate on specific customer challenges

and goals, show where we can provide solutions, and ensure alignment for the best customer experience. |

| |

● |

Leveraging

decades of combined experience. Our sales and technical staff have a combined total of nearly 100 years’ experience

in food plant environments. By working together, our team is able to help solve the many challenges our customers face. |

| |

● |

Innovative

solutions. Our team continues to educate itself on industry trends and trajectory to help take our customer experience to

the next level. We are in the early stages of working with industry partners on conceptual development to enhance the sanitation

processes using internet of things (IoT), software as a service (SaaS), and automation in addition to ongoing R&D work. |

Tim

Steffensmeier, Vice President of Sales, said, “Our efficacy and unique safety profile is opening doors across the food processing

industry as the go-to final step for killing resistant bacteria. The Company’s unique regulatory approvals and application technology

allows food processing plants to use our chemistry in the production process as an effective intervention step, in addition to routine

and periodic cleaning. We view this as a competitive advantage that further differentiates our solution versus the status quo. Customer

focus, team experience and leveraging new application technology, as well as trade show attendance and targeted marketing have heightened

our brand awareness and solutions within the food safety industry. Doors that were once closed are now opening,” concluded Steffensmeier.

About

PURE Bioscience, Inc.

PURE

is focused on developing and commercializing our proprietary antimicrobial products primarily in the food safety arena. We provide solutions

to combat the health and environmental challenges of pathogen and hygienic control. Our technology platform is based on patented, stabilized

ionic silver, and our initial products contain silver dihydrogen citrate, better known as SDC. This is a broad-spectrum, non-toxic antimicrobial

agent, and formulates well with other compounds. As a platform technology, SDC is distinguished from existing products in the marketplace

because of its superior efficacy, reduced toxicity and mitigation of bacterial resistance. PURE’s mailing address located in El

Cajon, California (San Diego County area) serves as its official address for all business requirements. Additional information on PURE

is available at www.purebio.com.

Forward-looking

Statements: Any statements contained in this press release that do not describe historical facts may constitute forward-looking

statements as that term is defined in the Private Securities Litigation Reform Act of 1995. Statements in this press release, including

quotes from management, concerning the Company’s expectations, plans, business outlook, future performance, future potential revenues,

expected results of the Company’s marketing efforts, the execution of contracts under negotiation and any other statements concerning

assumptions made or expectations as to any future events, conditions, performance or other matters, are “forward-looking statements.”

Forward-looking statements inherently involve risks and uncertainties that could cause our actual results to differ materially from any

forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, the Company’s

failure to implement or otherwise achieve the benefits of its proposed business initiatives and plans; acceptance of the Company’s

current and future products and services in the marketplace, including the Company’s ability to convert successful evaluations

and tests for PURE Control and PURE Hard Surface into customer orders and customers continuing to place product orders as expected and

to expand their use of the Company’s products; the Company’s ability to maintain relationships with its partners and other

counterparties; the Company’s ability to generate sufficient revenues and reduce its operating expenses in order to reach profitability;

the Company’s ability to raise the funding required to support its continued operations and the implementation of its business

plan; the ability of the Company to develop effective new products and receive required regulatory approvals for such products, including

the required data and regulatory approvals required to use its SDC-based technology as a direct food contact processing aid in raw meat

processing and to expand its use in OLR poultry processing; competitive factors, including customer acceptance of the Company’s

SDC-based products that are typically more expensive than existing treatment chemicals; dependence upon third-party vendors, including

to manufacture its products; and other risks detailed in the Company’s periodic report filings with the Securities and Exchange

Commission (the SEC), including its Form 10-K for the fiscal year ended July 31, 2023 and Form 10-Q for the fiscal first quarter ended

October 31, 2023. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this press

release. By making these forward-looking statements, the Company undertakes no obligation to update these statements for revisions or

changes after the date of this release.

Contact:

Mark

Elliott, VP Finance

PURE

Bioscience, Inc.

Phone:

619-596-8600 ext.: 116

PURE

Bioscience, Inc.

Condensed

Consolidated Balance Sheets

| | |

October 31, 2023 | | |

July 31, 2023 | |

| | |

(Unaudited) | | |

| |

| Assets | |

| | |

| |

| Current assets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 1,440,000 | | |

$ | 1,095,000 | |

| Accounts receivable | |

| 347,000 | | |

| 285,000 | |

| Inventories, net | |

| 104,000 | | |

| 88,000 | |

| Restricted cash | |

| 75,000 | | |

| 75,000 | |

| Prepaid expenses | |

| 100,000 | | |

| 61,000 | |

| Total current assets | |

| 2,066,000 | | |

| 1,604,000 | |

| Property, plant and equipment, net | |

| 184,000 | | |

| 221,000 | |

| Total assets | |

$ | 2,250,000 | | |

$ | 1,825,000 | |

| Liabilities and stockholders’ equity (deficiency) | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Accounts payable | |

$ | 652,000 | | |

$ | 422,000 | |

| Accrued liabilities | |

| 154,000 | | |

| 110,000 | |

| Total current liabilities | |

| 806,000 | | |

| 532,000 | |

| Long-term liabilities | |

| | | |

| | |

| Note payable to related parties | |

| 1,827,000 | | |

| 1,021,000 | |

| Total long-term liabilities | |

| 1,827,000 | | |

| 1,021,000 | |

| Total liabilities | |

| 2,633,000 | | |

| 1,553,000 | |

| Commitments and contingencies | |

| | | |

| | |

| Stockholders’ equity (deficiency) | |

| | | |

| | |

| Preferred stock, $0.01 par value: 5,000,000 shares authorized, no shares issued and outstanding | |

| — | | |

| — | |

| Common stock, $0.01 par value: 150,000,000 shares authorized, 111,856,473 shares issued and outstanding at October 31, 2023, and July 31, 2023 | |

| 1,119,000 | | |

| 1,119,000 | |

| Additional paid-in capital | |

| 132,478,000 | | |

| 132,398,000 | |

| Accumulated deficit | |

| (133,980,000 | ) | |

| (133,245,000 | ) |

| Total stockholders’ equity (deficiency) | |

| (383,000 | ) | |

| 272,000 | |

| Total liabilities and stockholders’ equity (deficiency) | |

$ | 2,250,000 | | |

$ | 1,825,000 | |

PURE

Bioscience, Inc.

Condensed

Consolidated Statements of Operations

(Unaudited)

| | |

Three months ended | |

| | |

October 31, | |

| | |

2023 | | |

2022 | |

| Net product sales | |

$ | 718,000 | | |

$ | 467,000 | |

| Royalty revenue | |

| 4,000 | | |

| 4,000 | |

| Total revenue | |

| 722,000 | | |

| 471,000 | |

| Cost of goods sold | |

| 280,000 | | |

| 214,000 | |

| Gross Profit | |

| 442,000 | | |

| 257,000 | |

| Operating costs and expenses | |

| | | |

| | |

| Selling, general and administrative | |

| 1,073,000 | | |

| 1,165,000 | |

| Research and development | |

| 80,000 | | |

| 78,000 | |

| Total operating costs and expenses | |

| 1,153,000 | | |

| 1,243,000 | |

| Loss from operations | |

| (711,000 | ) | |

| (986,000 | ) |

| Other income (expense) | |

| | | |

| | |

| Other income (expense), net | |

| — | | |

| (5,000 | ) |

| Interest expense, net | |

| (24,000 | ) | |

| (2,000 | ) |

| Total other income (expense) | |

| (24,000 | ) | |

| (7,000 | ) |

| Net loss | |

$ | (735,000 | ) | |

$ | (993,000 | ) |

| Basic and diluted net loss per share | |

$ | (0.01 | ) | |

$ | (0.01 | ) |

| Shares used in computing basic and diluted net loss per share | |

| 111,856,473 | | |

| 111,356,473 | |

PURE

Bioscience, Inc.

Condensed

Consolidated Statement of Stockholders’ Equity (Deficiency)

(Unaudited)

| | |

Common Stock | | |

Additional Paid-In | | |

Accumulated | | |

Total Stockholders’ Equity | |

| | |

Shares | | |

Amount | | |

Capital | | |

Deficit | | |

(Deficiency) | |

| Balance July 31, 2023 | |

| 111,856,473 | | |

$ | 1,119,000 | | |

$ | 132,398,000 | | |

$ | (133,245,000 | ) | |

$ | 272,000 | |

| Share-based compensation expense - stock options | |

| — | | |

| — | | |

| 80,000 | | |

| — | | |

| 80,000 | |

| Net loss | |

| — | | |

| — | | |

| — | | |

| (735,000 | ) | |

| (735,000 | ) |

| Balance October 31, 2023 (Unaudited) | |

| 111,856,473 | | |

$ | 1,119,000 | | |

$ | 132,478,000 | | |

$ | (133,980,000 | ) | |

$ | (383,000 | ) |

| | |

Common Stock | | |

Additional Paid-In | | |

Accumulated | | |

Total Stockholders’ | |

| | |

Shares | | |

Amount | | |

Capital | | |

Deficit | | |

Equity | |

| Balance July 31, 2022 | |

| 111,356,473 | | |

$ | 1,114,000 | | |

$ | 132,079,000 | | |

$ | (129,284,000 | ) | |

$ | 3,909,000 | |

| Share-based compensation expense - stock options | |

| — | | |

| — | | |

| 63,000 | | |

| — | | |

| 63,000 | |

| Share-based compensation expense - restricted stock units | |

| — | | |

| — | | |

| 21,000 | | |

| — | | |

| 21,000 | |

| Net loss | |

| — | | |

| — | | |

| — | | |

| (993,000 | ) | |

| (993,000 | ) |

| Balance October 31, 2022 (Unaudited) | |

| 111,356,473 | | |

$ | 1,114,000 | | |

$ | 132,163,000 | | |

$ | (130,277,000 | ) | |

$ | 3,000,000 | |

PURE

Bioscience, Inc.

Condensed

Consolidated Statements of Cash Flows

(Unaudited)

| | |

Three Months Ended | |

| | |

October 31, | |

| | |

2023 | | |

2022 | |

| Operating activities | |

| | | |

| | |

| Net loss | |

$ | (735,000 | ) | |

$ | (993,000 | ) |

| Adjustments to reconcile net loss to net cash used in operating activities: | |

| | | |

| | |

| Share-based compensation | |

| 80,000 | | |

| 84,000 | |

| Depreciation and amortization | |

| 37,000 | | |

| 30,000 | |

| Changes in operating assets and liabilities: | |

| | | |

| | |

| Accounts receivable | |

| (62,000 | ) | |

| (51,000 | ) |

| Inventories | |

| (16,000 | ) | |

| (60,000 | ) |

| Prepaid expenses | |

| (39,000 | ) | |

| (36,000 | ) |

| Accounts payable and accrued liabilities | |

| 274,000 | | |

| 124,000 | |

| Interest on note payable | |

| 21,000 | | |

| — | |

| Net cash used in operating activities | |

| (440,000 | ) | |

| (902,000 | ) |

| Investing activities | |

| | | |

| | |

| Purchases of property, plant and equipment | |

| — | | |

| (37,000 | ) |

| Net cash used in investing activities | |

| — | | |

| (37,000 | ) |

| Financing activities | |

| | | |

| | |

| Net proceeds from note payable to related parties | |

| 785,000 | | |

| — | |

| Net cash provided by financing activities | |

| 785,000 | | |

| — | |

| Net increase and (decrease) in cash and cash equivalents, and restricted cash | |

| 345,000 | | |

| (939,000 | ) |

| Cash and cash equivalents, and restricted cash at beginning of period | |

| 1,170,000 | | |

| 3,466,000 | |

| Cash and cash equivalents, and restricted cash at end of period | |

$ | 1,515,000 | | |

$ | 2,527,000 | |

| Reconciliation of cash and cash equivalents, and restricted cash to the condensed consolidated balance sheets | |

| | | |

| | |

| Cash and cash equivalents | |

$ | 1,440,000 | | |

$ | 2,452,000 | |

| Restricted cash | |

$ | 75,000 | | |

$ | 75,000 | |

| Total cash and cash equivalents and restricted cash | |

$ | 1,515,000 | | |

$ | 2,527,000 | |

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

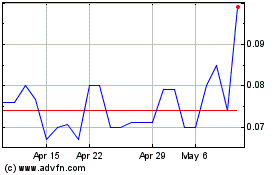

PURE Bioscience (QB) (USOTC:PURE)

Historical Stock Chart

From Mar 2024 to Apr 2024

PURE Bioscience (QB) (USOTC:PURE)

Historical Stock Chart

From Apr 2023 to Apr 2024