0000719135false00007191352023-11-212023-11-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

November 21, 2023

Date of Report (date of earliest event reported)

APYX MEDICAL CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

Delaware | 001-31885 | 11-2644611 |

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification No.) |

5115 Ulmerton Road, Clearwater, Florida 33760

(Address of principal executive offices, zip code)

(727) 384-2323

(Issuer's telephone number)

_____________________________________________________________

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A common stock | APYX | Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

o

Item 5.02 - Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Appointment of Matthew Hill as Chief Financial Officer

On November 28, 2023, Apyx Medical Corporation (the “Company”) announced that it had appointed Matthew Hill as its Chief Financial Officer, effective December 4, 2023 (the “Effective Date”).

Immediately prior to joining the Company, Mr. Hill, age 55, served as the Chief Financial Officer of PDS Biotechnology Corporation (Nasdaq: PDSB) (“PDS Biotech”), a clinical-stage immunotherapy company, where he led all aspects of the company’s budgeting, forecasting, financial management and reporting. Prior to joining PDS Biotech, he served as Chief Financial Officer of Strata Skin Sciences (Nasdaq: SSKN), a medical technology company developing, commercializing and marketing products for the treatment of dermatologic conditions, from 2018 to 2021. Prior to joining Strata Skin Sciences, Mr. Hill served as Chief Financial Officer at several companies, including Velcera, Inc., which developed pet medication for the companion animal health industry, and EP MedSystems, which developed and marketed cardiac electrophysiology products. He was also a Senior Manager at the international accounting and consulting firm, Grant Thornton LLP. Mr. Hill holds a Bachelor of Science in Accounting from Lehigh University.

With the exception of Mr. Hill’s Employment Agreement described below, there are no arrangements or understandings between Mr. Hill and any other person pursuant to which Mr. Hill was selected as Chief Financial Officer. Mr. Hill does not have any familial relationships with any director or executive officer of the Company. The Company has not engaged in any transaction with Mr. Hill that requires disclosure under Item 404(a) of Regulation S-K under the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Employment Agreement with Matthew Hill

On November 21, 2023, in connection with his appointment as Chief Financial Officer, the Company entered into an Employment Agreement with Mr. Hill, effective December 4, 2023 (the “Employment Agreement”). On the Effective Date, Mr. Hill will also serve as the Company’s Principal Financial Officer and Principal Accounting Officer.

Pursuant to the terms of the Employment Agreement, Mr. Hill will receive an initial annual base salary of $425,000 (the “Base Salary”). Mr. Hill will also be entitled to receive a sign on bonus of $50,000 within 30 days of the Effective Date, subject to the recoupment of any unearned portion if Mr. Hill is terminated for Cause (as defined therein) or Mr. Hill terminates the Employment Agreement without Good Reason (as defined therein) prior to the one-year anniversary of the Effective Date.

Additionally, Mr. Hill shall have the opportunity to earn an annual bonus under a bonus plan to be determined and established by the Company. The target bonus shall be equal to not less than 50% of his Base Salary, subject to the achievement of bonus objectives. Pursuant to an option award agreement between Mr. Hill and the Company that will be delivered to Mr. Hill in or about January 2024, Mr. Hill will also be entitled to receive a non-qualified stock option to purchase 150,000 shares of the Company’s common stock at an exercise price equal to the closing price of the Company’s common stock on its principal exchange on the date of such grant, subject to the applicable vesting requirements.

If Mr. Hill’s employment with the Company is terminated for any of the reasons set forth in the Employment Agreement, Mr. Hill (or his estate or beneficiaries in the case of his death) shall receive certain earned but unpaid amounts and other benefits, provided (i) a Release (as defined in the Employment Agreement) is executed and the applicable revocation period with respect to the Release expires without any revocation of any portion of the Release, and (ii) none of the Restrictive Covenants (as defined in the Employment Agreement) are breached.

The foregoing is only a summary of the material terms of the Employment Agreement and is qualified in its entirety by reference to the full text of the Employment Agreement, a copy of which is attached hereto as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein by reference.

Item 7.01 Regulation FD Disclosure.

On November 28, 2023, the Company issued a press release (the “Press Release”) announcing the appointment of Mr. Hill as its Chief Financial Officer. A copy of the Press Release is attached hereto as Exhibit 99.1.

The information in this Item 7.01 and in Exhibit 99.1 attached hereto, is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that Section, nor shall it be deemed subject to the requirements of amended Item 10 of Regulation S-K, nor shall it be deemed incorporated by reference into any filing of the Company under the Securities Act of 1933, as amended, or the Exchange Act, whether made before or after the date hereof, regardless of any general incorporation language in such filing. The furnishing of this information hereby shall not be deemed an admission as to the materiality of such information.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| 10.1 | | |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| Date: November 28, 2023 | Apyx Medical Corporation | |

| | | |

| | | |

| | | |

| | | |

| | | |

| By: | /s/ Charles D. Goodwin, II | |

| | Charles D. Goodwin, II | |

| | Cheif Executive Officer | |

EMPLOYMENT AGREEMENT

THIS EMPLOYMENT AGREEMENT, effective as of December 4, 2023 (the “Effective Date”), is hereby entered into by and between Apyx Medical Corporation, a corporation organized and existing under the laws of the State of Delaware (the “Company”) and Matthew Hill (the “Executive”).

WITNESSETH:

WHEREAS, the Company agrees to employ the Executive and the Executive agrees to be employed by the Company on the terms and conditions set forth herein.

NOW, THEREFORE, for and in consideration of the mutual covenants contained herein, the parties hereto agree as follows:

1)EMPLOYMENT OF EXECUTIVE: The Company hereby employs the Executive and the Executive hereby accepts employment with the Company, in each case pursuant to the terms and conditions of this Agreement.

2)DUTIES: The Executive shall be the Chief Financial Officer of the Company and shall have the authority, functions, duties, powers and responsibilities normally associated with such position, and such other title, authority, functions, duties, powers and responsibilities as may be assigned to the Executive from time to time by the Chief Executive Officer of the Company (“CEO”) and the Board of Directors of the Company (the “Board”) consistent with the Executive’s position with the Company. Executive shall report to the CEO. The Executive agrees to devote substantially all of his business time and efforts to the performance of his duties, except for customary vacations and reasonable absences due to illness or other incapacity as set forth herein, and to perform all of his duties to the best of his professional ability and comply with such reasonable policies, standards, and regulations of the Company as are from time to time established by the Board. Executive shall have no outside business activities that are competitive with or present a conflict of interest with the Company, or that would conflict or interfere with the performance of his duties hereunder. Notwithstanding the foregoing, nothing contained herein shall be construed so as to prohibit or prevent the Executive from engaging in charitable causes, sitting on the boards of directors of not-for-profit entities, or managing his and his family’s personal finances, so long as such activities do not conflict or interfere with the performance of his duties hereunder. By entering into this Agreement, the Executive represents that he is not a party to any restrictive covenants, or other agreement or understanding that would conflict or interfere with the performance of any of his duties hereunder.

3)TERM: The term of employment under this Agreement shall commence on the Effective Date and shall continue until terminated in accordance with Section 11 hereof (the “Term”).

4)PLACE OF EMPLOYMENT: Executive’s principal work location shall be in Lumberton, New Jersey. Executive shall travel to such other locations as reasonably necessary to carry out his duties hereunder on an as-needed basis.

5)COMPENSATION: For all services rendered to the Company, the Executive agrees to accept as total compensation a sum computed as set forth in this Section 5. All payments of compensation (whether under this Section 5 or under any other section of this Agreement) shall be subject to all applicable withholdings and deductions in accordance with applicable law and Company policies and procedures.

(a)Base Salary. The Company shall pay the Executive an annual base salary at the rate of Four Hundred Twenty Five Thousand Dollars ($425,000.00) per year (“Base Salary”), in accordance with the customary payroll practices of the Company applicable to senior executives. During the Term, the Company’s Compensation Committee of the Board shall review the Base Salary and may provide for such increases (but not decreases) in Base Salary as it may, in its sole and exclusive discretion, deem appropriate.

(b)Annual Incentive Plan. During the Term, the Executive shall have the opportunity to earn an annual bonus under a bonus plan to be determined and established annually by the Company (the “Bonus Plan”). The Bonus Plan shall be subject to prior Board approval. The criteria used to determine the amount of the Executive’s annual bonus (“Performance Bonus”) under the Bonus Plan will be established by the Company in its sole discretion, and shall have a target bonus in an amount equal to not less than 50% of the Executive’s Base Salary. The Performance Bonus will be paid no later than April 30 of the following calendar year.

(c)Sign-On Bonus. As a further inducement to execute this Agreement and commence and continue employment with the Company, the Company shall pay to the Executive, in a single lump sum within 30 days following the Effective Date, the gross amount of Fifty Thousand Dollars ($50,000) (“Sign-On Bonus”). The amount equal to 1/12th of the Sign-On Bonus shall be earned by Executive for each full month of employment that he works for the Company beginning as of the Effective Date. In the event that the Executive terminates his employment without Good Reason, as defined in Section 11(d), or is terminated for Cause, as defined in Section 11(b), prior to the one-year anniversary of the Effective Date, the Executive agrees that he shall reimburse the Company for the unearned portion of the Sign-On Bonus within 30 days of his termination of employment.

(d)Equity Awards.

1.General. Executive shall be eligible to participate in the equity-based incentive plans of the Company and may receive awards thereunder, as determined by the Compensation Committee from time to time and subject to the terms and conditions of such plans and any award agreement between the Company and Executive evidencing such awards.

2.Sign-On Award. Pursuant to an option award agreement between the Company and the Executive that shall be delivered to the Executive in or about January 2024 (the “Award Agreement”) the Company shall grant to the Executive a non-qualified stock option (an “Option”) to purchase 150,000 shares of Apyx common stock at an exercise price equal to the closing price of the shares of the Company’s common stock on its principle exchange on the date of the grant. The Options will vest as follows: 50% on the first anniversary of Executive’s commencement of employment and the remaining 50% on the second anniversary of Executive’s commencement of employment. Executive must be employed by the Company on the vesting dates referenced in the prior sentence in order for the Options to vest.

3.All unvested Options and other equity-based incentive plans will vest immediately upon a Change of Control (as defined in Section 11(f) below).

6)VACATION/SICK TIME: Executive shall be entitled to paid time off during Executive's employment pursuant to the Company’s policies applicable to senior executives, as may be amended from time to time.

7)REIMBURSEMENT OF BUSINESS EXPENSES: The Company agrees to pay, either directly or indirectly by payment to the Executive, for all of the Executive's reasonable entertainment, travel and other miscellaneous business expenses incurred by him in the

performance of his services under this Agreement, in accordance with the Company’s policies regarding such reimbursements. As a prerequisite to any payment or reimbursement by the Company for business expenses, the Executive shall submit receipts of all such expenses to the Company; and the Company's obligation to effect payment or reimbursement of such expenses shall be only to the extent of such receipts.

8)ADDITIONAL BENEFITS: The Executive and his dependents shall be eligible to participate in the Company’s medical and dental insurance plans applicable to senior executives at the Company in accordance with the terms and conditions of such plans.

9)COMPANY PROPERTY: The Executive understands and agrees that Company files, customer files, legal files, legal research files, form files, forms, examples, samples, and all briefs and memoranda, intellectual property and other work product or property, and all copies thereof (collectively, “Company Property”) are the sole and exclusive property of the Company; and the same shall remain in the possession of the Company and shall constitute the property of the Company irrespective of who prepared the same. The Executive shall not remove, photocopy, photograph, or in any other manner duplicate or otherwise remove or use any Company Property other than in the performance of his duties hereunder.

10)DISPOSITION OF PROPERTY UPON TERMINATION OF EMPLOYMENT: In the event that Executive’s employment with the Company is terminated for any reason, the Executive agrees and understands that all Company Property in his possession or control shall be, at the Company’s option, promptly destroyed or returned to the Company, and the Executive shall have no right, title or interest in the same.

11)TERMINATION OF EMPLOYMENT AND CHANGE OF CONTROL: Upon Executive’s termination of employment for any reason, he shall automatically be deemed to have stepped down from all positions and offices held with the Company. The employment of the Executive may be terminated as follows:

(a)Termination upon Death or Disability. This Agreement and the Executive’s employment hereunder shall automatically terminate on the date on which the Executive dies or becomes permanently incapacitated. The Executive shall be deemed to have become “permanently incapacitated” on the date that is thirty (30) days after the Company has determined that the Executive has suffered a Permanent Incapacity (as defined below) and so notifies the Executive. For purposes of this section, “Permanently Incapacitated” shall mean (i) the Executive’s actual or anticipated inability, due to physical or mental incapacity, to substantially perform his duties and responsibilities under this Agreement with or without reasonable accommodation for six (6) months out of any twelve (12) month period, or four (4) consecutive months; or (ii) the Executive is receiving income benefits for a period of ninety (90) days under any long-term disability plan by reason of any medically determinable physical or mental impairment that can be expected to result in death or can be expected to last for a continuous period of four (4) months or more.

(b)Termination by the Company for Cause. The Company may terminate this Agreement and the Executive’s employment hereunder for Cause (as defined below), effective immediately upon delivery of written notice (the “Termination Notice”) to the Executive given at any time during the Term (without any necessity for prior notice). For purposes of this Agreement, “Cause” shall mean the Executive’s: (1) conviction of any felony or any other crime involving dishonesty or moral turpitude, (2) commission of any act of fraud or dishonesty by the Executive, or theft of or intentional damage to the property of the Company or any of its subsidiaries or affiliates, (3) engaging in any act that has had, or can reasonably be expected to have, a significant adverse financial effect on the Company or a significant adverse effect on the Company’s reputation, (4) willful or intentional breach of Executive’s fiduciary

duties to the Company, (5) breach by Executive of any material provision of this Agreement, or (6) violation of a material policy of the Company as in effect from time-to-time. Prior to a termination by the Company of the Executive's employment for Cause under subsections (5) or (6) of this Section 11(b), in the event that the Company deems the breach curable in its sole reasonable discretion, the Executive shall first have an opportunity to cure or remedy such breach within fifteen (15) days following the Termination Notice, or such longer period as is reasonable under the circumstances, and provided that Executive diligently pursues such cure within such fifteen (15) day period, and if the same is cured or remedied within such period, such Termination Notice shall become null and void.

(c)Termination by the Company without Cause. The Company may terminate this Agreement and Executive’s employment hereunder without Cause, upon at least thirty (30) days prior written notice to the Executive.

(d)Termination by the Executive for Good Reason. The Executive may terminate this Agreement and Executive’s employment hereunder with Good Reason (as defined below). For purposes of this Agreement, “Good Reason” shall mean (i) the material reduction of the Executive’s title, authority, duties and responsibilities or the assignment to the Executive of duties materially inconsistent with the Executive’s position or positions with the Company; (ii) a change in the Executive’s principal work location without Executive’s consent to a location that is more than 35 miles from the Executive’s principal work location first established under Section 4 of this Agreement, or (iii) the Company’s material breach of this Agreement. Notwithstanding the foregoing, (x) Good Reason shall not be deemed to exist unless notice of termination on account thereof (specifying a termination date thirty (30) days from the date of such notice) is given no later than 60 days after the time at which the event or condition purportedly giving rise to Good Reason first occurs or arises and (y) if there exists (without regard to this clause (y)) an event or condition that constitutes Good Reason, the Company shall have fifteen (15) days from the date notice of such a termination is given to cure such event or condition and, if the Company does so, such event or condition shall not constitute Good Reason hereunder.

(e)Termination by the Executive other than for Good Reason. The Executive may terminate this Agreement and Executive’s employment hereunder other than for Good Reason, provided that the Executive gives the Company no less than thirty (30) days prior written notice of such termination.

(f)Definition of Change of Control. For purposes of this Agreement, “Change of Control” shall mean any of the following:

(i)any one person, or more than one person acting as a group, acquires ownership of stock of the Company that, together with stock held by such person or group, constitutes more than fifty percent (50%) of the total voting power of the stock of the Company;

(ii)any consolidation or merger of the Company into another corporation or entity where the stockholders of the Company, immediately prior to the consolidation or merger, would not, immediately after the consolidation or merger, beneficially own, directly or indirectly, securities representing in the aggregate more than fifty percent (50%) of the combined voting power of all the outstanding securities of the surviving corporation (or of its ultimate parent corporation, if any).

(iii)the sale, lease or other transfer of all or substantially all of the Company’s assets to an independent, unaffiliated third party in a single transaction or a series of related transactions.

(iv)the date that a majority of the members of the Company’s Board of Directors is replaced during any twelve (12) month period by directors whose appointment or election is not endorsed by a majority of the members of the Company’s Board of Directors prior to the date of the appointment or election.

(g) In the event of a Change of Control as defined in 11(f) above, all of Executive’s stock option grants shall immediately vest in accordance with the terms of the applicable plan and award agreement(s), and the options shall immediately become and remain exercisable for a period of 12 months following the date of occurrence of a Change of Control.

12)PAYMENTS UPON TERMINATION. In the event of the termination of this Agreement and the Executive’s employment hereunder, the Executive shall receive the amounts and benefits set forth below so long as the Executive (or the Executive’s estate or beneficiaries in the case of the death of the Executive) (x) executes a separation agreement and general release and waiver of all claims in a form reasonably satisfactory to the Company (the “Release”) and the applicable revocation period with respect to such Release expires without the Executive having revoked any portion of the Release, in each case within thirty (30) days following the date of termination, and (y) does not breach any of the restrictive covenants in this Agreement (collectively, “Restrictive Covenants”). Subject to the foregoing, any payments to be made in accordance with this Section 12 will commence on the first payroll date following the end of the 30-day period described in the preceding sentence.

(a)Upon termination of this Agreement and Executive’s employment hereunder pursuant to Section 11(a) hereof, the Executive (or the Executive’s estate or beneficiaries in the case of the death of the Executive) (i) shall be entitled to (A) receive any unpaid Base Salary earned and accrued under this Agreement prior to the date of termination (and reimbursement under this Agreement for expenses incurred prior to the date of termination), (B) indemnification in accordance with any applicable indemnification plan, program, corporate governance document or other arrangement, and any vested rights pursuant to any insurance plan, benefit plan or retirement plan, (C) a pro rata bonus payment under the Bonus Plan for the year of termination, if applicable, determined by multiplying (I) the bonus payment that the Executive would have received under the Bonus Plan for such year had his employment continued by (II) a fraction, the numerator of which is the number of days employed during such year and the denominator of which is 365, (D) treatment of the Executive’s stock option grants in accordance with the terms of the applicable plan and award agreement, provided that the portion of the Executive’s options that were exercisable as of the Effective Date, and the portion of the Executive’s options that would have become exercisable on the next anniversary of the Effective Date following the date of termination, shall become and remain exercisable for a period of 12 months following the date of termination, and (E) if Executive is eligible for and elects continuation benefits under COBRA, the Company will pay the employer portion of the COBRA coverage premium for the continuation of the same level of Executive’s medical and dental insurance benefits for the shorter of (x) the 12-month period following the date of termination, or (y) the time at which Executive becomes eligible for medical and dental benefits through another employer, which eligibility must immediately be disclosed by Executive to the Company, and (ii) shall have no further rights to any other compensation or benefits hereunder, or any other rights hereunder.

(b)Upon termination of this Agreement and Executive’s employment hereunder by the Company for Cause pursuant to Section 11(b) hereof or by Executive other than for Good Reason pursuant to Section 11(e) hereof, the Executive (i) shall be entitled to (A) receive any unpaid Base Salary earned and accrued under this Agreement prior to the date of termination (and reimbursement under this Agreement for expenses incurred prior to the date of termination), and (B) indemnification in accordance with any applicable indemnification plan, program, corporate governance document or other arrangement, and any vested rights pursuant

to any insurance plan, benefit plan or retirement plan, and (C) in the case of the termination of the Executive’s employment by the Executive other than for Good Reason pursuant to Section 11(e) hereof, treatment of the Executive’s stock option grants in accordance with the terms of the applicable plan and award agreement, provided that the Executive’s options (or a portion thereof) that were exercisable as of the date of termination shall remain exercisable for a period of 3 months following the date of termination, and (ii) shall have no further rights to any other compensation or benefits hereunder, or any other rights hereunder.

(c)Upon termination of this Agreement and Executive’s employment hereunder (x) by the Company without Cause pursuant to Section 11(c) hereof, or (y) by the Executive for Good Reason pursuant to Section 11(d) hereof, the Executive (or the Executive’s estate or beneficiaries in the case of the death of the Executive following the termination of Executive’s employment) (i) shall be entitled to (A) receive any unpaid Base Salary and other benefits earned and accrued under this Agreement prior to the date of termination (and reimbursement under this Agreement for expenses incurred prior to the date of termination), (B) a pro rata bonus for the year of termination, determined by multiplying (I) the bonus that Executive would have received under the Bonus Plan for such year had his employment continued by (II) a fraction, the numerator of which is the number of days employment during such year and the denominator of which is 365; (C) indemnification in accordance with any applicable indemnification plan, program, corporate governance document or other arrangement, and any vested rights pursuant to any insurance plan, benefit plan or retirement plan, (D) continued payment of his Base Salary for the twelve (12) month period following the date of termination, (E) treatment of Executive’s option grants in accordance with the terms of the applicable plan and award agreement, provided that the portion of the Executive’s options that were exercisable as of the date of termination, and the portion of the Executive’s options that would have become exercisable on the next anniversary of the Effective Date following the date of termination, shall become and remain exercisable for a period of 12 months following the date of termination, and (F) if Executive is eligible for and elects continuation benefits under COBRA, the Company will pay the employer portion of the COBRA coverage premium for the continuation of the same level of Executive’s medical and dental insurance benefits for the shorter of (x) the twelve (12) month period following the date of termination, or (y) the time at which Executive becomes eligible for medical and dental benefits through another employer, which eligibility must immediately be disclosed by Executive to the Company, and (ii) shall have no further rights to any other compensation or benefits hereunder, or any other rights hereunder.

(d)Upon the occurrence of a Change in Control as defined Section 11(f) hereof, and Executive’s termination of employment without cause, or the material diminution of Executive’s authority, in either case within the six (6) month period immediately subsequent to the occurrence of the Change of Control, in addition to any other rights provided for herein upon a Change of Control, Executive (i) shall be entitled to (A) receive any unpaid Base Salary and other benefits earned and accrued under this Agreement prior to the date of termination (and reimbursement under this Agreement for expenses incurred prior to the date of termination), (B) a pro rata bonus for the year of termination, determined by multiplying (I) the bonus that Executive would have received under the Bonus Plan for such year had his employment continued by (II) a fraction, the numerator of which is the number of days employment during such year and the denominator of which is 365; (C) indemnification in accordance with any applicable indemnification plan, program, corporate governance document or other arrangement, and any vested rights pursuant to any insurance plan, benefit plan or retirement plan, (D) continued payment of his Base Salary for the 12-month period following the date of termination, and (E) if Executive is eligible for and elects continuation benefits under COBRA, the Company will pay the employer portion of the COBRA coverage premium for the continuation of the same level of Executive’s medical and dental insurance benefits for the shorter of (x) the 12-month period following the date of termination, or (y) the time at which Executive becomes eligible for medical and dental benefits through another employer, which eligibility must immediately be

disclosed by Executive to the Company, and (ii) shall have no further rights to any other compensation or benefits hereunder, or any other rights hereunder.

13)RESTRICTIVE COVENANTS.

(a) Noncompetition. Executive acknowledges and agrees that during the period of his employment with the Company and for the 12-month period following the termination of such employment, regardless of the reason for such termination (the “Restricted Period”), he shall not, directly or indirectly: (i) engage in, manage, operate, control, supervise, or participate in the management, operation, control or supervision of any business, entity or division that competes with any business of the Company or any of its subsidiaries (a “Competitor”) or serve as an employee, consultant or in any other capacity for a Competitor; (ii) have any ownership or financial interest, directly, or indirectly, in any Competitor including, without limitation, as an individual, partner, shareholder (other than as a shareholder of a publicly-owned corporation in which the Executive owns less than five percent (5%) of the outstanding shares of such corporation), officer, director, employee, principal, agent or consultant; or (iii) serve as a representative of any Competitor.

(b) Non-Solicitation; No-Hire. Executive acknowledges and agrees that during the Restricted Period he shall not, directly or indirectly, other than in connection with carrying out his duties hereunder, (i) solicit or induce any employee or consultant of the Company (or any individual who was an employee or consultant of the Company at any time during the 12-month period preceding any such solicitation or inducement) to (A) terminate his or his employment or relationship with the Company, and/or (B) work for the Executive or any Competitor, or (ii) hire, engage or be involved in the process of any business, entity or division in hiring or engaging, any employee or consultant of the Company (or any individual who was an employee or consultant of the Company at any time during the 12-month period preceding any such hiring).

(a)Non-Solicitation of Clients. Executive acknowledges and agrees that during the Restricted Period he shall not, directly or indirectly, solicit, take away or divert, or attempt to solicit, take away or divert, the business or patronage of any client or customer of the Company with the intention or for the purpose of providing services that compete with the services provided by the Company at the time of Executive’s termination.

(b)Non-Disruption. Executive agrees that during the Restricted Period Executive will not, directly or through others, encourage or assist any person to take any action to solicit, induce, or influence any third party, including any customer, provider of goods or services to the Company, to terminate, divert, interfere with, or diminish in any manner whatsoever his, her, or its business relationship with the Company, even if Executive is not the one to initiate contact with the aforementioned.

(e) Disparaging Comments. Executive agrees not to make critical, negative or disparaging remarks at any time during the Term or thereafter regarding the Company or its management, employees, investors, businesses, agents, or employment practices; provided that nothing in this Section 13(e) shall be deemed to prevent the Executive from responding fully and accurately to any question, inquiry or request for information when required by applicable law or legal process, or to enforce this Agreement. The Company and its officers and directors shall not make critical, negative or disparaging remarks about the Executive; provided that nothing in this Section 13(e) shall be deemed to prevent the Company or its officers or directors from responding fully and accurately to any question, inquiry or request for information when required by applicable law or legal process, or to enforce this Agreement.

(f) Confidentiality. The Executive acknowledges and agrees that the Company’s business is highly competitive and that the Executive will be involved in and become aware of the Company’s trade secrets, materials, know-how (whether or not in writing), technology, product information and intellectual property belonging to the Company (“Trade Secrets”) and all confidential matters (whether available in written, electronic form or orally) relating to the Company and its business (including without limitation its strategies, models, business and marketing plans, pricing, sales and revenue information, financial performance, etc.), and personal and other confidential information relating to its owners, managers, investors, members, shareholders, executives, and employees (the “Confidential Information”), all of which has been developed at great investment of time and resources by the Company so as to engender substantial good will, and all of which are and will remain the exclusive property of the Company. Therefore, the Executive agrees that during the period of his employment with the Company and at all times thereafter, Executive shall not disclose, shall keep secret, shall retain in strictest confidence and shall not use for his benefit or the benefit of others, except in connection with the business and affairs of the Company, any Trade Secret or Confidential Information. The foregoing will not prohibit disclosure of Confidential Information as required by law or regulation, including, but not limited to, those of the U.S. Securities And Exchange Commission and the rules of any exchange, quotation system and/or self-regulatory organization on which or with which the Company’s securities are quoted, listed and/or traded, as the case may be; provided that if the Executive is required to make a disclosure pursuant to the foregoing, he agrees to give the Company prompt written notice thereof and cooperate with the Company’s efforts to seek a protective order. Neither the foregoing nor anything else herein shall prohibit Executive from reporting possible violation of federal or state law or regulations to any governmental agency of self-regulatory organization, or making other disclosures that are protected under whistleblower or other provisions of applicable federal or state law or regulations. Notwithstanding any other provision of this Agreement: (a) The Executive will not be held criminally or civilly liable under any federal or state trade secret law for any disclosure of a trade secret that: (i) is made: (A) in confidence to a federal, state, or local government official, either directly or indirectly, or to an attorney, and (B) solely for the purpose of reporting or investigating a suspected violation of law; or (ii) is made in a complaint or other document that is filed under seal in a lawsuit or other proceeding ; and (b) if the Executive files a lawsuit for retaliation by the Company for reporting a suspected violation of law, the Executive may disclose the Company’s trade secrets to the Executive’s attorney and use the trade secret information in the court proceeding if the Executive: (i) files any document containing the trade secret under seal; and (ii) does not disclose the trade secret except pursuant to court order. Executive shall not need the prior authorization of the Company to make any such reports or disclosures and Executive is not required to notify the Company that he has made such reports or disclosures.

(g) Inventions and Discoveries. Executive agrees to promptly disclose in writing to the Board all ideas, processes, methods, devices, business concepts, inventions, improvements, discoveries, know-how, and other creative achievements (hereinafter referred to collectively as “Discoveries”), whether or not the same or any part thereof is capable of being patented, trademarked, copyrighted, or otherwise protected, which Executive, while employed with the Company, as well as those communicated to Executive by other employees/consultants of the Company, conceives, makes, develops, acquires or reduces to practice, whether acting alone or with others and whether during or after usual working hours, and which are related in any way to the Company’s business or interests. Executive hereby transfers and assigns to the Company in perpetuity all right, title and interest in and to such Discoveries, including but not limited to, any and all domestic and foreign copyrights and patent and trademark rights therein and any renewals thereof, all of which are hereby deemed provided to the Company as a “Work for Hire” without claim by Executive. On request of the Company, Executive will, without any additional compensation, whether during the Term or afterwards, execute such further instruments (including, without limitation, applications for copyrights, letters patent, trademarks

and assignments thereof in any and all countries) and do all such other acts and things as may be deemed necessary or desirable by the Company to protect and/or enforce its right in respect of such Discoveries. All expenses of filing or prosecuting any patent, trademark or copyright application shall be borne by the Company, but Executive shall cooperate in filing and/or prosecuting any such application. In the event the Company is unable, after reasonable effort, to obtain Executive’s signature on any such documents, Executive hereby irrevocably designates and appoints the Company as his agent and attorney-in-fact, to act for and on Executive’s behalf solely to execute and file any such application or other document and do all other lawfully permitted acts to further the prosecution and issuance of patents, copyrights, or other intellectual property protection related to the Discoveries with the same legal force and effect as if Executive had executed them. Executive agrees that this power of attorney is coupled with an interest.

(i) For purposes of this Agreement, any Discovery shall be deemed to have been made during Executive’s employment with the Company if, during such period, the Discovery was conceived or first actually reduced to practice, and Executive agrees that any patent application filed by Executive within one (1) year after the end of the Term shall be presumed to relate to an invention made during Executive’s employment with the Company unless Executive can establish the contrary. Executive shall keep and maintain adequate and correct written records of all Discoveries made by Executive (solely or jointly with others) during Executive’s employment with the Company. The records will be available to and remain the property of the Company at all times.

(ii) Any assignment of copyrights under this Agreement includes all rights of paternity, integrity, disclosure, and withdrawal and any other rights that may be known as "moral rights" (collectively, "Moral Rights"). Executive hereby irrevocably waives, to the extent permitted by applicable law, any and all claims Executive may now or hereafter have in any jurisdiction to any Moral Rights with respect to the Discoveries.

(h) Acknowledgement. Executive agrees and acknowledges that each restrictive covenant in this Section 13 is reasonable as to duration, terms and geographical area and that the same is necessary to protect the legitimate interests of the Company, imposes no undue hardship on Executive, and is not injurious to the public.

14)INJUNCTIVE RELIEF. The Executive agrees that the precise value of the covenants in Sections 13 are so difficult to evaluate that no accurate measure of liquidated damages could possibly be established and that, in the event of a breach or threatened breach of such provisions, the Company shall be entitled to temporary and permanent injunctive relief (without the position of a bond or other security) restraining Executive from such breach or threatened breach without the requirement of posting a bond or other security. In the event that any of the covenants made in Section 13 shall be more restrictive than permitted by applicable law, the parties agree that such covenant shall be interpreted to be as restrictive as otherwise allowed under applicable law. Additionally, all time periods described in Sections 13 shall be extended by a period during which Executive is in violation of any provision of this Agreement, and for any time during which there is pending in any court of competent jurisdiction any action (including any appeal from final judgment) brought by any person, whether or not a party to this Agreement, in which the Company seeks to enforce any covenant contained in this Agreement, or in which any person contests the validity or enforceability of any covenant contained in this Agreement, or seeks to avoid performance or enforcement of a covenant contained within this Agreement.

15)INDEMNIFICATION: During and after the period of Executive’s employment by the Company, the Company shall indemnify the Executive to the maximum extent permitted by any applicable agreement, arrangement or corporate governance document of the Company or, in the event no such agreement, arrangement or document exists, to the maximum extent permitted

by applicable law, in either case against all liabilities, losses, damages and expenses actually and reasonably incurred by the Executive in connection with any claim or proceeding arising out of, or relating to, his services for the Company, other than (i) any claim or proceeding by the Company against the Executive and (ii) any claim or proceeding by the Executive against the Company (“Losses”). The Company shall advance to the Executive to the extent permitted by law all Losses incurred by him provided the Executive undertakes to repay the amount of such advances if it shall ultimately be determined that he is not entitled to be indemnified against such Losses.

16)NOTICES: Any notice required or permitted to be given pursuant to the provisions of this shall be sufficient if in writing, and if personally delivered to the party to be notified or if sent by registered or certified mail to said party at the following addresses, or such other address as provided by the parties in writing:

If to the Company: Apyx Medical Corporation

5115 Ulmerton Road

Clearwater, FL 33760

Attn: Charles D. Goodwin II

With a copy to: Ruskin Moscou Faltischek, P.C.

1425 RXR Plaza

East Tower, 15th Floor

Uniondale, New York 11556

Attn: Adam P. Silvers, Esq.

If to the Executive: Matthew Hill

69 Kingsbridge Drive

Lumberton, NJ 08048

17)SEVERABILITY: In the event any portion of this Agreement is held to be invalid or unenforceable, the invalid or unenforceable portion or provision shall not affect any other provision hereof and this Agreement shall be construed and enforced as if the invalid provision had not been included. The parties further agree that a court is expressly authorized to modify any unenforceable provision of this Agreement by making such modifications as it deems warranted to carry out the intent and agreement of the parties hereto, which is to enforce the terms of this Agreement to the maximum extent permitted by law.

18)BINDING EFFECT: This Agreement shall inure to the benefit of and shall be binding upon the Company and upon any person, firm or corporation with which the Company may be merged or consolidated or which may acquire all or substantially all of the Company's assets through sale, lease, liquidation or otherwise. Except as otherwise specifically provided herein, the rights and benefits of Executive are personal to him and no such rights or benefits shall be subject to assignment or transfer by Executive.

19)GOVERNING LAW: This Agreement shall be construed and interpreted in accordance with the laws of the State of Florida, without regard to its conflict of laws provisions. Any legal proceeding arising out of or relating to this Agreement will be instituted in a state or federal court in Pinellas County, Florida, and the Executive and the Company hereby consent to the personal and exclusive jurisdiction of such court(s) and hereby waive any objection(s) that they may have to personal jurisdiction, the laying of venue of any such proceeding and any claim or defense of inconvenient forum.

20)ENTIRE AGREEMENT: This Agreement constitutes the entire agreement between the parties and merges, integrates and supersedes any prior agreement or discussion in its entirety; and there are no other agreements between the parties with respect to the subject matter contained herein except as set forth herein.

21)AMENDMENT AND MODIFICATION: All terms, conditions and provisions of this Agreement shall remain in full force and effect unless modified, changed, altered or amended, in writing, executed by both parties.

22)NON-WAIVER. No waiver of any breach of any term or provision of this Agreement shall be construed to be, or shall be, a waiver of any other breach of this Agreement. No waiver shall be binding unless in writing and signed by the party waiving the breach.

23)SECTION 280G. Notwithstanding anything in this Agreement to the contrary, in the event that any payment or benefit received or to be received by the Executive (including any payment or benefit received in connection with a Change of Control or the termination of Executive’s employment, whether pursuant to the terms of this Agreement or any other plan, arrangement or agreement) (all such payments and benefits being hereinafter referred to as the “Total Payments”) would not be deductible (in whole or part) by the Company as a result of Section 280G of the Internal Revenue Code of 1986, as amended (the “Code”), then, to the extent necessary to make such portion of the Total Payments deductible (and after taking into account any reduction in the Total Payments provided by reason of Section 280G of the Code in any such other plan, arrangement or agreement), the portion of the Total Payments that do not constitute deferred compensation within the meaning of Section 409A of the Code shall first be reduced (if necessary, to zero), and all other Total Payments shall thereafter be reduced (if necessary, to zero), with cash payments being reduced before non-cash payments, and payments to be paid last being reduced first; provided, however, that such reduction shall only be made if the amount of such Total Payments, as so reduced (and after subtracting the net amount of federal, state and local income taxes on such reduced Total Payments) is greater than or equal to the amount of such Total Payments without such reduction (but after subtracting the net amount of federal, state and local income taxes on such Total Payments and the amount of the excise tax imposed under Section 4999 of the Code on such unreduced Total Payments). It is possible that, after the determinations and selections made pursuant to this Section 23, the Executive will receive Total Payments that are, in the aggregate, either more or less than the amount properly determined under this Section 23 (hereafter referred to as an “Excess Payment” or “Underpayment”, as applicable). If it is established, pursuant to a final determination of a court or an Internal Revenue Service proceeding that has been finally and conclusively resolved, that an Excess Payment has been made, then Executive shall promptly repay the Excess Payment to the Company, together with interest on the Excess Payment at the applicable federal rate (as defined in Section 1274(d) of the Code) from the date of Executive’s receipt of such Excess Payment until the date of such repayment. In the event that it is determined by a court or by the accounting firm which was, immediately prior to the Change in Control, the Company's independent auditor, upon request of either party, that an Underpayment has occurred, the Company shall promptly pay an amount equal to the Underpayment to Executive (but in any event within ten (10) days of such determination), together with interest on such amount at the applicable federal rate from the date such amount would have been paid to the Executive had the provisions of this Section 23 not been applied until the date of payment.

24)SECTION 409A. This Agreement is intended to comply with or be exempt from Section 409A of the Code and will be interpreted, administered and operated in a manner consistent with that intent. Notwithstanding anything herein to the contrary, if at the time of the Executive’s separation from service with the Company he is a “specified employee” as defined in Section 409A of the Code (and the regulations thereunder) and any payments or benefits otherwise payable hereunder as a result of such separation from service are subject to Section

409A of the Code, then the Company will defer the commencement of the payment of any such payments or benefits hereunder (without any reduction in such payments or benefits ultimately paid or provided to the Executive) until the date that is six months following the Executive’s separation from service with the Company (or the earliest date as is permitted under Section 409A of the Code), and the Company will pay any such delayed amounts in a lump sum at such time. If any other payments of money or other benefits due to the Executive hereunder could cause the application of an accelerated or additional tax under Section 409A of the Code, such payments or other benefits shall be deferred if deferral will make such payment or other benefits compliant under Section 409A of the Code, or otherwise such payment or other benefits shall be restructured, to the extent possible, in a manner, determined by the Company, that does not cause such an accelerated or additional tax. To the extent any reimbursements or in-kind benefits due to the Executive under this Agreement constitute “deferred compensation” under Section 409A of the Code, any such reimbursements or in-kind benefits shall be paid to the Executive in a manner consistent with Treas. Reg. Section 1.409A-3(i)(1)(iv). Each payment made under this Agreement shall be designated as a “separate payment” within the meaning of Section 409A of the Code. References to “termination of employment” and similar terms used in this Agreement are intended to refer to “separation from service” within the meaning of Section 409A of the Code to the extent necessary to comply with Section 409A of the Code. Whenever a payment under this Agreement may be paid within a specified period, the actual date of payment within the specified period shall be within the sole discretion of the Company. In no event may the Executive, directly or indirectly, designate the calendar year of any payment to be made under this Agreement. Any provision in this Agreement providing for any right of offset or set-off by the Company shall not permit any offset or set-off against payments of “non-qualified deferred compensation” for purposes of Section 409A of the Code or other amounts or payments to the extent that such offset or set-off would result in any violation of Section 409A or adverse tax consequences to the Executive under Section 409A.

25)SURVIVAL. This Agreement will survive the cessation of the Executive’s employment to the extent necessary to fulfill the purposes and intent of this Agreement.

26)CAPTIONS. Captions of the sections or paragraphs of this Agreement are intended solely for convenience and no provision of this Agreement is to be construed by reference to the caption or heading of any section or paragraph.

27)PREVAILING PARTY. In the event of an action to remedy a breach of any provision hereof or to enforce the terms of this Agreement by either of the parties, the prevailing party shall be entitled to recover his/its costs and reasonable attorney’s fees, in addition to all other available remedies...

28)WAIVER OF JURY TRIAL. Executive hereby irrevocably agrees to waive his right to a jury trial of any claim or cause of action based upon or arising out of this Agreement or any dealings between the parties relating to this Agreement and the relationships thereby established. The scope of this waiver is intended to be all-encompassing of any and all disputes that may be filed in any court and that relate to the subject matter of this Agreement, including employment law claims, contract claims, tort claims, breach of duty claims, and all other statutory and common law claims. This waiver shall apply to any subsequent amendments, renewals, supplements or modifications of this Agreement.

29)COUNTERPARTS. This Agreement may be executed electronically, by email or facsimile, and in counterparts, and shall be fully binding and enforceable upon the parties when so executed.

[signature page to follow]

APYX MEDICAL CORPORATION

| | | | | | | | |

/s/ Charles D. Goodwin II | | Date: November 21, 2023 |

By: Charles D. Goodwin II | | |

Title: Chief Executive Officer | | |

BY SIGNING IN THE SPACE PROVIDED, EXECUTIVE ACKNOWLEDGES AND AGREES THAT HE HAS FULLY READ, UNDERSTANDS AND VOLUNTARILY ENTERS INTO THIS AGREEMENT AS OF THE DATE SET FORTH BELOW.

| | | | | | | | |

/s/ Matthew Hill | | Date: November 21, 2023 |

| MATTHEW HILL | | |

Apyx Medical Corporation Appoints Matthew Hill as Chief Financial Officer

CLEARWATER, FL — November 28, 2023 - Apyx Medical Corporation (Nasdaq:APYX) (“Apyx Medical;” the “Company”), the manufacturer of a proprietary helium plasma and radiofrequency technology marketed and sold as Renuvion®, today announced the appointment of Matthew Hill to the position of Chief Financial Officer, effective December 4, 2023. Mr. Hill succeeds Tara Semb, whose departure was announced by the Company on November 9, 2023.

“Matt joins our executive leadership team with over 30 years of financial and operational experience, more than 20 years of which has been in the healthcare industry, where he has served as the Chief Financial Officer of four publicly-traded healthcare companies,” said Charlie Goodwin, President and Chief Executive Officer of Apyx Medical. “I’m pleased to welcome Matt to Apyx Medical and look forward to working with him to execute our strategic initiatives and position the Company to deliver strong, sustainable, long-term growth.”

“With its innovative Renuvion technology, large, global market opportunity, recent operational progress and an enhanced balance sheet, I believe Apyx Medical is well-positioned for future success in the cosmetic surgery market,” said Mr. Hill. “I am pleased to join the Company at this exciting time, and look forward to working with Charlie and the rest of the team as we lead Apyx Medical through its next stage of growth and development.”

Mr. Hill joins Apyx Medical from PDS Biotechnology Corporation (Nasdaq: PDSB; “PDS Biotech”), a clinical-stage immunotherapy company, where he served as Chief Financial Officer, leading all aspects of the company’s budgeting, forecasting, financial management and reporting. Prior to joining PDS Biotech, he served as Chief Financial Officer of Strata Skin Sciences (Nasdaq: SSKN), a medical technology company developing, commercializing and marketing products for the treatment of dermatologic conditions, from 2018 to 2021.

Prior to joining Strata Skin Sciences, Mr. Hill held CFO roles at several companies, including Velcera, Inc., which developed pet medication for the companion animal health industry, and EP MedSystems, which developed and marketed cardiac electrophysiology products. He was also a Senior Manager at the international accounting and consulting firm, Grant Thornton LLP. Mr. Hill holds a Bachelor of Science in Accounting from Lehigh University.

About Apyx Medical Corporation:

Apyx Medical Corporation is an advanced energy technology company with a passion for elevating people’s lives through innovative products, including its Helium Plasma Technology products marketed and sold as Renuvion® in the cosmetic surgery market and J-Plasma® in the hospital surgical market. Renuvion® and J-Plasma® offer surgeons a unique ability to provide controlled heat to tissue to achieve their desired results. The Company also leverages its deep expertise and decades of experience in unique waveforms through OEM agreements with other medical device manufacturers. For further information about the Company and its products, please refer to the Apyx Medical Corporation website at www.ApyxMedical.com.

Cautionary Statement on Forward-Looking Statements:

Certain matters discussed in this release and oral statements made from time to time by representatives of the Company may constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and the Federal securities laws. Although the Company believes that the expectations reflected in such forward-looking statements are based upon reasonable assumptions, it can give no assurance that its expectations will be achieved.

All statements other than statements of historical fact are statements that could be deemed forward-looking statements, including but not limited to, projections of net revenue, margins, expenses, net earnings, net earnings per share, or other financial items; projections or assumptions concerning the possible receipt by the Company of any regulatory approvals from any government agency or instrumentality including but not limited to the U.S. Food and Drug Administration (the “FDA”), supply chain disruptions, component shortages, manufacturing disruptions or logistics challenges; or macroeconomic or geopolitical matters and the impact of those matters on the Company’s financial performance.

Forward-looking statements and information are subject to certain risks, trends and uncertainties that could cause actual results to differ materially from those projected. Many of these factors are beyond the Company’s ability to control or predict. Important factors that may cause the Company’s actual results to differ materially and that could impact the Company and the statements contained in this release include but are not limited to risks, uncertainties and assumptions relating to the regulatory environment in which the Company is subject to, including the Company’s ability to gain requisite approvals for its products from the FDA and other governmental and regulatory bodies, both domestically and internationally; the impact of the March 14, 2022 FDA Safety Communication on our business and operations; sudden or extreme volatility in commodity prices and availability, including supply chain disruptions; changes in general economic, business or demographic conditions or trends; changes in and effects of the geopolitical environment; liabilities and costs which the Company may incur from pending or threatened litigations, claims, disputes or investigations; and other risks that are described in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022 and the Company’s other filings with the Securities and Exchange Commission. For forward-looking statements in this release, the Company claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. The Company assumes no obligation to update or supplement any forward-looking statements whether as a result of new information, future events or otherwise.

Investor Relations Contact:

ICR Westwicke on behalf of Apyx Medical Corporation

Mike Piccinino, CFA

investor.relations@apyxmedical.com

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

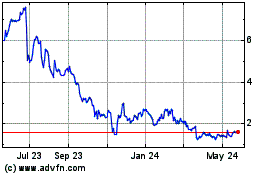

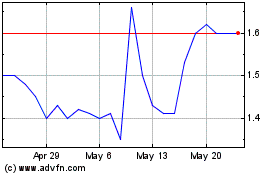

Apyx Medical (NASDAQ:APYX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Apyx Medical (NASDAQ:APYX)

Historical Stock Chart

From Apr 2023 to Apr 2024