Pre-Market U.S. Stock Movers

JD.com (NASDAQ:JD) gained over +4% in

pre-market trading after the retailer reported better-than-expected

Q3 results.

Solid Biosciences (NASDAQ:SLDB) surged about

+27% in pre-market trading after announcing that the FDA cleared

the company’s IND for Duchenne gene therapy candidate SGT-003.

Edgio (NASDAQ:EGIO) soared over +20% in

pre-market trading following the announcement that existing

investor Lynrock Lake Master Fund had provided the company with

$66M of new financing.

Arcturus Therapeutics Holdings (NASDAQ:ARCT)

climbed more than +19% in pre-market trading after the company

reported upbeat Q3 results.

PolishedCom (AMEX:POL) slid over -9% in

pre-market trading after postponing the reporting of its Q3

results.

Wix.Com (NASDAQ:WIX) rose more than +2% in

pre-market trading after Barclays upgraded the stock to Overweight

from Equal Weight.

Keep An Eye Out

Today, all eyes are focused on the U.S. Producer Price Index

(PPI) in a couple of hours. Economists, on average, forecast that

October U.S. PPI will stand at +0.1% m/m and +1.9% y/y, compared to

the previous values of +0.5% m/m and +2.2% y/y.

Also, investors will likely focus on U.S. Core Retail Sales

data, which came in at +0.6% m/m in September. Economists foresee

the new figure to be -0.2% m/m.

U.S. Core PPI data will come in today. Economists expect

October’s figures to be +0.3% m/m and +2.7% y/y, compared to the

previous numbers of +0.3% m/m and +2.7% y/y.

U.S. NY Empire State Manufacturing Index will be reported today.

Economists foresee this figure to stand at -2.80 in November,

compared to the previous figure of -4.60.

U.S. Retail Sales data will also be closely watched today.

Economists forecast October’s figure to be -0.3% m/m, compared to

the previous value of +0.7% m/m.

U.S. Crude Oil Inventories data will be reported today as well.

Economists estimate this figure to be +1.793M, compared to the

previous number of +0.774M.

In the bond markets, United States 10-year rates are at 4.467%,

up +0.56%.

Don’t Trade Without Seeing

The Orderbook

ANALYST RECOMMENDATIONS

Aflac Incorporated: Morgan Stanley maintains

its market weight recommendation and raises the target price from

USD 75 to USD 80.

Altria Group: Jefferies maintains its buy

recommendation and reduces the target price from USD 56 to USD

50.

Ameriprise Financial: Morgan Stanley maintains

its market weight recommendation and raises the target price from

USD 360 to USD 365.

Biomarin Pharmaceutical: Wells Fargo initiates

an overweight recommendation with a target price of USD 100.

Celanese Corporation: Jefferies maintains its

hold recommendation and raises the target price from USD 125 to USD

135.

Datadog: CICC initiates an Outperform

recommendation with a target price of USD 116.

Devon Energy Corporation: RBC Capital maintains

its sector perform recommendation and reduces the target price from

USD 60 to USD 55.

Eog Resources: Mizuho Securities maintains its

buy recommendation and reduces the target price from USD 158 to USD

150.

Equifax: Jefferies maintains its hold

recommendation with a price target raised from USD 180 to USD

200.

Fair Isaac Corporation: Jefferies maintains its

buy recommendation and raises the target price from USD 1035 to USD

1210.

Kraft Heinz: Bernstein upgrades to outperform

from market perform with a target price of USD 40.

The Home Depot: Guggenheim maintains its buy

recommendation and reduces the target price from USD 360 to USD

340.

The Jm Smucker Company: Bernstein downgrades to

market perform from underperform with a price target reduced from

USD 123 to USD 119.

Vertex Pharmaceuticals Incorporated: Daiwa

Securities maintains its buy recommendation and raises the target

price from USD 410 to USD 430.

Warner Music Group: Wells Fargo initiates an

Equalweight recommendation with a target price of USD 35.

Today’s U.S. Earnings Spotlight: Wednesday – November

15th

Cisco (CSCO), TJX (TJX), Palo Alto Networks (PANW), NetEase

(NTES), Target (TGT), Alcon (ALC), Xpeng (XPEV), Huazhu (HTHT),

Tetra Tech (TTEK), Catalent Inc (CTLT), GlobalE Online (GLBE),

Maximus (MMS), Copa (CPA), Advance Auto Parts (AAP), Endava (DAVA),

J & J Snack Foods (JJSF), Hillenbrand (HI), Grupo Aval (AVAL),

Kulicke&Soffa (KLIC), Griffon (GFF), INTL FCStone (SNEX),

Corporacion America Airports (CAAP), Sonos (SONO), Chase (CCF), ZIM

Integrated Shipping Services (ZIM), RMR Group Inc (RMR), Riskified

(RSKD).

US Options Trader

Live Realtime Streaming: US

Options (OPRA), NYSE, NASDAQ, AMEX prices + Dow Jones and S&P

indices – and our innovative Options Tools, featuring Live Options

Flow.

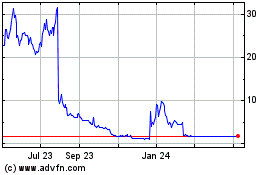

Polished (AMEX:POL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Polished (AMEX:POL)

Historical Stock Chart

From Apr 2023 to Apr 2024