UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO

RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2023

Commission File Number: 001-36582

Altamira Therapeutics Ltd.

(Exact name of registrant as specified in its

charter)

Clarendon House, 2 Church Street

Hamilton HM 11, Bermuda

(Address of principal executive office)

Indicate by check mark whether the registrant files

or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒

Form 40-F ☐

Partial Spin-Off of Bentrio® Business

On November 21, 2023, Altamira

Therapeutics Ltd., an exempted company limited by shares incorporated in Bermuda (the “Company”) closed the transaction for

the partial spin-off of its Bentrio® business pursuant to that share purchase agreement, dated November 17, 2023 (the “Purchase

Agreement”) by and between Auris Medical AG (“Seller”), a wholly-owned subsidiary of the Company, and a Swiss private

equity investor (“Purchaser”). Under the Purchase Agreement, the Company sold a 51% stake in its subsidiary Altamira Medica

AG (“Medica”) as part of its strategic repositioning around its RNA delivery technology. Medica’s key asset is Bentrio®,

a drug-free OTC nasal spray utilized for the treatment of allergic rhinitis, which has been cleared by the FDA and is being commercialized

in a growing number of countries.

Pursuant to the Purchase

Agreement, the Company received a cash consideration of CHF 2,040,000 (about $2.3 million) for the 51% stake in Medica and retained

49% of the company’s share capital. Further, the Company is entitled to receive 25% of Medica’s future gross licensing

income. The transaction also includes the sale of Auris Medical Pty Ltd, Melbourne (Australia) and a cash contribution of CHF

1,000,000 in total to Medica’s capital by its two shareholders pro rata of their shareholdings following the closing. Medica

will continue its operations under its current name and with current staff in collaboration with the Company, including the

continued provision of certain services at cost. The Company anticipates recording a financial gain of approximately $5.2 million

from the transaction in accordance with International Financial Reporting Standards (IFRS).

The Purchase Agreement also

contains customary representations, warranties and covenants by both parties, as well as customary provisions relating to indemnification,

confidentiality and other matters. The foregoing description of the terms of the Purchase Agreement is qualified in its entirety by reference

to the full text of the Purchase Agreement, which is filed as Exhibit 2.1 to this Report on Form 6-K and incorporated by reference herein.

Compliance with Continued Listing Rule

As previously announced, on

May 25, 2023 the Company received written notification from the Listing Qualifications Department of Nasdaq, indicating that based on

the Company’s shareholders’ equity of $(8.3) million for the period ended December 31, 2022, the Company was no longer in

compliance with the minimum shareholders’ equity requirement of $2.5 million as set forth in Nasdaq Listing Rule 5550(b)(1) for

continued listing on Nasdaq. On July 10, 2023, the Company submitted a plan to Nasdaq to regain compliance with the Stockholders’

Equity Requirement, and on July 25, 2023 Nasdaq notified the Company that it would be granted an extension until November 21, 2023, to

demonstrate compliance with Listing Rule 5550(b)(1) to meet the continued listing requirements of Nasdaq, conditioned upon the Company

evidencing compliance with the listing rule.

As previously announced, on

July 10, 2023 the Company raised net proceeds of $4.2 million through the public offering of 11,111,112 common shares (or pre-funded warrants)

at $0.45 each and 11,111,112 warrants with an exercise price of CHF 0.40 and a 5-year duration.

As previously announced, on

May 1, 2023 the Company entered into a convertible loan agreement with FiveT Investment Management (“FiveT IM”), pursuant

to which FiveT IM has agreed to loan to the Company CHF 2,500,000, which bears interest at the rate of 10% per annum and matures 22 months

from May 4, 2023. FiveT IM will have the right to convert all or part of the convertible loan, including accrued and unpaid interest,

at its option, into common shares, subject to the limitation that FiveT IM own no more than 4.99% of the common shares at any time. The

conversion price was fixed at CHF 1.42 per common share (subject to adjustment for share splits or other similar events). Further, FiveT

IM received warrants to purchase an aggregate of 1,625,487 common shares at an exercise price of CHF 1.538 per common share, which may

be exercised up to five years.

Commencing 60 days after May

4, 2023, but not before July 1, 2023 and subject to availability of an effective registration statement, the Company must repay at least

1/20th of the outstanding loan plus accrued interest pro rata in monthly tranches which, at the Company’s discretion, may be paid

at any time during the month either in: (i) cash plus 3% or (ii) common shares, or a combination of both. Such shares will be priced at

the lower of (i) the mean daily trading volume weighted average price for the common shares on the 20 trading days preceding the repayment

date or (ii) 90% of the daily trading volume weighted average price for common shares on the repayment date. The Company may repay all

or part of the convertible loan after three months. Until March 31, 2024, FiveT IM may cause the Company to redeem the convertible loan

for cash in an amount of up to 20% of the cash proceeds from an out-licensing or divestiture transaction executed by the Company that

results in gross cash proceeds of at least CHF 1,000,000.

Subsequent to June 30, 2023,

a net amount of $0.2 million under the 2023 FiveT Loan has been amortized into equity.

As described above in this

report, on November 21, 2023 the Company closed the transaction for the partial spin-off of its Bentrio® business. As a result of

spinoff described above, the Company anticipates recording a financial gain of approximately $5.2 million, as a result of, among other

things: (i) the cash proceeds received from the Purchaser, (ii) the Company retaining partial ownership of the equity of Medica and (iii)

the recognition of previously deferred income.

As a result of the foregoing

events, as of the date of this report the Company believes it has regained compliance with the stockholders’ equity requirement

on a pro forma basis. Nevertheless, Nasdaq will continue to monitor the Company’s ongoing compliance with the stockholders’

equity requirement and, if at the time of its next periodic report the Company does not evidence compliance, that it may be subject to

delisting.

EXHIBIT INDEX

Certain portions of this exhibit have been redacted as they are both

not material and are of the type of information that the registrant treats as private or confidential. The omissions have been indicated

by “[***]”. The Company agrees to furnish supplementally an unredacted copy of the exhibit to the SEC upon its request.

INCORPORATION BY REFERENCE

This Report on Form 6-K, including

the exhibit to this Report on Form 6-K, shall be deemed to be incorporated by reference into the registration statements on Form F-3 (Registration

Numbers 333-228121, 333-249347, 333-261127, 333-264298, 333-267584 and 333-272338) and Form S-8 (Registration Numbers 333-232735

and 333-252141) of Altamira Therapeutics Ltd. and to be a part thereof from the date on which this report is filed, to the extent not

superseded by documents or reports subsequently filed or furnished.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

Altamira Therapeutics Ltd. |

| |

|

| Date: November 21, 2023 |

By: |

/s/ Thomas Meyer |

| |

|

Name: |

Thomas Meyer |

| |

|

Title: |

Chief Executive Officer |

3

Exhibit 2.1

CERTAIN PORTIONS OF THIS EXHIBIT HAVE BEEN

REDACTED AS THEY ARE BOTH NOT MATERIAL AND ARE OF THE TYPE OF INFORMATION THAT THE REGISTRANT TREATS AS PRIVATE OR CONFIDENTIAL. THE OMISSIONS

HAVE BEEN INDICATED BY “[***]”.

SHARE PURCHASE AGREEMENT

dated 17 November

2023

by and between

Auris Medical AG, Peter Merian-Strasse

90, 4052 Basel, Switzerland

(“Seller”)

and

[***]

(the “Purchaser”)

(the Seller and the Purchaser together the “Parties”

and each of them a “Party”)

regarding the purchase and sale of

51% of the share capital of Altamira Medica

AG

Table Of contents

| 1. |

DEFINED TERMS |

6 |

| |

|

|

| 2. |

SALE AND PURCHASE OF SALE SHARES |

6 |

| 2.1 |

Object of

Sale and Purchase |

6 |

| 2.2 |

Purchase

Price |

7 |

| 2.3 |

Locked Box |

7 |

| 2.4 |

No Leakage |

7 |

| |

|

|

| 3. |

CONTRIBUTIONS |

8 |

| |

|

|

| 4. |

FRAMEWORK AGREEMENT AND EXIT PARTICIPATION |

8 |

| |

|

|

| 5. |

Transfer of IP Rights |

9 |

| |

|

|

| 6. |

CONDITIONS PRECEDENT TO CLOSING |

9 |

| |

|

|

| 7. |

CLOSING |

10 |

| 7.1 |

Date and

Place of Closing |

10 |

| 7.2 |

Closing

Actions of the Seller |

10 |

| 7.3 |

Closing

Actions of the Purchaser |

11 |

| 7.4 |

Closing

Minutes |

11 |

| 7.5 |

Non-Performance

of the Closing Actions |

11 |

| |

|

|

| 8. |

ACTIONS BETWEEN SIGNING AND CLOSING |

11 |

| 8.1 |

General;

Good Faith |

11 |

| 8.2 |

Ordinary

Course of Business |

12 |

| |

|

|

| 9. |

EXTRAORDINARY SHAREHOLDERS’ MEETING |

12 |

| |

|

|

| 10. |

REPRESENTATIONS AND WARRANTIES |

12 |

| |

|

|

| 10.1 |

Representations and Warranties of the Seller |

12 |

| |

10.1.1 |

Capacity |

12 |

| |

10.1.2 |

Shares; Legal Title |

13 |

| |

10.1.3 |

Incorporation and Existence of the Company; Conduct of Business |

13 |

| |

10.1.4 |

Records and Financial Statements |

13 |

| |

10.1.5 |

Assets |

13 |

| |

10.1.6 |

Contracts |

13 |

| |

10.1.7 |

Litigation |

14 |

| |

10.1.8 |

Intellectual Property |

14 |

| |

10.1.9 |

Taxes |

14 |

| |

|

|

|

| 10.2 |

Representations and Warranties of Purchaser |

14 |

| |

10.2.1 |

Capacity |

14 |

| |

10.2.2 |

Effects of Execution of Agreement |

15 |

| |

10.2.3 |

Proceedings Pending |

15 |

| |

10.2.4 |

Financial Position and Solvency |

15 |

| |

|

|

|

| 10.3 |

Exceptions; Representations and Warranties Exclusive |

15 |

| |

|

|

| 11. |

COVENANTS OF PURCHASER |

16 |

| |

|

|

| 12. |

REMEDIES IN CASE OF MISREPRESENTATION OR BREACH OF WARRANTY |

16 |

| |

|

|

| 12.1 |

Term of Representations and Warranties |

16 |

| |

|

|

| 12.2 |

Notice of Breach |

16 |

| |

|

|

| 12.3 |

Remedies of the Purchaser |

17 |

| |

|

|

| 12.4 |

Limitation and Exclusion of Remedies of the Purchaser |

17 |

| |

|

|

| 12.5 |

Remedies of the Seller |

17 |

| |

|

|

| 12.6 |

Time Limitations and Remedies Exclusive |

17 |

| |

|

|

| 13. |

LIMITATIONS OF SELLER’S LIABILITY; THIRD PARTY CLAIMS |

18 |

| |

|

|

| 13.1 |

Limitations of Seller’s Liability under this Agreement |

18 |

| |

|

|

| 13.2 |

Third Party Claims |

19 |

| |

|

|

| 14. |

MISCELLANEOUS |

20 |

| |

|

|

| 14.1 |

Entire Agreement; Amendments |

20 |

| |

|

|

| 14.2 |

No Waiver |

20 |

| |

|

|

| 14.3 |

Severability |

20 |

| |

|

|

| 14.4 |

Notices |

20 |

| 14.5 |

Confidentiality |

21 |

| |

|

|

| 14.6 |

Press Releases |

21 |

| |

|

|

| 14.7 |

Assignment |

21 |

| |

|

|

| 14.8 |

Cost and Expenses; Taxes |

22 |

| |

|

|

| 14.9 |

Form Requirements |

22 |

| |

|

|

| 15. |

APPLICABLE LAW AND DISPUTE RESOLUTION |

22 |

Table

of Schedules

| 1 |

|

Defined Terms |

| 3(a) |

|

Loan Contribution Agreement |

| 3(b) |

|

Transfer Documents regarding Auris Australia |

| 3(c) |

|

Australian Loan Contribution Agreement |

| 3(d) |

|

Cash Contribution Agreement |

| 4 |

|

Framework Agreement |

| 7.2(i) |

|

Shareholders’ Agreement |

| 10.1.8 |

|

Intellectual Property |

WHEREAS:

| (A) | The Seller is a stock corporation incorporated under the laws of Switzerland having its registered address

at Peter Merian-Strasse 90, 4052 Basel, Switzerland. The Seller is a subsidiary of Altamira Therapeutics Ltd., a limited company incorporated

under the laws of Bermuda having its registered address at Clarendon House, 2 Church Street, Hamilton HM 11, Bermuda (“CYTO”).

The CYTO shares are listed on the NASDAQ. |

| (B) | Altamira Medica AG, a stock corporation duly incorporated under the laws of Switzerland having its registered

address at Peter Merian-Strasse 90, 4052 Basel, Switzerland (the “Company”), has a fully paid share capital of CHF

3,000,000, divided into 3,000,000 registered shares with a par value of CHF 1.00 each (the “Share Capital”). The Seller

owns the entire Share Capital. The Company is active in the development and commercialization of medical devices, notably the drug-free

nasal spray Bentrio® (“Bentrio”). |

| (C) | Purchaser has conducted a due diligence review with respect to the Company together with Purchaser’s

professional advisors. Purchaser and Purchaser’s professional advisors had access to, reviewed and analysed detailed financial,

legal and operational information regarding the Company and the Business, received all requested related documentation and held discussions

and interviews with the management of the Company (such review, analysis and discussions, the “Due Diligence”). |

| (D) | Purchaser wishes to purchase from Seller 51% of the Share Capital, and Seller wishes to sell to Purchaser

51% of the Share Capital, subject to the terms and conditions set out in this Agreement. |

| (E) | Further, the Parties wish to make directly or indirectly certain contributions to the Company in order

to restructure the Company and to enter into or procure the entry into the Framework Agreement between the Seller and the Company, all

subject to the terms and conditions set out in this Agreement. |

NOW, THEREFORE, the Parties herewith AGREE

as follows:

As used in this Agreement, capitalised

terms shall have the meaning set forth in Schedule 1.

| 2. | SALE AND PURCHASE OF SALE SHARES |

| 2.1 | Object of Sale and Purchase |

In accordance with the terms of this

Agreement, Seller hereby sells 1,530,000 registered shares in the Company comprising 51% of the Share Capital (the “Sale Shares”)

and agrees to transfer legal ownership on the Closing Date to the Purchaser, and the Purchaser hereby purchases from Seller the Sale Shares.

The purchase price for the Sale Shares

(the “Purchase Price”) amounts to CHF 2,040,000 (two million forty thousand) and shall be paid by Purchaser to

the Seller in immediately available funds (same day value) without any set-off or deductions whatsoever on the Closing Date pursuant to

Section 7.3(a) to the following bank account: [***], or any other bank account as notified by Seller in writing to Purchaser. The

Purchase Price represents the agreed equity value attributable to the Company as of September 30, 2023 (the “Locked Box

Date”). Without prejudice to Section 2.4 below, the Purchase Price shall be firm and not adjusted for any reason.

Unless provided otherwise in this Agreement,

Purchaser shall commercially bear all risks in, and receive all benefits from, the Company as of October 1, 2023, 00:00 a.m.

| (a) | Seller confirms and covenants to Purchaser that, from the Locked Box Date until Closing, no Leakage (except

for Permitted Leakage) from the Company has occurred or will occur. |

| (b) | Subject always to Closing taking place, the Seller undertakes to, irrespective of any fault, indemnify

and hold harmless the Purchaser in the sense of article 111 CO for any Leakage in the period from (but excluding) the Locked Box Date

until the Closing by paying in cash to the Purchaser on a CHF for CHF basis the amount of such Leakage received by the Seller or its Affiliates

or Related Parties and, if applicable, upon request of Purchaser, use reasonable efforts to procure the termination, cancellation or rescission

of any agreement or arrangement that constitutes Leakage. |

| (c) | The limitations of Section 13.1(b) (except for para. (iii)) shall apply by analogy to Seller’s

liability under this Section 2.4. |

| (d) | The amount of any Leakage to be indemnified shall take into account any Tax liabilities payable and any

Tax benefits of the Company or the Purchaser and its Affiliates in connection with such Leakage or the repayment thereof and shall be

increased or reduced accordingly. |

| (e) | The obligations of the Seller under this Section 2.4 shall be forfeited and precluded from being

made (verwirkt) on the date falling six months after the Closing Date unless Purchaser has notified the Seller in writing by that

time of any Leakage, setting out the identity of the Seller and the amount and reasonable details of such Leakage, together with reasonable

evidence thereof to the extent available enabling the Seller to remedy or procure remediation of the Leakage. With respect to any claims

for Leakage notified by Purchaser in accordance with this paragraph, on the date falling three months after such notice unless the Purchaser

has by that time initiated arbitral proceedings in accordance with Section 15 (Applicable Law and Dispute Resolution) in respect

of such claim for Leakage. |

| (f) | The Seller has the right within 30 (thirty) Business Days from receipt of Purchaser’s notice of

any Leakage to remedy or procure remediation of the respective Leakage as required in respect of the nature of such Leakage and Purchaser

shall, and shall procure that the Company will, upon Seller’s request reasonably cooperate with the Seller with respect to such

Leakage remedy. |

| (g) | Any payments by the Seller to the Purchaser in discharge of its obligations under Section 2.4 shall

be treated as a reduction of the Purchase Price. |

Subject to the terms and conditions of

this Agreement, the Parties hereby agree to make directly or indirectly no later than at Closing, and subject to Closing, the following

contributions into the legal capital reserves (Gesetzliche Kapitalreserve) of the Company and to enter (or procure the entry) with

the Company into the corresponding agreements as set forth below:

| (a) | The Seller shall procure that CYTO contributes to the Company all subordinated loans granted by CYTO to

the Company outstanding at the date hereof pursuant to the loan contribution agreement in the form as attached as Schedule 3(a)

(the “Loan Contribution Agreement”), which subordinated loans shall be thereby cancelled due to confusion of the creditor

and the debtor of the subordinated loans. |

| (b) | The Seller shall transfer and contribute to the Company all shares in Auris Medical Pty Ltd, Collingwood,

Australia (“Auris Australia”), pursuant to the terms and conditions of the transfer documents in the form as attached

in Schedule 3(b). |

| (c) | The Seller shall contribute to the Company the loan granted by the Seller to Auris Australia under the

loan agreement “AM-301” dated June 12, 2023 in the amount of [***] (including accrued interest thereon) pursuant to the loan

contribution agreement in the form as attached as Schedule 3(c) (“Australian Loan Contribution Agreement”). |

| (d) | The Purchaser shall make a cash contribution to the Company in the amount of CHF 510,000 (the “Purchaser

Cash Contribution”) pursuant to the terms and conditions of the contribution agreement in the form as attached as Schedule 3(d)

(the “Cash Contribution Agreement”). |

| (e) | The Seller shall make a cash contribution to the Company in the amount of CHF 490,000 (the “Seller

Cash Contribution”) pursuant to the terms and conditions of the Cash Contribution Agreement. |

| 4. | FRAMEWORK AGREEMENT AND EXIT PARTICIPATION |

| (a) | The Parties agree that at Closing the Seller and the Company shall enter into a framework agreement in

the form as attached hereto as Schedule 4 (the “Framework Agreement”), with a ten-year term regarding certain

contributions by the Seller to the Company in connection with the supply chain, commercialization, technical support and business development,

in particular licensing, of Bentrio, against a consideration in the amount of the cost of such contributions plus twenty-five percent

(25%) of any and all cash or non-cash gross proceeds received by the Company (before tax, discounts, expenses or other deductions) from

any and all out-licensing of rights or property to and in Bentrio (the “Licensing-out Revenues”). |

| (b) | Should for any reason whatsoever (i) the Framework Agreement be terminated by either party or (ii) the

agreed Licensing-out Revenues to which the Seller is entitled under the Framework Agreement be reduced prior to the expiration of the

ten-year term of the Framework Agreement, the Purchaser and the Seller agree that the Seller shall continue to receive the Licensing-out

Revenues as had been agreed under the Framework Agreement and the Purchaser and the Seller shall take all actions and enter into (or procure

the entry into) all such agreements as is reasonably necessary to enable the continued payment of the Licensing-out Revenues to the Seller. |

| (c) | In the event of a sale, transfer or other disposal to a third party (including to an Affiliate of Purchaser)

after Closing of (i) some or all of the Sale Shares by the Purchaser or (ii) Bentrio or (iii) the other Company’s assets with substantially

the same effect (the “Sale”), the Seller has the right to receive twenty-five percent (25%) of all proceeds of the

Purchaser resulting from such Sale to the extent such proceeds exceed the amount of the Purchase Price plus the Purchaser Cash Contribution,

i.e. CHF 2,550,000 in total, all as set forth in the Shareholders’ Agreement. |

| (a) | No later than 30 days after the Closing Date, the Seller undertakes to procure that its subsidiary Auris

Medical Ltd., Dublin, Ireland, either (i) transfers and assigns to the Company full ownership of the trademarks “Bentrio™”,

“Bentrio®”, “Rhionic™” and “Rhionic®” (the “Additional IP”), free

and clear of any Encumbrance, or (ii) grants to the Company a perpetual, irrevocable, exclusive, worldwide, royalty free and fully paid-up

license to the Additional IP, in each case without any further consideration. |

| (b) | The Seller undertakes to execute and deliver (and procure the execution and delivery) of all documents

or instruments and to take and procure any further action required and/or reasonably requested by the Company to perfect or evidence the

transfer and assignment or the license (as the case may be) of the Additional IP and/or the Company’s ownership thereof or right

thereto as set forth in Section 5(a). |

| 6. | CONDITIONS PRECEDENT TO CLOSING |

The consummation

of the sale and purchase of the Sale Shares by the Purchaser shall be subject to the following condition precedent being satisfied or

waived jointly by the relevant Party in writing, in whole or in part, on or prior to the Closing Date: The Closing shall not have been

prohibited by a judgment or injunction or other authoritative relief or measure, and there shall be no legal action or application of

any Third Person pending before any state court, arbitral tribunal or other authoritative body which seeks to prohibit the Closing.

| 7.1 | Date and Place of Closing |

| (a) | The actions set forth in Section 7.2 (Closing Actions of Seller) and Section 7.3 (Closing Actions

of Purchaser) (the “Closing”) shall occur, assuming the condition precedent as per Section 5 (Condition

Precedent to Closing) is satisfied or waived, immediately following the signing of this Agreement (i.e. on the Signing Date) or on

such other date as the Parties may agree in writing (in each case the “Closing Date”) but in any event no later than

21 November 2023. |

| (b) | The Parties agree that Closing may continue for one more Business Day until all (but not some only) of

the events detailed in Section 7.2 (Closing Actions of Seller) and Section 7.3 (Closing Actions of Purchaser) have occurred. |

| (c) | All deliveries made and actions taken at Closing shall be considered to have been taken place simultaneously

as a part of a single transaction (Zug um Zug) and in the proper sequence, and no action shall be considered to have taken place

and no delivery shall be considered to have been made until all and each of the below actions and deliveries have been completed by all

Parties. |

| (d) | Closing shall occur at the offices of Walder Wyss Ltd, Seefeldstrasse 123, 8002 Zurich, Switzerland,

or at such other place as the Parties may agree in writing. |

| 7.2 | Closing Actions of the Seller |

Concurrently with

and in exchange for the closing actions of Purchaser pursuant to Section 7.3 (Closing Actions of Purchaser), Seller shall, on the

Closing Date:

| (a) | deliver to the Purchaser a copy of the Loan Contribution Agreement, duly executed by CYTO and the Company;

and |

| (b) | deliver to the Purchaser copies of all documents required for the valid transfer of the shares in Auris

Australia by Seller to the Company; and |

| (c) | deliver to the Purchaser a copy of the Australian Loan Contribution Agreement, duly executed by Seller

and the Company; and |

| (d) | deliver to the Purchaser a written assignment declaration covering the Sale Shares, duly executed by the

Seller; and |

| (e) | deliver to Purchaser the share register of the Company evidencing that Purchaser is registered as shareholder

of the Company regarding the Sale Shares with full voting power as of the Closing Date; and |

| (f) | deliver to Purchaser the Cash Contribution Agreement, duly executed by Seller and the Company; and |

| (g) | pay the Seller Cash Contribution to the Company Account; and |

| (h) | deliver to Purchaser a copy of the Framework Agreement, duly executed by the Seller and the Company; and |

| (i) | deliver to Purchaser the shareholders’ agreement as set out in Schedule 7.2(i) (the

“Shareholders’ Agreement”), duly executed by the Seller. |

| 7.3 | Closing Actions of the Purchaser |

Concurrently with and in exchange for

the closing actions of Seller pursuant to Section 7.2 (Closing Actions of the Seller), Purchaser shall, at the Closing Date:

| (a) | pay the Purchase Price as indicated in Section 2.2; and |

| (b) | deliver to Seller the Cash Contribution Agreement, duly executed by the Purchaser; and |

| (c) | pay the Purchaser Cash Contribution to the Company Account; and |

| (d) | deliver to Seller original signed acceptance declaration of Purchaser to be elected as new member of the

board of directors of the Company as of Closing together with his original notarized signature specimen; and |

| (e) | deliver to Seller a notification in accordance with art. 697j CO regarding the identification of the beneficial

ownership in the Sale Shares; |

| (f) | deliver all other documents reasonably required by Seller to be delivered on or prior to the Closing Date

pursuant to this Agreement; and |

| (g) | deliver to Seller the Shareholders’ Agreement, duly executed by the Purchaser. |

At Closing, the Parties shall execute

closing minutes evidencing the occurrence of the closing actions pursuant to Sections 7.2 (Closing Actions of the Seller) and 7.3

(Closing Actions of the Purchaser) (the “Closing Minutes”). The Closing Minutes shall be prepared, reasonably

prior to the Closing Date, by Seller’s legal counsel in cooperation with Purchaser’s legal counsel.

| 7.5 | Non-Performance of the Closing Actions |

If a Party does not perform its respective

closing actions on or before the Closing Date, such Party shall be deemed in default in accordance with article 102 et seq. CO, and the

other Party shall have the rights conferred by the aforementioned provisions of the CO without having to give notice of default.

| 8. | ACTIONS BETWEEN SIGNING AND CLOSING |

From the Signing Date to the Closing

Date, each Party shall use its best efforts to procure that the condition precedent to Closing set forth in Section 5 (Condition Precedent

to Closing) will be satisfied as soon as reasonably possible and in any event on or before Closing Date. The Parties shall promptly

inform each other of any facts or circumstances which could lead to a non-satisfaction of the condition precedent to Closing, and shall

in all other respects co-operate in good faith to consummate the transactions contemplated by this Agreement.

| 8.2 | Ordinary Course of Business |

Except as otherwise provided for in

this Agreement or required in light of mandatory laws, Seller shall cause the Business to be operated pending Closing only in the ordinary

course, taking all such action as is reasonably necessary or desirable to maintain or enhance existing and prospective business relationships

and product development; and the Company shall not take any action or make any agreements or commitments extending beyond the Closing

Date except those made in the ordinary course of business, those which may be required to carry out the terms of this Agreement, or those

made with Purchaser’s prior written consent.

| 9. | EXTRAORDINARY SHAREHOLDERS’ MEETING |

| (a) | Immediately after the Closing (i.e. on the Closing Date), the Parties shall hold an extraordinary shareholders’

meeting of the Company, at which (i) Purchaser shall be elected as new member of the board of directors of the Company as of the Closing

Date and (ii) the current director of the Company shall be granted discharge for his acts or omissions as director or manager of the Company

in the period until the Closing. |

| (b) | The Parties shall use their reasonable best efforts to procure that the Company submits a duly signed

application to the commercial register for the record of the changes in composition of the board of directors of the Company as promptly

as possible after the extraordinary general meeting. |

| 10. | REPRESENTATIONS AND WARRANTIES |

| 10.1 | Representations and Warranties of the Seller |

Subject to the terms, exceptions and

limitations contained in this Agreement, including, without limitation, the exceptions set forth in Section 10.3 (Exceptions, Representations

and Warranties Exclusive), Seller hereby represents and warrants to Purchaser that each of the statements in this Section 10.1 (Representations

and Warranties of the Seller) is true and accurate, unless otherwise specified hereafter, both at the Signing Date and, immediately

prior to Closing, at the Closing Date.

| (a) | This Agreement has been duly and validly executed and delivered by Seller and constitutes valid, legal

and binding obligations of Seller, enforceable in accordance with its terms. |

| (b) | Seller is duly organised and validly existing under Swiss law and has full power and authority to enter

into this Agreement and to perform its obligations under this Agreement. |

| (c) | The execution and delivery by Seller of this Agreement, the performance by Seller of its obligations hereunder

and the consummation by Seller of the transactions contemplated hereby have been duly authorised by all requisite action on the part of

Seller. |

| 10.1.2 | Shares; Legal Title |

Seller is the legal

and beneficial owner of all the Sale Shares and, at Closing, shall deliver legal and beneficial ownership of such Sale Shares to the Purchaser

free and clear from any Encumbrance.

| 10.1.3 | Incorporation and Existence of the Company; Conduct of Business |

The Company is

duly incorporated and validly existing under Swiss law. It has at all times carried on its Business in all material respects in accordance

with its constitutional documents for the time being in force. The Company has the right to own property and transact business in all

jurisdictions in which it transacts the Business at the date hereof in the manner in which the Business is conducted and has to the Seller’s

best knowledge all material licenses, consents, permits and authorities necessary to do so and it has conducted its Business in all material

respects in accordance with all applicable laws of all such jurisdictions.

| 10.1.4 | Records and Financial Statements |

| (a) | To the Seller’s best knowledge, the books, accounts and records required by law to be maintained

by the Company have been so maintained and were prepared in all material respects in accordance with the applicable statutory provisions. |

| (b) | The Financial Statements have been prepared in accordance with generally accepted accounting principles

(Swiss law) at the applicable dates. They fairly present in all material respects the financial condition and operating results of the

Company as of the dates, and for the periods, indicated therein, subject to normal audit adjustments in the case of the unaudited financial

statements for the first nine months of the business year 2023. |

| (a) | The Company is the owner of all its material assets. All assets used by the Company are in good workable

condition save for normal wear and tear having regard to their age and usage and have been regularly maintained. |

| (b) | The Company owns 100% of the share capital of Auris Australia. |

| (a) | No notice of termination has been given with regard to the material contracts which the Company is a party

to. |

| (b) | None of the material contracts which the Company is a party to entitles the contract counter party to

a compensation (such as finders’ fees, retrocessions or similar) which is not fully reflected in the Financial Statements. |

There is no litigation, arbitration,

administrative, criminal or other procedure or investigation pending against the Company with an amount in dispute above CHF 50,000,

and, to the Seller’s best knowledge, no such proceedings have been threatened in writing.

| 10.1.8 | Intellectual Property |

| (a) | The Intellectual Property as set out in

Schedule 10.1.8 comprises all the registered Intellectual Property owned by or licensed

to the Company, which is materially relevant for the Company to operate the Business as operated

at the date of this Agreement (the “IPRs”). |

| (b) | No claims have been made or threatened challenging the use, validity or enforceability of the IPRs and

no grounds exist which may support such claims. |

| (a) | Since the Company’s foundation, all Tax Returns required to be filed by or on behalf of the Company

prior to the Closing Date and subject to the extension of deadlines for such filings, have been or will be timely filed prior to the Closing

Date. All such Tax Returns were to the Seller’s best knowledge true, correct and complete in all material respects and were prepared

in accordance with applicable laws. |

| (b) | Since the Company’s foundation, all Taxes of the Company have been or will be timely paid in full,

and, where payment of such Taxes is not yet due, such Taxes have been fully accrued or reserved against in the interim accounts. |

| 10.2 | Representations and Warranties of Purchaser |

Subject to the terms, exceptions and

limitations contained in this Agreement, the Purchaser hereby warrants to Seller that each of the statements in this Section 10.2

(Representations and Warranties of the Purchaser) is true and accurate, unless otherwise specified hereafter, both at the Signing

Date and, immediately prior to Closing, at the Closing Date.

The Purchaser is

duly organised and validly existing under Swiss law and has full legal capacity, rights and authority to enter into this Agreement and

to perform its obligations under this Agreement.

| 10.2.2 | Effects of Execution of Agreement |

| (a) | This Agreement constitutes valid, legal and binding obligations of Purchaser, enforceable in accordance

with its terms. The execution and delivery of this Agreement by Purchaser, and the consummation of the transactions contemplated by this

Agreement by Purchaser will be in full compliance with and not violate any agreement to which the Purchaser is a party or any law or order

of any court or Governmental Authority binding upon, or applicable to the Purchaser. |

| (b) | Purchaser has obtained and will obtain all governmental consents or consents or permits of any nature

to enter into this Agreement and to consummate the transactions contemplated by this Agreement. |

| 10.2.3 | Proceedings Pending |

There are no actions, suits or proceedings

pending against the Purchaser or its Affiliate before any court or administrative board, agency or commission that involve a claim by

a governmental or regulatory authority, or by a Third Person, that would operate to hinder, or substantially impair, the Closing and the

Purchaser is not aware of any such actions, suits or proceedings having been threatened to be filed or instituted against the Purchaser

or its Affiliate.

| 10.2.4 | Financial Position and Solvency |

Purchaser has sufficient cash, available

lines of credit or other sources of immediately available funds to pay in cash the Purchase Price to the Seller and fulfil its other payment

obligations under this Agreement on the terms and conditions contemplated by this Agreement. Purchaser is not insolvent (bankrupt) or

unable to pay his debts within the meaning of laws applicable to him.

| 10.3 | Exceptions; Representations and Warranties Exclusive |

| (a) | The representations and warranties of Seller as set forth in Section 10.1 (Representations and Warranties

of the Seller) are the sole and exclusive representations and warranties made by Seller in respect of the subject matter of this Agreement,

and no other representations or warranties are made by Seller or relied upon by Purchaser, whether express or implied, whether based on

agreement, statutory law or any other ground, other than those explicitly made in Section 10.1 (Representations and Warranties of the

Seller). In particular, without limitation, nothing in this Agreement or the disclosed information shall be understood or construed

to express or imply any representation or warranty in respect of any budgets, business plans, forward looking statements, development

or any other projections of any nature in respect of the Company and/or its Business. |

| (b) | Purchaser has conducted its own independent investigation of the Company and its Business. Purchaser further

acknowledges that it and its representatives have been provided with sufficient access to the personnel, properties and records of the

Company for such purpose. |

| 11. | COVENANTS OF PURCHASER |

Purchaser shall not make, and procure

that the Company shall not make, any claim (i) against any director or manager of the Company in connection with their acts or omissions

as directors or managers of the Company in the period prior to the Closing, and (ii), without prejudice to Purchaser’s right to

bring a claim against the Seller under this Agreement, against the Seller or any of its directors or officers in connection with the Seller’s

position as direct or indirect shareholder, or (if any) the Seller’s or any of its directors’ or officers’ shadow directorship

(faktische Organschaft) in the Company.

| 12. | REMEDIES IN CASE OF MISREPRESENTATION OR BREACH OF WARRANTY |

| 12.1 | Term of Representations and Warranties |

| (a) | The representations and warranties of Seller set forth in Section 10.1 (Representations and Warranties

of Seller) shall expire, and any claims of Purchaser for a breach thereof shall be forfeited on and precluded from being made (Verwirkung)

after the first anniversary of the Closing Date. |

| (b) | The time period set forth in Section 12.1(a) shall be deemed to be complied with if Seller receives a

Notice of Breach in accordance with Section 12.2 (Notice of Breach) within such time period. If Seller does not receive a Notice

of Breach in accordance with Section 12.2 within the time period set forth in Section 12.1(a), Purchaser shall be deemed to have

waived, and shall have forfeited and be precluded from raising (Verwirkung), any claim or right against Seller for misrepresentation

or breach of warranty in respect of such claim. |

| (c) | If Seller has received a Notice of Breach in accordance with Section 12.2 (Notice of Breach) within

the time period set forth in Section 12.1(a), and Seller disputes such breach or claim, Purchaser shall, within a period of three months

from the date of its Notice of Breach in respect of such claim, initiate arbitral proceedings in accordance with Section 15(b) (Applicable

Law and Dispute Resolution) in respect of such claim. Should Purchaser not initiate arbitral proceedings in accordance with Section 15(b)

within such three-month period, any claim or right of Purchaser against the Seller for misrepresentation or breach of warranty in respect

of such claim shall be forfeited and precluded from being made (Verwirkung). |

Should Purchaser detect any misrepresentation

or breach of warranty, or should a Third Party Claim be raised, Purchaser shall, within 20 Business Days from having obtained knowledge

of the circumstances of such misrepresentation or breach of warranty or of such Third Party Claim, deliver to Seller a notice in writing

describing the facts and the claim in reasonable detail, referring to the basis for its claim under this Agreement and stating the amount

of reasonably anticipated damages relating to such claim, as well as disclosing to Seller reasonably available documents and information

in possession of Purchaser supporting its claim (the “Notice of Breach”).

| 12.3 | Remedies of the Purchaser |

In the event of a breach by Seller of

the representations and warranties set forth in Sections 10.1 (Representations and Warranties of the Seller) which breach has been

notified by the Purchaser in accordance with Section 12.1 (Term of Representations and Warranties) and Section 12.2 (Notice

of Breach), subject to the exclusions and limitations set forth in Section 12.4 (Limitation and Exclusion of Remedies of the Purchaser)

and Section 13.1 (Limitation of Seller’s Liability under this Agreement), Seller shall:

| (a) | have the right, within two months from receipt of the Notice of Breach, to put the Company in the position

in which it would be, had no such misrepresentation or breach of warranty occurred; and |

| (b) | to the extent that such remedy cannot be effected or is not effected within such period of time, reimburse

Purchaser for the direct losses actually suffered and incurred by the latter, yet in any case excluding consequential damages, loss of

profits and punitive damages. |

| 12.4 | Limitation and Exclusion of Remedies of the Purchaser |

The Seller’s obligation to remedy

a misrepresentation or breach of warranty in accordance with Section 12.3 (Remedies of the Purchaser) shall be excluded if and

to the extent that (i) any matter, fact or circumstance that would otherwise give rise to a misrepresentation or breach of warranty is

or reasonably should have been known to the Purchaser or its representatives as of the Signing Date, or (ii) has been disclosed to Purchaser

in the Due Diligence.

| 12.5 | Remedies of the Seller |

The representations and warranties of

the Purchaser set forth in Section 10.2 (Representations and Warranties of the Purchaser) shall be valid for a period of one year

from the Closing Date. The provisions of Section 12.2 (Notice of Breach) and Section 12.3 (Remedies of the Purchaser) shall

apply by analogy in the event of a breach by the Purchaser of any of its representations and warranties set forth in Section 10.2.

| 12.6 | Time Limitations and Remedies Exclusive |

| (a) | No statutory examination or notification requirements shall apply to this Agreement. The provisions contained

in Section 10.1 (Representations and Warranties of the Seller), Section 10.2 (Representations and Warranties of the Purchaser)

Sections 12.1 (Term of Representations and Warranties), 12.2 (Notice of Breach) and Section 12.3 (Remedies of the Purchaser)

shall supersede the provisions of articles 201 and 210 CO, which shall not be applicable to this Agreement. |

| (b) | The remedies set forth in this Section 12 (Remedies in case of Misrepresentation or Breach of Warranty)

for misrepresentation or breach of warranty shall be in lieu of and supersede any remedies provided for or available under applicable

laws, and the Parties hereby waive, to the fullest extent possible under mandatory provisions of applicable laws, any such other remedies

not set forth in this Section 12. In particular, without limitation, articles 192 et seq. CO and articles 197 et seq. CO (including article

97 CO to the extent that it applies to misrepresentations or breaches of warranties) and the rules of culpa in contrahendo shall

not apply to this Agreement, and the Parties hereby explicitly waive any rights thereunder, as well as any right to partially or fully

rescind or challenge the validity of this Agreement under article 23 et seq. CO or article 205 CO. |

| 13. | LIMITATIONS OF SELLER’S LIABILITY; THIRD PARTY CLAIMS |

| 13.1 | Limitations of Seller’s Liability under this Agreement |

| (a) | Except where specifically provided otherwise in this Agreement, the Seller shall be liable for any claim

of the Purchaser under or in connection with this Agreement, including, without limitation, for a misrepresentation or breach of warranty

in accordance with Section 12.3(b) (Remedies of the Purchaser) only: |

| (i) | if and to the extent that the Seller has not otherwise remedied a breach under this Agreement as permitted

by this Agreement; and |

| (ii) | if such claim on a stand-alone basis exceeds the amount of CHF 10,000 (the “De Minimis Amount”),

and the aggregate amount of all such claims which exceed the De Minimis Amount exceeds CHF 50,000, it being understood and agreed

that any and all claims exceeding such amount shall be taken into account in full, and several claims based on the same set of facts or

origin shall be deemed to be one claim for the purposes of this Section 13.1(a)(ii); and |

| (iii) | provided that all claims of the Purchaser under this Agreement taken together shall in no event exceed

the maximum aggregate liability of the Seller under this Agreement of CHF 200,000 (the “Cap”), except for such claims

which are caused by fraud or wilful misconduct on the part of the Seller for which the Cap shall not apply. |

| (b) | The liability of the Seller for any claim of the Purchaser under or in connection with this Agreement,

including, without limitation, for a misrepresentation or breach of warranty in accordance with Section 12.3(b) (Remedies of the Purchaser)

which qualifies for reimbursement in accordance with Section 13.1(a), shall further be limited or reduced if and to the extent that: |

| (i) | facts, matters or circumstances which give rise to a claim against the Seller in accordance with this

Agreement has been disclosed to the Purchaser as part of its Due Diligence; |

| (ii) | facts, matters or circumstances which give rise to a claim against the Seller in accordance with this

Agreement result in any financial benefits or financial advantages for the Company, the Purchaser or any Affiliate of the Purchaser, in

which event the Seller’s liability will be reduced by the amount equal to any such benefits and advantages; |

| (iii) | such claim has been caused or increased by a failure of the Purchaser or any of its Affiliates or, as

from the Closing Date, the Company, to comply with the duty to mitigate the damage; |

| (iv) | the Purchaser would recover from the Seller under this Agreement or otherwise more than the amount of

its actual losses incurred, and no loss may be recovered more than once; |

| (v) | Purchaser or any of its Affiliates has recovered or, by applying reasonable efforts, could have reasonably

expected to recover from any third party, including an insurer, the losses in respect of any matter to which the asserted claim relates; |

| (vi) | an accrual, provision, liability, reserve or valuation allowance has been or is made or included in the

Financial Statements, or the facts, matters or circumstances which give rise to a claim against Seller under this Agreement was taken

into account in the Financial Statements; |

| (vii) | Purchaser or any of its Affiliates has received, or will receive any repayments, set-off or reduction

of Taxes which it would not have received but for the circumstances giving rise to a claim. |

| (viii) | such claim arises or is increased as a result of any new legislation, regulation, rule of law or practice

not in force at the Signing Date or any amendment of any legislation, regulation, rule of law or practice after the Signing Date. |

| (a) | If a third party claim, or a series of third party claims based on the same set of facts or origin, is

brought or threatened to be brought after the Closing Date and which has been notified by the Purchaser in accordance with Section 12.2

(the “Third Party Claims”): |

| (i) | the Seller shall have the right (but not the obligation) to defend, at its own cost and expense, by its

own counsel and, to the extent possible, in its own name, such Third Party Claim or claims, and the Purchaser shall use its commercially

reasonable best efforts to assist the Seller in the defence of such Third Party Claims at its own cost and expense, including, without

limitation, by promptly providing to the Seller all documentation and access to the books, records, premises and representatives of the

Purchaser, the Company and their respective Affiliates, and by promptly providing all other support in relation to such Third Party Claim

as requested by the Seller or its/their counsel; or |

| (ii) | to the extent that the Seller does not defend such Third Party Claim or claims in accordance with Section 13.2(a)(i),

the Purchaser shall oppose and defend, and cause the Company to oppose and defend, such Third Party Claim in accordance with the instructions

of the Seller at its cost and expense and with legal counsel designated by it or, failing such instruction and/or election, at the Purchaser’s

cost and expenses and with the Purchaser’s counsel. The Purchaser and the Company shall not settle any such Third Party Claim without

the prior written consent of the Seller, which consent shall not be unreasonably withheld or delayed. |

| (b) | The Purchaser shall have the right at any time to compromise any liability asserted against the Purchaser,

its Affiliates, the Company under any Third Party Claim or to settle any Third Party Claim. Any such compromise or settlement shall be

deemed to constitute a full, irrevocable and unconditional waiver by the Purchaser of any claims under this Agreement against the Seller

in respect of such Third Party Claim. |

| 14.1 | Entire Agreement; Amendments |

| (a) | This Agreement constitutes the entire agreement of the Parties regarding the transaction contemplated

by this Agreement and supersedes all previous agreements or arrangements, negotiations, discussions, correspondence, undertakings and

communications, whether oral or in writing, explicit or implied. |

| (b) | This Agreement including this Section shall be modified only by an agreement in writing executed by the

Parties which shall explicitly refer to this Section 14.1 |

The failure of either of the Parties

to enforce any of the provisions of this Agreement or any rights with respect to this Agreement shall in no way be considered as a waiver

of such provisions or rights or in any way affect the validity of this Agreement. The waiver of any breach of this Agreement by either

Party shall not operate or be construed as a waiver of any other prior or subsequent breach.

If any provision of this Agreement is

held to be invalid or unenforceable for any reason, such provision shall, if possible, be adjusted rather than voided, in order to achieve

a result which corresponds to the fullest possible extent to the intention of the Parties. The nullity or adjustment of any provision

of this Agreement shall not affect the validity and enforceability of any other provision of this Agreement, unless this appears to be

unreasonable for any of the Parties.

| (a) | Any notice, request or instruction to be made under or in connection with this Agreement shall be made

in writing and be delivered by registered mail or courier or by facsimile or by e-mail (in case of facsimile or email to be confirmed

in writing delivered by registered mail or courier) to the following addresses (or such other addresses as may from time to time have

been notified according to this Section 14.4): |

Auris Medical AG, Peter Merian-Strasse

90, 4052 Basel, Switzerland, Thomas Meyer, CEO

E-mail: [***]

[***]

E-Mail: [***]

| (b) | Any notice, request or instruction made under or in connection with this Agreement shall be deemed to

have been delivered on the Business Day on which it has been received (by courier, postal service, facsimile or email) by the recipient

thereof. |

Subject to Section 14.6 (Press

Releases), neither the Seller nor the Purchaser shall, without the prior written consent of the other Party, disclose to any Third

Person and each shall keep in strict confidence this Agreement, its contents, and all information received and acquired in connection

with the negotiation of this Agreement.

All public announcements or press releases

issued in connection with the transaction contemplated by this Agreement shall only be published after the Seller and the Purchaser shall

have consulted and agreed on the contents and the timing of such public announcements or press releases.

Nothing in this Agreement shall restrict

or prohibit:

| (a) | any announcement or disclosure required by statutory law or by any competent judicial or regulatory authority

or by any competent securities exchange (in which case the Parties shall cooperate in good faith, if possible, in order to agree on the

content of any such announcement prior to it being made); |

| (b) | the Seller or the Purchaser from making any disclosure to any of its or their directors, officers, employees,

agents or advisors who are required to receive such information to carry out their duties (conditional upon any such person agreeing to

keep such information confidential in accordance with Section 14.5 (Confidentiality) or a requirement of applicable law). |

| (a) | Subject to Section 14.7(b), neither Party shall assign this Agreement or any rights, claims, obligations

or duties under this Agreement to any Person without the prior written consent of the other Party. |

| (b) | Seller shall have the right to assign this Agreement in whole to any of its Affiliates; provided that

in the event of such assignment, Seller shall (i) remain liable for the assignee’s obligations and duties under this Agreement,

and (ii) indemnify Purchaser and hold Purchaser fully harmless from all damage incurred by Purchaser as a result of such assignment. |

| 14.8 | Cost and Expenses; Taxes |

Unless provided otherwise in this Agreement,

each Party shall bear all its Taxes, costs and expenses incurred by it in connection with the transactions contemplated by this Agreement.

Except where written form is required

by statutory law, this Agreement and all ancillary documents related thereto may be executed in writing or in electronic form (such as

an electronic file which contains a scan of the wet ink signature or signed by Skribble, DocuSign or AdobeSign or a similar tool) and

be delivered by electronic mail or another transmission method (unless otherwise is required by law); the counterpart so executed and

delivered shall be deemed to have been duly executed and validly delivered and be valid and effective for all purposes.

| 15. | APPLICABLE LAW AND DISPUTE RESOLUTION |

| (a) | This Agreement shall be subject to and governed by Swiss substantive law, to the exclusion of its conflict

of law principles and the UN Convention on the International Sale of Goods dated 11 April 1980. |

| (b) | Any dispute, controversy or claim arising out of or in relation to this Agreement, including regarding

the validity, invalidity, breach or termination hereof, shall be resolved by arbitration in accordance with the Swiss Rules of International

Arbitration of the Swiss Arbitration Centre in force on the date on which the Notice of Arbitration is submitted in accordance with those

Rules. The number of arbitrators will be three. The seat of the arbitration shall be in Zurich, Switzerland. The arbitral proceedings

shall be conducted in German. |

[Signature page follows this page]

IN WITNESS WHEREOF, the Parties have executed

this Agreement on the date first above written.

| Auris Medical AG |

|

| |

|

| |

|

| Name: |

Mr. Thomas Meyer |

|

| Title: |

Member of the Board of Directors |

|

| |

|

| |

|

| [***] |

|

Schedule 1

Defined

Terms

The capitalised terms used in the Agreement

shall have the meaning ascribed to them in this Schedule 1.

“Additional IP” shall

have the meaning set forth in Section 5(a).

“Affiliates” shall

mean any person or entity that directly or indirectly through one or more intermediaries controls or is controlled by or is under common

control with the person specified and includes Related Parties, particularly including any relatives. “Control” shall

hereby include the direct or indirect power to instruct the managing body of an entity or to direct a person or entity, whether through

voting power, agreement or otherwise.

“Agreement” shall

mean this share purchase agreement between the Seller and the Purchaser regarding the sale and purchase of the Sale Shares, including

all Schedules hereto.

“Auris Australia”

shall have the meaning set forth in Section 3(b).

“Australian Loan Contribution

Agreement” shall have the meaning set forth in Section 3(c).

“Bentrio” shall have

the meaning set forth in Recital (B).

“Business”

shall mean the business of the Company carried on by the Company as at the date of this Agreement.

“Business Day” shall

mean any day, other than a Saturday or Sunday, on which banks are generally open for the transaction of normal commercial business in

Basel.

“Cap” shall have the

meaning set forth in Section 13.1(a)(iii).

“Cash Contribution Agreement”

shall have the meaning set forth in Section 3(b).

“CHF” shall mean Swiss

Francs being the lawful currency of Switzerland.

“Closing” shall have

the meaning set forth in Section 7.1(a).

“Closing Date” shall

have the meaning set forth in Section 7.1(a).

“Closing Minutes”

shall have the meaning set forth in Section 7.4 (Closing Minutes).

“CO” shall mean the

Swiss Code of Obligations (Obligationenrecht) of March 30, 1911, as amended.

“Company” shall mean

Altamira Medica AG, as further specified in Recital (B).

“Company Account”

shall mean [***].

“CYTO” shall have

the meaning set forth on the cover page of the Agreement.

“De Minimis Amount”

shall have the meaning set forth in Section 13.1(a)(ii).

“Due Diligence” shall

have the meaning set forth in Recital (C).

“Encumbrance” shall

mean any pledge, mortgage, indenture, lien, charge, encumbrance or other Security Interest, whether based on agreement or undertaking

or arising by the operation of law or otherwise.

“Financial

Statements” shall mean (i) the unaudited financial statements of the Company (comprising of a balance sheet and a profit and

loss account) for the business years 2020-2022, and (ii) the Locked Box Accounts, in each case on a stand-alone basis.

“Framework Agreement”

shall have the meaning set forth in Section 4.

“Governmental

Authority” shall mean any (i) federal, state, local, foreign or other governmental, quasi-governmental or administrative body,

instrumentality, department or agency, (ii) court tribunal or administrative hearing body, (iii) body exercising, or entitled to exercise,

any administrative, executive, judicial, legislative, police, regulatory or taxing authority or power of any nature, (iv) any state-owned,

state-controlled, or state-operated entity or enterprise, or (v) any public international organization (such as the World Bank, United

Nations, World Trade Organization, etc.).

“Intellectual Property”

shall mean patents, rights to inventions, utility models, copyright, trademarks, service marks, trade, business and domain names, rights

in designs, rights in computer software and any other intellectual property rights, in each case whether registered or unregistered and

including all applications for and renewals or extensions of such rights, and all similar or equivalent rights or forms of protection

in any part of the world.

“IPRs” shall have

the meaning set forth in Section 10.1.8(a).

“Leakage” shall mean:

| (i) | any actual or hidden dividend or other distribution declared, paid or made or other distribution or comparable

return of capital (whether by reduction of capital or redemption or purchase of shares or otherwise) by the Company to the Seller or any

of its Affiliates or Related Parties; |

| (ii) | any directors’ fees, shareholder fees, management fees or monitoring fees paid or agreed to be paid

by the Company to the Seller or any of its Affiliates or Related Parties; |

| (iii) | any assumption by the Company of any liability of, and the grant of any guarantee or indemnity with, the

Seller or any of its Affiliates or Related Parties; |

| (iv) | any (full or partial) waiver or release by the Company of any claim or benefit owed to it by the Seller

or any of its Affiliates or Related Parties; |

| (v) | any commitment or undertaking by the Company to do any of the above; |

in each case to or for the benefit of

the Seller or any of its Affiliates or Related Parties (excluding the Company) and always excluding Permitted Leakage.

“Licensing-out Revenues”

shall have the meaning set forth in Section 4.

“Loan Contribution

Agreement” shall have the meaning set forth in Section 3(a).

“Locked Box Accounts”

shall mean the unaudited financial statements of the Company (comprising of a balance sheet and a profit and loss account) for the third

quarter of 2023 as of 30 September 2023 on a stand-alone basis.

“Locked Box Date”

shall have the meaning set forth in Section 2.2 (Purchase Price).

“Notice of Breach”

shall have the meaning set forth in Section 12.2 (Notice of Breach).

“Party” shall mean

either of, and “Parties” shall mean all of, the Seller and the Purchaser.

“Permitted Leakage”

means:

| (i) | any payments to the Seller or its Affiliates or Related Parties, in each case in their capacity as employees

of the Company, by way of employee remuneration, benefits or expenses, in each case in accordance with their service, employment or engagement

agreement and any board membership fees and related reimbursement of costs and expenses in the ordinary course of business consistent

with past practice; |

| (ii) | any transaction made at arm’s length terms; |

| (iii) | any payments or liabilities to the extent the amounts have been accrued or reserved or provisioned in

the Locked Box Accounts; |

| (iv) | any matter undertaken by or on behalf of the Company at the request or with the consent of the Purchaser; |

| (v) | any payment made or agreed to be made by or on behalf of the Company to the extent required by the terms

of the Agreement; |

| (vi) | any Leakage to the extent refunded to the Company on or prior to Closing; |

| (vii) | any Tax payable by the Company or for which the Company is liable in consequence of any matters referred

to in para. (i) to (vii) above. |

“Person” shall mean

any individual person (natürliche Person), any corporation, company, association, foundation or other incorporated legal entity

(juristische Person), any general or limited partnership or other non-incorporated organisation (Rechtsgemeinschaft) doing

business, or any state, governmental or other authoritative administration, entity or body.

“Purchaser” shall

have the meaning set forth on the cover page of the Agreement.

“Purchase Price” shall

have the meaning set forth in Section 2.2 (Purchase Price).

“Purchaser Cash Contribution”

shall have the meaning set forth in Section 3(b).

“Related Parties”

shall mean persons or entities that are considered related in the sense of art. 678 CO.

“Sale Shares” shall

have the meaning set forth in Section 2.1 (Object of Sale and Purchase).

“Schedule” shall mean

a schedule attached to the Agreement.

“Section” shall mean

a section of the Agreement.

“Security Interest”

shall mean any mortgage, charge, pledge, lien, assignment, hypothecation, security interest, title retention or any other security agreement

or arrangement, or any agreement to create any of the above.

“Seller” shall have

the meaning set forth on the cover page of the Agreement.

“Seller Cash Contribution”

shall have the meaning set forth in Section 3(e).

“Share Capital” shall

have the meaning set forth in Recital (B).

“Shareholders’ Agreement”

shall have the meaning set forth in Section 7.2(i).

“Signing Date” shall

mean the date of the Agreement as set forth on the cover page of the Agreement.

“Taxes” shall mean

all tax liabilities payable by any Person to any competent tax authority in any jurisdiction, in particular (without limitation) personal

and corporate income taxes, capital taxes, issuance duties, transfer duties and other stamp duties, withholding taxes, value added taxes

and customs duties, including any related interest, penalties, costs and expenses.

“Tax Returns” shall

mean all returns applications, and reports (including elections, declarations, disclosures, schedules, estimates and information returns)

required to be supplied to a Governmental Authority relating to Taxes, including any amendments thereof or attachments thereto.

“Third Party Claims”

shall have the meaning set forth in Section 13.2.

“Third Person” shall

mean any Person which is not under the control of, has no control over, and does not act on the account (auf Rechnung) of, any

Seller, the Purchaser, the Company or any of their respective Affiliates.

IV

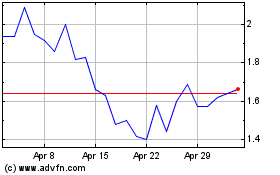

Altamira Therapeutics (NASDAQ:CYTO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Altamira Therapeutics (NASDAQ:CYTO)

Historical Stock Chart

From Apr 2023 to Apr 2024