false000108499100010849912022-11-142022-11-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): November 14, 2023 NATURAL GAS SERVICES GROUP, INC.

(Exact Name of Registrant as Specified in Charter) | | | | | | | | | | | | | | |

Colorado | | 1-31398 | | 75-2811855 |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

404 Veterans Airpark Lane, Suite 300

Midland, TX 79705

(Address of Principal Executive Offices)

(432) 262-2700

(Registrant's Telephone Number, Including Area Code)

N/A

(Former Name or Former Address if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)).

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-14(c)).

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common Stock, Par Value $0.01 | | NGS | | NYSE |

| | | | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 1.01 Entry into a Material Definitive Agreement.

The information provided in Item 2.03 of this Current Report on Form 8-K is hereby incorporated by reference in this Item 1.01

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

On November 14, 2023, Natural Gas Services Group, Inc. and the guarantors from time to time party thereto entered into a First Amendment to Amended and Restated Credit Agreement (the "Amendment”) with Texas Capital Bank, as administrative agent and the lenders thereto. The Amendment amends certain provisions under our existing credit facility with the lenders, primarily to (i) increase the lender commitment from $175 million to $225 million, and (ii) to add First-Citizens Bank & Trust Company as a new lender under the facility. In connection with the Amendment, we agreed to pay fees of $562,500 (representing fees equal to 1.125% of the $50 million increase in the commitment) and reimburse the lenders for their expenses.

The foregoing description of the Amendment does not purport to be complete and is qualified in its entirety by reference to the First Amendment, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K and incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

The following exhibits are included with this Current Report on Form 8-K:

| | | | | |

| Exhibit No. | Description |

| First Amendment to Amended and Restated Credit Agreement dated November 14, 2023, among Natural Gas Services Group, Inc., the other Loan Parties thereto, Texas Capital Bank, in its capacity as Administrative Agent and the Lenders party thereto. |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | |

| | | | | |

| | | NATURAL GAS SERVICES GROUP, INC. |

| | | | | |

| | | | | |

| Date: | November 14, 2023 | | By: | | /s/ Stephen C. Taylor |

| | | | | |

| | | | | Stephen C. Taylor |

| | | | | Interim Chief Executive Officer |

FIRST AMENDMENT TO AMENDED AND RESTATED CREDIT AGREEMENT

This FIRST AMENDMENT TO AMENDED AND RESTATED CREDIT AGREEMENT (this “First Amendment”) is dated effective as of November 14, 2023 (the “First Amendment Effective Date”), by and among NATURAL GAS SERVICES GROUP, INC., a Colorado corporation (“Holdings”), the other Loan Parties party hereto, TEXAS CAPITAL BANK, in its capacity as Administrative Agent (in such capacity, the “Administrative Agent”), Swing Line Lender and L/C Issuer, and the Accordion Lenders (as defined below).

RECITALS:

WHEREAS, the Loan Parties are party to that certain Amended and Restated Credit Agreement dated as of February 28, 2023 (as amended, restated, amended and restated, supplemented or otherwise modified prior to the date hereof, the “Credit Agreement”), by and among Holdings, the other Loan Parties from time to time party thereto, the Lenders from time to time party thereto and the Administrative Agent. Capitalized terms used but not defined herein have the meaning set forth in the Credit Agreement, as amended by this First Amendment (the “Amended Credit Agreement”).

WHEREAS, the parties hereto desire to enter into this First Amendment to, among other things, (a) evidence the increase by the Accordion Lenders in the aggregate Commitments of the Lenders from $175,000,000 to $225,000,000 and (b) amend the Credit Agreement, in each case as set forth herein.

WHEREAS, Holdings has requested that First-Citizens Bank & Trust Company (the “New Lender”) become a Lender under the Amended Credit Agreement with a Commitment as of the First Amendment Effective Date in the amount shown opposite the New Lender’s name on Schedule 2.1 to the Amended Credit Agreement.

WHEREAS, Holdings has requested that each of Texas Capital Bank, Bank of America, N.A. and Flagstar Specialty Finance Company, LLC (formerly known as NYCB Specialty Finance Company, LLC) (each, an “Increasing Lender”, and together with the New Lender, collectively, the “Accordion Lenders”) agree to increase its Commitment as of the First Amendment Effective Date resulting in the Commitment amount shown opposite such Increasing Lender’s name on Schedule 2.1 to the Amended Credit Agreement.

WHEREAS, subject to and upon the terms and conditions set forth herein, the Administrative Agent and the Accordion Lenders have agreed to Holdings’ requests as set forth herein.

NOW THEREFORE, in consideration of the mutual agreements herein contained and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto agree as follows:

SECTION 1.Amendments to the Credit Agreement. In reliance upon the representations, warranties, covenants and conditions contained in this First Amendment, and subject to the terms, and satisfaction of the conditions precedent set forth in Section 3 hereof, the Credit Agreement is hereby amended as of the First Amendment Effective Date in the manner provided in this Section 1.

1.1Additional Definitions. Section 1.1 of the Credit Agreement is hereby amended to add in alphabetical order the following definitions which shall read in full as follows:

“First Amendment” means that certain First Amendment to Amended and Restated Credit Agreement dated as of the First Amendment Effective Date, by and among Holdings, the other Borrowers and Loan Parties party thereto, the Administrative Agent and the Lenders party thereto.

“First Amendment Effective Date” means November 14, 2023.

1.2Restated Definitions. The definitions of the following terms contained in Section 1.1 of the Credit Agreement are hereby amended and restated in their respective entireties to read in full as follows:

“Commitment” means, as to each Lender, its obligation to (a) make Revolving Credit Loans to Borrowers pursuant to Section 2.1(a), (b) purchase participations in L/C Obligations, and (c) purchase participations in Swing Line Loans, in an aggregate principal amount at any one time outstanding not to exceed the amount set forth opposite such Lender’s name on Schedule 2.1 under the caption “Commitment” or opposite such caption in the Assignment and Assumption pursuant to which such Lender becomes a party hereto, as applicable, as such amount may be

4853-3763-4445v.8 TEX183/52000

adjusted from time to time in accordance with this Agreement. The aggregate Commitment of the Lenders as of the First Amendment Effective Date is $225,000,000.

“Loan Documents” means this Agreement, the First Amendment, each Guaranty, the Security Documents, the Notes, the Issuer Documents, each Fee Letter, and all other promissory notes, security agreements, deeds of trust, assignments, letters of credit, guaranties, and other instruments, documents, or agreements executed and delivered pursuant to or in connection with this Agreement or the Security Documents; provided that the term “Loan Documents” shall not include any Bank Product Agreement.

1.3Replacement of Schedule 2.1 to the Credit Agreement. Effective as of the First Amendment Effective Date, the parties hereto hereby agree that the aggregate Commitments are hereby increased from $175,000,000 to $225,000,000, such increase by the Accordion Lenders shall be deemed to be in conformity with Section 2.10 of the Amended Credit Agreement, and Schedule 2.1 attached to the Credit Agreement is hereby replaced in its entirety with Schedule 2.1 attached hereto. Schedule 2.1 attached hereto shall be deemed to be attached as Schedule 2.1 to the Amended Credit Agreement as of the First Amendment Effective Date. Immediately after giving effect to this First Amendment and any Borrowings made on the First Amendment Effective Date, (a) each Accordion Lender (including the New Lender) shall advance new Loans which shall be disbursed to the Administrative Agent and used to repay Loans outstanding to each Lender who holds Loans in an aggregate amount greater than its Applicable Percentage (immediately after giving effect to this First Amendment) of all Loans, (b) each Lender’s (including the New Lender’s) participation in each Letter of Credit, if any, shall be automatically adjusted to equal its Applicable Percentage (immediately after giving effect to this First Amendment), (c) such other adjustments shall be made as the Administrative Agent shall reasonably specify so that the Revolving Credit Exposure applicable to each Lender (including the New Lender) equals its Applicable Percentage (immediately after giving effect to this First Amendment) of the aggregate Revolving Credit Exposures of all Lenders, and (d) upon the written request by any applicable Lender, Holdings shall be required to make any break funding payments owing to such Lender under Section 3.5 of the Credit Agreement as a result of the reallocation of Loans and the other adjustments described in this Section 1.3.

SECTION 2.New Lender. The New Lender hereby joins in, becomes a party to, and agrees to comply with and be bound by the terms and conditions of the Amended Credit Agreement as a Lender thereunder and under each and every other Loan Document to which any Lender is required to be bound by the Amended Credit Agreement, to the same extent as if the New Lender were an original signatory thereto. The New Lender hereby appoints and authorizes the Administrative Agent to take such action as the Administrative Agent on its behalf and to exercise such powers and discretion under the Amended Credit Agreement as are delegated to the Administrative Agent by the terms thereof, together with such powers and discretion as are reasonably incidental thereto. The New Lender represents and warrants that (a) it has full power and authority, and has taken all action necessary, to execute and deliver this First Amendment, to consummate the transactions contemplated hereby and to become a Lender under the Amended Credit Agreement, (b) it has received a copy of the Credit Agreement and has received or has been accorded the opportunity to receive copies of the most recent financial statements delivered pursuant to Section 6.1 thereof, and such other documents and information as it has deemed appropriate to make its own credit analysis and decision to enter into this First Amendment and to become a Lender on the basis of which it has made such analysis and decision independently and without reliance on the Administrative Agent or any other Lender, and (c) from and after the First Amendment Effective Date, it shall be a party to and be bound by the provisions of the Amended Credit Agreement and the other Loan Documents and have the rights and obligations of a Lender thereunder.

SECTION 3.Conditions Precedent to First Amendment. This First Amendment will be effective as of the First Amendment Effective Date on the condition that the following conditions precedent will have been satisfied:

1.1Counterparts. The Administrative Agent shall have received counterparts of this First Amendment duly executed by each of the Loan Parties, the Administrative Agent, the Swing Line Lender, the L/C Issuer and the Accordion Lenders (constituting at least the Required Lenders) as required hereby and pursuant to the Credit Agreement.

1.2Notes. The Administrative Agent shall have received duly executed Notes (or any amendment and restatement thereof, as the case may be) payable to each Accordion Lender requesting a Note (or amendment and restatement thereof, as the case may be) in a principal amount equal to its Commitment dated as of the date hereof.

1.3Officer’s Certificate. The Administrative Agent shall have received a certificate of a Responsible Officer of each of the Loan Parties setting forth and/or attaching thereto (a) resolutions of the members,

board of directors or other appropriate governing body with respect to the authorization of each such Loan Party to execute and deliver this First Amendment and the other Loan Documents to which it is a party and to enter into the transactions contemplated in those documents, (b) the officers of each such Loan Party who are authorized to sign the Loan Documents to which such Loan Party is a party and who will, until replaced by another officer or officers duly authorized for that purpose, act as its representative for the purposes of signing documents and giving notices and other communications in connection with the Amended Credit Agreement, and the transactions contemplated thereby, (c) specimen signatures of such authorized officers, (d) the Constituent Documents of each such Loan Party, certified as being true and complete, and (e) a certificate of the appropriate government officials of the state of incorporation or organization of such Loan Party as to the existence and standing of such Loan Party dated as of a recent date hereof.

1.4Closing Certificate. The Administrative Agent shall have received a certificate of a Responsible Officer of the Borrower Representative certifying (which statements shall constitute a representation and warranty made by the Loan Parties to the Lenders hereunder on the First Amendment Effective Date) that, as of the First Amendment Effective Date, (a) no Default or Event of Default has occurred and is continuing, (b) all representations and warranties made by any Loan Party contained in the Credit Agreement and the other Loan Documents, in each case as amended hereby, are true and correct in all material respects (without duplication of any materiality qualification applicable thereto) on and as of the date hereof as though made on and as of the date hereof, except to the extent such representations and warranties expressly relate to an earlier date, in which case such representations and warranties were true and correct as of such earlier date, and except for any change of facts expressly permitted under the provisions of the Amended Credit Agreement and the other Loan Documents and (c) Holdings is in pro forma compliance with the financial covenants contained in Section 8.1 and Section 8.2 of the Credit Agreement and attached to such certificate are reasonably detailed calculations demonstrating compliance thereof.

1.5Borrowing Base Report. The Administrative Agent shall have received an updated Borrowing Base Report which calculates the Borrowing Base as of a date acceptable to the Administrative Agent (the “Specified Borrowing Base Report”), along with customary supporting documentation satisfactory to the Administrative Agent.

1.6Fees. The Administrative Agent shall have received all fees and other amounts due and payable on or prior to the First Amendment Effective Date.

1.7Expenses. The Administrative Agent shall have received payment or reimbursement of its out-of-pocket expenses in connection with this First Amendment and any other out-of-pocket expenses of the Administrative Agent required to be paid or reimbursed pursuant to the Credit Agreement, including the reasonable fees, charges and disbursements of counsel for the Administrative Agent.

1.8Other Documents. The Administrative Agent shall have been provided with such documents, instruments and agreements, and the Borrowers shall have taken such actions, in each case as the Administrative Agent may reasonably require in connection with this First Amendment and the transactions contemplated hereby.

SECTION 4.Representations and Warranties. Each Loan Party hereby represents and warrants to the Lenders the following:

1.1Representations and Warranties. The representations and warranties contained in the Amended Credit Agreement and the other Loan Documents are true and correct in all material respects (without duplication of any materiality qualification applicable thereto) on and as of the date hereof as though made on and as of the date hereof, except to the extent such representations and warranties expressly relate to an earlier date, in which case such representations and warranties are true and correct as of such earlier date, and except for any change of facts expressly permitted under the provisions of the Amended Credit Agreement and the other Loan Documents.

1.2No Default. No Default or Event of Default has occurred and is continuing as of the date hereof.

1.3Enforceability. This First Amendment has been duly executed and delivered by such Loan Party, and the Amended Credit Agreement constitutes a legal, valid and binding obligation of such Loan Party, enforceable against such Loan Party in accordance with its terms, subject to applicable bankruptcy, insolvency, reorganization, moratorium or other similar laws affecting creditors’ rights generally and subject to general principles of equity, regardless of whether considered in a proceeding in equity or at law.

SECTION 5.Survival of Representations and Warranties. All representations and warranties made in this First Amendment, including any Loan Document furnished in connection with this First Amendment, shall survive the execution and delivery of this First Amendment and the other Loan Documents, and no investigation by the Administrative Agent or any closing shall affect the representations and warranties or the right of the Administrative Agent or any Lender to rely upon them.

SECTION 6.Expenses. As provided in Section 11.1 of the Amended Credit Agreement, and subject to the limitations expressly set forth therein, Holdings hereby agrees to pay on demand all legal and other fees, costs and expenses incurred by the Administrative Agent in connection with the negotiation, preparation, and execution of this First Amendment and all related documents.

SECTION 7.No Implied Waivers. No failure or delay on the part of the Administrative Agent or any Lender in exercising, and no course of dealing with respect to, any right, power or privilege under this First Amendment, the Credit Agreement or any other Loan Document shall operate as a waiver thereof, nor shall any single or partial exercise of any right, power or privilege under this First Amendment, the Credit Agreement or any other Loan Document preclude any other or further exercise thereof or the exercise of any other right, power or privilege.

SECTION 8.Ratification and Affirmation of Loan Parties. Each of the Loan Parties hereby expressly (a) acknowledges the terms of this First Amendment, (b) ratifies and affirms its obligations under the Loan Documents to which it is a party, (c) acknowledges, renews and extends its continued liability under the Loan Documents to which it is a party, and (d) agrees, with respect to each Loan Party that is a Guarantor, that its guarantee under the Guaranty remains in full force and effect with respect to the Obligations as amended hereby. Any and all of the terms and provisions of the Credit Agreement and the other Loan Documents shall, except as amended hereby, remain in full force and effect. The Loan Parties hereby extend the Liens securing the Obligations (as amended hereby) until the Obligations have been paid in full, and agree that the amendments herein contained shall in no manner affect or impair the Obligations or the Liens securing payment and performance thereof, all of which are ratified and confirmed.

SECTION 9.Severability. Any provision of this First Amendment that is prohibited or unenforceable in any jurisdiction shall, as to such jurisdiction, be ineffective to the extent of such prohibition or unenforceability without invalidating the remaining portions hereof or affecting the validity or enforceability of such provision in any other jurisdiction.

SECTION 10.APPLICABLE LAW. THIS FIRST AMENDMENT SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE LAWS OF THE STATE OF TEXAS.

SECTION 11.Successors and Assigns. This First Amendment is binding upon and shall inure to the benefit of the Administrative Agent, the Lenders and the Loan Parties and their respective successors and permitted assigns, except the Loan Parties may not assign or transfer any of their rights or obligations hereunder without the prior written consent of the Administrative Agent, other than as expressly permitted under the terms of the Amended Credit Agreement.

SECTION 12.Counterparts. This First Amendment may be executed in any number of counterparts and by different parties hereto in separate counterparts, each of which when so executed and delivered shall be deemed an original but all of which when taken together shall constitute but one and the same instrument. Delivery of an executed signature page of this First Amendment by facsimile transmission or PDF electronic transmission shall be effective as delivery of a manually executed counterpart hereof. The execution and delivery of this First Amendment shall be deemed to include Electronic Signatures on electronic platforms approved by the Administrative Agent, which shall be of the same legal effect, validity or enforceability as delivery of a manually executed signature, to the extent and as provided for in any applicable law, including the Federal Electronic Signatures in Global and National Commerce Act, the New York State Electronic Signatures and Records Act, or any other similar state laws based on the Uniform Electronic Transactions Act; provided that, upon the request of any party hereto, such Electronic Signature shall be promptly followed by the original thereof.

SECTION 13.Effect of Consent. No consent or waiver, express or implied, by the Administrative Agent to or for any breach of or deviation from any covenant, condition or duty by the Borrowers shall be deemed a consent or waiver to or of any other breach of the same or any other covenant, condition or duty.

SECTION 14.Headings. The headings of this First Amendment are for purposes of reference only and shall not limit or otherwise affect the meaning hereof.

SECTION 15.Reaffirmation of Loan Documents. This First Amendment shall be deemed to be an amendment to the Credit Agreement, and the Amended Credit Agreement and the other Loan Documents are hereby ratified, approved and confirmed in each and every respect. All references to the Credit Agreement herein and in any other document, instrument, agreement or writing shall hereafter be deemed to refer to the Amended Credit Agreement.

SECTION 16.Loan Document. This First Amendment constitutes a “Loan Document” under and as defined in the Amended Credit Agreement.

SECTION 17.Entire Agreement. THE CREDIT AGREEMENT, THIS FIRST AMENDMENT, THE OTHER LOAN DOCUMENTS, AND ALL OTHER INSTRUMENTS, DOCUMENTS AND AGREEMENTS EXECUTED AND DELIVERED IN CONNECTION WITH THIS FIRST AMENDMENT REPRESENT THE FINAL AGREEMENT AMONG THE PARTIES AND MAY NOT BE CONTRADICTED BY EVIDENCE OF PRIOR, CONTEMPORANEOUS OR SUBSEQUENT ORAL AGREEMENTS OF THE PARTIES. THERE ARE NO ORAL AGREEMENTS AMONG THE PARTIES.

[THE REMAINDER OF THIS PAGE HAS BEEN INTENTIONALLY LEFT BLANK]

IN WITNESS WHEREOF, the parties hereto have executed this First Amendment as of the date set forth above.

BORROWERS:

NATURAL GAS SERVICES GROUP, INC.,

a Colorado corporation

By: /s/ Stephen C. Taylor

Name: Steve Taylor

Title: Interim Chief Executive Officer

[Signature Page to First Amendment to Amended and Restated Credit Agreement – Natural Gas Services Group, Inc.]

GUARANTORS:

NGSG PROPERTIES, LLC,

a Colorado limited liability company

By: /s/ Steve Taylor

Name: Steve Taylor

Title: President

[Signature Page to First Amendment to Amended and Restated Credit Agreement – Natural Gas Services Group, Inc.]

ADMINISTRATIVE AGENT, SWING LINE LENDER, L/C ISSUER AND LENDER:

TEXAS CAPITAL BANK,

as Administrative Agent, Swing Line Lender, L/C Issuer and an Increasing Lender

By: /s/ Jeff Tompkins

Name: Jeff Tompkins

Title: Managing Director

[Signature Page to First Amendment to Amended and Restated Credit Agreement – Natural Gas Services Group, Inc.]

BANK OF AMERICA, N.A.,

as an Increasing Lender

By: /s/ Tanner J. Pump

Name: Tanner J. Pump

Title: Senior Vice President

[Signature Page to First Amendment to Amended and Restated Credit Agreement – Natural Gas Services Group, Inc.]

FLAGSTAR SPECIALTY FINANCE COMPANY, LLC,

as an Increasing Lender

By: /s/ Willard D. Dickerson, Jr.

Name: Willard D. Dickerson, Jr.

Title: Senior Vice President

[Signature Page to First Amendment to Amended and Restated Credit Agreement – Natural Gas Services Group, Inc.]

FIRST-CITIZENS BANK & TRUST COMPANY,

as the New Lender

By: /s/ Christopher Solley

Name: Christopher Solley

Title: Vice President

[Signature Page to First Amendment to Amended and Restated Credit Agreement – Natural Gas Services Group, Inc.]

SCHEDULE 2.1

Commitments and Applicable Percentages

| | | | | | | | |

| Lender | Commitment | Applicable

Percentage |

| Texas Capital Bank | $57,500,000.00 | 25.555555556% |

| Bank of America, N.A. | $52,500,000.00 | 23.333333333% |

| Flagstar Specialty Finance Company, LLC | $35,000,000.00 | 15.555555556% |

| Webster Business Credit, a division of Webster Bank, N.A. | $25,000,000.00 | 11.111111111% |

| Caterpillar Financial Services Corporation | $20,000,000.00 | 8.888888889% |

| First-Citizens Bank & Trust Company | $20,000,000.00 | 8.888888889% |

| Bank of Hope | $15,000,000.00 | 6.666666666% |

| Total: | $225,000,000.00 | 100.0000000% |

v3.23.3

Cover Page

|

Nov. 14, 2022 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 14, 2023

|

| Entity Registrant Name |

NATURAL GAS SERVICES GROUP, INC.

|

| Entity Incorporation, State or Country Code |

CO

|

| Entity File Number |

1-31398

|

| Entity Tax Identification Number |

75-2811855

|

| Entity Address, Address Line One |

404 Veterans Airpark Lane, Suite 300

|

| Entity Address, City or Town |

Midland

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

79705

|

| City Area Code |

432

|

| Local Phone Number |

262-2700

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, Par Value $0.01

|

| Trading Symbol |

NGS

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001084991

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

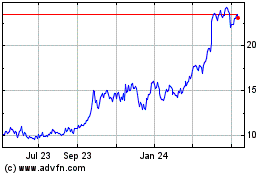

Natural Gas Services (NYSE:NGS)

Historical Stock Chart

From Mar 2024 to Apr 2024

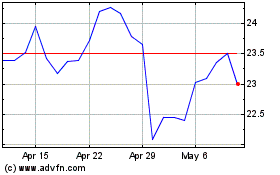

Natural Gas Services (NYSE:NGS)

Historical Stock Chart

From Apr 2023 to Apr 2024