0001320695false00013206952023-12-012023-12-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 1, 2023

TreeHouse Foods, Inc.

(Exact name of registrant as specified in charter)

Commission File Number: 001-32504

| | | | | | | | | | | |

| Delaware | | 20-2311383 |

(State or Other Jurisdiction

of Incorporation) | | (IRS Employer

Identification No.) |

| | | | |

2021 Spring Road

Suite 600 | | |

| Oak Brook | IL | | 60523 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (708) 483-1300

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| |

Securities registered pursuant to section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value | THS | New York Stock Exchange LLC |

| | | | | | | | | | | | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). |

| | | | |

| Emerging growth company | ☐ | | | |

| | | | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐ |

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Effective December 1, 2023, Timothy Smith will step down from his role as Senior Vice President, Division President of TreeHouse Foods, Inc. (the “Company”).

Mr. Smith has served this role since February 2022, with responsibility for overseeing the ongoing operations and growth of TreeHouse Foods’ categories. A search is underway for Mr. Smith’s successor. In the interim, Mr. Smith’s responsibilities will be overseen by existing leadership and the Company’s Business Unit General Managers will report directly to Steven Oakland, Chairman, Chief Executive Officer and President of TreeHouse Foods.

In connection with his separation, upon execution of the Company’s form separation and release agreement, Mr. Smith will receive separation benefits consistent with a qualifying termination of employment without cause under the Company’s Executive Severance Plan.

The foregoing description is qualified in its entirety by the Form of Separation and Release Agreement, a copy of which is attached hereto as Exhibit 10.1 and incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d)Exhibit

| | | | | | | | |

Exhibit

Number | | Exhibit Description |

| | | |

| 10.1 | | | |

| 104 | | | Cover Page Interactive Data File (formatted as Inline XBRL) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | TreeHouse Foods, Inc. |

| | | | |

| Date: | December 1, 2023 | | By: | /s/ Kristy N. Waterman |

| | | | Kristy N. Waterman |

| | | | |

| | | | Executive Vice President, Chief Human Resources Officer, General Counsel, and Corporate Secretary |

Exhibit 10.1

SEPARATION AND RELEASE AGREEMENT

THIS SEPARATION and RELEASE AGREEMENT (“Agreement”) is entered by and between _______________________ (“Employee”) and TreeHouse Foods, Inc., (together with its subsidiaries and affiliates, the “Company”). The Parties agree as follows:

1.Termination Date. Employee’s employment by the Company shall terminate effective __________________________ (Employee’s “Effective Termination Date”). Except as specifically provided by this Agreement, Employee agrees that the Company shall have no other obligations or liabilities to Employee following Employee's Effective Termination Date.

2.Separation Benefits.

In consideration of Employee’s acceptance of and compliance with this Agreement the Company will provide the following benefits:

◦Separation Pay. The Company will pay Employee twelve (12) months of base compensation as separation pay. Payments shall be paid in accordance with the Company’s standard payroll practices (e.g., biweekly) and are in lieu of, and not in addition to, any other contractual, notice or statutory pay obligations (other than accrued but unpaid wages and deferred compensation). The separation payments will begin on the first regular payroll date following Employee’s execution of this Agreement and the expiration of the seven (7) revocation period and will be subject to all applicable federal, state, and local income tax withholding.

◦Career Counseling. The Company agrees to provide Employee with its career continuation counseling for a period of twelve (12) months, provided Employee commences said counseling no later than one month following the Effective Termination Date. The Company shall have no obligation to pay Employee an amount equal to the value or cost for any career continuation counseling service should Employee elect to terminate or abandon such service.

◦Deferred Compensation. Any benefits due to Employee at termination will be paid in accordance with the terms of the TreeHouse Foods, Inc. Executive Deferred Compensation Plan.

◦Short-Term Incentive Bonus. The Company agrees to pay Employee the short-term incentive bonus that Employee would have become entitled to had Employee’s employment continued until the date upon which eligibility for such bonus is triggered under the applicable plan. Any such payment will be paid in a single lump sum and shall be paid at “target” for the relevant plan year, as defined by the plan document. Payment shall be made at the same time all active employees covered under the plan receive payment. Any bonus payment shall be subject to all applicable federal, state, and local income tax withholding.

3.Benefits. As of Employee’s Effective Termination Date, Employee will become ineligible to participate in the Company’s health insurance program subject to the Employee’s right, if any, to continuation coverage under COBRA.

However, as additional consideration for the promises and obligations contained herein, and provided Employee has elected such health insurance coverage prior to Employee’s Effective Termination Date, the Company agrees to continue to pay the employer’s applicable share of the premium for such coverage for a period of twelve (12) months, or until Employee becomes eligible for other health care coverage, whichever comes first, provided that Employee timely elects COBRA coverage and continues to pay an amount equivalent to the employee share of the applicable premium(s). Thereafter, Employee will be solely responsible for the entire COBRA premium payment for the remaining months of the COBRA coverage period made available pursuant to applicable law. The medical insurance provided herein does not include any disability coverage.

4.Sufficiency of Consideration. Employee understands and agrees that in consideration for his/her acceptance and execution of this Agreement that he/she is receiving compensation and/or benefits in excess of those to which he/she is otherwise entitled and acknowledges the sufficiency of such consideration.

5.Release of Claims.

(a) In exchange for the foregoing Severance Benefits, Employee, on behalf of himself/herself, his/her heirs, representatives, agents and assigns hereby RELEASES, INDEMNIFIES, HOLDS HARMLESS, and FOREVER DISCHARGES (i) TreeHouse Foods, Inc., (ii) its parent, subsidiaries and affiliated entities, (iii) all of their present and former directors, officers, employees, and agents as well as (iv) all predecessors, successors and assigns (“Released Parties”) thereof from any and all actions, charges, claims, demands, damages or liabilities of any kind or character whatsoever, known or unknown, which Employee now has or may have had through the date of execution of this Agreement.

(b) Without limiting the generality of the foregoing release, it shall include: (i) all waivable claims or potential claims arising under any federal, state or local laws relating to the Parties’ employment relationship, including (without limitation) any claims Employee may have under the Civil Rights Acts of 1866, 1964, and 1991, as amended, 42 U.S.C. §§ 1981 and 2000(e) et seq.; the Age Discrimination in Employment Act, as amended, 29 U.S.C. §§ 621 et seq.; the Americans with Disabilities Act of 1990, as amended, 42 U.S.C. §§ 12,101 et seq.; the Worker Adjustment and Retraining Notification Act, 29 U.S.C. §§ 2101, et seq.; the Sarbanes-Oxley Act of 2002, including the Corporate and Criminal Fraud Accountability Act, 18 USC § 1514A; the Employee Retirement Income Security Act, as amended, 29 U.S.C. §§ 1101 et seq.; the Family and Medical Leave Act of 1993 as amended, 29 U.S.C. §§ 2601 et seq.; and any other federal, state or local law governing the Parties’ employment relationship; (ii) any claims on account of, arising out of or in any way connected with Employee’s employment with the Company or leaving of that employment; (iii) any claims relating to the conduct of any employee, officer, director, agent or other representative of the Company; (iv) any claims of discrimination, whistleblowing, harassment or retaliation on any basis; (v) any claims arising from any legal restrictions on an employer’s right to separate its employees; (vi) any claims for personal injury, compensatory or punitive damages or other forms of relief; and (vii) all other causes of action sounding in contract, tort or other common law basis, including (without limitation) (a) the breach of any alleged oral or written contract, (b) negligent or intentional misrepresentations, (c) defamation, (d) wrongful discharge, (e) interference with contract or business relationship or (f) negligent or intentional infliction of emotional distress. Employee does not release any claims which cannot be waived or released as a matter of law. Employee affirms that he/she has reported all hours worked as of the date of this Agreement and that he/she is not aware of any

facts on which a claim under the Fair Labor Standards Act or under applicable state minimum wage or wage payment laws could be brought.

6.Older Workers Benefit Protection Act. The Parties acknowledge that it is their mutual and specific intent that the above waiver fully comply with the requirements of the Older Workers Benefit Protection Act (29 U.S.C. § 626) and any similar law governing release of claims. Accordingly, Employee hereby acknowledges that:

a.Employee is advised to consult with an attorney of his/her choice prior to signing this Agreement; and

b.Employee has been offered at least twenty-one (21) days within which to review, consider and execute this Agreement; and

c.Is, through this Agreement, releasing the Company from any and all claims Employee may have against the Company, including claims under the federal Age Discrimination in Employment Act (with the exception of challenges under the Older Workers Benefits Protection Act to a waiver of such claims), to the extent permitted by law.

d.Knowingly and voluntarily agrees to the terms set forth in this Agreement.

e.Knowingly and voluntarily intends to be legally bound by the same.

f.Was advised and hereby is advised in writing to consider the terms of this Agreement and as is Employee’s right, consult prior to executing this Agreement with an attorney of Employee’s choice and at Employee’s expense.

g.Has a full seven (7) days following the execution of this Agreement to revoke this Agreement by delivering notice of revocation to [REDACTED] at TreeHouse Foods, Inc., 2021 Spring Road, Suite 600, Oak Brook, IL 60523, before the end of such seven-day period; and has been and hereby is advised in writing that this Agreement shall not become effective or enforceable until such revocation period has expired.

h.Understands that rights or claims under the Age Discrimination in Employment Act of 1967 (29 U.S.C. § 621, et seq.) that may arise after the date this Agreement is executed are not waived.

7.Covenant Not to Sue. Employee agrees that he/she will not file any lawsuit or action against the Company or the Released Parties with respect to any claims or liability released above. Nothing in this Agreement shall be interpreted, however, as interfering with the right to file, assist or participate in a claim that cannot be waived. Further, nothing shall be interpreted as interfering with the right to file, assist or participate in a charge with the EEOC or other fair employment practices agency, however, even if Employee has such right, he/she agrees that he/she shall not obtain, and hereby waives his/her right to, any monetary or other relief for any released claim or liability released in this Agreement. Nothing in this Agreement shall prevent Employee from challenging, under the Older Workers Benefit Protection Act (29 U.S.C. § 626), the knowing and voluntary nature of Employee’s release of any age claims in this Agreement.

8.No Waiver of Certain Rights. The Parties agree that nothing contained herein shall purport to waive or otherwise affect any of Employee’s rights or claims that may arise after Employee signs this Agreement. It is further understood by the Parties that nothing in this Agreement shall affect any rights Employee may have under any employee benefit plan sponsored by the

Company as of the date of his/her termination, such items to be governed exclusively by the terms of the applicable plan documents.

9.Restricted Information. Employee acknowledges that the Company as well as its parent, subsidiary, and affiliated companies (“Companies” herein) possess, and s/he has been granted access to, certain trade secrets as well as other confidential and proprietary information that they have acquired at great effort and expense. Such information includes, without limitation, confidential information regarding products and services, marketing strategies, business plans, operations, costs, current or, prospective customer information (including customer contacts, requirements, creditworthiness and like matters), product concepts, designs, prototypes or specifications, regulatory compliance issues, research and development efforts, technical data and know-how, sales information, including pricing and other terms and conditions of sale, financial information, internal procedures, techniques, forecasts, methods, trade information, trade secrets, software programs, project requirements, inventions, trademarks, trade names, and similar information regarding the Companies’ business (collectively referred to herein as “Restricted Information”). Employee agrees that all such Restricted Information is and shall remain the sole and exclusive property of the Company. Except as may be expressly authorized by the Company in writing, or as may be required by law after providing due notice thereof to the Company, Employee agrees not to disclose, or cause any other person or entity to disclose, any Restricted Information to any third party for as long thereafter as such information remains confidential (or as limited by applicable law) and agrees not to make use of any such Restricted Information for Employee’s own purposes or for the benefit of any other entity or person. The Parties acknowledge that Restricted Information shall not include any information that is otherwise made public through no fault of Employee or other wrongdoing. The foregoing shall not apply to information that the Employee is required to disclose by applicable law, regulation, or legal process (provided that the Employee provides the Company with prior notice of the contemplated disclosure and cooperates with the Company at its expense in seeking a protective order or other appropriate protection of such information). Restricted Information does not include any information that is, or becomes, in the public domain through no disclosure or other action (whether direct or indirect) by Employee. The obligations in this paragraph with respect to a particular piece of Restricted Information shall remain in effect until that piece of information enters the public domain through no breach of contract or duty by Employee.

10.Return of Property, Deductions. On or before Employee’s Effective Termination Date Employee agrees to return the original and all copies of Company property, including but not limited to any and all Restricted Information and all documents, files, manuals, forms, records, contact information or lists, financial information, drawings, plans, hardware, software, access codes, keys, credit cards, and any and all other physical, intellectual, or personal property of the Company or its affiliates. Employee hereby authorizes the Company to deduct as an offset from the above-referenced separation payments the value of any Company property not returned or returned in a damaged condition as well as any monies paid by the Company on Employee’s behalf (e.g., payment of any outstanding American Express bill), unless prohibited by applicable law. Employee further represents that s/he has not retained any non-public information about the Company or its affiliates or subsidiaries on any personal computer or portable data storage device or in any other manner.

11.Non-Disparagement. Employee agrees not to make any written or oral statement that may defame, disparage, or cast in a negative light so as to do harm to the personal or professional reputation of (a) the Company and its subsidiaries and affiliate entities, (b) their employees, officers, directors, or trustees or (c) the services and/or products provided by the Company and its subsidiaries or affiliate entities.

12.Cooperation. Employee agrees to cooperate with the Company and its subsidiaries or affiliate entities in connection with any pending or future litigation, proceeding or other matter which may be filed against or by the Company and its subsidiaries and affiliate entities with any agency, court, or other tribunal and concerning or relating to any matter falling within Employee’s knowledge or former area of responsibility. Employee agrees to provide reasonable assistance and completely truthful testimony in such matters as needed, and the Company will reimburse Employee for all reasonable associated out of pocket expenses incurred at the request of the Company.

13.Confidentiality of Agreement. Employee agrees that s/he will treat the terms of this Agreement as confidential and that unless required by law, s/he will not disclose the terms of the Agreement or benefits provided pursuant to this Agreement to any person, except their spouse or partner, attorney, or accountant, provided that they also maintain the confidentiality of the terms of this Agreement. Nothing herein should be construed as a limitation on Employee’s ability to consult with their counsel or an administrative agency.

14.Breach. If Employee breaches or threatens to breach any provision of this Agreement, Employee agrees that the Company shall be entitled to seek any and all equitable and legal relief provided by law, specifically including immediate and permanent injunctive relief. Employee hereby waives any claim that the Company has an adequate remedy at law. In addition, and to the extent not prohibited by law, Employee agrees that the Company shall be entitled to discontinue providing any additional benefits hereunder upon such breach or threatened breach as well as an award of all costs and attorneys’ fees incurred by the Company in any successful effort to enforce the terms of this Agreement. Employee agrees that the foregoing relief shall not be construed to limit or otherwise restrict the Company’s ability to pursue any other remedy provided by law, including the recovery of any actual, compensatory, or punitive damages.

15.No Admission of Liability. Employee acknowledges that this Agreement shall not be construed as an admission of liability or wrongdoing by the Company and further acknowledges that the Company has expressly denied any such liability or wrongdoing.

16.Binding Agreement. Each of the promises and obligations shall be binding upon and shall inure to the benefit of the heirs, executors, administrators, assigns and successors in interest of each of the Parties.

17.Severability. The Parties agree that each and every paragraph, sentence, clause, term, and provision of this Agreement is severable and that, if any portion of this Agreement should be deemed not enforceable for any reason, such portion shall be stricken, and the remaining portion or portions thereof shall continue to be enforced to the fullest extent permitted by applicable law.

18.Choice of Law. This Agreement shall be governed by and interpreted in accordance with the laws of the State of Illinois without regard to any applicable state’s choice of law provisions to the extent not preempted by applicable federal law.

19.Regulatory Compliance. Employee acknowledges and agrees that it is the Company’s policy, communicated to Employee and other employees, that employees are requested to bring to the Company’s attention any incidents of misconduct or wrongdoing in any areas of statutory or regulatory compliance, both governmental and industry. Employee hereby affirms that Employee has acted in accordance with such policy and that Employee has, at this time, no

knowledge of any such incident, which Employee has not brought to the attention of the Company.

20.I.R.C. 409(A). Separation pay is being paid under this Agreement as a result of an involuntary separation from service and is intended to be exempt from Internal Revenue Code Section 409A pursuant to Treas. Reg. 1.409A-1(b)(9)(iii). As a result, the separation payments made under this agreement shall in no event exceed two times the lesser of the Employee’s annualized compensation based upon the annual rate of pay for services provided to the Employer for the taxable year of the Employee preceding the year in which the Employee separated from service from the Employer, or the maximum amount that may be taken into account under a qualified plan under Internal Revenue Code Section 401(a)(17) for the year the Employee separated from service. In addition, all separation payments made under this Agreement must be paid no later than the last day of the second taxable year of the Employee following the year in which the Employee separated from service from the Employer.

21.Entire Agreement. This Agreement represents the entire agreement between the Parties concerning the subject matter hereof and shall only be amended or modified in writing executed by both Parties except that this Agreement specifically incorporates by reference all prior agreements Employee has entered into with the Company regarding confidentiality, trade secrets, inventions, or unfair competition. Employee acknowledges that s/he has not relied on any representations, promises, or agreements of any kind made in connection with their decision to accept this Agreement, except for those set forth herein.

PLEASE READ CAREFULLY. THIS SEPARATION AND RELEASE AGREEMENT INCLUDES A COMPLETE RELEASE OF ALL KNOWN AND UNKNOWN CLAIMS.

IN WITNESS WHEREOF, the Parties have themselves signed, or caused a duly authorized agent thereof to sign, this Agreement on their behalf, and thereby acknowledge their intent to be bound by its terms and conditions.

| | | | | | | | |

EMPLOYEE | | TREEHOUSE FOODS, INC. |

| | |

Signed: | | Signed: |

Printed: | | Printed: |

Dated: | | Dated: |

| | |

| NOT VALID IF SIGNED PRIOR TO | | |

| EFFECTIVE DATE OF TERMINATION | | |

| | |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

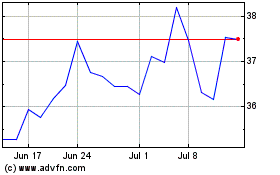

Treehouse Foods (NYSE:THS)

Historical Stock Chart

From Mar 2024 to Apr 2024

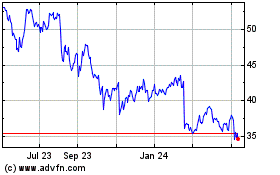

Treehouse Foods (NYSE:THS)

Historical Stock Chart

From Apr 2023 to Apr 2024