In the pre-market on Wednesday, U.S. index futures show a

positive trend. Investors are anticipating the quarterly earnings

of Deere & Co (NYSE:DE), while analyzing the

recent results of Nvidia (NASDAQ:NVDA) and the

minutes from the last FOMC meeting, released the day before.

At 06:04 AM, Dow Jones futures (DOWI:DJI) rose 49 points, or

0.14%. S&P 500 futures rose 0.15% and Nasdaq-100 futures rose

0.20%. The yield on 10-year Treasury bonds was at 4.371%.

In the commodities market, West Texas Intermediate crude oil for

January fell 0.90%, to $77.07 per barrel. Brent crude oil for

January fell 0.80% to around $81.79 per barrel. Iron ore with a

concentration of 62%, traded on the Dalian exchange, rose 1.04%, to

$134.65 per ton, the highest value since February 21.

On Wednesday’s economic agenda, investors await the October

durable goods orders and weekly unemployment insurance claims at

08:30 am. At 10:00 am, data on final consumer sentiment for

November will be awaited.

European markets are operating higher, with a focus on media and

real estate stocks. Sage Group (LSE:SGE) hit a

record after an 18% increase in annual operating profit, boosting

sector shares with margin expansion to 20.9%.

Asian markets closed variably after the release of the Fed’s

minutes, indicating restrictive monetary policy. The Japanese

government foresees a moderate economic recovery, while Singapore’s

GDP grew 1.1% in the third quarter, exceeding expectations. Market

indices varied: Shanghai SE fell 0.79%, while Nikkei rose

0.29%.

Israel and Hamas agreed on a four-day pause in fighting for the

release of 50 hostages in Gaza, in exchange for 150 Palestinian

prisoners and humanitarian aid. The agreement, mediated by Qatari

and U.S. officials, may be extended with the further release of

hostages.

U.S. stocks fell on Tuesday, with the Dow Jones retreating

0.18%, the S&P 500 dropping 0.20%, and the Nasdaq yielding

0.59%. The pullback occurred as some traders sought to realize

profits after recent gains, and as the Federal Reserve minutes

indicated the maintenance of restrictive interest rates. Shares of

American Eagle Outfitters (NYSE:AEO) fell 15.8%,

despite better-than-expected results. Kohl’s

(NYSE:KSS), Lowe’s (NYSE:LOW), and Best

Buy (NYSE:BBY) also saw declines due to

lower-than-expected results. Airline and semiconductor sectors

fell, while gold stocks rose with the price of the metal.

On Tuesday’s corporate earnings front, investors will be

watching the reports from Deere (NYSE:DE),

Tremor International (NASDAQ:TRMR),

BaoZun (NASDAQ:BZUN).

Wall Street Corporate Highlights for Today

Microsoft (NASDAQ:MSFT) – OpenAI has agreed on

the return of Sam Altman as CEO, ending uncertainties. The

restructuring included appointments, praised by Microsoft. The

threat of a mass employee exit pressured the board, resulting in

Altman’s reinstatement. The outcome was celebrated by the team,

highlighting unity.

Apple (NASDAQ:AAPL) – Apple faces accusations

from the National Labor Relations Board for not granting enhanced

benefits to unionized workers at an Apple store in Towson,

Maryland, allegedly violating federal labor laws. The union alleges

discrimination and the use of benefits to discourage unionization

at other locations. The complaint arises after the unionization of

the Towson store and allegations of lack of good-faith negotiations

by Apple.

Amazon (NASDAQ:AMZN) – Jeff Bezos, founder of

Amazon, plans to sell a significant part of his shares, estimated

at over $1 billion, after having sold about $240 million last week.

He has been liquidating shares to fund Blue Origin, his space

company, since stepping down as Amazon’s CEO.

Broadcom (NASDAQ:AVGO) – Broadcom plans to

complete the acquisition of VMWare (NYSE:VMW) for

$69 billion, after China approved the deal with restrictive

conditions. The Chinese regulator stated that VMWare software could

operate with local hardware without restrictions on purchasing

Broadcom products. The deal’s closure was expected for November

26.

Alibaba (NYSE:BABA) – Jack Ma, founder of

Alibaba, canceled his plans to sell 10 million shares of the

company due to the recent fall in value. He believes in Alibaba’s

growth potential and will not sell his shares, despite concerns

about competition and the U.S.-China rivalry.

Foxconn (USOTC:FXCOF) – A subsidiary of

Foxconn, Foxconn Industrial Internet Co., was fined $2,800 by

Chinese tax authorities for inflating research and development

expenses in 2021 and 2022. This comes amid a broader investigation

into the company’s operations and suppliers of

Apple (NASDAQ:AAPL) in China. Foxconn founder

Terry Gou, running for the presidency of Taiwan, stated that the

Chinese government would not harm his business empire.

Walt Disney (NYSE:DIS) – On Tuesday, Walt

Disney revealed that new collective bargaining agreements with the

Directors Guild of America, WGA, and SAG-AFTRA will result in

increased content creation costs. The company anticipates capital

expenditures of approximately $6 billion in fiscal 2024, with

spending on produced and licensed content reaching about $25

billion.

Starbucks (NASDAQ:SBUX) – The Strategic

Organizing Center nominated three candidates for the Starbucks

board, using a shareholder tactic. The annual meeting, on March 13,

2024, will decide on the candidates. Starbucks stated it has

invested over $3 billion in the past three years in wage

improvements, training, and technology, and has created a board

committee to enhance stakeholder engagement, including

employees.

Airbnb (NASDAQ:ABNB) – Canada introduced fiscal

measures to alleviate housing shortages, limiting tax deductions

for short-term rentals, including Airbnb, starting in January. The

change aims to control the housing crisis, while Airbnb argues that

restrictions harm additional income and do not solve the structural

problem.

Luminar Technologies (NASDAQ:LAZR) – Luminar

Technologies canceled the acquisition of Forbes by CEO Austin

Russell, as he failed to secure the necessary funding. Russell

previously agreed to acquire 82% of Forbes in a deal valued at

nearly $800 million. The cancellation will not affect Forbes’

day-to-day operations.

Berkshire Hathaway (NYSE:BRK.B) – Warren

Buffett donated approximately $866 million in Berkshire Hathaway

shares to four family charities. In a letter to shareholders, he

reaffirmed his commitment to donating over 99% of his fortune and

indicated that Greg Abel will succeed as CEO. At 93, he highlighted

his satisfaction with his health and peculiar eating habits. Since

2006, Buffett has donated more than half of his shares to

charity.

Blackstone (NYSE:BX), Adevinta

(USOTC:ADEVY) – The private equity consortium, led by Permira and

Blackstone, plans to acquire eBay’s online classifieds group for

$13.1 billion. The offer of 115 crowns per share, with a premium of

52.6%, is supported by shareholders, including Schibsted and

eBay (NASDAQ:EBAY). The deal involves selling half

of eBay’s shares for $2.2 billion and exchanging the remainder for

a 20% stake in the new private entity. Completion is expected in

the second quarter of 2024, subject to regulatory approvals.

Barclays (NYSE:BCS) – Barclays no longer

expects the U.S. Federal Reserve to raise interest rates in

January, reversing a previous forecast of a 25 basis point

increase. The brokerage now projects stable rates until December

2023, with possible cuts in 2024, depending on progress in

disinflation.

Citigroup (NYSE:C) – Citigroup implemented

appointments in Asia-Pacific as part of a global reorganization.

Jan Metzger will lead the investment bank for the North Asia,

Australia, and South Asia cluster. Kaleem Rizvi and K

Balasubramanian were appointed heads of corporate banking for

specific regions. Citi plans to reduce layers of management as part

of a significant reform announced on Monday.

Morgan Stanley (NYSE:MS) – Morgan Stanley

Co-President Andy Saperstein revealed in an internal memo that he

has been diagnosed with cancer. Saperstein, who leads wealth and

investment management, assured employees that he will limit travel

but plans to continue working during treatment.

Rio Tinto (NYSE:RIO) – Rio Tinto agreed to pay

a $28 million fine to end a six-year SEC investigation into its

problematic acquisition of a coal mining company in 2011. Rio Tinto

also hired an independent consultant to guide its compliance

policies. The SEC had accused the company of inflating the value of

Mozambique coal assets and hiding significant losses from

investors.

Ford Motor (NYSE:F) – Ford Motor will reduce

investments, capacity, and jobs at its electric vehicle battery

plant in Michigan, following criticism for using CATL technology.

Ford plans to resume construction, producing iron-lithium batteries

starting in 2026. The original investment of $3.5 billion will be

reduced to about $2 billion.

General Motors (NYSE:GM) – General Motors plans

to provide a business update on November 29 following the

ratification of labor agreements in the U.S. and Canada. With

rising costs due to new union agreements and challenges in the

autonomous unit Cruise, GM is cutting fixed costs and adjusting its

electric vehicle launch strategy.

Boeing (NYSE:BA) – Hackers exploited a flaw in

Citrix Systems software called Citrix Bleed to attack Boeing and

other companies. The LockBit 3.0 ransomware group was responsible

for the attack, which held systems hostage and demanded payment to

unlock files. Boeing shared information with affected third

parties.

Palantir Technologies (NYSE:PLTR) – Palantir

Technologies led a group that secured a contract from the National

Health Service of England, though the contract value was lower than

expected and involved more partners than previously thought.

Ryanair (NASDAQ:RYAAY) – Ryanair CEO Michael

O’Leary criticized Italy’s antitrust investigation into the

airline’s flight prices, calling it a “joke” and attributing it to

Italian populist leadership. He claimed the investigation

overlooked the fact that most bookings occur on desktop

computers.

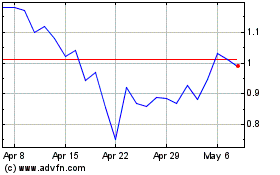

Virgin Galactic (NYSE:SPCE) – Virgin Galactic

was downgraded from “Equal Weight” to “Underweight” by Morgan

Stanley, and the price target was revised from $4 to $1.75,

according to Fly. This resulted in a 5.63% drop in Wednesday’s

pre-market, with shares now trading at $2.01.

Earnings

Nvidia (NASDAQ:NVDA) – Nvidia is down 0.8% in

Wednesday’s pre-market after reporting third-quarter results with

an adjusted profit of $4.02 per share and revenue of $18.12

billion. Market estimates were a profit of $3.37 per share on

revenue of $16.18 billion. For the fourth quarter, Nvidia forecasts

fiscal revenue of $20.00 billion, above the consensus estimate of

$17.86 billion.

HP Inc (NYSE:HPQ) – HP shares fell 2.7% in

Wednesday’s pre-market due to below-estimate fourth-quarter revenue

performance. HP reported revenue of $13.82 billion, below the LSEG

consensus estimate of $13.85 billion. However, earnings were in

line with projections.

Analog Devices (NASDAQ:ADI) – Analog Devices

projected first-quarter revenue and profit below market estimates

due to semiconductor industry oversupply. The company expects

first-quarter revenue of $2.50 billion compared to LSEG estimates

of $2.68 billion. The company anticipates normalizing growth in the

second half, reducing inventories and slowing capacity expansion.

Revenue fell 16% to $2.72 billion but beat estimates. Adjusted

earnings were $2.01 per share, largely in line with

expectations.

Autodesk (NASDAQ:ADSK) – Autodesk is down -4.7%

in the pre-market despite the software company beating analysts’

expectations for third-quarter revenues and earnings. Adjusted

earnings of $2.07 per share were higher than analysts’ estimate of

$1.99 per share, according to LSEG. Revenue was $1.41 billion,

surpassing the consensus estimate of $1.39 billion.

dLocal (NASDAQ:DLO) – dLocal shares fell 13%

due to the CFO’s departure and below-expectation third-quarter

revenue results. Although earnings were in line with estimates,

revenue of $163.9 million fell short of the $165.5 million

predicted by analysts. The company adjusted its earnings outlook

and maintained its revenue forecast for the year.

Jack in the Box (NASDAQ:JACK) – Jack in the Box

reported fourth-quarter operating earnings that did not meet

expectations and issued a full-year operating earnings forecast

below expected, according to FactSet consensus estimates.

Urban Outfitters (NASDAQ:URBN) – Urban

Outfitters exceeded third-quarter expectations with a net profit of

$83 million and revenue of $1.28 billion. Same-store sales

increased by 5.6%.

Guess (NYSE:GES) – Shares fell 14.8% in

Wednesday’s pre-market after the clothing company reported

disappointing adjusted third-quarter earnings and revenues,

according to FactSet consensus estimates. Excluding unusual events,

the company announced an earnings per share projection between

$2.67 and $2.74, a decrease from the previous estimate of $2.88 to

$3.08 per share.

Nordstrom (NYSE:JWN) – The department store

chain reported third-quarter revenue of $3.32 billion, below

analysts’ expectations of $3.40 billion, according to LSEG. The

retailer announced an adjusted third-quarter earnings of 25 cents

per share, surpassing analysts’ forecasts of 13 cents per

share.

Burlington Stores (NYSE:BURL) – Burlington

Stores shares jumped on Tuesday after the company reported a

third-quarter net profit of $48.6 million, nearly tripling from the

previous year, with adjusted earnings per share of 98 cents. Total

revenue was $2.29 billion, with same-store sales growing 6.0%. The

company expects adjusted earnings per share between $3.04 and $3.19

in the fourth quarter and projects 5% to 7% sales growth.

Virgin Galactic (NYSE:SPCE)

Historical Stock Chart

From Mar 2024 to Apr 2024

Virgin Galactic (NYSE:SPCE)

Historical Stock Chart

From Apr 2023 to Apr 2024