Form 8-K - Current report

December 01 2023 - 4:25PM

Edgar (US Regulatory)

false

0001830072

0001830072

2023-11-30

2023-11-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of report (date of earliest event reported):

November 30, 2023

iPower

Inc.

(Exact name of registrant as specified in its charter)

| Nevada |

|

001-40391 |

|

82-5144171 |

|

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

8798

9th Street

Rancho

Cucamonga, CA 91730

(Address Of Principal Executive Offices) (Zip Code)

(626)

863-7344

(Registrant’s Telephone Number, Including

Area Code)

___________________________

(Former name or former address, if changed since

last report.)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock $0.001 per share |

|

IPW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act.

| Item 5.02 |

Departure of Directors or Certain

Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

Effective November 30, 2023, the board of directors

of iPower Inc., a Nevada company (the “Company”) adopted an Incentive-Based Compensation Recovery (Clawback) Policy (the “Clawback

Policy”) in order to comply with Section 10D and Rule 10D-1 of the Securities Exchange Act of 1934, as amended, and the listing

standards adopted by the Nasdaq Stock Market. The Clawback Policy provides for the mandatory recovery of erroneously awarded incentive-based

compensation from the Company’s current and former executive officers (as defined in the Clawback Policy) in the event that the

Company is required to restate its financials.

The foregoing description

of the Clawback Policy is a summary only and is qualified in its entirety by reference to the full text of the Clawback Policy, a copy

of which is filed as Exhibit 10.1 to this Current Report on Form 8-K, and incorporated herein by reference.

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

iPower Inc. |

| Dated: December 1, 2023 |

|

|

| |

By: |

/s/ Chenlong Tan |

| |

Name: |

Chenlong Tan |

| |

Title: |

Chief Executive Officer |

Exhibit 10.1

iPower

Inc.

Incentive-BASED

Compensation Recovery (clawback) Policy

| 1. |

Policy Purpose. The purpose of this incentive-based compensation recovery, or clawback, policy (the “Clawback Policy”) adopted by iPower Inc. (the “Company”) is to enable the Company to recover Erroneously Awarded Compensation in the event that the Company is required to prepare an Accounting Restatement. This Clawback Policy is intended to comply with the requirements set forth in The Nasdaq Stock Market Listing Rule 5608 of the corporate governance rules (the “Listing Rule”) and shall be construed and interpreted in accordance with such intent. Unless otherwise defined in this Clawback Policy, capitalized terms shall have the meaning ascribed to such terms in Section 7. This Clawback Policy shall become effective on December 1, 2023. Where the context requires, reference to the Company shall include the Company’s subsidiaries and affiliates (as determined by the Committee in its discretion). |

| |

|

| 2. |

Policy Administration. This Clawback Policy shall be administered by the Compensation Committee of the Board (the “Committee”) unless the Board determines to administer this Clawback Policy itself. The Committee has full and final authority to make all determinations under this Clawback Policy. All determinations and decisions made by the Committee pursuant to the provisions of this Clawback Policy shall be final, conclusive and binding on all persons, including the Company, its affiliates, its stockholders and Executive Officers. Any action or inaction by the Committee with respect to an Executive Officer under this Clawback Policy in no way limits the Committee’s actions or decisions not to act with respect to any other Executive Officer under this Clawback Policy or under any similar policy, agreement or arrangement, nor shall any such action or inaction serve as a waiver of any rights the Company may have against any Executive Officer other than as set forth in this Clawback Policy. |

| |

|

| 3. |

Policy Application. This Clawback Policy applies to all Incentive-Based Compensation received by a person: (a) after October 2, 2023, and beginning service as an Executive Officer; (b) who served as an Executive Officer at any time during the performance period for such Incentive-Based Compensation; (c) while the Company had a class of securities listed on a national securities exchange or a national securities association; and (d) during the three completed fiscal years immediately preceding the Accounting Restatement Date. In addition to such last three completed fiscal years, the immediately preceding clause (d) includes any transition period that results from a change in the Company’s fiscal year within or immediately following such three completed fiscal years; provided, however, that a transition period between the last day of the Company’s previous fiscal year end and the first day of its new fiscal year that comprises a period of nine to twelve months shall be deemed a completed fiscal year. For purposes of this Section 3, Incentive-Based Compensation is deemed received in the Company’s fiscal period during which the Financial Reporting Measure specified in the Incentive-Based Compensation award is attained, even if the payment or grant of the Incentive-Based Compensation occurs after the end of that period. For the avoidance of doubt, Incentive-Based Compensation that is subject to both a Financial Reporting Measure vesting condition and a service-based vesting condition shall be considered received when the relevant Financial Reporting Measure is achieved, even if the Incentive-Based Compensation continues to be subject to the service-based vesting condition. |

| |

|

| 4. |

Policy Recovery Requirement. In the event of an Accounting Restatement, the Company must recover, reasonably promptly, Erroneously Awarded Compensation, in amounts determined pursuant to this Clawback Policy. The Company’s obligation to recover Erroneously Awarded Compensation is not dependent on if or when the Company files restated financial statements. Recovery under this Clawback Policy with respect to an Executive Officer shall not require the finding of any misconduct by such Executive Officer or such Executive Officer being found responsible for the accounting error leading to an Accounting Restatement. In the event of an Accounting Restatement, the Company shall satisfy the Company’s obligations under this Clawback Policy to recover any amount owed from any applicable Executive Officer by exercising its sole and absolute discretion in how to accomplish such recovery. The Company’s recovery obligation pursuant to this Section 4 shall not apply to the extent that the Committee, or in the absence of the Committee, a majority of the independent directors serving on the Board, determines that such recovery would be impracticable and: |

| a. |

The direct expense paid to a third party to assist in enforcing this Clawback Policy would exceed the amount to be recovered. Before concluding that it would be impracticable to recover any amount of Erroneously Awarded Compensation based on expense of enforcement, the Company must make a reasonable attempt to recover such Erroneously Awarded Compensation, document such reasonable attempt(s) to recover, and provide that documentation to the Stock Exchange; or |

| |

|

| b. |

Recovery would likely cause an otherwise tax-qualified retirement plan, under which benefits are broadly available to employees of the registrant, to fail to meet the requirements of Section 401(a)(13) or Section 411(a) of the Code. |

| 5. |

Policy Prohibition on Indemnification and Insurance Reimbursement. The Company is prohibited from indemnifying any Executive Officer or former Executive Officer against the loss of Erroneously Awarded Compensation. Further, the Company is prohibited from paying or reimbursing an Executive Officer for purchasing insurance to cover any such loss. |

| |

|

| 6. |

Required Policy-Related Filings. The Company shall file all disclosures with respect to this Clawback Policy in accordance with the requirements of the federal securities laws, including disclosures required by U.S. Securities and Exchange Commission (the “SEC”) filings. |

| |

|

| 7. |

Definitions. |

| a. |

“Accounting Restatement” means an accounting restatement due to the material noncompliance of the Company with any financial reporting requirement under the securities laws, including any required accounting restatement to correct an error in previously issued financial statements that is material to the previously issued financial statements, or that would result in a material misstatement if the error were corrected in the current period or left uncorrected in the current period. |

| |

|

| b. |

“Accounting Restatement Date” means the earlier to occur of: (i) the date the Board, a committee of the Board, or the officer or officers of the Company authorized to take such action if the Board action is not required, concludes, or reasonably should have concluded, that the Company is required to prepare an Accounting Restatement; and (ii) the date a court, regulator, or other legally authorized body directs the Company to prepare an Accounting Restatement. |

| |

|

| c. |

“Board” means the board of directors of the Company. |

| |

|

| d. |

“Code” means the U.S. Internal Revenue Code of 1986, as amended. Any reference to a section of the Code or regulation thereunder includes such section or regulation, any valid regulation or other official guidance promulgated under such section, and any comparable provision of any future legislation or regulation amending, supplementing, or superseding such section or regulation. |

| |

|

| e. |

“Erroneously Awarded Compensation” means, in the event of an Accounting Restatement, the amount of Incentive-Based Compensation previously received that exceeds the amount of Incentive-Based Compensation that otherwise would have been received had it been determined based on the restated amounts in such Accounting Restatement, and must be computed without regard to any taxes incurred or paid by the relevant Executive Officer; provided, however, that for Incentive-Based Compensation based on stock price or total stockholder return, where the amount of Erroneously Awarded Compensation is not subject to mathematical recalculation directly from the information in an Accounting Restatement: (i) the amount of Erroneously Awarded Compensation must be based on a reasonable estimate of the effect of the Accounting Restatement on the stock price or total stockholder return upon which the Incentive-Based Compensation was received; and (ii) the Company must maintain documentation of the determination of that reasonable estimate and provide such documentation to the Stock Exchange. |

| |

|

| f. |

“Executive Officer” means the Company’s president, principal financial officer, principal accounting officer (or if there is no such accounting officer, the controller), any vice-president of the Company in charge of a principal business unit, division, or function (such as sales, administration, or finance), any other officer who performs a policy-making function, or any other person who performs similar policy-making functions for the Company. An executive officer of the Company’s parent or subsidiary is deemed an “Executive Officer” if the executive officer performs such policy making functions for the Company. For the avoidance of doubt, “Executive Officer” includes, but is not limited to, any person identified as an executive officer pursuant to Item 401(b) of Regulation S-K under the U.S. Securities Act of 1933, as amended. |

| g. |

“Financial Reporting Measure” means any measure that is determined and presented in accordance with the accounting principles used in preparing the Company’s financial statements, and any measure that is derived wholly or in part from such measure; provided, however, that a Financial Reporting Measure is not required to be presented within the Company’s financial statements or included in a filing with the SEC to qualify as a “Financial Reporting Measure.” For purposes of this Clawback Policy, “Financial Reporting Measure” includes, but is not limited to, stock price and total stockholder return. |

| |

|

| h. |

“Incentive-Based Compensation” means any compensation that is granted, earned, or vested based wholly or in part upon the attainment of a Financial Reporting Measure. |

| |

|

| i. |

“Stock Exchange” means the national stock exchange on which the Company’s common stock is listed. |

| 8. |

Acknowledgement. Each Executive Officer shall sign and return to the Company, within 30 calendar days following the later of (i) the effective date of this Clawback Policy first set forth above or (ii) the date the individual becomes an Executive Officer, the Acknowledgement Form attached hereto as Exhibit A, pursuant to which the Executive Officer agrees to be bound by, and to comply with, the terms and conditions of this Clawback Policy. |

| |

|

| 9. |

Committee Indemnification. Any members of the Committee, and any other members of the Board who assist in the administration of this Clawback Policy, shall not be personally liable for any action, determination or interpretation made with respect to this Clawback Policy and shall be fully indemnified by the Company to the fullest extent under applicable law and Company policy with respect to any such action, determination or interpretation. The foregoing sentence shall not limit any other rights to indemnification of the members of the Board under applicable law or Company policy. |

| |

|

| 10. |

Severability. The provisions in this Clawback Policy are intended to be applied to the fullest extent of the law. To the extent that any provision of this Clawback Policy is found to be unenforceable or invalid under any applicable law, such provision shall be applied to the maximum extent permitted, and shall automatically be deemed amended in a manner consistent with its objectives to the extent necessary to conform to any limitations required under applicable law. |

| |

|

| 11. |

Amendment; Termination. The Board may amend this Clawback Policy from time to time in its sole and absolute discretion and shall amend this Clawback Policy as it deems necessary to reflect the Listing Rule. The Board may terminate this Clawback Policy at any time. |

| |

|

| 12. |

Other Recovery Obligations; General Rights. To the extent that the application of this Clawback Policy would provide for recovery of Incentive-Based Compensation that the Company recovers pursuant to Section 304 of the Sarbanes-Oxley Act or other recovery obligations, the amount the relevant Executive Officer has already reimbursed the Company will be credited to the required recovery under this Clawback Policy. This Clawback Policy shall not limit the rights of the Company to take any other actions or pursue other remedies that the Company may deem appropriate under the circumstances and under applicable law. To the maximum extent permitted under the Listing Rule, this Clawback Policy shall be administered in compliance with (or pursuant to an exemption from the application of) Section 409A of the Code. |

| |

|

| 13. |

Successors. This Clawback Policy is binding and enforceable against all Executive Officers and their beneficiaries, heirs, executors, administrators or other legal representatives. |

| |

|

| 14. |

Governing Law; Venue. This Clawback Policy and all rights and obligations hereunder are governed by and construed in accordance with the internal laws of the State of New York, excluding any choice of law rules or principles that may direct the application of the laws of another jurisdiction. All actions arising out of or relating to this Clawback Policy shall be heard and determined exclusively in the state and federal courts in New York. |

EXHIBIT A

iPOWER

INC.

Incentive-BASED

Compensation Recovery (CLAWBACK) Policy

Acknowledgement

Form

By signing below, the undersigned acknowledges

and confirms that the undersigned has received and reviewed a copy of the iPower Inc. (the “Company”) Incentive-Based

Compensation Recovery Policy (the “Clawback Policy”).

By signing this acknowledgement form, the undersigned

acknowledges and agrees that the undersigned is and will continue to be subject to the Clawback Policy and that the Clawback Policy will

apply both during and after the undersigned’s employment with the Company. Further, by signing below, the undersigned agrees to

abide by the terms of the Clawback Policy, including, without limitation, by returning any Erroneously Awarded Compensation (as defined

in the Clawback Policy) to the Company to the extent required by, and in a manner consistent with, the Clawback Policy. Further, by signing

below, the undersigned agrees that the terms of the Clawback Policy shall govern in the event of any inconsistency between the Clawback

Policy and the terms of any employment agreement to which the undersigned is a party, or the terms of any compensation plan, program or

agreement under which any compensation has been granted, awarded, earned or paid.

| |

EXECUTIVE OFFICER |

| |

|

| |

Signature |

| |

|

| |

Print Name |

| |

|

| |

Date |

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

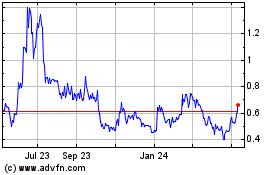

iPower (NASDAQ:IPW)

Historical Stock Chart

From Mar 2024 to Apr 2024

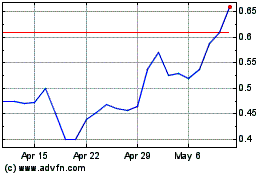

iPower (NASDAQ:IPW)

Historical Stock Chart

From Apr 2023 to Apr 2024