false

0001567900

0001567900

2023-11-24

2023-11-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of report (Date of earliest event reported): November 24, 2023

BLACKBOXSTOCKS INC.

(Exact name of registrant as specified in its charter)

|

Nevada

|

|

001-41051

|

|

45-3598066

|

|

(State or other jurisdiction of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

5430 LBJ Freeway, Suite 1485, Dallas, Texas

|

75240

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s Telephone Number, Including Area Code: (972) 726-9203

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.001 per share

|

|

BLBX

|

|

The NASDAQ Capital Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

Amendment to the Amended Letter of Intent

On November 24, 2023, Blackboxstocks, Inc., a Nevada corporation (the “Company”) entered into a Binding Amendment to Amended Letter of Intent (the “LOI Amendment”) with Evtec Group Limited, Evtec Automotive Limited, and Evtec Aluminium Limited (collectively, “Evtec”), which amends a non-binding Amended Letter of Intent (the “LOI”) dated April 14, 2023. Pursuant to the LOI Amendment, the Company has agreed to continue to negotiate in good faith to consummate a proposed acquisition of Evtec contemplated by the LOI (the “Proposed Transaction”), subject to the terms of the LOI Amendment.

As a condition to the Company’s continued good faith negotiations regarding the Proposed Transaction, Evtec has agreed to (i) pay the Company aggregate extension fees totaling $400,000 which are to be guaranteed by a credit worthy affiliate of Evtec, (ii) provide extension loans of up to $400,000 to the Company if the Proposed Transaction has not closed on or before certain dates, (iii) pay the Company amounts in cash equal to any documented legal fees and third-party expenses incurred or payable by the Company in connection with the Proposed Transaction up to $175,000, including any such expenses incurred prior to the date of the LOI Amendment, (iv) forfeit and return 2,400,000 shares of the Company’s Series B Convertible Preferred Stock, $0.001 par value per share (the “Blackbox Series B Shares”) acquired by Evtec Group Limited under the terms of that certain Securities Exchange Agreement dated June 9, 2023 (the “Exchange Agreement”), and (v) permit the Company to convert each of the 4,086 preferred shares of Evtec Group Limited issued to the Company pursuant to the Exchange Agreement into one ordinary share of Evtec Group Limited.

Forfeiture Agreement

As provided for in the LOI Amendment, Evtec Group Limited entered into an agreement with the Company dated November 28, 2023 (the “Forfeiture Agreement”) in which Evtec Group Limited agreed to forfeit all of its right, title and interest in and to the 2,400,000 Blackbox Series B Shares acquired by Evtec Group Limited pursuant to the Exchange Agreement in order to further induce the Company to continue to negotiate in good faith to consummate the Proposed Transaction. Pursuant to the Forfeiture Agreement, the Company has no obligation to make any payment to Evtec Group Limited, in cash or otherwise, for any such Blackbox Series B Shares that are so forfeited. The Blackbox Series B Shares forfeited by Evtec Group Limited were cancelled as of the date as of the date of the Forfeiture Agreement.

The foregoing descriptions of the LOI Amendment and the Forfeiture Agreement do not purport to be complete and are subject to, and are qualified in its entirety by reference to, the full text of the LOI Amendment and the Forfeiture Agreement, which are attached as Exhibit 10.1 and Exhibit 10.2, respectively, to this Current Report on Form 8-K.

Item 9.01 Financial Statements and Exhibits.

(d) The following exhibits are filed with this Current Report on Form 8-K.

|

Exhibits

|

Description

|

|

10.1

|

|

|

10.2

|

|

| 104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Dated: November 28, 2023

|

Blackboxstocks Inc.

|

|

| |

|

|

| |

By:

|

/s/ Gust Kepler

|

|

| |

|

Gust Kepler

President and Chief Executive Officer

|

|

Exhibit 10.1

November 21, 2023

EVTEC Group Limited

EVTEC Automotive Limited

EVTEC Aluminum Limited

Attention: David Roberts, CEO

Re: Binding Amendment to Amended Letter of Intent

Dear David:

Reference is made to that certain amended letter of intent, dated April 14, 2023 (the “LOI”), among Blackboxstocks, Inc. (“Blackbox”), EVTEC Group Limited (“Evtec Group”), EVTEC Automotive Limited (“Evtec Automotive”) and EVTEC Aluminum Limited (“Evtec Aluminum”). Capitalized terms used herein but not otherwise defined shall have the meanings ascribed to them in the LOI.

Since the execution of the LOI, the Parties have determined to structure the proposed Transaction as an acquisition of Evtec Automotive and Evtec Aluminum under the terms of a Share Exchange Agreement (the “Definitive Agreement”) which has been the subject of ongoing negotiation among the Parties.

In light of the delay in negotiations and diligence matters with respect to the Targets, Blackbox has determined that it will only continue to negotiate in good faith to consummate the Transaction upon terms set forth herein.

Upon execution and delivery of this letter agreement (the “LOI Amendment”), the Parties hereby agree as follows:

1. Extension of Negotiations. Subject to the terms hereof, including specifically, timely payment/delivery of the Extension Fees (hereinafter defined), Extension Loans (hereinafter defined) and Guaranteed Transaction Expenses (hereinafter defined), the Parties will continue to negotiate in good faith to finalize and execute the Definitive Agreement. Notwithstanding the foregoing, any party may terminate Transaction negotiations by delivering written notice to the other party (i) in the event Evtec fails to (A) take any action specified herein, (B) make any agreed payment or loan, or (C) deliver the Series B Shares (hereinafter defined) under the terms of this LOI Amendment on or before the date(s) provided for such action, payments, loans or delivery, as applicable; or (ii) on or after May 1, 2024 if a Transaction has not been consummated.

2. Guaranteed Extension Fees and Extension Loans.

a. Guaranteed Extension Fees. Evtec Group, Evtec Automotive and Evtec Aluminum (collectively, “Evtec”) hereby agree, jointly and severally, to pay Blackbox the following extension fees (“Guaranteed Extension Fees”), which shall be guaranteed by a credit worthy affiliate of Evtec acceptable to Blackbox pursuant to an unconditional guaranty agreement in a form acceptable to Blackbox, in cash on the schedule set forth below:

(i) $100,000 on or before November 22, 2023

(ii) $100,000 on or before December 8, 2023

(iii) $100,000 on or before December 21, 2023

(iv) $100,000 on or before January 9, 2024

b. Extension Loans. In the event that a Transaction for the acquisition of one or more of the Targets has not Closed on or before the dates set forth below, Evtec shall loan Blackbox the following principal amounts (the “Extension Loans”) which shall be unsecured and bear interest at a rate of [●]% per annum:

(i) $200,000 on or before March 1, 2024

(ii) $200,000 on or before April 1, 2024

3. Guaranteed Transaction Expenses. Evtec will pay Blackbox an amount in cash equal to any documented legal fees and Transaction related third party expenses (“Guaranteed Transaction Expenses”) incurred or payable by Blackbox in connection with the Transaction up to $175,0000, including any such Transaction Expenses incurred to date, within five (5) business days of request for payment by Blackbox, but in any event, no later than December 31, 2023. The Guaranteed Transaction Expenses shall be guaranteed by a credit worthy affiliate of Evtec acceptable to Blackbox pursuant to an unconditional guaranty agreement in a form acceptable to Blackbox.

4. Forfeiture of Blackbox Equity. As additional consideration for the agreements set forth herein, Evtec Group hereby agrees to forfeit and return, endorsed for transfer to Blackbox for cancellation no later than November 24, 2023, the 2,400,000 shares of Blackbox Series B Convertible Preferred Stock, $0.001 par value per share (the “Series B Shares”) acquired by Evtec Group under the terms of that certain Securities Exchange Agreement dated June 9, 2023 (the “Exchange Agreement”). Upon receipt by Blackbox, the Series B Shares shall be deemed forfeited and Evtec Group shall have no further rights with respect to such shares which shall be cancelled on the Blackbox books and stockholder ledger.

5. Conversion of Evtec Group Equity. Evtec Group shall promptly, but in no event later than November 24, 2023, take all action necessary to permit Blackbox to immediately convert each of the 4,086 preferred shares of Evtec Group (the “Evtec Shares”) issued under the terms of the Exchange Agreement into one ordinary share in the capital of Evtec Group.

6. Transaction Consideration. The Blackbox Shares to be issued in consideration for the Transaction shall not exceed 90.5% of the issued and outstanding shares of Common Stock of Blackbox immediately following Closing. The Parties further acknowledge and agree that in the event the acquisition of Evtec Aluminum is consummated independently of Evtec Automotive, the anticipated share consideration issuable in the combined Transactions shall not dilute pre-Transaction Blackbox stockholders by more than 90.5%.

7. Further Assurances. Each party shall do and perform or cause to be done and performed, all such further acts and things, and shall execute and deliver all such other agreements, certificates, instruments and documents, as the other party may reasonably request in order to carry out the intent and accomplish the purposes of this LOI Amendment and the consummation of the transactions contemplated hereby.

8. Binding Agreement; Choice of Law. This LOI Amendment shall be binding upon the Parties and governed by and construed in accordance with the laws of the State of Texas, without giving effect to any choice or conflict of law provision or rule (whether of the State of Texas or any other jurisdiction) that would cause the application of the laws of any jurisdiction other than the State of Texas.

9. Counterparts. This letter agreement may be executed in any number of counterparts (including counterparts by facsimile or any other form of electronic communication) and all such counterparts taken together shall be deemed to constitute one and the same instrument.

[Signature Page Follows]

This letter agreement has been executed by the parties to be effective as of November 21, 2023.

| |

BLACKBOXSTOCKS INC. |

|

| |

|

|

|

| |

|

|

|

| |

|

|

|

| |

By: |

|

|

| |

|

Gust Kepler, |

|

| |

|

President and Chief Executive Officer |

|

| ACCEPTED AND AGREED: |

|

| |

|

|

| EVTEC Group Limited |

|

| |

|

|

| By: |

|

|

| Name: |

|

|

| Title: |

|

|

| |

|

|

| |

|

|

| EVTEC Automotive Limited |

|

| |

|

|

| |

|

|

| By: |

|

|

| Name: |

|

|

| Title: |

|

|

| |

|

|

| |

|

|

| EVTEC Aluminum Limited |

|

| |

|

|

| |

|

|

| By: |

|

|

| Name: |

|

|

| Title: |

|

|

Exhibit 10.2

FORFEITURE AGREEMENT

This Forfeiture Agreement (the “Agreement”), is entered into by and between Blackboxstocks, Inc., a Nevada corporation (“Blackbox”) and Evtec Group Limited, a company registered in England and Wales with company number 13046319 (“Evtec Group”), and is made effective as of November 28, 2023 (the “Effective Date”). Blackbox and Evtec Group may be collectively referred to as the “Parties” or individually as a “Party”. Unless otherwise specifically indicated herein, each capitalized term used in this Agreement but not defined in this Agreement shall have the meaning assigned to such term in the Securities Exchange Agreement dated June 9, 2023 (the “Exchange Agreement”).

WHEREAS, under the terms of the Exchange Agreement, Blackbox issued 2,400,000 shares of Series B Convertible Preferred Stock, $0.001 par value per share (the “Blackbox Series B Shares”) in exchange for 4,086 newly issued preference shares of Evtec Group (the “Evtec Preference Shares”); and

WHEREAS, effective as of November 24, 2023, Blackbox entered into a Binding Amendment to the Amended Letter of Intent (the “LOI Amendment”) with Evtec Group, Evtec Automotive Limited, and Evtec Aluminium Limited, which amends the Amended Letter of Intent among the parties dated April 14, 2023; and

WHEREAS, as provided for in the LOI Amendment, in order to further induce Blackbox to continue to negotiate in good faith to consummate the proposed transaction in which Blackbox will acquire 100% of the issued and outstanding ordinary shares of Evtec Aluminium Limited and Evtec Group (the “Proposed Transaction”), Evtec Group has agreed to forfeit all of the Blackbox Series B Shares that were issued to Evtec Group pursuant to the Exchange Agreement.

NOW THEREFORE, in consideration of the foregoing, the covenants and agreements contained in this Agreement, the LOI Amendment and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged by the Parties, the Parties, intending to be legally bound, hereby agree as follows:

1. Forfeiture of Class B Interest.

(a) Effective as of the Effective Date, Evtec Group hereby forfeits all of its right, title and interest in and to the Blackbox Series B Shares and delivers herewith the Stock Power attached hereto as Exhibit A transferring the Blackbox Series B Shares to Blackbox for cancellation. Blackbox has no obligation to make any payment to Evtec Group, in cash or otherwise, for any such Blackbox Series B Shares that are so forfeited. For the avoidance of doubt, the Blackbox Series B Shares forfeited hereby are cancelled as of the Effective Date.

2. Representations and Warranties of Evtec Group. Evtec Group hereby represents and warrants to Blackbox as follows, in each case, as of the Effective Date:

(a) Evtec Group has the right, power, legal capacity, and authority to enter into and to perform Evtec Group’s obligations under this Agreement.

(b) This Agreement constitutes a valid, legal and binding obligation of Evtec Group, enforceable against Evtec Group in accordance with its terms, and no approval or consent of any other Person is required in connection with Evtec Group’s execution and delivery of this Agreement.

(c) Evtec Group is capable of evaluating the merits and risks hereof and of protecting Evtec Group’s own interests in connection herewith.

(d) Evtec Group acknowledges that this Agreement was the product of an arm’s-length negotiation with Blackbox and that the transactions contemplated by this Agreement represent a bargained for exchange between Evtec Group and Blackbox in consideration of Blackbox’s role in facilitating the matters described in the recitals to this Agreement.

(e) Evtec Group has independently, and without reliance upon Blackbox, any of its Affiliates or any officer, director, manager, partner, employee, agent, or representative of any of the foregoing (each a “Covered Person”), and based on such information as Evtec Group has deemed appropriate, made Evtec Group’s own analysis and decision to enter into this Agreement.

(f) Evtec Group has not received any investment advice from any Covered Person or sought such advice from any Covered Person as to whether the transactions contemplated by this Agreement are prudent or suitable.

(g) Evtec Group has adequate information concerning Blackbox and the Blackbox Series B Shares to make an informed decision regarding the transactions contemplated by this Agreement and has received all information and documents that Evtec Group has deemed appropriate to make Evtec Group’s own analysis regarding the transactions contemplated by this Agreement.

(h) Evtec Group acknowledges that the transactions contemplated by this Agreement are fair and reasonable to Evtec Group and Evtec Group’s interests.

(i) Evtec Group further warrants and represents that Evtec Group is the current legal and beneficial owner of the Blackbox Series B Shares and the Blackbox Series B Shares have not been sold, transferred, assigned, pledged, encumbered or contracted to be sold, transferred, assigned, pledged or encumbered.

EVTEC GROUP ACKNOWLEDGES AND AGREES THAT NO COVERED PERSON HAS MADE ANY REPRESENTATION, ORAL OR WRITTEN, PAST, PRESENT OR FUTURE, OF, AS TO, OR CONCERNING THE EXISTING OR PROPOSED BUSINESS, FINANCIAL CONDITION, PROPERTIES, OPERATIONS AND/OR PROSPECTS OF BLACKBOX.

3. Representations and Warranties of Blackbox. Blackbox hereby represents and warrants to Evtec Group as follows:

(a) Blackbox has the right, power, legal capacity and authority to enter into and to perform its obligations under this Agreement.

(b) This Agreement constitutes a valid, legal, and binding obligation of Blackbox, enforceable against Blackbox in accordance with its terms, and any approval or consent of any other Person is necessary in connection with the execution and delivery of this Agreement by Blackbox have been obtained.

(c) To the current, actual knowledge of Gust Kepler as of the Effective Date, Evtec Group has not violated or breached (A) any provision of the Exchange Agreement that is applicable to Evtec Group or (B) any agreement entered into by and between Blackbox or any of its Affiliates, on the one hand, and Evtec Group or any of its Affiliates, on the other hand.

4. Further Assurances. Each party shall do and perform or cause to be done and performed, all such further acts and things, and shall execute and deliver all such other agreements, certificates, instruments and documents, as the other party may reasonably request in order to carry out the intent and accomplish the purposes of this Agreement and the consummation of the transactions contemplated hereby.

5. Relationship to Exchange Agreement. Except to the extent amended by this Agreement, the Exchange Agreement shall remain in full force and effect in accordance with its terms. From and after the date hereof, references in the Exchange Agreement to “this Agreement” shall be construed to refer to the Exchange Agreement as amended hereby, unless the context clearly otherwise requires.

6. Governing Law. THIS AGREEMENT IS TO BE CONSTRUED IN ACCORDANCE WITH AND GOVERNED BY THE LAWS OF THE STATE OF TEXAS WITHOUT GIVING EFFECT TO ANY CHOICE OF LAW RULE THAT WOULD CAUSE THE APPLICATION OF THE LAWS OF ANY OTHER JURISDICTION.

7. Savings Clause. Should any provision of this Agreement be declared to be determined by any court to be illegal or invalid, the validity of the remaining parts, terms or provisions shall not be affected thereby and said illegal or invalid part, term or provision shall be deemed not to be a part of this Agreement.

8. Entire Agreement; Amendment. This Agreement, the Exchange Agreement (to the extent not amended hereby), and the LOI Amendment set forth the entire agreement between the Parties with respect to the subject matter addressed herein and therein. The recitals to this Agreement are hereby incorporated into, and made a part of, this Agreement for all purposes. This Agreement, the Exchange Agreement, as amended hereby, and the LOI Amendment may not be amended, modified or supplemented to add additional terms or conditions except in a written agreement executed by each of the Parties that specifically references the Exchange Agreement, this Agreement, and the LOI Amendment.

9. Binding Effect; Assignment. This Agreement shall be binding upon and inure to the benefit of the Parties and their respective successors and permitted assigns. Evtec Group shall not assign any of Evtec Group’s rights or obligations under this Agreement without the prior written consent of Blackbox, which consent may be granted, conditioned or withheld in its sole discretion.

10. Counterparts. This Agreement may be executed in counterparts, each of which shall be deemed an original, and such counterparts shall constitute but one and the same instrument. Any Party may deliver an executed copy of this Agreement by facsimile, electronic mail (in .pdf format) or other electronic method (including, without limitation, DocuSign) to the other Party and such delivery shall have the same force and effect as any other delivery of a manually signed copy of this Agreement.

[Signature Page Follows]

IN WITNESS WHEREOF, the Parties have executed this Agreement as of the day and year first above written.

| |

BLACKBOXSTOCKS, INC. |

|

| |

|

|

|

| |

|

|

|

| |

By: |

|

|

| |

|

Gust Kepler |

|

| |

|

President and Chief Executive Officer |

|

| |

|

|

|

| |

EVTEC GROUP LIMITED |

|

| |

|

|

|

| |

|

|

|

| |

By: |

|

|

| |

|

David Roberts |

|

| |

|

Director |

|

Exhibit A

Stock Power

STOCK POWER

(Assignment and Forfeiture)

FOR VALUE RECEIVED, the undersigned shareholder, Evtec Group Limited, hereby sells, assigns and transfers unto Blackboxstocks, Inc. (the “Assignee”), 2,400,000 shares of Blackbox Series B Convertible Preferred Stock, $0.001 par value per share, (the "Shares") of Blackboxstocks, Inc., a Nevada corporation (the “Company”), and standing in its name on the books of the Company, and does hereby irrevocably constitute and appoint the proper officers of the Company as his attorney to transfer the said Shares on the books of the Company maintained for that purpose, with full power of substitution in the premises.

Dated: November 28, 2023

| |

|

|

| |

Name: |

David Roberts |

|

| |

Title: |

|

|

v3.23.3

Document And Entity Information

|

Nov. 24, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

BLACKBOXSTOCKS INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Nov. 24, 2023

|

| Entity, Incorporation, State or Country Code |

NV

|

| Entity, File Number |

001-41051

|

| Entity, Tax Identification Number |

45-3598066

|

| Entity, Address, Address Line One |

5430 LBJ Freeway, Suite 1485

|

| Entity, Address, City or Town |

Dallas

|

| Entity, Address, State or Province |

TX

|

| Entity, Address, Postal Zip Code |

75240

|

| City Area Code |

972

|

| Local Phone Number |

726-9203

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

BLBX

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

true

|

| Entity, Ex Transition Period |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001567900

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

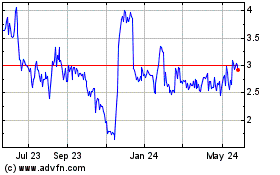

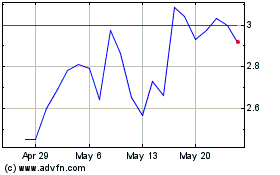

BlackBoxStocks (NASDAQ:BLBX)

Historical Stock Chart

From Mar 2024 to Apr 2024

BlackBoxStocks (NASDAQ:BLBX)

Historical Stock Chart

From Apr 2023 to Apr 2024