false000105628500010562852023-11-302023-11-30

Top of Form

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

|

Date of Report (Date of Earliest Event Reported): |

|

November 30, 2023 |

Kirkland's, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Tennessee |

|

000-49885 |

|

62-1287151 |

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

|

|

|

|

|

5310 Maryland Way, Brentwood, Tennessee |

|

|

|

37027 |

(Address of principal executive offices) |

|

|

|

(Zip Code) |

|

|

|

Registrant’s telephone number, including area code: |

|

615-872-4800 |

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common Stock |

KIRK |

NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Top of Form

Item 2.02 Results of Operations and Financial Condition.

On November 30, 2023, Kirkland’s Inc. (“the Company”) issued a press release reporting its results of operations for the 13-week and 39-week periods ended October 28, 2023 (the “Press Release”).

A copy of the Press Release is attached hereto as Exhibit 99.1, and is being furnished, not filed, under Item 2.02 of this Current Report on Form 8-K.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

Top of Form

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

Kirkland's, Inc. |

|

|

|

|

November 30, 2023 |

|

By: |

/s/ Carter R. Todd |

|

|

|

Name: Carter R. Todd |

|

|

|

Title: Vice President and General Counsel |

Exhibit 99.1

KIRKLAND’S HOME REPORTS THIRD QUARTER 2023 RESULTS

NASHVILLE, Tenn. (November 30, 2023) — Kirkland’s, Inc. (Nasdaq: KIRK) (“Kirkland’s Home” or the “Company”), a specialty retailer of home décor and furnishings, announced financial results for the 13-week and 39-week periods ended October 28, 2023.

Third Quarter 2023 Summary

•Net sales were $116.4 million, with comparable sales decreasing 9.2%.

•Gross profit margin improved 130 basis points year-over-year to 26.3%.

•Operating loss was flat year-over-year at $6.7 million.

•Adjusted EBITDA loss of $3.2 million.

•Ended the period with a cash balance of $5.8 million and $62.0 million in outstanding debt.

•Closed one store and relocated one store to end the quarter with 339 stores.

Management Commentary

“The third quarter demonstrated execution of our strategic repositioning as we experienced sequential improvements in traffic and comparable sales each month of the quarter, along with expanded gross margins,” said Ann Joyce, interim CEO of Kirkland’s Home. “Over the last six months, we have spent a significant amount of time assessing every aspect of the business and acted quickly to implement changes to better position us going into our ever-important holiday selling season. During the quarter, we saw promising indicators that our pivots are beginning to work. We increased lapsed customer reactivations, drove improved traffic and conversion with less promotional activity, reduced operating expenses, and improved our inventory position for the remainder of the year.

“While persistent challenges in the macro-economy continue to weigh on consumers, we believe that our renewed emphasis on value and seasonally relevant décor is beginning to resonate with our customers. In fact, the trend continued into the fiscal fourth quarter, which has started off with a low single-digit increase in comparable sales for the month of November at a much-improved merchandise margin as we continue to execute against our holiday promotional strategy.

“Although there is still much work to be done, we are optimistic and encouraged by our recent improvements. We expect solid year-over-year improvement in profitability during the fourth quarter as we continue to progress towards our goal of returning to our historical average adjusted EBITDA margin in the mid-to-high single-digit range. In fiscal 2024, we will look to build off this recent momentum and continue to execute upon our strategy to return the Company to profitable growth.”

Third Quarter 2023 Financial Results

Net sales in the third quarter of 2023 were $116.4 million, compared to $131.0 million in the prior year quarter. Comparable same-store sales decreased 9.2%, including an 8.5% decline in e-commerce sales. The decrease was primarily driven by a decline in traffic and a decrease in average ticket, partially offset by increased conversion.

Gross profit in the third quarter of 2023 was $30.7 million, or 26.3% of net sales, compared to $32.7 million, or 25.0% of net sales in the prior year quarter. The improvement as a percentage of net sales was primarily a result of improved merchandise margin, partially offset by the deleverage of fixed cost components on the lower sales base.

Operating loss in the third quarter of 2023 and 2022 remained consistent at $6.7 million, as lower operating costs, including reduced corporate compensation expense, offset the decline in gross profit dollars.

EBITDA in the third quarter of 2023 was a loss of $3.9 million compared to a loss of $2.6 million in the prior year quarter. Adjusted EBITDA in the third quarter of 2023 was a loss of $3.2 million compared to a loss of $1.7 million in the prior year quarter.

1

Net loss in the third quarter of 2023 improved to $6.4 million, or a loss of $0.50 per diluted share, compared to a net loss of $7.3 million, or a loss of $0.58 per diluted share in the prior year quarter.

As of October 28, 2023, the Company had a cash balance of $5.8 million, with $62.0 million of outstanding debt under its $90.0 million senior secured revolving credit facility. As of November 30, 2023, the Company had $35.0 million of outstanding debt under its senior secured revolving credit facility.

Investor Conference Call and Web Simulcast

Kirkland’s Home management will host a conference call to discuss its financial results for the third quarter ended October 28, 2023, followed by a question-and-answer period with Interim CEO Ann Joyce, President and COO Amy Sullivan, and EVP and CFO Mike Madden.

Date: Thursday, November 30, 2023

Time: 9:00 a.m. Eastern Time

Toll-free dial-in number: (855) 560-2577

International dial-in number: (412) 542-4163

Conference ID: 10184344

Please call the conference telephone number 10-15 minutes prior to the start time. An operator will register your name and organization. If you have any difficulty connecting with the conference call, please contact Gateway Group at (949) 574-3860.

The conference call will be broadcast live and available for replay here and via the investor relations section of the Company’s website at www.kirklands.com. The online replay will follow shortly after the call and remain available for one year.

A telephonic replay of the conference call will be available after the conference call through December 7, 2023.

Toll-free replay number: (877) 344-7529

International replay number: (412) 317-0088

Replay ID: 7702205

About Kirkland’s, Inc.

Kirkland’s, Inc. is a specialty retailer of home décor and furnishings in the United States, currently operating 339 stores in 35 states as well as an e-commerce website, www.kirklands.com, under the Kirkland’s Home brand. The Company provides its customers with an engaging shopping experience characterized by a curated, affordable selection of home décor along with inspirational design ideas. This combination of quality and stylish merchandise, value pricing and a stimulating online and store experience allows the Company’s customers to furnish their home at a great value. More information can be found at www.kirklands.com.

2

Forward-Looking Statements

Except for historical information contained herein, certain statements in this release, constitute forward-looking statements that are subject to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and are subject to the finalization of the Company’s quarterly financial and accounting procedures. Forward-looking statements deal with potential future circumstances and developments and are, accordingly, forward-looking in nature. You are cautioned that such forward-looking statements, which may be identified by words such as "anticipate," "believe," "expect," "estimate," "intend," "plan," "seek," "may," "could," "strategy," and similar expressions, involve known and unknown risks and uncertainties, many of which are outside of the Company’s control, which may cause the Company's actual results to differ materially from forecasted results. Those risks and uncertainties include, among other things, risks associated with the Company's liquidity including cash flows from operations and the amount of borrowings under the secured revolving credit facility, the Company’s actual and anticipated progress towards its short-term and long-term objectives including its brand strategy, the risk that natural disasters, pandemic outbreaks (such as COVID-19), global political events, war and terrorism could impact the Company’s revenues, inventory and supply chain, the continuing consumer impact of inflation and countermeasures, including raising interest rates, the effectiveness of the Company’s marketing campaigns, risks related to changes in U.S. policy related to imported merchandise, particularly with regard to the impact of tariffs on goods imported from China and strategies undertaken to mitigate such impact, the Company’s ability to retain its senior management team, continued volatility in the price of the Company’s common stock, the competitive environment in the home décor industry in general and in the Company's specific market areas, inflation, fluctuations in cost and availability of inventory, increased transportation costs and potential interruptions in supply chain, distribution systems and delivery network, including our e-commerce systems and channels, the ability to control employment and other operating costs, availability of suitable retail locations and other growth opportunities, disruptions in information technology systems including the potential for security breaches of the Company's information or its customers’ information, seasonal fluctuations in consumer spending, and economic conditions in general. Those and other risks are more fully described in the Company's filings with the Securities and Exchange Commission, including the Company’s Annual Report on Form 10-K filed on April 4, 2023 and subsequent reports. Forward-looking statements included in this release are made as of the date of this release. Any changes in assumptions or factors on which such statements are based could produce materially different results. Except as required by law, the Company disclaims any obligation to update any such factors or to publicly announce results of any revisions to any of the forward-looking statements contained herein to reflect future events or developments.

3

KIRKLAND’S, INC.

UNAUDITED CONSOLIDATED CONDENSED STATEMENTS OF OPERATIONS

(In thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

13-Week Period Ended |

|

|

|

October 28, |

|

|

October 29, |

|

|

|

2023 |

|

|

2022 |

|

Net sales |

|

$ |

116,365 |

|

|

$ |

130,962 |

|

Cost of sales |

|

|

85,712 |

|

|

|

98,275 |

|

Gross profit |

|

|

30,653 |

|

|

|

32,687 |

|

Operating expenses: |

|

|

|

|

|

|

Compensation and benefits |

|

|

19,841 |

|

|

|

20,794 |

|

Other operating expenses |

|

|

16,104 |

|

|

|

16,757 |

|

Depreciation (exclusive of depreciation included in cost of sales) |

|

|

1,043 |

|

|

|

1,577 |

|

Asset impairment |

|

|

316 |

|

|

|

219 |

|

Total operating expenses |

|

|

37,304 |

|

|

|

39,347 |

|

Operating loss |

|

|

(6,651 |

) |

|

|

(6,660 |

) |

Other expense, net |

|

|

1,036 |

|

|

|

624 |

|

Loss before income taxes |

|

|

(7,687 |

) |

|

|

(7,284 |

) |

Income tax (benefit) expense |

|

|

(1,290 |

) |

|

|

57 |

|

Net loss |

|

$ |

(6,397 |

) |

|

$ |

(7,341 |

) |

Loss per share: |

|

|

|

|

|

|

Basic |

|

$ |

(0.50 |

) |

|

$ |

(0.58 |

) |

Diluted |

|

$ |

(0.50 |

) |

|

$ |

(0.58 |

) |

Weighted average shares outstanding: |

|

|

|

|

|

|

Basic |

|

|

12,921 |

|

|

|

12,754 |

|

Diluted |

|

|

12,921 |

|

|

|

12,754 |

|

4

KIRKLAND’S, INC.

UNAUDITED CONSOLIDATED CONDENSED STATEMENTS OF OPERATIONS

(In thousands, except per share data)

|

|

|

|

|

|

|

|

|

|

|

39-Week Period Ended |

|

|

|

October 28, |

|

|

October 29, |

|

|

|

2023 |

|

|

2022 |

|

Net sales |

|

$ |

302,744 |

|

|

$ |

336,348 |

|

Cost of sales |

|

|

228,781 |

|

|

|

256,844 |

|

Gross profit |

|

|

73,963 |

|

|

|

79,504 |

|

Operating expenses: |

|

|

|

|

|

|

Compensation and benefits |

|

|

59,097 |

|

|

|

63,193 |

|

Other operating expenses |

|

|

44,932 |

|

|

|

50,549 |

|

Depreciation (exclusive of depreciation included in cost of sales) |

|

|

3,471 |

|

|

|

4,870 |

|

Asset impairment |

|

|

1,542 |

|

|

|

447 |

|

Total operating expenses |

|

|

109,042 |

|

|

|

119,059 |

|

Operating loss |

|

|

(35,079 |

) |

|

|

(39,555 |

) |

Other expense, net |

|

|

2,069 |

|

|

|

991 |

|

Loss before income taxes |

|

|

(37,148 |

) |

|

|

(40,546 |

) |

Income tax expense |

|

|

720 |

|

|

|

355 |

|

Net loss |

|

$ |

(37,868 |

) |

|

$ |

(40,901 |

) |

Loss per share: |

|

|

|

|

|

|

Basic |

|

$ |

(2.95 |

) |

|

$ |

(3.22 |

) |

Diluted |

|

$ |

(2.95 |

) |

|

$ |

(3.22 |

) |

Weighted average shares outstanding: |

|

|

|

|

|

|

Basic |

|

|

12,852 |

|

|

|

12,686 |

|

Diluted |

|

|

12,852 |

|

|

|

12,686 |

|

5

KIRKLAND’S, INC.

UNAUDITED CONSOLIDATED CONDENSED BALANCE SHEETS

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

October 28, |

|

|

January 28, |

|

|

October 29, |

|

|

|

2023 |

|

|

2023 |

|

|

2022 |

|

ASSETS |

|

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

5,765 |

|

|

$ |

5,171 |

|

|

$ |

11,245 |

|

Inventories, net |

|

|

105,190 |

|

|

|

84,071 |

|

|

|

126,315 |

|

Prepaid expenses and other current assets |

|

|

5,863 |

|

|

|

5,089 |

|

|

|

7,126 |

|

Total current assets |

|

|

116,818 |

|

|

|

94,331 |

|

|

|

144,686 |

|

Property and equipment, net |

|

|

31,648 |

|

|

|

38,676 |

|

|

|

42,629 |

|

Operating lease right-of-use assets |

|

|

130,513 |

|

|

|

134,525 |

|

|

|

136,280 |

|

Other assets |

|

|

6,848 |

|

|

|

6,714 |

|

|

|

7,979 |

|

Total assets |

|

$ |

285,827 |

|

|

$ |

274,246 |

|

|

$ |

331,574 |

|

LIABILITIES AND SHAREHOLDERS’ (DEFICIT) EQUITY |

|

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

55,729 |

|

|

$ |

43,739 |

|

|

$ |

47,157 |

|

Accrued expenses |

|

|

23,484 |

|

|

|

26,069 |

|

|

|

27,027 |

|

Operating lease liabilities |

|

|

39,966 |

|

|

|

41,499 |

|

|

|

40,156 |

|

Total current liabilities |

|

|

119,179 |

|

|

|

111,307 |

|

|

|

114,340 |

|

Operating lease liabilities |

|

|

108,248 |

|

|

|

114,613 |

|

|

|

119,254 |

|

Revolving line of credit |

|

|

62,000 |

|

|

|

15,000 |

|

|

|

60,000 |

|

Other liabilities |

|

|

3,685 |

|

|

|

3,553 |

|

|

|

4,915 |

|

Total liabilities |

|

|

293,112 |

|

|

|

244,473 |

|

|

|

298,509 |

|

Shareholders’ (deficit) equity |

|

|

(7,285 |

) |

|

|

29,773 |

|

|

|

33,065 |

|

Total liabilities and shareholders’ (deficit) equity |

|

$ |

285,827 |

|

|

$ |

274,246 |

|

|

$ |

331,574 |

|

6

KIRKLAND’S, INC.

UNAUDITED CONSOLIDATED CONDENSED STATEMENTS OF CASH FLOWS

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

39-Week Period Ended |

|

|

|

October 28, |

|

|

October 29, |

|

|

|

2023 |

|

|

2022 |

|

Cash flows from operating activities: |

|

|

|

|

|

|

Net loss |

|

$ |

(37,868 |

) |

|

$ |

(40,901 |

) |

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

Depreciation of property and equipment |

|

|

9,118 |

|

|

|

12,925 |

|

Amortization of debt issue costs |

|

|

80 |

|

|

|

69 |

|

Asset impairment |

|

|

1,542 |

|

|

|

447 |

|

(Gain) loss on disposal of property and equipment |

|

|

(20 |

) |

|

|

195 |

|

Stock-based compensation expense |

|

|

891 |

|

|

|

1,460 |

|

Changes in assets and liabilities: |

|

|

|

|

|

|

Inventories, net |

|

|

(21,119 |

) |

|

|

(12,286 |

) |

Prepaid expenses and other current assets |

|

|

(891 |

) |

|

|

3,184 |

|

Accounts payable |

|

|

11,885 |

|

|

|

(14,648 |

) |

Accrued expenses |

|

|

(2,775 |

) |

|

|

(1,873 |

) |

Income taxes payable (refundable) |

|

|

307 |

|

|

|

(1,684 |

) |

Operating lease assets and liabilities |

|

|

(3,933 |

) |

|

|

(4,670 |

) |

Other assets and liabilities |

|

|

97 |

|

|

|

(427 |

) |

Net cash used in operating activities |

|

|

(42,686 |

) |

|

|

(58,209 |

) |

|

|

|

|

|

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

Proceeds from sale of property and equipment |

|

|

130 |

|

|

|

35 |

|

Capital expenditures |

|

|

(3,313 |

) |

|

|

(6,964 |

) |

Net cash used in investing activities |

|

|

(3,183 |

) |

|

|

(6,929 |

) |

|

|

|

|

|

|

|

Cash flows from financing activities: |

|

|

|

|

|

|

Borrowings on revolving line of credit |

|

|

52,000 |

|

|

|

60,000 |

|

Repayments on revolving line of credit |

|

|

(5,000 |

) |

|

|

— |

|

Debt issuance costs |

|

|

(456 |

) |

|

|

— |

|

Cash used in net share settlement of stock options and restricted stock units |

|

|

(81 |

) |

|

|

(2,383 |

) |

Proceeds received from employee stock option exercises |

|

|

— |

|

|

|

16 |

|

Repurchase and retirement of common stock |

|

|

— |

|

|

|

(6,253 |

) |

Net cash provided by financing activities |

|

|

46,463 |

|

|

|

51,380 |

|

|

|

|

|

|

|

|

Cash and cash equivalents: |

|

|

|

|

|

|

Net increase (decrease) |

|

|

594 |

|

|

|

(13,758 |

) |

Beginning of the period |

|

|

5,171 |

|

|

|

25,003 |

|

End of the period |

|

$ |

5,765 |

|

|

$ |

11,245 |

|

|

|

|

|

|

|

|

Supplemental schedule of non-cash activities: |

|

|

|

|

|

|

Non-cash accruals for purchases of property and equipment |

|

$ |

804 |

|

|

$ |

573 |

|

7

Non-GAAP Financial Measures

To supplement our unaudited consolidated condensed financial statements presented in accordance with generally accepted accounting principles (“GAAP”), this earnings release and the related earnings conference call contain certain non-GAAP financial measures, including EBITDA, adjusted EBITDA and adjusted operating loss. These measures are not in accordance with, and are not intended as alternatives to, GAAP financial measures. The Company uses these non-GAAP financial measures internally in analyzing our financial results and believes that they provide useful information to analysts and investors, as a supplement to GAAP financial measures, in evaluating the Company’s operational performance.

The Company defines EBITDA as net loss before interest and the provision for income tax, which is equivalent to operating loss, adjusted for depreciation, adjusted EBITDA as EBITDA with non-GAAP adjustments and adjusted operating loss as operating loss with non-GAAP adjustments.

Non-GAAP financial measures are intended to provide additional information only and do not have any standard meanings prescribed by GAAP. Use of these terms may differ from similar measures reported by other companies. Each non-GAAP financial measure has its limitations as an analytical tool, and you should not consider them in isolation or as a substitute for analysis of the Company’s results as reported under GAAP. The Company’s non-GAAP adjustments remove asset impairment and stock-based compensation expense, due to the non-cash nature of these expenses, and remove severance charges and lease termination costs, as those expenses can fluctuate based on the needs of the business and do not represent a normal, recurring operating expense.

The following table shows a reconciliation of operating loss to EBITDA and adjusted EBITDA (in thousands) for the 13-week and 39-week periods indicated:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

13-Week Period Ended |

|

|

39-Week Period Ended |

|

|

|

October 28, 2023 |

|

|

October 29, 2022 |

|

|

October 28, 2023 |

|

|

October 29, 2022 |

|

Operating loss |

|

$ |

(6,651 |

) |

|

$ |

(6,660 |

) |

|

$ |

(35,079 |

) |

|

$ |

(39,555 |

) |

Depreciation |

|

|

2,769 |

|

|

|

4,088 |

|

|

|

9,118 |

|

|

|

12,925 |

|

EBITDA |

|

|

(3,882 |

) |

|

|

(2,572 |

) |

|

|

(25,961 |

) |

|

|

(26,630 |

) |

Non-GAAP adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

Closed store and lease termination costs in cost of sales(1) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

46 |

|

Asset impairment(2) |

|

|

316 |

|

|

|

219 |

|

|

|

1,542 |

|

|

|

447 |

|

Stock-based compensation expense(3) |

|

|

277 |

|

|

|

295 |

|

|

|

891 |

|

|

|

1,460 |

|

Severance charges(4) |

|

|

50 |

|

|

|

397 |

|

|

|

957 |

|

|

|

776 |

|

Total adjustments in operating expenses |

|

|

643 |

|

|

|

911 |

|

|

|

3,390 |

|

|

|

2,683 |

|

Total non-GAAP adjustments |

|

|

643 |

|

|

|

911 |

|

|

|

3,390 |

|

|

|

2,729 |

|

Adjusted EBITDA |

|

|

(3,239 |

) |

|

|

(1,661 |

) |

|

|

(22,571 |

) |

|

|

(23,901 |

) |

Depreciation |

|

|

2,769 |

|

|

|

4,088 |

|

|

|

9,118 |

|

|

|

12,925 |

|

Adjusted operating loss |

|

$ |

(6,008 |

) |

|

$ |

(5,749 |

) |

|

$ |

(31,689 |

) |

|

$ |

(36,826 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) Costs associated with asset disposals, closed store and lease termination costs.

(2) Asset impairment charges are related to property and equipment, software costs and cloud computing implementation costs.

(3) Stock-based compensation expense includes amounts amortized to expense related to equity incentive plans.

(4) Severance charges include expenses related to severance agreements and permanent store closure compensation costs.

8

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

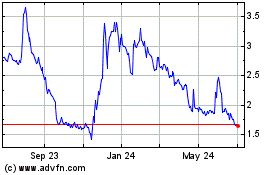

Kirklands (NASDAQ:KIRK)

Historical Stock Chart

From Mar 2024 to Apr 2024

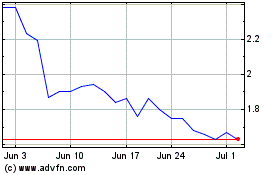

Kirklands (NASDAQ:KIRK)

Historical Stock Chart

From Apr 2023 to Apr 2024