false

0001566243

0001566243

2023-11-28

2023-11-28

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

DC 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15 (d) of the Securities Exchange Act of 1934

Date

of Report (date of earliest event reported): Nov 28, 2023

ARAX

HOLDINGS CORP.

(Exact

name of Registrant as specified in its charter)

| Nevada |

|

333-185928 |

|

99-0376721 |

| (State

or other jurisdiction of incorporation or organization) |

|

(Commission

File Number) |

|

(IRS

employer identification no.) |

820

E Park Ave, Bld.

D200

Tallahassee,

Florida |

|

32301 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: 850

254 1161

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| None |

|

|

|

|

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under

any of the following provisions:

| | ☐ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | |

| | ☐ | Soliciting material pursuant to Rule 14a-12 under

the Exchange Act (17 CFR 240.14a-12) |

| | | |

| | ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | |

| | ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

7.01 Regulation FD Disclosure

Arax

Holdings Corp. (“Registrant”) issued a press release today, a copy of which is attached to this current report as

Exhibit 99.1

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf

by the undersigned thereunto duly authorized.

| |

Arax

Holdings Corp. |

| |

|

|

| Dated:

November 28, 2023 |

By: |

/s/

Christopher D. Strachan |

| |

|

Christopher

D. Strachann |

| |

|

Chief

Financial Officer |

Exhibit

99.1

Arax

Holdings Corp Takes an

Important Step in Fintech with

Revolutionary Payment Protocol

Arax

Holdings Corp Revolutionizes Digital Asset Management with Core Token Deployment on Core Blockchain

Arax

Holdings Corp. (ARAT OTC:PKC) and Core Business Holdings announce the successful deployment of Core Token on Core Blockchain and,

with it, the revolutionary CBC20 digital token standard, marking a new era in digital asset management.

Following

the acquisition of Core Business Holdings (CBH) earlier this year, the launch combines Arax Holdings Corp’s digital asset innovation

with world-leading compliance and regulatory frameworks. Therefore, we proudly announce the Core Blockchain EcoSystem engine consisting

of Core Token, Ping Exchange, a hybrid exchange, Wall Money, a regulated lifestyle platform, and Core Pay, a new-generation payment gateway.

Each

part of the CBH EcoSystem engine comprises several key components designed to enhance our digital asset management capabilities:

| ● | Core

Token: Core Token, as a tokenization and smart contract platform, is set to revolutionize

asset tokenization, offering unprecedented flexibility and security in digital asset management. |

| ● | Ping

Exchange: Ping Exchange, a hybrid digital asset exchange, combines the speed and user-friendliness

of centralized platforms with the security and transparency of decentralized systems. |

| ● | Wall

Money: Wall Money emerges as a regulated lifestyle platform, seamlessly integrating digital

asset management into everyday life while ensuring compliance with the highest regulatory

standards. |

| ● | Core

Pay: Core Pay, a next-generation payment gateway, simplifies digital transactions, offering

users a secure and efficient way to manage payments within the Core ecosystem. |

This

multifaceted launch underscores Core Business Holdings' position as a pivotal element of Arax Holdings Corp.'s diverse and dynamic portfolio,

propelling us into a future where digital asset management is more accessible, secure, and efficient.

Arax

Holdings Corp. and Core Business Holdings acknowledge the pioneering efforts and significant strides made in the DeFi space on existing

blockchains, recognizing them as foundational steps in the evolution of digital finance. Building upon this groundwork, we are committed

to enhancing and refining these early developments, integrating them into a more cohesive and robust Web3 ecosystem. This commitment

is rooted in a vision of a world that not only deserves but urgently needs a more secure, transparent, and user-focused digital experience

that seamlessly bridges the divide between traditional finance and the burgeoning possibilities of the blockchain.

Core

Token: A Revolution in Digital Asset Management

We

are excited to confirm that Core Token was officially deployed on the Core Blockchain network at 17:23 UTC on November 17th 2023, marking

its existence as a tangible and ready-to-distribute asset. This momentous occasion can be witnessed on blockindex.net, the official

block explorer for Core Blockchain. This deployment demonstrates the tangible value of Core Token and showcases the capabilities and

potential of the newly established CBC20 Standard.

Core

Token is at the forefront of the digital revolution. As a token based on the Core Blockchain, employing the cutting-edge CBC20 standard,

Core Token is more than just a digital asset. It is a token that opens doors to a myriad of services in the Core Ecosystem and facilitates

the integration of real-world assets into the digital asset management platform. With a total supply of 1 billion tokens, Core Token

is set to redefine the landscape of digital currencies and asset management, where efficiency, security, and adaptability take center

stage.

The

technical advancements inherent in CBC20 facilitate seamless asset conversion, ensuring that digital assets can move fluidly across different

forms and platforms. This capability streamlines the user experience and injects much-needed liquidity into the digital asset market,

making it more vibrant and accessible.

At

the heart of CBC20's innovation is a commitment to accuracy and transparency in asset valuation. Real-time pricing ensures that digital

assets are always traded at their true market value, instilling confidence and trust among users. This feature is crucial in a market

known for its volatility, as it provides a stable and reliable foundation for asset management and investment decisions.

Enhanced

security and convenience are also paramount outcomes of the CBC20 Standard. The ability to execute transactions securely, even in offline

modes, adds a new layer of flexibility and significantly reduces the risk of cyber threats. This feature is invaluable in an era where

digital security is a top concern for users and investors alike.

Moreover,

the incentivization mechanism introduced by CBC20 creates a vibrant ecosystem where user participation and engagement are actively encouraged.

By allowing rewards for on-chain activities, CBC20 fosters a more active and robust blockchain network, driving innovation and growth

within the Core Ecosystem.

Finally,

the upgradable nature of the CBC20 Standard ensures that Core Token and its ecosystem are future-proof. This adaptability means that

as new technologies and market needs emerge, Core Token can evolve to incorporate these advancements, maintaining its relevance and leadership

in the digital asset space.

These

technical enhancements collectively elevate the Core Token beyond a mere digital currency. They transform it into a dynamic and integral

component of the digital asset world, redefining how assets are managed, valued, and secured, paving the way for a more robust, efficient,

and user-centric future in digital asset management.

CBC20

vs ERC20: Setting New Standards in Blockchain Technology

The

CBC20 Standard is a groundbreaking advancement over the traditional Ethereum-based ERC20 token standard. ERC20 has been the bedrock of

blockchain token functionalities, enabling basic yet crucial operations like token transfers, approvals, and overall token management.

However,

the CBC20 Standard elevates these foundations to new heights. It retains all the essential features of ERC20 and introduces a suite of

advanced functionalities designed to revolutionize digital asset management. These enhancements include sophisticated contract capabilities,

such as AccessControl, which presents a new level of management for roles and user interactions, creating a more secure, adaptable, and

user-friendly experience for everyone involved.

Key

improvements are its focus on scalability and adaptability – critical factors for any technology in this fast-paced digital age,

not simply meeting today's needs but also being ready for tomorrow's challenges. CBC20 brings enhanced customization options, bolstering

the security and flexibility of digital assets, and ensures that the system can evolve with the ever-changing landscape of blockchain

technology.

In

essence, CBC20 is more than just an upgrade; it's a testament to Arax's commitment to pushing the boundaries of blockchain technology,

offering heightened security, control, compliance, and versatility in digital asset management.

The

Transformative Impact of Real-World Asset Tokenization

Tokenization

is reshaping the future of asset funding, trading, and management. By 2030, the market for tokenized assets, including real estate, art,

and financial instruments, is expected to exceed $4 trillion. This shift represents a significant portion of the global economy,

indicating a major transformation in how we value and exchange assets.

Core

Blockchain is at the forefront of this evolution with its Core Token Smart Contract and integrated CorePass KYC and AML compliance platform.

We are transitioning to a world where virtually any asset, from luxury items to complex financial products, can be tokenized. This move

into digital tokens marks a turning point for blockchain technology, particularly in private market assets.

The

growth potential here is enormous. For instance, Citi predicts a more than 80-fold increase in private market tokenization by

2030. Similarly, the Boston Consulting Group forecasts tokenization could unlock a $16 trillion global market, offering significant cost

savings in clearing and settlement processes. Bain Capital suggests that tokenization could eventually encompass up to $540 trillion

in private assets, currently unrepresented in the financial system.

Additionally,

the rise of Central Bank Digital Currencies (CBDCs), likely backed by regulated fiat currencies and programmable for smart contracts,

could add up to $5 trillion to this market. Core Business Holdings’ blockchain-based banking products align with this trend, highlighting

our role in this groundbreaking financial landscape.

Understanding

Tokenization in the CBH Ecosystem

ARAX's

Core EcoSystem engine leverages highly secure, fully decentralized blockchain technology to bring efficiency, transparency, accountability,

and enhanced liquidity to the forefront for real-world assets. This democratization of access to various assets changes investment perspectives

and interactions with economic elements, offering a digital representation of assets and attaching rights and information in a programmable

manner. It makes previously indivisible or hard-to-trade assets manageable and transaction-friendly.

CorePass,

integrated with all the CBH EcoSystem platforms, complements this by providing a secure, regulatory-compliant environment through Regulation

Technology, opening investment avenues to a broader audience. It ensures continuous compliance with KYC and AML standards, making the

process secure and trustworthy.

The

CBH Ecosystem platform facilitates several key use case sectors that will be tradable on ARAX's hybrid Ping Exchange Platform:

| Sector |

Description |

| Real

Estate |

Tokenized

commercial, residential, and development projects. |

| Financial

Assets |

Including

public and private equity, commodities, and investment funds. |

| Infrastructure |

Smart

city solutions, energy, transportation, waste management, and communication infrastructures are deployable on networks like the Lunaº

Mesh. |

| Art

and Collectibles |

Digital

representation of fine art, luxury wearables, and collectibles. |

| Gaming

and Entertainment |

In-game

assets, digital art, and entertainment-related tokens. |

| Data |

Personal,

intellectual property, financial, and IoT data are securely exchangeable via Core Pass and integrated digital attribute management

platforms. |

| Commodities

and Metals |

Tradeable

assets, including precious metals and other commodities. |

| NFTs

and Gamified Tokens |

Unique

digital assets and tokens for gaming and entertainment. |

| DeFi-Related

Instruments |

Decentralized

finance instruments, including debt, underwriting, and more. |

The

interoperable Tokenization and Smart Contract platform ensure, at all times, digital asset token security as the Core Blockchain is built

on ED448 encryption standards, and assets are stored and traded in cold wallets, and when traded, offline signatures are used in the

exchange process, a key feature offered by the Ping Exchange. Other features of tokenized real-world assets to be traded on the Ping

Exchange include

| ● | Enhanced

asset-backed token accessibility and transparent 24/7 trading. |

| ● | Efficient,

paperless transactions with reduced costs. |

| ● | Lower

costs and access for individual investors. |

| ● | Increased

access for SMEs and exposure to new markets. |

| ● | Ongoing

KYC and AML monitoring and verification |

CorePass

ID data and any connected digitally attributed data are not stored on any platforms to ensure complete compliance and provide any potential

data location regulatory compliance. The CorePass warrants users secure self-sovereign identity information, including any digital attributes,

as all data is facilitated in a decentralized p2p federated data network. At the same time, the platform maintains all data constituents

on the user's device for interconnected p2p data requests and verifications between users. Future integration of the Lunaº Mesh

will even allow all such data to be geographically decentralized if required by users.

With

the expected surge in tokenized assets, Core Business Holdings is poised to capitalize on this growth, particularly in the real estate,

financial assets, and Data industries. The integration with CorePass ID's fully decentralized Digital Identity ensures compliance and

security, allowing any individual or institution to attach any attribute in the form of a tokenized asset through the Core Token Smart

Contract Platform to a CorePass ID and to connect such tokenized digital assets to a Digital Asset Management Platform.

Embark

on the Tokenization Journey with ARAX and CBH

Despite

its potential, tokenization faces hurdles like regulatory ambiguity and limited public understanding. CorePass addresses these by offering

clear regulatory frameworks, digital asset and stablecoin trading regulations, market accessibility, accredited investor verification,

and comprehensive AML and KYC controls, ensuring a balanced approach that enhances adoption and protects investors at all times. Core's

holistic approach to transparent and traceable accountability while fostering innovation will expand its platform reach in driving the

Core Token value as well as the shareholder value of ARAX.

ARAX

and Core Blockchain Holdings invite businesses to explore tokenization's potential within their operations and invite any interested

people and organizations to join the soon-to-be-released Blockchain Hub, an affiliated central point of information on blockchain-based

projects. Starting with a tokenization-readiness workshop, the Blockchain Hub offers guidance in developing a strategic approach and

partnering with leading technology providers to ensure seamless integration tailored to specific needs.

In

conclusion, ARAX, CBH, and CorePass are not just participating in the tokenization wave of real-world assets; they are shaping its future.

By offering a secure, compliant, and versatile platform, they are poised to lead the charge in redefining digital asset management and

investment in the digital age.

For

more information about Arax Holdings Corp. and its ventures, please, visit the official website: arax.cc.

Safe

Harbor Statement Under the Private Securities Litigation Reform Act of 1995

Certain statements contained in this press release may be construed as “forward-looking statements”

as defined in the Private Securities Litigation Reform Act of 1995 (the “Act”). All statements that are not historical facts

are “forward-looking statements.” The words “estimate,” “project,” “intends,” “expects,”

“anticipates,” “believes,” and similar expressions are intended to identify forward-looking statements. Such

forward-looking statements are made based on management’s beliefs, as well as assumptions made by, and information currently available

to, management pursuant to the “safe harbor” provisions of the Act. These statements are subject to certain risks and uncertainties

that may cause actual results to differ materially from those projected on the basis of these statements. Investors should consider this

cautionary statement, and furthermore, no assurance can be made that the transaction described in this press release will be consummated.

Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date made. The Company

also undertakes no obligation to disclose any revision to these forward-looking statements to reflect events or circumstances after the

date made or to reflect the occurrence of unanticipated events.

Arax

Holdings Corp

+1 850-254-1161

email us here

Investor@arax.cc

Visit us on social media: Twitter LinkedIn

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

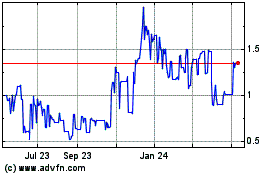

Arax (PK) (USOTC:ARAT)

Historical Stock Chart

From Mar 2024 to Apr 2024

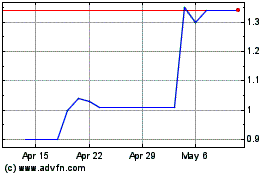

Arax (PK) (USOTC:ARAT)

Historical Stock Chart

From Apr 2023 to Apr 2024