false2024Q10000730263--07-31http://www.thorindustries.com/20231031#PropertyPlantAndEquipmentAndFinanceAndOperatingLeaseRightOfUseAssetAfterAccumulatedDepreciationAndAmortizationhttp://www.thorindustries.com/20231031#PropertyPlantAndEquipmentAndFinanceAndOperatingLeaseRightOfUseAssetAfterAccumulatedDepreciationAndAmortizationhttp://fasb.org/us-gaap/2023#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrenthttp://www.thorindustries.com/20231031#PropertyPlantAndEquipmentAndFinanceAndOperatingLeaseRightOfUseAssetAfterAccumulatedDepreciationAndAmortizationhttp://www.thorindustries.com/20231031#PropertyPlantAndEquipmentAndFinanceAndOperatingLeaseRightOfUseAssetAfterAccumulatedDepreciationAndAmortizationhttp://fasb.org/us-gaap/2023#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrent44200007302632023-08-012023-10-3100007302632023-11-30xbrli:shares00007302632023-10-31iso4217:USD00007302632023-07-31iso4217:USDxbrli:shares00007302632022-08-012022-10-3100007302632022-07-3100007302632022-10-310000730263us-gaap:CommonStockMember2023-07-310000730263us-gaap:AdditionalPaidInCapitalMember2023-07-310000730263us-gaap:RetainedEarningsMember2023-07-310000730263us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-310000730263us-gaap:TreasuryStockCommonMember2023-07-310000730263us-gaap:ParentMember2023-07-310000730263us-gaap:NoncontrollingInterestMember2023-07-310000730263us-gaap:RetainedEarningsMember2023-08-012023-10-310000730263us-gaap:ParentMember2023-08-012023-10-310000730263us-gaap:NoncontrollingInterestMember2023-08-012023-10-310000730263us-gaap:TreasuryStockCommonMember2023-08-012023-10-310000730263us-gaap:CommonStockMember2023-08-012023-10-310000730263us-gaap:AdditionalPaidInCapitalMember2023-08-012023-10-310000730263us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-08-012023-10-310000730263us-gaap:CommonStockMember2023-10-310000730263us-gaap:AdditionalPaidInCapitalMember2023-10-310000730263us-gaap:RetainedEarningsMember2023-10-310000730263us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-10-310000730263us-gaap:TreasuryStockCommonMember2023-10-310000730263us-gaap:ParentMember2023-10-310000730263us-gaap:NoncontrollingInterestMember2023-10-310000730263us-gaap:CommonStockMember2022-07-310000730263us-gaap:AdditionalPaidInCapitalMember2022-07-310000730263us-gaap:RetainedEarningsMember2022-07-310000730263us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-07-310000730263us-gaap:TreasuryStockCommonMember2022-07-310000730263us-gaap:ParentMember2022-07-310000730263us-gaap:NoncontrollingInterestMember2022-07-310000730263us-gaap:RetainedEarningsMember2022-08-012022-10-310000730263us-gaap:ParentMember2022-08-012022-10-310000730263us-gaap:NoncontrollingInterestMember2022-08-012022-10-310000730263us-gaap:TreasuryStockCommonMember2022-08-012022-10-310000730263us-gaap:CommonStockMember2022-08-012022-10-310000730263us-gaap:AdditionalPaidInCapitalMember2022-08-012022-10-310000730263us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-08-012022-10-310000730263us-gaap:CommonStockMember2022-10-310000730263us-gaap:AdditionalPaidInCapitalMember2022-10-310000730263us-gaap:RetainedEarningsMember2022-10-310000730263us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-10-310000730263us-gaap:TreasuryStockCommonMember2022-10-310000730263us-gaap:ParentMember2022-10-310000730263us-gaap:NoncontrollingInterestMember2022-10-31tho:segment0000730263srt:NorthAmericaMemberus-gaap:OperatingSegmentsMembertho:NorthAmericanTowableRecreationalVehiclesMember2023-08-012023-10-310000730263srt:NorthAmericaMemberus-gaap:OperatingSegmentsMembertho:NorthAmericanTowableRecreationalVehiclesMember2022-08-012022-10-310000730263srt:NorthAmericaMembertho:NorthAmericanMotorizedRecreationalVehiclesMemberus-gaap:OperatingSegmentsMember2023-08-012023-10-310000730263srt:NorthAmericaMembertho:NorthAmericanMotorizedRecreationalVehiclesMemberus-gaap:OperatingSegmentsMember2022-08-012022-10-310000730263srt:NorthAmericaMemberus-gaap:OperatingSegmentsMember2023-08-012023-10-310000730263srt:NorthAmericaMemberus-gaap:OperatingSegmentsMember2022-08-012022-10-310000730263srt:EuropeMemberus-gaap:OperatingSegmentsMembertho:EuropeanRecreationalVehiclesMember2023-08-012023-10-310000730263srt:EuropeMemberus-gaap:OperatingSegmentsMembertho:EuropeanRecreationalVehiclesMember2022-08-012022-10-310000730263us-gaap:OperatingSegmentsMember2023-08-012023-10-310000730263us-gaap:OperatingSegmentsMember2022-08-012022-10-310000730263us-gaap:MaterialReconcilingItemsMember2023-08-012023-10-310000730263us-gaap:MaterialReconcilingItemsMember2022-08-012022-10-310000730263us-gaap:IntersegmentEliminationMember2023-08-012023-10-310000730263us-gaap:IntersegmentEliminationMember2022-08-012022-10-310000730263us-gaap:CorporateNonSegmentMember2023-08-012023-10-310000730263us-gaap:CorporateNonSegmentMember2022-08-012022-10-310000730263srt:NorthAmericaMemberus-gaap:OperatingSegmentsMembertho:NorthAmericanTowableRecreationalVehiclesMember2023-10-310000730263srt:NorthAmericaMemberus-gaap:OperatingSegmentsMembertho:NorthAmericanTowableRecreationalVehiclesMember2023-07-310000730263srt:NorthAmericaMembertho:NorthAmericanMotorizedRecreationalVehiclesMemberus-gaap:OperatingSegmentsMember2023-10-310000730263srt:NorthAmericaMembertho:NorthAmericanMotorizedRecreationalVehiclesMemberus-gaap:OperatingSegmentsMember2023-07-310000730263srt:NorthAmericaMemberus-gaap:OperatingSegmentsMember2023-10-310000730263srt:NorthAmericaMemberus-gaap:OperatingSegmentsMember2023-07-310000730263srt:EuropeMemberus-gaap:OperatingSegmentsMembertho:EuropeanRecreationalVehiclesMember2023-10-310000730263srt:EuropeMemberus-gaap:OperatingSegmentsMembertho:EuropeanRecreationalVehiclesMember2023-07-310000730263us-gaap:OperatingSegmentsMember2023-10-310000730263us-gaap:OperatingSegmentsMember2023-07-310000730263us-gaap:MaterialReconcilingItemsMember2023-10-310000730263us-gaap:MaterialReconcilingItemsMember2023-07-310000730263us-gaap:CorporateNonSegmentMember2023-10-310000730263us-gaap:CorporateNonSegmentMember2023-07-310000730263us-gaap:InterestRateSwapMemberus-gaap:NondesignatedMember2023-08-012023-10-310000730263us-gaap:InterestRateSwapMemberus-gaap:NondesignatedMember2022-08-012022-10-310000730263us-gaap:NondesignatedMember2023-08-012023-10-310000730263us-gaap:NondesignatedMember2022-08-012022-10-310000730263us-gaap:InterestRateSwapMember2023-08-012023-10-310000730263us-gaap:InterestRateSwapMember2022-08-012022-10-310000730263us-gaap:CashFlowHedgingMemberus-gaap:ForeignExchangeForwardMemberus-gaap:SalesMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-08-012023-10-310000730263us-gaap:CashFlowHedgingMemberus-gaap:InterestExpenseMemberus-gaap:ForeignExchangeForwardMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-08-012023-10-310000730263us-gaap:CashFlowHedgingMemberus-gaap:ForeignExchangeForwardMemberus-gaap:SalesMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-08-012022-10-310000730263us-gaap:CashFlowHedgingMemberus-gaap:InterestExpenseMemberus-gaap:ForeignExchangeForwardMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-08-012022-10-310000730263us-gaap:CashFlowHedgingMemberus-gaap:InterestRateSwapMemberus-gaap:SalesMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-08-012023-10-310000730263us-gaap:CashFlowHedgingMemberus-gaap:InterestRateSwapMemberus-gaap:InterestExpenseMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-08-012023-10-310000730263us-gaap:CashFlowHedgingMemberus-gaap:InterestRateSwapMemberus-gaap:SalesMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-08-012022-10-310000730263us-gaap:CashFlowHedgingMemberus-gaap:InterestRateSwapMemberus-gaap:InterestExpenseMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-08-012022-10-310000730263us-gaap:ForeignExchangeForwardMemberus-gaap:SalesMember2023-08-012023-10-310000730263us-gaap:InterestExpenseMemberus-gaap:ForeignExchangeForwardMember2023-08-012023-10-310000730263us-gaap:ForeignExchangeForwardMemberus-gaap:SalesMember2022-08-012022-10-310000730263us-gaap:InterestExpenseMemberus-gaap:ForeignExchangeForwardMember2022-08-012022-10-310000730263us-gaap:CommodityContractMemberus-gaap:SalesMember2023-08-012023-10-310000730263us-gaap:CommodityContractMemberus-gaap:InterestExpenseMember2023-08-012023-10-310000730263us-gaap:CommodityContractMemberus-gaap:SalesMember2022-08-012022-10-310000730263us-gaap:CommodityContractMemberus-gaap:InterestExpenseMember2022-08-012022-10-310000730263us-gaap:InterestRateSwapMemberus-gaap:SalesMember2023-08-012023-10-310000730263us-gaap:InterestRateSwapMemberus-gaap:InterestExpenseMember2023-08-012023-10-310000730263us-gaap:InterestRateSwapMemberus-gaap:SalesMember2022-08-012022-10-310000730263us-gaap:InterestRateSwapMemberus-gaap:InterestExpenseMember2022-08-012022-10-310000730263us-gaap:SalesMember2023-08-012023-10-310000730263us-gaap:InterestExpenseMember2023-08-012023-10-310000730263us-gaap:SalesMember2022-08-012022-10-310000730263us-gaap:InterestExpenseMember2022-08-012022-10-310000730263us-gaap:NondesignatedMember2023-10-310000730263us-gaap:NondesignatedMember2023-07-310000730263tho:RecreationVehiclesMember2023-10-310000730263tho:RecreationVehiclesMember2023-07-310000730263us-gaap:AllOtherSegmentsMember2023-10-310000730263us-gaap:AllOtherSegmentsMember2023-07-310000730263us-gaap:LandMember2023-10-310000730263us-gaap:LandMember2023-07-310000730263us-gaap:BuildingAndBuildingImprovementsMember2023-10-310000730263us-gaap:BuildingAndBuildingImprovementsMember2023-07-310000730263us-gaap:MachineryAndEquipmentMember2023-10-310000730263us-gaap:MachineryAndEquipmentMember2023-07-310000730263tho:RentalVehiclesMember2023-10-310000730263tho:RentalVehiclesMember2023-07-310000730263tho:DealerNetworkAndCustomerRelationshipsMember2023-10-310000730263tho:DealerNetworkAndCustomerRelationshipsMember2023-07-310000730263us-gaap:TrademarksMember2023-10-310000730263us-gaap:TrademarksMember2023-07-310000730263tho:DesignTechnologyAndOtherIntangiblesMember2023-10-310000730263tho:DesignTechnologyAndOtherIntangiblesMember2023-07-310000730263us-gaap:NoncompeteAgreementsMember2023-10-310000730263us-gaap:NoncompeteAgreementsMember2023-07-310000730263srt:NorthAmericaMembertho:TowablesMembertho:RecreationVehiclesMember2023-07-310000730263srt:NorthAmericaMembertho:MotorizedMembertho:RecreationVehiclesMember2023-07-310000730263srt:EuropeMembertho:RecreationVehiclesMember2023-07-310000730263srt:NorthAmericaMembertho:TowablesMembertho:RecreationVehiclesMember2023-08-012023-10-310000730263srt:NorthAmericaMembertho:MotorizedMembertho:RecreationVehiclesMember2023-08-012023-10-310000730263srt:EuropeMembertho:RecreationVehiclesMember2023-08-012023-10-310000730263us-gaap:AllOtherSegmentsMember2023-08-012023-10-310000730263srt:NorthAmericaMembertho:TowablesMembertho:RecreationVehiclesMember2023-10-310000730263srt:NorthAmericaMembertho:MotorizedMembertho:RecreationVehiclesMember2023-10-310000730263srt:EuropeMembertho:RecreationVehiclesMember2023-10-310000730263srt:NorthAmericaMembertho:TowablesMembertho:RecreationVehiclesMember2022-07-310000730263srt:NorthAmericaMembertho:MotorizedMembertho:RecreationVehiclesMember2022-07-310000730263srt:EuropeMembertho:RecreationVehiclesMember2022-07-310000730263us-gaap:AllOtherSegmentsMember2022-07-310000730263srt:NorthAmericaMembertho:TowablesMembertho:RecreationVehiclesMember2022-08-012022-10-310000730263srt:NorthAmericaMembertho:MotorizedMembertho:RecreationVehiclesMember2022-08-012022-10-310000730263srt:EuropeMembertho:RecreationVehiclesMember2022-08-012022-10-310000730263us-gaap:AllOtherSegmentsMember2022-08-012022-10-310000730263srt:NorthAmericaMembertho:TowablesMembertho:RecreationVehiclesMember2022-10-310000730263srt:NorthAmericaMembertho:MotorizedMembertho:RecreationVehiclesMember2022-10-310000730263srt:EuropeMembertho:RecreationVehiclesMember2022-10-310000730263us-gaap:AllOtherSegmentsMember2022-10-310000730263tho:TNRPHoldingLLCMembertho:ClassARPUnitsMember2022-12-30xbrli:pure0000730263tho:TNRPHoldingLLCMembertho:TechNexusMembertho:ClassCRPUnitsMember2022-12-300000730263tho:TNRPHoldingLLCMember2023-10-310000730263tho:TNRPHoldingLLCMember2023-07-310000730263us-gaap:SalesRevenueNetMembertho:FreedomRoadsMemberus-gaap:CustomerConcentrationRiskMember2023-08-012023-10-310000730263us-gaap:SalesRevenueNetMembertho:FreedomRoadsMemberus-gaap:CustomerConcentrationRiskMember2022-08-012022-10-310000730263us-gaap:AccountsReceivableMembertho:FreedomRoadsMemberus-gaap:CustomerConcentrationRiskMember2023-08-012023-10-310000730263us-gaap:AccountsReceivableMembertho:FreedomRoadsMemberus-gaap:CustomerConcentrationRiskMember2022-08-012023-07-310000730263us-gaap:FairValueInputsLevel1Member2023-10-310000730263us-gaap:FairValueInputsLevel1Member2023-07-310000730263us-gaap:FairValueInputsLevel2Member2023-10-310000730263us-gaap:FairValueInputsLevel2Member2023-07-310000730263tho:TermOfProductWarrantyOneMember2023-08-012023-10-310000730263tho:TermOfProductWarrantyTwoMember2023-08-012023-10-310000730263tho:TermLoanMember2023-10-310000730263tho:TermLoanMember2023-07-310000730263us-gaap:UnsecuredDebtMembertho:SeniorUnsecuredNotesDue2029Member2023-10-310000730263us-gaap:UnsecuredDebtMembertho:SeniorUnsecuredNotesDue2029Member2023-07-310000730263tho:AssetBasedCreditFacilityMember2021-09-010000730263tho:TermLoanMembertho:SecuredOvernightFinancingRateSOFRMembertho:UsTrancheMember2023-10-310000730263tho:TermLoanMembertho:SecuredOvernightFinancingRateSOFRMembertho:UsTrancheMember2023-07-310000730263tho:TermLoanMembertho:EuroTrancheMember2023-10-310000730263tho:TermLoanMembertho:EuroTrancheMember2023-07-310000730263tho:AssetBasedCreditFacilityMember2023-10-310000730263tho:AssetBasedCreditFacilityMember2023-07-310000730263us-gaap:UnsecuredDebtMembertho:SeniorUnsecuredNotesDue2029Member2021-10-14iso4217:EUR0000730263tho:UnsecuredSeriesOneDebtMember2023-10-310000730263tho:UnsecuredSeriesTwoDebtMember2023-10-310000730263tho:OtherLongTermDebtMembersrt:MinimumMember2023-10-310000730263tho:OtherLongTermDebtMembersrt:MaximumMember2023-10-310000730263us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-08-012023-10-310000730263us-gaap:SellingGeneralAndAdministrativeExpensesMember2022-08-012022-10-310000730263tho:DecemberTwentyTwentyOneShareRepurchasePlanMember2021-12-210000730263tho:JuneTwentyTwentyTwoShareRepurchasePlanMember2022-06-2400007302632021-12-212023-10-310000730263tho:DecemberTwentyTwentyOneShareRepurchasePlanMember2023-10-310000730263tho:JuneTwentyTwentyTwoShareRepurchasePlanMember2023-10-310000730263srt:NorthAmericaMemberus-gaap:OperatingSegmentsMembertho:TravelTrailersMembertho:RecreationVehiclesMember2023-08-012023-10-310000730263srt:NorthAmericaMemberus-gaap:OperatingSegmentsMembertho:TravelTrailersMembertho:RecreationVehiclesMember2022-08-012022-10-310000730263srt:NorthAmericaMemberus-gaap:OperatingSegmentsMembertho:RecreationVehiclesMembertho:FifthWheelsTowablesMember2023-08-012023-10-310000730263srt:NorthAmericaMemberus-gaap:OperatingSegmentsMembertho:RecreationVehiclesMembertho:FifthWheelsTowablesMember2022-08-012022-10-310000730263srt:NorthAmericaMembertho:TowablesMemberus-gaap:OperatingSegmentsMembertho:RecreationVehiclesMember2023-08-012023-10-310000730263srt:NorthAmericaMembertho:TowablesMemberus-gaap:OperatingSegmentsMembertho:RecreationVehiclesMember2022-08-012022-10-310000730263srt:NorthAmericaMemberus-gaap:OperatingSegmentsMembertho:ClassaMotorizedMembertho:RecreationVehiclesMember2023-08-012023-10-310000730263srt:NorthAmericaMemberus-gaap:OperatingSegmentsMembertho:ClassaMotorizedMembertho:RecreationVehiclesMember2022-08-012022-10-310000730263srt:NorthAmericaMembertho:ClasscMotorizedMemberus-gaap:OperatingSegmentsMembertho:RecreationVehiclesMember2023-08-012023-10-310000730263srt:NorthAmericaMembertho:ClasscMotorizedMemberus-gaap:OperatingSegmentsMembertho:RecreationVehiclesMember2022-08-012022-10-310000730263srt:NorthAmericaMembertho:ClassbMotorizedMemberus-gaap:OperatingSegmentsMembertho:RecreationVehiclesMember2023-08-012023-10-310000730263srt:NorthAmericaMembertho:ClassbMotorizedMemberus-gaap:OperatingSegmentsMembertho:RecreationVehiclesMember2022-08-012022-10-310000730263srt:NorthAmericaMembertho:MotorizedMemberus-gaap:OperatingSegmentsMembertho:RecreationVehiclesMember2023-08-012023-10-310000730263srt:NorthAmericaMembertho:MotorizedMemberus-gaap:OperatingSegmentsMembertho:RecreationVehiclesMember2022-08-012022-10-310000730263srt:NorthAmericaMemberus-gaap:OperatingSegmentsMembertho:RecreationVehiclesMember2023-08-012023-10-310000730263srt:NorthAmericaMemberus-gaap:OperatingSegmentsMembertho:RecreationVehiclesMember2022-08-012022-10-310000730263srt:EuropeMemberus-gaap:OperatingSegmentsMembertho:MotorcaravanMembertho:RecreationVehiclesMember2023-08-012023-10-310000730263srt:EuropeMemberus-gaap:OperatingSegmentsMembertho:MotorcaravanMembertho:RecreationVehiclesMember2022-08-012022-10-310000730263srt:EuropeMembertho:CampervanMemberus-gaap:OperatingSegmentsMembertho:RecreationVehiclesMember2023-08-012023-10-310000730263srt:EuropeMembertho:CampervanMemberus-gaap:OperatingSegmentsMembertho:RecreationVehiclesMember2022-08-012022-10-310000730263srt:EuropeMembertho:CaravanMemberus-gaap:OperatingSegmentsMembertho:RecreationVehiclesMember2023-08-012023-10-310000730263srt:EuropeMembertho:CaravanMemberus-gaap:OperatingSegmentsMembertho:RecreationVehiclesMember2022-08-012022-10-310000730263srt:EuropeMemberus-gaap:OperatingSegmentsMembertho:RecreationVehiclesMembertho:OtherRvRelatedMember2023-08-012023-10-310000730263srt:EuropeMemberus-gaap:OperatingSegmentsMembertho:RecreationVehiclesMembertho:OtherRvRelatedMember2022-08-012022-10-310000730263srt:EuropeMemberus-gaap:OperatingSegmentsMembertho:RecreationVehiclesMember2023-08-012023-10-310000730263srt:EuropeMemberus-gaap:OperatingSegmentsMembertho:RecreationVehiclesMember2022-08-012022-10-310000730263us-gaap:OperatingSegmentsMembertho:RecreationVehiclesMember2023-08-012023-10-310000730263us-gaap:OperatingSegmentsMembertho:RecreationVehiclesMember2022-08-012022-10-310000730263tho:CorporateAndEliminationsMember2023-08-012023-10-310000730263tho:CorporateAndEliminationsMember2022-08-012022-10-310000730263us-gaap:AccumulatedTranslationAdjustmentMember2023-07-310000730263us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-07-310000730263tho:AccumulatedOtherGainLossAttributableToParentMember2023-07-310000730263us-gaap:AociAttributableToNoncontrollingInterestMember2023-07-310000730263us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2023-07-310000730263us-gaap:AccumulatedTranslationAdjustmentMember2023-08-012023-10-310000730263us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-08-012023-10-310000730263tho:AccumulatedOtherGainLossAttributableToParentMember2023-08-012023-10-310000730263us-gaap:AociAttributableToNoncontrollingInterestMember2023-08-012023-10-310000730263us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2023-08-012023-10-310000730263us-gaap:AccumulatedTranslationAdjustmentMember2023-10-310000730263us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-10-310000730263tho:AccumulatedOtherGainLossAttributableToParentMember2023-10-310000730263us-gaap:AociAttributableToNoncontrollingInterestMember2023-10-310000730263us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2023-10-310000730263us-gaap:AccumulatedTranslationAdjustmentMember2022-07-310000730263us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-07-310000730263tho:AccumulatedOtherGainLossAttributableToParentMember2022-07-310000730263us-gaap:AociAttributableToNoncontrollingInterestMember2022-07-310000730263us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2022-07-310000730263us-gaap:AccumulatedTranslationAdjustmentMember2022-08-012022-10-310000730263us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-08-012022-10-310000730263tho:AccumulatedOtherGainLossAttributableToParentMember2022-08-012022-10-310000730263us-gaap:AociAttributableToNoncontrollingInterestMember2022-08-012022-10-310000730263us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2022-08-012022-10-310000730263us-gaap:AccumulatedTranslationAdjustmentMember2022-10-310000730263us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-10-310000730263tho:AccumulatedOtherGainLossAttributableToParentMember2022-10-310000730263us-gaap:AociAttributableToNoncontrollingInterestMember2022-10-310000730263us-gaap:AociIncludingPortionAttributableToNoncontrollingInterestMember2022-10-310000730263tho:TermLoanMemberus-gaap:SubsequentEventMembertho:UsTrancheMember2023-11-152023-11-150000730263tho:TermLoanMemberus-gaap:BaseRateMemberus-gaap:SubsequentEventMembertho:UsTrancheMember2023-11-152023-11-150000730263tho:TermLoanMembertho:SecuredOvernightFinancingRateSOFRMemberus-gaap:SubsequentEventMembertho:UsTrancheMember2023-11-152023-11-150000730263tho:TermLoanMemberus-gaap:SubsequentEventMembertho:UsTrancheMember2023-11-150000730263tho:TermLoanMemberus-gaap:SubsequentEventMembertho:EuroTrancheMember2023-11-150000730263us-gaap:SubsequentEventMembertho:AssetBasedCreditFacilityMember2023-11-150000730263tho:TermLoanAndAssetBasedCreditFacilityMembersrt:ScenarioForecastMember2023-11-012024-01-310000730263tho:ToddWoelferMember2023-08-012023-10-310000730263tho:ToddWoelferMember2023-10-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

☑ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 for the quarterly period ended October 31, 2023.

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 for the transition period from ____ to ____.

COMMISSION FILE NUMBER 001-09235

| | | | | | | | | | | | | | | | | | | | |

| THOR INDUSTRIES, INC. |

| (Exact name of registrant as specified in its charter) |

| | | | | | |

| Delaware | | | 93-0768752 |

| (State or other jurisdiction of | | (I.R.S. Employer |

| incorporation or organization) | | Identification No.) |

| | | | |

601 E. Beardsley Ave., Elkhart, IN | | 46514-3305 |

| (Address of principal executive offices) | | (Zip Code) |

| | | |

| | (574) 970-7460 | | |

| (Registrant’s telephone number, including area code) | |

| | | | |

| None | |

| (Former name, former address and former fiscal year, if changed since last report) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | Name of each exchange |

| Title of each class | | Trading Symbol(s) | | on which registered |

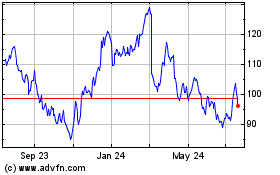

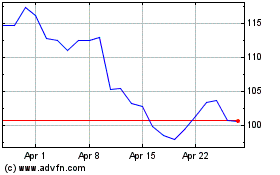

| Common stock (Par value $0.10 Per Share) | | THO | | New York Stock Exchange |

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Yes ☑ No ☐

Indicate by check mark whether the registrant has submitted electronically, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Yes ☑ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☑ Accelerated filer ☐

Non-accelerated filer ☐ Smaller reporting company ☐

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act).

Yes ☐ No ☑

As of November 30, 2023, 53,323,337 shares of the registrant’s common stock, par value $0.10 per share, were outstanding.

PART I – FINANCIAL INFORMATION (Unless otherwise indicated, amounts in thousands except share and per share data.)

ITEM 1. FINANCIAL STATEMENTS

THOR INDUSTRIES, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS (UNAUDITED)

| | | | | | | | | | | |

| October 31, 2023 | | July 31, 2023 |

ASSETS | | | |

Current assets: | | | |

| Cash and cash equivalents | $ | 425,828 | | | $ | 441,232 | |

| | | |

| Accounts receivable, trade, net | 548,800 | | | 543,865 | |

| | | |

| Accounts receivable, other, net | 67,819 | | | 99,354 | |

| Inventories, net | 1,714,229 | | | 1,653,070 | |

| Prepaid income taxes, expenses and other | 48,853 | | | 56,059 | |

| | | |

| Total current assets | 2,805,529 | | | 2,793,580 | |

| Property, plant and equipment, net | 1,377,647 | | | 1,387,808 | |

Other assets: | | | |

| Goodwill | 1,768,777 | | | 1,800,422 | |

| Amortizable intangible assets, net | 950,495 | | | 996,979 | |

| Deferred income tax assets, net | 2,586 | | | 5,770 | |

| Equity investments | 130,100 | | | 126,909 | |

| Other | 137,339 | | | 149,362 | |

| Total other assets | 2,989,297 | | | 3,079,442 | |

TOTAL ASSETS | $ | 7,172,473 | | | $ | 7,260,830 | |

| | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

Current liabilities: | | | |

| Accounts payable | $ | 748,922 | | | $ | 736,275 | |

| Current portion of long-term debt | 10,952 | | | 11,368 | |

| Short-term financial obligations | 58,820 | | | 49,433 | |

| Accrued liabilities: | | | |

Compensation and related items | 203,639 | | | 189,324 | |

Product warranties | 333,274 | | | 345,197 | |

Income and other taxes | 100,149 | | | 100,631 | |

Promotions and rebates | 135,723 | | | 163,410 | |

| Product, property and related liabilities | 43,025 | | | 54,720 | |

| Dividends payable | 25,539 | | | — | |

| | | |

Other | 56,755 | | | 66,124 | |

| | | |

| Total current liabilities | 1,716,798 | | | 1,716,482 | |

| Long-term debt | 1,271,877 | | | 1,291,311 | |

| Deferred income tax liabilities, net | 76,498 | | | 75,668 | |

| Unrecognized tax benefits | 15,240 | | | 14,835 | |

| Other liabilities | 168,470 | | | 179,136 | |

| Total long-term liabilities | 1,532,085 | | | 1,560,950 | |

Contingent liabilities and commitments | | | |

Stockholders’ equity: | | | |

Preferred stock – authorized 1,000,000 shares; none outstanding | — | | | — | |

Common stock – par value of $.10 per share; authorized 250,000,000 shares; issued 66,686,498 and 66,344,340 shares, respectively | 6,669 | | | 6,634 | |

| Additional paid-in capital | 551,491 | | | 539,032 | |

| Retained earnings | 4,119,589 | | | 4,091,563 | |

| Accumulated other comprehensive loss, net of tax | (128,471) | | | (68,547) | |

Less: Treasury shares of 13,480,026 and 13,030,030, respectively, at cost | (633,817) | | | (592,667) | |

| Stockholders’ equity attributable to THOR Industries, Inc. | 3,915,461 | | | 3,976,015 | |

| Non-controlling interests | 8,129 | | | 7,383 | |

| Total stockholders’ equity | 3,923,590 | | | 3,983,398 | |

TOTAL LIABILITIES AND STOCKHOLDERS’ EQUITY | $ | 7,172,473 | | | $ | 7,260,830 | |

See Notes to the Condensed Consolidated Financial Statements.

THOR INDUSTRIES, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE INCOME (UNAUDITED)

| | | | | | | | | | | |

| Three Months Ended October 31, |

| 2023 | | 2022 |

Net sales | $ | 2,500,759 | | | $ | 3,108,084 | |

| Cost of products sold | 2,142,827 | | | 2,621,608 | |

| Gross profit | 357,932 | | | 486,476 | |

| Selling, general and administrative expenses | 217,896 | | | 241,624 | |

Amortization of intangible assets | 32,344 | | | 35,219 | |

| | | |

| | | |

| Interest expense, net | 20,197 | | | 22,807 | |

| Other income (expense), net | (14,913) | | | (7,555) | |

| Income before income taxes | 72,582 | | | 179,271 | |

| Income tax provision | 17,549 | | | 41,848 | |

| Net income | 55,033 | | | 137,423 | |

| Less: Net income attributable to non-controlling interests | 1,468 | | | 1,238 | |

| Net income attributable to THOR Industries, Inc. | $ | 53,565 | | | $ | 136,185 | |

| | | |

| Weighted-average common shares outstanding: | | | |

| Basic | 53,295,835 | | | 53,656,415 | |

| Diluted | 53,853,719 | | | 53,928,751 | |

| | | |

Earnings per common share: | | | |

| Basic | $ | 1.01 | | | $ | 2.54 | |

| Diluted | $ | 0.99 | | | $ | 2.53 | |

| | | |

| | | |

| | | |

| | | |

| Comprehensive income (loss): | | | |

| Net income | $ | 55,033 | | | $ | 137,423 | |

Other comprehensive income (loss), net of tax | | | |

| Foreign currency translation gain (loss), net of tax | (60,646) | | | (43,329) | |

| Unrealized gain on derivatives, net of tax | — | | | 804 | |

| | | |

| Total other comprehensive income (loss), net of tax | (60,646) | | | (42,525) | |

| Total Comprehensive income (loss) | (5,613) | | | 94,898 | |

| Less: Comprehensive income (loss) attributable to non-controlling interests | 746 | | | 804 | |

| Comprehensive income (loss) attributable to THOR Industries, Inc. | $ | (6,359) | | | $ | 94,094 | |

See Notes to the Condensed Consolidated Financial Statements.

THOR INDUSTRIES, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (UNAUDITED)

| | | | | | | | | | | |

| Three Months Ended October 31, |

| 2023 | | 2022 |

| Cash flows from operating activities: | | | |

| Net income | $ | 55,033 | | | $ | 137,423 | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | |

| Depreciation | 34,934 | | | 31,774 | |

| Amortization of intangible assets | 32,344 | | | 35,219 | |

| Amortization of debt issuance costs | 2,872 | | | 2,835 | |

| | | |

| | | |

| Deferred income tax expense (benefit) | 2,417 | | | (1,920) | |

| (Gain) loss on disposition of property, plant and equipment | 49 | | | (141) | |

| Stock-based compensation expense | 10,452 | | | 8,392 | |

| Changes in assets and liabilities: | | | |

| Accounts receivable | 20,979 | | | 131,483 | |

| Inventories | (94,527) | | | (116,151) | |

| Prepaid income taxes, expenses and other | 23,839 | | | 17,345 | |

| Accounts payable | 25,150 | | | (141,934) | |

| | | |

| Accrued liabilities | (46,438) | | | (8,047) | |

| Long-term liabilities and other | (7,436) | | | (2,262) | |

| Net cash provided by operating activities | 59,668 | | | 94,016 | |

| Cash flows from investing activities: | | | |

| Purchases of property, plant and equipment | (38,211) | | | (55,883) | |

| Proceeds from dispositions of property, plant and equipment | 275 | | | 2,935 | |

| Business acquisitions, net of cash acquired | (4,000) | | | — | |

| | | |

| | | |

| Other | (9,126) | | | (5,000) | |

| Net cash used in investing activities | (51,062) | | | (57,948) | |

| Cash flows from financing activities: | | | |

| | | |

| Borrowings on revolving asset-based credit facilities | 53,449 | | | — | |

| Payments on revolving asset-based credit facilities | (51,925) | | | (15,000) | |

| | | |

| Payments on term-loan credit facilities | — | | | (12,355) | |

| | | |

| Payments on other debt | (1,767) | | | (2,714) | |

| | | |

| | | |

| Payments on finance lease obligations | (180) | | | (310) | |

| Purchase of treasury shares | (30,037) | | | (25,407) | |

| | | |

| Short-term financial obligations and other, net | 11,307 | | | 2,537 | |

| Net cash used in financing activities | (19,153) | | | (53,249) | |

| Effect of exchange rate changes on cash and cash equivalents | (4,857) | | | (2,668) | |

| Net decrease in cash and cash equivalents | (15,404) | | | (19,849) | |

| Cash and cash equivalents, beginning of period | 441,232 | | | 311,553 | |

| | | |

| | | |

| Cash and cash equivalents, end of period | $ | 425,828 | | | $ | 291,704 | |

| Supplemental cash flow information: | | | |

| Income taxes paid | $ | 7,153 | | | $ | 17,174 | |

| Interest paid | $ | 26,203 | | | $ | 25,786 | |

| Non-cash investing and financing transactions: | | | |

| Capital expenditures in accounts payable | $ | 7,427 | | | $ | 2,940 | |

| Quarterly dividends payable | $ | 25,539 | | | $ | 24,081 | |

| | | |

| | | |

See Notes to the Condensed Consolidated Financial Statements.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| THOR INDUSTRIES, INC. AND SUBSIDIARIES |

| CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY |

FOR THE THREE MONTHS ENDED OCTOBER 31, 2023 AND 2022 (UNAUDITED) |

| | | | | | | | | | |

| Three Months Ended October 31, 2023 |

| | | | | Accumulated | | | Stockholders’ | | |

| | | Additional | | Other | | | Equity | Non- | Total |

| Common Stock | Paid-In | Retained | Comprehensive | Treasury Stock | Attributable | controlling | Stockholders’ |

| Shares | Amount | Capital | Earnings | Income (Loss) | Shares | Amount | to THOR | Interests | Equity |

| Balance at August 1, 2023 | 66,344,340 | | $ | 6,634 | | $ | 539,032 | | $ | 4,091,563 | | $ | (68,547) | | 13,030,030 | | $ | (592,667) | | $ | 3,976,015 | | $ | 7,383 | | $ | 3,983,398 | |

| Net income | — | | — | | — | | 53,565 | | — | | — | | — | | 53,565 | | 1,468 | | 55,033 | |

| Purchase of treasury shares | — | | — | | — | | — | | — | | 327,876 | | (30,037) | | (30,037) | | — | | (30,037) | |

| Restricted stock unit activity | 342,158 | | 35 | | 2,007 | | — | | — | | 122,120 | | (11,113) | | (9,071) | | — | | (9,071) | |

Dividends $0.48 per common share | — | | — | | — | | (25,539) | | — | | — | | — | | (25,539) | | — | | (25,539) | |

| Stock-based compensation expense | — | | — | | 10,452 | | — | | — | | — | | — | | 10,452 | | — | | 10,452 | |

| Other comprehensive income (loss) | — | | — | | — | | — | | (59,924) | | — | | — | | (59,924) | | (722) | | (60,646) | |

| | | | | | | | | | |

| | | | | | | | | | |

| Balance at October 31, 2023 | 66,686,498 | | $ | 6,669 | | $ | 551,491 | | $ | 4,119,589 | | $ | (128,471) | | 13,480,026 | | $ | (633,817) | | $ | 3,915,461 | | $ | 8,129 | | $ | 3,923,590 | |

| | | | | | | | | | |

| |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

|

|

|

| | | | | | | | | | |

| Three Months Ended October 31, 2022 |

| | | | | Accumulated | | | Stockholders’ | | |

| | | Additional | | Other | | | Equity | Non- | Total |

| Common Stock | Paid-In | Retained | Comprehensive | Treasury Stock | Attributable | controlling | Stockholders’ |

| Shares | Amount | Capital | Earnings | Income (Loss) | Shares | Amount | to THOR | Interests | Equity |

| Balance at August 1, 2022 | 66,059,403 | | $ | 6,606 | | $ | 497,946 | | $ | 3,813,261 | | $ | (181,607) | | 12,382,441 | | $ | (543,344) | | $ | 3,592,862 | | $ | 7,792 | | $ | 3,600,654 | |

| Net income | — | | — | | — | | 136,185 | | — | | — | | — | | 136,185 | | 1,238 | | 137,423 | |

| Purchase of treasury shares | — | | — | | — | | — | | — | | 338,733 | | (25,407) | | (25,407) | | — | | (25,407) | |

| Restricted stock unit activity | 266,732 | | 27 | | 3,241 | | — | | — | | 91,845 | | (6,765) | | (3,497) | | — | | (3,497) | |

Dividends $0.45 per common share | — | | — | | — | | (24,081) | | — | | — | | — | | (24,081) | | — | | (24,081) | |

| Stock-based compensation expense | — | | — | | 8,392 | | — | | — | | — | | — | | 8,392 | | — | | 8,392 | |

| Other comprehensive income (loss) | — | | — | | — | | — | | (42,091) | | — | | — | | (42,091) | | (434) | | (42,525) | |

| | | | | | | | | | |

| | | | | | | | | | |

| Balance at October 31, 2022 | 66,326,135 | | $ | 6,633 | | $ | 509,579 | | $ | 3,925,365 | | $ | (223,698) | | 12,813,019 | | $ | (575,516) | | $ | 3,642,363 | | $ | 8,596 | | $ | 3,650,959 | |

| | | | | | | | | | |

| |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

See Notes to the Condensed Consolidated Financial Statements.

NOTES TO THE CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (UNAUDITED)

(All U.S. Dollar and Euro amounts presented in thousands except share and per share data or except as otherwise specified)

1. Nature of Operations and Accounting Policies

Nature of Operations

THOR Industries, Inc. was founded in 1980 and is the sole owner of operating subsidiaries (collectively, the “Company” or “THOR”), that, combined, represent the world's largest manufacturer of recreational vehicles (“RVs”). The Company manufactures a wide variety of RVs primarily in the United States and Europe and sells those vehicles, as well as related parts and accessories, primarily to independent, non-franchise dealers throughout the United States, Canada and Europe. Unless the context requires or indicates otherwise, all references to “THOR,” the “Company,” “we,” “our” and “us” refer to THOR Industries, Inc. and its subsidiaries.

The July 31, 2023 amounts are derived from the annual audited financial statements of THOR. The interim financial statements are unaudited. In the opinion of management, all adjustments (which consist of normal, recurring adjustments) necessary to present fairly the financial position, results of operations and cash flows for the interim periods presented have been made. These financial statements should be read in conjunction with the Company’s Annual Report on Form 10-K for the fiscal year ended July 31, 2023. Due to seasonality within the recreational vehicle industry, the impact of the ongoing supply chain disruptions primarily in Europe, inflation and shifting consumer demand on our industry, among other factors, annualizing the results of operations for the three months ended October 31, 2023 would not necessarily be indicative of the results expected for the full fiscal year.

2. Business Segments

The Company has three reportable segments, all related to recreational vehicles: (1) North American Towable Recreational Vehicles, (2) North American Motorized Recreational Vehicles and (3) European Recreational Vehicles. The operations of the Company's Airxcel and Postle subsidiaries are included in “Other”. Net sales included in Other relate primarily to the sale of specialized component parts and aluminum extrusions. Intercompany eliminations adjust for Airxcel and Postle sales to the Company’s North American Towable and North American Motorized segments, which are consummated at established transfer prices generally consistent with the selling prices of products to third parties.

The following tables reflect certain financial information by reportable segment:

| | | | | | | | | | | | | | | |

| | | Three Months Ended October 31, |

| NET SALES: | | | | | 2023 | | 2022 |

| Recreational vehicles | | | | | | | |

| North American Towable | | | | | $ | 945,454 | | $ | 1,317,806 |

| North American Motorized | | | | | 711,159 | | 1,123,519 |

| Total North America | | | | | 1,656,613 | | 2,441,325 |

| European | | | | | 708,201 | | 504,302 |

| Total recreational vehicles | | | | | 2,364,814 | | 2,945,627 |

| Other | | | | | 198,921 | | 232,648 |

| Intercompany eliminations | | | | | (62,976) | | (70,191) |

| Total | | | | | $ | 2,500,759 | | $ | 3,108,084 |

| | | | | | | | | | | | | | | |

| | | Three Months Ended October 31, |

| INCOME (LOSS) BEFORE INCOME TAXES: | | | | | 2023 | | 2022 |

| | | | | | | |

| Recreational vehicles | | | | | | | |

| North American Towable | | | | | $ | 49,249 | | $ | 111,007 |

| North American Motorized | | | | | 37,052 | | 124,433 |

| Total North America | | | | | 86,301 | | 235,440 |

| European | | | | | 28,767 | | (6,468) |

| Total recreational vehicles | | | | | 115,068 | | 228,972 |

| Other, net | | | | | 9,476 | | 4,745 |

| Corporate | | | | | (51,962) | | (54,446) |

| Total | | | | | $ | 72,582 | | $ | 179,271 |

| | | | | | | | | | | | | | | |

| TOTAL ASSETS: | October 31, 2023 | | July 31, 2023 | | | | |

| Recreational vehicles | | | | | | | |

| North American Towable | $ | 1,442,405 | | $ | 1,429,899 | | | | |

| North American Motorized | 1,269,984 | | 1,268,109 | | | | |

| Total North America | 2,712,389 | | 2,698,008 | | | | |

| European | 2,787,150 | | 2,898,175 | | | | |

| Total recreational vehicles | 5,499,539 | | 5,596,183 | | | | |

| Other | 1,032,989 | | 1,048,076 | | | | |

| Corporate | 639,945 | | 616,571 | | | | |

| Total | $ | 7,172,473 | | $ | 7,260,830 | | | | |

| | | | | | | | | | | | | | | |

| DEPRECIATION AND INTANGIBLE ASSET AMORTIZATION EXPENSE: | | | Three Months Ended October 31, |

| | | | 2023 | | 2022 |

| Recreational vehicles | | | | | | | |

| North American Towable | | | | | $ | 13,764 | | $ | 15,437 |

| North American Motorized | | | | | 8,942 | | 8,161 |

| Total North America | | | | | 22,706 | | 23,598 |

| European | | | | | 30,397 | | 27,302 |

| Total recreational vehicles | | | | | 53,103 | | 50,900 |

Other | | | | | 13,626 | | 15,648 |

Corporate | | | | | 549 | | 445 |

| Total | | | | | $ | 67,278 | | $ | 66,993 |

| | | | | | | | | | | | | | | |

| | | Three Months Ended October 31, |

| CAPITAL ACQUISITIONS: | | | | | 2023 | | 2022 |

| Recreational vehicles | | | | | | | |

| North American Towable | | | | | $ | 6,930 | | $ | 21,174 |

| North American Motorized | | | | | 7,475 | | 19,064 |

| Total North America | | | | | 14,405 | | 40,238 |

| European | | | | | 14,760 | | 8,920 |

| Total recreational vehicles | | | | | 29,165 | | 49,158 |

Other | | | | | 8,291 | | 4,812 |

Corporate | | | | | 2,735 | | 120 |

| Total | | | | | $ | 40,191 | | $ | 54,090 |

3. Earnings Per Common Share

The following table reflects the weighted-average common shares used to compute basic and diluted earnings per common share as included on the Condensed Consolidated Statements of Income and Comprehensive Income:

| | | | | | | | | | | | | | | |

| | | Three Months Ended October 31, |

| | | | | 2023 | | 2022 |

Weighted-average common shares outstanding for basic earnings per share | | | | | 53,295,835 | | | 53,656,415 | |

| Unvested restricted stock units and performance stock units | | | | | 557,884 | | | 272,336 | |

Weighted-average common shares outstanding assuming dilution | | | | | 53,853,719 | | | 53,928,751 | |

The Company excluded 51,298 and 204,441 unvested restricted stock units and performance stock units that have an antidilutive effect from its calculation of weighted-average common shares outstanding assuming dilution at October 31, 2023 and October 31, 2022, respectively.

4. Derivatives and Hedging

The total amounts presented in the Condensed Consolidated Statements of Income and Comprehensive Income due to changes in the fair value of the derivative instruments are as follows:

| | | | | | | | | | | | | | |

| | Three Months Ended October 31, |

| | 2023 | | 2022 |

| Gain (Loss) on Derivatives Designated as Cash Flow Hedges | | | | |

| | | | |

| Gain (Loss) recognized in Other Comprehensive Income (Loss), net of tax | | | | |

| | | | |

Interest rate swap agreements (1) | | $ | — | | | $ | 746 | |

| Total gain (loss) | | $ | — | | | $ | 746 | |

(1)Other comprehensive income (loss), net of tax, before reclassification from accumulated other comprehensive income (“AOCI”) was $0 and $854 for the three months ended October 31, 2023 and 2022, respectively.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended October 31, |

| | 2023 | | 2022 |

| | | | | Interest | | | | | Interest |

| | Sales | | | Expense | | Sales | | | Expense |

| Gain (Loss) Reclassified from AOCI, Net of Tax | | | | | | | | | | |

| Foreign currency forward contracts | | $ | — | | | | $ | — | | | $ | (58) | | | | $ | — | |

| Interest rate swap agreements | | — | | | | — | | | — | | | | 108 | |

| Gain (Loss) on Derivatives Not Designated as Hedging Instruments | | | | | | | | | | |

| Amount of gain (loss) recognized in income, net of tax | | | | | | | | | | |

| | | | | | | | | | |

| Foreign currency forward contracts | | $ | 157 | | | | $ | — | | | $ | 828 | | | | $ | — | |

| Commodities swap agreements | | — | | | | — | | | (662) | | | | — | |

| Interest rate swap agreements | | — | | | | 64 | | | — | | | | 254 | |

| Total gain (loss) | | $ | 157 | | | | $ | 64 | | | $ | 108 | | | | $ | 362 | |

As of October 31, 2023 and July 31, 2023 there were no derivative instruments designated as cash flow hedges. The Company has certain other derivative instruments which have not been designated as hedges. These other derivative instruments had a notional amount totaling approximately $35,878 and a fair value liability value of $643 as of October 31, 2023. These other derivative instruments had a notional amount totaling approximately $25,248 and a fair value liability of $932 as of July 31, 2023. For these derivative instruments, changes in fair value are recognized in earnings.

Net Investment Hedges

The foreign currency transaction gains and losses on the Euro-denominated portion of the term loan, which is designated and effective as a hedge of the Company’s net investment in its Euro-denominated functional currency subsidiaries, are included as a component of the foreign currency translation adjustment. Gains, net of tax, included in the foreign currency translation adjustments were $13,409 for the three months ended October 31, 2023 and $9,385 for the three months ended October 31, 2022.

There were no amounts reclassified out of AOCI pertaining to the net investment hedge during the three-month periods ended October 31, 2023 or October 31, 2022.

5. Inventories

Major classifications of inventories are as follows:

| | | | | | | | | | | |

| October 31, 2023 | | July 31, 2023 |

| Finished goods – RV | $ | 252,534 | | | $ | 164,456 | |

| Finished goods – other | 86,533 | | | 93,476 | |

| Work in process | 348,032 | | | 313,006 | |

| Raw materials | 517,116 | | | 563,614 | |

| Chassis | 672,618 | | | 681,122 | |

Subtotal | 1,876,833 | | | 1,815,674 | |

| Excess of FIFO costs over LIFO costs | (162,604) | | | (162,604) | |

| Total inventories, net | $ | 1,714,229 | | | $ | 1,653,070 | |

Of the $1,876,833 and $1,815,674 of inventories at October 31, 2023 and July 31, 2023, $1,267,808 and $1,224,069, respectively, were valued on the first-in, first-out (“FIFO”) method, and $609,025 and $591,605, respectively, were valued on the last-in, first-out (“LIFO”) method.

6. Property, Plant and Equipment

Property, plant and equipment consists of the following:

| | | | | | | | | | | |

| October 31, 2023 | | July 31, 2023 |

| Land | $ | 151,719 | | | $ | 147,633 | |

| Buildings and improvements | 1,047,989 | | | 1,038,394 | |

| Machinery and equipment | 671,351 | | | 672,499 | |

| Rental vehicles | 102,591 | | | 99,360 | |

| Lease right-of-use assets – operating | 45,200 | | | 47,969 | |

| Lease right-of-use assets – finance | 5,331 | | | 5,518 | |

| Total cost | 2,024,181 | | | 2,011,373 | |

| Less: Accumulated depreciation | (646,534) | | | (623,565) | |

| Property, plant and equipment, net | $ | 1,377,647 | | | $ | 1,387,808 | |

See Note 15 to the Condensed Consolidated Financial Statements for further information regarding the lease right-of-use assets.

7. Intangible Assets and Goodwill

The components of Amortizable intangible assets are as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | |

| | | October 31, 2023 | | July 31, 2023 |

| | | | | Accumulated | | | | Accumulated |

| | | Cost | | Amortization | | Cost | | Amortization |

Dealer networks/customer relationships | | | $ | 1,099,750 | | | $ | 542,468 | | | $ | 1,112,273 | | | $ | 526,327 | |

Trademarks | | | 351,075 | | | 99,552 | | | 355,560 | | | 96,087 | |

Design technology and other intangibles | | | 252,404 | | 110,772 | | 258,868 | | 107,483 |

| | | | | | | | | |

Non-compete agreements | | | 1,400 | | 1,342 | | 1,400 | | 1,225 |

Total amortizable intangible assets | | | $ | 1,704,629 | | | $ | 754,134 | | | $ | 1,728,101 | | | $ | 731,122 | |

Estimated future amortization expense is as follows:

| | | | | |

| For the remainder of the fiscal year ending July 31, 2024 | $ | 96,360 |

| For the fiscal year ending July 31, 2025 | 116,771 |

| For the fiscal year ending July 31, 2026 | 105,577 |

| For the fiscal year ending July 31, 2027 | 96,923 |

| For the fiscal year ending July 31, 2028 | 89,602 |

| For the fiscal year ending July 31, 2029 and thereafter | 445,262 |

| $ | 950,495 |

Changes in the carrying amount of Goodwill by reportable segment for the three months ended October 31, 2023 are summarized as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| North American Towable | | North American Motorized | | European | | Other | | Total |

| Net balance as of August 1, 2023 | $ | 337,883 | | | $ | 65,064 | | | $ | 965,758 | | | $ | 431,717 | | | $ | 1,800,422 | |

| Fiscal 2024 activity: | | | | | | | | | |

| Goodwill acquired | — | | | — | | | — | | | 3,751 | | | 3,751 | |

| | | | | | | | | |

| Foreign currency translation | — | | | — | | | (35,396) | | | — | | | (35,396) | |

| | | | | | | | | |

| Net balance as of October 31, 2023 | $ | 337,883 | | | $ | 65,064 | | | $ | 930,362 | | | $ | 435,468 | | | $ | 1,768,777 | |

Changes in the carrying amount of Goodwill by reportable segment for the three months ended October 31, 2022 are summarized as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| North American Towable | | North American Motorized | | European | | Other | | Total |

| Net balance as of August 1, 2022 | $ | 344,975 | | | $ | 53,875 | | | $ | 893,383 | | | $ | 511,918 | | | $ | 1,804,151 | |

| Fiscal 2023 activity: | | | | | | | | | |

| | | | | | | | | |

| Measurement period adjustments | — | | | — | | | — | | | 4,682 | | | 4,682 | |

| Foreign currency translation | — | | | — | | | (24,879) | | | — | | | (24,879) | |

| | | | | | | | | |

| Net balance as of October 31, 2022 | $ | 344,975 | | | $ | 53,875 | | | $ | 868,504 | | | $ | 516,600 | | | $ | 1,783,954 | |

8. Equity Investments

As discussed in Note 8 to the Company’s Consolidated Financial Statements included in the Fiscal 2023 Form 10-K, effective December 30, 2022, the Company formed a joint venture with TechNexus Holdings LLC (“TechNexus”), whereby the Company transferred TH2Connect, LLC d/b/a Roadpass Digital and its associated legal entities to TN-RP Holdings, LLC (“TN-RP”), following which the Company and TechNexus own 100% of the Class A-RP units and Class C-RP units, respectively, issued by TN-RP.

TN-RP is a variable interest entity (“VIE”), in which both the Company and TechNexus each have a variable interest. The Company’s equity interest, which entitles the Company to a share of future distributions from TN-RP, represents a variable interest. The Company has significant influence due to its Class A-RP unit ownership interest, non-majority seats on the TN-RP advisory board and certain protective rights, and therefore the Company’s investment in TN-RP is accounted for under the equity method of accounting and reported as a component of Equity investments in the Condensed Consolidated Balance Sheets. Similarly, the Company holds an additional investment that is also a VIE over which the Company has significant influence. This is also reported as a component of Equity investments in the Condensed Consolidated Balance Sheets.

The Company had the following aggregate investment and maximum exposure to loss related to these VIEs:

| | | | | | | | | | | | | | |

| | October 31, 2023 | | July 31, 2023 |

| Carrying amount of investments | | $ | 130,100 | | | $ | 126,909 | |

| Maximum exposure to loss | | $ | 153,019 | | | $ | 161,459 | |

The Company’s share of gains and losses accounted for under the equity method of accounting are included in Other income (expense), net in the Condensed Consolidated Statements of Income and Comprehensive Income. The losses recognized in the three months ended October 31, 2023 were $5,935, and the amounts recognized in the three months ended October 31, 2022 were not material.

9. Concentration of Risk

One dealer, FreedomRoads, LLC, accounted for 14% of the Company’s consolidated net sales for the three-month period ended October 31, 2023 and 15% of the Company’s consolidated net sales for the three-month period ended October 31, 2022. The majority of the sales to this dealer are reported within the North American Towable and North American Motorized reportable segments. This dealer also accounted for 19% and 13% of the Company’s consolidated trade accounts receivable at October 31, 2023 and July 31, 2023, respectively. The loss of this dealer or a deterioration in the liquidity or creditworthiness of this dealer could have a material effect on the Company’s business.

10. Fair Value Measurements

The financial assets and liabilities that are accounted for at fair value on a recurring basis at October 31, 2023 and July 31, 2023 are as follows:

| | | | | | | | | | | | | | | | | |

| Input Level | | October 31, 2023 | | July 31, 2023 |

| Cash equivalents | Level 1 | | $ | 302,255 | | $ | 286,984 |

| Deferred compensation plan mutual fund assets | Level 1 | | $ | 38,496 | | $ | 40,220 |

| Equity investments | Level 1 | | $ | 1,235 | | $ | 4,105 |

| | | | | |

| Foreign currency forward contract liability | Level 2 | | $ | 165 | | $ | — |

| | | | | |

| Interest rate swap liability | Level 2 | | $ | 808 | | $ | 932 |

| | | | | |

Cash equivalents represent investments in short-term money market instruments that are direct obligations of the U.S. Treasury and/or repurchase agreements backed by U.S. Treasury obligations. These investments are reported as a component of Cash and cash equivalents in the Condensed Consolidated Balance Sheets.

Deferred compensation plan assets accounted for at fair value are investments in securities (primarily mutual funds) traded in an active market held for the benefit of certain employees of the Company as part of a deferred compensation plan. Additional plan investments in corporate-owned life insurance are recorded at their cash surrender value, not fair value, and therefore are not included above.

Equity investments represent stock investments that are publicly traded in an active market.

The fair value of foreign currency forward contracts is estimated by discounting the difference between the contractual forward price and the current available forward price for the residual maturity of the contract using observable market rates.

The fair value of interest rate swaps is determined by discounting the estimated future cash flows based on the applicable observable yield curves.

11. Product Warranties

The Company generally provides retail customers of its products with a one-year or two-year warranty covering defects in material or workmanship, with longer warranties on certain structural components.

Changes in our product warranty liability during the indicated periods are as follows:

| | | | | | | | | | | | | | |

| | Three Months Ended October 31, |

| | 2023 | | 2022 |

| Beginning balance | | $ | 345,197 | | $ | 317,908 |

| Provision | | 74,435 | | 89,425 |

| Payments | | (84,171) | | (80,141) |

| | | | |

| Foreign currency translation | | (2,187) | | (1,479) |

| Ending balance | | $ | 333,274 | | $ | 325,713 |

12. Long-Term Debt

The components of long-term debt are as follows:

| | | | | | | | | | | | | | |

| | October 31, 2023 | | July 31, 2023 |

| Term loan | | $ | 740,275 | | | $ | 758,094 | |

| | | | |

| Senior unsecured notes | | 500,000 | | | 500,000 | |

| Unsecured notes | | 26,548 | | | 27,558 | |

| Other debt | | 38,474 | | | 41,753 | |

| Total long-term debt | | 1,305,297 | | | 1,327,405 | |

| Debt issuance costs, net of amortization | | (22,468) | | | (24,726) | |

| Total long-term debt, net of debt issuance costs | | 1,282,829 | | | 1,302,679 | |

| Less: Current portion of long-term debt | | (10,952) | | | (11,368) | |

| Total long-term debt, net, less current portion | | $ | 1,271,877 | | | $ | 1,291,311 | |

As discussed in Note 13 to the Company’s Consolidated Financial Statements included in the Fiscal 2023 Form 10-K, the Company is a party to a term loan (“term loan”) agreement, which consists of both a U.S. dollar-denominated term loan tranche and a Euro-denominated term loan tranche, and a $1,000,000 revolving asset-based credit facility (“ABL”).

Effective November 15, 2023, the Company amended its term loan and ABL agreements to extend maturities and lower the applicable margins used to determine the interest rate on the U.S. dollar-denominated term loan tranche. See Note 19 for additional details on these amendments.

As of October 31, 2023, the entire outstanding U.S. term loan tranche balance of $271,900 was subject to a Secured Overnight Financing Rate (“SOFR”)-based rate totaling 8.439%. As of July 31, 2023, the entire outstanding U.S. term loan tranche balance of $271,900 was subject to a SOFR-based rate totaling 8.433%. The total interest rate on the October 31, 2023 outstanding Euro term loan tranche balance of $468,375 was 6.94%, and the total interest rate on the July 31, 2023 outstanding Euro term loan tranche of $486,194 was 6.625%.

As of October 31, 2023 and July 31, 2023, there were no outstanding ABL borrowings.

Availability under the ABL agreement is subject to a borrowing base based on a percentage of applicable eligible receivables and eligible inventory. The unused availability under the ABL is generally available to the Company for general operating purposes, and based on October 31, 2023 eligible receivables and eligible inventory balances and net of amounts drawn, if any, totaled approximately $998,000.

As discussed in Note 13 to the Company’s Consolidated Financial Statements included in the Fiscal 2023 Form 10-K, on October 14, 2021, the Company issued an aggregate principal amount of $500,000 of 4.000% Senior Unsecured Notes due 2029 (“Senior Unsecured Notes”) that will mature on October 15, 2029 unless redeemed or repurchased earlier. Interest on the Senior Unsecured Notes is payable in semi-annual installments on April 15 and October 15 of each year.

The unsecured notes of 25,000 Euro ($26,548) relate to long-term debt of our European segment. There are two series, 20,000 Euro ($21,238) with an interest rate of 1.945% maturing in March 2025, and 5,000 Euro ($5,310) with an interest rate of 2.534% maturing March 2028. Other debt relates primarily to real estate loans with varying maturity dates through September 2032 and interest rates ranging from 2.38% to 2.87%.

Total contractual gross debt maturities as of October 31, 2023, prior to the November 15, 2023 amendments discussed above and in Note 19, are as follows:

| | | | | |

| For the remainder of the fiscal year ending July 31, 2024 | $ | 9,073 |

| For the fiscal year ending July 31, 2025 | 31,895 |

| For the fiscal year ending July 31, 2026 | 743,337 |

| For the fiscal year ending July 31, 2027 | 2,602 |

| For the fiscal year ending July 31, 2028 | 7,975 |

| For the fiscal year ending July 31, 2029 and thereafter | 510,415 |

| $ | 1,305,297 |

For the three-month periods ended October 31, 2023 and October 31, 2022, interest expense on the term loan, ABL, Senior Unsecured Notes and other debt facilities totaled $20,327 and $20,179, respectively, and also included the amortization of capitalized fees to secure the term loan, ABL and Senior Unsecured Notes, which are being amortized over the respective terms of those arrangements, of $2,872 and $2,835, respectively.

The fair value of the Company’s term loan debt at October 31, 2023 and July 31, 2023 approximates carrying value. The fair value of the Company’s Senior Unsecured Notes at October 31, 2023 and July 31, 2023 was $406,100 and $430,650, respectively. The fair value of other debt held by the Company approximates carrying value. The fair values of the Company’s long-term debt are primarily estimated using Level 2 inputs as defined by ASC 820, based on quoted prices in markets that are not active.

13. Provision for Income Taxes

The overall effective income tax rate for the three months ended October 31, 2023 was 24.2%. This rate was favorably impacted by certain foreign tax rate differences which include certain interest income not subject to corporate income tax. The favorable foreign rate differential was partially offset by additional tax expense related to the jurisdictional mix of earnings between foreign and domestic operations during the three months ended October 31, 2023. The overall effective income tax rate for the three months ended October 31, 2022 was 23.3%, which was favorably impacted by certain foreign tax rate differences, which include certain interest income not subject to corporate income tax. The favorable foreign rate differential was partially offset by tax expense from the vesting of share-based compensation awards during the three months ended October 31, 2022.

Within the next 12 months, the Company does not anticipate any material changes in its unrecognized tax benefits as of October 31, 2023.

The Company files income tax returns in the U.S. federal jurisdiction and in many U.S. state and foreign jurisdictions. The Company is currently under exam by certain foreign jurisdictions for fiscal years ended 2016 through 2021. The Company believes it has adequately reserved for its exposure to additional payments for uncertain tax positions in its liability for unrecognized tax benefits.

14. Contingent Liabilities, Commitments and Legal Matters

The Company’s total commercial commitments under standby repurchase obligations on global dealer inventory financing were $3,704,564 and $3,893,048 as of October 31, 2023 and July 31, 2023, respectively. The commitment term is generally up to eighteen months.

The Company accounts for the guarantee under repurchase agreements of independent dealers’ financing by deferring a portion of the related product sale that represents the estimated fair value of the guarantee at inception. This estimate is based on recent historical experience supplemented by the Company’s assessment of current economic and other conditions affecting its independent dealers. This deferred amount is included in the repurchase and guarantee reserve balances of $13,155 and $12,114 as of October 31, 2023 and July 31, 2023, respectively, which is included in Other current liabilities in the Condensed Consolidated Balance Sheets.

Losses incurred related to repurchase agreements that were settled during the three months ended October 31, 2023 and October 31, 2022 were not material. Based on current market conditions and other conditions affecting its independent dealers, the Company believes that any future losses under these agreements will not have a material effect on the Company’s consolidated financial position, results of operations or cash flows.

The Company is also involved in certain litigation arising out of its operations in the normal course of its business, most of which is based upon state “lemon laws,” warranty claims and vehicle accidents (for which the Company carries insurance above a specified self-insured retention or deductible amount). The outcomes of legal proceedings and claims brought against the Company are subject to significant uncertainty. There is significant judgment required in assessing both the probability of an adverse outcome and the determination as to whether an exposure can be reasonably estimated. Based on current conditions, and in management’s opinion, the ultimate disposition of any current legal proceedings or claims against the Company will not have a material effect on the Company’s financial condition, operating results or cash flows. Litigation is, however, inherently uncertain and an adverse outcome from such litigation could have a material effect on the operating results of a particular reporting period.

A product recall was issued in late fiscal 2021 related to certain purchased parts utilized in certain of our products, and a reserve to cover anticipated costs was established at that time. Beginning in fiscal 2022, the reserve has been adjusted quarterly based on developments involving the recall, including our expectations regarding the extent of vendor reimbursements and the estimated total cost of the recall. The Company has been, and will continue to be, reimbursed for a portion of the costs it will incur related to this recall. In addition, the Company accrued expenses during fiscal 2022 based on developments related to an ongoing investigation by certain German-based authorities regarding the adequacy of historical disclosures of vehicle weight in advertisements and other Company-provided literature in Germany. The Company is fully cooperating with the investigation. In the first quarter of fiscal 2024, the Company recognized $10,000 of income as a component of selling, general and administrative expense from adjustments related to these matters, and in the first quarter of fiscal 2023, the impact of the Company’s adjustments related to these matters was not material. Based on current available information, the Company does not believe there will be a material adverse impact to our future results of operations and cash flows due to these matters.

15. Leases

The Company has operating leases principally for land, buildings and equipment and has various finance leases for certain land and buildings principally expiring through 2035.

Certain of the Company’s leases include options to extend or terminate the leases, and these options have been included in the relevant lease term to the extent that they are reasonably certain to be exercised.

The Company does not include significant restrictions or covenants in our lease agreements, and residual value guarantees are not generally included within our operating leases.

The components of lease costs for the three-month periods ended October 31, 2023 and October 31, 2022 were as follows:

| | | | | | | | | | | | | | | |

| | | Three Months Ended October 31, |

| | | | | 2023 | | 2022 |

| Operating lease cost | | | | | $ | 8,011 | | | $ | 6,879 | |

| Finance lease cost: | | | | | | | |

| Amortization of right-of-use assets | | | | | 186 | | | 186 | |

| Interest on lease liabilities | | | | | 83 | | | 105 | |

| Total lease cost | | | | | $ | 8,280 | | | $ | 7,170 | |

Other information related to leases was as follows:

| | | | | | | | | | | |

| Three Months Ended October 31, |

| Supplemental Cash Flows Information | 2023 | | 2022 |

| Cash paid for amounts included in the measurement of lease liabilities: | | | |

| Operating cash flows from operating leases | $ | 7,987 | | | $ | 6,853 | |

| Right-of-use assets obtained in exchange for lease obligations: | | | |

| Operating leases | $ | 914 | | | $ | 3,395 | |

| | | |

| | | |

| | | | | | | | | | | |

| Supplemental Balance Sheet Information | October 31, 2023 | | July 31, 2023 |

| Operating leases: | | | |

| Operating lease right-of-use assets | $ | 45,200 | | | $ | 47,969 | |

| | | |

| Operating lease liabilities | | | |

| Other current liabilities | $ | 10,968 | | | $ | 11,238 | |

| Other long-term liabilities | 34,348 | | | 36,775 | |

| Total operating lease liabilities | $ | 45,316 | | | $ | 48,013 | |

| | | |

| Finance leases: | | | |

| Finance lease right-of-use assets | $ | 5,331 | | | $ | 5,518 | |

| | | |

| Finance lease liabilities | | | |

| Other current liabilities | $ | 779 | | | $ | 754 | |

| Other long-term liabilities | 2,517 | | | 2,722 | |

| Total finance lease liabilities | $ | 3,296 | | | $ | 3,476 | |

| | | | | | | | | | | |

| October 31, 2023 | | July 31, 2023 |

| Weighted-average remaining lease term: | | | |

| Operating leases | 9.3 years | | 9.3 years |

| Finance leases | 3.6 years | | 3.8 years |

| Weighted-average discount rate: | | | |

| Operating leases | 4.8 | % | | 4.7 | % |

| Finance leases | 9.7 | % | | 9.7 | % |

Future minimum rental payments required under operating and finance leases as of October 31, 2023 were as follows:

| | | | | | | | | | | | | | |

| | Operating Leases | | Finance Leases |

| For the remainder of the fiscal year ending July 31, 2024 | | $ | 12,906 | | | $ | 796 | |

| For the fiscal year ending July 31, 2025 | | 13,343 | | | 1,083 | |

| For the fiscal year ending July 31, 2026 | | 9,397 | | | 1,107 | |

| For the fiscal year ending July 31, 2027 | | 6,340 | | | 896 | |

| For the fiscal year ending July 31, 2028 | | 4,132 | | | 58 | |

| For the fiscal year ending July 31, 2029 and thereafter | | 15,898 | | | — | |

| Total future lease payments | | 62,016 | | | 3,940 | |

| Less: Amount representing interest | | (16,700) | | | (644) | |

| Total reported lease liability | | $ | 45,316 | | | $ | 3,296 | |

16. Stockholders’ Equity

Total stock-based compensation expense recognized in the three-month periods ended October 31, 2023 and October 31, 2022 for stock-based awards totaled $10,452 and $8,392, respectively.

Share Repurchase Program

As discussed in Note 17 to the Company’s Consolidated Financial Statements included in the Fiscal 2023 Form 10-K, on December 21, 2021, the Company’s Board of Directors authorized Company management to utilize up to $250,000 to repurchase shares of the Company’s common stock through December 21, 2024. On June 24, 2022, the Board authorized Company management to utilize up to an additional $448,321 to repurchase shares of the Company’s common stock through July 31, 2025.

During the three-month period ended October 31, 2023, the Company purchased 327,876 shares of its common stock, at various times in the open market, at a weighted-average price of $91.61 and held them as treasury shares at an aggregate purchase price of $30,037, all from the December 21, 2021 authorization. Since the inception of the December 21, 2021 authorization, the Company has purchased 2,821,651 shares of its common stock, at various times in the open market, at a weighted-average price of $84.05 and held them as treasury shares at an aggregate purchase price of $237,151.

As of October 31, 2023, the remaining amount of the Company's common stock that may be repurchased under the December 21, 2021 $250,000 authorization expiring on December 21, 2024 is $12,849. As of October 31, 2023, the remaining amount of the Company’s common stock that may be repurchased under the June 24, 2022 authorization expiring on July 31, 2025 is $448,321. As of October 31, 2023, the total remaining amount of the Company’s common stock that may be repurchased under these two authorizations is $461,170.

17. Revenue Recognition

The table below disaggregates revenue to the level that the Company believes best depicts how the nature, amount, timing and uncertainty of the Company’s revenue and cash flows are affected by economic factors. Other RV-related revenues shown below in the European segment include sales related to accessories and services, new and used vehicle sales at owned dealerships and RV rentals. Other sales relate primarily to component part sales to RV original equipment manufacturers and aftermarket sales through dealers and retailers, as well as aluminum extruded components. All material revenue streams are considered point-in-time.

| | | | | | | | | | | | | | |

| | Three Months Ended October 31, |

| NET SALES: | | 2023 | | 2022 |

| Recreational vehicles | | | | |

| North American Towable | | | | |

| Travel Trailers | | $ | 619,538 | | | $ | 822,869 | |

| Fifth Wheels | | 325,916 | | | 494,937 | |

| Total North American Towable | | 945,454 | | | 1,317,806 | |

| North American Motorized | | | | |

| Class A | | 207,911 | | | 404,578 | |

| Class C | | 333,776 | | | 490,787 | |

| Class B | | 169,472 | | | 228,154 | |

| Total North American Motorized | | 711,159 | | | 1,123,519 | |

| Total North America | | 1,656,613 | | | 2,441,325 | |

| European | | | | |

| Motorcaravan | | 346,511 | | | 239,785 | |

| Campervan | | 221,609 | | | 139,166 | |

| Caravan | | 64,627 | | | 61,615 | |

| Other RV-related | | 75,454 | | | 63,736 | |

| Total European | | 708,201 | | | 504,302 | |

| Total recreational vehicles | | 2,364,814 | | | 2,945,627 | |

| Other | | 198,921 | | | 232,648 | |

| Intercompany eliminations | | (62,976) | | | (70,191) | |

| Total | | $ | 2,500,759 | | | $ | 3,108,084 | |

18. Accumulated Other Comprehensive Income (Loss)

The components of other comprehensive income (loss) (“OCI”) and the changes in the Company's accumulated other comprehensive income (loss) (“AOCI”) by component were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended October 31, 2023 |

| | Foreign Currency

Translation

Adjustment | | Unrealized

Gain (Loss) on

Derivatives | | Other | | AOCI, net of tax, Attributable to THOR | | Non-controlling Interests | | Total AOCI |

| Balance at beginning of period, net of tax | | $ | (68,911) | | | $ | — | | | $ | 364 | | | $ | (68,547) | | | $ | (2,583) | | | $ | (71,130) | |

| OCI before reclassifications | | (59,924) | | | — | | | — | | | (59,924) | | | (722) | | | (60,646) | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| OCI, net of tax for the fiscal year | | (59,924) | | | — | | | — | | | (59,924) | | | (722) | | | (60,646) | |

| AOCI, net of tax | | $ | (128,835) | | | $ | — | | | $ | 364 | | | $ | (128,471) | | | $ | (3,305) | | | $ | (131,776) | |

| | | | | | | | | | | | |

| | Three Months Ended October 31, 2022 |

| | Foreign Currency

Translation

Adjustment | | Unrealized

Gain (Loss) on

Derivatives | | Other | | AOCI, net of tax, Attributable to THOR | | Non-controlling Interests | | Total AOCI |

| Balance at beginning of period, net of tax | | $ | (183,453) | | | $ | 675 | | | $ | 1,171 | | | $ | (181,607) | | | $ | (2,205) | | | $ | (183,812) | |

| OCI before reclassifications | | (42,895) | | | 1,123 | | | — | | | (41,772) | | | (434) | | | (42,206) | |

Income taxes associated with OCI before reclassifications (1) | | — | | | (269) | | | — | | | (269) | | | — | | | (269) | |

| Amounts reclassified from AOCI | | — | | | (62) | | | — | | | (62) | | | — | | | (62) | |

| Income taxes associated with amounts reclassified from AOCI | | — | | | 12 | | | — | | | 12 | | | — | | | 12 | |

| OCI, net of tax for the fiscal year | | (42,895) | | | 804 | | | — | | | (42,091) | | | (434) | | | (42,525) | |

| AOCI, net of tax | | $ | (226,348) | | | $ | 1,479 | | | $ | 1,171 | | | $ | (223,698) | | | $ | (2,639) | | | $ | (226,337) | |

| | | | | | | | | | | | |

| | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

(1)We do not recognize deferred taxes for a majority of the foreign currency translation gains and losses because we do not anticipate reversal in the foreseeable future.

19. Subsequent Event