Whether youU+02019re just

starting your investing journey or have years of experience,

exchange-traded funds (ETFs) might be a suitable addition to your

portfolio, depending on your investment goals and risk appetite,

according to experts.

ETFs function as a container for

individual assets such as stocks and bonds, much like mutual funds.

However, they often offer greater tax efficiency and lower expense

ratios than mutual funds, which has led many investors to prefer

them.

"Over the past 15 to 20 years,

ETFs have evolved significantly," noted Barry Glassman, a certified

financial planner and founder and president of Glassman Wealth

Services in McLean, Virginia, who is also part of CNBC’s Financial

Advisor Council.

In 2022, a notable shift

occurred, with investors withdrawing over $900 billion from mutual

funds and redirecting approximately $600 billion into ETFs, as per

Morningstar. This marked the largest net difference

recorded.

Benefits of ETF investing

Amidst this trend, CNBC’s FA

Council experts share their insights on integrating ETFs into

client portfolios.

One major advantage of ETFs,

especially in brokerage accounts where capital gains and dividends

are taxed annually, is their tax efficiency. Unlike certain mutual

funds that distribute capital gains at year-end, most ETFs do not.

"This is a key reason why ETFs are attractive," Glassman explained.

Cathy Curtis, a CFP and founder of Curtis Financial Planning in

Oakland, California, also emphasizes their role in managing tax

impacts, particularly in high-tax states like

California.

ETFs also play a vital role in

diversifying portfolios and balancing risk and reward. They can be

part of a core portfolio, with ETFs tracking broad-based indices

like the

S&P 500 providing

stability, as Kamila Elliott, an Atlanta-based CFP and co-founder

and CEO of Collective Wealth Partners, uses them.

On the other hand, ETFs in

satellite portfolios offer diversification opportunities, reducing

exposure to specific asset risks. Marguerita Cheng, a CFP and CEO

of Blue Ocean Global Wealth in Gaithersburg, Maryland, cited a

client interested in the video game industry who found a suitable

video game ETF.

While ETFs in such specialized

areas can be less risky than individual stocks, they still carry

the potential for significant losses and gains, given the

unpredictability of industry winners, including in sectors like

video games.

Millennials are bullish on bond-focused

ETFs

Millennials are showing a

stronger preference for bond exchange-traded funds (ETFs) than

older generations, a trend experts caution may not be the most

beneficial strategy. According to a Charles Schwab survey,

millennials, born from the early 1980s to the mid-1990s, have

allocated an average of 45% of their investment portfolios to fixed

income. This figure is notably higher than the allocations of

Generation X (37%) and baby boomers (31%).

Furthermore, 51% of millennials

are planning to invest in fixed-income ETFs in the coming year,

exceeding the 45% of Gen X and 40% of boomers. However, this

conservative approach might not align well with the typically

longer investment horizon of millennials, explains Ted Jenkin, a

certified financial planner and CEO and founder of oXYGen Financial

in Atlanta.

With more time to invest,

millennials can generally afford, and should perhaps consider,

taking on more risk by favoring stocks, which have historically

outperformed bonds over extended periods, notes Jenkin, a member of

CNBC’s Advisor Council.

Jenkin advises that

millennialsU+02019 current 45% bond allocation might be excessively

conservative. He suggests using the "Rule of 120" as a basic

guideline: subtract your age from 120 to gauge an appropriate stock

allocation. For instance, a 35-year-old would ideally have 85% of

their portfolio in stocks and the remaining 15% in fixed

income.

Experts believe several

factors contribute to millennials’ conservative investment stance.

Emotional factors, like the financial scars from the 2008 crisis or

the dot-com bubble, could influence their decisions. David Botset,

head of strategy and product at Schwab Asset Management, suggests

these challenging experiences during formative years might lead

millennials to be more cautious investors.

"Loss aversion bias," a tendency

to prioritize avoiding financial loss, may also play a role.

However, this can be detrimental in the long run as stocks

typically drive portfolio growth. Holding too few stocks relative

to oneU+02019s investment period could mean missing out on

potential retirement income.

Additionally, Jenkin points out

that current high-interest rates make bonds and cash more

attractive, offering safer investments with decent returns.

However, he cautions that despite the appeal of a 5% annual return

from safer fixed-income investments, bonds have generally

underperformed stocks over the long term.

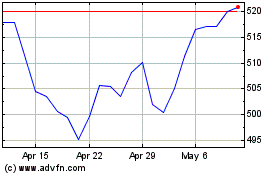

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Mar 2024 to Apr 2024

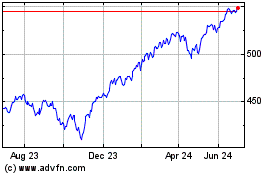

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Apr 2023 to Apr 2024