Today, market participants will be closely monitoring the

release of the Federal Reserve’s minutes from the November meeting

for any new insights into the future trajectory of interest

rates.

“We are not expecting any major new information, but the minutes

could be less dovish than the current market pricing. The minutes

are likely to indicate that the door is still open for another hike

and emphasize that rates need to be kept on hold for longer,” said

Mohit Kumar, a managing director at Jefferies International.

Also, investors will likely focus on U.S. Existing Home Sales

data. Economists, on average, forecast that October Existing Home

Sales will stand at 3.90M, compared to the previous value of

3.96M.

In the bond markets, United States 10-year rates are at 4.412%,

down -0.27%.

On the earnings front, notable companies like NVIDIA (NVDA),

Lowe’s (LOW), Medtronic (MDT), Analog Devices (ADI), Autodesk

(ADSK), HP Inc (HPQ), Best Buy (BBY), and Dick’s Sporting Goods

(DKS) are set to report their quarterly figures today.

Pre-Market U.S. Stock Movers

Symbotic (NASDAQ:SYM) surged about +22% in

pre-market trading after the company posted upbeat Q4 results and

provided above-consensus Q1 revenue guidance.

Agilent Technologies (NYSE:A) climbed over +6%

in pre-market trading after the company reported

better-than-expected Q4 results.

Avita Medical (NASDAQ:RCEL) plunged more than

-10% in pre-market trading after the skin restoration-focused

pharmaceutical company lowered its annual commercial revenue

guidance.

Keysight Technologies (NYSE:KEYS) rose over +1%

in pre-market trading after the company reported

stronger-than-expected Q4 results.

Xylem (NYSE:XYL) gained about +1% in pre-market

trading after Deutsche Bank upgraded the stock to Buy from

Hold.

Gen Digital (NASDAQ:GEN) climbed more than +3%

in pre-market trading after Morgan Stanley upgraded the stock to

Overweight from Equal Weight.

Today’s U.S. Earnings Spotlight: Tuesday – November

21st

NVIDIA (NVDA), Lowe’s (LOW), Medtronic (MDT), Analog Devices

(ADI), Autodesk (ADSK), Baidu (BIDU), HP Inc (HPQ), Jacobs

Engineering (J), Best Buy (BBY), Dick’s Sporting Goods (DKS),

Burlington Stores (BURL), Miniso (MNSO), Dlocal (DLO), iQIYI (IQ),

NewJersey Resources (NJR), Abercrombie&Fitch (ANF), Urban

Outfitters (URBN), Kohl’s Corp (KSS), Nordstrom (JWN), Golar

(GLNG), GDS Holdings (GDS), Golden Ocean (GOGL), Jack In The Box

(JACK), Kingsoft Cloud (KC), Guess (GES), Caleres (CAL), Embecta

(EMBC), Hibbett Sports (HIBB), Tsakos Energy (TNP), Yatsen (YSG),

GreenTree Hospitality (GHG), Agora (API).

ANALYST RECOMMENDATIONS

Agilent Technologies.: JP Morgan maintains its

overweight recommendation and reduces the target price from $150 to

$140.

American Tower Corporation: BMO Capital Markets

maintains its outperform rating and raises the target price from

$220 to $230.

Atmos Energy Corporation: Morgan Stanley

maintains its overweight rating and reduces the target price from

$115 to $110.

Crown Castle: BMO Capital Markets maintains its

underperform recommendation and raises the target price from $85 to

$95.

Exelon Corporation: Mizuho Securities

downgrades to neutral from buy with a price target reduced from $45

to $40.

Intuitive Surgical: Leerink Partners maintains

its outperform recommendation and raises the target price from $342

to $357.

Keysight Technologies: Barclays maintains its

equalweight recommendation and reduces the target price from $144

to $134.

Moody’S Corporation: Daiwa Securities maintains

a neutral recommendation with a price target raised from $355 to

$370.

Newmont Corporation: Macquarie initiates an

Outperform recommendation with a target price of $45.

Synopsys: Wells Fargo maintains its overweight

rating and raises the target price from $505 to $600.

The Hershey Company: RBC Capital downgrades to

sector perform from outperform with a price target reduced from

$239 to $213.

Ulta Beauty: Oppenheimer maintains its

outperform rating and reduces the target price from $540 to

$525.

Zoom Video Communications.: Goldman Sachs

maintains a neutral recommendation with a price target reduced from

$75 to $70.

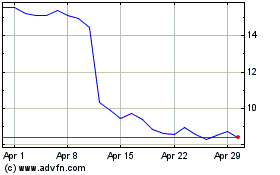

Avita Medical (NASDAQ:RCEL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Avita Medical (NASDAQ:RCEL)

Historical Stock Chart

From Apr 2023 to Apr 2024